reading

Sunday, 31 January 2016 - 5:57pm

This week, I have been mostly reading:

- Beyond ISIS: The Folly of World War IV — Andrew Bacevich at TomDispatch:

A de facto collaboration of four successive administrations succeeded in reducing Iraq to what it is today: a dysfunctional quasi-state unable to control its borders or territory while serving as a magnet and inspiration for terrorists. The United States bears a profound moral responsibility for having made such a hash of things there. Were it not for the reckless American decision to invade and occupy a nation that, whatever its crimes, had nothing to do with 9/11, the Islamic State would not exist. Per the famous Pottery Barn Rule attributed to former Secretary of State Colin Powell, having smashed Iraq to bits a decade ago, we can now hardly deny owning ISIS.

- Men at work — Allison J Pugh, in Aeon:

Most Americans might expect very little from their employers – as one layoff survivor told me: ‘Just a paycheck and a certain amount of respect, I would say.’ They might shrug their shoulders about job insecurity as the inevitable cost of doing business in a globalised economy (even though some economists have found that layoffs usually end up costing firms rather than boosting stock prices or productivity). At home, however, working‑class men expect more of their intimate partners, and brittle yearning turns those expectations into betrayal if they fall short. Abandoned by both employer and wife, Gary aims his ire at just one of these.

- Twitter Wants You To Feel Bad — Britney Summit-Gil in The Society Pages:

The analytics don’t teach you how to tweet better, how to reach a broader audience, or how to make a bigger impact. For example, last month the tweet on my account that got the most impressions also had zero engagement. People saw it and breezed by, not even clicking on it. And, of course, Twitter isn’t interested in making you a better tweeter, it’s interested in selling you promotional services.

- QE for People – Neither Right nor Left, Just the Way Forward — Frank Van Lerven, of Positive Money, and some notable quotables:

In sum, there is a strong intellectual body of history behind the various alternative proposals for QE. That this body of history is composed by some of most important economists of our time, on both sides of the political spectrum, should show that these types of ideas are credible and merit more consideration. Ultimately, People’s QE types of proposals are nether right nor left, they are simply the way forwards!

- Racism: the achilles heel of middle class liberalism — Kevin Ovenden:

Anti-Semitism – the socialism of fools, as the great German socialist August Bebel so brilliantly put it – had a special corrupting effect. It provided an alternative world view – what we might now recognise as a “clash of civilisations” – with The Jew representing both international finance and international Marxism. It glided the path from socialist opposition to the capitalist system towards all sorts of reactionary positions, including fascism, which had a pseudo-antiestablishment veneer. Islamophobia is the Jewish Question of our day. It is not simply one reactionary idea among many, which all principled socialists oppose. It plays a particular corrupting role across politics and society as a whole.

- How to Be an Anticapitalist Today — Erik Olin Wright, Jacobin:

If you are concerned about the lives of others, in one way or another you have to deal with capitalist structures and institutions. Taming and eroding capitalism are the only viable options. You need to participate both in political movements for taming capitalism through public policies and in socioeconomic projects of eroding capitalism through the expansion of emancipatory forms of economic activity.

- Five things we learned from the Bank of England this week — Christine Berry at the New Economics Foundation:

Seven years on from the crisis of 2008, the Bank acknowledges that we are still seeing “relatively tight credit conditions” for small and medium-sized enterprises (SMEs). In other words, banks are still reluctant to support the real economy, despite all the subsidies that have been thrown at them. In that respect at least, the post-crisis period seems to be far from over. […] At the same time, lending for mortgages and consumer spending is starting to recover some of its pre-crisis exuberance: consumer lending increased at an annualised rate of 8.2% in October, the highest level since before the banking crisis.

- Do Not Be Impressed by Mark Zuckerberg’s Phony Generosity — Ted Rall:

If you’re a conservative who thinks government can’t do anything right, let me show you a charity that’s worse. The Gates Foundation wants to destroy teachers’ unions to take away their benefits and drive down their wages — hardly a way to attract the best and brightest young college graduates into the profession. And it has poured millions into the disastrous Common Core, which has created today’s “teach to the test” culture in public schools. Given Zuckerberg’s previous involvement in public schools, a $100 million fiasco in Newark, New Jersey that declared war on teachers, fetishized standardized testing and led to so many school closures that kids wound up walking miles through gang territory to new schools chosen for them by, really, an algorithm — it isn’t a stretch to guess that Chan Zuckerberg will look a lot like Bill and Melinda Gates.

- How can you help Flint? Do not send us bottles of water. Instead, join us in a revolt. — Michael Moore:

This is a catastrophe of unimaginable proportions. There is not a terrorist organization on Earth that has yet to figure out how to poison 100,000 people every day for two years – and get away with it. That took a Governor who subscribes to an American political ideology hell-bent on widening the income inequality gap and conducting various versions of voter and electoral suppression against people of color and the poor.

- Elizabeth Warren Challenges Clinton, Sanders to Prosecute Corporate Crime Better Than Obama — David Dayen, The Intercept:

In virtually all the cases she cites — from Standard & Poor’s delivering inflated credit ratings to defraud investors during the financial crisis, to Novartis giving kickbacks to pharmacists to steer customers to their products, to an explosion at a Bayer CropScience pesticide plant that killed two employees — the Department of Justice declined to prosecute individual executives or the corporations themselves, resorting to settlements with minuscule fines that barely disrupt the corporations’ business models. […] Warren also published an op-ed in the New York Times on Friday discussing her report.

- Unreasonable expectations and unpalatable truths — Frances Coppola:

Now, the supply of deposits vastly exceeds the demand for loans, interest rates are on the floor, and payments have become a vital (and largely free) public service. And this […] creates a problem. Customers - including asset managers, apparently - want banks to provide a deposit-taking service regardless of whether banks have a productive use for the money. Banks may of course provide such a service, but if they can't use the money to fund profitable activities, they will not pay customers for it. Why should they borrow money at interest when they have no profitable use for it? It would be wholly irrational, and probably a failure of fiduciary duty towards their shareholders.

[To my mind "a world of excess money" which is simultaneously a world of high un/underemployment requires intervention via fiscal policy, rather than fatalistic accommodation to the new normal.] - How bad were the good old days of Hawke/Keating? — Paul Frijters at Club Troppo:

In hindsight, I am simply not sure whether to call the Hawke/Keating years the glory days of de-regulation, or the disaster years of a regulatory explosion. I do know that inequality increased a lot following those reform years, in part because of the tax changes then introduced. And the interest groups then created are among the biggest obstacles to a fairer society now.

- US jobs recovery biased towards low-pay jobs — Bill Mitchell:

On average, the US labour market has added 237,000 net jobs per month over the last 12 months. What I was curious about was whether these were predominantly low paid jobs or not. I found that the jobs lost in low-pay sectors in the downturn have more than being offset by jobs added in these sectors in the upturn. However, the massive number of jobs lost in above-average paying sectors have not yet been recovered in the upturn. In other words there is a bias in employment generation towards sectors that on average pay below average weekly earnings.

- Defining austerity — Simon Wren-Lewis:

I want to define austerity as “fiscal consolidation that leads to a significant increase in involuntary unemployment, or perhaps more formally but less colloquially as leading to a noticeably more negative output gap.”

- When Inequality Kills — Joe Stiglitz at Project Syndicate:

The median income of a full-time male employee is lower than it was 40 years ago. Wages of male high school graduates have plummeted by some 19% in the period studied by Case and Deaton. To stay above water, many Americans borrowed from banks at usurious interest rates. In 2005, President George W. Bush’s administration made it far more difficult for households to declare bankruptcy and write off debt. Then came the financial crisis, which cost millions of Americans their jobs and homes. When unemployment insurance, designed for short-term bouts of joblessness in a full-employment world, ran out, they were left to fend for themselves, with no safety net (beyond food stamps), while the government bailed out the banks that had caused the crisis.

- The Politics behind Piketty — Elizabeth Anderson at Crooked Timber:

Ideology matters for politics. Once people have acquired income or wealth through the market, they feel strongly entitled to it. In the U.S. and increasingly in the rest of the OECD, the population at large, taken in by such representations, is reluctant to tax. Redistributing income and wealth by means of taxation, as Piketty proposes, becomes harder once people have it in their hands. We need to scrutinize the rules by which income and wealth get generated through the market, before it is taxed. They have been changing in a plutocratic direction for the past 45 years. The rule changes have not only increased r (at least for the top 1%), but also depressed g, by increasing monopoly power, shifting savings from real investment to speculation and scams, shifting top talent from production to value-extraction, and depressing aggregate demand.

- Liberal, Nationals and Labor combine to increase Australian students' debt up to 33% — Mid North Coast Greens:

Until now, the $1025 Student Start-Up Scholarship went to all eligible students twice a year. It was a modest amount of money that provided relief at critical times of year for uni students, allowing them to cover bills for textbooks, laptops, internet access and other necessities. Taking away scholarships and turning them into loans means an extra $6000 of debt for the average Bachelor student upon graduation.

- Reward is better than punishment: A Work for the Dole alternative — Jade Manson, Independent Australia:

The main argument for Work for the Dole is that it benefits community organisations and job-seekers themselves, by providing them with a chance to contribute and a daily routine. However, it also takes away people’s ability to decide who they will volunteer for. This goes against the spirit of volunteer work and the benefit it brings people knowing they are working for a cause they believe in. Although anecdotal reports have suggested Work for the Dole provides participants with a sense of purpose and "something to do", this assumes that they would not have found something better to do had they not been forced to participate in Work for the Dole.

- Delusion Regarding the Fall of Neoliberalism and Globalization — Ian Welsh:

Corbyn is not wrong to say “make the necessary adjustments so it will work today, and go back to post-war policies.” It failed, yes, but it was the last economy which spread money evenly through the economy. Make sure it’s not sexist and racist, update it for new energy technology, and try it. […] Until the developed world’s sanctioned intellectuals (as opposed to pariahs like myself and my ilk) and their masters come to grip with these facts, the population will continue to turn elsewhere. They may turn to sane and reasonable people like Corbyn, or they may turn to people like LePen and Trump, but people will not put up with “it’s going to get worse for the forseeable future” forever.

- Who should be responsible for creating money? — Duncan McCann at New Economics Foundation:

Currently commercial banks create 97% of the UK money supply. However the ultimate decision on whether to change the monetary system rests with our elected politicians who are in no rush to understand how it could work better, let alone change it. A recent survey revealed that only 10% of MPs understand the UK’s monetary system.

- No more nudges – only an entrepreneurial state can give us a green revolution — Mariana Mazzucato in the Green Alliance Blog:

Signals and nudges to the private sector will not get us where we need to go. If we are to have a green revolution, characterised by the kind of sweeping and widespread technological changes that characterised the IT revolution, then we need to learn the right lessons. More nudging is fudging it. Instead, states around the world must act boldly and courageously to tilt the playing field in the right direction.

- Donald Trump’s “Ban Muslims” Proposal Is Wildly Dangerous But Not Far Outside the U.S. Mainstream — Glenn Greenwald, The Intercept:

No matter how extreme and menacing Trump becomes, that’s all one can expect from large sectors of the U.S. media: cowardly neutrality, feigned analytical objectivity (how will Trump’s fascism play with New Hampshire independents?) as an excuse for not taking any sort of stand. We are indeed a long, long way away from Edward R. Murrow’s sustained, continuous, unapologetic denunciations of Joseph McCarthy.

Sunday, 24 January 2016 - 9:30pm

This week, I have been mostly reading:

- Beyond neoliberalism: Universities and the public good — Ravinder Sidhu in the Australian Review of Public Affairs reviews Learning under Neoliberalism: Ethnographies of Governance in Higher Education:

Writing almost twenty years ago, Clare O’Farrell made the prescient observation that: ‘the State has become educationally out of date. [It] must necessarily fall behind those institutions whose job it is to keep abreast with and create new developments in specialised fields [such as] universities’ (1996, p. 8). O’Farrell highlighted the need for academics to find alternative ways of self-governing. Her compelling argument, in favour of winding back the intrusion and displacement wrought by various accountability audits to restore ‘the scholarly balance’, retains its urgency. A small step towards this end is by attending to professional and democratic accountability in university governance. Such changes are necessary if universities are to continue to be relevant to public life.

- Iceland, Ireland, and Devaluation Denial — Paul Krugman, New York Times:

When big adjustments in a country’s wages and prices relative to trading partners are necessary, it’s much easier to achieve these adjustments via currency depreciation than via relative deflation — which is one main reason there have been such big costs to the euro.

- Review: Another “Minsky moment” may be on the way — Edward Chancellor for Reuters reviews Randy Wray's new book on the work of his late mentor:

Prudent financial arrangements give way to what he called “Ponzi finance,” which describes the situation when borrowers are unable to service their debts or repay principal from their current income. Ponzi borrowers depend on refinancing against the collateral of rising asset prices to maintain solvency. Long before former Fed Chairman Ben Bernanke and other economists hailed the “Great Moderation” of low inflation and stable growth, Minsky elaborated the “Financial Instability Hypothesis.” This is expressed in his trademark comment – “stability is destabilizing” – since, as Minsky argued, people respond to good times by changing their risk preferences.

- Who’s the most efficient of them all: income tax or GST? — Peter Davidson Holy cow, this is comprehensive — and worth memorising in order to quote from it at length at the next high-society soiree you attend, assuming you don't want to be invited to any more:

In short, the equity impacts of a change in the tax mix from personal income to consumption are quantifiable and negative, while any economic efficiency gains are uncertain and hard to quantify. Alternative tax reform options, such as broadening the income tax base by removing inefficient tax shelters, would improve equity and efficiency at the same time.

- Jeremy Corbyn 'Systematically' Attacked By British Press The Moment He Became Leader, Research Claims — Louise Ridley, the Huffington Post:

News articles, in which the media ostensibly do not editorialise, were actually the most critical of Corbyn, the report says. Out of 292 news pieces, 181 were judged negative, while 92 were 'neutral' and just 19 'positive', the report found. 'One might expect news items, as opposed to comment and editorial pieces, to take a more balanced approach but in fact the opposite is true.'

It's more a tally than a report, but the appendix on themes ("Them and Us - Extremism Vs. Moderation", "What will happen to Labour and the Left?", "Personal Character") is bang-on. - Challenging the Oligarchy — Paul Krugman in the New York Review of Books ah, reviews a book, in New York. A finer fulfillment of a publication's mandate you will search for in vain. Specifically, he reviews Robert Reich's new one.:

Modern technology, or so it was claimed, reduced the need for routine manual labor while increasing the demand for conceptual work. And while the average education level was rising, it wasn’t rising fast enough to keep up with this technological shift. Hence the rise of the earnings of the college-educated and the relative, and perhaps absolute, decline in earnings for those without the right skills. […] But while one still encounters people invoking skill-biased technological change as an explanation of rising inequality and lagging wages—it’s especially popular among moderate Republicans in denial about what’s happened to their party and among “third way” types lamenting the rise of Democratic populism—the truth is that SBTC has fared very badly over the past quarter-century, to the point where it no longer deserves to be taken seriously as an account of what ails us.

- Hungover Bear and Friends: Flying Solo — Ali Fitzgerald in McSweeney's Internet Tendency:

- 'Poor internet for poor people': India's activists fight Facebook connection plan — Cory Doctorow in The Guardian:

Since the spring of 2015, Indian activists have built ferocious momentum against Facebook’s bid to take charge of the nation’s internet through a program called Free Basics. […] Free Basics’s pitch has been: we’ll get “the next billion internet users” (that is, poor people in developing nations) connected by cutting deals with local phone companies. Under these deals, there will be no charge for accessing the services we hand-pick. We will define the internet experience for these technologically unsophisticated people, with our products at the centre and no competition. It’s philanthropy!

- Against School — the late lamented Aaron Swartz in New Republic:

A group of bold entrepreneurs find they can make cloth more efficiently by building large mills. The girls who staff them keep causing strikes and other trouble, so they require their employees go to school from a young age and learn to behave themselves. But obviously most people won’t be thrilled to go to school so that they can learn to accept lower wages without complaint. So the bosses develop a cover story: schools are about teaching people the things they need to know to survive in the world of business. It’s not true, of course—there’s no connection between the facts memorized in school and the skills needed on the job—but the story is convincing enough.

- Are luxury condo purchases hiding dirty money? — Husna Haq at the Christian Science Monitor:

An investigation conducted by The New York Times in 2015 revealed that nearly half of homes that sold for more than $5 million across the country were purchased by shell companies. That figure would probably be higher in high-end real estate markets like New York and Miami. In fact, using shell companies, or limited liability companies, to hide a buyer's identity is actually relatively common, and legal. But the practice could drive up real estate prices in some markets, and contribute to real estate booms. Federal authorities are also concerned that the practice enables foreign buyers to easily find a safe haven for illicit money in American real estate.

- Six Responses to Bernie Skeptics — Robert Reich practically endorses Bernie. This is huge, because Reich is very influential and used to work for… ah… Clinton… Bill Clinton, the president who… I'll get me coat.

- In Late 2007, Obama Trailed Clinton By 26 Points. Bernie Sanders Is 2016's Barack Obama — H.A. Goodman, Huffington Post:

[I]t's difficult to generate enthusiasm when you're a Democratic nominee who voted for Iraq and is funded by prison lobbyists, but alas, Clinton supporters base their vote upon the perception of political power. This viewpoint ignores the fact that Democrats lose elections when voter turnout is low, and only Bernie Sanders can ensure a high voter turnout in 2016. Between an expanding FBI investigation, Clinton's negative favorability ratings, and her longstanding ties to Donald Trump, Republicans would win the White House with a Clinton nomination.

- 'Australia headed for recession': Yanis Varoufakis, former Greek finance minister — Mark Mulligan, Australian Financial Review:

He said after nearly 25 years without recession, Australia was caught up in the same global pattern of weak aggregate demand and excessive corporate savings, which are being handed back to shareholders via buybacks and dividends instead of being re-invested in additional capacity or productivity enhancement.

Taking issue with Varoufakis is: - Recessions are always a problem and can always be avoided — Bill Mitchell:

Recessions are incredibly costly and totally unnecessary. The claims that they offer a bush-fire type “cleansing” to drive higher productivity in the future and increased material living standards are often made but not very strongly evidenced in the research literature. Governments can always maintain full employment if they choose and should do so given the highly damaging effects that recessions have on individuals, which span many generations as a consequence of the inheritance of disadvantage by children in jobless households. I am surprised that a progressive economist (so-called) is buying into the mainstream myth that recessions are not a problem.

- IMF continues with its wage-cutting line — Bill Mitchell:

Now if we took the [IMF's logic] one could easily argue that with inflation so low in the Eurozone, these results would suggest that an across-the-board wage increase in the Eurozone would have strong positive impacts on growth without undermining any relative competitiveness for any particular nation. The IMF, of course, doesn’t take the reader down that interpretation of their results because the paper is really designed to justify the existing policy of wage cutting and so-called ‘structural reforms’, which are really about undermining working conditions, job security, Occupational Health & Safety regulations, and other things that make work more tolerable.

- German wage moderation and the EZ Crisis — Peter Bofinger at VOX, CEPR's Policy Portal:

An EZ Crisis narrative that does not that does not account for the effects of the German wage moderation is incomplete. Germany is by far the largest EZ economy and it is a very open economy with strong trade links to all other EZ member states. It would be difficult to explain why such a strong internal devaluation, which is regarded as a key determinant of Germany’s success story in the 2000s (Dustmann et al. 2014), did not have significant repercussions for the rest of the EZ.

- Secular stagnation and the financial sector — John Quiggin:

[T]he financial sector benefits from an evolutionary strategy similar to that of an Australian eucalypt forest. Eucalypts are both highly flammable (they generate lots of combustible oil) and highly fire resistant. So eucalypt forests are subject to frequent fires which kill competing species, and allow the eucalypts to extend their range.

- This might be the most controversial theory for what’s behind the rise of ISIS — Jim Tankersley, The Washington Post:

Piketty is particularly scathing when he blames the inequality of the region, and the persistence of oil monarchies that perpetuate it, on the West: "These are the regimes that are militarily and politically supported by Western powers, all too happy to get some crumbs to fund their [soccer] clubs or sell some weapons. No wonder our lessons in social justice and democracy find little welcome among Middle Eastern youth." Terrorism that is rooted in inequality, Piketty continues, is best combated economically.

- Corbyn - what's a leader really for? — Jeremy Gilbert:

One perspective basically thinks that politics is about selling your party to consumers; the other thinks that it’s mainly about building up a coalition of social groups with common interests. Spoiler alert: it’s the second one that’s right, mostly.

- The New Supply-Side Economics — Mark Thoma in The Fiscal Times:

During the period of mild fluctuations in output and employment from 1982 through 2007 known as the Great Moderation monetary policy could do the job by itself, and to a large extent we forgot about fiscal policy as a stabilization tool. But the Great Recession made it clear that monetary policy can only do so much, and fiscal policy has an important role to play in deep economic downturns. We didn’t fully exploit the potential of fiscal policy during the Great Recession, and the turn to austerity in 2010 was a mistake that worked against the recovery, but the lesson is there to be learned for those willing to take off their ideological blinders and see it.

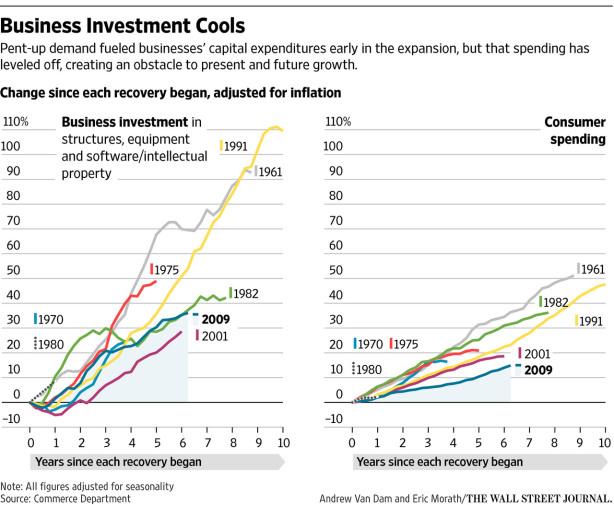

- Chart of the day — David F. Ruccio:

Consumer spending isn’t growing because, face it, most people’s incomes (whether measured in terms of real wages or median incomes) are stagnant. Whatever spending they are doing (e.g., on cars and higher education) is fueled by taking on more and more debt. What about investment? While profits (especially from domestic sources) continue to grow, corporations are using those profits not for investment, but for other uses, including stock buybacks, mergers and acquisitions, and CEO salaries.

- Going down the same old road: driverless cars aren’t a fix for our transport woes — Curtin's peter Newman in The Conversation:

Autonomous trains have been around for 30 years and have a very good track record. That’s because they don’t require humans suddenly being able to intervene. Nor do they have a chance of harming others as they are completely isolated on separate tracks. But autonomous cars present both these problems.

- Jeremy Corbyn and the Syrian Bombing Vote — Ian Welsh:

Corbyn has always said he would bring more democracy to Labour, and this is in line with that promise. This is a case of one principle “no war” going against another principle “more democracy.” Also, letting Labour MPs vote against bombing Syria, when the majority of Labour party members are for it, may be very smart politics. Smoke the pro-war MPs out, let them run up their flags, and when the time comes for candidate selection, well, everyone will know who is for war. The majority of voters selecting candidates are free to use the next election to ensure that Corbyn has a party of MPs who are anti-war.

- Woody Guthrie, ‘Old Man Trump’ and a real estate empire’s racist foundations — Will Kaufman, The Conversation:

For Guthrie, Fred Trump came to personify all the viciousness of the racist codes that continued to put decent housing – both public and private – out of reach for so many of his fellow citizens.

Sunday, 17 January 2016 - 4:37pm

This week, I have been mostly reading:

- Meet the lefty club behind a blitz of new laws in cities around the country — Lydia DePillis at the Washington Post on municipal governments joining together to think big:

The central idea of Local Progress […] is that no issue is out of bounds for city government. Besides environmental groups, it has heavy involvement from the labor movement; an AFL-CIO vice president sits on the organization’s board, and the conference in October had a session on the Service Employees International Union’s Fight for $15 minimum wage campaign, along with numerous appearances by union officials. Those outside groups are essential to getting new policy ideas into practice.

- Why Do Americans Work So Much? — Rebecca J. Rosen, The Atlantic:

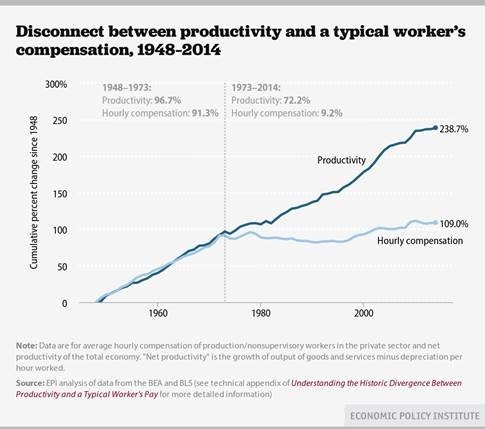

According to [Benjamin M.] Friedman, “Between 1947 and 1973 the average hourly wage for nonsupervisory workers in private industries other than agriculture (restated in 2013 dollars) nearly doubled, from $12.27 to $21.23—an average growth rate of 2.1 percent per annum. But by 2013 the average hourly wage was only $20.13—a 5 percent fall from the 1973 level.” For most people, then, the magic of increasing productivity stopped working around 1973, and they had to keep working just as much in order to maintain their standard of living.

- This Fake Bomb Detector Is Blamed for Hundreds of Deaths. It’s Still in Use. — Murtaza Hussain, The Intercept:

The BBC investigation led to a subsequent export ban on the devices, as well as a 10-year prison sentence for the British businessman, James McCormick, responsible for their manufacture and sale. An employee of McCormick who later became a whistleblower said that after becoming concerned and questioning McCormick about the device, McCormick told him the ADE 651 “does exactly what it’s designed to. It makes money.”

- Coding Bootcamps and the New For-Profit Higher Ed — Coding Bootcamps and the New For-Profit Higher Ed:

Of the more than 5000 career programs that the Department of Education tracks, 72% of those offered by for-profit institutions produce graduates who earn less than high school dropouts.

- Did Money Evolve? You Might (Not) Be Surprised — Steve Roth, Evonomics:

The main finding from all this: the earliest uses of money in recorded civilization were not coins, or anything like them. They were tallies of credits and debits (gives and takes), assets and liabilities (rights and responsibilities, ownership and obligations), quantified in numbers. Accounting.

- How the Gates Foundation Reflects the Good and the Bad of “Hacker Philanthropy” — Michael Massing, The Intercept:

Despite its impact, few book-length assessments of the foundation’s work have appeared. Now Linsey McGoey, a sociologist at the University of Essex, is seeking to fill the gap. “Just how efficient is Gates’s philanthropic spending?” she asks in No Such Thing as a Free Gift. “Are the billions he has spent on U.S. primary and secondary schools improving education outcomes? Are global health grants directed at the largest health killers? Is the Gates Foundation improving access to affordable medicines, or are patent rights taking priority over human rights?” As the title of her book suggests, McGoey answers all of these questions in the negative.

- Australia – investment spending contracts sharply, recession looming — Bill Mitchell:

In light of the latest investment expectations revealed in today’s ABS data release, the Government should abandon their fiscal strategy immediately and announce a significant stimulus package. Unemployment is already at elevated levels and will rise further under the current trends. This is another case of neo-liberal austerity white-anting the capacity of the economy to deliver prosperity for all.

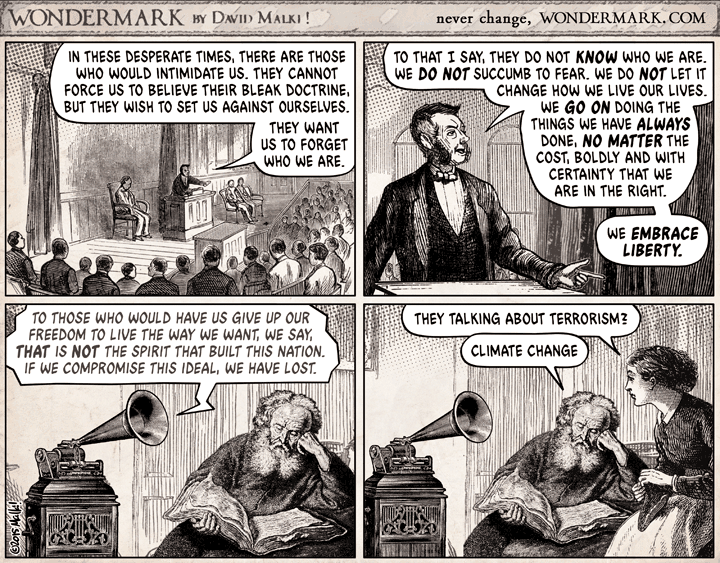

- Stay the course — Wondermark:

- Spending Review 2015: the graphs you need to see — Olivier Vardakoulias. New Economics Foundation:

As real wages stagnate, unsecured household borrowing – like credit card debts, personal loans, or utility bills – are propping up activity in the economy.

Sunday, 10 January 2016 - 6:10pm

This week, I have been mostly writing an essay I should have started a month earlier, but also reading:

- Thinking About the Trumpthinkable — Alan Abramowitz via Paul Krugman in the NYT:

If none of the totally crazy things he’s said up until now have hurt him among Republican voters, why would any crazy things he says in the next few months hurt him?

- How Labour will secure the high-wage, hi-tech economy of the future — Chancellor-in-waiting John McDonnell in the Guardian:

The OECD thinks a developed country such as Britain should be spending a minimum of 3.5% of GDP on infrastructure. A Labour government would exceed that commitment. At present companies are sitting on a £400bn cash pile. So we will also look to change the corporate tax system and work constructively with companies to give them incentives to invest wisely.

But yes, he did really end with the punchline "It’s time to look to the future: socialism with an iPad." Urgh. - To Understand Climbing Death Rates Among Whites, Look To Women Of Childbearing Age — Laudan Aron, Lisa Dubay, Elaine Waxman, and Steven Martin at Health Affairs Blog say it's complicated:

The causes and consequences of the US health disadvantage, especially among women, are much more complex and serious than this analysis suggests. […] Improving the conditions of life that shape the health of women and their families and social networks and that are contributing to the “epidemic of pain” is critical. Many systemic and environmental factors are likely at work behind these mortality trends, including unstable and low-paying jobs, a fraying social safety net, and other stressors. When life conditions undermine health or one’s ability to make healthy choices, we all suffer.

- Donald Trump and the “F-Word” — Rick Perlstein at The Washington Spectator:

My main interest, though, is that moment of symbiosis between man and mob. They feed off each other. The way his people eat up Trump’s unalloyed joy in bullying: the way a purse of his lips and a glance offstage summoned the security guard who ejected Univision’s Jorge Ramos from a press conference, like a casino pit boss with a whale who gets too handsy with the cocktail waitresses. Trump’s not-quite-veiled threat to Megyn Kelly: “I’ve been very nice to you, although I could probably maybe not be. But I wouldn’t do that.” The body language he uses to intimidate a hapless and plaintive Jeb Bush during the second Republican debate. If he’s just giving the people what they want, consider the people. Consider what they want.

Good grief! Is that all? Isn't there a danger the Internet will cease to exist if I'm not there?

Sunday, 3 January 2016 - 5:26pm

This week, I have been mostly reading:

- Pregnant Silence — George Monbiot explains why the big problem isn't the number of people; it's the number of other animals bred for those people to eat in their lifetime:

Perhaps it’s no coincidence that so many post-reproductive white men are obsessed with human population growth, as it’s about the only environmental problem of which they can wash their hands.

- Do we still need microfoundations? — Daniel Little. I've been thinking about this in both the economics and sociology contexts. As desirable as it would be to reduce macroeconomics to microeconomics and social forces to the actions of individuals, insisting on such a reconciliation before any work can be done would be like rejecting gravity until Einstein came along to explain Newton's spooky force as the geometry of spacetime. Or denying Einstein the bodge of the cosmological constant in special relativity, or forbidding the use of dark energy in contemporary cosmology. Of course you can take provisional place-holding assumptions to unhealthy extremes, for instance by insisting that your model works perfectly well under the conditions in which it works, and that everywhere else, it is reality which is at fault. (So that is why we didn't see the financial crisis coming, your majesty.)

- Poor research-industry collaboration: time for blame or economic reality at work? — Glyn Davis:

We need teams of managers with the expertise to translate promising early research into commercial development. […] These people – venture catalysts – could work with inventors to package opportunities for investors.

ZOMG! MOAR MANAGERS!!! - The Most Perverse Story to Justify Inequality: The narrative of economic elites — Eric Michael Johnson, Evonomics:

When we were children we wouldn’t have understood that using financial derivatives to repackage subprime loans in order to resell them as AAA-rated securities was an unfair thing to do. Few of us today (including members of the commission charged with overseeing the financial services industry) can even understand that now. But we did know it was unfair when our sibling got a bigger piece of pie than we did. We began life with a general moral sense of what was fair and equitable and we built onto the framework from there. Chimpanzees, according to this study, appear to have a similar moral sense. The intricacies of what we judge to be fair or unfair would seem to have more to do with human cognitive complexity than anything intrinsically unique to our species. In other words, what we’re witnessing here is a difference of degree rather than kind.

- Bernie Sanders is a Socialist and So Are You — Ted Rall:

Setting aside the rather idiotic idea of voting for a candidate because everyone else is voting for her […] I have to wonder whether an electorate that knows nothing about socialism is qualified to vote at all.

- Saturday Morning Breakfast Cereal:

- MMT and Bernie Sanders — Randy Wray at New Economic Perspectives:

I think people are enthusiastic to finally have a candidate who is not the Wall Street candidate. Bernie’s spending priorities match those of the vast majority of the population—and are not supported by the top 1% on Wall Street. I think that if elected Bernie would give us an updated version of Roosevelt’s New Deal. The original New Deal is what brought America into the 20th century. We need a similar effort to bring us into the 21st.

- Yanis Varoufakis: Australia is a ‘plaything’ of world economic forces it cannot control — Martin Farrer in the Guardian:

“Australia – especially Sydney and Melbourne – has always insulated itself from facts about the world. Aided and abetted by the remarkable flow of capital towards the property market in Sydney and Melbourne, it has created a false sense of wellbeing,” he told the Guardian.

- “Socialism is as American as apple pie” — Bernie Sanders, via Occasional Links and Commentary:

What this campaign, from my perspective, is about, and I say this in every speech that I give: It's not just electing Bernie Sanders to be president (and I surely would appreciate your support) but, very honestly, it is much more than that. Because no president, not Bernie Sanders or anybody else, can implement the kind of changes we need in this country unless millions of people begin to stand up and fight back.

- Recently Bought a Windows Computer? Microsoft Probably Has Your Encryption Key — Micah Lee at the Intercept:

One of the excellent features of new Windows devices is that disk encryption is built-in and turned on by default, protecting your data in case your device is lost or stolen. But what is less well-known is that, if you are like most users and login to Windows 10 using your Microsoft account, your computer automatically uploaded a copy of your recovery key — which can be used to unlock your encrypted disk — to Microsoft’s servers, probably without your knowledge and without an option to opt out.

- DDoSing a regulator: A how-to manual from Facebook’s Free Basics — Rohin Dharmakumar, Times of India Blogs:

[…] a DDoS attack is one in which the perpetrators use a large number of unwitting PCs and servers to launch an attack on a site, so as to prevent the latter from serving its legitimate users and performing its stated function. What Facebook had carefully and deliberately crafted in India was a method to overwhelm [India’s apex telecom regulator] TRAI with a distributed set of responses that didn’t have anything to do with its consultation paper or questions.

- Some Big Changes in Macroeconomic Thinking from Lawrence Summers — Adam S. Posen, Peterson Institute for International Economics RealTime Economic Issues Watch:

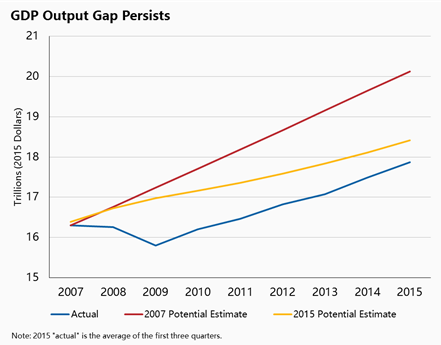

In a working paper the Institute just released, Olivier Blanchard, Eugenio Cerutti, and Summers examine essentially all of the recessions in the OECD economies since the 1960s, and find strong evidence that in most cases the level of GDP is lower five to ten years afterward than any prerecession forecast or trend would have predicted. In other words, to quote Summers’ speech at our conference, “the classic model of cyclical fluctuations, that assume that they take place around the given trend is not the right model to begin the study of the business cycle. And [therefore]…the preoccupation of macroeconomics should be on lower frequency fluctuations that have consequences over long periods of time [that is, recessions and their aftermath].”

The business cycle is dead. Hysteresis rules, OK? - The political aftermath of financial crises: Going to extremes — Manuel Funke, Moritz Schularick, Christoph Trebesch at VoxEU.org:

The typical political reaction to financial crises is as follows: votes for far-right parties increase strongly, government majorities shrink, the fractionalisation of parliaments rises and the overall number of parties represented in parliament jumps. These developments likely hinder crisis resolution and contribute to political gridlock. The resulting policy uncertainty may contribute to the much-debated slow economic recoveries from financial crises.

Sunday, 27 December 2015 - 5:59pm

This week, I have been mostly reading:

- Islamic State’s Goal: “Eliminating the Grayzone” of Coexistence Between Muslims and the West — Murtaza Hussain, The Intercept:

The [Charlie Hebdo] attack had “further [brought] division to the world,” the group said, boasting that it had polarized society and “eliminated the grayzone,” representing coexistence between religious groups. As a result, it said, Muslims living in the West would soon no longer be welcome in their own societies. Treated with increasing suspicion, distrust and hostility by their fellow citizens as a result of the deadly shooting, Western Muslims would soon be forced to “either apostatize … or they [migrate] to the Islamic State, and thereby escape persecution from the crusader governments and citizens,” the group stated, while threatening of more attacks to come.

- From Pol Pot to ISIS: the blood never dried — John Pilger, On Line Opinion:

The Americans dropped the equivalent of five Hiroshimas on rural Cambodia during 1969-73. They leveled village after village, returning to bomb the rubble and corpses. The craters left giant necklaces of carnage, still visible from the air. The terror was unimaginable. A former Khmer Rouge official described how the survivors "froze up and they would wander around mute for three or four days. Terrified and half-crazy, the people were ready to believe what they were told... That was what made it so easy for the Khmer Rouge to win the people over." A Finnish Government Commission of Inquiry estimated that 600,000 Cambodians died in the ensuing civil war and described the bombing as the "first stage in a decade of genocide". What Nixon and Kissinger began, Pol Pot, their beneficiary, completed.

- Thrashing Not Swimming — Craig Murray:

Indeed one of the many extraordinary features of this fervid political period is that the neo-cons (be they Tory or Blairite) who are so actively beating the drum for war, are the ones who absolutely refuse to acknowledge that the source of the poison is Saudi Arabia. Cameron today told Westminster that the head of the snake is in Raqqa. That is plainly untrue. The head of the snake is in Riyadh. But if your God is Mammon, that is blasphemy.

- My Carpet Liquidation Center Really is Going Out of Business This Time — Patrick McKay at McSweeney's Internet Tendency:

I’d always wanted to be a carpet liquidator. Way back when I first opened this place, I said, “Man, this is it. I’ve joined a community. I’m staying here forever.” The calendar pages dropped away as I made my home, waved to my neighbors, and swept the shattered glass below my driver’s side window every Monday morning. Then, it happened. Completely out of the blue, my carpet liquidation center that’d been going out of business for 11 straight years, was suddenly going out of business! And I never saw it coming!

- Accumulate, accumulate! Or not — David F. Ruccio:

What are U.S. corporations doing with all the surplus they’re managing to rake in? Well, they’re not investing it. Instead, they’re paying it out to shareholders and upper-management, buying back their stock and expanding their portfolios of financial assets, and hoarding the rest in cash. The net effect is to dampen the rate of economic growth and the creation of new jobs.

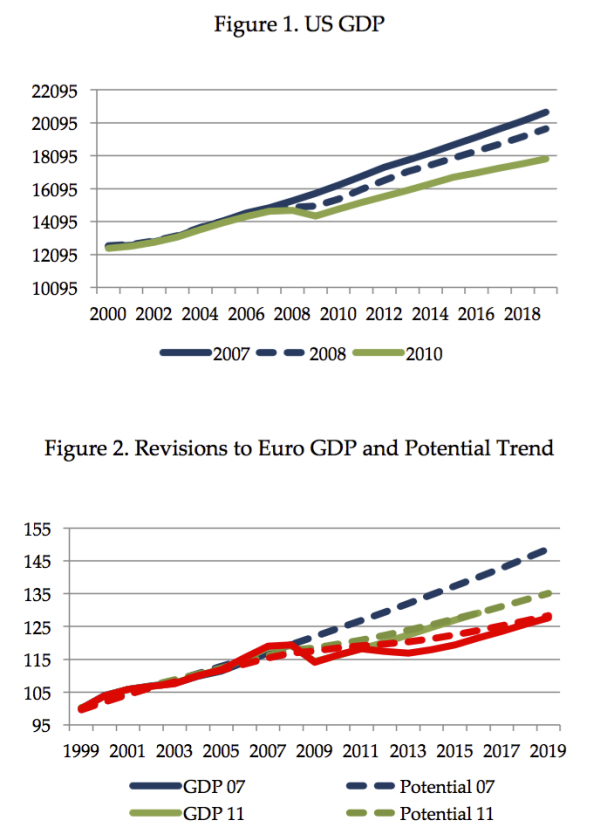

- ‘On the first day of Christmas, my true love gave to me’ … a bunch of econ charts! — Jared Bernstein and Ben Spielberg. Including my favourites, US GDP hysteresis:

… and the post-oil-shock pay/productivity gap:

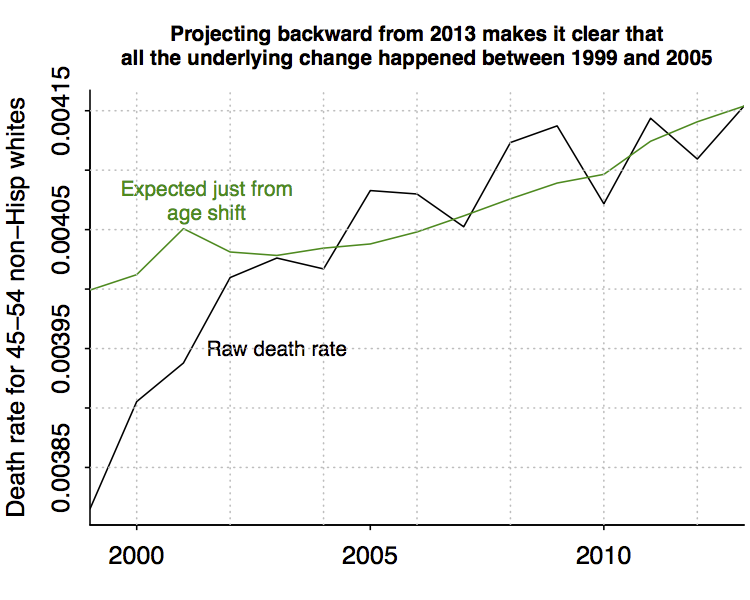

- First, second, and third order bias corrections — Andrew Gelman re-analyses the death rate data on middle-aged non-hispanic white Americans, which had provoked much scratching of heads (including mine). Apparently, apart from a small shift from 1998-2003, it's in line with what you'd expect as the baby boomers leave this cohort:

Sadly, despite my successful completion of the third-year "Advanced Social Research" unit at SCU (where the definition of "advanced", and for that matter "university", departs from common usage), I still have had no instruction in elementary statistics, so I can't comment on the validity of these corrections. - The Dangers of the Gates Foundation: Displacing Seeds and Farmers — From a presentation by Mariam Mayet, Other Worlds:

Monsanto and Pioneer Hi Bred, both US multinational companies, control most of the hybrid maize market in southern Africa. Through the acquisition of South Africa’s maize company, Panaar Seed, by Pioneer HiBred, hybrid pioneer [seeds] will make a lot of incursions [elsewhere] into Africa. We see and fear a great deal of social dislocation, of collapse of our farming systems – and it’s already happened. In industrialized-agriculture countries like South Africa, farmers have become completely deskilled and divorced from production decisions, which are made in laboratories or in far-away board rooms.

The Gates Foundation is a crony capitalist scam, not a charity. - The problem with self-driving cars: who controls the code? — Cory Doctorow in The Guardian:

A car is a high-speed, heavy object with the power to kill its users and the people around it. A compromise in the software that allowed an attacker to take over the brakes, accelerator and steering (such as last summer’s exploit against Chrysler’s Jeeps, which triggered a 1.4m vehicle recall) is a nightmare scenario. The only thing worse would be such an exploit against a car designed to have no user-override – designed, in fact, to treat any attempt from the vehicle’s user to redirect its programming as a selfish attempt to avoid the Trolley Problem’s cold equations. Whatever problems we will have with self-driving cars, they will be worsened by designing them to treat their passengers as adversaries.

- Pirate Bay Founder Builds The Ultimate Piracy Machine — Ernesto Van der Sar at TorrentFreak:

One of Peter [Sunde]’s major frustrations is how the entertainment industries handles the idea of copying. When calculating the losses piracy costs, they often put too much value on pirated copies. […] The “Kopimashin” makes 100 copies of the Gnarls Barkely track “Crazy” every second. This translates to more than eight million copies per day and roughly $10 million in ‘losses.’ […] The Kopimashin does make real copies of the track, but they are sent to /dev/null, which means that they are not permanently stored. The most important message, however, is that the millions of dollars in losses the industry claims from him and the other TPB founders are just as fictitious as the number displayed on the Kopimashin.

- Australia – wages growth at record low as redistribution to profits continues — Bill Mitchell:

What is clear is that since the September-quarter 1997, real wages have grown by only 11.4 per cent (so just over 0.6 per cent on average per year), whereas hourly labour productivity has grown by 28.9 per cent (or 1.7 per cent on average per year). This is a massive redistribution of national income to profits and away from wage-earners and the gap is widening each quarter.

Sunday, 20 December 2015 - 9:20pm

This week, I have been mostly miserable and sleeping my way out through it, but also reading:

- You may soon need a licence to take photos of that classic designer chair you bought — Glyn Moody at Ars Technica UK:

Changes to UK copyright law will soon mean that you may need to take out a licence to photograph classic designer objects even if you own them. That's the result of the Enterprise and Regulatory Reform Act 2013, which extends the copyright of artistic objects like designer chairs from 25 years after they were first marketed to 70 years after the creator's death. In most cases, that will be well over a hundred years after the object was designed. During that period, taking a photo of the item will often require a licence from the copyright owner regardless of who owns the particular object in question.

- Lightbulb DRM: Philips Locks Purchasers Out Of Third-Party Bulbs With Firmware Update — Tim Cushing at Techdirt:

The world of connected devices is upon us and things have never been better. Criminals can access your email account by breaking into your fridge. Your child's toys and your television record your conversations and send them to manufacturers' servers, where criminals are (again) able to access them. Your home thermostat goes HAL 9000 and attempts to set your house on fire. And, now, your lightbulbs won't do the one thing you expect them to do: produce light.

- Saturday Morning Breakfast Cereal:

- Young people who question Government or media may be extremists, officials tell parents — Jon Stone, The Independent:

A leaflet drawn up by an inner-city child safeguarding board warns that “appearing angry about government policies, especially foreign policies” is a sign “specific to radicalisation”. Parents and carers have also been advised by the safeguarding children board in the London Borough of Camden that “showing a mistrust of mainstream media reports and a belief in conspiracy theories” could be a sign that children are being groomed by extremists.

Scarfolk is alive and well in Camden. - Caring doesn't scale — Brian Sletten in the service of O'Reilly's ego:

If the cost of integration falls to almost nothing it becomes easier to support casual interactions. They may turn into more formal, long-lived integrations down the road, but for now we can exchange information with anyone at any time about any subject for way less effort than you probably can imagine given the pains you have seen elsewhere. Our ability to do anything with this information isn't immediately guaranteed, but freeing it from silos is the first step.

Sunday, 13 December 2015 - 5:23pm

This week, I have been mostly letting the reading slide, with some exceptions:

- To Weld, Perchance, to Dream — Simon Critchley in the New York Times:

The pre-Socratic thinker Thales falls into a ditch because he’s too busy contemplating the heavens and their origins. A Thracian serving girl is said to have laughed heartily at Thales’ pratfall. And that’s how I like to think about philosophy: it doesn’t so much begin in the confined elegance of Oxbridge tutorials as in a ditch with a nasty bruise on one’s head and possibly some ligament damage.

- It's Too Late to Turn Off Trump — Matt Taibbi is mad as hell and not going to take it anymore, in Rolling Stone:

This world of schlock stereotypes and EZ solutions is the one experience a pampered billionaire can share with all of those "paycheck-to-paycheck" voters the candidates are always trying to reach. TV is the ultimate leveling phenomenon. It makes everyone, rich and poor, equally incapable of dealing with reality.

- Do Not Ask Western Leadership to Fix Anything — Ian Welsh:

If you want to fix any problem in the West, or have the West be helpful for fixing any global problem, you need to fix the Western leadership class. That means fixing Western media, education, corporations, etc, etc. The list is long, because they have deliberately broken virtually everything to turn it into an opportunity for a very few people to become richer. If you are British, you have a decent, honorable man who actually wants to do almost all the right things: Corbyn. Get to work supporting him, however you can. If he goes down, the political class will take it as a lesson that trying to help ordinary people is a really bad idea.

- One Night in Kunduz, One Morning in New York — Laura Gottesdiener, TomDispatch:

At 2:56 a.m., on the morning of the attack, an MSF representative in Kabul again texted an official of the American-led mission, demanding an end to the strikes, which had lasted nearly an hour. By then, flames had overtaken the main building, with children still trapped inside. Abdul Manar, a caretaker at the hospital, recalled the sound of their cries. "I could hear them screaming for help inside the hospital while it was set ablaze by the bombing," he told Al Jazeera.

- Hysteresis and Monetary Policy — Bill Craighead:

In macroeconomics, hysteresis occurs when an economic downturn has a lasting effect on economic capacity (i.e., reduced "potential output"); that is, lack of demand creates its own lack of supply. […] People with spells of long-term unemployment have a harder time finding jobs. But looking at the unemployed leaves out those who left the labor force entirely. The last several years have seen a significant drop in labor force participation rates, even among people aged 25-54. […] the unemployment (and presumably the depressed participation rate, too) is "structural" in nature, and not amenable to any improvement in aggregate demand that might be generated with expansionary monetary policy.

Sunday, 6 December 2015 - 6:58pm

This week, I have been mostly reading:

- Leftie Come Lately — Ted Rall:

- How New Zealand fell further behind — John Quiggin in Inside Story:

Australians of all political persuasions understand that “reform” is code for harder work, lower pay and a more unequal distribution of income, and “austerity” means cuts in tax for the rich and cuts in services and benefits for everyone else. On these criteria, we are indeed trailing most of the English-speaking world. All the advocates of reform and austerity need to do now is convince us that these countries are outperforming us on the measures that count. This is difficult, to put it mildly.

- Dream of New Kind of Credit Union Is Extinguished by Bureaucracy — Nathaniel Popper, NYT: The only good thing about Bitcoin is that it keeps the avaricious and gullible so preoccupied that they are limited in the harm they can do to anyone else. However, killing off a Brewster Kahle project is like kneecapping Santa Claus on December 24th.

'The original vision of this thing — of helping nonprofit workers, or helping the poor — they will not allow it,' Mr. Kahle said.

- Modern Monetary Theory and Value Capture — Bill Mitchell:

Public sector infrastructure developments push up land values in nearby areas and deliver windfall gains to land owners sometimes well in excess of the initial outlays required to fund the project in question. […] Land Value Capture this aims to ensure that those who gain windfall profits from land holdings that skyrocket in value because of a particular government decision (rezoning, infrastructure project etc) pay for some or all of the project.

- Moral Blankness — George Monbiot:

In leaked correspondence with the Conservative leader of Oxfordshire County Council (which covers his own constituency), David Cameron expresses his horror at the cuts being made to local services. This is the point at which you realise that he has no conception of what he has done.

- Gendering The Making of Modern Finance? — Adrienne Roberts at Progress in Political Economy makes some intriguing observations about and around this year's blockbuster book of historical political economy. For example:

Like all financial frauds, the practice of shaving metal off the edges of coins is inextricably tied to the social markers of gender and class. Women’s participation in this practice was conditioned by their relation with the market and with silver, which, as Knafo points out, was associated with daily transactions, whereas gold was associated with mercantile activities.

- What if the adventure chooses you? — Jonathan Rees:

Personalized learning, the pitch goes, allows professors to spend less time doing things that others can do better (like lecture), you can spend more time helping students learn. Unfortunately, like Lucy and Ethel in that chocolate factory back in the 1950s, it is easy for your employers to speed up your line by giving you more students – particularly if you work in an online setting where the size of the classroom is no longer a limiting factor.

"Professor"? What's a professor? - The Philanthropy Hustle — Linsey McGoey in Jacobin:

In 2014, the Gates Foundation announced an $11 million grant to Mastercard to establish a financial inclusion “lab” in Nairobi, Kenya. The grant will last three years, after which Mastercard has indicated that, should the venture prove sufficiently lucrative, the company may be willing to foot the bill for further financial expansion in the region. […] The gift to Mastercard — and it is a gift, rather than a loan or an equity investment — is the latest in a long list of donations that the Gates Foundation has offered to the world’s wealthiest corporations. From Vodafone, a British company notorious for paying zero corporate tax in the United Kingdom, to leading education companies such as Scholastic Inc., the Gates Foundation doesn’t simply partner with for-profit companies: it subsidizes their bottom-line.

- Friction is now between global financial elite and the rest of us — Robert Reich in the Guardian:

Fifty years ago, when General Motors was the largest employer in America, the typical GM worker earned $35 an hour in today’s dollars. By 2014, America’s largest employer was Walmart and the typical entry-level Walmart worker earned about $9 an hour. This does not mean the typical GM employee half a century ago was “worth” four times what the typical Walmart employee in 2014 was worth. The GM worker was not better educated or motivated than the Walmart worker. The real difference was that GM workers 50 years ago had a strong union behind them that summoned the collective bargaining power of all carworkers to get a substantial share of company revenues for its members.

- Republicans’ Lust for Gold — Paul Krugman, NYT:

[T]he Friedman compromise — trash-talking government activism in general, but asserting that monetary policy is different — has proved politically unsustainable. You can’t, in the long run, keep telling your base that government bureaucrats are invariably incompetent, evil or both, then say that the Fed, which is, when all is said and done, basically a government agency run by bureaucrats, should be left free to print money as it sees fit.

- Friday lay day – Is MMT applicable to the Eurozone? — Bill Mitchell provides an introduction to the German translation of Warren Mosler's book The Seven Deadly Innocent Frauds of Economic Policy, which also serves as a handy summary of same:

The use of the term – Innocent Frauds – is Mosler’s generous interpretation of the way that these myths emerge and are sustained in the public domain. […] Among this list of dolts who push ‘innocently’ these tawdry lies are “mainstream economists, the media, and most of all, politicians”. One could easily dispute the presumption of innocence. There is ample evidence that across each of these cohorts a more sinister agenda pervades – one that is centred on class control and developing conditions that permit the maximum redistribution of national income to the top end of the income distribution.

- Students Left in Crushing Debt as For-Profit College Empire Collapses — Mark Karlin, Buzzflash: But the higher ed. bubble isn't burst till the public system goes under…

Sunday, 29 November 2015 - 11:25am

- Internet or Intifada? — Shlomo Ben-Ami, Project Syndicate:

According to Israeli Prime Minister Binyamin Netanyahu, the ongoing wave of knife attacks on Jews by young Palestinian “lone wolves” can be blamed entirely on incitement by Palestinian Authority and Islamist websites. Netanyahu evidently expects Israelis, and the world, to believe that if these sites were posting cat videos, the Palestinians would cease their agitation and submit quietly to occupation.

- What We Know About the Computer Formulas Making Decisions in Your Life — Lauren Kirchner, ProPublica:

Sophisticated algorithms are now being used to make decisions in everything from criminal justice to education. But when big data uses bad data, discrimination can result. […] Here are a few good stories that have contributed to our understanding of this relatively new field.

- The Ever-Growing Ed-Tech Market — Angela Chen, The Atlantic:

The testing and assessment market, which raked in $2.5 billion during the reported year, was the single largest category of any segment. The assessment market increased so quickly because of the growth of test-friendly Common Core standards a few years back when this data was being collected, Billings explained. She added that—given President Barack Obama’s recent push to limit testing in schools—the segment may soon see a testing pushback that will hurt revenue down the road.

- The Most Brazen Corporate Power Grab in American History — Chris Hedges in Truthdig:

Wages will decline. Working conditions will deteriorate. Unemployment will rise. Our few remaining rights will be revoked. The assault on the ecosystem will be accelerated. Banks and global speculation will be beyond oversight or control. Food safety standards and regulations will be jettisoned. Public services ranging from Medicare and Medicaid to the post office and public education will be abolished or dramatically slashed and taken over by for-profit corporations. Prices for basic commodities, including pharmaceuticals, will skyrocket. Social assistance programs will be drastically scaled back or terminated. And countries that have public health care systems, such as Canada and Australia, that are in the agreement will probably see their public health systems collapse under corporate assault.

- Ongoing crises of capitalism — David F. Ruccio:

This persistent crisis of capitalism, which was ignored by mainstream economists, also challenges the mainstream traditions of explaining business cycles by technology shocks and of separating long-term growth dynamics from short-run business cycles.

- Workers’ Control in Academia — Jonathan Rees in The Academe Blog:

Faculty-centered online education can be both convenient for students and pedagogically innovative. Quite simply, professors can do extraordinary things using digital tools in online, hybrid and regular face-to-face classes. Unfortunately, that assumes that their administrators let them. If the online course universe is controlled by Associate Deans trying to make a name for themselves and populated entirely by adjunct faculty who cannot control their own courses, these minor technological miracles are unlikely to happen.

- Is economics a science? — Invisible hand-waving:

For Lakatos, the hallmark of a ‘progressive’ scientific research programme is not whether it is falsifiable. […] Rather, the hallmark of a progressive scientific research programme is whether or not the theory makes successful novel predictions. In other words, is the theory is able to successfully predict new phenomena which it was not originally built to explain?

- Limits of the profit motive — Chris Dillow:

My point here is not to decry the profit motive. It has a place. But that place must be circumscribed not only by the regulation of predatory capitalism but also by greater socialization of investment to exploit and develop new technologies and by a more widespread ownership of capital - via worker ownership, a sovereign wealth fund or more widespread participation in equity markets.

- Edward Snowden Explains How To Reclaim Your Privacy — Micah Lee at The Intercept: It's scary how few of these things I do, even though I know better.

- Beware of ads that use inaudible sound to link your phone, TV, tablet, and PC — Dan Goodin, Ars Technica:

The ultrasonic pitches are embedded into TV commercials or are played when a user encounters an ad displayed in a computer browser. While the sound can't be heard by the human ear, nearby tablets and smartphones can detect it. When they do, browser cookies can now pair a single user to multiple devices and keep track of what TV commercials the person sees, how long the person watches the ads, and whether the person acts on the ads by doing a Web search or buying a product.

- I was held hostage by Isis. They fear our unity more than our airstrikes — Nicolas Hénin in the Guardian:

Why France? For many reasons perhaps, but I think they identified my country as a weak link in Europe – as a place where divisions could be sown easily. That’s why, when I am asked how we should respond, I say that we must act responsibly. And yet more bombs will be our response.

- The Cannibalized Company — Karen Brettell, David Gaffen and David Rohde for Reuters:

Share repurchases are part of what economists describe as the increasing “financialization” of the U.S. corporate sector, whereby investment in financial instruments increasingly crowds out other types of investment.

- Privatisations: why we need a fiscal watchdog — Simon Wren-Lewis:

The key point with privatisations is that reducing current debt may harm the health of the public finances. Any normal investor would only sell an asset if they thought they could get a price that exceeded what the asset was really worth. Although selling the asset would reduce the government’s net borrowing today, it would increase their net borrowing in the future because the government would not get the dividends the shares paid out.

- 'Economic Policy Splits Democrats' — Mark Thoma at Economist's View:

So, should I adopt a message I don't think is true because it sells with independents who have been swayed by Very Serious People, or should I say what I believe and try to convince people they are barking up the wrong tree? (For the most part anyway, I believe both the technological/globalization and institutional/unfairness explanations have validity -- but how do workers capture the gains Third Way wants to create through growth and wealth creation without the bargaining power they have lost over time with the decline in unionization, threats of offshoring, etc.? That's the bigger problem.)

- Reform Won’t Do It, Australian Universities Need Revolution — Kristen Lyons and Richard Hil in New Matilda:

If, as community economy advocates argue, non-market (including household) activities represent an estimated 30 to 50 per cent of all work, then why do universities continually genuflect to market principles? And given that non-market work has a potentially greater impact on social wellbeing, why don’t we take more time to understand its value in education and other domains? There is plenty of evidence to suggest that such non-market practices – including the diverse activities that make up the informal and exchange economy – are not only basic to meeting human needs, but can (through a more civic orientation) contribute significantly to the “good life”, with educators and students playing their part as active change agents.

- The End of the Humanities? — Martha Nussbaum interviewed by James Garvey for The Philosophers' Magazine:

“Philosophy is constitutive of good citizenship. It’s not just a means to it. It becomes part of what you are when you are a good citizen – a thoughtful person. Philosophy has many roles. It can be just fun, a game that you play. It can be a way you try to approach your own death or illness or that of a family member. It has a wide range of functions in human life. Some of them are connected to ethics, and some of them are not. Logic itself is beautiful. I’m just focusing on the place where I think I can win over people, and say ‘Look here, you do care about democracy don’t you? Then you’d better see that philosophy has a place.’”

- Reading The Making of Modern Finance as an Invitation to Critical Uses of History — Christine Desan, Progress in Political Economy:

The modern monetary system depends, then, on a kind of cash that depends on public debt. But the value of public debt depends in turn on the value attributed to cash. In other words, there is an irreducibly political aspect to the most basic medium of the market. There is no working exchange without a governance decision (and constant re-decision) about the value of money.

- Private infrastructure finance and secular stagnation — John Quiggin at Crooked Timber:

The financialization of the global economy has produced a hugely costly financial sector, extracting returns that must, in the end, be taken out of the returns to investment of all kinds. The costs were hidden during the pre-crisis bubble era, but are now evident to everyone, including potential investors. So, even massively expansionary monetary policy doesn’t produce much in the way of new private investment.

- Decoding the Design of Money — Christine Desan provides a précis of her new book, which sounds like a corker:

Corrected for inflation, the modern money supply in England is more than 65-times larger than it was when the Bank was established. That abundance follows from the modern mode of money creation: rather than bringing bullion to the mint, an applicant brings a promise of productivity to a banker. If the industry now in charge of the money supply finds the pitch credible, money issues. […] Just as striking, the modern design for money creation renders the system susceptible to new fragilities, given its reliance on finance-based expansion. Rather than the harsh limits on liquidity that haunted the Middle Ages, we have the booms and busts, the bubbles and bank runs associated with a money supply based on fiat credit creation and cleared in a far smaller reserve comprised of the sovereign unit of account.

- First They Jailed the Bankers, Now Every Icelander to Get Paid in Bank Sale — Claire Bernish, Anti-Media:

If Finance Minister Bjarni Benediktsson has his way — and he likely will — Icelanders will be paid kr 30,000 after the government takes over ownership of the bank. […] Because Icelanders took control of their government, they effectively own the banks. Benediktsson believes this will bring foreign capital into the country and ultimately fuel the economy — which, incidentally, remains the only European nation to recover fully from the 2008 crisis. Iceland even managed to pay its outstanding debt to the IMF in full — in advance of the due date.

- Despair, American Style — Paul Krugman, NYT:

Basically, white Americans are, in increasing numbers, killing themselves, directly or indirectly. Suicide is way up, and so are deaths from drug poisoning and the chronic liver disease that excessive drinking can cause. We’ve seen this kind of thing in other times and places – for example, in the plunging life expectancy that afflicted Russia after the fall of Communism. But it’s a shock to see it, even in an attenuated form, in America.

- A shift towards industry-relevant degrees isn’t helping students get jobs — Richard Hil and Kristen Lyons, the Conversation:

Skills and knowledge “competencies”, “attributes” and other measures of performance have turned traditionally accepted pedagogical priorities like “critical thinking” into commodities marketed at prospective employers through e-portfolios and job-ready CVs. Although the humanities, arts and social sciences continue to make up two-thirds of the undergraduate intake, these areas have been subjected to deep cuts or, as in the case of La Trobe University, fine-tuned to meet industry needs, or abandoned altogether (as occurred at QUT) in favour of “creative industries”.