reading

Sunday, 3 July 2016 - 4:49pm

This week, I have been mostly not reading, with some exceptions:

- Ignored for Years, a Radical Economic Theory Is Gaining Converts — Michelle Jamrisko in Bloomberg, no less:

“There’s an acknowledgment, even in the investor community, that monetary policy is kind of running out of ammo,” said Thomas Costerg, economist at Standard Chartered Bank in New York. “The focus is now shifting to fiscal policy.” That’s where it should have been all along, according to Modern Money Theory. The 20-something-year-old doctrine, on the fringes of economic thought, is getting a hearing with an unconventional take on government spending in nations with their own currency.

- How I Stopped Worrying and Learned to Love the Drone — Ted Rall:

- E.J Dionne Is Far Too Generous, “Moderate Progressives” Were Promoting Inequality — Dean Baker, CEPR:

It's also worth noting that Clinton's cult of deficit reduction and balanced budgets contributed to the victory of austerity politics following the downturn. Many Clintonites absurdly argued that the prosperity of the late 1990s was due to the fact that Clinton balanced the budget and subsequently ran surpluses. Of course the reality was the exact opposite. (The unexpected boom, due to a stock bubble, lead to the surpluses.) Nonetheless, the power of this Clinton myth made it more difficult for progressives to push the case for stimulus following the collapse of the housing bubble.

- The Era of Free Trade Might Be Over. That’s a Good Thing — Jared Bernstein:

So we should welcome the end of the era of F.T.A.s, which had long devolved into handshakes between corporate and investor interests on both sides of the border, allowing little voice for working people. With such noise behind us, we might be ready to foster the next generation of advanced production and help our exporters fight back against currency manipulators. That would be more productive than fighting tooth and nail over the next big trade deal.

Plus additional remarks on his blog, "where real estate is dirt cheap". - The New Truth About Free Trade — Robert Reich notices the US has spent decades negotiating the export of monopolies and the import of monopoly rents:

Big American corporations no longer make many products in the United States for export abroad. Most of what they sell abroad they make abroad. The biggest things they “export” are ideas, designs, franchises, brands, engineering solutions, instructions, and software, coming from a relatively small group of managers, designers, and researchers in the U.S. The Apple iPhone is assembled in China from components made in Japan, Singapore, and a half-dozen other locales. The only things coming from the U.S. are designs and instructions from a handful of engineers and managers in California.

- Both sides now. — Jonathan Rees:

Yes, MOOCs can’t do what professors do, but what happens if what you do gets redefined so that they can? You know that education is not the same as content transmission, but unless you stay engaged with all the two-bit hucksters who think it is they will win the battle of public opinion and your tenured sinecure will dry up when your students all enroll at some barely acceptable online clown college.

- Global Inequality: Branko Milanovic Takes on the World — Dean Baker in HuffPo:

It is more than a bit absurd that many intellectual types are running around worried that the robots will take all the jobs (when they aren’t worried about the demographic crisis creating a shortage of workers) when the “problem” can be easily solved by reducing work hours. But this issue actually segues nicely into my more fundamental criticism of [Milanovic's] book. While it does not outright say this anywhere, many readers will likely believe that the harm to the middle class and working class in rich countries was a necessary price for the gains in the developing world. This is a huge leap which certainly does not follow from standard economic theory. […] There is also the question of intellectual property rights, which Milanovic frustratingly treats as a fact of nature. Again, one of the great absurdities of debates on inequality is that we have people wringing their hands over how we can reverse the upward redistribution of income, while we constantly write new laws and trade agreements that make patent and copyright protection longer and stronger. Instead of deliberately designing policies that promote upward redistribution, we could instead look to alternative mechanisms to finance innovation and creative work.

Sunday, 26 June 2016 - 5:20pm

This week, I have been mostly reading:

- How Bernie Gives Hope for the Future — Ian Welsh provides a nuanced and pursuasive variant on the "nothing left to lose" argument for social change, to which I've never subscribed, but hey, you take your hope where you can get it:

This is not the 2000s or 90s. This is not the age of compromise. The fruits of neoliberalism, neoconservatism, and oligarchy are being reaped; the youngsters have now grown up and never known a good economy. Many barely remember a time when the US wasn’t at war. […] The Democrats are the conservative party right now. They are about the status quo: Keep neo-liberaling, keep bombing and invading brown people’s countries, keep shoveling money to the rich. […] But Bernie lost in a genuinely hopeful way, showing that a socialist is now viable in the US and that young people are massively against the status quo.

- On decriminalizing the sex trade — Chris Dillow:

Here, though, is the thing. I – and I, strongly suspect, Mr Corbyn too – favour legalization of the sex industry in the context of other policies that empower women to reject exploitation. For me, these include full employment policies to give them other career possibilities; a mass housebuilding programme to reduce rents; and – of course - a basic income to improve their outside options.

- What Will Many Bernie Sanders Voters Do After July? — Ralph Nader in Common Dreams:

Here we go again. Every four years, the Democratic leaders define the Democratic candidate by how bad the Republicans are. This is designed to panic and mute their followers. Every four years, both parties become more corporatist. Sanders’ voters want to define the Democratic Party by how good it can be for the people. […] Where does this leave the Sanders people who see Hillary as experienced in waging wars, qualified as an entrenched pol, and realistic to suit the plutocracy’s tastes, and not really getting much of anything progressive done (alluding to the ways she has described herself)?

- The trouble with getting the BBC to be less popular — David Mitchell, who—damn him—is still occasionally funny, in the Guardian:

A report, commissioned by the Department for Culture, Media and Sport and published last week, argues that “greater distinctiveness” in the BBC’s output will allow its commercial rivals to make an extra £115m a year. […] Unfortunately the distinctiveness of a Hitchcock movie, a Lowry painting or a Cole Porter lyric doesn’t seem to be the sort the report is getting at, because that’s a kind people really like. That would be entirely counterproductive to its stated aims. By “distinctiveness”, the report means that the BBC should deliberately target smaller and more niche audiences, in order to allow the commercial sector to take the bigger ones. Its distinctive flavour would be less like chicken liver and more like calves’ brains. Because that would be fairer on the market place.

- Paul Samuelson on Deficit Myths — L. Randall Wray at New Economic Perspectives:

[…] the need to balance the budget over some time period determined by the movements of celestial objects, or over the course of a business cycle is a myth, an old-fashioned religion. But that superstition is seen as necessary because if everyone realizes that government is not actually constrained by the necessity of balanced budgets, then it might spend “out of control”, taking too large a percent of the nation’s resources. Samuelson sees merit in that view. It is difficult not to agree with him. But what if the religious belief in budget balance makes it impossible to spend on the necessary scale to achieve the public purpose? […] We don’t need myths. We need more democracy, more understanding, and more transparency. We do need to constrain our leaders—but not through dysfunctional superstitions.

- The Fed shouldn’t accept the “new normal” without a fight — Josh Bivens at the Economic Policy Institute:

[A] key contributor to productivity growth is technological advance. This technological advance does not fall from the sky, rather it is the product of directed investment (R&D) and trial and error (workers learning by doing). When the pace of R&D investment is slow and output growth is slow enough to provide fewer opportunities for learning by doing, it is not shocking that technological advancement may slow. Further, there is ample evidence that firms boost labor-saving investments (which boost productivity) when labor costs are rising rapidly. Rapid labor cost growth has not been a feature of the recovery from the Great Recession. Between 2007 and 2014, real hourly pay for the median worker, for example, has slightly declined (see Table 1 here), and the share of corporate sector income accruing to capital owners rather than to employees reached historic highs. This labor market slack and weak wage growth has provided very little spur to boost productivity in the search for higher profits.

- How negative-gearing changes can bring life back to eerily quiet suburbs — Kim Dovey in The Conversation:

It is impossible to say how much this production of empty architecture is a function of negative gearing since it also goes hand-in-hand with neoliberal markets and high disparities of wealth. However, the curbing of negative gearing will have a significant impact in getting empty housing onto the market. This in turn could go some way to reversing this cycle of emptiness – bringing life to the shops, offices, streets, parks and public transport.

- It's Time to Rid the DNC of DINOs, Starting With the Chair — by a gestalt creature called The Daily Take Team, from The Thom Hartmann Program:

Jim Fouts, a three-term Independent mayor of Warren, Michigan, attended Sunday's Democratic debate, just like he had attended the Republican debate on Thursday. […] He told BuzzFeed News that he was seated behind Wasserman Schultz, and that he was praising Bernie's performance and talking about how this debate proved that more debates were a good idea for the Democrats. Then, during an early commercial break, Fouts and his assistant were taken out of their seats and the sergeant at arms told him, "The people that run this want you ejected, they don't want you here." Fouts was allowed to watch the rest of the debate from his seat, but he had to be careful about even clapping too loud or at the wrong time, for fear of getting ejected. […] Debbie Wasserman Schultz isn't the only Democrat-In-Name-Only (DINO) in the Democratic leadership. But as the DNC Chair, she is the highest-ranking DINO in the party.

Tim Canova will take her seat in Congress, but Clinton is sure to give her a plum job elsewhere, for services rendered during the primaries. - On the results of the UK referendum — DiEM25:

OUT won because the EU establishment have made it impossible, through their anti-democratic reign (not to mention the asphyxiation of weaker countries like Greece), for the people of Britain to imagine a democratic EU.

- The American Fascist — Robert Reich:

As did the early twentieth-century fascists, Trump is focusing his campaign on the angers of white working people who have been losing economic ground for years, and who are easy prey for demagogues seeking to build their own power by scapegoating others. […] As the Washington Post’s Jeff Guo has pointed out, Trump performs best in places where middle-aged whites are dying the fastest.

- Whither Europe? The Modest Camp vs the Federalist Austerians — Yanis Varoufakis and James Galbraith:

Soon after the Great Crisis of the Eurozone struck, Europe decided to treat it piecemeal – as though each affected country had committed separate and unrelated policy errors. The governing institutions of Europe denied that the difficulties of Greece, Ireland, Spain, Portugal and Italy could be part of a single disaster, spanning at once the realms of banking, public debt and investment.

- Negative Gearing. It's turning us into a nation of landlords and serfs — Peter Martin:

The great Australian dream meant owning your own home. "Getting ahead" means getting ahead of someone else. It's how Treasurer Scott Morrison sees the Australian dream. […] It's certainly what negative gearing is about. "The vast bulk of Australians who use negative gearing are just trying to get ahead and trying to get their family in a better position," Morrison says. But negative gearing only gets them ahead if prices climb. The more that people negatively gear in order to get ahead, the more prices climb. The further they climb, the harder houses become to buy. And the harder they become to buy, the more the Australian dream recedes.

- Whittingdale is wrong: it is advertisers who are destroying the digital economy — Alexander Hanff in openDemocracy:

Publishers feel like they have no control over the type of ads being forced on them by adtech companies and advertising agencies. This is a situation that needs to change – publishers should control all of the content they publish – including ads; and traditionally that was always the case. […] Advertisers and brands need to understand that their route to the audience is via the publishers whose content they are poisoning through invasive technologies and an ever increasing greed for more and more data. They need to purify the water before they can persuade us to start drinking it again – they need to stop tracking and profiling us, they need to better police their networks and platforms to eliminate malvertising and they need to yield control of the experience back to the publishers who own the audience.

[Needless to say, we should object to being considered "owned" by publishers as well.]

Sunday, 19 June 2016 - 9:29pm

This week, I have been mostly reading:

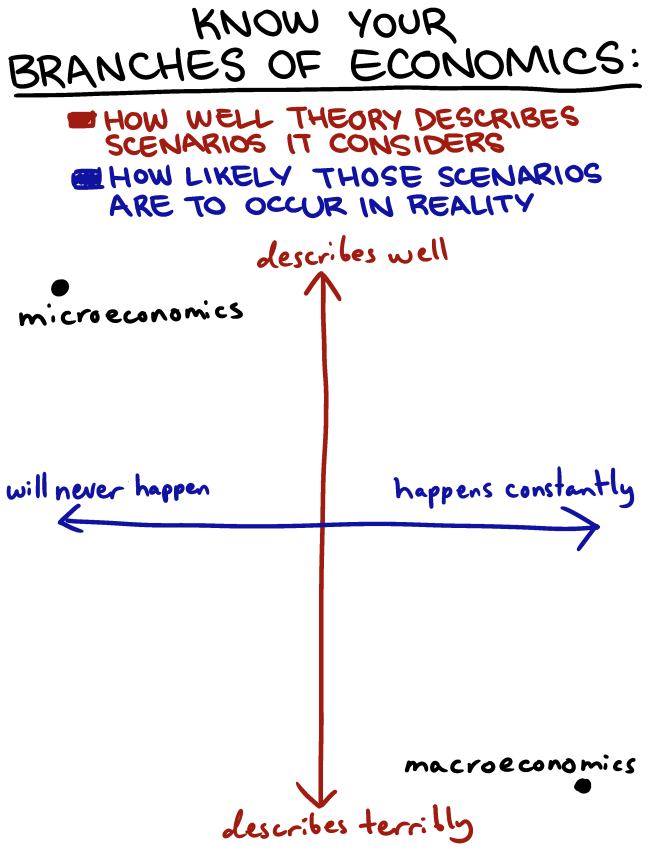

- Saturday Morning Breakfast Cereal (via Timothy Taylor):

- The rise of Donald Trump — Dean Baker, Real World Economics Review Blog:

Whatever the final outcome of the presidential race, Trump has exposed a sense of extreme anger among large segments of the population. These people are unhappy about economic policies that have undermined their financial security. Their anger may be misdirected towards immigrants or other countries, but it is not about to go away unless the policies change.

- Larry Fink and His BlackRock Team Poised to Take Over Hillary Clinton’s Treasury Department — David Dayen at The Intercept:

BlackRock is far from a household name, but it is the largest asset management firm in the world, controlling $4.6 trillion in investor funds — about a trillion dollars more than the annual federal budget, and five times the assets of Goldman Sachs. And Larry Fink, BlackRock’s CEO, has assembled a veritable shadow government full of former Treasury Department officials at his company. […] And his priorities appear to be so in sync with Clinton’s that it’s not entirely clear who shares whose agenda. Clinton, for her part, has refused to rule out a treasury secretary drawn from Wall Street.

- Joe Wilson to Hillary Clinton in 2010: Baghdad “Has Been Bled to Death” — Zaid Jilani in The Intercept:

My trip to Baghdad (September 6-11) has left me slack jawed. I have struggled to find the correct historical analogy to describe a vibrant, historically important Middle Eastern city being slowly bled to death. Berlin and Dresden in World War II were devastated but they and their populations were not subjected to seven years of occupation that included ethnic cleansing, segregation of people by religious identity, and untold violence perpetrated upon them by both military and private security services. […] The service people don’t see themselves there to bring peace, light, joy or even democracy to Iraq. They are there to kill the “camel jockeys.”

- Why Trump? — George Lakoff:

Language that fits [a conservative or progressive] worldview activates that worldview, strengthening it, while turning off the other worldview and weakening it. The more Trump’s views are discussed in the media, the more they are activated and the stronger they get, both in the minds of hardcore conservatives and in the minds of moderate progressives. This is true even if you are attacking Trump’s views. The reason is that negating a frame activates that frame, as I pointed out in the book Don’t Think of an Elephant! It doesn’t matter if you are promoting Trump or attacking Trump, you are helping Trump.

- The Federal Reserve and the Global Fracture — Antti J. Ronkainen interviews Michael Hudson:

The aim of lowering interest rates was to provide banks with cheap credit. The pretense was that banks might lend to help the economy get going again. But the Fed’s idea was simply to re-inflate the Bubble Economy. It aimed at restoring the value of the mortgages that banks had in their loan portfolios. The hope was that easy credit would spur new mortgage lending to bid housing prices back up – as if this would help the economy rather than simply raising the price of home ownership. […] Banks did make money, but not by lending into the “real” production and consumption economy. They mainly engaged in arbitrage and speculation, and lending to hedge funds and companies to buy their own stocks yielding higher dividend returns than the low interest rates that were available.

- RICHARD KOO: The 'struggle between markets and central banks has only just begun' — David Scutt of Business Insider Australia points us towards this illustration of how trying to increase the amount of broad money by issuing base money is "pushing on a string":

- The Unemployment Rate Isn’t Used to Keep Unemployment Low (With Graph) — Ian Welsh:

So, the unemployment rate from late 70s and on, has been used to determine if wages should cause inflation, and to then raise interest rates to make sure they don’t. Not incidentally, the result is also to crush wages, because, essentially, wages that improve are nothing more than wages that increase faster than non-wage inflation. The unemployment rate not only doesn’t measure how good the economy feels for ordinary people, it was actually used, with purposeful action, to crush wages.

- There's more than one way to kill negative gearing — Peter Martin:

Before John Howard halved the headline rate of capital gains tax at the turn of the century, negative gearing was relatively unattractive. Landlords as a group made money. In 1999-2000 they made a combined $219 million. Ever since then they've lost money. In 2012-13 they lost a net $5.4 billion... Capital gains matter because they are the mechanism negative gearers use to make money. The profits they make from eventually selling their properties are meant to exceed their annual losses from rent. A cut-rate capital gains tax makes those profits more likely. Investors can write off their annual losses at the full tax rate and pay tax on their eventual profits at only half the rate.

- Exit Planning — Thomas Geoghegan in The Baffler:

Toe-to-toe, it’s the elderly and not the robots who are taking jobs from the young. […] The more we shrink the welfare state—I mean cut back on private pensions, Social Security, and Medicare so that older Americans must stay in the workforce—the harder it is for a young person to land a job. D.C. think tanks love to tell the elderly that we’re really in fine shape and that it is our duty to keep on working. To an audience of older college grads, like me, they say, “Hang on to those college-type jobs.” At the same time, they push more young people into college. Isn’t this a contradiction? It seems that the one hand does not know what the other hand is doing. That’s the problem with neoliberalism.

Sunday, 12 June 2016 - 7:54pm

This week, I have been mostly reading:

- So Sue Them: What We’ve Learned About the Debt Collection Lawsuit Machine — Paul Kiel, ProPublica:

In 1996, there were around 500 court judgments in New Jersey from suits filed by debt buyers. By 2008, that number had reached 140,000. […] For the most part, debt buyers purchase defaulted credit card accounts, typically for a few pennies on the dollar. Starting in the late 90’s, the industry began a period of rapid growth and then exploded in the middle of the last decade. That led to a sharp spike in suits, many of them by smaller debt buying companies that have since gone out of business. The industry is now dominated by several large companies.

- Hey Joe, banks can’t lend out reserves — Steve Keen:

For me, watching academic economists and Central Bankers (the vast majority of whom trained as economists) tell the banks to “lend your excess reserves to the public, dammit!”, is akin to watching some delusional person in a playground watching two kids playing on a see-saw, and criticising them because they weren’t both up in the air at the same time.

- The Barbarism of Donald Trump — Ian Welsh:

I don’t know if Clinton will torture. I know Bernie Sanders won’t. I know there are options available in the American election that don’t sell the tattered remains of America’s soul.

- Corbyn's Progress — Tariq Ali:

Blair, angered by this outburst of democracy in a party that he had moulded in his own image, declared that the Labour Party would be unelectable unless Corbyn was removed. Brown kept relatively quiet, perhaps because he was busy negotiating his very own private finance initiative with the investment firm Pimco (Ben Bernanke and the former ECB president Jean-Claude Trichet are also joining its ‘global advisory board’). Simultaneously, his ennobled former chancellor, Lord Darling, was on his way to work for Morgan Stanley in Wall Street. Blair, an adviser to J.P. Morgan since 2008, must have chuckled. At last, a New Labour reunion in the land of the free. All that ‘light-touch’ regulation was bearing rich fruit. Virtually every senior member of the Blair and Brown cabinets went to work for a corporation that had benefited from their policies.

- Folks Worried About Robots Taking Our Jobs Need to Learn Arithmetic — Dean Baker:

It is important to recognize that “owning robots” is a political issue, not an economic one. Specifically, people own robots because we give them patent monopolies. In most cases robots would be very cheap to produce if the government didn’t threaten to arrest people for not respecting patents. […] So we end up with money going from the rest of us to people who own robots because the government has given these people a monopoly over the use of the technology. Suppose the government didn’t give a monopoly over the use of the technology. Suppose that we funded the research through a different mechanism or at least made the monopolies shorter and weaker. Then the folks who developed the robots would not have so much money, the robots would be cheaper, and the rest of us would be richer.

- MMT, trade balance and balance of payments — Mike Norman:

A net importer is gaining "stuff" in an exchange with a net exporter, and the net exporter is accumulating the currency of the net importer. Thus the net importer is benefiting in real terms while the next exporter is benefiting in financial terms. The net exporter is diminishing domestic product (real) for domestic use, and the net importer is increasing indebtedness (financial) to the net exporter. On the other hand, net imports are beneficial to the economy and nation at full employment. The nation has more stuff than it would otherwise have at the current level of productivity. Because foreign workers are contributing to domestic productivity. And the country is not exporting jobs.

- Saturday Morning Breakfast Cereal:

- Listening to past Treasurers is a dangerous past-time — Bill Mitchell:

On January 23, 2016, a former Australian Treasurer Peter Costello (1996-2007) gave a speech to the Young Liberals (the youth movement of the conservative party in Australia) – Balanced Budgets as a Youth Policy – which was sad in the sense that some people never get over being dumped as out of touch and unpopular and was ridiculous in the sense that it is a denial of reality and macroeconomic understanding. He mounted the same old arguments that have been used to justify the pursuit of fiscal surpluses (grandchildren etc) but failed to recognise that his period as Treasurer was abnormal in terms of our history and left the nation exposed to the GFC as a result of the massive buildup in private sector debt over his period of tenure. The only reason he achieved the surpluses was because growth was driven by the household credit binge which ultimately proved to be unsustainable. Fiscal deficits are historically normal and should not be resisted. They are the mirror image in a national accounting sense of non-government surpluses, which historically, have proven to be the best basis for sustained growth and low unemployment.

- Tilting at windmills: The Faustian folly of quantitative easing — Steve Keen, Real World Economics Review Blog:

QE gets into the money supply—not via lending, which is impossible, but via asset purchases, which far and away benefit rich households more than poor ones. Rich households also benefit from the income the share transactions generate. And finally, some of that money gets to poor households when the rich ones—made richer still by QE—buy some services off them. The real economy has thus received some impetus from QE, but only a relatively trivial amount of the money created has got into circulation in Main Street. As Michael Hudson puts it, Bernanke’s helicopter dumped money on Wall Street, not Main Street. The bubble before the financial crisis had already exaggerated income inequality past what is sustainable in a capitalist society. Central Bank meddling via QE has made this problem worse, and without the illusion of a boom (like the Internet and Subprime Bubbles) to make it seem somehow palatable.

And Neil Wilson adds some more context, though I must admit that I couldn't follow his logic for one crucial step. - Bernie Sanders proved politicians can make it this far without selling their souls — Robert Reich in the Guardian:

Sanders’ courage in taking on the political establishment has emboldened millions to stand up and demand our voices be heard. Regardless of what Sanders decides to do now, he has ignited a movement that will fight onward. We will fight to put more progressives into the House and Senate. We will fight at the state level. We will organize for the 2020 presidential election. We will not succumb to cynicism. We are in it for the long haul. We will never give up.

- We are being led by imbeciles — Bill Mitchell:

I was reading John Maynard Keynes recently – circa 1928 – that is, 8 years before the publication of the General Theory with his Treatise on Money intervening. He was railing against the principles and practice of ‘sound finance’, which he noted had deliberately caused billions of pounds in lost income for the British economy. He urged the Treasury and the Bank of England to abandon their conservative (austerity) approach to the economy and, instead, embark on wide-scale fiscal stimulus to create jobs and prosperity. He concluded that with thousands of workers idling away in mass unemployment that it was “utterly imbecile to say that we cannot afford” to stimulate employment via large-scale public works – building infrastructure etc. He considered the policy makers who opposed such options were caught up in “the delirium of mental confusion”. The stark reality is that 88 years later, he could have written exactly the same article and would have been ‘right on the money’.

- Why I don't use heroin — Chris Arnade, The Guardian:

Addiction is a symptom of something very wrong with our society. That in any city or town, across all of America, people live on the streets, shooting up, selling themselves for another bag, should make us all stop and ask ourselves “why does our society create and allow such pain?”.

Sunday, 5 June 2016 - 8:25am

This week, I have been mostly reading:

- Wall Street’s Message to Young Adults: “You are Clueless” — Bill Black at NEP elicits a LOL:

Wall Street CEOs are very upset with young adults. They believe you are “clueless” and “voting against [your] own interests” when you support Bernie Sanders. A Wall Street CEO took to the pages of the Wall Street Journal to decry the fact that “Millennials are flocking to Sanders.” It would be cruel to note that one has to be clueless to believe that writing an op ed in the WSJ was a good way to reach millennials supporting Bernie.

- Dear Paul — Gerald Friedman (Context here):

While you don’t know me, you seem to feel free to speculate about my values and interests. You assume that an outsider economist like myself must be considered not particularly “insightful or even technically competent.” And, elaborating this theory, you conclude that envy would lead me to jump on an opportunity for self-advancement by shilling for an outsider politician. Now this theory might be tested empirically. You could easily have tested your theory by investigating my motives empirically. You could have called me and asked. Or you could have read any of the news stories where I explained how I stumbled on this research project, and where I explained my (lack of) connection to the Sanders campaign.

Krugman's continuing public self-immolation is baffling. - Saturday Morning Breakfast Cereal:

- Who are the capitalists? — David F. Ruccio:

It’s one of the questions I ask my students. And they always get the answer wrong. So, in my experience, do most other people. But it’s a key issue. If we’re going to figure out how capitalism works—and, perhaps even more important, how to change it—we need to know who the capitalists are.

- Surprised by the rise of Bernie Sanders and Jeremy Corbyn? Then you need to get out more — Simon Wren-Lewis:

Political commentators talk to politicians who talk to political commentators. It tells us how embedded the influence of the City and Wall Street is. The media relies on economists from the financial sector, and so tends to see the economy from their perspective. The blind spot is mostly to the left, because we have the Daily Mail and Fox News. As a result, it came as a complete surprise that a crisis caused by the financial sector that left that sector unscathed but instead led to a diminished role for the state, might make many people rather angry.

- Robert Samuelson Is Unhappy that We Have Evidence Based Economics — Dean Baker at CEPR:

There are still millions of unemployed or underemployed workers who would like full-time jobs. This means that the concern about balanced budgets is needlessly keeping these people unemployed. And the weakness of the labor market is keeping tens of millions of workers from having the bargaining power necessary to get their share of the benefits from economic growth in higher wages. Perhaps even worse, the obsession with deficits prevents us from doing things we really need to do. The neglected items form a long list, from early childhood education and affordable college to keeping the kids in Flint from being poisoned.

- Australia’s Housing Bubble: In the Grip of Insanity — Pater Tenebrarum, who appears to be some kind of gold bug, but as the link comes via Naked Capitalism, and I agree with the conclusion, I'm prepared to overlook the tinfoil hat:

In this particular case, the boom has already progressed to a rare extreme: with home prices at 10 to 12 times disposable income (far higher than the peaks attained in the housing bubbles in the US, Ireland and Spain), the end is clearly getting close. Australian home-owners, property investors and banks will be in for quite a rude awakening.

- How to Explain the Sanders Campaign to an Idiot, Paul Krugman or a Clintonite in 8 Sentences — Seth Abramson in the Huffington Post:

Bernie Sanders […] is staying in the race because all the extant hard data suggests he is a stronger general election candidate than Mrs. Clinton, because he passionately believes the Democrats must defeat Donald Trump in the fall, and because Mrs. Clinton’s stunning failure to secure 59 percent of pledged delegates didn’t merely invite but indeed encouraged him to take his case to superdelegates in July […] The Democratic Party has never, in modern history, run a candidate with an unfavorable rating as high as Mrs. Clinton’s […] Sanders plans to continue his campaign in the hope of saving Democratic elders from their slavish devotion to a political dynasty that’s turned the Party from its New Deal roots toward a neoliberal corporatism now destroying the middle class.

- Waist deep in the Big Muddy — John Quiggin:

The sudden collapse of four for-profit vocational education enterprises including Aspire college is the latest in a string of scandals, failures and license revocations in the sector. […] The provision of public funds to for-profit operators has been a predictable, and predicted disaster. Of all the disasters perpetrated under the banner of microeconomic reform, education reform has probably been the worst.

- Morrison's tax swap would have taken from the poor and given to the rich — Peter Martin:

The most shocking thing in the Treasury analysis delivered to Scott Morrison on January 25 isn't the finding that a cut in income tax funded by a lift in the goods and services tax wouldn't boost the economy at all. It's what Morrison asked the Treasury to model. He asked it to model a lift in GST from 10 to 15 per cent and then the handing back of every possible cent in income tax cuts. Because boosting the GST automatically results in extra spending on benefits such as Newstart, family allowances and pensions as prices climb it isn't possible to give all of it back. But it is possible to hand back $30 billion of the $35 billion as tax cuts, and that's what Morrison asked the Treasury to model in the first instance, not legislated increases in benefits of the kind delivered by his predecessor Peter Costello when introducing the GST. The impact is horrific.

- To Fix Inequality and Steady the Economy, Think Radically — Lynn Parramore at INET interviews Adair Turner:

[…] for the decade leading up to 2007, a whole lot of people who weren’t getting raises felt that they were doing ok because they managed to buy a house that was going up in price. But it all came to and end, a catastrophic end. Rising inequality can create a more highly leveraged economy, and it can then make the economy vulnerable to a crash like 2008. And in that crash, the really malign thing is that the crash itself tends to further increase inequality because it tends to be the people at the lower end of the wealth distribution who were highly leveraged and had to borrow lots of money to buy their house. In the downswing, they lose all the wealth they’ve got.

Sunday, 29 May 2016 - 4:38pm

This week, I have been mostly reading:

- Thomas Piketty on the rise of Bernie Sanders: the US enters a new political era — Thomas Piketty in Le Monde via the Guardian:

In many respects, we are witnessing the end of the politico-ideological cycle opened by the victory of Ronald Reagan at the 1980 elections.

- Lobbyist Superdelegates Tip Nomination Toward Hillary Clinton — Lee Fang, The Intercept:

There are 712 superdelegates in all, which is about 15 percent of the total delegates available and 30 percent of the total needed to win the nomination. If the nomination process is close, superdelegates may effectively pick the party’s presidential nominee, potentially overriding the will of voters.

[This is why "Jeb!" couldn't make it in the big league. His vote-rigging skills are inadequate. Bernie has already won 2016 by a far wider margin than Gore won 2000, but Debbie Wasserman Shultz can halt a landslide with a single Medusa glare.] - Sydney Uni’s sweeping restructure: cutback and fightback ahead — Dylan Griffiths at Solidarity Online:

On the last day of work for 2015, the University of Sydney’s Chancellor, Belinda Hutchinson, announced a drastic restructure of the University. The decisions were made in a secret Senate meeting days earlier. They include amalgamating ten faculties and six schools into six faculties and three schools and cutting down 122 degrees to 20 degrees.

- The free market is an impossible utopia — Henry Farrell chats with Fred Block and Margaret Somers about Karl Polanyi, Washington Post:

In the first instance the market is simply one of many different social institutions; the second represents the effort to subject not just real commodities (computers and widgets) to market principles but virtually all of what makes social life possible, including clean air and water, education, health care, personal, legal, and social security, and the right to earn a livelihood. When these public goods and social necessities (what Polanyi calls “fictitious commodities”) are treated as if they are commodities produced for sale on the market, rather than protected rights, our social world is endangered and major crises will ensue.

- If you thought one Bernie Sanders was good, how about 100 of him? — Anoa Changa in the Guardian:

I am a part of an initiative called Brand New Congress. Many of us are former Sanders campaign staffers, who are hoping to help elect Bernie Sanders-like candidates in at least 100 different districts in the next two years. […] The aim is to run one campaign for hundreds of candidates. Instead of running the races separately, we will be centralizing fundraising, awareness raising and organizing for campaigns across the country. Our unified process will level the playing field, and thus permit new leaders to rise up from the ranks of our working and middle class.

- ‘You want a description of hell?’ OxyContin’s 12-hour problem — Harriet Ryan, Lisa Girion and Scott Glover, LA Times:

Reps were ordered to visit doctors and “refocus the clinician back to q12h.” Doctors needed to be reminded “on every call,” they were told. “There is no Q8 dosing with OxyContin,” one sales manager told her reps, according to a memo cited in an FDA filing. She added that 8-hour dosing “needs to be nipped in the bud. NOW!!” If a doctor complained that OxyContin didn’t last, Purdue reps were to recommend increasing the strength of the dose rather than the frequency. There is no ceiling on the amount of OxyContin a patient can be prescribed, sales reps were to remind doctors, according to the presentation and other training materials. […] An analysis of the medical records of more than 32,000 patients on OxyContin and other painkillers in Ontario, Canada, found that one in 32 patients on high doses fatally overdosed. […] OxyContin “does a great job of keeping me out of a wheelchair and moving...for 8 hours. Then I start going into withdrawal,” one patient wrote on an online message board in 2004.

- Reclaiming Innovation — Jim Groom and Brian Lamb in Educause Review Online:

The myriad costs associated with supporting LMSs crowd out budget and staff time that might be directed toward homegrown, open-source, and user-driven innovation. Indeed, institutional leaders may refuse to support alternative systems, such as blogs and wikis, lest they draw attention and users away from the "serious" enterprise learning tool, diverting resources and endangering investments. If a technology is sufficiently large and complex, it can dictate policy, resource allocation, and organizational behavior far beyond its immediate application.

- The Faulty Foundation of Higher Education —

Todd Rose, Ed.D., and Ogi Ogas, Ph.D., who have qualifications, in Psychology Today:

Within our Taylorized system of college education, a Bachelor of Arts in Civil Engineering is designed to be equivalent to a Bachelor of Arts in English Literature, each diploma held to represent an equal unit of learning independent of who a graduate is or which college she graduated from. This uniformity was intended to ensure that the brain of every student who earned a diploma attained the same level of “critical thinking,” “civic awareness,” “cultural literacy,” or some other normative set of skills or knowledge.

- Why Britain’s Housing Crisis Heralds the Next Financial Crash — Steve Rushton at Occupy.com:

Housing prices in London have risen by 50% in the last five years. If the U.K. property bubble goes boom, it will be proportionally biggerthan the U.S. housing bust at the onset of the financial crisis in 2007. How did we get here? For starters, U.K. banks in 2015 lent over £1 trillion ($1.4 trillion) for housing, accounting for 70% of newly made loans. The result is that when this bubble pops, it could catalyze another global financial meltdown. While there are many other possible triggers, the next financial crash is more likely than not.

- Guest Post: POSITIVE MONEY IN ACTION — Geoffrey Gardiner's Modest Proposal at New Economic Perspectives:

The system of transaction accounts at the central bank will be used to keep track of the population. Every person will be allocated an account at birth and vital details will be recorded and updated. The records will include a record of the person’s genome. The bank will issue identity documents. The transaction account number will be the person’s identity and passport number, and also the number of his or her tax account. Transaction account statements will be sent automatically to the tax office, which will have the duty to debit it with all assessed taxes. Every immigrant or visitor to the country will get an account and give similar identity details.

Sunday, 22 May 2016 - 9:16pm

This last few weeks, I have been mostly going insane with stress (or the "Coffs Harbour lifestyle", as it's known), and only reading:

- “Where to Invade Next” Is the Most Subversive Movie Michael Moore Has Ever Made — Jon Schwarz, The Intercept:

By the end of Where to Invade Next […] you may realize that the entire movie is about how other countries have dismantled the prisons in which Americans live: prison-like schools and workplaces, debtor’s prisons in order to pay for college, prisons of social roles for women, and the mental prison of refusing to face our own history. You’ll also perceive clearly why we’ve built these prisons. It’s because the core ideology of the United States isn’t capitalism, or American exceptionalism, but something even deeper: People are bad.

- Iceland's Pirate Party secures more election funding than all its rivals as it continues to top polls — Matt Broomfield at the Independent:

The anti-establishment party, which calls for a 35-hour working week, direct democracy and total drug decriminalisation, has the lead in eight out of the last ten polls. They look set to form a crucial part of a coalition government in this autumn's general election.

- Disappointing: Elsevier Buys Open Access Academic Pre-Publisher SSRN — Mike Masnick at Techdirt:

Everyone involved, of course, insists that "nothing will change" and that Elsevier will leave SSRN working as before, but perhaps with some more resources behind it (and, sure, SSRN could use some updates and upgrades). But Elsevier has such a long history of incredibly bad behavior that it's right to be concerned.

- EFF Asks Court to Reverse Chelsea Manning’s Conviction for Violating Federal Anti-Hacking Law — Electronic Frontier Foundation:

"Congress intended to criminalize the act of accessing a computer that you aren’t authorized to access, such as breaking into a corporate computer to steal user data or trade secrets or to spread viruses. The law should not be used to turn a violation of an employer’s computer use restrictions into a federal crime. That’s what happened here," said EFF Legal Fellow Jamie Williams.

Sunday, 1 May 2016 - 6:38pm

This week, I have been mostly reading:

- The Zombie Doctrine — George Monbiot:

The freedom neoliberalism offers, which sounds so beguiling when expressed in general terms, turns out to mean freedom for the pike, not for the minnows. Freedom from trade unions and collective bargaining means the freedom to suppress wages. Freedom from regulation means the freedom to poison rivers, endanger workers, charge iniquitous rates of interest and design exotic financial instruments. Freedom from tax means freedom from the distribution of wealth that lifts people out of poverty.

- The full employment productivity multiplier — Jared Bernstein in the Washington Post:

What if stronger demand led to full employment? And what if that gave their workers enough bargaining power to push up labor costs? Then, to maintain their profit margins, [otherwise low-wage, high inefficiency businesses] would have to find efficiency gains to offset their higher wage costs. Less turnover, for example. Less reason to hang onto extra workers who weren’t always needed but were cheap to have around. And this is a description of stronger demand leading to higher productivity.

- NHS: New report reveals marketisation is failing — Richard Murphy:

I do know something about markets, quasi-markets and organisation structures and what I can say, beyond a shadow of a doubt, is that if there are buying and other management inefficiencies in the NHS then they can be blamed fairly and squarely at successive governments who have thought that introducing market practices would help its efficiency. They were wrong. Markets do not drive everyone to efficiency, especially when NHS organisations cannot, ultimately, fail. All they can do is create division.

- Wondermark #1196; The Currency of Cute — David Malki:

- Problems with Economics: The Cult of Utility — Ian Welsh:

Basically, utility says, “Whatever action people choose to take is the one from which they derive the most usefulness.” This is known as revealed preference. This is a circular definition; metaphysical in the worst sense. Any action we take is utility maximization. A person can never fail to maximize utility (within their budget), because their actions are what defines the actions’ utility.

- Australia guts government climate research — Scott K. Johnson, Ars Technica:

Staff at Australia’s Commonwealth Scientific and Industrial Research Organisation (CSIRO) received an unpleasant e-mail when they came to work Thursday morning, one that outlined some specifics of long-awaited restructuring plans. The gist of the message? You've done such a good job, we have to let you go.

- “Negative” Interest Rates and the War on Cash — Richard Werner, who speculates persuasively about the war on cash being also a war on not-for-profit banking, but I can't quite follow him all the way to tinfoil hat territory where all commercial banking is eliminated and all citizens of credit-worthy standing are microchipped by the central bank:

The main reason advanced by the Bank of England for wanting to abolish cash is that it wishes to stimulate the UK economy, and to do so it wants to use interest rates. Since rates are already zero, it is now only reasonable to lower them into negative territory. However, to make such a policy effective, the possibility to move from electronic money into cash needs to be taken away. If cash is abolished, we can then enjoy the benefits of negative interest rates – or so the official narrative goes. This story is so full of holes that it is hard to know where to start.

- Must-read: Our dysfunctional monetary system — Steve Keen, Real-World Economics Review Blog:

The fetish for small government and budget surpluses means that the government has […] effectively abrogated money creation to the private banking sector. This strategy had no obvious negative consequences while the private banks were on a credit-money-creation binge—as they were effectively from the end of WWII till 2008. But once private debt began to dwarf GDP and the growth of credit slowed to a trickle, the inherent stupidity of this policy became apparent. In their attempt to promote the private sector, conservative proponents of small government are actually strangling it. […] Rather than understanding the real cause of the crisis, we’ve seen the symptom—rising public debt—paraded as its cause.

- A Scheme to Encrypt the Entire Web Is Actually Working — Andy Greenberg at Wired:

It’s available to websites anywhere in the world—even far-flung countries like Cuba and Iran that sometimes aren’t served by other major certificate authorities. And it’s automatically configured with a piece of code that runs on any server that wants to switch on HTTPS. “This is the silver bullet that…lowers the barrier to encrypted web communications,” says Ross Schulman, the co-director of the cybersecurity initiative at the New America Foundation. “It brings the cost of executing a secure website down to zero.”

Sunday, 24 April 2016 - 4:27pm

This week, I have been mostly writing, but in the last couple of days, I've been reading:

- Why Are Universities Fighting Open Education? — Elliot Harmon, Common Dreams:

Why were some universities opposing a rule that would directly benefit their students and faculty? When you dig a bit deeper, it looks like universities’ opposition to open licensing has nothing to do with students’ access to educational resources. What’s really playing out is a longstanding fight over how universities use patents—more specifically, software patents. Open education just happens to be caught in the crossfire.

- Paul Krugman, Bernie Sanders, and the Experts — Dean Baker at CEPR:

The experts insisted that we would have a Second Great Depression if we didn’t bail out the Wall Street banks. Really? Was there some magical curse that would overcome the country if Goldman Sachs and Citigroup went out of business? Would Keynesian stimulus no longer work? We got out of the first Great Depression in 1941 by spending a ton of money fighting World War II. It is hard to see any reason why we couldn’t have ended the depression a decade sooner by spending a ton of money in 1931 on infrastructure, health care, and education. The same story would have applied in 2009.

- Q: When is a dollar pegged to gold not on a gold standard? A: From 1934-1971 — Eric Rauchway at Crooked Timber:

[…]as the economist Edward Bernstein (who was in the Roosevelt Treasury, at Bretton Woods, and later served in the IMF) succinctly explained, years later. 'In spite of the Gold Reserve Act, the United States was not really on a gold standard after 1933. The essence of the gold standard is that the money supply must be limited by the gold reserve. The last time that the Federal Reserve tightened its policy because the gold reserve ratio had fallen close to the legal minimum was on March 3, 1933, when the Federal Reserve Bank of New York raised the discount rate to 3-1/2 per cent. Thereafter, whenever the gold reserve neared the legal minimum, the required reserve ratio was reduced and finally eliminated. A country that loses more than half of its gold reserve, as the United States did in 1958-71, without reducing its money supply is not on the gold standard.'

- Economists Prove That Capitalism is Unnecessary: The nonsensical logic of mainstream economics — Steve Keen, paywalled in Forbes, published in Evonomics:

It’s an assumption that individuals in a market economy are so all-knowing that, in effect, they don’t need markets at all: they can just work it all out in their heads. Yet if anything defines a capitalist economy, it’s the dominance of markets. So effectively the mainstream reaction to anything which disturbs their preferred way of modeling a market economy is to make assumptions that, if they were true, would make a market economy itself unnecessary in the first place.

- The West Is Traveling The Road To Economic Ruin — Paul Craig Roberts (warning: a bit of a fruitcake at times) reviews the career of "best economist in the world" Michael Hudson:

Hudson learned that monetary theory concerns itself only with wages and consumer prices, not with the inflation of asset prices such as real estate and stocks. He saw that economic theory serves as a cover for the polarization of the world economy between rich and poor. The promises of globalism are a myth. Even left-wing and Marxist economists think of exploitation in terms of wages and are unaware that the main instrument of exploitation is the financial system’s extraction of value into interest payments. Economic theory’s neglect of debt as an instrument of exploitation caused Hudson to look into the history of how earlier civilizations handled the build up of debt.

- How Boots went rogue — Aditya Chakrabortty, The Guardian, in what they call "The Long Read", presumably because "You're Not Going to Enjoy This, But it's Good For You" didn't test so well with key demographics:

This is the tale of how one of Britain’s oldest and biggest businesses went rogue – to the point where its own pharmacists claim their working conditions threaten the safety of patients, and experts warn that the management’s pursuit of demanding financial targets poses a risk to public health. (Boots denies this, saying that “offering care for our colleagues, customers and the communities which we serve…is an integral part of our strategy.”) At the heart of this story is one of the most urgent debates in post-crash Britain: what large companies owe the rest of us – in taxes, in wages, and in standards of behaviour.

- Explaining Why Federal Deficits Are Needed — Thornton (Tip) Parker at New Economic Perspectives [I'm definitely using this one]:

The economy is like a car. Government spending is the accelerator. Taxes are the brakes. To keep going or speed up, press the accelerator. To slow down, ease off the accelerator or press the brakes. Driving too fast could lead to hyper-inflation, but that never happened here because the country always slowed down in time.

Sunday, 17 April 2016 - 10:13pm

This week, I have been mostly reading:

- Sanders, Corbyn and the financial crisis — Simon Wren-Lewis refuses to follow his neoclassical colleague Krugman into Very Serious Person-hood:

The right has succeeded in morphing the financial crisis into an imagined crisis in financing government debt (or, in the Eurozone with the ECB’s help, into an actual crisis) which required a reduction in the size of the state that neoliberals dream about. The financial crisis, far from exposing neoliberal flaws, has led to its triumph. Confronted with this extraordinary turn of events, many of those on the centre left want to concede defeat and accept austerity! That is all scandalous, and if the left’s established leaders will not recognise this, it is not surprising that party members and supporters will look elsewhere to those who do.

- The Problem With Hillary Clinton Isn’t Just Her Corporate Cash. It’s Her Corporate Worldview. — Naomi Klein in The Nation:

The real issue, in other words, isn’t Clinton’s corporate cash, it’s her deeply pro-corporate ideology: one that makes taking money from lobbyists and accepting exorbitant speech fees from banks seem so natural that the candidate is openly struggling to see why any of this has blown up at all.

- How a Cashless Society Could Embolden Big Brother — Sarah Jeong at The Atlantic:

Transactions route through several tangled layers of vendors, processors, and banks. At various points in the chain, all transactions squeeze through bottlenecks created by big players like Visa, Mastercard, and Paypal: These are the choke points for which Operation Choke Point is named. The choke points are private corporations that are not only subject to government regulation on the books, but have shown a disturbing willingness to bend to extralegal requests—whether it is enforcing financial blockades against the controversial whistleblowing organization WikiLeaks or the website Backpage, which hosts classified ads by sex workers, and allegedly ads from sex traffickers as well. A little bit of pressure, and the whole financial system closes off to the government’s latest pariah.

- Paul Krugman Unironically Anoints Himself Arbiter of “Seriousness”: Only Clinton Supporters Eligible — Glenn Greenwald at The Intercept:

To any of you Sanders supporters who previously believed that you possessed serious policy expertise, such as Dean Baker; or former Clinton Labor Secretary and Professor of Economic Policy Robert Reich (who yesterday wrote that “Bernie Sanders is the most qualified candidate to create the political system we should have”); or the 170 policy experts who signed a letter endorsing Sanders’ financial reform plan over Clinton’s: sorry, but you must now know that you are not Serious at all. The Very Serious Columnist has spoken. He has a Seriousness Club, and you’re not in it. If you want to be eligible, you need to support the presidential candidate of the Serious establishment, led by Paul Krugman.

[Krugman seems determined to follow the sad example of Christopher Hitchens: If you're determined to pose as a contrarian, it's far more comfortable to be a contrarian for the establishment.]