Sunday, 24 January 2016 - 9:30pm

This week, I have been mostly reading:

- Beyond neoliberalism: Universities and the public good — Ravinder Sidhu in the Australian Review of Public Affairs reviews Learning under Neoliberalism: Ethnographies of Governance in Higher Education:

Writing almost twenty years ago, Clare O’Farrell made the prescient observation that: ‘the State has become educationally out of date. [It] must necessarily fall behind those institutions whose job it is to keep abreast with and create new developments in specialised fields [such as] universities’ (1996, p. 8). O’Farrell highlighted the need for academics to find alternative ways of self-governing. Her compelling argument, in favour of winding back the intrusion and displacement wrought by various accountability audits to restore ‘the scholarly balance’, retains its urgency. A small step towards this end is by attending to professional and democratic accountability in university governance. Such changes are necessary if universities are to continue to be relevant to public life.

- Iceland, Ireland, and Devaluation Denial — Paul Krugman, New York Times:

When big adjustments in a country’s wages and prices relative to trading partners are necessary, it’s much easier to achieve these adjustments via currency depreciation than via relative deflation — which is one main reason there have been such big costs to the euro.

- Review: Another “Minsky moment” may be on the way — Edward Chancellor for Reuters reviews Randy Wray's new book on the work of his late mentor:

Prudent financial arrangements give way to what he called “Ponzi finance,” which describes the situation when borrowers are unable to service their debts or repay principal from their current income. Ponzi borrowers depend on refinancing against the collateral of rising asset prices to maintain solvency. Long before former Fed Chairman Ben Bernanke and other economists hailed the “Great Moderation” of low inflation and stable growth, Minsky elaborated the “Financial Instability Hypothesis.” This is expressed in his trademark comment – “stability is destabilizing” – since, as Minsky argued, people respond to good times by changing their risk preferences.

- Who’s the most efficient of them all: income tax or GST? — Peter Davidson Holy cow, this is comprehensive — and worth memorising in order to quote from it at length at the next high-society soiree you attend, assuming you don't want to be invited to any more:

In short, the equity impacts of a change in the tax mix from personal income to consumption are quantifiable and negative, while any economic efficiency gains are uncertain and hard to quantify. Alternative tax reform options, such as broadening the income tax base by removing inefficient tax shelters, would improve equity and efficiency at the same time.

- Jeremy Corbyn 'Systematically' Attacked By British Press The Moment He Became Leader, Research Claims — Louise Ridley, the Huffington Post:

News articles, in which the media ostensibly do not editorialise, were actually the most critical of Corbyn, the report says. Out of 292 news pieces, 181 were judged negative, while 92 were 'neutral' and just 19 'positive', the report found. 'One might expect news items, as opposed to comment and editorial pieces, to take a more balanced approach but in fact the opposite is true.'

It's more a tally than a report, but the appendix on themes ("Them and Us - Extremism Vs. Moderation", "What will happen to Labour and the Left?", "Personal Character") is bang-on. - Challenging the Oligarchy — Paul Krugman in the New York Review of Books ah, reviews a book, in New York. A finer fulfillment of a publication's mandate you will search for in vain. Specifically, he reviews Robert Reich's new one.:

Modern technology, or so it was claimed, reduced the need for routine manual labor while increasing the demand for conceptual work. And while the average education level was rising, it wasn’t rising fast enough to keep up with this technological shift. Hence the rise of the earnings of the college-educated and the relative, and perhaps absolute, decline in earnings for those without the right skills. […] But while one still encounters people invoking skill-biased technological change as an explanation of rising inequality and lagging wages—it’s especially popular among moderate Republicans in denial about what’s happened to their party and among “third way” types lamenting the rise of Democratic populism—the truth is that SBTC has fared very badly over the past quarter-century, to the point where it no longer deserves to be taken seriously as an account of what ails us.

- Hungover Bear and Friends: Flying Solo — Ali Fitzgerald in McSweeney's Internet Tendency:

- 'Poor internet for poor people': India's activists fight Facebook connection plan — Cory Doctorow in The Guardian:

Since the spring of 2015, Indian activists have built ferocious momentum against Facebook’s bid to take charge of the nation’s internet through a program called Free Basics. […] Free Basics’s pitch has been: we’ll get “the next billion internet users” (that is, poor people in developing nations) connected by cutting deals with local phone companies. Under these deals, there will be no charge for accessing the services we hand-pick. We will define the internet experience for these technologically unsophisticated people, with our products at the centre and no competition. It’s philanthropy!

- Against School — the late lamented Aaron Swartz in New Republic:

A group of bold entrepreneurs find they can make cloth more efficiently by building large mills. The girls who staff them keep causing strikes and other trouble, so they require their employees go to school from a young age and learn to behave themselves. But obviously most people won’t be thrilled to go to school so that they can learn to accept lower wages without complaint. So the bosses develop a cover story: schools are about teaching people the things they need to know to survive in the world of business. It’s not true, of course—there’s no connection between the facts memorized in school and the skills needed on the job—but the story is convincing enough.

- Are luxury condo purchases hiding dirty money? — Husna Haq at the Christian Science Monitor:

An investigation conducted by The New York Times in 2015 revealed that nearly half of homes that sold for more than $5 million across the country were purchased by shell companies. That figure would probably be higher in high-end real estate markets like New York and Miami. In fact, using shell companies, or limited liability companies, to hide a buyer's identity is actually relatively common, and legal. But the practice could drive up real estate prices in some markets, and contribute to real estate booms. Federal authorities are also concerned that the practice enables foreign buyers to easily find a safe haven for illicit money in American real estate.

- Six Responses to Bernie Skeptics — Robert Reich practically endorses Bernie. This is huge, because Reich is very influential and used to work for… ah… Clinton… Bill Clinton, the president who… I'll get me coat.

- In Late 2007, Obama Trailed Clinton By 26 Points. Bernie Sanders Is 2016's Barack Obama — H.A. Goodman, Huffington Post:

[I]t's difficult to generate enthusiasm when you're a Democratic nominee who voted for Iraq and is funded by prison lobbyists, but alas, Clinton supporters base their vote upon the perception of political power. This viewpoint ignores the fact that Democrats lose elections when voter turnout is low, and only Bernie Sanders can ensure a high voter turnout in 2016. Between an expanding FBI investigation, Clinton's negative favorability ratings, and her longstanding ties to Donald Trump, Republicans would win the White House with a Clinton nomination.

- 'Australia headed for recession': Yanis Varoufakis, former Greek finance minister — Mark Mulligan, Australian Financial Review:

He said after nearly 25 years without recession, Australia was caught up in the same global pattern of weak aggregate demand and excessive corporate savings, which are being handed back to shareholders via buybacks and dividends instead of being re-invested in additional capacity or productivity enhancement.

Taking issue with Varoufakis is: - Recessions are always a problem and can always be avoided — Bill Mitchell:

Recessions are incredibly costly and totally unnecessary. The claims that they offer a bush-fire type “cleansing” to drive higher productivity in the future and increased material living standards are often made but not very strongly evidenced in the research literature. Governments can always maintain full employment if they choose and should do so given the highly damaging effects that recessions have on individuals, which span many generations as a consequence of the inheritance of disadvantage by children in jobless households. I am surprised that a progressive economist (so-called) is buying into the mainstream myth that recessions are not a problem.

- IMF continues with its wage-cutting line — Bill Mitchell:

Now if we took the [IMF's logic] one could easily argue that with inflation so low in the Eurozone, these results would suggest that an across-the-board wage increase in the Eurozone would have strong positive impacts on growth without undermining any relative competitiveness for any particular nation. The IMF, of course, doesn’t take the reader down that interpretation of their results because the paper is really designed to justify the existing policy of wage cutting and so-called ‘structural reforms’, which are really about undermining working conditions, job security, Occupational Health & Safety regulations, and other things that make work more tolerable.

- German wage moderation and the EZ Crisis — Peter Bofinger at VOX, CEPR's Policy Portal:

An EZ Crisis narrative that does not that does not account for the effects of the German wage moderation is incomplete. Germany is by far the largest EZ economy and it is a very open economy with strong trade links to all other EZ member states. It would be difficult to explain why such a strong internal devaluation, which is regarded as a key determinant of Germany’s success story in the 2000s (Dustmann et al. 2014), did not have significant repercussions for the rest of the EZ.

- Secular stagnation and the financial sector — John Quiggin:

[T]he financial sector benefits from an evolutionary strategy similar to that of an Australian eucalypt forest. Eucalypts are both highly flammable (they generate lots of combustible oil) and highly fire resistant. So eucalypt forests are subject to frequent fires which kill competing species, and allow the eucalypts to extend their range.

- This might be the most controversial theory for what’s behind the rise of ISIS — Jim Tankersley, The Washington Post:

Piketty is particularly scathing when he blames the inequality of the region, and the persistence of oil monarchies that perpetuate it, on the West: "These are the regimes that are militarily and politically supported by Western powers, all too happy to get some crumbs to fund their [soccer] clubs or sell some weapons. No wonder our lessons in social justice and democracy find little welcome among Middle Eastern youth." Terrorism that is rooted in inequality, Piketty continues, is best combated economically.

- Corbyn - what's a leader really for? — Jeremy Gilbert:

One perspective basically thinks that politics is about selling your party to consumers; the other thinks that it’s mainly about building up a coalition of social groups with common interests. Spoiler alert: it’s the second one that’s right, mostly.

- The New Supply-Side Economics — Mark Thoma in The Fiscal Times:

During the period of mild fluctuations in output and employment from 1982 through 2007 known as the Great Moderation monetary policy could do the job by itself, and to a large extent we forgot about fiscal policy as a stabilization tool. But the Great Recession made it clear that monetary policy can only do so much, and fiscal policy has an important role to play in deep economic downturns. We didn’t fully exploit the potential of fiscal policy during the Great Recession, and the turn to austerity in 2010 was a mistake that worked against the recovery, but the lesson is there to be learned for those willing to take off their ideological blinders and see it.

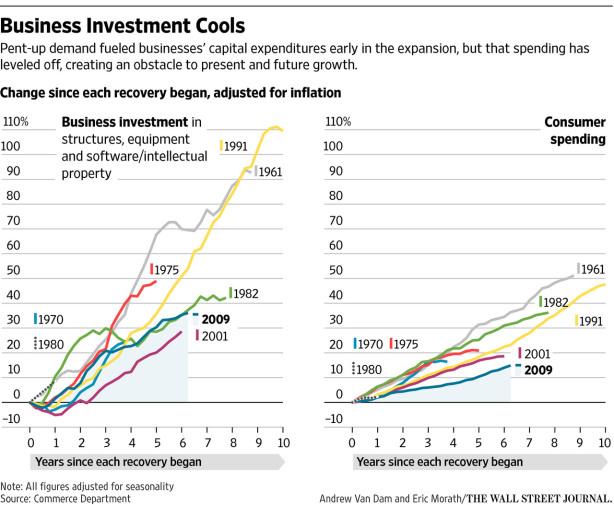

- Chart of the day — David F. Ruccio:

Consumer spending isn’t growing because, face it, most people’s incomes (whether measured in terms of real wages or median incomes) are stagnant. Whatever spending they are doing (e.g., on cars and higher education) is fueled by taking on more and more debt. What about investment? While profits (especially from domestic sources) continue to grow, corporations are using those profits not for investment, but for other uses, including stock buybacks, mergers and acquisitions, and CEO salaries.

- Going down the same old road: driverless cars aren’t a fix for our transport woes — Curtin's peter Newman in The Conversation:

Autonomous trains have been around for 30 years and have a very good track record. That’s because they don’t require humans suddenly being able to intervene. Nor do they have a chance of harming others as they are completely isolated on separate tracks. But autonomous cars present both these problems.

- Jeremy Corbyn and the Syrian Bombing Vote — Ian Welsh:

Corbyn has always said he would bring more democracy to Labour, and this is in line with that promise. This is a case of one principle “no war” going against another principle “more democracy.” Also, letting Labour MPs vote against bombing Syria, when the majority of Labour party members are for it, may be very smart politics. Smoke the pro-war MPs out, let them run up their flags, and when the time comes for candidate selection, well, everyone will know who is for war. The majority of voters selecting candidates are free to use the next election to ensure that Corbyn has a party of MPs who are anti-war.

- Woody Guthrie, ‘Old Man Trump’ and a real estate empire’s racist foundations — Will Kaufman, The Conversation:

For Guthrie, Fred Trump came to personify all the viciousness of the racist codes that continued to put decent housing – both public and private – out of reach for so many of his fellow citizens.