reading

Sunday, 27 November 2016 - 5:02pm

It's been a weird week of extremes of relief and despair (in that order), so I have been mostly bookmarking rather than reading:

- Who Will Command The Robot Armies? — Maciej Cegłowski (via Tregeagle):

Letting robots do more of the fighting makes it possible to engage in low-level wars for decades at a time, without creating political pressure for peace. As it becomes harder to inflict casualties on Western armies, their opponents turn to local civilian targets. These are the real victims of terrorism; people who rarely make the news but suffer immensely from the state of permanent warfare.

Sunday, 20 November 2016 - 6:03pm

This week, I have been mostly reading:

- The Higher Education White Paper: Euphemisms for Destruction — Will Davies in the Political Economy Research Centre blog:

It is easy to moan about ‘privatization’ of higher education, but this is arguably something worse. With privatization go some of the benefits of privacy. Instead, we have a technocratic dream of perfectly calibrated ‘satisfaction’ and fees, where every ‘incentive’ is ‘aligned’. It all stems from a Benthamite fantasy that (as I explore in The Happiness Industry) money and subjective experience have a simple, stable relationship to each other. Sustaining the fantasy in an area like higher education involves regulatory complexity on a scale and cost that even Blairites might have blanched at. Technical complexity of this nature benefits one ‘stakeholder’ above all others: consultants.

- Polls Showed Sanders Had a Better Shot of Beating Trump–but Pundits Told You to Ignore Them — Adam Johnson, at Fairness and Accuracy In Reporting (FAIR):

There was a debate last spring, when the Sanders/Clinton race was at its most heated, as to whether Bernie Sanders’ consistently out-polling Hillary Clinton was to be taken as a serious consideration in favor of his nomination. […] Never mind, the pundits said—Clinton had been “vetted” and Sanders had not.

- Obama said Hillary will Continue his Legacy – Indeed! — Michael Hudson. Okay, academic now, but this is a very important point I've not heard expressed from anybody else. Forget superdelegates; the Democratic primary process included essentially irrelevant states in the sample that was supposed to prove Clinton's electability:

Appointed as DNC head by President Obama in 2008, [Tim Kaine] dismantled Howard Dean’s 50-state strategy, not bothering to fight Republicans in the South and other solid Republican states. His move let them elect governors who gerrymandered their voting districts after the 2010 census. The DNC designated these “neglected” states to come first in the presidential primaries. They were the ones that Hillary won. Sanders won most of the swing states and those likely to vote Democratic. That made him the party’s strongest nominee – obliging the DNC to maneuver to sideline him.

- Time to ditch Rawls? — Branko Milanovic:

Liberal democracies do not affirm the principles of liberalism, as Rawls expected, neither domestically nor internationally. It is inconceivable for Rawls, if these societies would be working well, that they would, as in the US now, generate a third or more of “malcontent” population that clearly does not believe in liberal principles nor is willing to affirm them in their daily lives. Far from it. This, plus the pervasive role of money in electoral politics, lower tax rates for capital than labor, neglect of public education etc. imply that domestically so called liberal societies are very far from Rawls’ idea of liberalism. The difference is so great that we cannot, I think, speak of the discrepancy any longer as the expected difference between an abstract idea and what exist in reality. These societies belong to an entirely different category. Moreover, in foreign policy, as became clear with the Iraq war, they act like outlaw states since they break the fundamental rules on which the international community is founded, namely absence of wars of aggression.

- The Gig Economy — Ted Rall:

- Building a Progressive International — Yanis Varoufakis continues his crusade of optimism in the pages of Project Syndicate:

Bernie Sanders’s “political revolution” in the US, Jeremy Corbyn’s leadership of the UK’s Labour Party, DiEM25 (the Democracy in Europe Movement) on the continent: these are the harbingers of an international progressive movement that can define the intellectual terrain upon which democratic politics must build. But we are at an early stage and face a remarkable backlash from the global troika: witness Sanders’ treatment by the Democratic National Committee, the run against Corbyn by a former pharmaceutical lobbyist, and the attempt to have me indicted for daring to oppose the EU’s plan for Greece.

- Why Jeremy Corbyn Matters — Richard King in 3 Quarks Daily:

It's this prospect of genuine grass-roots democracy that scares the bejesus out of the establishment. The Blairites like to talk about "credibility" and to lament or decry Corbyn's lack of it. But they know as well as anyone that the public's notions of what is credible are changing faster than Donald Trump's policy positions. Boris Johnson, a man who can't comb his own hair and describes African people as "piccaninnies", has just been made British Foreign Secretary: how's that for "credibility"? No, the Blairites aren't anti-Corbyn because they think he can't beat May in a general election. They are anti-Corbyn because they're worried he will.

- Class in America and Donald Trump — Karin Kamp interviews historian Nancy Isenberg for BillMoyers.com:

Donald Trump’s success is rooted in a raw, unscripted speech, outright rudeness and his ability to project anger without being constrained by the well-measured idiom of the politician. His campaign manager admits he is “projecting an image.” Who’s surprised? Our electoral politics has always countenanced con artists and has abided identity politics. An Australian observer described the phenomenon succinctly back in 1949, and it’s true today: Americans have a taste for a “democracy of manners,” he insisted, which was in fact different from real democracy. Voters accept huge disparities in wealth, he observed, while expecting their leaders to “cultivate the appearance of being no different from the rest of us.”

- My Fellow Americans: We Are Fools — Margot Kidder vents on CounterPunch on the occasion of Hillary "We came, we saw, he died" Clinton's coronation as Democratic nominee:

I am half Canadian, I was brought up there, with very different values than you Americans hold, and tonight — after the endless spit ups and boasts and rants about the greatness of American militarism, and praise for American military strength, and boasts about wiping out ISIS, and America being the strongest country on earth, and an utterly inane story from a woman whose son died in Obama’s war, about how she got to cry in gratitude on Obama’s shoulder — tonight I feel deeply Canadian. Every subtle lesson I was ever subliminally given about the bullies across the border and their rudeness and their lack of education and their self-given right to bomb whoever they wanted in the world for no reason other than that they wanted something the people in the other country had, and their greed, came oozing to the surface of my psyche.

Sunday, 13 November 2016 - 6:22pm

This week, I have been mostly reading:

- Surpluses & deficits are hotly debated – but what about the currency? — Emile Woolf, Renegade Inc:

When a British importer buys German goods he must pay for them in euros. For that purpose he (or his agent) will acquire euros from a German bank, and after settling the bill the German exporter (or his bank) is now a holder of British pounds. What will he do them? He can use them to buy British goods, or even UK treasury bonds, or he can exchange them for a different currency – but if, instead, he just sits on them indefinitely he will, just like the retailer who never cashes your cheque, be handing the importer a free gift!

- John McDonnell is right: we do disagree on macroeconomic policy — Richard Murphy:

I said he should not agree to a fiscal charter promising a balanced budget which is wholly economically unnecessary and even destructive. But he did. I also argued against the fundamentally neoliberal concept of an independent central bank that takes control of key aspects of economic management out of democratic control and which was Ed Balls idea. But John bought into it. And as a result he backed off from People’s QE : he was advised that a central bank cannot create money to help ordinary people, job creation or the building of social housing. Instead John accepted that central banks can only use that power for the sake of saving bankers.

- The macroeconomic challenge of the twenty first century — Richard Murphy:

Petrodollars created the architecture of the economies of the world that are now creaking at potential massive cost to us all. Now wise management of the fiscally created dollars, euros, pounds, yen and more can provide the alternative, costless but ultimately liberating source of the lubricant for our future economies. As a result we no longer need to burn the planet to liberate the potential in all people. The fiscal dollar can instead build the foundations for prosperity and social harmony that we all crave.

- New Paper: Demand-Side Business Dynamism — Mike Konczal and Marshall Steinbaum in Roosevelt Forward:

This paper argues that the decline in mobility, dynamism, and entrepreneurship is a result of declining labor demand since 2000. When it is hard to find another job, employed workers stay at the jobs they have, impairing their ascent up the job ladder and the accompanying wage growth over careers that historically led to the middle class. Declining entrepreneurship can also be explained by workers’ reluctance to leave large, stable incumbents to start their own firm or to work at a start-up when they cannot be assured that they will have a more stable job to return to. Thus, we find that the concentration of employment in old firms and in large firms mirrors the timing of declining labor mobility due to declining demand.

- Understanding Trump — George Lakoff:

Private enterprise and private life utterly depend on public resources. Have you ever said this? Elizabeth Warren has. Almost no other public figures. And stop defending “the government.” Talk about the public, the people, Americans, the American people, public servants, and good government. And take back freedom. Public resources provide for freedom in private enterprise and private life. The conservatives are committed to privatizing just about everything and to eliminating funding for most public resources. The contribution of public resources to our freedoms cannot be overstated. Start saying it.

- How Did We Get Such a Terrible Nominee? — Ted Rall:

- The Bank of Japan needs to introduce Overt Monetary Financing next — Bill Mitchell:

When economists talk of ‘printing money’ they are referring to the process whereby the central bank adds some numbers to the treasury’s bank account to match its spending plans and in return is given treasury bonds to an equivalent value. That is where the term ‘debt monetisation’ comes from. Instead of selling debt to the private sector, the treasury simply sells it to the central bank, which then creates new funds in return. This accounting smokescreen is, of course, unnecessary. The central bank doesn’t need the offsetting asset (government debt) given that it creates the currency ‘out of thin air’. So the swapping of public debt for account credits is just an accounting convention.

- Economic change will not happen until the left understands money — Ann Pettifor in openDemocracy:

The fact is that as western economies try to recover, they are sunk again by a mountain of private debt whose repayment is made less likely by austerity policies. These are policies with the ideological aim of “shrinking the state” but which, in the process contract both public and private sector investment, employment and incomes. The consequence of weak demand built on a mountain of debt is deflation: a generalized fall in prices and wages. Most economists, especially those in thrall to the finance sector, have an obsession with, and an aversion to inflation. The reason is that inflation erodes the value of debt. Deflation does the very opposite: it inflates the value of debt. Creditors are not disturbed by deflation, as it effortlessly, and silently increases the value of their most valuable asset: debt.

- Education, The Enlightenment, and the 21st-Century — Fred van Leeuwen for the RSA:

There is an inherent conflict between blind faith and critical thinking. That is true whether it is religious fanaticism or the imposition of political ideologies or nationalistic or ethnic dogmas in schools. Although I am not confounding barbaric terrorism with the “values” of the market, it is a danger if one grants markets and management thinking unexamined reverence. Placing education in such a straightjacket is having a major impact on development because it is affecting the way in which communities are conceived, justice is understood, and democracy is practised.

- The DNC Email Leaks: The Gift That Keeps On Feeding Distrust — John Kiriakou in Truthdig:

As my friend the State Department whistleblower Peter Van Buren said recently, “People are claiming the Russian government risked something close to war to hack DNC emails to embarrass [Hillary] Clinton after her own email shenanigans and to help [Donald] Trump, who maybe would win in November and who maybe would make decisions favorable to Russia? You realize that’s what has to be true for this [Vladimir] Putin scenario to be true, right? We’re back to the 1950s, accusing politicians of being in league with the Russians.” […] The issue is that the DNC colluded and conspired to favor the Clinton campaign and deny Bernie Sanders the Democratic nomination for president. The DNC’s actions were Nixonian, and they read like an account of that shamed president’s actions from a chapter of “All the President’s Men.”

- Overt Monetary Financing would flush out the ideological disdain for fiscal policy — Bill Mitchell:

Monetary policy is really such a blunt and ineffective tool that it should be rendered redundant. The mainstream have never provided a convincing case that manipulating interest rates is somehow the preferable and effective option for stabilising the spending cycle. The GFC experience would suggest otherwise. All the monetary policy gymnastics have had very little impact. It would be much better to set the overnight rate at zero and leave it there and allow the longer term rates (which are impacted by inflation risk) settle as low as possible. Then, manage the spending cycle with fiscal initiatives that can be targetted, adjusted fairly quickly and which have direct impacts.

- Democrats, Trump, and the Ongoing, Dangerous Refusal to Learn the Lesson of Brexit — Glenn Greenwald:

Put simply, Democrats knowingly chose to nominate a deeply unpopular, extremely vulnerable, scandal-plagued candidate, who — for very good reason — was widely perceived to be a protector and beneficiary of all the worst components of status quo elite corruption. It’s astonishing that those of us who tried frantically to warn Democrats that nominating Hillary Clinton was a huge and scary gamble — that all empirical evidence showed that she could lose to anyone and Bernie Sanders would be a much stronger candidate, especially in this climate — are now the ones being blamed: by the very same people who insisted on ignoring all that data and nominating her anyway.

Sunday, 6 November 2016 - 5:54pm

This week, I have been mostly reading:

- The Incalculable Cost of our Aversion to Government Debt — Ari Andricopoulos:

Thanks to austerity there is both a non-growing pie and workers receiving a smaller share of it (due to austerity forcing interest rates down). So there is low demand because of low government spending and high supply of labour because of benefit sanctions. The inevitable result of this is a low wage economy.

- The elites hate Momentum and the Corbynites - and I’ll tell you why — David Graeber in the Guardian:

The real battle is not over the personality of one man, or even a couple of hundred politicians. If the opposition to Jeremy Corbyn for the past nine months has been so fierce, and so bitter, it is because his existence as head of a major political party is an assault on the very notion that politics should be primarily about the personal qualities of politicians. It’s an attempt to change the rules of the game, and those who object most violently to the Labour leadership are precisely those who would lose the most personal power were it to be successful: sitting politicians and political commentators.

- Fears For Pauline Hanson’s Health After She Realises Some Asians Are Also Muslim — The Shovel:

- A comment on Keen’s “Credit plus GDP” measure — Cameron Murray:

There are two extremes I have in mind in this analysis. First, if all new credit is directed to new capital investments, we would expect a very close match between credit creation and increases in nominal GDP. Second, if all credit creation is to fund asset purchases, we might expect a much lower relationship between new credit and GDP growth. This idea fits nicely with the story that we should use the banking system to support new capital investment instead of funding asset purchases, which simply leads to asset price growth and speculative cycles. In this story it matters what new credit (money) is used for, not just the levels of new credit.

And, related: - The Truth about Banks — Michael Kumhof and Zoltán Jakab, in the IMF's Finance & Development magazine:

In modern neoclassical intermediation of loanable funds theories, banks are seen as intermediating real savings. Lending, in this narrative, starts with banks collecting deposits of previously saved real resources (perishable consumer goods, consumer durables, machines and equipment, etc.) from savers and ends with the lending of those same real resources to borrowers. But such institutions simply do not exist in the real world. There are no loanable funds of real resources that bankers can collect and then lend out. […] financing, is of course the key activity of banks. The detailed steps are as follows. Assume that a banker has approved a loan to a borrower. Disbursement consists of a bank entry of a new loan, in the name of the borrower, as an asset on its books and a simultaneous new and equal deposit, also in the name of the borrower, as a liability. This is a pure bookkeeping transaction that acquires its economic significance through the fact that bank deposits are the generally accepted medium of exchange of any modern economy, its money.

- I’m already tired of the ‘lessons’ of Chilcot. What can we learn from a report that ignores Iraqis? — Robert Fisk, the Independent:

Yes, [Blair] sure was a nasty piece of work, lying to us Brits and then lying to us again after Chilcot was published, and then waffling on about faith and “the right thing to do” when we all know that smiting vast numbers of innocent people – and even bringing about the smiting of a vaster number of the very same Muslims, Christians and Yazidis up to this very day – was a very, very bad thing to do. For these victims – anonymous and almost irrelevant in the Chilcot report – we cannot say “even unto the end”, because they are dying unto the present day. The real “end” for these victims cometh not even yet.

- #1236; In which a Reminder is constant — Wondermark, by David Malki!:

- Credentialism and Corruption: The Opioid Epidemic and “the Looting Professional Class” — Lambert Strether in Naked Capitalism:

As reader Clive wrote: "Increasingly, if you want to get and hang on to a middle class job, that job will involve dishonesty or exploitation of others in some way." And you’ve got to admit that serving as a transmission vector for an epidemic falls into the category of “exploitation of others.”

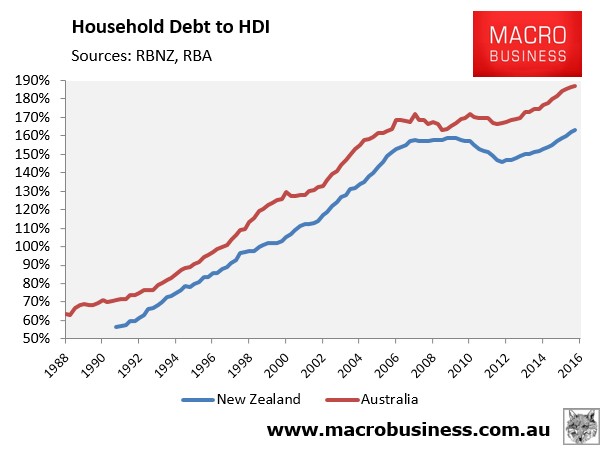

- WBC warns on NZ household debt. What about Australia’s? — Leith van Onselen at MacroBusiness compares the household debt/income levels of us and them next door:

- Regulator Warns Commercial Real Estate Bubble Is Biggest US Bank Risk — Yves Smith, Naked Capitalism:

The reason commercial real estate lending is so hazardous is banks routinely lose more than 100% of the loan when the projects go bad. Not only do all the loan proceeds go “poof,” but when they foreclose, they are typically stuck with a completed or partially completed project. If it is completely and not fundamentally unsound (say an office building in an up-and-coming area), it’s possible to get a partial recovery. But for a white elephant or a half-finished building, the bank will need to clear the property, which means throwing good money after bad, and is stuck with land plus perhaps some general previous owner improvements (if a subdivision, getting zoning and running in plumbing; in an urban setting, doing the assemblage). Moreover, commercial properties are idiosyncratic, so liquidating them is also inherently time-consuming.

- That Far Left Entryist Takeover of the Labour Party — Craig Murray:

At its height in the 1980’s, Militant claimed 8,000 members. In 2013 its descendant, the Socialist Party, claimed 2,500 members and crowed that it was now bigger than the Socialist Workers Party. The SWP replied, not by claiming to have more than 2,500 members, but by saying that the Socialist Party’s claim of 2,500 was inflated. The various manifestations of the Communist Party are smaller. […] I have therefore watched with bemusement the claims that the 120,000 new Labour members now banned from voting, and perhaps half of the remaining 400,000 Labour electorate, are entryists from organisations of the “hard left”. Anybody who believes there are over 300,000 members of “hard left” groups in the UK is frankly bonkers.

- Robot Bombs: A One Time Thing, Right? — Ted Rall:

- Paul Krugman’s stock market advice — Dean Baker, in the Real World Economics Review Blog:

[Apple, Google, and Microsoft] are companies that depend to a large extent on government-granted monopolies in the form of patent and copyright protection. We have made these protections much stronger and longer over the last four decades through a variety of laws and trade agreements. Of course the point of these protections is to give an incentive for innovation and creative work. But in a period where we are supposedly troubled by an upward redistribution from people who work for a living to people who “own” the technology, perhaps we should not be giving those people ever stronger claims to ownership of technology.

- The Trojan Drone: An Illegal Military Strategy Disguised as Technological Advance — Rebecca Gordon in TomDispatch:

The technical advances embodied in drone technology distract us from a more fundamental change in military strategy. However it is achieved -- whether through conventional air strikes, cruise missiles fired from ships, or by drone -- the United States has now embraced extrajudicial executions on foreign soil. Successive administrations have implemented this momentous change with little public discussion. And most of the discussion we’ve had has focused more on the new instrument (drone technology) than on its purpose (assassination). It’s a case of the means justifying the end. The drones work so well that it must be all right to kill people with them.

- Why are license "agreements" so uniformly terrible? — at Boing Boing, an excerpt from The End of Ownership: Personal Property in the Digital Economy, by Aaron Perzanowski and Jason Schultz:

The current iTunes Terms and Conditions are over 19,000 words, translating into fifty-six pages of fine print, longer than Macbeth. Not to be outdone, PayPal’s terms weigh in at 36,000 words, besting Hamlet by a wide margin. The demands of these prolix legal documents are jaw-dropping. Take Adobe’s Flash, a software platform installed on millions of computers each day. Assume the average user can read the 3,500-word Flash license in ten minutes—a generous assumption given the dense legalese in which it is written. If everyone who installed Flash in a single day read the license, it would require collectively over 1,500 years of human attention. That’s true every single day, for just one software product. Imagine what would happen if you tried to read every license you encountered. […] License terms are not negotiable. So there’s little to gain from a careful reading. […] Adobe is not going to negotiate a new license with you. They won’t even entertain the idea. So your choice is simple. Either use the product—and live with the license—or don’t. Take it or leave it.

- Sole and Despotic Dominion — Cory Doctorow in Locus Online:

If the mere presence of a copyrighted work in a device means that its manufacturer never stops owning it, then it means that you can never start owning it. There’s a word for this: feudalism. In feudalism, property is the exclusive realm of a privileged few, and the rest of us are tenants on that property. In the 21st century, DMCA-enabled version of feudalism, the gentry aren’t hereditary toffs, they’re transhuman, immortal artificial life-forms that use humans as their gut-flora: limited liability corporations.

- Gnome Ann — xkcd:

Sunday, 30 October 2016 - 6:52pm

This week, I have been mostly reading:

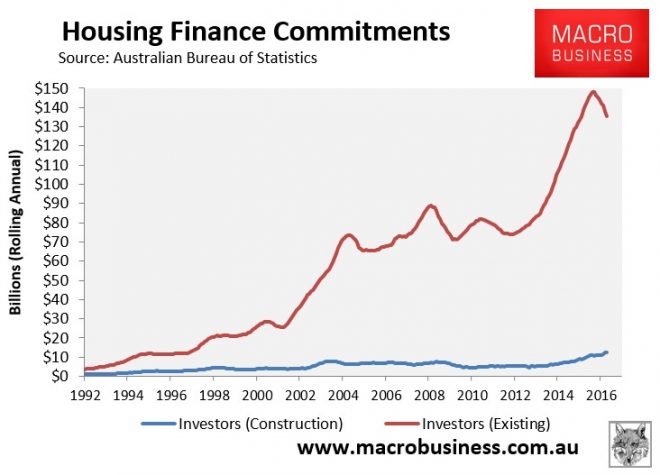

- HIA should have backed Labor’s tax reforms — Leith van Onselen at MacroBusiness shows what negative gearing and capital gains tax exemptions haven't done for new housing construction, with this particularly explicit bit of chart porn:

- 2008 All Over Again — Chris Hedges interviews Michael Hudson, Truthdig:

If there is anyone who is responsible for the Brexit it is Hillary Clinton and Barack Obama […] They destroyed Libya. They turned over Libyan weapons to ISIS, Al Quaeda and Al Nusra. It was their war in Syria, where many of these weapons ended up, that created the massive exodus of refugees intoEurope. This exodus exacerbated nationalism and anti-immigrant sentiment. Clinton and Obama are also responsible for a huge exodus of Ukrainians. This is all a response to American war policy the Middle East and Ukraine. In central Europe, with the expansion of NATO, Washington is meanwhile demanding that governments spend billions on weapons rather than on recovering the economy.

- What next after Brexit? — Steve Keen appears to be saying that Brexit will be nowhere near as devastating as Thatcherism. Well, yes, obviously.

- Syd/Melb house price-to-income ratio hits record high — Leith van Onselen at MacroBusiness. Important to note these are median household, not individual, incomes:

In March 2016 the ratio of house prices to annual household income in Sydney was 9.8 and for units it was 7.2. Both property types are currently recording a record-high ratio. 12 months ago these ratios were recorded at 8.9 for houses and 6.8 for units. Note that the data goes as far back as September 2001 and at that time the ratios were recorded at: 6.0 for houses and 5.7 for units.

- Brexit is a 'heartbreaking wake-up call' – and other meaningless political clichés used this week — Robert Fisk, the Independent:

Corbyn […] moved inexorably into this horrible language when he talked, in his first reaction to the Brexit vote, about immigrants’ “skill sets”. […] It was almost a relief to hear poor old Jeremy banging on about the need for the poor to get “a fair crack of the whip”. But why didn’t he just say “equal chance” or, if he wanted to be inventive, use that wonderful Australian expression “a fair suck of the sauce bottle”? Anything rather than whips.

- Lessons From the Past: The Stanford Prison Experiment (SPE) revisited — Phil Zimbardo plugs the new film in Psychology Today:

In 2004, people around the world witnessed online photos of horrific actions of American Military Police guards in Iraq’s Abu Ghraib Prison against prisoners they should have been caring for. It was portrayed as the work of a “few bad apples” according to military brass and Bush administration spokesmen. I publicly challenged this traditional focus on individual dispositions by portraying American servicemen as good apples that were forced to operate in a Bad Barrel (the Situation) created by Bad Barrel Makers (the System). I became an expert witness in the defense of the Staff Sergeant in charge of the night shift, where all the abuses took place. In that capacity I had personal access to the defendant, to all 1000 photos, many videos, to all dozen military investigations, and more. It was sufficient to validate my view of that prison as a replica of the Stanford prison experiment—on steroids, and my defendant, Chip Frederick, as a really Good Apple corrupted by being forced to function 12-hours every night for many months in the worse barrel imaginable.

- Control: beyond left and right — Chris Dillow:

Consider some popular political positions. There’s support for immigration controls and fiscal austerity on the one hand but also for nationalization and even price controls on the other: one Yougov poll found (pdf) that 45% of people favour rent controls and 35% even controls on food prices. These positions make no sense if you think in terms of left and right. But they become perfectly consistent once you see that people want things to be controlled: the popularity of austerity, I suspect, arises from the view that the public finances are “out of control.” This demand for control is, if not the sigh of the oppressed, then the sigh of the insecure. When faced with uncertainty – not just about their economic lives but about cultural change too – people want a sense of control. […] Herein, however, lies a massive opportunity for the left. We should be offering solutions to uncertainty – a stronger better social safety net and a job guarantee.

- (Marketing) Virtual Reality in Education: A History — Audrey Watters:

According to the marketing hype – offered with very little recognition of any media research or media history – VR will be a new and unique “empathy machine.” A century after Thomas Edison’s famous assertion that “books will soon be obsolete in schools” thanks to the wonders of film, watching movies in class is re-presented as progressive pedagogy, as technological innovation.

- The myth of public opinion — Clive Hamilton in the Conversation:

When a party leader declares victory by saying “Australians have spoken”, he or she is doing a number of things. Firstly, he is making a claim to personify the collective psyche, the spirit of the nation that rises above all social divisions to express the pure will of the people. It is what gives a great leader a kind of mandate of heaven, and can be a very dangerous thing. Second, he is asserting his right to govern unopposed against the claims of the losers who may see themselves as a powerful voice that must be heard. The claim that “Australians have spoken” is a means of putting the losers in their place even if they secured 49 per cent of the vote.

- Theresa May, Your New Islamophobic Prime Minister? — Craig Murray:

Britain has draconian anti-terrorism laws that would make a dictatorship blush. It is an offence to “glorify” terrorism. It is specifically “terrorism” for me to write, here and now, that Nelson Mandela was justified in supporting the bombing campaign that got him arrested. I just knowingly committed “glorifying terrorism” under British law. It is specifically “terrorism” to deface the property in the UK of a foreign state with a political motive. If I spray “Gay Pride” on the Saudi embassy, that is terrorism. We also have secret courts, where “terrorists” can be convicted without ever seeing the “intelligence-based” evidence against them. We have convicted young idiots for discussing terror fantasies online. We have convicted a wife who “must have known” what her husband was doing (at least that one was overturned on appeal).

Sunday, 23 October 2016 - 6:00pm

This week, I have been mostly reading:

- There has to be a better way — Steve Keen:

I knew Abbott and Turnbull in their Sydney University days: they were both active student politicians, while I was one of the leaders of the student revolt against the economics curriculum there. Abbott and Turnbull both tried to play a role in this “Political Economy” dispute—and their approach then mirrors their styles today. One believed he knew the word of God, while the other believed he was God.

- Treasury analysis supports Labor’s negative gearing policy — Leith van Onselen at MacroBusiness:

Now the ABC has received a document from the Australian Treasury, under Freedom of Information, which claims most of the windfall from negative gearing and the capital gains tax (CGT) discount goes to high-income earners: "The modelling said more than half of the negative gearing tax benefits go to the top 20 per cent of incomes in Australia."

- What should the level of basic income be in 24 European & OECD countries? — Valerija Korošec for BIEN:

We don’t want to make the system worse than it is. It’s logical, then, that the minimal level of BI should reach, at least, the level of current Social Assistance (SA): we could call this ‘partial’ BI. All BI proposals included in this analysis satisfy this condition. It follows that implementation of a BI close to the level offered by the current social security system (e.g., the SA level) implies budget neutrality in countries with a more universal system.

- The Secret to the Incredible Wealth of Bill Gates — Dean Baker in Truthout:

The story of Bill Gates' copyright protection, along with patent protection for prescription drugs and all sorts of other things, are a big part of the story of inequality. The key issue is that these protections are created by the government. They don't come from the technology. It is the protections that make some people very rich, not the technology. We grant patent and copyright monopolies in order to provide an incentive for innovation and creative work. It is arguable whether these mechanisms are the best way to provide these incentives. For example, in addition to making drugs very expensive, even when they would be cheap in a free market, patent protection also provides an enormous incentive for drug companies to misrepresent the safety and effectiveness of their drugs. But the key point for the inequality issue is that the strength and length of these monopolies is set by government policy.

- Humans vs Houses: Australia’s perverse tax system — Cameron Murray in MacroBusiness:

I often joke that my investment property earns more than I do. Thinking more about this led me to the realisation that my investment property has a privileged position in the tax system when compared to a measly old human being. […] our current system appears to be designed exclusively for the betterment of the property community, rather than the people community. It’s unreal.

- Faking it: made up universities and degrees — Paul Greatrix at Wonkhe:

It does seem to be a continuing problem and I was struck by this recent example reported in the Manchester Evening News. According to the paper the Manchester Open University claims to have a campus on Oxford Road with 2,000 students but was being investigated by the National Fraud Intelligence Bureau: "The Manchester Open University claims to have a campus based on Oxford Road with 2,000 students from 90 different countries – and offers degrees in history, English, and medicine. But education officials say they can’t find a single trace of the institution and that the IP address used by organisation’s website is hosted hundreds of miles away in France."

- Smart cities wouldn’t let housing costs drive the worse-off into deeper disadvantage — Emma Baker, Andrew Beer and Rebecca Bentley:

The relatively well-off and the upwardly mobile improve the areas in which they live over an extended period. The more economically vulnerable tend to make more frequent, multiple moves – living in slightly less advantaged areas each time. To put it in plain terms, the poor move to poor areas where they may become even more disadvantaged. Meanwhile, the middle classes move through our cities gradually climbing the housing ladder.

- Straya: Strong on terror…unless you buy a house — Leith van Onselen, MacroBusiness:

The Australia Government first agreed to implement the second tranche of AML [anti-money laundering] regulations in 2003. Yet 13 years later, these have been delayed indefinitely by the government. This indefinite delay comes despite the Paris-based Financial Action Task Force (FATF) last year releasing a scathing report highlighting that Australian residential property is a haven for international money laundering, particularly from China, and recommending that Australia implement counter-measures to ensure that real estate agents, lawyers and accountants facilitating real estate transactions are captured by the regulatory net.

- Negative gearing: Myths and facts — John Haly, Independent Australia:

Between July 1985 and 1987, the Hawke Government abolished it and rent prices fell everywhere except in Perth, and to a lesser extent, in Sydney. This was not due to the absence of negative gearing but the very low “available” vacancy rates and competition from inflated rent prices (Grattan Report, p 34-34). Thereafter through, a less quarantined negative gearing was reinstated. Housing and rent prices rose but not at the rate they have since 1999. What mitigated the potential effects on the economy of unchecked negative gearing, was the 1985 introduction of a CPI indexed Capital Gains Tax. In 1999, the Howard Government removed indexing and introduced a 50% discount for capital gains for individuals. From that point on, housing prices (and rent) skyrocketed an average of 7.3% annually (Grattan Report, p 31).

- Who Will Accept It? Currency-Issuing Governments are Constrained by Resources, Not Money — Peter Cooper:

When it comes to Modern Monetary Theory (MMT), I think a simple but central point to get across is that for currency-issuing governments the hard policy constraints relate to real resources, not money. We need to convey that money is not the constraint but in almost the same breath call for the focus to be on real resources when pondering questions of economic policy.

- It’s Time to Base Economics on Human Nature, Not Homo Economicus — Jonathan Rowe in Evonomics:

To an economist [Wikipedia] doesn’t make sense. People don’t work for free. Readers are “consumers,” not producers; and consumers do not produce what they consume. Yet they are doing so; and this kind of social co-production is flourishing not only on the Web, but in the society at large. In the U.S. and elsewhere, people are turning their backs on everyday low prices and choosing the social cohesion and productivity of their local Main Streets instead. Researchers and software designers are foregoing property rights – i.e. patents — to their work and are releasing it over the Web for free. So doing they are enriching the public domain that sustains their own work and also that of others. All of this – and more – defies the supposed “laws” of economics.

- The Economist as...?: The Public Square and Economists — Brad DeLong; an intelligent and honourable mainstream economist muses on the responsibilities of his profession:

Of course to provide someone with knowledge of the consequences may be simply to give them the kind of freedom that is necessity: the freedom to do what is the right thing. The old Cold War joke was of the strategist who would offer the president three possible options: immediate surrender to the Russians, total thermonuclear war, and his preferred policy. To the extent that there is no grave disagreement about what the good is and what the ends are, control is exercised not by the one who chooses the ends but rather the one who chooses how the means are evaluated.

- Economists as public intellectuals — Antonio Callari, guestblogging for David F. Ruccio, picks apart DeLong's piece above:

Curiously absent from DeLong’s history are important intellectual thresholds, most notably in late (European) medieval times (e.g., Ibn-Khaldun, Thomas Aquinas) , at which the legal, institutional, and even (and profoundly) cultural foundations were laid out for markets: the general discussions about the nature of property and the embeddedness of prices/incomes in social contexts. It’s not just whole schools of thought (i.e., the Sraffa-Smith tradition) that drop out of DeLong’s purview, but also whole interesting episodes of philosophical and intellectual history that get taken out. This can’t be because DeLong doesn’t know about them: he makes sure we know he reads beyond “economics” (he knows figures I grew up with, Homer and Cicero; figures I know of, Leon Trotsky and Alasdair Macintyre; and figures I frankly don’t know, St. Benedict). So, what is it that makes him, as such a well-read person, neglect the intellectual episodes others (e.g., Schumpeter) found important in the history of economics? A complacent, and problematic, view of the “economist” as “scientist”? A complacent, and problematically orthodox, definition of the core of “economics” as a study of “exchange”?

- Universal Basic Income, Job Killing Robots, and the Washington Post — Dean Baker addresses robophobia, or Grimwade's Syndrome, as it is known in some parts of the galaxy:

What possible difference can it make if a job is displaced by a robot or a more efficient assembly line? We have seen whole industries, like photographic film, wiped out by digital technology. Would the former workers at Kodak somehow be worse off if they had lost their jobs to robots than to digital cameras? The point is that robots are productivity growth. Say that a few thousands times until it sinks in. The impact of robots on the economy is nothing more or less than any other innovation that produces the same amount of productivity growth.

- Brexit: Clearing Up the Economic Nonsense — David L. Glotzer wields a mean hypothetical (but is wrong about Maastricht; the UK is a signatory):

Take the EU “membership fee.” For arguments sake assume that all of it is wasted, on let’s say muffins. What actually happens when over the course of a year £13bn is sent to the EU? What is the impact of this on the British economy? First Parliament instructs George Osborn to send money to the European Commission. George Osborn tells someone who works for him to type a number into a computer (here British Pounds are literally ‘keystroked’ into existence) transferring a certain amount of money to a British bank account held by the European Commission. Since the British Pound is only used as a currency within the British economy the EC can only buy muffins from British Bakers, thereby boosting the demand for British baked goods and increasing British GDP.

- Basic Income Revisited — Robert Skidelsky in Project Syndicate:

The ethical case for [UBI's…] source is the idea, found both in the Bible and in classical economics, that work is a curse (or, as economists put it, a “cost”), undertaken only for the sake of making a living. As technological innovation causes per capita income to rise, people will need to work less to satisfy their needs. Both John Stuart Mill and John Maynard Keynes looked forward to a horizon of growing leisure: the reorientation of life away from the merely useful toward the beautiful and the true. UBI provides a practical path to navigate this transition.

- Money for Nothing: Confessions of a Payday Lender: “I Felt Like a Modern-Day Gangster” — Gary Rivlin, the Intercept:

Spending time with Locke in Michigan often meant listening to long rants about the lack of gratitude among the partners he had brought into the payday business, despite all the money he had made them. “Friends screwing me over,” Locke said. “Business partners screwing me over. People who begged me to get them into the business — screwing me over.” He’s kind of a human Eeyore who wears his disappointment as an outer garment. Of his customers, Locke said, “I feel bad for these people.” But he seemed to feel sorry mainly for himself.

- Math Education — Saturday Morning Breakfast Cereal, by Zach Weinersmith:

- Basic Income, Job Guarantees and the Non-Monetary Value of Jobs: Response to Davenport and Kirby — Kate McFarland, Basic Income Earth Network (BIEN):

To take just one example, Zipcar CEO Robin Chase spoke of her research on “passion jobs” a recent White House roundtable discussion on automation an UBI. She has interviewed individuals from a cab driver who wrote music that made autistic children happy (but could not afford to pursue this passion full-time) to a computer programmer who slept on friends’ couches while writing open source software for 3D printers. In her informal research, she has encountered many people who are unable to pursue socially valuable and personally gratifying projects, simply because these projects are not financially lucrative; instead, these people are stuck in “crummy jobs”, detached from their passions. Chase herself supports a UBI as a way to allow individuals to pursue vocations that would give their lives much more meaning than the jobs to which they must resort for income.

- The Greater Happiness for the More Workers: Basic Income vs Job Guarantee Pt 2 — Kate McFarland at BIEN continues:

Neurodivergent individuals, and others who do not fit neatly in the mold of society, can be stifled and inhibited by traditional work environments. Such individuals are better able to flourish personally–and, in turn, become more valuable contributors to society–if they are able to working outside of traditional jobs, or perhaps take the time to a job that is a better match.

- Socrates on Debt and Ibn Khaldun on the Cyclical Rise and Fall of Societies — Michael Hudson in Naked Capitalism:

In Book I of Plato’s Republic (380 BC), Socrates discusses the morality of repaying debts. Cephalus, a businessman living in the commercial Piraeus district, states the typical ethic that it is fair and just to pay back what one has borrowed or received. Socrates replies that it would not be just to return weapons to a man who has turned into a lunatic. Because of the consequences, paying back the debt would be the wrong thing to do. At issue is not the micro-economic morality of paying a debt, but how this act affects society. If a madman is intent on murder, returning his weapon to him will enable him to commit unjust acts. The morality of paying back all debts is not necessarily justice. We need to take the overall consequences into account.

Sunday, 16 October 2016 - 8:11pm

I have had the most beastly week, and in rare moments when I've managed to gather up some scraps of dignity and hope, I have been mostly reading:

- Want to Kill Your Economy? Have MBA Programs Churn out Takers Not Makers. — Rana Foroohar, in Evonomics, adapted from part of her book "Makers & Takers: The Rise of Finance and the Fall of American Business":

With very few exceptions, MBA education today is basically an education in finance, not business—a major distinction. So it’s no wonder that business leaders make many of the finance-friendly decisions. MBA programs don’t churn out innovators well prepared to cope with a fast-changing world, or leaders who can stand up to the Street and put the long-term health of their company (not to mention their customers) first; they churn out followers who learn how to run firms by the numbers. Despite the financial crisis of 2008, most top MBA programs in the United States still teach standard “markets know best” efficiency theory and preach that share price is the best representation of a firm’s underlying value, glossing over the fact that the markets tend to brutalize firms for long-term investment and reward them for short-term paybacks to investors.

- Why we need to teach political philosophy in schools — Jonathan Floyd in the Conversation:

What is the spectre haunting Europe today? It’s simple. The thing that truly dogs us, that really drags at our heels, is ignorance. Ignorance of the fundamental ideas at the heart of politics. Ignorance of the key terms of political argument: liberty, equality, power, justice, and so on. Ignorance of the subject matter of political philosophy. […] We are ignorant of our ignorance of it, as well as what that ignorance costs us. It is, to borrow from Donald Rumsfeld, an unknown unknown, when it could be something else: the thing that liberates the minds of our citizens; a weapon of mass deduction.

- How housing bubbles destroy productivity — Leith van Onselen at MacroBusiness:

The Australian Housing and Urban Research Institute (AHURI) has released a new report exploring “the nature and magnitude of the relationship between house prices, household debt and the labour market decisions of Australian households”, which paints a sobering picture for the economy and financial stability. The key conclusion from the report is that “households accumulate debt as house prices increase, leaving them vulnerable to housing and labour market shocks. House price increases also potentially promote or dampen labour supply and labour force productivity”. In other words, Australia’s housing bubble is distorting the economy.

- Advertising — Flea Snobbery:

- These charts show why some experts fear an apartment glut — Clancy Yeates in the Age provides your chart porn for the week:

- How the two major parties shape up on debate around student loan reform — in the Conversation, Andrew Norton (higher education policy's evil incarnate) discovers that students paying the post hoc education tax often pool their resources by sharing their accommodation with others. Like animals. This barbarous custom is unheard of among employees of the Grattan Institute, and means the income-contingent payment threshold must be lowered to make graduates pay for their disgusting habits:

Because HELP debtors often live with other people, their personal income is not always a reliable guide to their living standards. They share expenses and sometimes income with others. Grattan’s analysis found that half the debtors who would be affected by a $42,000 threshold live with a partner.

Sunday, 9 October 2016 - 5:49pm

This week, I have been mostly reading:

- Time to Kill Security Questions—or Answer Them With Lies — In Wired, Lily Hay Newman asks you to "please reset your mother's maiden name":

The notion of using robust, random passwords has become all but mainstream—by now anyone with an inkling of security sense knows that “password1” and “1234567” aren’t doing them any favors. But even as password security improves, there’s something even more problematic that underlies them: security questions.

- Billionaire: Chinese real estate is 'biggest bubble in history' — Jethro Mullen and Andrew Stevens, CNN Money [I wouldn't normally cite CNN, but it's worth it for the tl;dr. You can't avert a private-sector debt crisis without fiscal policy. Private sector deleveraging without public sector spending is a) unlikely, and b) suicidal.]:

"The problem is the economy hasn't bottomed out," Wang said. "If we remove leverage too fast, the economy may suffer further. So we'll have to wait until the economy is back on the track of rebounding -- that's when we gradually reduce leverage and debts."

- What’s So Bad about the Trade Deficit? — David Glasner reproduces a column he wrote in 1984, because we're still having the same misbegotten arguments:

Just what is so dangerous about receiving more goods from foreigners than we give them back is never actually explained, but it is often suggested that that it causes a loss of American jobs. […] It almost seems tedious to do so, but it apparently still needs to be pointed out that buying less from foreigners means that they will buy less from us for the simple reason that they will have fewer dollars with which to purchase our products. […] Anyone who has ever thought about it has probably wondered why a country that gives up more goods in trade than it gets back is said to have a favorable balance of trade.

- Anti-Intellectualism, Terrorism, and Elections in Contemporary Education: a Discussion with Noam Chomsky — an interview by Dan Falcone and Saul Isaacson in CounterPunch:

I mean even before the Second World War Paris was one of the main centers of intellectual and cultural life. But now Paris is a kind of subsidiary of Germany, their traditional enemy and they can’t come to terms with it. They’ve tried to create one crazy thing after another to try to be exciting, each one more lunatic than the last, and this is one of them. And it’s picked up here in mostly literature departments and some humanities departments. It kind of gives the impression of being serious. Like you use big words and you have complicated sentences and there’s things nobody can understand, so we must be like physicists because I can’t understand them and they can’t understand me.

- Chartalism and Stock-Flow Consistency: A Reply to Nick Rowe — Alexander X. Douglas:

In a world of perfect certainty, there would be no need to accumulate dollars: people would spend all their dollars (or whatever currency) buying what they need today on the spot market and everything they need tomorrow on the forward market. Cue the requisite Keynes quotations about money as the barometer of uncertainty.

- How Perfect Markets Concentrate Wealth and Strangle Growth and Prosperity — Steve Roth:

The dynamics are straightforward here: poorer people spend a larger percentage of their income than richer people. So if less money is transferred to richer people (or more to poorer people), there’s more spending — so producers produce more (incentives matter), there’s more surplus from production, more income, more wealth…rinse and repeat.

- Undercommoning within, against and beyond the university-as-such — the Undercommoning Collective have been reading Paulo Freire:

We recognize that the university as it currently exists is part of an archipelago of social institutions of neoliberal, free-market racial capitalism. It includes the for-profit prison and the non-for-profit agency, the offshore army base and the offshore tax haven, the underfunded public and the elite private school, the migrant-worker staffed shop floor and the Wall Street trading floor, the factory and the factory farm. All are organs for sorting, exalting, exploiting, drilling, controlling and/or wasting what they call “human capital” and that we call our lives.

- OECD joins the rush to fiscal expansion – for now at least — Bill Mitchell:

In the last month or so, we have seen the IMF publish material that is critical of what they call neo-liberalism. They now claim that the sort of policies that the IMF and the OECD have championed for several decades have damaged the well-being of people and societies. They now advocate policy positions that are diametrically opposite their past recommendations (for example, in relation to capital controls). In the most recent OECD Economic Outlook we now read that their is an “urgent need” for fiscal expansion – for large-scale expenditure on public infrastructure and education – despite this organisation advocating the opposite policies at the height of the crisis. It is too early to say whether these ‘swallows’ constitute a break-down of the neo-liberal Groupthink that has dominated these institutions over the last several decades. But for now, we should welcome the change of position, albeit from elements within these institutions. They are now advocating policies that Modern Monetary Theory (MMT) proponents have consistently proposed throughout the crisis.

- Public spaces are going private – and our cities will suffer — Harry Smith in the Conversation:

Part of the explanation for this trend is that local authorities are increasingly using existing public spaces to raise funds, by charging for events or leasing their spaces to companies. In many cases, cash-strapped authorities are suffering from public sector cuts, and trying to improve or maintain their open spaces by entering into deals with private organisations.

- National borders exist to pen poor people into reservations of poverty — Giles Fraser in the Guardian:

We are so hypocritical about borders. We cheer when the Berlin Wall comes down. We condemn the Israelis for their separation barrier and Donald Trump for his ludicrous Mexican fence. But are we really so different? We also police our borders with guns and razor wire as if we had some God-given right to this particular stretch of land. Through the random lottery of life, I have a UK passport. I didn’t work for it or do anything whatsoever to deserve it. In economic terms, I just happened to be born lucky. […] It’s like our own little version of The Hunger Games. And it is so normal to us, we don’t even recognise it as a moral issue.

- Why universal basic income is seizing the agenda — Richard Murphy in iNews:

So why do it? There are many reasons. First, a lot (bit not all) of state benefits would roll over into the basic income and that would simplify the whole benefits system, saving a great deal. Second, work would always pay, but the tax rate when taking work and losing benefits would fall to a much more acceptable level, which would end the poverty trap that still ensnares far too many people in the current system.

- Cutting Australia’s Corporate Income Tax: A Gift to the U.S. Treasury Department — Dean Baker for Crikey:

One of the ironies of proposals to reduce Australia’s tax rate is that the U.S. Treasury would be a major beneficiary. The logic is straightforward, even if seldom advertised by proponents of the tax cut. Under tax treaties, the U.S. credits it multinationals with tax payments to the Australian government on a dollar for basis. This means that if a U.S. multinational has its Australian tax bill cut by $10 million then its U.S. tax bill likely increases by the same amount. The money saved by the company in Australia will go straight to the U.S. Treasury.

[Okay, sectoral balances and all that: the money actually goes to the Fed, where it just redeems the liability incurred when the money was issued, and the Fed actually provides new money when Treasury spends. However the irony stands.] - Adjuncts are unionizing, but that won’t fix what’s wrong in higher education — Lisa Liberty Becker in the Washington Post:

The Service Employees International Union (SEIU), also the force behind the Fight for 15 movement, has mobilized adjuncts in such spots as Washington, Boston and Los Angeles. During this past semester alone, according to the SEIU, adjuncts at 11 schools have ratified or agreed on union contracts. While there have been short-term gains, the deeper we become entrenched in adjunct unions, the more we are locked in an educational structure that shortchanges students by skimping on teaching.

- Six thoughts on teaching — Richard Seymour:

In a way, the teacher’s job isn’t to inform students of what they, ignorant little twits, don’t know. It is to place a different value on not-knowing. It is to enable students to make peace with the fact that not-knowing is the usual state of affairs.

- Conquer Your Day With the Power of Breakfast! — in McSweeney’s Internet Tendency, Curtis Retherford makes me LOL, and a LOL from me does not come cheap, my friend:

Breakfast. Breakfast stands alone. Breakfast is the most important meal of the day. It is the meal that fuels you for everything you encounter, that gets you ready for those important meetings. First thing in the morning, sit down and eat a bunch of eggs, and you will be able to tackle the day with confidence. You’ll be able to lean in to those who stand in your way and whisper softly in their ear, “my stomach is filled with eggs.” Their eyes will widen. They will not have realized that you have come prepared.

- The Great British higher education sell-off — Ehsan Masood, openDemocracy:

Private sector involvement in public services is now so mainstream it is surprising that it has taken so long for the market to meet higher education. But surprised we should be. The idea that we should be allowed to become rich from the education of present and future generations was a step too far even for Margaret Thatcher. Not so, however, for her successors.[…] I challenge any entrepreneur to read the research and HE bill, and not emerge feeling that you have struck oil. If these proposals become law, then, over time, the fee-paying student will become the human equivalent of black gold.

- Let’s Get Fiscal — Bill Emmott (former editor-in-chief of The Economist) at Project Syndicate:

In the inflation-plagued 1970s and 1980s, when investors’ demand for inflation-risk premia pushed up long-term borrowing costs, larger deficits tended to boost long-term interest rates further, while smaller deficits reduced them. It was this experience that caused policymakers after 2010 to assume that reducing government demand would help to boost private investment. […] But times have changed. For starters, we are no longer living in an inflationary era. On the contrary, Japan and some eurozone countries face deflation, while inflation in the UK is essentially zero. Only in America is inflation picking up – and only gently. Moreover, long-term borrowing costs are at historic lows, just as they have been throughout the last five years. Pursuing austerity in this context has resulted in a drag on growth so severe that not even the halving of energy prices over the last 18 months has overcome it.

- ‘Chemophobia’ is irrational, harmful – and hard to break — Corey S Powell:

In reality, ‘natural’ products are usually more chemically complicated than anything we can create in the lab. […] The distinction between natural and synthetic chemicals is not merely ambiguous, it is non-existent. The fact that an ingredient is synthetic does not automatically make it dangerous, and the fact that it is natural doesn’t make it safe. Botulinum, produced by bacteria that grow in honey, is more than 1.3 billion times as toxic as lead and is the reason why infants should never eat honey. A cup of apple seeds contains enough natural cyanide to kill an adult human.

- Herstory, for Real — Ted Rall:

Sunday, 2 October 2016 - 5:32pm

This week, I have been mostly reading:

- In which Review causes Relief — Wondermark, by David Malki!:

- The False Promise of Negative Interest Rates — Robert Skidelsky:

Economists are now busy devising new feats of monetary wizardry for when the latest policy fails: taxing cash holdings, or even abolishing cash altogether; or, at the other extreme, showering the population with “helicopter drops” of freshly printed money. The truth, however, is that the only way to ensure that “new money” is put into circulation is to have the government spend it. The government would borrow the money directly from the central bank and use it to build houses, renew transport systems, invest in energy-saving technologies, and so forth. Sadly, any such monetary financing of public deficits is for the moment taboo. It is contrary to European Union regulations – and is opposed by all who regard post-crash governments’ fiscal difficulties as an opportunity to shrink the role of the state.

- Yanis Varoufakis: Australia's negative gearing is 'scandalous' — Gabrielle Jackson commits some nauseating journalisticisms in her interview with "he, with his vibrant purple shirt and erect posture" for the Guardian:

In Australia we have a scandalous system called negative gearing, the purpose of which is to subsidise the rich. […] Australia does not have a debt problem. The idea that Australia is on the verge of becoming a new Greece would be touchingly funny if it were not so catastrophic in its ineptitude. Australia does not have a public debt problem, it has a private debt problem.

- Is David Cameron's Austerity Three Times as Bad as Brexit? — Dean Baker at CEPR (US):

If we can credit the I.M.F. research staff for knowing what they were doing in their 2008 projections, then the U.K.'s austerity policies have cost it an amount of output equal to 16.8 percentage points of 2007 GDP or more than three times the estimated cost of Brexit. This means that if Brexit is an economic disaster then Cameron's austerity has been three times as costly as an economic disaster.

- The Rough Beasts of Ed-Tech — Audrey Watters:

“They’re brine shrimp,” my father explained to me when I begged him to let me order some, destroying the image I had in my head that these were little cartoon mermaids and mermen and mer-families. […] I’ve thought recently that for every silly news story we see that insists some new product is “like Uber but for education” or “like Facebook but for education,” one could easily substitute “like Sea Monkeys but for education.”

- Viet Con — Mr. Fish in Truthdig:

- The Brazilian Coup and Washington’s “Rollback” in Latin America — Mark Weisbrot in the Huffington Post:

It is clear that the executive branch of the U.S. government favors the coup underway in Brazil, even though they have been careful to avoid any explicit endorsement of it. Exhibit A was the meeting between Tom Shannon, the 3rd ranking U.S. State Department official and the one who is almost certainly in charge of handling this situation, with Senator Aloysio Nunes, one of the leaders of the impeachment in the Brazilian Senate, on April 20. By holding this meeting just three days after the Brazilian lower house voted to impeach President Dilma Rousseff, Shannon was sending a signal to governments and diplomats throughout the region and the world that Washington is more than ok with the impeachment. Nunes returned the favor this week by leading an effort (he is chair of the Brazilian Senate Foreign Relations Committee) to suspend Venezuela from Mercosur, the South American trade bloc.

- London’s empty towers mark a very British form of corruption — Simon Jenkins in the Guardian:

Now we know. The glitzy 50-storey tower that looms over London’s Vauxhall and Pimlico is, as the Guardian revealed yesterday, just a stack of bank deposits. Once dubbed Prescott Tower, after the minister who approved it against all advice, it is virtually empty. At night, vulgar lighting more suited to a casino cannot conceal the fact that its interior is dark, owned by absent Russians, Nigerians and Chinese. It makes no more contribution to London than a gold bar in a bank vault, but is far more prominent, a great smudge of tainted wealth on the city’s horizon.

- ECB’s expanded asset purchase programme – more smoke and mirrors — Bill Mitchell:

We now have sufficient data to assess what has been going on under [the ECB's QE] program, and specifically under the public sector purchase programme (PSPP) components (one of three parts to the overall policy initiative). The conclusion is that the scheme has had very little impact on growth and inflation – which is no surprise. However, the pattern of purchases makes it clear that the ECB and the relevant National Central Banks (NCBs) have been engaged in a fiscal operation which has provided extensive debt relief to all Member States other than Greece. This is a demonstration of the European institutions once again engaging in smoke and mirrors (pretending to be operating within the ambit of the Treaties but openly doing the opposite) and behaving belligerently towards one nation (Greece) to ensure it stays subjugated.

- Iceland proves the nation state is alive and well — Bill Mitchell dismisses "grand (delusional) schemes of a Pan Europe Democracy":

The scaremongers who claim that the weaker euro nations would experience massive and ongoing currency plunges are in denial of history. Iceland’s approach to the crisis was less painful and more effective. Greece and other weaker euro nations could have enjoyed similar improvements in their external competitiveness if they had exited the EMU and allowed their currencies to float. Internal devaluation has clearly not been an effective route to increasing international competitiveness despite all the neo-liberal claims to the contrary.

Sunday, 25 September 2016 - 8:49pm

This week, I have been mostly reading:

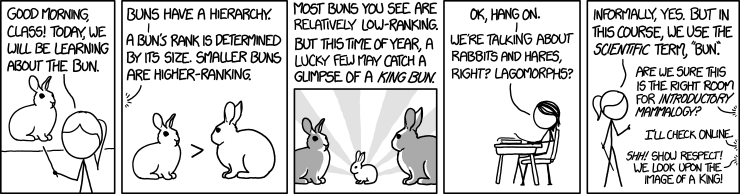

- Bun — xkcd [I believe I know this lecturer]:

- The household debt bubble won’t grow forever — Laurie MacFarlane at the New Economics Foundation:

In the economy, total income equals total spending: every pound spent somewhere is earned somewhere else. So if one sector of the economy is spending less than it’s earning and saving, the other sectors must collectively be spending more than they’re earning, and accumulating debt or running down savings. After the financial crisis in 2008, households started spend less to pay down debt, so the government spent more and ran large deficits to offset the effects of the crisis. But with the government pursuing further cuts to public spending in order to achieve a budget surplus by 2019-20, the only way that growth can be achieved and consumption maintained is by households running down savings and accumulating debt.

[And linked from this, something I must have missed in March:] - How household debt is becoming the new safety net — Sarah Lyall at the New Economics Foundation:

Credit is being used as a safety net by millions in the UK, according to new polling data released by debt advice charity Stepchange. They estimate that 15% of people - 7.4 million individuals nationally – have turned to debt for essential day-to-day spending, while 6% of people (around 3 million) use this credit safety net on a weekly or monthly basis.

- The empty brain — Robert Epstein in Aeon:

Senses, reflexes and learning mechanisms – this is what we start with, and it is quite a lot, when you think about it. If we lacked any of these capabilities at birth, we would probably have trouble surviving. But here is what we are not born with: information, data, rules, software, knowledge, lexicons, representations, algorithms, programs, models, memories, images, processors, subroutines, encoders, decoders, symbols, or buffers – design elements that allow digital computers to behave somewhat intelligently. Not only are we not born with such things, we also don’t develop them – ever.

- The Political Movement that Dared not Speak its own Name: The Neoliberal Thought Collective Under Erasure — Philip Mirowski in an INET working paper:

The neoliberals believed that the market always knew better than any human being; but humans would never voluntarily capitulate to that truth. People would resist utter abjection to the demands of the market; they would never completely dissolve into undifferentiated ‘human capital’; they would flinch at the idea that the political franchise needed to be restricted rather than broadened; they would be revolted that the condition of being ‘free to choose’ only meant forgetting any political rights and giving up all pretense of being able to take charge of their own course through life. Neoliberal ideals would always be a hard sell; how much easier to avoid all that with simplistic stories that fogged the mind of the masses: government is always bad; everything you need to know is already in Adam Smith; you can be anything you want to be; there is no such thing as class or the dead hand of history; everything can be made better if you just express yourself on some social media platform; there is nothing wrong with you that a little shopping won’t fix.

- WashPost Makes History: First Paper to Call for Prosecution of Its Own Source (After Accepting Pulitzer) — Glenn Greenwald:

In the face of a growing ACLU and Amnesty-led campaign to secure a pardon for Snowden, timed to this weekend’s release of the Oliver Stone biopic “Snowden,” the Post editorial page today not only argued in opposition to a pardon, but explicitly demanded that Snowden — the paper’s own source — stand trial on espionage charges or, as a “second-best solution,” accept “a measure of criminal responsibility for his excesses and the U.S. government offers a measure of leniency.” In doing so, the Washington Post has achieved an ignominious feat in U.S. media history: the first-ever paper to explicitly editorialize for the criminal prosecution of its own source — one on whose back the paper won and eagerly accepted a Pulitzer Prize for Public Service.

- Keynes and the Quantity Theory of Money — Frances Coppola:

Expanding the monetary base with QE while simultaneously reducing government spending and raising taxes to "fix the fiscal finances" is a wash. No, it's worse than that. It transfers money from households who would actually spend that money on goods and services, and businesses who would invest it for future growth, to banks and the rich, who only spend it on assets. The wealth effects from inflated asset prices may at the margin encourage more spending among those foolish enough to borrow (or dis-save) on the strength of unrealised capital gains, while the depressed interest rates that are the inevitable consequence of inflated asset prices may also encourage borrowing by those who would struggle to service debts if interest rates were higher. I am constantly amazed that any policymaker thinks that such unwise behaviour is to be encouraged. Deficit spending would be both safer and more effective than flooding banks with reserves and blowing up asset price bubbles. But we have tied ourselves into a ridiculous straitjacket because of wholly unjustified fear of government debt.

- Keep on truckin’—without drivers — David F. Ruccio:

I was perplexed. I couldn’t figure out what all the fascination was with self-driving cars. Why all the investment in designing cars that could be operated with little or no hands-on attention by a human driver? So, I asked a friend what that was all about, and he quickly responded: it’s really about trucks, not cars. In a country whose system of transporting commodities is insanely organized around highways and trucks (as against, e.g., railroads and trains), and where truck-drivers’ pay is once-again rising […] it makes perfect—profitable—sense to design trucks that can operate without drivers.

- The Labour leadership battle between Jeremy Corbyn and his critics will soon be over – for three minutes — Mark Steel in the Independent:

At last the result of the leadership election will finish this period of Labour’s squabbling. Then a new period of squabbling can begin, three minutes after the result is announced, when a group of 45 MPs issue a statement saying: 'During the last three minutes, it has become increasingly clear that Jeremy Corbyn has lost the support of the party and must step down immediately.'

- For the first time, Saudi Arabia is being attacked by both Sunni and Shia leaders — Robert Fisk in the Independent:

The Saudis step deeper into trouble almost by the week. Swamped in their ridiculous war in Yemen, they are now reeling from an extraordinary statement issued by around two hundred Sunni Muslim clerics who effectively referred to the Wahhabi belief – practiced in Saudi Arabia – as “a dangerous deformation” of Sunni Islam. The prelates included Egypt’s Grand Imam, Ahmed el-Tayeb of al-Azhar, the most important centre of theological study in the Islamic world, who only a year ago attacked “corrupt interpretations” of religious texts and who has now signed up to “a return to the schools of great knowledge” outside Saudi Arabia.

- Making things matters. This is what Britain forgot — Ha-Joon Chang in the Guardian:

Another argument is that we now live in a post-industrial knowledge economy, in which “making things” no longer matters. The proponents of this argument wheel out Switzerland, which has more than twice the per capita income of the UK despite – or rather because of – its reliance on finance and tourism. However Switzerland is actually the most industrialised country in the world, measured by manufacturing output per head. In 2013 that manufacturing output was nearly twice the US’s and nearly three times the UK’s. The discourse of post-industrial knowledge economy fundamentally misunderstands the role of manufacturing in economic prosperity.