Sunday, 17 January 2016 - 4:37pm

This week, I have been mostly reading:

- Meet the lefty club behind a blitz of new laws in cities around the country — Lydia DePillis at the Washington Post on municipal governments joining together to think big:

The central idea of Local Progress […] is that no issue is out of bounds for city government. Besides environmental groups, it has heavy involvement from the labor movement; an AFL-CIO vice president sits on the organization’s board, and the conference in October had a session on the Service Employees International Union’s Fight for $15 minimum wage campaign, along with numerous appearances by union officials. Those outside groups are essential to getting new policy ideas into practice.

- Why Do Americans Work So Much? — Rebecca J. Rosen, The Atlantic:

According to [Benjamin M.] Friedman, “Between 1947 and 1973 the average hourly wage for nonsupervisory workers in private industries other than agriculture (restated in 2013 dollars) nearly doubled, from $12.27 to $21.23—an average growth rate of 2.1 percent per annum. But by 2013 the average hourly wage was only $20.13—a 5 percent fall from the 1973 level.” For most people, then, the magic of increasing productivity stopped working around 1973, and they had to keep working just as much in order to maintain their standard of living.

- This Fake Bomb Detector Is Blamed for Hundreds of Deaths. It’s Still in Use. — Murtaza Hussain, The Intercept:

The BBC investigation led to a subsequent export ban on the devices, as well as a 10-year prison sentence for the British businessman, James McCormick, responsible for their manufacture and sale. An employee of McCormick who later became a whistleblower said that after becoming concerned and questioning McCormick about the device, McCormick told him the ADE 651 “does exactly what it’s designed to. It makes money.”

- Coding Bootcamps and the New For-Profit Higher Ed — Coding Bootcamps and the New For-Profit Higher Ed:

Of the more than 5000 career programs that the Department of Education tracks, 72% of those offered by for-profit institutions produce graduates who earn less than high school dropouts.

- Did Money Evolve? You Might (Not) Be Surprised — Steve Roth, Evonomics:

The main finding from all this: the earliest uses of money in recorded civilization were not coins, or anything like them. They were tallies of credits and debits (gives and takes), assets and liabilities (rights and responsibilities, ownership and obligations), quantified in numbers. Accounting.

- How the Gates Foundation Reflects the Good and the Bad of “Hacker Philanthropy” — Michael Massing, The Intercept:

Despite its impact, few book-length assessments of the foundation’s work have appeared. Now Linsey McGoey, a sociologist at the University of Essex, is seeking to fill the gap. “Just how efficient is Gates’s philanthropic spending?” she asks in No Such Thing as a Free Gift. “Are the billions he has spent on U.S. primary and secondary schools improving education outcomes? Are global health grants directed at the largest health killers? Is the Gates Foundation improving access to affordable medicines, or are patent rights taking priority over human rights?” As the title of her book suggests, McGoey answers all of these questions in the negative.

- Australia – investment spending contracts sharply, recession looming — Bill Mitchell:

In light of the latest investment expectations revealed in today’s ABS data release, the Government should abandon their fiscal strategy immediately and announce a significant stimulus package. Unemployment is already at elevated levels and will rise further under the current trends. This is another case of neo-liberal austerity white-anting the capacity of the economy to deliver prosperity for all.

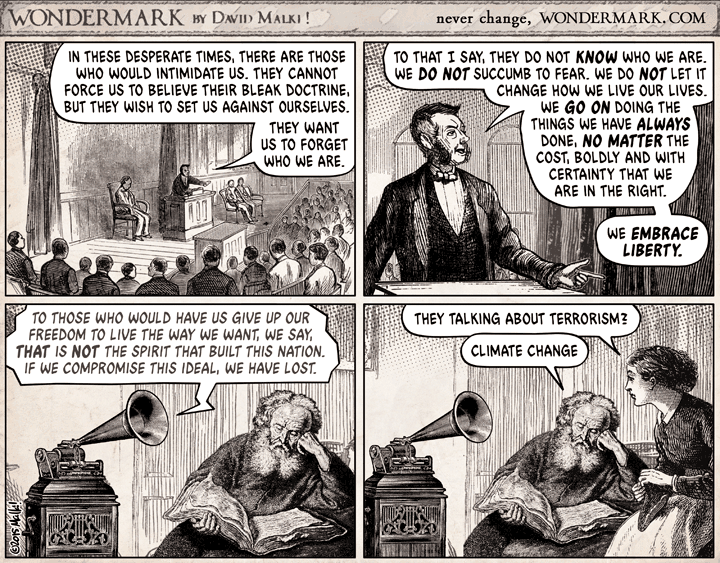

- Stay the course — Wondermark:

- Spending Review 2015: the graphs you need to see — Olivier Vardakoulias. New Economics Foundation:

As real wages stagnate, unsecured household borrowing – like credit card debts, personal loans, or utility bills – are propping up activity in the economy.