You are here:

You are here

- Internet or Intifada? — Shlomo Ben-Ami, Project Syndicate:

According to Israeli Prime Minister Binyamin Netanyahu, the ongoing wave of knife attacks on Jews by young Palestinian “lone wolves” can be blamed entirely on incitement by Palestinian Authority and Islamist websites. Netanyahu evidently expects Israelis, and the world, to believe that if these sites were posting cat videos, the Palestinians would cease their agitation and submit quietly to occupation.

- What We Know About the Computer Formulas Making Decisions in Your Life — Lauren Kirchner, ProPublica:

Sophisticated algorithms are now being used to make decisions in everything from criminal justice to education. But when big data uses bad data, discrimination can result. […] Here are a few good stories that have contributed to our understanding of this relatively new field.

- The Ever-Growing Ed-Tech Market — Angela Chen, The Atlantic:

The testing and assessment market, which raked in $2.5 billion during the reported year, was the single largest category of any segment. The assessment market increased so quickly because of the growth of test-friendly Common Core standards a few years back when this data was being collected, Billings explained. She added that—given President Barack Obama’s recent push to limit testing in schools—the segment may soon see a testing pushback that will hurt revenue down the road.

- The Most Brazen Corporate Power Grab in American History — Chris Hedges in Truthdig:

Wages will decline. Working conditions will deteriorate. Unemployment will rise. Our few remaining rights will be revoked. The assault on the ecosystem will be accelerated. Banks and global speculation will be beyond oversight or control. Food safety standards and regulations will be jettisoned. Public services ranging from Medicare and Medicaid to the post office and public education will be abolished or dramatically slashed and taken over by for-profit corporations. Prices for basic commodities, including pharmaceuticals, will skyrocket. Social assistance programs will be drastically scaled back or terminated. And countries that have public health care systems, such as Canada and Australia, that are in the agreement will probably see their public health systems collapse under corporate assault.

- Ongoing crises of capitalism — David F. Ruccio:

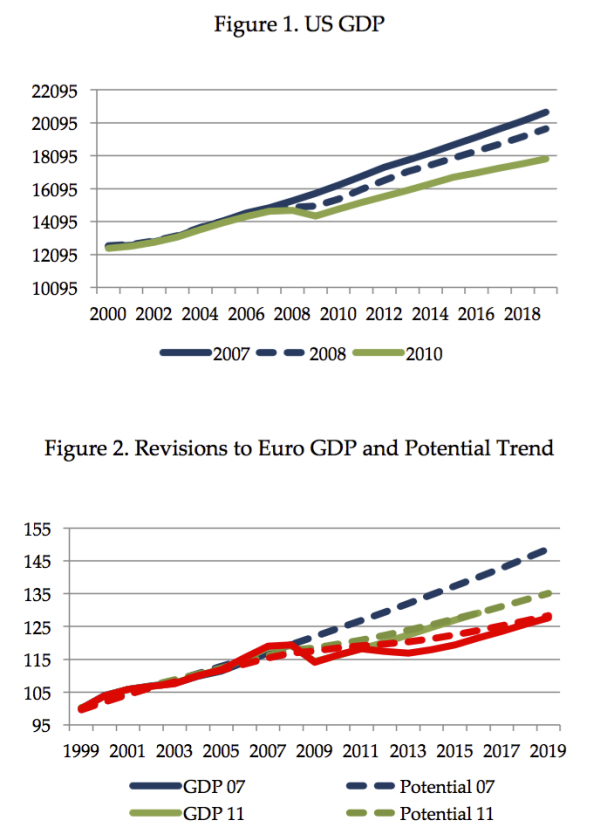

This persistent crisis of capitalism, which was ignored by mainstream economists, also challenges the mainstream traditions of explaining business cycles by technology shocks and of separating long-term growth dynamics from short-run business cycles.

- Workers’ Control in Academia — Jonathan Rees in The Academe Blog:

Faculty-centered online education can be both convenient for students and pedagogically innovative. Quite simply, professors can do extraordinary things using digital tools in online, hybrid and regular face-to-face classes. Unfortunately, that assumes that their administrators let them. If the online course universe is controlled by Associate Deans trying to make a name for themselves and populated entirely by adjunct faculty who cannot control their own courses, these minor technological miracles are unlikely to happen.

- Is economics a science? — Invisible hand-waving:

For Lakatos, the hallmark of a ‘progressive’ scientific research programme is not whether it is falsifiable. […] Rather, the hallmark of a progressive scientific research programme is whether or not the theory makes successful novel predictions. In other words, is the theory is able to successfully predict new phenomena which it was not originally built to explain?

- Limits of the profit motive — Chris Dillow:

My point here is not to decry the profit motive. It has a place. But that place must be circumscribed not only by the regulation of predatory capitalism but also by greater socialization of investment to exploit and develop new technologies and by a more widespread ownership of capital - via worker ownership, a sovereign wealth fund or more widespread participation in equity markets.

- Edward Snowden Explains How To Reclaim Your Privacy — Micah Lee at The Intercept: It's scary how few of these things I do, even though I know better.

- Beware of ads that use inaudible sound to link your phone, TV, tablet, and PC — Dan Goodin, Ars Technica:

The ultrasonic pitches are embedded into TV commercials or are played when a user encounters an ad displayed in a computer browser. While the sound can't be heard by the human ear, nearby tablets and smartphones can detect it. When they do, browser cookies can now pair a single user to multiple devices and keep track of what TV commercials the person sees, how long the person watches the ads, and whether the person acts on the ads by doing a Web search or buying a product.

- I was held hostage by Isis. They fear our unity more than our airstrikes — Nicolas Hénin in the Guardian:

Why France? For many reasons perhaps, but I think they identified my country as a weak link in Europe – as a place where divisions could be sown easily. That’s why, when I am asked how we should respond, I say that we must act responsibly. And yet more bombs will be our response.

- The Cannibalized Company — Karen Brettell, David Gaffen and David Rohde for Reuters:

Share repurchases are part of what economists describe as the increasing “financialization” of the U.S. corporate sector, whereby investment in financial instruments increasingly crowds out other types of investment.

- Privatisations: why we need a fiscal watchdog — Simon Wren-Lewis:

The key point with privatisations is that reducing current debt may harm the health of the public finances. Any normal investor would only sell an asset if they thought they could get a price that exceeded what the asset was really worth. Although selling the asset would reduce the government’s net borrowing today, it would increase their net borrowing in the future because the government would not get the dividends the shares paid out.

- 'Economic Policy Splits Democrats' — Mark Thoma at Economist's View:

So, should I adopt a message I don't think is true because it sells with independents who have been swayed by Very Serious People, or should I say what I believe and try to convince people they are barking up the wrong tree? (For the most part anyway, I believe both the technological/globalization and institutional/unfairness explanations have validity -- but how do workers capture the gains Third Way wants to create through growth and wealth creation without the bargaining power they have lost over time with the decline in unionization, threats of offshoring, etc.? That's the bigger problem.)

- Reform Won’t Do It, Australian Universities Need Revolution — Kristen Lyons and Richard Hil in New Matilda:

If, as community economy advocates argue, non-market (including household) activities represent an estimated 30 to 50 per cent of all work, then why do universities continually genuflect to market principles? And given that non-market work has a potentially greater impact on social wellbeing, why don’t we take more time to understand its value in education and other domains? There is plenty of evidence to suggest that such non-market practices – including the diverse activities that make up the informal and exchange economy – are not only basic to meeting human needs, but can (through a more civic orientation) contribute significantly to the “good life”, with educators and students playing their part as active change agents.

- The End of the Humanities? — Martha Nussbaum interviewed by James Garvey for The Philosophers' Magazine:

“Philosophy is constitutive of good citizenship. It’s not just a means to it. It becomes part of what you are when you are a good citizen – a thoughtful person. Philosophy has many roles. It can be just fun, a game that you play. It can be a way you try to approach your own death or illness or that of a family member. It has a wide range of functions in human life. Some of them are connected to ethics, and some of them are not. Logic itself is beautiful. I’m just focusing on the place where I think I can win over people, and say ‘Look here, you do care about democracy don’t you? Then you’d better see that philosophy has a place.’”

- Reading The Making of Modern Finance as an Invitation to Critical Uses of History — Christine Desan, Progress in Political Economy:

The modern monetary system depends, then, on a kind of cash that depends on public debt. But the value of public debt depends in turn on the value attributed to cash. In other words, there is an irreducibly political aspect to the most basic medium of the market. There is no working exchange without a governance decision (and constant re-decision) about the value of money.

- Private infrastructure finance and secular stagnation — John Quiggin at Crooked Timber:

The financialization of the global economy has produced a hugely costly financial sector, extracting returns that must, in the end, be taken out of the returns to investment of all kinds. The costs were hidden during the pre-crisis bubble era, but are now evident to everyone, including potential investors. So, even massively expansionary monetary policy doesn’t produce much in the way of new private investment.

- Decoding the Design of Money — Christine Desan provides a précis of her new book, which sounds like a corker:

Corrected for inflation, the modern money supply in England is more than 65-times larger than it was when the Bank was established. That abundance follows from the modern mode of money creation: rather than bringing bullion to the mint, an applicant brings a promise of productivity to a banker. If the industry now in charge of the money supply finds the pitch credible, money issues. […] Just as striking, the modern design for money creation renders the system susceptible to new fragilities, given its reliance on finance-based expansion. Rather than the harsh limits on liquidity that haunted the Middle Ages, we have the booms and busts, the bubbles and bank runs associated with a money supply based on fiat credit creation and cleared in a far smaller reserve comprised of the sovereign unit of account.

- First They Jailed the Bankers, Now Every Icelander to Get Paid in Bank Sale — Claire Bernish, Anti-Media:

If Finance Minister Bjarni Benediktsson has his way — and he likely will — Icelanders will be paid kr 30,000 after the government takes over ownership of the bank. […] Because Icelanders took control of their government, they effectively own the banks. Benediktsson believes this will bring foreign capital into the country and ultimately fuel the economy — which, incidentally, remains the only European nation to recover fully from the 2008 crisis. Iceland even managed to pay its outstanding debt to the IMF in full — in advance of the due date.

- Despair, American Style — Paul Krugman, NYT:

Basically, white Americans are, in increasing numbers, killing themselves, directly or indirectly. Suicide is way up, and so are deaths from drug poisoning and the chronic liver disease that excessive drinking can cause. We’ve seen this kind of thing in other times and places – for example, in the plunging life expectancy that afflicted Russia after the fall of Communism. But it’s a shock to see it, even in an attenuated form, in America.

- A shift towards industry-relevant degrees isn’t helping students get jobs — Richard Hil and Kristen Lyons, the Conversation:

Skills and knowledge “competencies”, “attributes” and other measures of performance have turned traditionally accepted pedagogical priorities like “critical thinking” into commodities marketed at prospective employers through e-portfolios and job-ready CVs. Although the humanities, arts and social sciences continue to make up two-thirds of the undergraduate intake, these areas have been subjected to deep cuts or, as in the case of La Trobe University, fine-tuned to meet industry needs, or abandoned altogether (as occurred at QUT) in favour of “creative industries”.