reading

Sunday, 22 November 2015 - 2:10pm

This week, I have been mostly reading:

- Heartland of Darkness - Paul Krugman, New York Times:

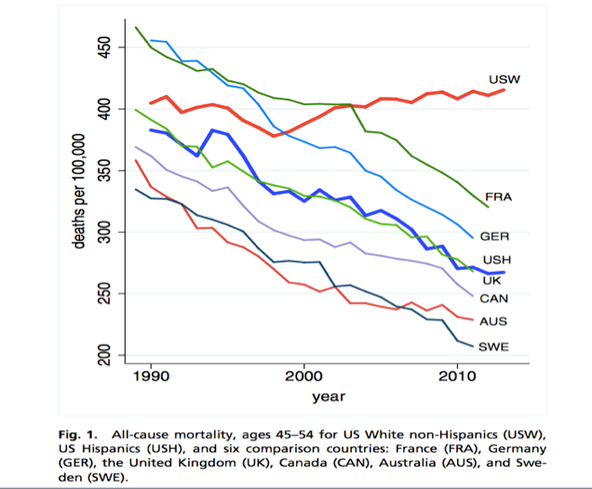

What the data look like is a society gripped by despair, with a surge of unhealthy behaviors and an epidemic of drugs, very much including alcohol. This picture goes along with declining labor force participation and other indicators of social unraveling. Something terrible is happening to white American society.

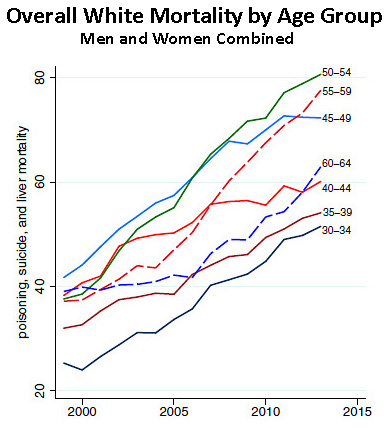

And Kevin Drum at Mother Jones points out that it's not just middle-aged men:

Bear in mind the measure on the vertical axis has changed, but still it's seriously weird. I can't even begin to speculate about what's going on. - Digital Tutoring is Linked to Lower Achievement for Some Students - A summary of research by Patricia Burch and Annalee Good and Carolyn Heinrich. By Sarah Garcia in The Society Pages:

Burch, Good, and Heinrich examined the digital providers’ role in out-of-school time (OST) tutoring. They completed a mixed-method longitudinal study of federally funded OST tutoring companies in five urban sites over four years and found that these companies had a reach as high as 88% of students in one district. The study sample included students eligible for OST tutoring under No Child Left Behind. They examined student attendance patterns and the relationship of different digital provider characteristics and access points to the reading and math achievement outcomes of students from low-income families.

- #Occupy the university - Marko Beljac in On Line Opinion:

In neoliberal society only that which commands the assent of the market, which means corporations and the rich who have the capacity to provide ready demand, are permitted to exist. Cultural studies graduates are not demanded by the rich so literary and cultural studies courses are closed. This might enrich universities and businesses but it impoverishes all of us.

- The Future of the BBC: the BBC as Market Shaper and Creator - Mariana Mazzucato in the LSE Media Policy Project Blog:

The assumption is that there is an existing market, and if the BBC takes a larger chunk of it, there is less left for the private sector, and this leads to criticisms that active public organizations like the BBC not only crowd out but also stifle innovation. In fact, […] the public sector not only ‘de-risks’ the private sector by sharing its risk, it often ‘leads the way’‒ courageously taking on risk that the private sector fears. Thus rather than analysing public sector investment via the need to correct ‘market failures’ it is necessary to build a theory of how the public sector shapes and creates markets—as it has done in the history of the IT revolution.

- Students in Debt, Professors in Poverty -- What's Going Wrong? - Laurie Jones and

Wanda Evans-Brewer at HuffPo:

About 22 percent of adjunct professors live BELOW the poverty line. That does not account for the thousands of others who live at or just above it, in a US economy who's "poverty line" would actually have to be doubled in the majority of it's cities for a family of three to afford basic living necessities. In short, many adjuncts are poor. With well over a 40 hour work week preparing curriculums, grading papers, and writing lectures, their pay generally averages out to about $10.00 an hour.

- George H.W. Bush Was So Bored by Peace He Wanted to Quit - Jon Schwarz, The Intercept:

What’s even more important, and even more frightening, is that it’s not just Bush. It’s most of official Washington, D.C. that finds peace unbearably dull, and war the only thing that lends zest to their gray lives.

- Day Before Deadly Bombing, U.S. Official Asked if Any Taliban Were “Holed Up” At MSF Hospital - Murtaza Hussain:

As the attack continued, despite increasingly frantic communications by MSF to the U.S. military informing them that the hospital was under bombardment, desperate staff were forced to operate on their own grievously injured co-workers. […] According to the accounts of MSF staff, throughout the bombing the American AC-130 continued to circle the compound, targeting individuals as they tried to flee the main hospital building, with “medical staff [shot] while running to reach safety in a different part of the compound.”

- A timeless tonic for our modern malaise? Stoicism may be the way forward - Jane Goodall (not that one; an adjunct professor from Western Sydney University) in The Conversation:

If the situation is not in your control, the most effective thing to do is to focus your strength on maintaining your own psychological composure. That will contribute to mental clarity, which […] can be effective in actually turning the situation to your advantage.

- 'Worse Than We Thought': TPP A Total Corporate Power Grab Nightmare - Deirdre Fulton, Common Dreams: Well I for one always thought it would be worse than I thought.

- Austerity’s Grim Legacy - Paul Krugman, New York Times:

For those who don’t remember (it’s hard to believe how long this has gone on): In 2010, more or less suddenly, the policy elite on both sides of the Atlantic decided to stop worrying about unemployment and start worrying about budget deficits instead. This shift wasn’t driven by evidence or careful analysis. In fact, it was very much at odds with basic economics.

- Europe’s challenges in a global context – Interview with Dirk Pohlmann, KenFM - Yanis Varoufakis: Softball questions, but an entertaining, wide-ranging interview.

Sunday, 15 November 2015 - 6:19pm

This week, I have been mostly reading:

- Faith in an Unregulated Free Market? Don’t Fall for It - Bob Shiller plugs his latest book in the New York Times:

[T]he problem of market-incentivized professional manipulation and deception is fundamental, not an externality. In short, the superiority of untrammeled free markets — the fundamental theorem of welfare economics — has taken on the aura of a law from the heavens. Yet technology has advanced so that temptations are being manipulated ever more effectively. In fact, the real success of economies that embody free markets has much to do with the heroic efforts of campaigners for better values, both among private organizations and advocates of government regulation.

- Cynical workforce participation policy forces solo parents into ranks of unemployed - Warwick Smith:

I call this “pushing on a piece of string” for good reason. Unemployment in Australia is at 6.2 per cent. There are many more people looking for work than there are jobs. So, I’d be very keen to hear how pushing more single parents and grandparents into the job market is going to be a positive thing for this country or for the individuals concerned. Taking away payments from everyone because of the actions of a tiny minority is the kind of collective punishment that society long ago abandoned in every other sphere of life.

- Grattan Institute advocates cutting university research funding - John Quiggin:

Finally, lets come back to Norton’s rejection of the centuries-old scholar-teacher model in favor of a teaching-only approach. His defence of this position “the evidence that it improves teaching is less clear” is not exactly robust. Against this we can observe that worldwide, there are in fact plenty of examples of both teaching-only and research-intensive institutions. Nearly all are nominally funded on a per-student basis, whether through fees, government subsidies or both. So, what does the market test, which Norton ought to favor tell us. The answer is that students are beating down the doors of the research-intensive unis. Teaching-only schools are the second choice for nearly everyone.

Certainly a large part of my motivation to enrol was the prospect of meeting people who are doing interesting work. Of course now I'd just settle for meeting people. Or a person, at some stage. - Anthony Albanese Is Not Too Left Wing To Win Government. Indeed, He’s About Right - John Passant in New Matilda:

A genuine left wing party of the working class in Australia has not yet developed. Until it does we will remain in the Sisyphean oscillations between neoliberal Labor and pro-austerity Liberal governments. Because Albanese is no Jeremy Corbyn.

I have both Bernie Sanders' hair and Jeremy Corbyn's beard. Just saying that, if called upon to serve as PM, I would very carefully consider what is in the best interests of the country, and what would give me a lavish pension for the rest of my life. - Aren't we all Guatemala? - Pedro Abramovay, openDemocracy:

Guatemala is the radical expression of a crisis affecting almost every country in Latin America. The last decades have witnessed huge progress (depending on the country) in transparency policies, thanks to the strengthening of anti-corruption institutions and a new kind of citizen mobilization, highly demanding and autonomous, independent of the traditional parties and movements. The great promise was that this would alter, by itself, the political culture of corruption in our countries. This has not happened. Neither in Guatemala, nor in Chile, nor in Mexico, nor in Brazil.

- Own a Vizio Smart TV? It’s Watching You - Julia Angwin, ProPublica:

Vizio’s technology works by analyzing snippets of the shows you’re watching, whether on traditional television or streaming Internet services such as Netflix. Vizio determines the date, time, channel of programs — as well as whether you watched them live or recorded. The viewing patterns are then connected your IP address - the Internet address that can be used to identify every device in a home, from your TV to a phone.

- The replication crisis has engulfed economics - Andreas Ortmann, The Conversation:

The upshot is that even under the best of circumstances – one data set, what seems like a straightforward question to answer, and an exchange of ideas on the best method – arriving at consensus can be extraordinarily difficult. And it surely becomes even more difficult with multiple data sets and many teams.

- With idle labour equal to 14.5 per cent, the fiscal deficit is too low - Bill Mitchell:

Taken together, this data tells me that the fiscal deficit in Australia is well below what a responsible government should aspire to provide the Australian economy. I say provide in the sense that a fiscal deficit provides spending support to Australian businesses which allows them to employ people. If the current spending patterns of the non-government sector is delivering the sort of outcomes articulated in the list above, then we know that the fiscal support to the economy is inadequate. After we acknowledge that point then we can have a discussion about what the composition of the fiscal deficit should look like – that is, how much government consumption and investment spending there should be.

- Another Money Is Possible, Part I: Will the ScotPound Succeed As A Parallel Currency? - Steve Rushton at Occupy.com: A neat little primer on a few tools in the heterodox economic kit. Part two is Avoid the Next Financial Crash with People's Q.E., and part three is Holland Leads Experiment In Basic Income.

- Why we should give free money to everyone - Rutger Bregman, De Correspondent, a nice, comprehensive look at UBI, cited by Rushton in the above:

After decades of authorities’ fruitless pushing, pulling, fines and persecution, eleven notorious vagrants finally moved off the streets. Costs? 50,000 pounds a year, including the wages of the aid workers. In addition to giving eleven individuals another shot at life, the project had saved money by a factor of at least 7. Even The Economist concluded: ‘The most efficient way to spend money on the homeless might be to give it to them.’

- Why do we tax goods and services at the same rate, when goods are so much less sustainable? - Angie Silva and Talia Raphaely from Curtin, in The Conversation:

It is not hard to see why the world is awash with trash. In the United States, for instance, 80% of all goods are non-reusable, and more than 90% become waste within six weeks. Australians, meanwhile, currently produce the second most waste per person in the world.

- In Defense of the Late Ahmad Chalabi - Jon Schwarz, The Intercept:

Chalabi was also a source for much of the New York Times’ atrocious reporting on Iraq’s non-existent weapons of mass destruction, and was mentioned by name when the Times was finally forced to apologize. Moreover, he couldn’t have been much more in your face about it afterward, charmingly explaining in 2004 that “We are heroes in error. As far as we’re concerned we’ve been entirely successful. That tyrant Saddam is gone and the Americans are in Baghdad. What was said before is not important.” But if Americans want to blame someone for the Iraq War, we should be looking closer to home — at Bush, Dick Cheney, Colin Powell and ourselves. As former CIA officer Robert Baer put it: “Chalabi was scamming the U.S. because the U.S. wanted to be scammed.”

- Intellectual property rights and artistic creativity - Petra Moser, VoxEU:

[Data] suggests that extensions in the length of copyright beyond the duration of the author’s life create a negligible increase in income for the average author. Instead, copyright extensions only benefit the authors of an extremely small number of exceptionally long-lived works. To the extent that it is difficult to predict which types of works will continue to be popular 100 years after their original creation, copyright extensions are unlikely to encourage rational investments in creative work.

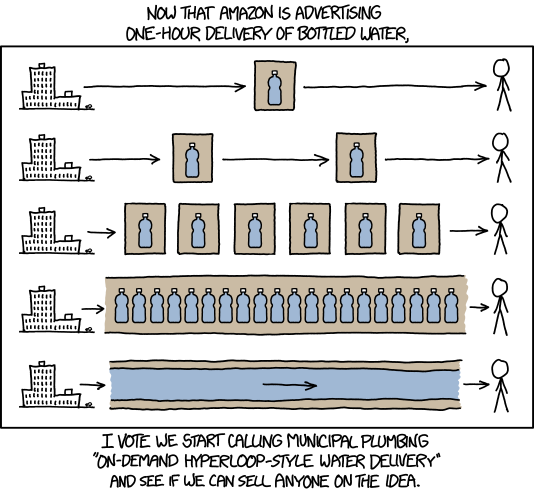

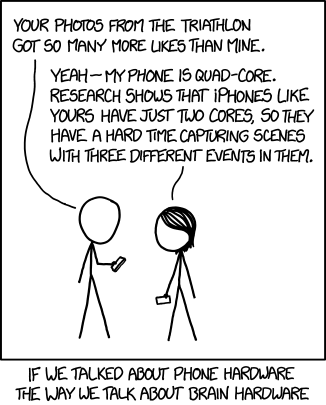

- Water Delivery - xkcd

- The Invention of Pad Thai - Alex Mayyasi, Priceonomics:

Yet [Prime Minister] Phibun took each and every part of his cultural campaign seriously. The National Cultural Act listed penalties for violating its edicts. Even as World War II began, he used a radio address to tell Thais, “Our dear ladies must not think that it is not necessary to wear hats in times of war. Now more than ever is it essential to go on wearing hats.”

Sunday, 8 November 2015 - 3:11pm

This week, I have been mostly reading:

- In defence of the annoying mature-age student

- Stephen Owen in The Guardian (via @tregeagle):

Almost all of them are amazed at the world of ideas into which they have arrived, and in which they are receiving the sort of intellectual nourishment that they thought was strictly for people other than themselves. This was also my experience; it turns out that mature-age study is transformative and can make you feel more at home with the world and with yourself, even if it can lead to risky behaviours (like postmodernism).

- Seumas Milne and His Swivel-Eyed Detractors - John Wight in CounterPunch:

Now the reason it is important to establish these salient ‘facts’ about Seumas Milne and his career is that his recent appointment by Jeremy Corbyn as his press and strategy chief has unleashed such a chorus of condemnation and calumniation – by a constituency of right wing hacks, former Trotskyists turned right wing bloggers, and embittered failed Labour candidates, among others – you could be forgiven for thinking we are talking about Charles Manson rather than one of the most esteemed journalists this country has every produced.

- Australian education fails one in four young people – but not the wealthy ones - Stephen Lamb in The Conversation:

The results show that while Australia’s highest-achieving students – who are more likely to be drawn from wealthier families – may be among the best in the world, there are vast differences in educational outcomes across social groups, challenging Australia’s claim of a fair education system.

- Could a new ‘basic income’ protect Australia’s most vulnerable? - Ben Spies-Butcher in The Conversation: Bernie Sanders is promoting "single payer" as "Medicare for all". Could UBI be Australia's "means-tested pension for all"?

- Martin, A Quick Word - Dan Hind skewers Martin Amis:

For all their faults, Corbyn and his contemporaries on the left of the Labour party – the Bennities, let’s call them – were campaigning for equality at home and abroad. What a laugh, I know! But the things they marched for – anti-racism, gay rights, democracy in Africa and Latin America – they were right about those things, weren’t they, at a time when a lot of people were for various reasons wrong? The monosyllabic bigots were wrong, of course. But those who eloquently insisted that these things were distractions from the purity of class struggle were wrong, too.

- Causes and consequences of persistently low interest rates - Sir Charles Bean at VoxEU:

This downward trend in the underlying world real interest rate had attracted the attention of policymakers even before the Crisis, with Fed Chairman Alan Greenspan describing it as a “conundrum”, while Fed Chairman-to-be Ben Bernanke subsequently attributed it to a “savings glut”, most notably in China (Bernanke 2005). Other authors, such as Larry Summers (2014), have focused on the other side of the market for loanable funds, suggesting that a decline in the propensity to invest is to blame, linking it also to the slowdown in output growth.

- The Islamic State meets the laws of economics - Felix Imonti in On Line Opinion:

The solution chosen by the caliphate is to turn to the gold Dinar that has as much symbolic value as is does as a means of financing the society. While gold speaks of wealth and security in the minds of most people, there is a hazard in adopting a gold currency. The value of the gold coins comes from the quality of gold metal and not from the quality of the issuer. Anyone doubting the longevity of the caliphate will be inclined to horde the coins under a rock somewhere or smuggle the coins outside. The loss of money from the economy will translate into an overall deflation as the scarcity of money raises its value; and that is likely to depress the economy even further.

- Heat Too Hot to Survive - Ian Welsh:

People rag on about how bad Communism was, how many deaths it caused, but they never properly add up capitalism’s deaths. The deaths resulting from the environmental crisis, however, will make capitalism anathema to our children.

- Postal Banks Are People’s Banks: 6 Things You Need To Know About Postal Banking - Matt Stannard at Occupy.com:

It’s being called “Bernie’s Brilliant Idea,”, and Bernie Sanders’s embrace of postal banking is indeed brilliant, both in timing and substance. But while his insurgent presidential campaign may give a credible boost to USPS financial services, Sanders’s endorsement is far from sufficient. To make postal banking happen requires a broad, mass coalition willing to keep pushing the issue regardless of the outcome of the 2016 elections.

- The Despotic Temptation - Ana Palacio, Project Syndicate:

Unfortunately, Western leaders have repeatedly shown that they lack the patience and dedication needed to engage consistently and humbly with communities in crisis-stricken countries or to provide the reliable, incremental, and prolonged governance assistance needed to prevent state collapse. With their short attention spans and heightened sense of their own importance, they prefer the option of simply installing a despot to deal with it. They need to get over themselves – for everyone’s sake.

- Britain is heading for another 2008 crash: here’s why - David Graeber:

Notice how the pattern is symmetrical? The top is an exact mirror of the bottom. This is what’s called an “accounting identity”. One goes up, the other must, necessarily, go down. What this means is that if the government declares “we must act responsibly and pay back the national debt” and runs a budget surplus, then it (the public sector) is taking more money in taxes out of the private sector than it’s paying back in. That money has to come from somewhere. So if the government runs a surplus, the private sector goes into deficit. If the government reduces its debt, everyone else has to go into debt in exactly that proportion in order to balance their own budgets. - Why Are We Hearing So Much about Those Damn Danes? - Josh Hoxie, OtherWords:

While I doubt Americans will embrace the Danes’ love for pickled fish, I’m hopeful we might connect the dots between their successful social outcomes and their progressive public policies.

Also, in Scandinavia there are so many programs, on radio and television, about the fish. - The Okinawa missiles of October - Aaron Tovish, Bulletin of the Atomic Scientists via The Intercept:

By Bordne's account, at the height of the Cuban Missile Crisis, Air Force crews on Okinawa were ordered to launch 32 missiles, each carrying a large nuclear warhead. Only caution and the common sense and decisive action of the line personnel receiving those orders prevented the launches—and averted the nuclear war that most likely would have ensued.

- Al-Qaeda, ISIS, and the wider fallout from the Iraq invasion - David Morrison:

Baroness Manningham-Buller confirmed to the Chilcot inquiry that the government was warned in advance that there was likely to be a heightened threat from al-Qaeda as a result of British participation in the invasion of Iraq. She agreed that her judgment prior to the invasion was that “a war in Iraq would aggravate the [terrorist] threat from whatever source to the United Kingdom” (p31) and that “there wasn't any particular controversy amongst the intelligence agencies about that judgment” (p32).

- Malnutrition and 'Victorian' diseases soaring in England 'due to food poverty and cuts' - Dean Kirby, The Independent And…

- Starving Irish people pleading for food from soup kitchen as last resort - Sasha Brady, Independent.ie

- Check Out Our Low, Low (Natural) Rates - Paul Krugman, NYT:

[Laubach and Williams] attribute the decline in the natural rate largely to the slowing of potential output, which in turn reflects demography and what looks like a slowdown in technological progress. That’s more speculative. But the low natural rate is as solid a result as anything in real time can be. This in turn tells you several things. It says that all the complaints that the Fed is artificially keeping rates low are nonsense; rates are low because that’s what the real economy wants, and the Fed’s only alternative would be to create a depression.

- The Pain in Spain - Simon Tilford at Project Syndicate:

Spain’s recovery is not quite what it seems, and there is scant evidence that what progress the country has made is the result of austerity and reforms. In fact, far from adhering to the usual austerity narrative – according to which fiscal consolidation revives business confidence and thus investment and job creation – Spain’s return to growth partly reflects the easing of austerity since early 2014. The country has sensibly resisted pressure from the European Commission to take more aggressive steps to reduce its deficit, which, at 5.9% of GDP, was the European Union’s third highest last year.

- The Tragedy of Ben Bernanke - Brad DeLong at Project Syndicate:

“It seems unlikely that the influence of [monetary] policy on the rate of interest will be sufficient by itself,” Keynes wrote in 1936. “I conceive, therefore, that a somewhat comprehensive socialization of investment will prove the only means of securing an approximation to full employment.” Those are words worth considering the next time we find ourselves needing the courage to act.

- When Does Technological Advancement Actually Lead to Prosperity? - Ian Welsh:

Productivity in America rose 80.4 percent from 1973 to 2011, but median real wages rose only 10.2 percent and median male wages rose 0.1 percent. (4) This was not the case from 1948 to 1973, when wages rose as fast as productivity did. Increases in productivity, in our ability to make more stuff, only lead to prosperity and affluence if we are making the right stuff, and we are actually distributing that stuff widely.

- GOP and the Rise of Anti-Knowledge - Mike Lofgren, Consortiumnews:

Thanks to these overlapping and mutually reinforcing segments of the right-wing media-entertainment-“educational” complex, it is now possible for the true believer to sail on an ocean of political, historical, and scientific disinformation without ever sighting the dry land of empirical fact. This effect is fortified by the substantial overlap between conservative Republicans and fundamentalist Christians. The latter group begins with the core belief that truth is revealed in a subjective process involving the will to believe (“faith”) rather than discovered by objectively corroberable means.

- For-profit education: plenty of blame to go around - John Quiggin:

The real problem is that no one is willing to admit the obvious lesson, already evident from the US; for-profit education, funded by public subsidies, is a recipe for disaster.

- What the Steve Jobs Movie Won’t Tell You About Apple’s Success - Lynn Parramore at INET interviews Mariana Mazzucato:

The economic crisis that followed from the financial crisis is still being felt strongly across the world. […] It’s not about lack of opportunities. It’s because businesses are choosing to hoard profits or to use them to simply prop up stock options (and hence executive pay). That is bad for innovation and there is nothing inevitable about it. At the same time, governments are being asked to cut back with the austerity craze that continues to plague many nations. So we have a crisis of investment on both the private and public side.

- Failing conventionally - Chris Dillow:

The Overton Window doesn't just exist in politics, but in finance, economics and management too. Some things are inside the window and acceptable - such as mergers, "professional judgment" and orthodox QE - whilst others, such as worker management, simple investment heuristics or helicopter money, are outside it.

- The disappearing middle class is threatening American mega brands - Hayley Peterson, who is a Business Insider, apparently: The sinister euphemism of the week is "consumer bifurcation".

Upper-income consumers are buying more premium treats, while lower-income individuals are purchasing discounted chocolates, [Hershey CEO John Bilbrey] said. Hershey’s has been losing market share, as a result.

- People's Deepest, Darkest Google Searches Are Being Used Against Them - Adrienne LaFrance in The Atlantic:

Consider, for example, a person who googles “need rent money fast” or “can’t pay rent.” Among the search results that Google returns, there may be ads that promise to help provide payday loans—ads designed to circumvent Google’s policies against predatory financial advertising. They’re placed by companies called lead generators, and they work by collecting and distributing personal information about consumers online. So while Google says it bans ads that guarantee foreclosure prevention or promise short-term loans without conveying accurate loan terms, lead generators may direct consumers to a landing page where they’re asked to input sensitive identifiable information. Then, payday lenders buy that information from the lead generators and, in some cases, target those consumers—online, via phone, and by mail—for the very sorts of short-term loans that Google prohibits.

- The digital revolution in higher education has already happened. No one noticed. - Clay Shirky at Medium (via @tregeagle):

Outside a relative handful of selective residential institutions, the principal function of college is to train and credential people for work. An Associate’s or Bachelor’s is no longer one way of getting a good job. It is just about the only way of avoiding low wages or unemployment. The earnings premium for having a college degree has stagnated, but the punishment for not having one continues to grow. The digital revolution is happening because a high school degree is a ticket to not very much, while the traditional form of college no longer works for the people who need a certificate of employability.

Sunday, 1 November 2015 - 7:06pm

This week, I have been mostly reading:

- Public R&D austerity spending cuts undermine our grandchildren’s future - Bill Mitchell:

In this period of fiscal austerity with suppressed overall growth rates and labour market deregulation that undermines working conditions and reduces the incentives to invest in best-practice technology labour productivity is falling – as will living standards in the coming years. The world is locked into an idiotic race-to-the-bottom. It is a curious period really. The hypocrisy of governments, aided and abetted by the right-wing think tanks, who claim they are cutting into public spending to reduce the drain on living standards of our children and grandchildren, is clear to see. What they are really doing is undermining the future prosperity of the next several generations at the same time that they push millions into unemployment and poverty now. Why are we so stupid that we tolerate this nonsense?

- Higher Education: Capitalism At Its Most Despicable - Paul Buchheit at Common Dreams:

The state of higher-ed teaching in America: Years of study by trusting young scholars who end up with academic positions that pay as much as entry-level fast food jobs. Adjuncts made up less than 1/4 of instructional staff in 1969, but now make up over 3/4 of instructors. They make a median wage of about $2,700 per course, with little or no benefits.

- Central bankers and their irrational fear - Simon Wren-Lewis:

A key feature of deficit fetishism is a concern about deficits in the short term. Politicians seem happy to take measures that cut deficits in the short term even if debt becomes higher in the longer term. Indeed the analysis presented by DeLong and Summers argues that hysteresis forces would not have to be that large before austerity would raise long run debt to GDP levels. We also know that deficit fetishism is specific to increases in debt caused by recessions: over the longer run if anything deficit bias implies rising rather than falling levels of government debt. So any form of fiscal stimulus that avoided an increase in debt in the short run but not in the long run would avoid deficit fetishism. That is what a money financed fiscal stimulus aka helicopter money aka People’s QE could do.

- What Clinton Got Wrong About Snowden - John Kiriakou, who knows a thing or two about whistleblowing, at OtherWords:

I’m disappointed, frankly, that somebody running for president of the United States doesn’t know that the Whistleblower Protection Act exempts national security whistleblowers. There are no protections for you if you work for the CIA, NSA, or other federal intelligence agencies — or serve them as a contractor. You take a grave personal risk if you decide to report wrongdoing, and there’s nobody who can protect you.

- Corbyn in the Media - Paul Myerscough in the London Review of Books:

The party members who voted for Corbyn hadn’t suddenly thrown their toys out of the pram just because Miliband lost. This is not a story of the last five years, but the last twenty, and their disillusionment with New Labour is about a great deal more than the Iraq War. For them, Miliband was not ‘too left-wing’; on the contrary, he was a final attempt at compromise. And when it failed, they realised they had had enough. It was too difficult to go on knocking on doors, summoning the necessary conviction, working towards the slim possibility of victory in the hope of implementing a platform of ever-weakening amelioration of the worst effects of neoliberalism. They looked at the candidates on offer, and saw that they had nothing left to lose.

- On Corbyn and our collapsing orthodoxies - Matthew Richmond, openDemocracy:

George Osborne’s supposed “pitch to Labour voters” at the same time as slashing the tax credits of the hard-working families he claims to be so fond of, was “clever politics”. The message is clear: it doesn’t matter that Osborne is pushing through an extreme policy that will make millions of working people dramatically poorer, the simple fact that he declares himself to be on the centre ground automatically makes it so. Or to put it another way, if you brazenly lie you deserve to be taken seriously. Those are the rules. Like it or lump it.

- Attacks on Sanders, Progressives Falsely Depict Obama As Lefty Failure as Opposed to Neoliberal Success - Yves Smith, Naked Capitalism:

In other words, any time anyone tries to present Obama as having failed to implement a “liberal” agenda because the right was too powerful is either an apologist or ignorant. Obama has achieved precisely what he intended to achieve, which was to implement center-right economic policies with tepid social justice measures to divert attention from how he was serving the interests of the 1% and even more so, the 0.1%. And the fact that his allies in Congress have in large measure been voted out of office, that Sanders is going from strength to strength despite his lack of big corporate support, and that the neoliberal diehard Clinton is being forced to feint to the left are signs that the political tectonic plates are shifting. Much more is possible now than was six years ago.

- Neo-liberal myths constrain our understanding of poverty - Bill Mitchell:

A currency-issuing government can always do that and should net spend so that all the idle resources (particularly labour) are productively employed. The solution to poverty is not complex. It is about a lack of income. That is often due to unemployment and insufficient wages (working poor). By ensuring there are enough jobs for all – and maintaining that continuity across the private spending cycle by introducing a – Job Guarantee – a national government can use its fiscal capacity (driven by the fact it issues its own currency) to reduce poverty and income inequality while sustaining economic growth.

- Free College vs. Cost-benefit Thinking - Elizabeth Popp Berman at orgtheory.net:

So I support the free college movement. But I’d like to see its champions stop saying it’s because we need to be globally competitive, or because it’s got a huge ROI. Instead, say it’s because our society will be stronger when more of us are better educated. Say that knowing higher education is an option, and an option you don’t have to mortgage your future for, will improve our quality of life. Say that colleges themselves will be better when they return to seeing students as students, and not as revenue streams.

- Union power and inequality - Florence Jaumotte and Carolina Osorio Buitron of the Research Department, IMF in VOX. Captain Obvious is uncredited:

If our findings are interpreted as causal, higher unionisation and minimum wages can help reduce inequality.

- Eurozone crosses Rubicon as Portugal's anti-euro Left banned from power - Ambrose Evans-Pritchard in The F**king Telegraph, of all places: S**t is f**ked up and bulls**t. End of history, my arse.

Europe’s socialists face a dilemma. They are at last waking up to the unpleasant truth that monetary union is an authoritarian Right-wing enterprise that has slipped its democratic leash, yet if they act on this insight in any way they risk being prevented from taking power.

- Original Sin and Global Stagnation - Paul Krugman, NYT:

[…] emerging markets still suffer to some extent from original sin — underdeveloped capital markets and a tendency to borrow in foreign currency. This sin isn’t nearly as strong as it was 15 years ago, when Barry Eichengreen and Ricardo Haussman coined the term, but corporate dollar-denominated borrowing after 2008 brought it partially back. […] Oh, and a US interest rate hike, which would not just hit the US economy but also, via a stronger dollar, hit the emerging markets via balance sheets, would do a lot to make things even worse.

- Central Banks Are Not Agricultural Marketing Boards: Depression Economics, Inflation Economics and the Unsustainability of Friedmanism - Brad DeLong, Washington Center for Equitable Growth:

Milton Friedman was very clear that economies could either have too much money (Inflation Economics) or too little money (Depression Economics)–and that a central bank was needed to try to hit the sweet spot. He hoped that hitting the sweet spot could be made into a somewhat automatic rule-controlled process, but he was wrong.

- I get what you get in ten years, in two days - Noah Smith:

The usual economist case for income redistribution is based on utilitarianism; the idea is that $1000 matters more to a poor person than to a rich person. [Greg] Mankiw wants to ditch this idea in favor of a value system based on "just deserts".

- We need to stop Australia’s genetic heritage from being taken overseas - Steve Wylie, The Conversation: Oh, so much wrong in such a small article.

Australia’s scientists should be mining Australia’s gene bank, and all Australians should benefit from the rewards of this intellectual property (IP). International collaboration is the lifeblood of scientific advancement, but so is competition and protecting IP. When Australia’s genetic heritage is lodged in other countries, we have lost control of our IP.

- Obfuscation: how leaving a trail of confusion can beat online surveillance - Julia Powles at The Guardian reviews Obfuscation: A User’s Guide for Privacy and Protest by Finn Brunton and Helen Nissenbaum:

More than 30 colourful examples – instructive vignettes in their own right – are used to build the case. Roughly a third are analogue, and the images stick. […] Iconic movie scenes, like the switching briefcases in The Thomas Crown Affair, or the powerful “I am Spartacus” moment in Kubrick’s 1960 epic. The authors bring in orb-making spiders, sim-card shuffles, loyalty-card swap meets, “babble tapes” (a digital file played in the background of a conversation in order to obscure it) – all examples where the individual merges with the tribe; where false signals muddy the genuine; where noise and quick feet offer “weapons of the weak”.

- Secret source code pronounces you guilty as charged - David Kravets at Ars Technica:

The results from a Pennsylvania company's TrueAllele DNA testing software have been used in roughly 200 criminal cases, from California to Florida, helping put murderers and rapists in prison. Criminal defense lawyers, however, want to know whether it's junk science. Defense attorneys have routinely asked, and have been denied, access to examine the software's 170,000 lines of source code in a bid to challenge the authenticity of its conclusions. The courts generally have agreed with Cybergenetics, the company behind TrueAllele, that an independent examination of the code is unwarranted, that the code is a proprietary trade secret, and disclosing it could destroy the company financially.

- Why An Open-Access Publishing Cooperative Can Work: A Proposal for the AAA’s Journal Portfolio - Alberto Corsín Jiménez, John Willinsky, Dominic Boyer, Giovanni da Col and Alex Golub in Cultural Anthropology:

Will [American Anthropological Association (AAA)] publications spend yet another decade locked within a publisher website where only research libraries can afford to purchase them? Or can our scholarly work join the growing body of research that is publicly available and accessible as a public good? In this piece we propose a concrete, practical, and financially sustainable way that the AAA can make its publishing program open-access: a cooperative model of scholarly publishing. This tailor-made design will cost the AAA nothing, while giving the organization a chance to be at the forefront of global innovation in scholarly communication.

- What is a knowledge city? - Nicholas Gruen:

We have before us an astonishing new set of technologies which are transforming our lives. Thinking of how we convert them into jobs is a little like welcoming the invention of printing by asking “How many printing jobs can we attract to our city/country”.

See also this on how the public are still being ripped off by publishers, it being "hard not to conclude that South Africans will in future be paying far more for knowledge – and will have even less access to it." - Marx's relevance today - Chris Dillow:

Marx asked, and answered, a fundamental question: what is the point of economic life? For him, it was to increase real freedom and self-realization. Capitalism, he said, doesn't do this but instead alienates us.

- The Rise and Fall of For-Profit Schools - James Surowiecki, The New Yorker:

Students at for-profit schools are able to borrow huge sums of money because the government does not take creditworthiness into account when making most student loans. The goal is noble: everyone should be able to go to college. The result, though, is that too many people end up with debts they cannot repay. Seen this way, the students at for-profit schools look a lot like the homeowners during the housing bubble. In both cases, powerful ideological forces pushed people to borrow (“Homeownership is the path to wealth”; “Education is the key to the future”). In both cases, credit was cheap and easy to come by. And in both cases the people pushing the loans (mortgage brokers and for-profit schools) didn’t have to worry about whether those loans were reasonable, since they got paid regardless.

- The British Tax Credits system is a sign of New Labour failure - Bill Mitchell:

I consider that no worker should be paid below what is considered the lowest tolerable material standard of living just because some low wage-low productivity operator wants to produce in a country and make ‘cheap’ profits. I don’t consider that the private ‘market’ is an arbiter of the values that a society should aspire to or maintain. That is where I differ significantly from my profession. The employers always want the wages system to be totally deregulated so that the ‘market can work’ without fetters. This will apparently tell us what workers are ‘worth’. The problem is that the so-called ‘market” in its pure conceptual form is an amoral, ahistorical construct and cannot project the societal values that bind communities and peoples to higher order considerations. The minimum wage is a values-based concept and should not be determined by a market.

- Avoiding the Financial Resource Curse - Noah Smith at Bloomberg View:

There is something unsettling about watching the financial sector become a bigger and bigger part of what people do for a living. After all, finance is all about allocation of resources -- pushing asset prices toward their correct value so businesses can know what projects to invest in. But when a huge percent of a country’s effort and capital are put into finance, there are less and less resources to reallocate. We can’t all get rich trading houses and bonds back and forth.

Sunday, 25 October 2015 - 11:48am

This week, I have been mostly reading:

- Crossed wires: ISPs are already struggling to retain our metadata - Philip Branch in the Conversation:

Today we learnt that 84% of internet service providers (ISPs) in Australia have not met the deadline set by the federal government for them to start collecting metadata. And 61% are asking for some exemption or variation in the requirements specified in the legislation.

Wait. We're doing what now? Clearly I have not been paying enough attention. - Snowden and Allies Issue Warnings as Australia Unleashes Mass Spying - Nadia Prupis, Common Dreams. Oh. Okay, it's this:

Beginning today, if you are Australian, everything you do online is being tracked, stored, and retained for 2 years. https://t.co/g8etUYgHGr

— Edward Snowden (@Snowden) October 12, 2015 - Unpaid Care Work, Women, and GDP - Tim Taylor:

In a broader sense, of course, the issue is not to chase GDP, but to focus on the extent to which people around the world are having the opportunity to fulfill their capabilities and to make choices about their lives. Countries where women have more autonomy also tend to be countries where the female-to-male ratios of time spent on unpaid care are not as high. The share of unpaid care provided by women highly correlated with women's ability to participate in the paid workforce, as well as to acquire skills and experience that lead to better-paying jobs, as well as participating in other activities like political leadership.

- Former U.S. Detainees Sue Psychologists Responsible For CIA Torture Program - Jenna McLaughlin at the Intercept:

“There’s much talk about interrogation” when it comes to Mitchell and Jessen, [ACLU attorney Steven Watt] says. “But it wasn’t about gathering information for them. It was about breaking [the inmates] down, it was about torturing them. That was their true intent.”

- On Building Armies (and Watching Them Fail): Why Washington Can’t “Stand Up” Foreign Militaries - Andrew Bacevich, TomDispatch:

Based on their performance, the security forces on which the Pentagon has lavished years of attention remain visibly not up to the job. Meanwhile, ISIS warriors, without the benefit of expensive third-party mentoring, appear plenty willing to fight and die for their cause. Ditto Taliban fighters in Afghanistan. The beneficiaries of U.S. assistance? Not so much. Based on partial but considerable returns, Vietnamization 2.0 seems to be following an eerily familiar trajectory that should remind anyone of Vietnamization 1.0. Meanwhile, the questions that ought to have been addressed back when our South Vietnamese ally went down to defeat have returned with a vengeance.

- TPP is “Worst Trade Agreement” for Medicine Access, Says Doctors Without Borders - Tharanga Yakupitiyage, Inter Press Service:

MSF treats almost 300,000 people with HIV/AIDS in 21 countries with generic drugs. These drugs have reduced the organization's cost of treatment from US$10,000 per patient per year to US$140 per patient per year. […] As part of the TPP negotiations, the U.S. sought to include the 12-year protection rule. Trade ministers went back and forth on the rule, finally settling on a mandatory minimum of five to eight years of data protection. […] MSF predicts that at least half a billion people will be unable to access medicines once the TPP takes effect.

- EasyJet and Gap Yahs - Richard Seymour:

The left critique of the EU says that it's a Europe of the neoliberal bourgeoisie, a Europe of spivs, business mercenaries and yuppies. Meanwhile, the major campaign for the EU defends it on the grounds that it's a Europe of the neoliberal bourgeoisie, a Europe of spivs, business mercenaries and yuppies.

- Weak States, Poor Countries - This week's Nobel laureate economist Angus Deaton in an article from 2013 republished by Project Syndicate:

The absence of state capacity – that is, of the services and protections that people in rich countries take for granted – is one of the major causes of poverty and deprivation around the world. Without effective states working with active and involved citizens, there is little chance for the growth that is needed to abolish global poverty.

(My emphasis.) - Structural Reform Beyond Glass-Steagall - Mike Konczal at the Roosevelt Institute. Worth reading for this quote:

One of the brilliant insights from the neoliberal political project is that if you want to do something brutal that politics won’t sustain, you have “the market” do it. Can’t destroy Medicare? Turn it over to the market it and give people coupons for it that slowly die out. Then it is seen as a natural outcome, even if “the market” here is just the continuation of politics by other means.

- A stimulus junkie's lament - Simon Wren-Lewis:

[I]mportantly, in the years preceding [2009, Germany] built up a huge competitive advantage by undercutting its Eurozone neighbours via low wage increases. This is little different in effect from beggar my neighbour devaluation. It is a demand stimulus, but (unlike fiscal stimulus) one that steals demand from other countries. This may or may not have been intended, but it should make German officials think twice before they laud their own performance to their Eurozone neighbours. If these neighbours start getting decent macro advice and some political courage, they might start replying that Germany’s current prosperity is a result of theft.

- Thanks to Sanders, Democratic Party Just Debated Merits of Capitalism - Sarah Lazare, Common Dreams: I prefer to think of it as "Thanks to growing popular opposition to neoliberalism, an avowed socialist can be a potential US president". Either way it's significant.

- Life plus 70: who really benefits from copyright’s long life? - Catherine Bond in the Conversation provides your summary of copyright state of play for this week:

According to data generated by the Australian Bureau of Statistics, a woman in Australia aged 30 in 2012 will likely live for another 54.90 years. If this figure is correct in my case, then copyright will protect this article for nearly 125 years. It will officially enter the public domain on 1 January, 2141. Is what I say in this article so significant that I, and many generations of Bonds to come, should enjoy a right to control who copies this piece for the course of the next century and beyond?

- Three Years Ago, These Chicago Workers Took Over a Window Factory. Today, They're Thriving - Sarah van Gelder, YES! Magazine:

This is what local power looks like: companies like New Era Windows and Doors creating the stability that comes with locally rooted employment, insulated from the speculative finance that, in the case of publicly traded companies, requires many jobs be moved to low-wage regions. These worker-owners focus on values, including the possibility for others to also be worker-owners, and the importance of producing ecologically smart products.

- The fiscal charter media fiasco - Simon Wren-Lewis:

Even the ‘highbrow’ news programmes like Channel 4 news and Newsnight chose to spend most of its time talking about U-turns on either side. No mention of the complete lack of economic support for this charter. On an issue with such important consequences, is that fulfilling a duty to inform? We have millions of hardworking but poor families who will be made substantially worse off as a result of a fiscal rule which no academic economist has supported? Will these families ever find that out? What does that tell us about our media, and our democracy?

- Brazil´s Sudden Neoliberal U-Turn - Franklin Serrano, North American Congress on Latin America (NACLA):

President Rousseff and her party […] decided — in an attempt to reduce the rising criticism from firms, banks, part of the Congress, and the media — that the government was intervening “too much” in the economy. They shifted the government’s economic role to providing incentives (generous, unconditional tax cuts to firms) for private investment so as that the business sector would lead (instead of follow) economic growth. This policy failed completely.

- Thinking the unthinkable - John Quiggin:

There is now overwhelming evidence that for-profit education has been a disastrous failure wherever it has been tried, and particularly where for-profit firms can gain access to public funds through policies designed to enhance “consumer choice”.

- This new $5 service will endure the hassle of canceling Comcast for you - Ashley Rodriguez, Quartz: Capitalism: Delivering innovative solutions to the problems it creates. And the problems created by those solutions. And so on.

- AUSTERITY 101: The Three Reasons Republican Deficit Hawks Are Wrong - Robert Reich explains Keynesian countercyclical stimulus:

- Conning the working-class - Chris Dillow:

[S]ocial comparison theory tells us that people compare themselves to those who are like them. […] It's tempting for lefties to believe that people vote Tory because of "neoliberal" ideology and the right-wing media. But there might be more to it than this. Even without such propaganda, there are cognitive biases at work which undermine class solidarity.

- What Do We Really Know About Osama bin Laden’s Death? - Jonathan Mahler: A mere six months late, the US newspaper of record concedes that Sy Hersh may be right and Hollywood may be wrong. The system works, America!

- Populism and Patrimonialism - John Quiggin at Crooked Timber:

There’s nothing inherently ludicrous in the suggestion that the very rich should pay most or all of the costs of sustaining a system that benefits them so greatly. […] Teenagers from high-income families are increasingly less likely to work, particularly in minimum wage jobs that do nothing for a resume. More importantly, as the real value of the minimum wage has fallen, the number of “working poor” or near-poor households has risen. […] So, it’s time for populism. A program based on taxing the rich much more heavily and raising the minimum wage is not only politically saleable but economically sensible.

- While Sanders Scores Small Donors, Clinton and Bush Buoyed by Wall Street - Deirdre Fulton, Common Dreams:

Wall Street's support for its former champion in the U.S. Senate, Clinton, is not surprising, despite her recent pledges to get tough on corporate malfeasance and Wall Street greed. "She’s doing that because of Bernie," Camden Fine, the head of the Independent Community Bankers of America, said in an interview with Morning Consult this week. "She’s gonna all of a sudden become Mrs. Wall Street if she’s elected. So it’s all Bernie theatrics right now. She’s a Clinton, for God’s sake. What do you expect?"

- Big Win For Fair Use In Google Books Lawsuit - Corynne McSherry: Court fails to crumble in the face of the evil incantation "intellectual property".

- How television fails in its duty to inform - Simon Wren-Lewis makes a pithy observation:

Take for example the clip where the Prime Minister lied about cuts to tax credits. There David Dimbleby asks him by saying “some people” have suggested tax credits would be cut, rather than “every non-partisan expert”. This may seem small, but this kind of detailed textual analysis is critical (and it is what many journalists have been trained to do).

- Everything You Need to Know about Laissez-Faire Economics - David S. Wilson interviews Alan Kirman:

[Gary] Becker had the economics of everything—divorce, whatever. You’d have these simple arguments, but not necessarily selection arguments, often some sort of justification in terms of a superior arrangement. The marginal utility of the woman getting divorced just has to equal the marginal utility of not getting divorced and that would be the price of getting divorced, and that sort of stuff. Adam Smith would have rolled over in this grave because he believed emotions played a strong role in all of this and the emotions that you have during divorce don’t tie into these strict calculations.

- Technical change as collective action problem - Chris Dillow:

We can imagine a society in which super-machines do indeed allow us all to live in luxurious leisure. But the decentralized decisions of capitalists might not get us there.

- The Hi-Tech Mess of Higher Education - David Bromwich in the New York Review of Books reviews the film Ivory Tower:

[H]owever fanciful the conceit may be, the MOOC movement has a clear economic motive. Many universities today want to cut back drastically on the payment of classroom teachers. It is important therefore to convince us that teachers have never been the focus of real learning.

- Why the Fiscal Charter makes no economic sense - James Meadway at New Economics Foundation:

A surplus on the government budget means the government is getting more in taxes than it is spending. Those taxes have to come from somewhere – us! If those tax receipts are not spent, this is simply sucking money out of the economy, rather than doing something useful with it. This is particularly acute when the economy enters a recession. Since a recession means households and firms are spending less, the government needs to spend more to compensate. A rule to always deliver a surplus would prevent that.

- Bernie Sanders has morphed into a serious contender - Bob Rigg, openDemocracy. Bernie hasn't morphed; the commentariat have, slowly and reluctantly:

What is really fascinating about the debate is that all three focus groups set up by CNN, Fox News and Fusion strongly endorsed Bernie Sanders. In the case of the CNN group, although more than half had supported Clinton when the debate began, a clear majority actively supported Sanders at the end. In the case of Fox News, an overwhelming majority enthusiastically supported Bernie Sanders, to the ill-concealed consternation of some resident talking heads.

- “Arabian Street Artists” Bomb Homeland: Why We Hacked an Award-Winning Series - Heba Amin, Caram Kapp, and Don Karl a.k.a Stone. Absolute genius:

At the beginning of June 2015, we received a phone call from a friend who […] had been contacted by “Homeland’s” set production company who were looking for “Arabian street artists” to lend graffiti authenticity to a film set of a Syrian refugee camp on the Lebanese/Syrian border for their new season. Given the series’ reputation we were not easily convinced, until we considered what a moment of intervention could relay about our own and many others’ political discontent with the series. It was our moment to make our point by subverting the message using the show itself.

- Hillary vs. Bernie Will Decide the Future of the American Left - Elizabeth Bruenig in the New Republic:

In November of 2014, Sweden’s prime minister Stefan Löfven explained the logic of universal benefits in a conversation at NYU Law School, saying the main focus of such programs is to build “a welfare system for everybody, for all, rich and poor—because universal solutions have lower transaction costs, and it also [has] the advantage that you mobilize everybody to support the institutions that brings this welfare system.”

- Scores of Scores: How Companies Are Reducing Consumers to Single Numbers - Frank Pasquale, The Atlantic:

Though consumers have not been able to glimpse the actual algorithms for setting scores, some basic contours of credit scoring are intelligible: Don’t run up too much debt, and don’t be late on payments. But by 2009, financiers were scrutinizing more data, in ways completely opaque to scored consumers. Buy “little felt pads that stop chair legs from scratching the floor”? You might be rewarded with a higher credit line, or lower interest-rate offers. Purchase a beer at a billiards bar? Expect the opposite.

- China's latest building binge: the education factory - Alexandra Harney at Reuters:

Cities around China are carving out tracts of land for school parks - dubbed "education factories" - designed to train hundreds of thousands of students.[…] But the expansion comes even as many existing vocational schools are struggling to live up to their promise.

Sounds oddly familiar. - Slow Burn: Bernie Sanders Ignites a Populist Movement - Rick Perlstein, The Washington Spectator:

The crowd’s response is so ecstatic it overdrives my tape recorder. It continues into a chant: “BERNIE! BERNIE! BERNIE! BERNIE!” And when the show ends, a crowd in a nearly post-coital mood of sated exhilaration doesn’t want to leave, doesn’t leave, until Bernie returns to to the podium for something I’ve never witnessed at a political event, an encore, and announces that the crowd numbered 6,000.

- Consequences of the Canadian Liberal Majority - Ian Welsh:

Justin Trudeau is going to feel good, for a while, compared to Harper. He will be better. He will repeal some of Harper’s worst policies. He will also not be an offensive creep, and that matters. But he is, at the end of the day, a believer in the neo-liberal consensus. He will run a kinder neoliberalism, but it will still be neoliberalism.

- Guest post: Dirty Rant About The Human Brain Project - Anonymous Neuroscientist that Cathy O'Neil knows:

So, the next time you see a pretty 3D picture of many neurons being simulated, think “cargo cult brain”. That simulation isn’t gonna think any more than the cargo cult planes are gonna fly. The reason is the same in both cases: We have no clue about what principles allow the real machine to operate. We can only create pretty things that are superficially similar in the ways that we currently understand, which an enlightened being (who has some vague idea how the thing actually works) would just laugh at.

Sunday, 18 October 2015 - 10:35am

This week, I have been mostly reading:

- CNN and the NYT Are Deliberately Obscuring Who Perpetrated the Afghan Hospital Attack - Glenn Greenwald at the Intercept: "The headline states: “Air attacks kill at least 19 at Afghanistan hospital; U.S. investigating.” What’s the U.S. role in this incident? They’re the investigators: like Sherlock Holmes after an unsolved crime. The article itself repeatedly suggests the same: “The United States said it was investigating what struck the hospital during the night.” It’s a fascinating whodunit and the U.S. is determined to get to the bottom of it."

- Sweden is shifting to a 6-hour work day - ScienceAlert: "A study published in The Lancet last month analysed data from 25 studies that monitored health of over 600,000 people from the US, Europe, and Australia for up to 8.5 years found that people who worked 55 hours a week had a 33 percent greater risk of having a stroke than people who worked a 35 - 40 hour week, and a 13 percent increased risk of developing coronary heart disease, while a separate study found that working 49-hour weeks was associated with lower mental health, particularly in women."

- Disliking Tragedy: Facebook’s Struggle to Convey Serious News - H.L. Starnes, the Society Pages: "Facebook, when taken on the whole, is a fantastic way for people to compare each others’ lives and share pictures of kittens and children, but when it comes to a tragedy, the platform is woefully inadequate at allowing its users to parse and process the gravity of events as they unfold. It is a thorough shock to a system that thrives on irreverent links and topical memes, and when faced with an item that requires genuine reflection and thought, it is often simpler – indeed, even more beneficial – for users to turn their heads until the kittens may resume."

- The Radically Changing Story of the U.S. Airstrike on Afghan Hospital: From Mistake to Justification - Glenn Greenwald at the Intercept: "[O]nly the most savage barbarians would decide that it’s justified to raze a hospital filled with doctors, nurses and patients to the ground. Yet mounting evidence suggests that this is exactly what the U.S. military did – either because it chose to do so or because its Afghan allies fed them the coordinates of this hospital which they have long disliked. As a result, we now have U.S. and Afghan officials expressly justifying the consummate war crime: deliberately attacking a hospital filled with doctors, nurses and wounded patients."

- Greece Without Illusions - Yanis Varoufakis, Project Syndicate: "The shift reflects the mandate that Prime Minister Alexis Tsipras sought and gained. Last January, when I stood with him, we asked voters to back our determination to end the “extend-and-pretend” bailouts that had pushed Greece into a black hole and operated as the template for austerity policies across Europe. The government that was returned on September 20 has the opposite mandate: to implement an “extend-and-pretend” bailout program – indeed, the most toxic variant ever."

- How Scientists Search the Cosmos for Encrypted Alien Signals (And Other Ones Too) - Micah Lee at the Intercept. I listened to this podcast, and thought this was the most forehead-slapping so-obvious-why-has-it-never-occured-to-me observation ever: "In any advanced civilization, there is only a “small period in the development of their society when all of their communications will be sent via the most primitive and most unprotected means,” Snowden said. And that if we pick up signals emanating from that civilization’s homeworld, such as television shows, phone calls, or satellite communication, it will most likely be encrypted because “all of their communications [would be] encrypted by default.” Because of how encryption works, those encrypted messages would be “indistinguishable to us from cosmic microwave background radiation.”"

- The Ideology of Money Scarcity - J.D. Alt at NEP: "The conservatives wield every opportunity to invoke the mantra that the government is broke and its spending must be reined in, while the liberals (like senator Sanders) find themselves helpless to refute the “logic” that the many things they want the government to spend money on are severely limited by the fact that everyone (including the U.S. government itself) is competing for what appears to be a finite and limited pot of dollars. […] It’s a “beautiful” business model if your goals are to maximize shareholder profits and executive bonuses. As a business model for humanity—and for humanity as a dependent member of the earth’s community of integrated ecosystems—it is fast becoming, quite simply, an unmitigated disaster."

- How Erratic Schedules Penalize Workers - Naomi Gerstel in the Society Pages: "Hit hardest are low-wage workers and women of color – frequently women who are single mothers. Understandably, the workers affected by so much unpredictability often experience stress, conflicts, and health problems. Low-wage employees cannot afford to pay for high-quality child care or care for elderly family members – a problem made worse when they must go to work at odd hours. These workers often do not get any vacation time, another workplace perk that is increasingly available only to the most privileged employees."

- The Unanswered Question Of The Trans-Pacific Partnership: What Sovereign Rights Did We Just Sign Away? - Ben Eltham at New Matilda: "Attacking the TPP shouldn’t be too difficult, given that the government has signed a contract that ordinary Australians aren’t even allowed to see. In a properly functioning democracy, we’d know exactly what the agreement says, and what Australia is singing up to. The TPP shows that’s far from the reality."

- Bitcoins are a waste of energy - literally - John Quiggin at ABC's the Drum: "The external value of fiat money is more subtle than that of a metal coin. It is inherent in the fact that the government issuing the currency is willing to accept it in payment of taxes and other obligations. If the US government ceased to exist, people might choose to go on using US dollars as a medium of exchange for a while. Ultimately, however, all currencies without an external source of value must share the fate of the Confederate dollar and similar former currencies, becoming, at best, collectors' items. In the end, Bitcoins will attain their true economic value of zero." This is the most MMT-informed reasoning I've yet heard from Quiggin. Welcome to the church, brother John.

- The TPP’s one-way ratchet - Quiggin again, at Inside Story. Does the man ever sleep?: "Until and unless the TPP comes into effect, there is no [Investor-State Dispute Settlement] clause in trade agreements between Australia and the United States. But this was no problem for Philip Morris: the company reincorporated itself in Hong Kong, which does have such a clause in its agreement with Australia. The TPP will render such dodges unnecessary for foreign companies based in signatory countries. The big benefit will be for Australian corporations which can base themselves in the United States and then, effectively, place themselves above Australian law."

- Why Free College Is Necessary - the unreasonably brilliant Tressie McMillan Cottom in Dissent: "I do not care if free college won’t solve inequality. As an isolated policy, I know that it won’t. I don’t care that it will likely only benefit the high achievers among the statistically unprivileged—those with above-average test scores, know-how, or financial means compared to their cohort. Despite these problems, today’s debate about free college tuition does something extremely valuable. It reintroduces the concept of public good to higher education discourse—a concept that fifty years of individuation, efficiency fetishes, and a rightward drift in politics have nearly pummeled out of higher education altogether. We no longer have a way to talk about public education as a collective good because even we defenders have adopted the language of competition. President Obama justified his free community college plan on the grounds that “Every American . . . should be able to earn the skills and education necessary to compete and win in the twenty-first century economy.” Meanwhile, for-profit boosters claim that their institutions allow “greater access” to college for the public. But access to what kind of education? Those of us who believe in viable, affordable higher ed need a different kind of language. You cannot organize for what you cannot name."

- Generation Debt - Mike Konczal in the same series of articles for Dissent: "Higher education also provides one of the last spaces for young people not shaped solely by market values. The American liberal arts model is unique in that it allows for experimentation, learning, and community-building. Attacks on higher education haven’t simply been about raising tuition but about dismantling this model itself. A notable example is Wisconsin Governor Scott Walker’s recent attempt to remove phrases such as “improve the human condition,” “the search for truth,” and “public service” from the state university’s mission, reorienting it simply toward the needs of business."

- Learning Nothing In Europe - Paul Krugman, NYT: "My spending is your income, your spending is my income, so if everyone slashes spending and tries to pay down debt at the same time, incomes fall and debt problems probably get worse. […] But German officials see this all as a tale of their virtue versus everyone else’s lack thereof. This means that nobody will change course aside from the ECB, which is in the process of finding out just how limited monetary policy really is when interest rates are already very low and fiscal policy is pulling in the wrong direction."

- 3 reasons why the Tories' obsession with 'hardwork' is blind idiocy - Gabriel Bristow, openDemocracy: "Have you ever heard somebody say that the cuts are 'ideological', rather than an economic necessity? Well, this is precisely what they mean. As [Jeremy] Hunt lays out so magnificently, cutting in-work benefits is a 'cultural signal' intended to somehow magic up some national spirit of graft. Not to worry that the crux of the issue is that low pay is set by unscrupulous employers and bears no relation to how hard people work whatsoever."

- What Ever Happened to Google Books? - Tim Wu in the New Yorker: "Unfortunately, Google made the mistake it often makes, which is to assume that people will trust it just because it’s Google. For their part, authors and publishers, even if they did eventually settle, were difficult and conspiracy-minded, particularly when it came to weighing abstract and mainly worthless rights against the public’s interest in gaining access to obscure works."

- Human Capital and Knowledge - Paul Romer: There are Grand Theory alarm bells to be heard in every sentence here, eg. "Here is the true micro-foundation that I used to think about human capital. Human capital is stored as neural connections in a brain."

- The Bezzle Years - John Kay, Project Syndicate: "The joy of the bezzle is that two people – each ignorant of the other’s existence and role – can enjoy the same wealth. […] Households in US cities received mortgages in 2006 that they could never hope to repay, while taxpayers never dreamed that they would be called on to bail out the lenders. Shareholders in banks could not have understood that the dividends they received before 2007 were actually money that they had borrowed from themselves."

- "The country can't afford" - Chris Dillow: "The cost of tax credits is NOT the £29.5bn which the government spends on them. This is a transfer. Instead, the costs are the deadweight costs associated with them: for example, the cost of administering a complex system (which is one reason why I prefer a basic income), or the disincentive effects they create - for example, the higher taxes levied on other people to pay tax credits. The latter are, however, moot: a big purpose of tax credits is to raise in-work income and so incentivize work. Whether tax credits are therefore a cost at all is thus questionable."

- 12 Questions Every Economics Student Should Ask About Their Education - Post-Crash Economics Society: I find this checklist more useful than vague assertions of acquired "learning outcomes" and "graduate attributes". Shame my university doesn't teach economics, or history, or philosophy, or…

- Sociology as Un-Learning - Afshan Jafar, the Society Pages: "At 10:37 a.m., exactly 12 minutes since class was supposed to start, I put my phone away, picked up the syllabus and started class as if nothing unusual had just transpired."

- Clinton's opposition encourages some TPP foes, but provokes critics who see it as political maneuver - Meteor Blades at Daily Kos: "Whether it's a fair judgment or not, Clinton's reputation for triangulation and an excessive wet-finger-in-the-wind approach to policy is going to dog any leftward change in viewpoint—or seeming change—that she makes throughout the campaign, even when those new viewpoints are ones her liberal critics support." I'm just not won over by Hillary's new sheep's clothing. At the end of the day, she still likes to kick back and enjoy a few brewskies with old pals like Greenspan and Kissinger.

- Politics as therapy: they want us to be just sick enough not to fight back - Michael Richmond, openDemocracy: "The capitalist class would like us to be just sick enough not to fight back, but not so sick that we cannot work. The challenge for us is to find ways of organising and helping each other so that we can find adequate levels of social reproduction, care and support to give us a platform to engage in the therapy of class struggle."

- Why the U.S. Owns the Rise of Islamic State and the Syria Disaster - Gareth Porter in Truthdig. A handy primer: "Pundits and politicians are already looking for a convenient explanation for the twin Middle East disasters of the rise of Islamic State and the humanitarian catastrophe in Syria. The genuine answer is politically unpalatable, because the primary cause of both calamities is U.S. war and covert operations in the Middle East, followed by the abdication of U.S. power and responsibility for Syria policy to Saudi Arabia and other Sunni allies."

- Australia Forgets that Code is Cultural: Replaces History and Geography with Computer Science - Jenny Davis in the Society Pages: "Before leaving his post as Australia’s Education Minister, Christopher Pyne approved a major restructuring of the public school curriculum. […] This replacement fundamentally misunderstands the deeply social nature of programming and code. To treat technical skill as somehow separate from socio-historical knowledge is not only fallacious, but bodes poorly for the future that the curricular shift is intended to improve. Computer science is historical and geographic. Code is culturally rooted and inherently creative."

- Uncovering The Secret History Of Myers-Briggs - Merve Emre - Digg: "I have heard bemused stories of how applicants to elite, cultish hedge funds and Silicon Valley startups are asked to take a Myers-Briggs test early in their job searches, only to be weeded out as unfavorable candidates based on their type. I have heard of managers who exploit personality profiles, invoking type to bully, shame, and strong-arm their employees. Employees, for their part, have little recourse. Ironically, personality testing's status as a pseudo-science — as opposed to a hard science, like DNA or medical testing — means that there are no legal safeguards in place that protect employees from discrimination based on type."

- Dear Old Trump University - Tom the Dancing Bug by Ruben Bolling

- Ben Bernanke Is Fed Up - Chad Stone, US News: "In Bernanke's harsh but accurate judgment, "fiscal policymakers, far from helping the economy, appeared to be actively working to hinder it." He's talking about Republican congressional efforts to use "must pass" legislation – e.g., raising the legal limit on total federal debt or approving annual spending bills to fund the government – as bargaining chips to achieve deep cuts in government spending, even when the economy is weak."

- Is Money Corrupting Research? - Luigi Zingales, NYT: "A paper can be misleading or economical with the truth even when not blatantly false. And reputational incentives work relatively well only for academic papers that circulate widely in the relevant academic community and are independently scrutinized in peer review. […] A scarier possibility is that reputational incentives do not work because the practice of bending an opinion for money is so widespread as to be the norm."

- Surgical Strike - George Monbiot: "There are no simple solutions to the chaos and complexities Western firepower has helped to unleash, though a good start would be to stop making them worse. […] Twelve years into the conflict in Iraq, 14 years into the fighting in Afghanistan, after repeated announcements of victory or withdrawal, military action appears only to have replaced the old forms of brutality and chaos with new ones. And yet it continues. War appears to have become an end in itself."

- Does apathy to the political system among young people point to a crisis in Australian democracy? - Travers McCloud from the Centre for Policy Development: TL;DR: Yes.

- Must-read: The Neoliberal Arts: How college sold its soul to the market - brilliant essay by William Deresiewicz in Harpers: "Instead of treating higher education as a commodity, we need to treat it as a right. Instead of seeing it in terms of market purposes, we need to see it once again in terms of intellectual and moral purposes. That means resurrecting one of the great achievements of postwar American society: high-quality, low- or no-cost mass public higher education. An end to the artificial scarcity of educational resources. An end to the idea that students must compete for the privilege of going to a decent college, and that they then must pay for it."

Sunday, 11 October 2015 - 11:58am

This week, I have been mostly reading the Internet. All of it: