inequality

My experience with geopolitics of knowledge in political philosophy so far

Geopolitics of knowledge is a fact. Only few (conservative) colleagues would contend otherwise. Ingrid Robeyns wrote an entry for this blog dealing with this problem. There, Ingrid dealt mostly with the absence of non-Anglophone colleagues in political philosophy books and journals from the Anglophone centre. I want to stress that this is not a problem of language, for there are other centres from which we, philosophers from the “Global South” working in the “Global South”, are excluded. In political philosophy, the centre is composed of the Anglophone world and three European countries: Italy, France, and Germany. From my own experience, the rest of us do not qualify as political philosophers, for we are, it seems, unable to speak in universal terms. We are, at best, providers of particular cases and data for Europeans and Anglophones to study and produce their own philosophical and universal theories. I think most of you who are reading are already familiar with the concept of epistemic extractivism, of which this phenomenon is a case. (If not, you should; in case you don’t read Spanish, there is this).

Critical political philosophy is one of the fields where the unequal distribution of epistemic authority is more striking. I say “striking” because it would seem, prima facie, that political philosophers with a critical inclination (Marxists, feminists, anti-imperialists, etc.) are people more prone to recognising injustice than people from other disciplines and tendencies. But no one lives outside a system of injustice and no one is a priori completely exempt from reproducing patterns of silencing. Not even ourselves, living and working in the “Global Southern” places of the world. Many political philosophers working and living in Latin America don’t even bother to read and cite their own colleagues. This is, to be sure, a shame, but there is a rationale behind this self-destructive practice. Latin American scholars know that their papers have even lesser chances of being sent to a reviewing process (we are usually desk-rejected) if they cite “too many” pieces in Spanish and by authors working outside of the academic centre.

In many reviews I’ve received in my career, I have been told to cite books by people from the centre just because they are trending or are being cited in the most prestigious Anglophone journals, even if they would contribute nothing to my piece and research. I have frequently been told by reviewers to give more information about the “particular” social-historical context I am writing from because readers don’t know a lot about it. This is an almost verbatim phrase from a review I got recently. I wonder if readers of Anglophone prestigious, Q1 journals stop being professional researchers the instant they start reading about José Carlos Mariátegui or Argentina’s last right-wing dictatorship. Why can’t they just do the research by themselves, why should we have to waste characters and words to educate an overeducated public? This is as tiresome as it is offensive. When I cite the work of non-Anglophone authors from outside of the imperial centres (UK, USA, Italy, Germany, and France, no matter the language they use to write), reviewers almost always demand that I include a reference to some famous native Anglophone (or Italian / German / French, without considering gender or race; the power differential here is simple geographical procedence) author who said similar things but decades after the authors I am quoting. I’ve read all your authors. Why haven’t they read “mine”? And why do they feel they have to suggest something else instead of just learning about “our” authors? This is what I want to reply to the reviewers. Of course, I don’t. I dilligently put the references they demand. I shouldn’t have to, but if I don’t, I don’t get published. There’s the imperial trick again.

English is also always a problem, but not for everyone who is not Anglophone. In 2020 I was in London doing research at LSE. I attended a lecture by a European political theorist. They gave the talk in English. Although they work at a United Statian University, their English was poor. The room was packed. The lecture was mediocre. I was annoyed. “Why do they feel they don’t have to make an effort to pronounce in an intelligible way?”, I thought. When I speak they don’t listen to me like that, with concentrated attention and making an effort to understand me. The reason is in plain view: coloniality of power. If you come from powerful European countries, you don’t need to ask for permission. You don’t need to excel. You don’t need to have something absolutely original to say. You just show up and talk. If you are from, let’s say, Argentina, and you work there (here), you have to adapt to the traditional analytic way of writing and arguing so typical in Anglophone contexts, including citing their literature, if you want to enter the room in the first place. You are not even allowed to use neologisms, although the omnipresent use of English as a lingua franca should have already made this practice at least tolerated. One cannot expect everyone to speak English and English to remain “English” all the same. Inclusion changes the game, if it doesn’t, then it is not isegoria what is going on but cultural homogenisation. (Here is a proposal for inclusive practices regarding Enlgish as a lingua franca). The manifest “Rethinking English as a lingua franca in scientific-academic contexts” offers a detailed critique of the idea and imposition of English as a lingua franca. I endorse it 100 %. (Here in Spanish, open access; here in Portuguese).

In my particular case, I am frequently invited to the academic centre, sometimes to write book chapters, encyclopaedia entries, and papers for special issues, sometimes to give talks and lectures. Not once have I not thought it was not tokenism. Maybe it is my own inferiority complex distorting my perception of reality, but we know from Frantz Fanon which is the origin of this inferiorisation.

I used to be pretty annoyed by this whole situation until I realised that I don’t need to try to enter conversations where I am not going to be heard, understood, or taken seriously. The fact is that we don’t need to be recognised as philosophers by those who willingly ignore our political philosophy. And this is why it is hard for me to participate in forums such as this blog. I just don’t want to receive the same comments I get when I send a paper to an Anglophone, Q1 journal, to put it simply.

But I also want to keep trying, not to feel accepted and to belong, but because I do believe in transnational solidarity and the collective production of emancipatory knowledge. It is a matter of recognition, and a question of whether it is possible for the coloniser to recognise the colonised, to name Fanon once more.

We could do things so very differently

There are rare moments when I think everything must change.

Sometimes, these have been personal.

Other times, I have realised that organisations I have been involved in need to change.

But this morning, I have a very real sense that the need for everything to change is very much bigger. I am increasingly thinking that society is becoming unsustainable. The political decisions of the past are coming home to roost. The current political narrative is not working and cannot ever work again. The risk of serious breakdown is very high.

The evidence is all around us, and I offer it in no particular order.

The COP28 has seen bizarre claims that we must burn carbon to save the planet. The scientific evidence is unequivocal that we must stop doing so. Our failure to do just that is very rapidly leading us to climate tipping points.

The war in Gaza is going to rewrite the politics of the Middle East, which have been so significant throughout my life. Israel's actions will change its standing in the world, whatever Hamas totally unjustifiably did.

Sellafield is leaking, and there is no answer to the questions about nuclear waste after a lifetime of it accumulating. The pretence that nuclear is the energy answer has to be over.

Fascism is on the rise. We have seen it in the Netherlands, but it is as apparent here. The Tories are discussing the suspension of human rights so that they can pursue a policy on extraditing immigrants to Rwanda that can do absolutely nothing to solve the migration issue because of the tiny numbers that will ever be involved.

In fairness to the Tories, it looks quite likely that they will split over this issue. The possibility that the supposed most effective electoral machine in democratic history might collapse under the weight of its own in-fighting looks to be very real. It could happen soon. The likelihood that the date of the next election is not Sunak's to choose is growing as he begins to lose his party's support in the Commons.

Labour has moved into Tory space to take on the centre-right role.

There is no leading left-of-centre political party in the UK in a two-party system now: the essential element of first-past-the-post, that it offers the electorate choice, even if it is only a limited one, has gone. As a result, we no longer have anything approaching a functioning democracy.

Nor, with Labour dedicated to austerity and cuts, will we have anything approaching acceptable public services left in the UK. The next round of doctors' strikes is evidence that this is unacceptable.

The migration issue is not going away: without inward migration, we cannot survive. Without it, there will be no provision for an ageing population in the UK that long ago ceased to replace itself. The self-destruct button is being pushed on this issue.

And the same is true of economics. The failure to recover from the 2008 crash is not by chance: it is because that crash was caused by the failure of neoliberalism and yet we are still trying to treat that failure with more neoliberalism, which clearly cannot work. But our politicians, civil service and the so-called economists who feed them the nonsense that informs what is supposedly called evidence-based policy cannot see this obvious fact, so blinded are they by ideology.

All of this, and more, suggests that the system we have cannot survive. It is literally, and very obviously, dying all around us.

We could do things so very differently.

We could care.

We could prioritise meeting the needs of all and not delivering the wants of a few.

We could plan for our children's and grandchildren's survival.

We could make financial services a servant and not a master.

We could fund strong public services.

We could take action to stop the massively destructive excess consumption of some that is destroying this planet for everyone else, which is also utterly distorting our economies.

We could have a functioning democracy.

If we did, we could stop fascism.

We could do all this.

But will we?

Avoidable Deaths of People with Learning Disabilities: The Statistics that Shame Our Civilised Society

Newsletter offer

Newsletter offer

Subscribe to our newsletter for exclusive editorial emails from the Byline Times Team.

My 34-year-old sister is currently more likely to die an avoidable death than at any other stage in her life, according to a shocking new report.

In the latest NHS-funded annual review of deaths among people with learning disabilities, a bleak line graph shows an “odds ratio of avoidable death for age group”, which peaks between the ages of 25 and 49.

Right now, I hasten to add, Raana – who has the learning disability fragile X syndrome – is in good health and is well cared for by her supported living staff in Hampshire.

But the report lays bare how part of our population is less likely to receive good quality health and social care. This makes people like Raana less likely to survive health problems that, for most of us, are preventable and treatable.

Researchers at King’s College London, the University of Central Lancashire and Kingston University London reviewed the deaths of 3,648 people with a learning disability. Overall, almost half died an avoidable death – compared to two in 10 in the general population. The median age of death in was 63 years – around 20 years less than usual.

These terrible facts shame our modern, civilised society, one that on Human Rights Day this Sunday will mark the 75th anniversary of the Universal Declaration of Human Rights Day. The day partly reflects equality 'for all'.

In contrast, the new report highlights a deep inequality. It reflects how learning disabled people from ethnic minority backgrounds are likely to die earlier, as well as those in deprived areas. It also warns of “excess deaths” caused by heatwaves related to climate change.

‘Nearly All Leading Voices in Learning Disability Advocacy Are White – This Must Change’

When the narrative is dominated by people who look different and don’t share ethnic minority experiences, the system will continue to fail, writes Ramandeep Kaur

Ramandeep Kaur

The findings are shocking enough, but equally unsettling is the fact that evidence of such premature deaths – and the actions needed to prevent them – are well-established, and have been so for years.

This is the sixth annual report of its kind (the deaths review programme began in 2017), and it is also a quarter of a century since Sheila Hollins, now a crossbench peer, led a report into the increased risk of early death among people with learning disabilities.

In the 25 years since, those original findings have been amplified by a multitude of similarly focused reports and inquiries exposing the significant health inequalities faced by this group of people.

This includes 2013’s Department of Health-funded Confidential Inquiry into the deaths of people with learning disabilities, two reports by Mencap in 2004 and 2007, a Disability Rights Commission study in 2006, and a Department of Health inquiry in 2009.

Just a month ago, an investigation by the watchdog Health Services Safety Investigations Body showed that hospitals put patients with learning disabilities at risk because their need are not met. It found the health and care system “is not always designed to effectively care for people with a learning disability”.

Of course, the investigations and research have laudable aims – to raise awareness, learn from and prevent avoidable deaths, improve care and reduce health inequality. But data alone does not dent entrenched structural inequalities – we need more effort, not just more evidence.

Successive governments – particularly the current one – instead seem content with facilitating and encouraging yet more data alone, while generally turning a blind eye to the recommendations suggested alongside it.

The actions raised by researchers involved in this latest report and previous ones include issues like prioritising people with a learning disability for vaccinations and boosters, a special focus on the health of people from ethnic minority backgrounds, and steps to make medical communication and appointments more accessible.

Yes, there are welcome developments from some with the power to act, mostly in response to campaigners. There is a greater push within some NHS regions for learning disabled people to take up annual health checks or the launch of accessible vaccination clinics, with reasonable adjustments as standard. And there is the roll-out of e-learning for health and care staff through the Oliver McGowan Mandatory Training in learning disability and autism.

But none of this is widespread or proportionate to need.

The hearings in the COVID Inquiry are another reminder that the Government had no plan for disabled people – especially disabled people from black, Asian or ethnic minority backgrounds – despite their higher risk of death in the pandemic.

Alongside the lack of specific action on the health of learning disabled people, the Government is also failing to tackle the wider determinants of wellbeing.

ENJOYING THIS ARTICLE? HELP US TO PRODUCE MORE

Receive the monthly Byline Times newspaper and help to support fearless, independent journalism that breaks stories, shapes the agenda and holds power to account.

We’re not funded by a billionaire oligarch or an offshore hedge-fund. We rely on our readers to fund our journalism. If you like what we do, please subscribe.

For example, it dropped long-awaited plans to reform the Mental Health Act, excluding it from the recent King’s Speech. These reforms would have meant fewer people with learning disabilities being detained in secure units (a group that is detained, despite not having mental health issues).

And it gave lip-service to Baroness Hollins’ long-awaited report calling for an end to the long-term segregation of learning disabled people in secure units. More than 2,000 people are still locked away in these inappropriate, restrictive and traumatising places.

More generally, the public sector cuts, lack of funding for social care, and the Government's move to block family members of overseas care workers from coming to the UK, threaten the already fragile support that exists. This further undermines the safety net that keeps people from a healthcare crisis.

No wonder then at the anger, sadness, disappointment and fear expressed by the Kingston University-based Staying Alive and Well Group, an advisory group of 10 people with a learning disability which informed the Learning from Lives and Deaths report.

In a statement and accessible video released as part of the report, the group renamed the study “Spot the Difference” because “we are saying the same things year after year after year… we sometimes feel like we are banging our heads against a brick wall, like nothing has changed”.

It is devastating that the words of this expert group of people with learning disabilities are as accurate and relevant today as they would have been when research in this area began – 25 years ago: “Everyone should be treated equally. Everyone has the right to live and be cared for. People with a learning disability can live well with the right support, but our lives are not valued enough.”

Saba Salman is the editor of 'Made Possible: Stories of Success by People with Learning Disabilities – In their Own Words’. She is the chair of the charity Sibs, which supports the siblings of disabled children and adults

Is it time to charge VAT on ultra-processed foods because of the massive harm that they do to society?

The Guardian has an article with this headline this morning:

It also has an article with this headline:

The two between them reveal a truth that is almost wholly unspoken and little appreciated. This truth is that type 2 diabetes is a disease largely created by the consumption of too much sugar in the form of fructose and that the disease can be reversed by largely eliminating fructose from the diet of those suffering from that disease.

Fructose is like nicotine in cigarettes: it is an addictive drug hidden in a processed product (in this case, most of the ultra-processed food on sale in the UK) that has massive social consequences.

Many of those ultra-processed foods are sold to give us dopamine highs. They succeed in doing so. They also leave us wanting more. So, we go back and get it. The result is obesity. And from that follows, in too many cases, type 2 diabetes. The progression is known about, predictable, heavily researched and largely unknown because there is a massive conspiracy to hide the truth.

Those conspiring not to tell the truth are food manufacturers, food retailers and big pharma. The food industry and its retailers want to keep selling large quantities of fructose. Big pharma wants to keep us in the dark on the easy reversibility of a disease that can be straightforwardly cured without costly drug interventions that are overburdening the NHS.

How do they do that? By deliberately ensuring that misinformation is available. As the author of the second Guardian article notes:

I now realize my doctor was making an honest attempt to follow the [treatment] guidelines issued by the American Diabetes Association. I didn’t ask him if he was aware that the top five funders of the ADA are the pharmaceutical companies Abbott, AstraZeneca, Eli Lilly and Co, Novo Nordisk and Regeneron.

The guidelines on treating diabetes in the USA (and so elsewhere) are created by big pharma to suit the need of big pharma to sell a lot of drugs and not to cure people of type 2 diabetes in months, which could be done by prescribing proper diets that would cost considerably less than that diabetes drugs.

I am not a fan of conspiracy theories. Far too many are just crackpot. But an open mind is also required in a case like this. We know the tobacco industry lied for decades about the impact of smoking.

We know that the Bank of England speaks nonsense when imposing its charges on society.

And the sugar-based food industry and big pharma are doing the same when it comes to fructose-based ultra-processed foods that are profoundly harmful.

There is no VAT on most food in the UK. I seriously wonder whether that should be changed now. Should the exemption just be available on non or low-processed foods? Wouldn't that make as much sense as taxes on tobacco?

The government’s desire to have access to the bank accounts of every benefit claimant – including pensioners – whilst refusing to take powers to tackle tax abuse – reveals malicious intent on their part

This speech was made by Labour backbench Sir Stephen Timms in the House of Commons on 29 November during a debate on the government's new Data Protection Bill. I thought it so significant it was worth sharing most of it, some more minor issues being edited out for the sake of clarity:

I rise to speak specifically to Government new clause 34 and connected Government amendments which, as we have been reminded, give Ministers power to inspect the bank accounts of anyone claiming a social security benefit. I think it has been confirmed that that includes child benefit and the state pension, as well as universal credit and all the others. Extremely wide powers are being given to Ministers.

The Minister told us that the measure is expected to save some half a billion pounds over the next five years.

We have also been told—I had not seen this assurance—that these powers will not be used for a few years. If that is correct, I am completely mystified by why this is being done in such a way. If we had a few years to get these powers in place, why did the Government not wait until there was some appropriate draft legislation that could be properly scrutinised, rather than bringing such measures forward now with zero Commons scrutiny and no opportunity for that to occur? There will no doubt be scrutiny in the other place, but surely a measure of this kind ought to undergo scrutiny in this House.

I chair the Work and Pensions Committee and we have received substantial concerns about this measure, including from Citizens Advice. The Child Poverty Action Group said that

it shouldn’t be that people have fewer rights, including to privacy, than everyone else in the UK simply because they are on benefits.

I think that sums up what a lot of people feel, although it appears to be the position that the Government are now taking. It is surprising that the Conservative party is bringing forward such a major expansion of state powers to pry into the affairs of private citizens, and particularly doing so in such a way that we are not able to scrutinise what it is planning. As we have been reminded, the state has long had powers where there were grounds for suspecting that benefit fraud had been committed. The proposal in the Bill is for surveillance where there is absolutely no suspicion at all, which is a substantial expansion of the state’s powers to intrude.

Annabel Denham, deputy comment editor at The Daily Telegraph warned in The Spectator of such a measure handing

authorities the power to snoop on people’s bank accounts.

I suspect that the views expressed there are more likely to find support on the Conservative Benches than on the Labour Benches, so I am increasingly puzzled by why the Government think this is an appropriate way to act. I wonder whether the fact that there have been such warnings prompted Ministers into rushing through the measure in this deeply unsatisfactory way, without an opportunity for proper scrutiny, because they thought that if there had been parliamentary scrutiny there would be substantial opposition from the Conservative Benches as well as from the Labour Benches. It is difficult to understand otherwise why it is being done in this way.

As we have been reminded, new clause 34 will give the Government the right to inspect the bank account of anyone who claims a state pension, which is all of us. It will give the Government the right to look into the bank account of every single one of us at some point during our lives, without suspecting that we have ever done anything wrong, and without telling us that they are doing it. The Minister said earlier that the powers of the state should be limited to those absolutely necessary, and I have always understood that to be a principle of the Conservative party. Yet on the power in the new clause to look into the bank account of everybody claiming a state pension, he was unable to give us any reason why the Government should do such a thing, or why they would ever need to look into the bank accounts of people—everybody—claiming a state pension. What on earth would the Government need to do that for? The entitlement to the state pension is not based on income, savings or anything like that, so why would the Government ever wish to do that?

If we cannot think of a reason why the Government would want to do that, why are they now taking the power to enable them to do so? I think that all of us would agree, whatever party we are in, that the powers of the state should be limited to those absolutely necessary.

The power in the new clause is definitely not absolutely necessary. Indeed, no one has been able to come up with any reason for why it would ever be used.

The amendment gives the Government extremely broad powers, with no checks in place, and it has been done in a way that minimises parliamentary scrutiny of what is proposed. I find it very hard to see how that can possibly be defended. No doubt the Minister will tell us that at some point there will be some document setting out checks and balances and so on, but that needs to be part of this scrutiny. It should not be that the Government take it all away to come back in a few months’ time to tell us how they will constrain the use of this power.

Finally, it occurs to me that the power being introduced could be used to establish benefit eligibility for people who do not currently claim benefits. We know, for example, that a large number of people do not claim pension credit, but are eligible for it. A lot of the information about whether they are entitled to pension credit is already held in the public sector, and in local councils in particular. If it were possible to check whether people had less than the threshold savings level, that could help in establishing eligibility for pension credit automatically. Can the Minister tell us whether that is intended with this proposal?

The critical parts of this speech are highlighted.

Twenty-two million people will have no control over their financial privacy if this Bill is enacted, including every old age pensioner, even though old age pension fraud is almost non-existent and there is no means testing related to it (although there is to pension credit).

The power that the government is taking is utterly unreasonable.

What is more, they are not even justifying it by saying that the power to collect data will be used to pay people sums to which they are entitled when unpaid benefits considerably exceed the cost of so-called pension fraud.

One final thought. I have long called for banks to be required to provide relatively modest amounts of data to HM Revenue & Customs each year on balances and deposits made by all UK-based limited companies to prevent corporation tax fraud, but no action has ever been taken on this when the need is very apparent, and the scale of fraud is very much larger. The government is, as ever, picking on the vulnerable and ignoring real crime in the UK.

‘Nearly All Leading Voices in Learning Disability Advocacy Are White – This Must Change’

Newsletter offer

Newsletter offer

Subscribe to our newsletter for exclusive editorial emails from the Byline Times Team.

"World-leading" and "ground-breaking" were the words Conservative MP Liam Fox used to persuade members of both the House of Commons and the Lords to enact into legislation a Private Members Bill for a Down Syndrome Act. With much fanfare and celebration of cross-party support, the Act was finally passed into law last April.

A consultation has since come and gone, and there is still no sign of the much-hailed guidance, which was the core element of the Act. This, it was claimed, would describe what specialist help was required by people with ‘Down Syndrome’ (Fox and his supporters insisted on the American usage) and how to implement it.

The Act’s many supporters argued that it would help people secure the right support in education, health, social care and housing. Even the youth justice system, it was said, would be improved.

That was 18 long months ago.

At the time, Stephen Unwin and I criticised in these pages the deeply divisive and ineffective nature of the legislation. But, throughout the campaign, there was one crucial omission: nobody listened to people from ethnic minority groups.

The so-called National Down Syndrome Policy Group (NDSPG) – all white, all middle-class – produced an ‘evidence-based’ paper to support its arguments, but there was not one mention of race, ethnicity or culture in its hefty 80 pages.

A new report by a national commission has found that ‘systemic racism embedded in the Government’s responses to the pandemic may have worsened outcomes’

Saba Salman

People like my son Harry, who has Down’s syndrome and is of mixed Indian and Northern Irish heritage, were completely ignored. When challenged, the NDSPG told me to find the evidence and report back. Here was a British Indian woman campaigning for the rights and dignities of her son, pointing out a problem not created by me, being told to go away and find the solution to something they had not even considered. Simply put, I was made to feel that I wasn’t wanted.

These problems occur across the public sector.

The COVID Inquiry recently heard from former Downing Street director of communications, Lee Cain, about how civil servants – especially policy-makers – are disastrously lacking in diversity (seen as a dirty word by some who argue that too much money is being spent on such things).

He explained that "if you lack that diversity within a team, you create problems in decision-making and policy development and culture". This inevitably resulted in the needs of people from ethnic minorities being almost completely ignored when plans were being developed around how to tackle the Coronavirus.

The impact, as we now know, was hugely negative – with by far the highest death rates being in the Bangladeshi and Pakistani communities. People with learning disabilities were up to six times more likely to die from COVID during the first wave of the pandemic. Harry, who still lives at home, was fine, but statistically his chances were very limited.

Professor Chris Hatton, of Manchester Metropolitan University, recently conducted research with the Race and Health Observatory into public policies affecting people with learning disabilities and found that the vast majority failed to consider ethnic minority groups at all. It also showed that, without significant improvements, the life expectancy of people with severe learning disabilities from ethnic minority groups will remain at the heartbreakingly young age of 34 years. It is devastating to realise that this is somehow seen as acceptable.

The truth is campaigners, lobbying groups, support groups and charity boards are all lacking in diversity. With the notable exception of journalist Saba Salman, nearly all the leading voices in learning disability advocacy are white. Much as I welcome their input, unless policy-makers start listening to other voices, we will never succeed in bringing about much needed change to the life chances of all people with learning disabilities.

ENJOYING THIS ARTICLE? HELP US TO PRODUCE MORE

Receive the monthly Byline Times newspaper and help to support fearless, independent journalism that breaks stories, shapes the agenda and holds power to account.

We’re not funded by a billionaire oligarch or an offshore hedge-fund. We rely on our readers to fund our journalism. If you like what we do, please subscribe.

And research shows that, when grassroots organisations from ethnic minority groups apply for funding, they are regularly frozen out. Even when they succeed, the amount is derisory and for very short-term projects. It feels almost impossible for us to secure support from anywhere.

The fact is that people like my Harry face enormous challenges regardless.

Punjabi families take great pride in announcing the birth of a boy, but with Harry, the celebrations were muted. He and I were shunned by people I had known most of my life. The stigma, shame and rejection are devastating. Sixteen years on, these attitudes are gradually changing and I campaign within the community for better attitudes and better practice. But there’s so much to be done.

But when the narrative is dominated by people who look different, who don’t share our experiences, or who need entirely different interventions and support mechanisms, the system will continue to fail. As the great Palestinian-American academic and literary critic Edward Said reminds us, the stories of people from the East have been dominated by people from the West. Surely, just occasionally, our voices should also be listened to?

People from ethnic minorities need to be empowered to emerge from the shadows in the formulating of public policy. Politicians, civil servants and commentators must move beyond describing us as ‘hard to reach’ – when the simple truth is that we are ‘easy to ignore’. Without the voices of people like us, families will continue to feel isolated, neglected and forgotten. We deserve better.

Until we accept that my gorgeous, Bollywood-obsessed 16-year-old son has the same value as any other learning-disabled person – as all other people – the endless sleepless nights worrying about a life being neglected, ignored and cut short will continue to leave me close to despair.

Why we do not need a wealth tax – but need to tax the income earned from wealth a great deal more

Many organisations on the left of UK politics are now calling for wealth taxes. The Taxing Wealth Report 2024 does not do so. It is appropriate to explain why that is the case.

As the Taxing Wealth Report 2024 has shown, because of the disparity between the tax rates applied to income and increases in wealth arising in each year it is possible that an additional capacity to tax of up to £170 billion per annum might be available in the UK. However, just because a potential tax base exists does not mean that it should be taxed. Nor does it mean that the tax base in question must be taxed in only one way.

It is my suggestion that it would not be wise or appropriate to introduce a wealth tax in the UK at this point in time. There are a number of reasons for saying so.

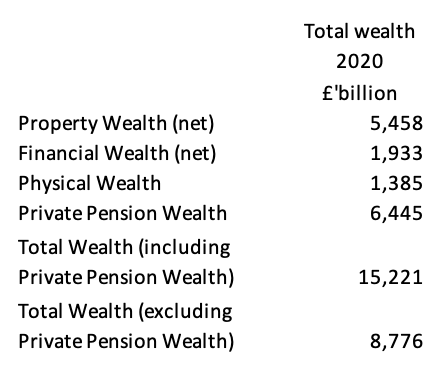

Firstly, whilst it is reported that there was personal wealth exceeding £15 trillion in the UK at the time that the last estimate was prepared in 2020 it is quite clear that a significant part of this might be unavailable as the basis for a wealth tax. The breakdown at that time was as follows:

Much of the UK’s property wealth is tied up in private housing and there would be considerable political resistance to imposing a wealth tax charge on people’s home, as past evidence has indicated. Whilst it is undeniable that some of that wealth is also second homes, buy-to-let property portfolios, commercial property, and land used for commercial and non-commercial purposes, and all of these might logically be within the basis for a wealth tax, this does not eliminate all the problems of imposing such a charge. There may well, in fact, be considerable difficulty in doing so, because of:

- Establishing who owns a property, since by no means all land and buildings are registered within the UK.

- Valuing these properties when those valuations might be deeply subjective in many cases, and therefore open to considerable (and costly) dispute.

- Establishing a basis for re-evaluation of property values on a recurring basis to ensure that a tax remained relevant. In this context, it should be noted that property valuations for the purposes of Council Tax in England have not been updated since 1992, precisely because of this difficulty.

It would be a brave government that took on these issues. To do so, thinking that the basis for a wealth tax on property could be established within the lifetime of a single parliament, would be wildly optimistic.

Property is not the only area where such difficulties might arise. For example, whilst most physical property would fall outside the scope of a wealth tax because it comprises household effects and things such as cars, there are inevitable exceptions to this rule, including valuable collections, works of art, and so on, all of which could, in theory, be subject to wealth taxation. However, once again, establishing a basis for taxation for such assets and updating it on a regular basis would be exceptionally difficult.

The same problem is to be found with regard to financial wealth. Of the total sum of such wealth noted, it is very unlikely that any government would be willing to impose a wealth tax charge on savings in pension funds. Included in the sum of £1.9 trillion of financial wealth outside such funds is at least £600 billion saved in ISA accounts. It is, again, unlikely that any government would be willing to impose a wealth tax charge on these texts incentivised accounts. This leaves approximately £1.3 trillion of other financial wealth but by no means all of this will be saved in readily marketable assets. Some will, for example, be tied up in the value of private companies and businesses. These are notoriously difficult to value with such valuation exercises often being the subject of protected negotiation and dispute between taxpayers and HM Revenue and Customs, which the imposition of a wealth tax would only make it worse.

Taking all these factors into account it has to, firstly, be concluded that the potential basis for a wealth tax charge is much lower than the total financial wealth of people resident in the UK.

Secondly, it should be apparent that providing an adequate legislative base for such a tax charge would be extremely difficult without creating significant opportunities for loopholes to be exploited.

Thirdly, taking into consideration the need for consultations on all stages of this process, the time required to create such a tax would be considerable.

Fourthly, even if all these processes could be concluded, there would then be a considerable cost to administering this tax because of the inevitable high level of disputes that would arise as to the basis of charge to be made. The fact that those subject to this tax would also, most likely, have the means to engage accountants and lawyers to assist them in pursuing these disputes only increases the likely potential cost of collecting any tax owing.

For all these reasons, it is inappropriate for practical reasons to impose a wealth tax in the UK however appealing such an idea might be when considering the gross inequalities that exist within the country and the apparent disparities in tax paid that we note do arise on a persistent basis.

This does not, however, mean that there are no available taxation solutions to tackling the issues that the Taxing Wealth Report 2024 has noted arise as a consequence of the disparity between the tax rates now paid on income arising during a period and the average increase in wealth of UK households accruing during the same period. What that report suggests in place of a wealth tax are a wide range of reforms to existing taxes payable either on high levels of income, or upon income arising from wealth, or on the enjoyment of certain types of wealth. The breadth of these reforms is potentially quite significant, and include:

- Aligning capital gains tax and income tax rates.

- Reducing the capital gains tax annual allowance.

- Abolishing entrepreneur’s relief in capital gains tax.

- Reforming inheritance tax.

- Pensions

- Business property

- Agricultural property

- Charities

- Houses

- Rates

- Reforming rates of income tax.

- Reforming national insurance charges on higher levels of earned income.

- Creating an investment income surcharge on unearned incomes.

- Restricting pension tax reliefs to the basic rate of income tax.

- Abolishing higher rate tax relief on gifts to charities.

- Abolishing the domicile rule.

- Reforming VAT to change tax rates on:

- Private school fees

- Financial advice

- Creating close company corporation tax rules.

- Companies House reform

- Reforming corporation tax admin

- Recreating large and small company corporation tax rates.

- Capping total ISA contributions.

- Council tax reform, including:

- Higher rates of tax for high-value properties

- Additional rates of tax on second and subsequent properties

- Additional taxes on vacant properties.

These reforms are of varying complexity. Some, such as the alignment of income tax and capital gains tax rates, would be easy to implement and have historical precedent. This is also true for investment income surcharges and close company rules for corporation tax, for both of which there are precedents that create significant knowledge bases that would assist the recreation of these charges. In the case of all the potential reforms of this type the creation of new charges should be a relatively straightforward matter, capable of implementation without significant time delays or the creation of substantial taxation disputes. This is the common characteristic to almost all these proposals: they are easy to deliver.

Importantly, however, because of the wide range of options available, it is obvious that not all these changes need to be implemented at the same time, and a rolling programme of reform could, instead, be undertaken. Critically, this suggests that the net outcome of this programme of reform would be significantly more successful than any attempt to impose a single wealth tax.

I offer an analogy by way of explanation. As any golfer knows, setting out to play a round of golf with just one club, whatever it might be, would result in a disastrous score. Golfers take a wide range of clubs because when doing so they have the range of tools necessary to address the wide range of scenarios that they will face whilst completing a game. I suggest that having a single wealth tax would be equivalent to playing a round of golf with, for example, a putter. Having the range of tax reforms proposed in the Taxing Wealth Report 2024 might instead be the equivalent to setting off with fourteen clubs in the golfer’s bag, which considerably increases the chance of achieving a good score. So it is with taxation. Having a wide ranges of taxes imposed at relatively low rates on relatively easy to identify tax bases is likely to produce an overall taxation yield greater than a single tax on a peculiar tax base might ever achieve. It is on the basis of this logic that the Taxing Wealth Report 2024 has been written. Reforming existing taxes can achieve so much more than a wealth tax might.

A summary of the proposals made in the Taxing Wealth Report 2024 is available here.

Recent Disparities in Earnings and Employment

The New York Fed recently released its latest set of Equitable Growth Indicators (EGIs). Updated quarterly, the EGIs continue to report demographic and geographic differences in inflation, earnings (real and nominal), employment, and consumer spending (real and nominal) at the national level. This release also launches a set of national wealth EGIs (which will be examined more closely on Liberty Street Economics early next year). Going forward, EGI releases will also include a set of regional EGIs, which will present disparities in inflation, earnings (real and nominal), employment, and consumer spending (real and nominal) in our region. Drawing on the just released EGIs, in this post, we present recent gender gaps in the labor market at the national and regional levels. We provide a picture of how gender wage and employment disparities have evolved since the pandemic, examining and contrasting gaps at the national and regional level. We find that the gaps between the employment rates and earnings of men and women have declined steadily following the pandemic, but have declined perceptibly more so in our region than in the nation.

Data

We use monthly, seasonally adjusted data on average weekly earnings and employment for men and women aged sixteen and older from the Current Population Survey. Creating a national panel, we draw a data set from respondents in all fifty states and Washington, D.C. We also conduct an analysis at the regional level, which includes respondents residing in New York State and the New York Metropolitan Statistical Area, except for Pennsylvania. We consider the time period from January 2019 to October 2023.

Labor Market Disparities

Gender wage and employment gaps have long been a persistent feature of the U.S. economy. At the onset of the COVID-19 pandemic, there was much uncertainty over how the event would impact these disparities. The shuttering of daycare centers and schools introduced concerns about the disproportionate number of women leaving the workforce to care for their children.

A more permanent change to labor market paradigms has been the rise in popularity of remote work. As more and more companies offered remote work options, many people have wondered: whether the increased flexibility would improve women’s labor market participation; whether women disproportionately taking advantage of remote work would be penalized compared to men who work in-person; or if the decline in childcare provided by in-person schooling might hinder women’s labor force participation. We examine how the labor market trends have evolved in the nation and in the region.

Employment Disparities

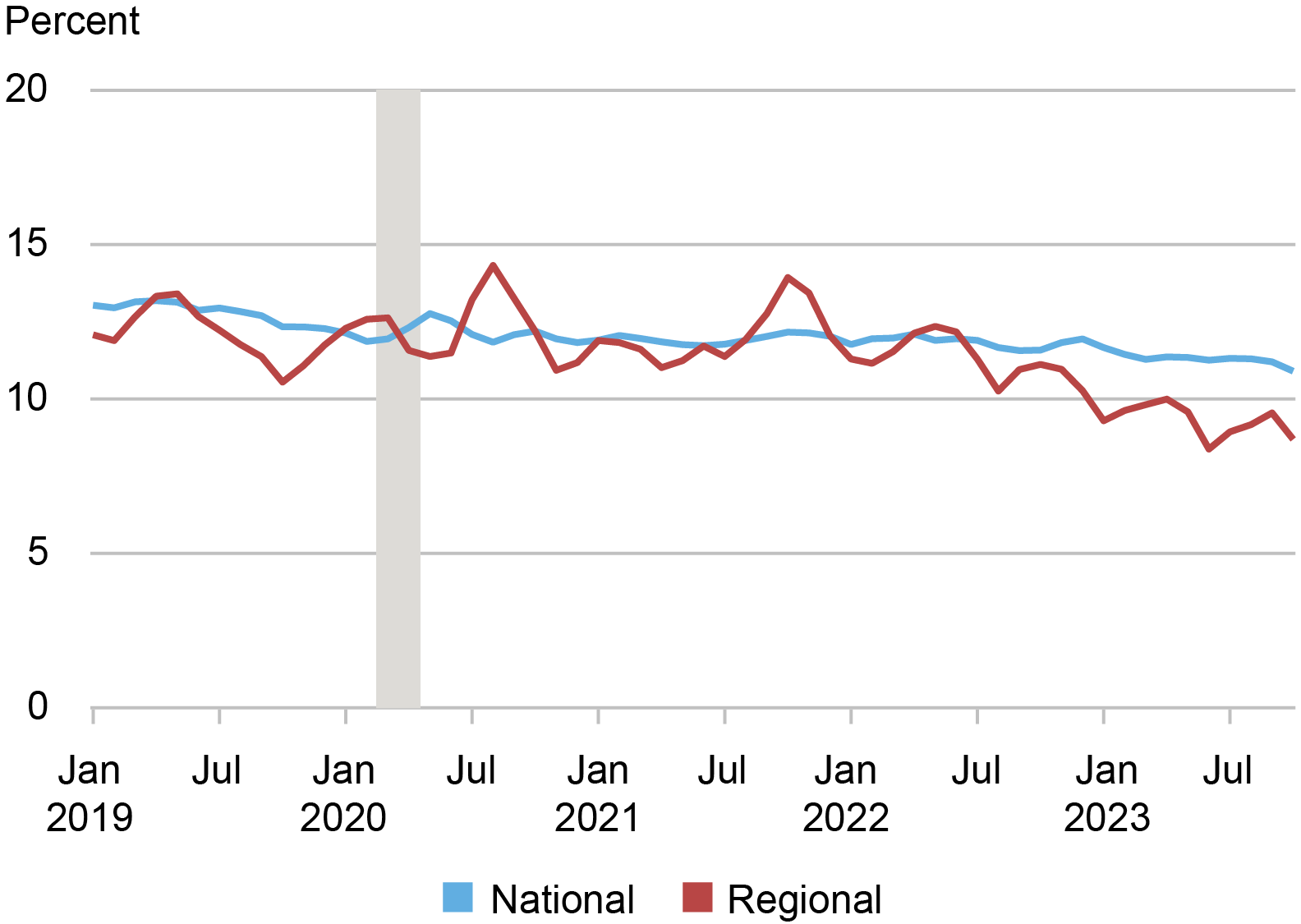

The gender gap for the employment to population ratio (or employment rate) at the national and regional levels between January 2019 and October 2023 is shown in the chart below. The employment gap is defined as the percentage point difference between the employment rate for men and the employment rate for women. Before the March 2020 pandemic and recession, the national and regional gender employment gaps were roughly equal, 12 and 12.6 percentage points, respectively. However, during the pandemic recession, both the national and the regional gender gap increased sharply, with the national gap approaching 13 percentage points in June 2020 and the regional gap exceeding 14 percentage points in August 2020. Women were more likely to exit employment than men during the pandemic recession for a variety of reasons, including more tenuous attachment to the labor force, shorter tenure in their current job, and the absence of in-person schooling as a source of childcare.

The Gender Employment Gap Has Declined at the National Level since the Pandemic but Perceptibly More Sharply in the Region

Source: Federal Reserve Bank of New York, Equitable Growth Indicators.

Source: Federal Reserve Bank of New York, Equitable Growth Indicators.

After these temporary increases, the national and regional gender employment gaps decreased at steady rates until mid-2022. Since then, the regional disparity declined perceptibly faster than the national gap. By October 2023, the gender employment gap had shrunk to around 10.9 percentage points at the national level and 8.7 percentage points at the regional level. Thus, employment gaps for women that initially widened at the onset of the pandemic have returned to a declining trend and fallen to well below pre-pandemic levels. The gender gap also declined faster in the region than in the nation as a whole. Although the regional and the national gap were very close in 2019, the regional gender gap is now over 2 percentage points less than the national gap.

Earnings Disparities

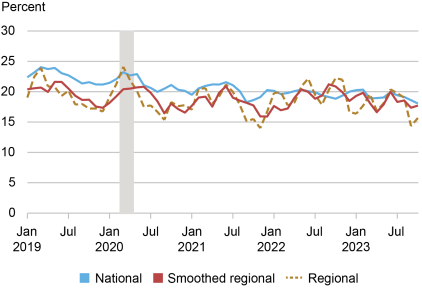

We now turn to looking at the gender gap in earnings, defined as the percentage difference between the earnings of men and women. The regional and national gender earnings gap trends, displayed in the chart below, are more volatile than the employment gaps. As the regional gaps are particularly volatile, we also present a smoothed regional gap to better appreciate the ways in which the regional gaps differ from the national gaps.

In 2019 and early 2020, both national and regional gender earnings gaps were decreasing, with disparities in our region substantially smaller than national ones. In December 2019, before the onset of the pandemic, gender earnings gaps hit a trough of 21.2 percent at the national level and 16.7 percent at the regional level, implying women earned 78.8 percent and 83.3 percent of what men earned, respectively. However, the declining trend was reversed as the pandemic brought on labor market changes, with women earning as much as 24 percent less than men at both the regional and national level in March 2020.

Part of the reason for this sharp reversal may have been selection: many lower-earning jobs mostly held by men, may have borne the brunt of layoffs during the very acute contraction of March 2020, leading to the men remaining employed being disproportionately those with higher earnings. Another reason may have been that women, who could afford to, dropped out of the labor force for childcare, as schools closed at the beginning of the pandemic.

Gender Earnings Gap Has Declined at the National Level since the Pandemic, but More So in the Region

Source: Federal Reserve Bank of New York, Equitable Growth Indicators.

Source: Federal Reserve Bank of New York, Equitable Growth Indicators.

As the pandemic eased, gender earnings gaps in both the nation and region declined. However, the regional gap flatlined between early 2022 and mid-2023, declining after that. In contrast, the national gap continued to decline slowly but steadily following the pandemic. The smoothed version of the regional gap shows more clearly that gender earnings disparities declined more sharply in the region than in the nation immediately following the pandemic, and generally remained lower than those in the nation. The national gap is less volatile, gradually decreasing to 18 percent by the end of October 2023. The regional gap did not decrease as rapidly for much of 2023, but has fallen to 16 percent in recent months.

Looking at the real earnings of men and women separately, as we do in this quarter’s EGIs, both in the nation as a whole and even more starkly in the region, women’s real earnings have tended to grow consistently faster than the real earnings of men. Overall, between January 2020 and October 2023, the national and regional gender earnings gap have decreased by more than 3 percentage points each. As of October 2023, men make 16 percent more than women do in our region, compared to 18 percent in the nation.

Conclusion

With the rise of remote work in recent years and the shock of the COVID-19 pandemic, it has been an open question how gender gaps in the labor market would evolve. We provide an analysis of trends in gender employment and earnings gaps at the national and regional level drawing on the New York Fed EGIs. We find that after initial increases during the COVID-19 pandemic, gender gaps at the national and regional level have decreased to below pre-pandemic levels for both employment rate and earnings. Although national and regional employment gaps were similar pre-pandemic, by October 2023 both employment and earnings gaps have become substantially lower in our region—which was particularly affected by the pandemic and its associated changes—compared to the national level.

Our findings are consistent with the increased incidence of work from home following the COVID-19 pandemic, which offered workers greater flexibility in balancing career and family. Women, especially more educated women, disproportionately took advantage of working from home, relative to before, which led to their increased: labor force participation, employment rate, and earnings relative to those of men. This effect may have been stronger in our region because of its relatively greater reliance on remote work, and because of its relatively more educated female workforce that was better positioned to take advantage of remote work. By making it easier to combine career and family, in the words of 2023 Nobel Laureate Claudia Goldin, remote work may have provided a “silver lining” to the effect of the pandemic on women.

National Earnings Report National Employment Report

Regional Earnings Report Regional Employment Report

Rajashri Chakrabarti is the head of Equitable Growth Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Kasey Chatterji-Len is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Dan Garcia is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Maxim Pinkovskiy is an economic research advisor in Equitable Growth Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Rajashri Chakrabarti, Kasey Chatterji-Len, Dan Garcia, and Maxim Pinkovskiy, “Recent Disparities in Earnings and Employment,” Federal Reserve Bank of New York Liberty Street Economics, December 1, 2023, https://libertystreeteconomics.newyorkfed.org/2023/12/recent-disparities....

The EGIs: Analyzing the Economy Through an Equitable Growth Lens

![]()

Economic Inequality: A Research Series

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

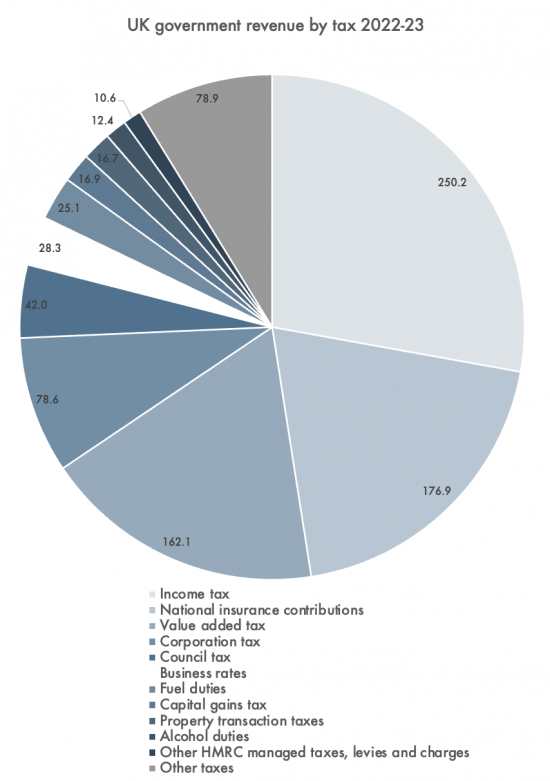

UK taxes paid by type 2022-23

I write this as part of the background data for the Taxing Wealth Report 2024 that I am now working on and thought it worth sharing here:

If you ask most people in the UK about taxes the one tax they will, almost invariably, think of is income tax. So do most politicians and commentators. That is why it is incredibly common to hear the claim that the wealthiest one percent of people in the UK pay more than 25% of all tax[1]. This is based upon the proportion of income tax that they supposedly pay, when it is unlikely that they pay nothing like the same amount of any other tax.

There are, in fact, very many taxes in the UK, even if none is as big in terms of revenue raised as income tax.

The data

The following chart summarises, the total sum paid for all the major UK taxes in the year to March 2023[2]:

The taxes paid are listed below the chart in order of size, working clockwise round the chart.

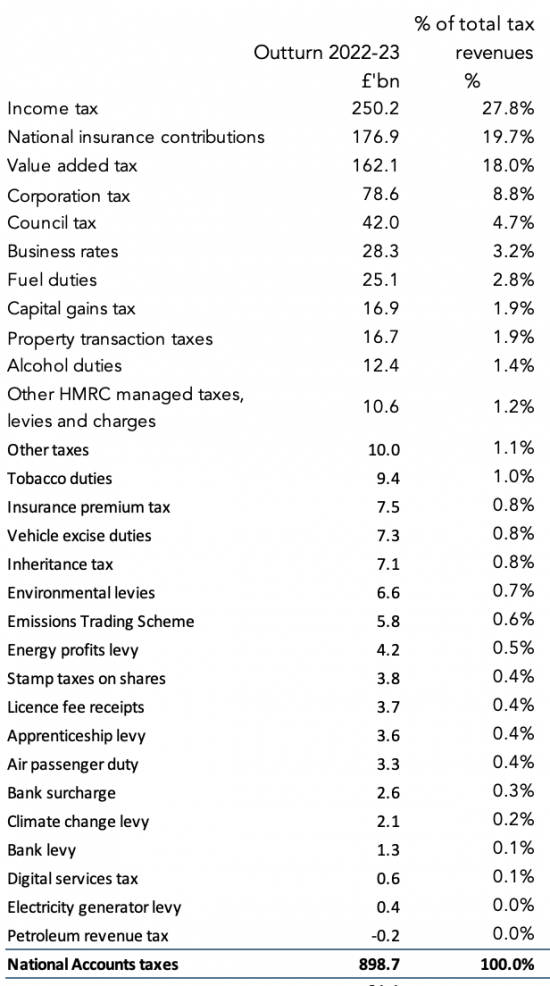

A more detailed list is as follows:

UK taxes paid by type 2022-23

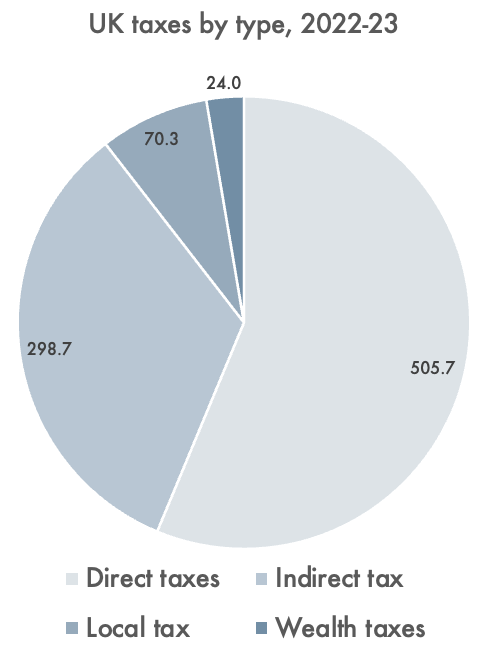

Categorisation by type of tax

Of these taxes, some are described as direct taxes. This means that they are taxed on income, whether of individuals or of companies. Income tax, national insurance and corporation tax are the most significant direct taxes.

Some taxes are local. Council tax and local business rates are by far the most significant of these.

Others are described as indirect taxes. They are, broadly speaking, charged on the value of sales made. Some are, in effect, charges. The largest of these are VAT and duties, but stamp duties can also be put in this category. Most of the smaller taxes listed are indirect taxes.

Few of our taxes are charged on wealth. Both inheritance tax and capital gains tanks could be described as direct taxes, however, they might be better to described as taxes on either wealth, or income derived from wealth.

Using these categorisations, total UK tax paid looks like this:

The Taxing Wealth Report 2024 is unsurprisingly, given its title, concerned with the taxes paid by the wealthiest people in the UK. However, because there are no taxes not paid by wealthy people, that means that every tax is potentially within its scope. That said, because of the difficulties that direct taxation of wealth creates, it has limited its focus to increasing the amounts of tax that might be paid by those with wealth in the UK that can be achieved by modifying existing taxes, or by reducing tax reliefs given by law at present that reduce the amount of tax paid.

Given that the aim is on revenue raising this does, inevitably mean it has also focussed on the largest taxes in the UK as noted above.

Footnotes

[1] The figure is itself uncertain. It depends on the basis of calculation. What is undoubtedly true is that the top 3% or so of income earners pay 25% of all income tax, but it is most likely that they pay much less of overall tax than that.

[2] Based on table A5 here: https://obr.uk/download/economic-and-fiscal-outlook-november-2023/?tmstv=1701349270

[3] This note is also available as a PDF here.

Pin up of the week

This is none other than Augustin Carstens – General Manager for the Bank of International Settlements. I draw attention to this principally to highlight an excellent article by the economist Ann Pettifor, where she illuminates the ill inflicted on us by central bankers who effectively exacerbate the already poor understanding of money. The article certainly... Read more