inequality

Public Policy for Equality and Opportunity: Evidence-based and Ethically Grounded

Inequality erodes opportunity, and limited opportunity exacerbates inequality. This vicious intergenerational cycle has brought inclusive growth into question, contributed to the rise of populist sentiment, and strained the social contract in many rich countries. The way forward for researchers and policy makers requires not only a clear understanding of the facts about what kind of inequality matters and how it matters, but also an ethical grounding that speaks to the outcomes and opportunities that are important to citizens not only in the here and now, but also in the next generation.

This is the argument I make in a keynote lecture that I have had the privilege to give, first on October 20th 2022 to the 8th Annual Congress de Economía y de Políticas Públicas, SobreMéxico in Mexico City, and second on November 17th 2022 to the Conference on Wealth Inequality and Intergenerational Mobility at the Vienna University of Economics and Business in Vienna.

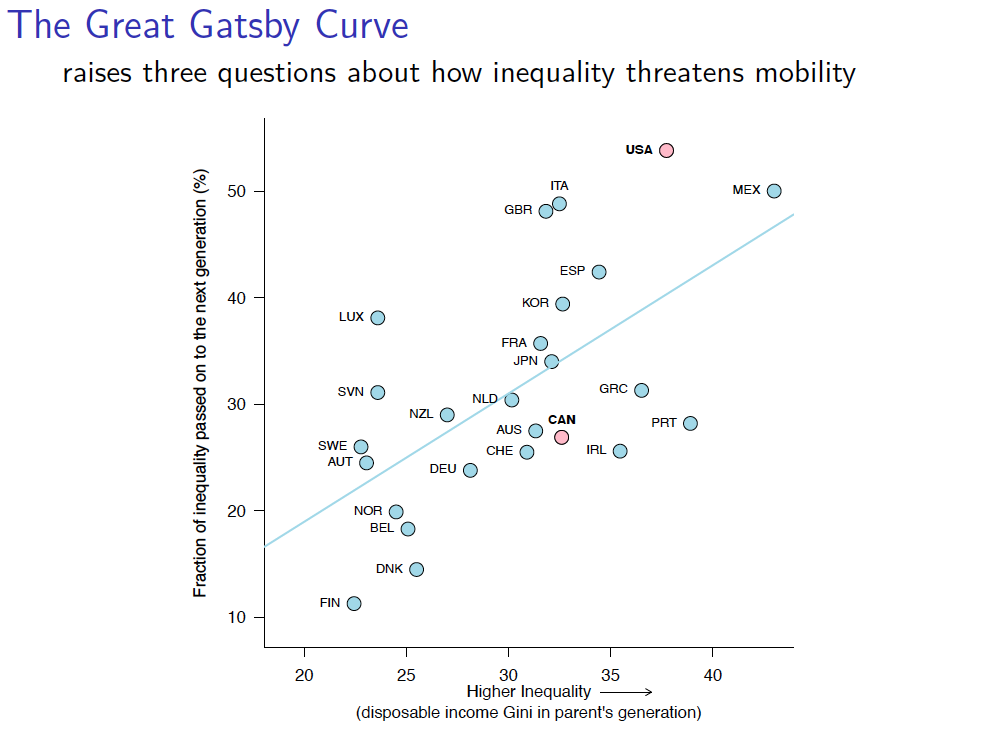

The Great Gatsby Curve poses three questions for economic theory, statistical measurement, and public policy

When comparing many countries, not just the rich but also across the entire globe, researchers have consistently found that the higher the level of income inequality about a generation ago, the more strongly children’s adult prospects are tied to their family backgrounds. This relationship between higher inequality and lower social mobility has become known as The Great Gatsby Curve.

Economic theory, statistical measurement, and public policy have all been most constructively informed by this picture when they explore

- What kind of inequality matters?

- What kind of social mobility do we care about?

- Which cross-country comparisons are most judicious, from which policy learning is best informed?

Watch this interview produced by the Institute for New Economic Thinking ,who gave me the opportunity to explain what the Great Gatsby is, and highlight how it offers a constructive framework for deeper conversations about the relationship between inequality and social mobility.

What will COVID Mean for the Future of Fiscal and Social Policy?

It is the stated goal of the Canadian federal government to foster “a strong and inclusive labour market that provides every Canadian with opportunities for a good quality of life.” The legacy of COVID has, however, led to policy incoherence, with some significant reforms directly putting this goal into question.

The federal government has repeatedly stated, in different ways, a concern for a more fair and a more inclusive society, one in which all Canadians can become all that they can be and lead the lives they value. For example, in a statement specifically directed to economic policy the government stresses that fiscal and monetary policy should be coordinated to support “a strong and inclusive labour market that provides every Canadian with opportunities for a good quality of life.”

What will COVID, the policy response to it and the legacy it sets, mean for the movement toward this goal? I answer this question by addressing three more specific questions, and suggest that while there is both possibility and challenge in the framing of social and macro-economic policy, there is unfortunate policy incoherence on the horizon that will do more to weaken than strengthen the development of an inclusive labour market.

To invoke Edvard Munch’s famous painting “The Scream” is almost cliche, but it is nonetheless a remarkable summary of how many might feel about fiscal and social policy directed to inclusive growth.

1. Is a Basic Income in the social policy future?

The Canada Emergency Response Benefit (CERB) clearly demonstrated the power of federal income transfers to lower the poverty rate. In fact, the official poverty rate fell by almost one-half between 2019 and 2020 to reach an unprecedented low, well below the poverty reduction target the federal government set for 2030.

It is no small wonder that this experience might raise the expectations of many advocating for a Basic Income.

Even if this experience makes clear that the federal government could effectively take over, or at least complement, the income transfer space traditionally in the domain of provincial social assistance programs, it is also clear that a universal demogrant is not part of the social policy future.

That said, Canadian social policy has always been made incrementally, and there are two considerations that both constrain and offer an opportunity for a more robust income safety net at the federal level.

The first is the pervasive influence of the distinction between the deserving and the non-deserving poor.

Whether from an ingrained belief, or from an appreciation of Canadian political culture, this distinction has framed social policy since 2015. Children in some sense are deserving, and so the federal government has taken significant strides in reducing child poverty. The elderly, of course, have long been seen as deserving and there have been repeated expansions of income supports to those in retirement. We have a Basic Income for children, the Canada Child Benefit, and we have a Basic Income for the elderly, the Guaranteed Income Supplement.

But the Poverty Reduction Strategy set targets to lower the rate of poverty by one-fifth in the near term and by one-half in the longer term for the entire population. The working-age poor, particularly those living on their own, have been recognized as falling though a gap. Public policy considers them to be among those “working hard” to join the middle class, and therefore expected to rely on labour market engagement to move above the poverty line. They, in other words, are not “deserving” poor.

The oxygen for discussions of Basic Income, at least in the near term, will be taken up by another group of “deserving” poor, those of working age with disabilities.

On June 22nd Minister Qualtrough re-introduced legislation to enact a federal income transfer program to support this group. Bill C-22 is entirely void of any design details, leaving eligibility and benefit rates to be determined by regulations, but it is certainly most likely to borrow from the targeted negative income tax structure of its cousin programs. A good deal will depend upon how “disability” is defined, but when it is up and running and somehow coordinated with provincial programs, it will likely leave many working age people out of scope.

The political economy of deserving versus non-deserving, as opposed to a rights-based framing, is a constraint on the future of social policy. But there is also opportunity in how rights-based advocates have come to understand the design of a Basic Income. My own observations suggest that there has been a considerable evolution from the notion of a universal demogrant to that of a negative income tax, with an appreciation of the design trade-offs associated with targeting, with a budget constraint, and with labour market incentives.

An ongoing conversation about Basic Income could well begin with the recognition that the government in an incremental, yet significant way, has complemented provincial programs through refundable tax credits, and that the way to further this agenda is to continue to press for working-age singles to be included.

This could happen through the continued evolution of the Canada Workers Benefit, adding to it not just a more generous benefit structure but also a component that is not conditional on employment income.

It could also happen through constructive engagement with provinces that wish to comprehensively reform their social insurance programs toward a Basic Income in a way that fosters agency among those in need. Prince Edward Island has moved in this direction, the legislature’s Special Committee on Poverty releasing a consensus report recommending a Basic Income Guarantee.

2. Are enhanced business subsidies part of the COVID legacy?

The big bugaboo in this discussion, one that sits at the heart of the deserving versus non-deserving distinction, is the belief that income support can encourage people to work less.

No single group in Canadian society has made so much of the work disincentives criticism, and to such great effect, than some lobbyists claiming to speak for the small business community. Yet, subsidies to business have most likely led to over-insurance and a powerful moral hazard that will put a break on innovation and productivity if they become a part of the post-COVID future.

Certainly public finance principles rationalize government interventions when there is a market failure, while recognizing that there will be an efficiency trade-off associated with changes in behaviour—be it labour supply, labour demand, or saving and investment—that are a response to taxes and transfers.

As fiscal policy moves forward it is important to consider how COVID support programs to businesses have performed, the unintended consequences associated with them, and the lessons for the future.

The Canada Emergency Wage Subsidy (CEWS) was by far the most significant of these programs, indeed of the entire package of COVID-related federal government expenditures with the monies spent on ostensibly maintaining the attachment of workers with their employers rivaling total direct transfers to individuals.

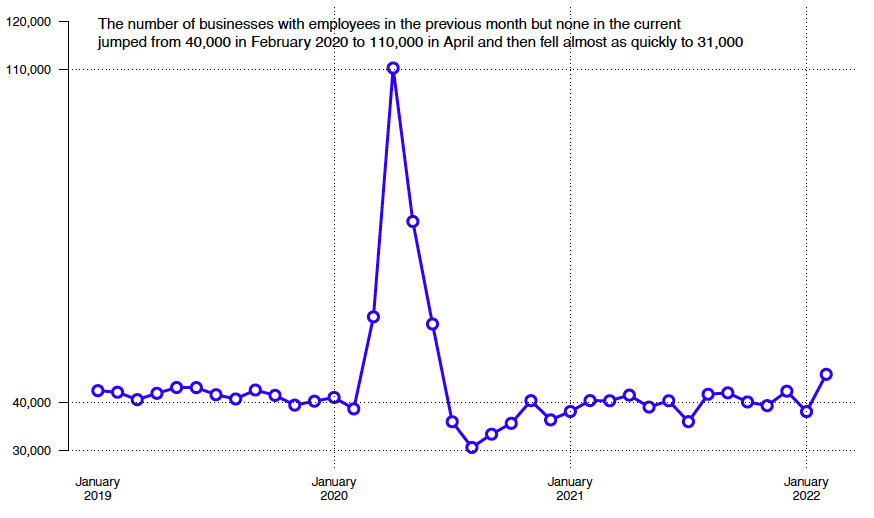

A major lesson of the pandemic is that a program like CEWS should not be looked at as a model for business sector support, whether in times of a sharp shock or whether as a long-term structural policy.

CEWS was slow off the mark at the onset of the pandemic as the bulk of business closures had already taken place before the program started accepting applicants in June of 2020. I have detailed this experience in an article to be published by the American Enterprise Institute.

It can also be reasonably argued that CEWS over-compensated businesses in a poorly targeted way lowering business closures during 2020 significantly below previous levels, something that can be a drag on innovation and efficiency.

At the most basic level, CEWS fell well short of its stated goal of maintaining the tie between workers and employers during the successive ways of the pandemic.

Going forward there are much more efficient and effective ways of achieving this goal. Aspects of a reformed Employment Insurance program, particularly its “work sharing” provisions are better suited. And besides the Employment Insurance program is hard-wired to maintain a tie between workers and employers because employer premiums are not experience-rated.

The CEWS teaches us that it is much more effective to compensate impacted individuals directly than through their employers.

But this experience has had important political economy consequences that bode ill for efficient and equitable fiscal policy. Lobbyists claiming to speak for small businesses were emboldened in a significant way, public attention being artfully shifted from the plight of essential workers early in the pandemic to the plight of troubled firms, with significant policy consequences.

The federal government was very attentive to a whole host of concerns that can only be charitably described as poor public policy. These include repeated extensions of the CEWS, intergenerational transfers of capital gains, and most recently campaigns for extensions and forgiveness of loans taken through the Canada Emergency Business Account (CEBA).

There is an important discussion to be had about the moral hazards associated with these changes, and their consequences for a dynamic and efficient small business sector. Indeed, all of this is piled onto a corporate tax structure that is increasingly making small businesses a tax haven and putting a break on productivity growth.

But the coup de grace in this unfortunate policy evolution is the government’s acquiesce to the demand for an expanded Temporary Foreign Worker program. Employers now have the opportunity to hire up to one-fifth, and in some cases 30 percent, of their low-wage workforce through the Temporary Foreign Worker program.

This represents a major wage subsidy, even if it is not recorded as an expenditure in the government’s books. It is just the opposite of what policy directed to an inclusive labour market should be doing. Low wage workers, those who have a tenuous foothold in the labour market either because they themselves are recent immigrants, have a disability, or are young, will likely see more limited wage growth and job opportunities as a result of this policy change.

This change may also potentially shut off the possibility of upgrading employment and human resource practices in the care economy, particularly in Long-Term Care facilities and in early childhood care. The pandemic illustrated that the use of contingent and itinerant work arrangements in long-term care homes had devastating and shameful consequences. The challenge for a policy maker wishing to promote an inclusive labour market is to transform this sector into a “craft” based economy, with upskilling of workers who offer community and family based care and support.

An unfortunate legacy of COVID on public policy directed to employers is the threat of growing inefficiencies and inequities as a result of subsidies that cannot be rationalized by any sort of market failure.

3. Will the management of the macro-economy encourage an inclusive labour market?

Income inequality is the clearest, though certainly not the only, marker of an inclusive labour market. There are important long-term structural causes of growing inequality in market incomes, but the COVID crisis directs us to also focus on cyclical aspects of inequality. It calls for more timely and progressive fiscal policy in macro-economic management.

Higher inequality makes macro-economic management more difficult.

Certainly, it is important to no longer frame policy in terms of representative agent models and trickle down economics. It is not clear that this was ever a good guide for policy, but it was the framing of the 1980s and 1990s, no consideration at all being given to the distributional consequences of macro-policy.

Inclusive growth means that policy directed to growth and business cycle stabilization go hand-in-hand with concerns over income distribution.

What did COVID teach us about macro-economic policy?

Well, big shocks matter!

We knew this from the experience of the Great Recession in 2008; we knew this from the bursting of the commodity price bubble in 2014; and now we know it all the more clearly as a result of a world-wide pandemic.

Big shocks matter beyond the fact that they are big, they also matter because they can have long-lasting consequences well after they have passed. There is a threat that income inequality jumps after a big shock, but does not return to its original level in its aftermath, ratcheting up as those who are hardest hit are also permanently scarred.

The Gini coefficient based on market incomes did in fact jump significantly in 2020, reflecting the fact that many Canadians, particularly those in professional and managerial occupations, kept working throughout the pandemic while others in more public-facing occupations suffered significant disruptions in their work and family lives.

But strikingly this increase was more than completely undone by the tax-transfer system, the associated Gini falling to its lowest level in 45 years.

This is an amazing development that echoes back to the recessions in the early 1980s and early 1990s when the tax-transfer system was more responsive and progressive.

These policy-induced recessions were intended to lower inflation, and solidify the independence of the Central Bank. But they had significant consequences for income inequality, which rose but did not return to pre-recession levels, The Canadian tax-transfer program was sufficiently progressive to completely undo these developments, with the after tax transfer Gini staying constant in spite of rising market income inequality.

But this was not the case after 1995 when the government made a determined effort to eliminate the deficit, cutting important transfers and the unemployment insurance program. As a result of these cuts after tax and transfer inequality has tracked rather than moved against market income inequality … except in 2020.

The Bank for International Settlements calls this “inequality hysteresis” a successive ratcheting up of inequality, that in turn risks making the macro-economy more unstable and risks further recessions and higher inequality.

… inequality increases faster and more persistently in the aftermath of recessions. Furthermore, greater income inequality is associated with deeper recessions, and with the reduced effectiveness of monetary policy in steering aggregate demand. Taken together, these results point to the risk of an adverse feedback loop: recessions persistently worsen inequality, and greater inequality serves to deepen recessions. These results highlight the importance of taking inequality into account when designing and implementing fiscal and monetary policy.

da Silva et al, Bank for International Settlements, May 2022

Big shocks matter, but the nature, the timing, the duration of big shocks are fundamentally uncertain. How do we conduct policy if we appreciate that we live in an era of fundamental uncertainty about big risks? How do we do it if we appreciate that growth and distribution are linked, an inherent part of inclusive growth in the long term but also an inherent part of macro-management in the short term?

We do it with rules-based program design as much as with discretionary choices. This calls for stronger automatic stabilzers, and this part of the Canadian policy tool kit needs to be enhanced, even if we accept that there will always be a role for discretion.

Most urgently this calls for two reforms. First, a more progressive income tax structure, which most notably requires a broader tax base. The obvious reform, that also has important implications for horizontal and vertical equity, is to stop giving capital income a free ride in the tax system. A higher inclusion rate for capital income is called for, moving from the current 50 per cent to at least 75 per cent, a rate that in fact has a precedent in the Canadian income tax structure.

Second, a much more robust Employment Insurance program is called, offering more complete income insurance, including wage insurance, broader coverage, and a capacity to respond in a more timely way to sharp regional and national downturns.

Post COVID policy incoherence threatens an inclusive labour market

Public policy may continue to make determined and important changes in a progressive and inclusive direction, and even take steps toward a tighter social safety net that some will appreciate as a basic income.

But other choices bring the very goal of a “strong and inclusive labour market” into question and in the long term threaten the sustainability of more generous transfers to individuals. The labour market will be more inefficient and inequitable because of sustained subsidies to small business and increased reliance on temporary foreign workers.

And more polarization and inequality of jobs, wages, and market incomes will in turn make the maco-economy more unstable and more challenging to manage.

What will COVID mean for the future of fiscal and social policy? The future is unclear not because of inherent uncertainty, but rather because of explicit choice and the incoherence that it has engendered.

[ This post is based upon my comments to a panel discussion on “What will COVID Mean for the Future of Fiscal and Social Policy?” organized by Michael Smart and Trevor Tombe of Finances of the Nation, and held as part of the 56th Annual Meetings of the Canadian Economics Association at Carleton University, Ottawa Canada on June 3, 2022. You can download a copy of my presentation at this link. ]

The Fed is the Treasury’s Bank. Does it Matter for the Dollar’s Global Status?

By Elham Saeidinezhad | There is a consensus amongst the economist that the shadow banking system and the repurchase agreements (repos) have become the pinnacle of the dollar funding. In the repo market, access to liquidity depends on the firms’ idiosyncratic access to high-quality collateral, mainly U.S. Treasuries, as well as the systemic capacity to reuse collateral. Yet, the emergence of the repo market, which is considered an offshore credit system, and the expectations of higher inflation, have sparked debates about the demise of the dollar. The idea is that the repo market is becoming less attractive from an accounting and risk perspective for a small group of global banks, working as workhorses of the dollar funding network. The regulatory movement after the Great Financial Crisis (GFC), including leverage ratio requirements and liquidity buffers, depressed their ability to take counterparty risks, including that of the repo contracts. Instead, large banks are driven to reduce the costs of maintaining large balance sheets.

This note argues that the concerns about the future of the dollar might be excessive. The new monetary architecture does not structurally reduce the improtance of the U.S. government liabilities as the key to global funding. Instead, the traditional status of the dollar as the world’s reserve currency is replaced by the U.S. Treausies’ modern function as the world’s safest asset and the pinnacle of the repo market. Lastly, I put the interactions between the Fed’s roles as the manager of the government’s debt on the one hand and monetary policy architect on the other at the center of the analysis. Recognizing the interconnectedness could deepen our understanding of the Fed’s control over U.S. Treasuries.

As a result of the Bretton Woods Agreement, the dollar was officially crowned the world’s reserve currency. Instead of gold reserves, other countries accumulated reserves of dollars, the liability of the U.S. government. Till the mid-1980s, the dollar was at the top of the monetary hierarchy in both onshore and offshore financial systems. In the meantime, the dollar’s reserve status remained in an natural way. Outside the U.S., a few large global banks were supplying dollar funding to the rest of the world. This offshore bank-oriented system was called the Eurodollar market. In the U.S., the Federal Funds market, an interbank lending market, became the pinnacle of the onshore dollar funding system. The Fed conducted a simple monetary policy, detached from the capital market, and managed exclusively within the traditional banking system.

Ultimately, events never quite followed this smooth pattern, which in retrospect may not be regretted. The growth of shadow banking system meant that international investors reduced their reliance on bank loans in the Eurodollar markte. Instead, they turned to the repo market and the FX swaps market. In the U.S., the rise of the repo market implied that the U.S. monetary policy should slowly leak into capital market and directly targe the security dealers. At the heart of this structural break was the growing acceptance of the securities as collaterals.

Classical monetary economics proved to be handicapped in detecting this architectural development. According to theories, the supply of the dollar is determined in the market for the loanable funds where large banks act as financial intermediaries and stand between savers and borrowers. In the process, they set the price of the dollar funding. Regarding the global value of the dollar, as long as the Fed’s credibility in stabilizing prices exceeds its peers, and Treasury keeps its promises to pay, the global demand for the dollar will be significant. And the dollar will maintain its world reserve currency status. These models totally overlooked the role of market-makers, also called dealers, in providing short-term liquidity. However, the rise of the shadow banking system made such an abstraction a deadly flaw. In the new structure, the dealers became the de facto providers of the dollar funding.

Shadow banking created a system where the dealers in the money market funded the securities lending activities of the security dealers in the capital market. This switch from traditional banking to shadow banking unveiled an inherent duality in the nature of the Fed. The Fed is tasked to strike a balance between two rival roles: On the one hand, the Fed is the Treasury’s banker and partially manages U.S. debt. On the other hand, it is the bankers’ bank and designs monetary policy. After the financial crises of the 1980s and 1990s, the Fed tried to keep these roles divided as separate arms of macroeconomic policy. The idea was that the links between U.S. debt management and liquidity are weak, as the money market and capital market are not interconnected parts of the financial ecosystem. This weak link allowed for greater separation between monetary policy and national debt management.

The GFC shattered this judgment and exposed at least two features of shadow banking. First, in the new structure, the monetary condition is determined in the repo market rather than the banking system. The repo market is very large and the vast majority of which is backed by U.S. Treasuries. This market finances the financial market’s primary dealers’ large holdings of fixed-income securities. Second, in the new system, U.S. Treasuries replaced the dollar. The repo instruments are essentially short-term loans secured by liquid “collateral”. Although hedge funds and other types of institutional investors are important suppliers of collateral, the single most important issuer of high quality, liquid collateral, is the U.S. Treasury.

U.S. Treasury securities have become the new dollar. Hence, its velocity began to matter. The velocity of collateral, including U.S. Treasuries, is the ratio of the total pledged collateral received by the large banks (that is eligible to be reused), divided by the primary collateral (ie, sourced via reverse repos, securities borrowing, prime brokerage, and derivative margins). Before the GFC, the use (and reuse) of pledged collateral was comparable with the velocity of monetary aggregates like M2. The “reusability” of the collateral became instrumental to overcome the good collateral deficit.

After the GFC, the velocity of collateral shrank due to the Fed’s QE policies (involving purchases of bonds) and financial regulations that restricted good collateral availability. Nontheless, the availability of collateral surpassed the importance of private credit-creation in the traditional banking system. It also started to leak into the monetary policy decision-making process as the Fed started to consider the Treasury market condition when crafting its policies. At first glance, the Treasury market’s infiltration into monetary policy indicates a structural shift in central banking. First, the Treasury market is a component of the capital market, not the money market. Second, the conventional view of the Fed’s relationship with the Treasury governs that its responsibilities are mainly limited to managing the Treasury account at the Fed, running auctions, and acting as U.S. Treasuries registrar.

However, a thorough study of the traditional monetary policy would paint a different picture of the Fed and the U.S. Treasuries. Modern finance is only making the Fed’s role as a de-facto U.S. national debt manager explicit. The Fed’s primary monetary policy tool, the open market operation, is essentially monetizing national debt. Essentially, the tool enabled the Fed to monetize some portion of the national debt to control the quantity of bank reserves. The ability to control the level of bank reserves permitted the Fed to limit the level of bank intermediation and private credit creation. This allowed the Fed to focus on compromising between two objectives of price stability and full employment.

What is less understood is that the open market operation also helped the Fed’s two roles, Treasury’s bank and the bankers’ bank, to coexist privately. As private bankers’ bank, the Fed designs monetary policy to control the funding costs. As the Treasury’s bank, the Fed is implicitly responsible for U.S. debt management. The open market operation enabled the Fed to control money market rates while monetizing some portion of the national debt. The traditional monetary system simply helped the Fed to conceal its intentions as Treasury’s bank when designing monetary policy.

The point to emphasize is that the traditional central banking was only hiding the Fed’s dual intentions. The Fed could in theory monetize anything— from gold to scrap metals—but it has stuck largely to Treasury IOUs. One reason is that, unlike gold, there has never been any shortage of them. Also, they are highly liquid so the Fed can sell them with as much ease as it buys them. But, a third, and equally important reason is that in doing so, the Fed explicitly fulfilled its “role” as the manager of the U.S. national debt. All this correctly suggests that the Fed, despite its lofty position at the pinnacle of the financial system, has always been, and is, none other than one more type of financial intermediary between the government and the banking system.

The high-level relationship between the Treasury and the Fed is “inherent” and at the heart of monetary policy. Yet, nowhere along the central banking learning curve has been a meaningful examination of the right balances between the Fed’s two roles. The big assumption has been that these functions are distinctly separated from each other. This hypothesis held in the past when the banks stood between savers and borrowers as financial intermediaries. In this pre-shadow banking world, the money market and capital market were not interconnected.

Yet, the GFC revealed that more than 85 percent of the lending was based on securities lending and other credit products, including the repo. In repo, broker-dealers, hedge funds, and banks construct short-term transactions. They put up collateral—mostly U.S. Treasury securities —with an agreement to buy them back the next day or week for slightly more, and invest the proceeds in the interim. The design and conduct of the monetary policy intimately deepened on the availability and price of the U.S. Treasuries, issues at the heart of the U.S. national debt management.

The U.S. debt management and monetary policy reunion happened in the repo market. In a sense, repo is a “reserve-less currency system,” in the global funding supply chain. It is the antithesis of the reserve currency. In traditional reserve currency, central banks and major financial institutions hold a large amount of currency to use for international transactions. It is also ledger money which indicates that the repo transactions, including the securities lending of its, are computed digitally by the broker-dealers. The repo market is a credit-based system that is a reserve-less, currency-less form of ledger money.

In this world of securities lending, which has replaced traditional bank lending, the key instrument is not the dollar but the U.S. Treasury securities that are used as collateral. The U.S. national debt is being used to secure funding for private institutional investors. Sometimes lenders repledge them to other lenders and take out repo loans of their own. And the cycle goes on. Known as rehypothecation, these transfers used to be done once or twice for each posted asset but are now sometimes done six to eight times, each time creating a new money supply. This process is the de-facto modern money creation—and equally depends on the Fed’s role as Treasury’s bank and bankers’ bank.

Understanding how modern money creation works has implications for the dollar’s status in the international monetary system. Some might argue that the dollar is losing its status as the global reserve currency. They refer to the collateralized repo market and argue that this market allows international banks operating outside the supervision of the Fed to create US dollar currency. Hence, the repo, not the dollar, is the real reserve currency. Such statements overlook the repo market’s structural reliance on the U.S. Treasury securities and neglect the Fed’s role as the de-facto manager of these securities. Shadow banking merely replaced the dollar with the U.S. Treasuries as the world’s key to funding gate. In the meantime, it combined the Fed’s two roles that used to be separate. Indeed, the shadow banking system has increased the importance of U.S. institutions.

The rising dominance of the repo market in the global funding supply chain, and the decline in collateral velocity, implies that the viability of the modern Eurodollar system depends on the U.S. government’s IOUs more than any time in history. US Treasuries, the IOU of the US government, is the most high-quality collateral. When times are good, repos work fine: The agreements expire without problems and the collateral gets passed back down the chain smoothly. But eventually, low-quality collateral lurks into the system. That’s fine, until markets hit an inevitable rough patch, like, March 2020 “Dash for Cash” episode. We saw this collateral problem in action. In March credit spreads between good and junkier debt widened and Treasury prices spiked as yields plummeted because of the buying frenzy. The interest rate on one-month Treasurys dropped from 1.61% on Feb. 18 to 0.00% on March 28. That was the scramble for good collateral. The reliance on the repo market to get funding indicates that no one will take the low-quality securities, and everyone struggles for good collateral. So whenever uncertainty is high, there will be a frenetic dash to buy Treasurys—like musical chairs with six to eight buyers eagerly eyeing one chair.

Elham Saeidinezhad is a Term-Assistant Professor of Economics at Barnard College, Columbia University. Before joining Barnard College, she was a lecturer of Economics at UCLA, a research economist in the International Finance and Macroeconomics research group at Milken Institute, Santa Monica, and a postdoctoral fellow at the Institute for New Economic Thinking (INET), New York. As a postdoctoral fellow, Elham worked closely with Prof. Perry Mehrling and studied his “Money View” framework. She obtained my Ph.D. from the University of Sheffield, UK, in empirical Macroeconomics in 2013. You may contact Elham via the Young Scholars Directory

Can “Money View” Provide an Alternative Theory of Capital Structure?

By Elham Saeidinezhad

Liquidity transformation is a crucial function for many banks and non-bank financial intermediaries. It is a balance sheet operation where the firm creates liquid liabilities financed by illiquid assets. However, liquidity transformation is a risky operation. For policymakers and macroeconomists, the main risk is to financial stability caused by systemic liquidation of assets, also called “firesale.” In this paper, I emphasize an essential characteristic of firesale that is less explored—the order of liquidation. The order of liquidation refers to the sequence at which financial assets are converted into cash or cash equivalents- when the funds face significant cash outflow. Normally, economists explain assets’ order of liquidation by using theories of capital structure. However, the financial market episodes, such as March 2020 “Cash for Dash,” have revealed that firms’ behaviors are not in line with the predictions of such classical theories. Capital structure theories, such as “Pecking Order” and “Trade-off,” argue that fund managers should use their cash holding as the first line of defense during a liquidity crunch before selling their least liquid asset. In contrast to such prophecies, during the recent financial turmoil, funds liquidated their least liquid assets, even US Treasuries, first, before unhoarding their cash and cash equivalents. In this paper, I explore a few reasons that generated the failure of these theories when explaining funds’ behavior during a liquidity crisis. I also explain why Money View can be used to build an alternative framework.

Traditional capital structure theories such as pecking order differentiate financial assets based on their “adverse selection” and “information costs” rather than their “liquidity.” The pecking order theory is from Myers (1984) and Myers and Majluf (1984). Since it is famous, I will be brief. Assume that there are two funding sources available to firms whenever they hit their survival constraint: cash (or retained earnings) and securities (including debt and equity). Cash has no “adverse selection” problem, while securities, primarily equity, are subject to serious adverse selection problems. Compared to equity, debt securities have only a minor adverse selection problem. From the point of view of an external investor, equity is strictly riskier than debt. Both have an adverse selection risk premium, but that premium is significant on equity. Therefore, an outside investor will demand a higher rate of return on equity than on debt. From the perspective of the firm’s managers, the focus of our paper, cash is a better source of funds than is securities. Accordingly, the firm would prefer to fund all its payments using “cash” if possible. The firm will sell securities only if there is an inadequate amount of cash.

In the trade-off theory, another popular conventional capital structure theory, a firm’s decision is a trade-off between tax-advantage and capital-related costs. In a world that firms follow trade-off theory, their primary consideration is a balance between bankruptcy cost and tax benefits of debt. According to this approach, the firm might optimize its financing strategies, including whether to make the payments using cash or securities, by considering tax and bankruptcy costs. In most cases, these theories suggest that the firms prefer to use their cash holdings to meet their financial obligations. They use securities as the first resort only if the tax benefit of high leverage exceeds the additional financial risk and higher risk premiums. The main difference between pecking order theory and trade-off theory is that while the former emphasizes the adverse selection costs, the latter highlights the high costs of holding extra capital. Nonetheless, similar to the pecking order theory, the trade-off theory predicts that firms prefer to use their cash buffers rather than hoarding them during a financial crisis.

After the COVID-19 crisis, such predictions became false, and both theories underwent a crisis of their own. A careful examination of how funds, especially intermediaries such as Money Market Funds, or MMFs, adjusted their portfolios due to liquidity management revealed that they use securities rather than cash as the first line of defense against redemptions. Indeed, such collective behavior created the system-wide “dash for cash” episode in March 2020. On that day, few funds drew down their cash buffers to meet investor redemptions. However, contrary to pecking order and trade-off theories, most funds that faced redemptions responded by selling securities rather than cash. Indeed, they sold more of the underlying securities than was strictly necessary to meet those redemptions. As a result, these funds ended March 2020 with higher cash levels instead of drawing down their cash buffers.

Such episodes cast doubt on the conventional theories of capital structure for liquidity management, which argues that funds draw on cash balances first and sell securities only as a last resort. Yet, they align with Money View’s vision of the financial hierarchy. Money View asserts that during the financial crisis, preservation of cash, the most liquid asset located at the top of the hierarchy, will be given higher priority. During regular times, the private dealing system conceals such priorities. In these periods, the private dealing system uses its balance sheets to absorb trade imbalances due to the change in preferences to hold cash versus securities. Whenever the demand for cash exceeds that of securities, the dealers maintain price continuity by absorbing the excess securities into their balance sheets. Price continuity is a characteristic of a liquid market in which the bid-ask spread, or difference between offer prices from buyers and requested prices from sellers, is relatively small. Price continuity reflects a liquid market. In the process, they can conceal the financial hierarchy from being in full display.

During the financial crisis, this hierarchy will be revealed for everyone to see. In such periods, the dealers cannot or are unwilling to use their job correctly. Due to the market-wide pressing need to meet payment obligations, the trade imbalances show up as an increased “qualitative” difference between cash and securities. In the course of this differentiation, there is bound to be an increase in the demand for cash rather than securities, a situation similar to the “liquidity trap.” A liquidity trap is a situation, described in Keynesian economics, in which, after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt which yields so low a rate of interest. In this environment, investors would prefer to reduce the holding of their less liquid assets, including US Treasuries, before using their cash reserves to make their upcoming payments. Thus, securities will be liquidated first, and cash will be used only as a last resort.

The key to understanding such behaviors by funds is recognizing that the difference in the quality of the financial instruments’ issuers creates a natural hierarchy of financial assets. This qualitative difference will be heightened during a crisis and determines the capital structure of the funds, and the “order of liquidation” of the assets, for liquidity management purposes. When the payments are due and liquidity is scarce, firms sell illiquid assets ahead of drawing down the cash balances. In the process, they disrupt money markets, including repo markets, as they put upward pressure on the price of cash in terms of securities. Thus, during a crisis, the liability of the central banks becomes the most attractive asset to own. On the other hand, securities, the IOUs of the private sector, become the less desirable asset to hold for asset managers.

So why do standard theories of capital structure fail to explain firms’ behavior during a liquidity crisis? First, they focus on the “fallacious” type of functions and costs during a liquidity crunch. While the dealers’ “market-making” function and liquidity are at the heart of Money View, the standard capital structure theories stress the “financial intermediation” and “adverse selection costs.” In this world, the “ordering” of financial assets to be liquidated may stem from sources such as agency conflicts and taxes. For Money View, however, what determines the order of firesaled assets, and the asset managers’ portfolio is less the agency costs and more the qualitative advantage of one asset than another. The assets’ status determines such qualitative differences in the financial hierarchy. By disregarding the role of dealers, standard capital structure models omit the important information that the qualitative difference between cash and credit will be heightened, and the preference will be changed during a crisis.

Such oversight, mixed with the existing confusion about the non-bank intermediaries’ business model, will be fatal for understanding their behavior during a crisis. The difficulty is that standard finance theories assume that non-bank intermediaries, such as MMFs, are in the business of “financial intermediation,” where the risk is transferred from security-rich agents to cash-rich ones. Such an analysis is correct at first glance. However, nowadays, the mismatch between the preferences of borrowers and the preferences of lenders is increasingly resolved by price changes rather than by traditional intermediation. A careful review of the MMFs balance sheets can confirm this viewpoint. Such examination reveals that these funds, rather than transforming the risks, “pool” them. Risk transformation is a defining characteristic of financial intermediation. Yet, even though it appears that an MMF is an intermediary, it is mainly just pooling risk through diversification and not much transforming risk.

Comprehending the MMF’s business as pooling the risks rather than transforming them is essential for understanding the amount of cash they prefer to hold. The MMF shares have the same risk properties as the underlying pool of bonds or stocks by construction. There is some benefit for the MMF shareholders from diversification. There is also some liquidity benefit, perhaps because open-end funds typically promise to buy back shares at NAV. But that means that MMFs have to keep cash or lines of credit for the purpose, even though it will lower their return and increase the costs for the shareholders.

Finally, another important factor that drives conventional theories’ failure is their concern about the cash flow patterns in the future and the dismissal of the cash obligations today. This is the idea behind the discounting of future cash flows. The weighted average cost of capital (WACC), generally used in these theories, is at the heart of discounting future cash flows. In finance, discounted cash flow analysis is a method of valuing security, project, company, or asset using the time value of money. Discounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management, and patent valuation. In this world, the only “type” of cash flow that matters is the one that belongs to a distant future rather than the present, when firms should make today’s payments. On the contrary, the present, not the future, and its corresponding cash flow patterns, is what Money View is concerned about. In Money View’s world, the firm should be able to pay its daily obligations. If it does not have continuous access to liquidity and cannot meet its cash commitments, there will be no future.

The pecking order theory derives much of its influence from a view that it fits naturally with several facts about how companies use external finance. Notably, this capital structure theory derives support from “indirect” sources of evidence such as Eckbo (1986). Whenever the theories are rejected, the conventional literature usually attributes the problem to cosmetic factors, such as the changing population of public firms, rather than fundamental ones. Even if the pecking order theory is not strictly correct, they argue that it still does a better job of organizing the available evidence than other theories. The idea is that the pecking order theory, at its worst, is the generalized version of the trade-off theory. Unfortunately, none of these theories can explain the behavior of firms during a crisis, when firms should rebalance their capital structure to manage their liquidity needs.

The status of classical theories, despite their failures to explain different crises, is symptomatic of a hierarchy in the schools of economic thought. Nonetheless, they are unable to provide strong capital structure theories as they focus on fallacious premises such as the adverse selection or capital costs of an asset. To build theories that best explain the financing choices of corporates, economists should emphasize the hierarchical nature of financial instruments that reliably determines the order of liquidation of financial assets. In this regard, Money View seems to be positioned as an excellent alternative to standard theories. After all, the main pillars of this framework are financial hierarchy, dealers, and liquidity management.

Elham Saeidinezhad is a Term-Assistant Professor of Economics at Barnard College, Columbia University. Before joining Barnard College, she was a lecturer of Economics at UCLA, a research economist in the International Finance and Macroeconomics research group at Milken Institute, Santa Monica, and a postdoctoral fellow at the Institute for New Economic Thinking (INET), New York. As a postdoctoral fellow, Elham worked closely with Prof. Perry Mehrling and studied his “Money View” framework. She obtained my Ph.D. from the University of Sheffield, UK, in empirical Macroeconomics in 2013. You may contact Elham via the Young Scholars Directory

Do Distributional Effects of Monetary Policy Pass through Debt, rather than Wealth?

Who has access to cheap credit? And who does not? Compared to small businesses and households, global banks disproportionately benefited from the Fed’s liquidity provision measures. Yet, this distributional issue at the heart of the liquidity provision programs is excluded from analyzing the recession-fighting measures’ distributional footprints. After the great financial crisis (GFC) and the Covid-19 pandemic, the Fed’s focus has been on the asset purchasing programs and their impacts on the “real variables” such as wealth. The concern has been whether the asset-purchasing measures have benefited the wealthy disproportionately by boosting asset prices. Yet, the Fed seems unconcerned about the unequal distribution of cheap credits and the impacts of its “liquidity facilities.” Such oversight is paradoxical. On the one hand, the Fed is increasing its effort to tackle the rising inequality resulting from its unconventional schemes. On the other hand, its liquidity facilities are being directed towards shadow banking rather than short-term consumers loans. A concerned Fed about inequality should monitor the distributional footprints of their policies on access to cheap debt rather than wealth accumulation.

Dismissing the effects of unequal access to cheap credit on inequality is not an intellectual mishap. Instead, it has its root in an old idea in monetary economics- the quantity theory of money– that asserts money is neutral. According to monetary neutrality, money, and credit, that cover the daily cash-flow commitments are veils. In search of the “veil of money,” the quantity theory takes two necessary steps: first, it disregards the payment systems as mere plumbing behind the transactions in the real economy. Second, the quantity theory proposes the policymakers disregard the availability of money and credit as a consideration in the design of the monetary policy. After all, it is financial intermediaries’ job to provide credit to the rest of the economy. Instead, monetary policy should be concerned with real targets, such as inflation and unemployment.

Nonetheless, the reality of the financial markets makes the Fed anxious about the liquidity spiral. In these times, the Fed follows the spirit of Walter Bagehot’s “lender of last resort” doctrine and facilitates cheap credits to intermediaries. When designing such measures, the Fed’s concern is to encourage financial intermediaries to continue the “flow of funds” from the surplus agents, including the Fed, to the deficit units. The idea is that the intermediaries’ balance sheets will absorb any mismatch between the demand-supply of credit. Whenever there is a mismatch, a financial intermediary, traditionally a bank, should be persuaded to give up “current” cash for a mere promise of “future” cash. The Fed’s power of persuasion lies in the generosity of its liquidity programs.

The Fed’s hyperfocus on restoring intermediaries’ lending initiatives during crises deviates its attention from asking the fundamental question of “whom these intermediaries really lend to?” The problem is that for both banks and non-bank financial intermediaries, lending to the real economy has become a side business rather than a primary concern. In terms of non-bank intermediaries, such as MMFs, most short-term funding is directed towards shadow banking businesses of the global banks. Banks, the traditional financial intermediaries, in return, use the unsecured, short-term liquidity to finance their near-risk-free arbitrage positions. In other words, when it comes to the “type” of borrowers that the financial intermediaries fund, households, and small-and-medium businesses are considered trivial and unprofitable. As a result, most of the funding goes to the large banks’ lucrative shadow banking activities. The Fed unrealistically relies on financial intermediaries to provide cheap and equitable credit to the economy. In this hypothetical world, consumers’ liquidity requirements should be resolved within the banking system.

This trust in financial intermediation partially explains the tendency to overlook the equitability of access to cheap credit. But it is only part of the story. Another factor behind such an intellectual bias is the economists’ anxiety about the “value of money” in the long run. When it comes to the design of monetary policy, the quantity theory is obsessed by the notion that the only aim of monetary theory is to explain those phenomena which cause the value of money to alter. This tension has crept inside of modern financial theories. On the one hand, unlike quantity theory, modern finance recognizes credit as an indispensable aspect of finance. But, on the other hand, in line with the quantity theory’s spirit, the models’ main concern is “value.”

The modern problem has shifted from explaining any “general value” of money to how and when access to money changes the “market value” of financial assets and their issuers’ balance sheets. However, these models only favor a specific type of agent. In this Wicksellian world, adopted by the Fed, agents’ access to cheap credit is essential only if their default could undermine asset prices. Otherwise, their credit conditions will be systemically inconsequential, hence neutral. By definition, such an agent can only be an “institutional” investor who’s big enough so that its financial status has systemic importance. Households and small- and medium businesses are not qualified to enter this financial world. The retail depositors’ omission from the financial models is not a glitch but a byproduct of mainstream monetary economics.

The point to emphasize is that the Fed’s models are inherently neutral about the distributional impacts of credit. They are built on the idea that despite retail credit’s significance for retail payment systems, their impacts on the economic transactions are insignificant. This is because the extent of retail credit availability does not affect real variables, including output and employment, as the demand for this “type” of credit will have proportional effects on all prices stated in money terms. On the contrary, wholesale credit underpin inequality as it changes the income and wealth accumulated over time and determines real economic activities.

The macroeconomic models encourage central bankers to neglect any conditions under which money is neutral. The growing focus on inequality in the economic debate has gone hand in hand to change perspective in macroeconomic modeling. Notably, recent research has moved away from macroeconomic models based on a single representative agent. Instead, it has focused on frameworks incorporating heterogeneity in skills or wealth among households. The idea is that this shift should allow researchers to explore how macroeconomic shocks and stabilization policies affect inequality.

The issue is that most changes to macroeconomic modeling are cosmetical rather than fundamental. Despite the developments, the models still examine inequality through income and wealth disparity rather than equitable access to cheap funding. For small businesses and non-rich consumers, the models identify wealth as negligible. Nonetheless, they assume the consumption is sensitive to income changes, and consumers react little to changes in the credit conditions and interest rates. Thus, in these models, traditional policy prescriptions change to target inequality only when household wealth changes.

At the heart of the hesitation to seriously examine distributional impacts of equitable access to credit is the economists’ understanding that access to credit is only necessary for the day-to-day operation of the payments system. Credit does not change the level of income and wealth. In these theories, the central concern has always been, and is, solvency rather than liquidity. In doing so, these models dismiss the reality that an agent’s liquidity problems, if not financed on time and at a reasonable price, could lead to liquidations of assets and hence insolvency. In other words, retail units’ access to credit daily affects not only the retail payments system but also the units’ financial wealth. Even from the mainstream perspective, a change in wealth level would influence the level of inequality. Furthermore, as the economy is a system of interlocking balance sheets in which individuals depend on one another’s promises to pay (financial assets), their access to funding also determines the financial wealth of those who depend on the validations of such cash commitments.

Such a misunderstanding about the link between credit accessibility and inequality is a natural byproduct of macroeconomic models that omit the payment systems and the daily cash flow requirement. Disregarding payment systems has produced spurious results about inequality. In these models, access to liquidity, and the smooth payment systems, is only a technicality, plumbing behind the monetary system, and has no “real” effects on the macroeconomy.

The point to emphasize is that everything about the payment system, and access to credit, is “real”: first, inthe economy as a whole, there is a pattern of cash flows emerging from the “real” side, production and consumption, and trade. A well-functioning financial market enables these cash flows to meet the cash commitments. Second, at any moment, problems of mismatch between cash flows and cash commitments show up as upward pressure on the short-term money market rate of interest, another “real” variable.

The nature of funding is evolving, and central banking is catching up. The central question is whether actual cash flows are enough to cover the promised cash commitments at any moment in time. For such conditions to be fulfilled, consumers’ access to credit is required. Otherwise, the option is to liquidate accumulations of assets and a reduction in their wealth. The point to emphasize is that those whose access to credit is denied are the ones who have to borrow no matter what it costs. Such inconsistencies show up in the money market where people unable to make payments from their current cash flow face the problem of raising cash, either by borrowing from the credit market or liquidating their assets.

The result of all this pushing and pulling is the change in the value of financial wealth, and therefore inequality. Regarding the distributional effects of monetary policy, central bankers should be concerned about the effects of monetary policy on unequal access to credit in addition to the income and wealth distribution. The survival constraint, i.e., agents’ liquidity requirements to meet their cash commitments, must be met today and at every moment in the future.

To sum up, in this piece, I revisited the basics of monetary economics and draw lessons that concern the connection between inequality, credit, and central banking. Previously, I wroteabout the far-reaching developments in financial intermediation, where non-banks, rather than banks, have become the primary distributors of credit to the real economy. However, what is still missing is the distributional effects of the credit provision rather than asset purchasing programs. The Fed tends to overlook a “distributional” issue at the heart of the credit provision process. Such an omission is the byproduct of the traditional theories that suggest money and credit are neutral. The traditional theories also assert that the payment system is a veil and should not be considered in the design of the monetary policy. To correct the course of monetary policy, the Fed has to target the recipients of credit rather than its providers explicitly. In this sense, my analysis is squarely in the tradition of what Schumpeter (1954) called “monetary analysis” and Mehrling (2013) called “Money View” – the presumption that money is not a veil and that understanding how it functions is necessary to understand how the economy works.

Elham Saeidinezhad is lecturer in Economics at UCLA. Before joining the Economics Department at UCLA, she was a research economist in International Finance and Macroeconomics research group at Milken Institute, Santa Monica, where she investigated the post-crisis structural changes in the capital market as a result of macroprudential regulations. Before that, she was a postdoctoral fellow at INET, working closely with Prof. Perry Mehrling and studying his “Money View”. Elham obtained her Ph.D. from the University of Sheffield, UK, in empirical Macroeconomics in 2013. You may contact Elham via the Young Scholars Directory

How do we 'build back better' after coronavirus? Close the income gap | Richard Wilkinson

Almost all problems in British society get worse when class differences increase – addressing this inequality must be a post-pandemic priority

The establishment of a free NHS in 1948 came just two days late for my fifth birthday. By the time I’d reached my twenties it was widely assumed to have eliminated health inequalities: almost no one knew whether life expectancy was longer at the top or bottom of the social ladder. Even doctors mistakenly believed “executive stress” was the biggest risk for heart attacks.

As a research student in the 1970s, my attention was drawn to official data showing not only that most of the major causes of death were two to three times more common among unskilled manual workers and their families than among professionals, but also that the gap in death rates had widened since the 1930s. Such large class differences in death rates came as a shock. Full of righteous indignation, I wrote a newspaper article addressed to the secretary of state for health, David Ennals, urging him to set up an urgent inquiry to address these issues.

Why coronavirus might just create a more equal society in Britain | Richard Wilkinson and Kate Pickett

Since the 1980s, inequality has risen. But the pandemic has forced the government to put wellbeing before growth

For those who are cooped up in a flat at the moment with a baby and no garden, worrying about getting the government’s 80% income replacement after losing your job, the lockdown must be almost intolerable. Then there is the rise in people needing food banks and in cases of domestic violence – both predictable results of lockdown. For those working at home with a secure income and a garden, it is much easier.

Governments, careless of the contrasts between rich and poor, always want us to believe “we are all in this together”. In the wake of the 2007-8 financial crisis we didn’t buy it: we remained strongly aware of divided interests and circumstances. However, this time, despite the stark differences in people’s experience, there is a strong feeling that we really are in it together. As with other great challenges, most notably the second world war, the present crisis has given rise to more neighbourliness, sociability and a desire to take care of each other.

Inequality breeds stress and anxiety. No wonder so many Britons are suffering | Richard Wilkinson and Kate Pickett

In equal societies, citizens trust each other and contribute to their community. This goes into reverse in countries like ours

The gap between image and reality yawns ever wider. Our rich society is full of people presenting happy smiling faces both in person and online, but when the Mental Health Foundation commissioned a large survey last year, it found that 74% of adults were so stressed they felt overwhelmed or unable to cope. Almost a third had had suicidal thoughts and 16% had self-harmed at some time in their lives. The figures were higher for women than men, and substantially higher for young adults than for older age groups. And rather than getting better, the long-term trends in anxiety and mental illness are upwards.

For a society that believes happiness is a product of high incomes and consumption, these figures are baffling. However, studies of people who are most into our consumerist culture have found that they are the least happy, the most insecure and often suffer poor mental health.

From Jane Austen to haunting memoirs: books to open your eyes to inequality

In the second part of our series, we asked Sarah Perry, Jeffrey Sachs, Sebastian Barry, Monica Ali, Richard Wilkinson, Julian Baggini, Kate Pickett and Afua Hirsch to tell us which titles helped shape their views on inequality

One Christmas my mother gave me Helen Forrester’s memoir Twopence to Cross the Mersey. What timing! I was warm, overfed on mince pies and wearing a new jumper, and had no idea these things made me rich. I suppose I had a child’s sense that some people were very poor, but thought it rare, and it never occurred to me that structural inequalities, unchecked capitalism, and foolish or malicious government policies could topple anyone at any time from comfort to penury.