Sunday, 16 July 2017 - 7:35pm

This week, I have been mostly reading:

- Amid Unprecedented Controversy, W3C Greenlights DRM for the Web — Cory Doctorow, Electronic Frontier Foundation:

It was the most controversial vote in W3C history. As weeks and then months stretched out without a decision, another W3C member, the Center for Democracy and Technology, proposed a very, very narrow version of the covenant, one that would only protect security researchers who revealed accidental or deliberate leaks of data marked as private and sensitive by EME. Netflix's representative dismissed the idea out of hand, and then the W3C's CEO effectively killed the proposal. Today, the W3C announced that it would publish its DRM standard with no protections and no compromises at all, stating that W3C Director Tim Berners-Lee had concluded that the objections raised "had already been addressed" or that they were "overruled."

- The Troubling Appeal of Education at For-Profit Schools — Dana Goldstein reviews the brilliant Tressie McMillan Cottom's new book in the NY Times:

In the revelatory “Lower Ed: The Troubling Rise of For-Profit Colleges in the New Economy,” the sociologist Tressie McMillan Cottom introduces us to London, a 48-year-old widow and single mother of three children. London lives in rural North Carolina, and has watched as decent working-class jobs in the textile industry disappeared from her region. […] At various times she trained to be a child care provider, a medical biller, a computer technician and, most recently, a medical assistant. Cottom asked London what she would do if she could not find the middle-class health care administration job she desired — a type of position that often requires training in a medical specialty like cardiology. London’s program at a branch of for-profit Everest College does not provide such specialized training. She smiled and told Cottom, “Jesus is my backup plan.”

- Lower Ed: A Review — Matt Reed at Inside Higher Ed has a longer and better review of the same:

In trying to answer the question of why so many students poured into for-profit colleges from about the mid-1990’s to 2010-ish, she argues for a different answer than the ones usually given. The usual answers are twofold. Either the for-profit colleges are simply slick thieves who preyed upon the unwitting, or the labor market suddenly required skills that nobody else could offer at scale. She suggests a third, which she calls credentialism. In her telling, students are not witless dupes, and technological change was not unique to the mid-90’s. Instead, for-profit colleges formed a sort of “negative social insurance” program by which students hoped to protect themselves against being left behind in a labor market that had outsourced training costs to workers themselves.

- The Good News is Obamacare is Probably OK. The Bad News… — Ted Rall:

- Pigouvian Taxes and Bounties — Timothy Taylor observes — to paraphrase a prominent public intellectual — who knew fiscal policy could be so complicated?:

A related problem in thinking about Pigovian taxes arises when choosing the tax rate. For example, in the case of alcohol there is some evidence that moderate consumption may have health benefits, through a reduction in blood pressure. However, inappropriate and excessive consumption of alcohol can also lead to drunken driving, violence, fetal alcohol syndrome, and other consequences. Thus, it seems as if the appropriate Pigouvian tax on alcohol should be to subsidize the light social drinker, but to impose a high tax on drinkers who impose high social costs. When the effects of an action on third parties are heterogenous in this way. choosing an appropriate Pigouvian tax becomes tricky, and society may well feel a need for use of alternative or complementary policy tools.

- RBA all but calls the dumb bubble — David Llewellyn-Smith quotes the Age quoting RBA Assistant Governor Michele Bullock:

“We don’t want households to find themselves in a situation where they have to emergency sell or whatever because they can’t afford it any more.” In the past year Sydney prices had climbed 18 per cent and Melbourne prices have risen 13 per cent.

- Careful Car Care Made Care Free - Tires and fluids! — Phil Are Go!:

Sunday, 9 July 2017 - 4:48pm

This week, I have been mostly reading:

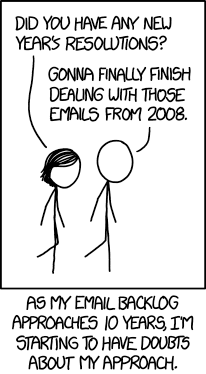

- Listening — xkcd:

- Current Genres of Fate: "Hardwired" — Paul North, 3 Quarks Daily:

Obviously "hardwired" is a way we talk. Like movies though, the way we talk tells us the secrets we keep. Newspaper headlines are also "talk"—they can be equally revealing. Even when the answer is no, we are not hard-wired to do this or that, just raising the question points right at our worry: are we hard-wired for this or that? (Look at "Are We Hard-Wired for War?" (NYT 9/28/13)). It's funny: "hard-wired" or as it's sometimes written—as if it were a technical term—"hardwired," is most often used in the press these days to talk about human psychology. It is, though, a metaphor. To date, no psychologist has discovered any "wires" in us.

- Careful Car Care Made Care Free #3 - Hand signals — Phil Are Go!:

- Domain plans data-driven mortgage and insurance push for post-float growth — Paul Smith at the AFR, part of the media wing of property bubble rider Fairfax:

Speaking on a panel on the smart use of data at The Australian Financial Review Business Summit on Wednesday, Domain boss Antony Catalano flagged the potential for the company to dig deeper into the information it generates and tracks on house sellers or buyers in order to establish new mortgage and insurance businesses. […] "We have got so many data points that allow us to move out of being just a classified advertising business, into perhaps being a mortgage or insurance originator," Mr Catalano said. "Our business generates about $500 per property. If I can provide a bank with a loan ... there can be 10 times as much money in being a mortgage originator than there is in the advertising business."

- The Basic Income and Job Guarantees are Complementary, not Opposing Policies — Brad Voracek:

Most people who support BIG worry that a JG would create “make-work”, quoting Keynes famous “bury bank notes and dig them back up” line. To them, just giving people the bank notes makes more sense. On the other hand, JG proponents worry about not having the social utility of work. People want to contribute to society, and they see work that needs to be done. Both policies seem hard to pass in todays political climate.

'Straya: Basically, she's rooted mate

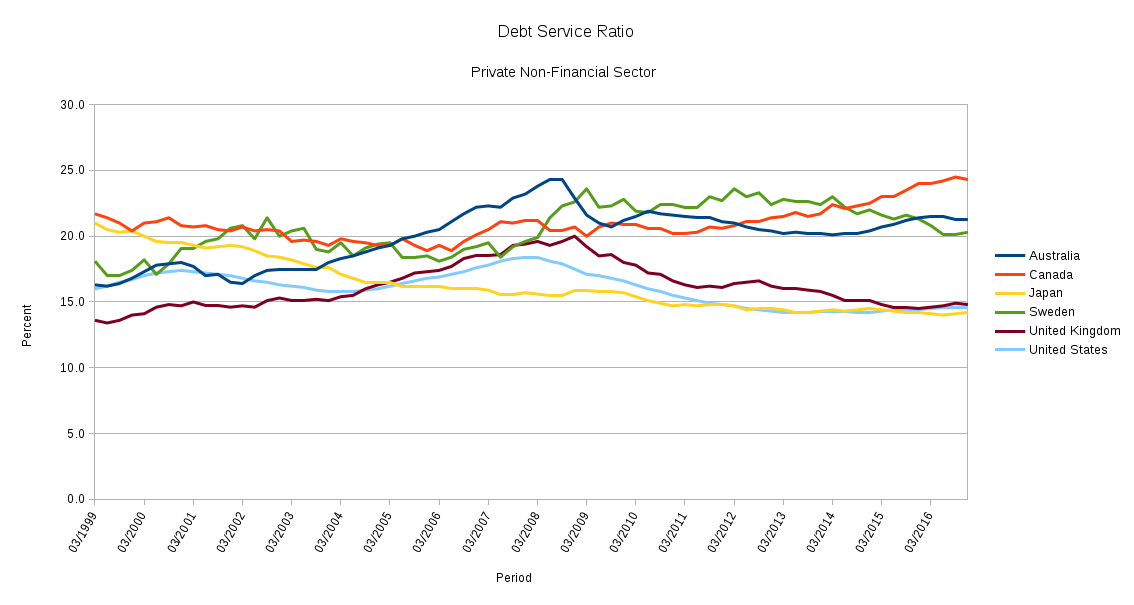

Charts! Nobody asked for them, but I have them anyway! Over the last few years the Bank for International Settlements have been publishing a fab set of statistics that are not usually brought to bear in the tea leaf reading of mainstream economists. This is a shame, as they are exactly the sort of statistics which would indicate the risk of imminent financial crisis. Last month the BIS updated the data to the end of (calendar year) 2016. Here's an illustration (courtesy of LibreOffice) of where Australia is, relative to some comparable and/or interesting countries (click to embiggen):

As the BIS explains, the Debt Service Ratio (DSR):

"reflects the share of income used to service debt and has been found to provide important information about financial-real interactions. For one, the DSR is a reliable early warning indicator for systemic banking crises. Furthermore, a high DSR has a strong negative impact on consumption and investment."

So as a measure of Australia's ability to pay at least the interest on our private sector debts, if not pay down the principal, you might think this is not a bad result. We clearly substantially delevered after the GFC, thanks in large part to the Rudd stimulus pouring public money into the private sector, then levered up a bit since, but we've ended up between Canada and Sweden, which is a pretty congenial neighbourhood. But this is total private sector debt; what happens when we take business out of the equation and just look at households (and non-profit institutions serving households - NPISHs)?

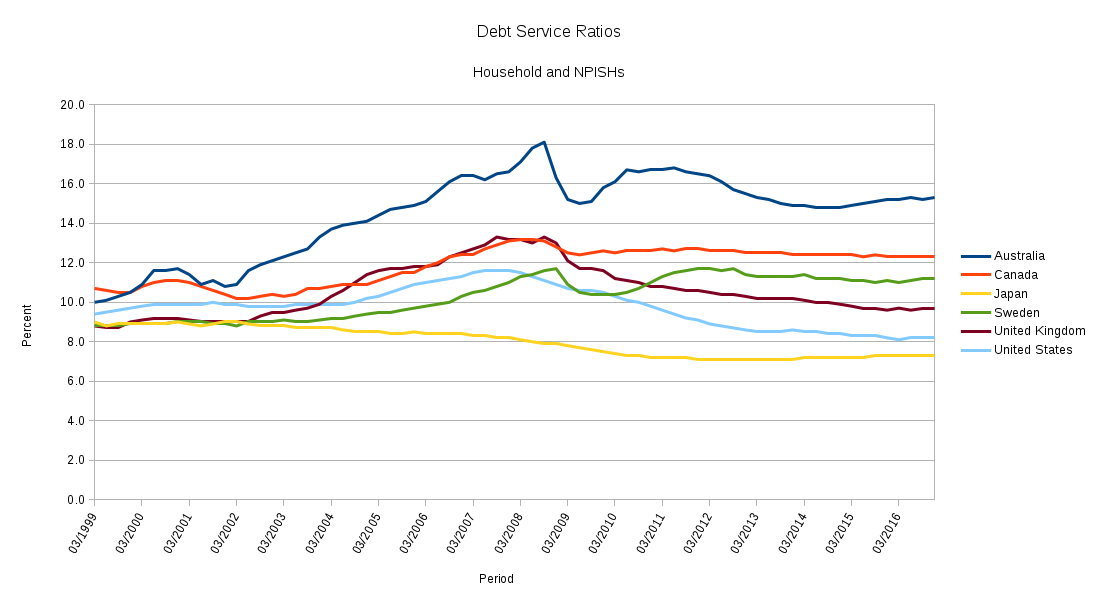

Woah! Suddenly we're in a league of our own. Canada's flatlined here since the GFC, meaning the subsequent increase in their total private debt burden has largely come from investment in business capital. In such a case, provided this investment is directed at increasing productive capacity, and is accompanied by public sector spending to proportionally increase demand, this is sustainable debt. Australia has been doing the opposite.

Here's another way of looking at the coming Australian debt crisis, private sector credit to GDP:

This ratio will rise whether the level of debt rises, GDP falls, or both, so it's another good indicator of unsustainable debt levels. The current total level (in blue) of over 200% is at about the ratio Japan was at when its real estate bubble burst in the early 1990s. Breaking this down again into household and corporate sectors, we see that over the mid-1990s Australia switched the majority of its private sector borrowing from business investment to sustaining households. What happened in the mid-90s? Data here from the OECD:

From the mid-1990s to 2007 Australia experienced the celebrated run of Howard/Costello government fiscal (or "budget") surpluses. We all know, or should know, thanks to Godley's sectoral balances framework, what happens when the public sector runs a surplus: the private sector must run a corresponding deficit, equal to the last penny. There is nowhere else, net of private sector bank credit creation (which zeroes out because every financial asset created in the private sector has a corresponding private sector liability), for money to come from. When the government taxes more than it spends, it is withdrawing money from the private sector. Mainstream economics calls this "sustainable", and "sound finance", meaning of course it is nothing of the sort.

How did the private sector, and the household sector in particular, continue to spend from that point onward, behaving as though losing money (not to mention public infrastructure and services) down the fiscal plughole was not merely benign but quite wonderful? It chose to Nimble it and move on, going on a massive credit binge. The banks were happy to provide all the credit demanded, because the bulk of the lending was ulitimately secured by residential real estate prices, and these were clearly going to keep rising without limit (thank heavens, because if they were to fall like they did in the US in 2007…).

The Global Financial Crisis put a dent in the demand for credit, but as subsequent government fiscal policy has tightened, under the rubric of "budget repair", it is rising again. We are already in a state of debt deflation: Australia's household debt service ratio (as above), at between 15 and 20 percent of household income for over a decade, has dampened domestic demand, leading to rising unemployment and underemployment, leading to more easy credit as a quick fix for income shortfalls ("debtfare"). More of what income remains is redirected to debt servicing rather than consumption, and so we spiral downwards, our incomes purchasing less and less with each turn. [I will post more about some of the social and microeconomic consequences in (over-)due course.]

The Australian government needs to spend much, much more - and quickly. Modern Monetary Theory, drawing on an understanding of the nature of money that goes back a century, shows us that government spending (contrary to conventional wisdom) is not revenue-constrained; a currency-issuing government can always buy anything available for sale in the currency it issues. There is nothing about our collective "budget" that needs repairing before we can do so. The same data from the OECD shows that most currency-issuing governments with advanced industrial economies run fiscal deficits almost all the time:

In fact, under all but exceptional conditions, government fiscal surpluses (i.e. private sector fiscal deficits) are a recipe for recession or depression. The greater the surplus, the greater the subsequent government spending required to lift the private sector out of crisis, as can be seen above in the wild swings in neoliberal governments' fiscal position from the mid-90s on. The fiscal balance over any given period is nothing more than a measurement of the flow of public investment into the private sector. What guarantees meaningful sustainability is a government's effective use of functional finance to manage the real (as opposed to financial) economy in pursuit of public policy objectives. Refusing to mobilise idle resources (including, crucially, labour) for needed public goods and services is not "sound finance"; it is the very definition of economic mismanagement, as was once widely recognised:

"It is true that war-time full employment has been accompanied by efforts and sacrifices and a curtailment of individual liberties which only the supreme emergency of war could justify; but it has shown up the wastes of unemployment in pre-war years, and it has taught us valuable lessons which we can apply to the problems of peace-time, when full employment must be achieved in ways consistent with a free society.

"In peace-time the responsibility of Commonwealth and State Governments is to provide the general framework of a full employment economy, within which the operations of individuals and businesses can be carried on.

"Improved nutrition, rural amenities and social services, more houses, factories and other capital equipment and higher standards of living generally are objectives on which we can all agree. Governments can promote the achievement of these objectives to the limit set by available resources.

"The policy outlined in this paper is that governments should accept the responsibility for stimulating spending on goods and services to the extent necessary to sustain full employment. To prevent the waste of resources which results from [un]employment is the first and greatest step to higher living standards."

We chose to forget all this from the 1980s onward. We can choose to remember it at any time.

Sunday, 2 July 2017 - 8:16pm

This week, I have been mostly reading:

- Against Willpower — Carl Erik Fisher in Nautilus:

Ignoring the idea of willpower will sound absurd to most patients and therapists, but, as a practicing addiction psychiatrist and an assistant professor of clinical psychiatry, I’ve become increasingly skeptical about the very concept of willpower, and concerned by the self-help obsession that surrounds it. Countless books and blogs offer ways to “boost self-control,” or even to “meditate your way to more willpower,” but what’s not widely recognized is that new research has shown some of the ideas underlying these messages to be inaccurate. More fundamentally, the common, monolithic definition of willpower distracts us from finer-grained dimensions of self-control and runs the danger of magnifying harmful myths—like the idea that willpower is finite and exhaustible. […] Notions of willpower are easily stigmatizing: It becomes OK to dismantle social safety nets if poverty is a problem of financial discipline, or if health is one of personal discipline.

- Why human capital is not capital — David F. Ruccio:

First, if [Noah] Smith wants to invoke human capital to say “education and skills are a form of wealth,” then why not include other ways people are able to earn more or less than their counterparts? Why not, for example, go beyond his reference to credentials (he has a Stanford degree) and intellectual abilities (apparently, he can do math well and write well) and refer to some of the other important ways people are sorted out within existing economic relations. I’m thinking of such things as gender, race and ethnicity, immigration status, and so on. They’re all ways workers are able to receive more or less income that have nothing to do with the effort they put into their jobs. Does Smith want to argue that masculinity, whiteness, and native birth are forms of human capital?

- How to get a nice, highly paid job in a bank — John Quiggin:

In the last week or so, two former state premiers, Anna Bligh and Mike Baird have been appointed to highly paid jobs in the banking sector. In both cases there was some peripheral controversy. In Bligh’s case, some Liberals, including Scott Morrison, apparently felt that such jobs should be reserved for their side of politics.

Sunday, 25 June 2017 - 7:29pm

This week, I have been mostly reading:

- The Philistine Factory — Stuart Whatley in the baffler:

One plank in the Republican education-policy platform is student-loan privatization, even though most economists doubt that “liberalizing” this market would do any good. If private banks are brought into the process of granting student loans, they will have an incentive to favor certain academic majors over others. Any course of study that does not promise easy employment and a high salary after graduation will be denied financing, or treated as a subprime, punitively high-interest loan. This will, no doubt, have the desired effect of homogenizing the future labor force to fit American corporations’ standardized needs. As it happens, the Democrats’ ultimate goal for education in recent years has amounted to the same thing. To the extent that Hillary Clinton offered specific education policy proposals in the 2016 election, she did so only in the context of boosting workforce competence and productivity. The sole purpose of education, apparently, is to enable “young people from everywhere . . . to be prepared to compete for those jobs.”

- Centrelink’s Data-Matching Fiasco — Gerard McPhee in Arena:

[…] ministers want to reduce Centrelink expenditure and have a deep-seated suspicion about a class of people ‘rorting the system’. The factual basis of that suspicion is not critical here. What is critical is that Cabinet has a predisposition to support any additional method to detect imagined ‘rorters’ or ‘undeserving’ poor people, and will do so at a policy level, not considering the consequences of added complexity or transactional volume to the systems it will call on.

- Ten points for Democracy Activists — George Lakoff:

Know the difference between framing and propaganda: Frames are mental structures used in thought; every thought uses frames. Every word in every language is defined relative to a mental structure — a frame. Frames, in themselves, are unavoidable and neutral. Honest framing is the use of frames you believe and that are used to express truths. Propaganda expresses lies that propagandists know are lies for the sake of political or social advantage.

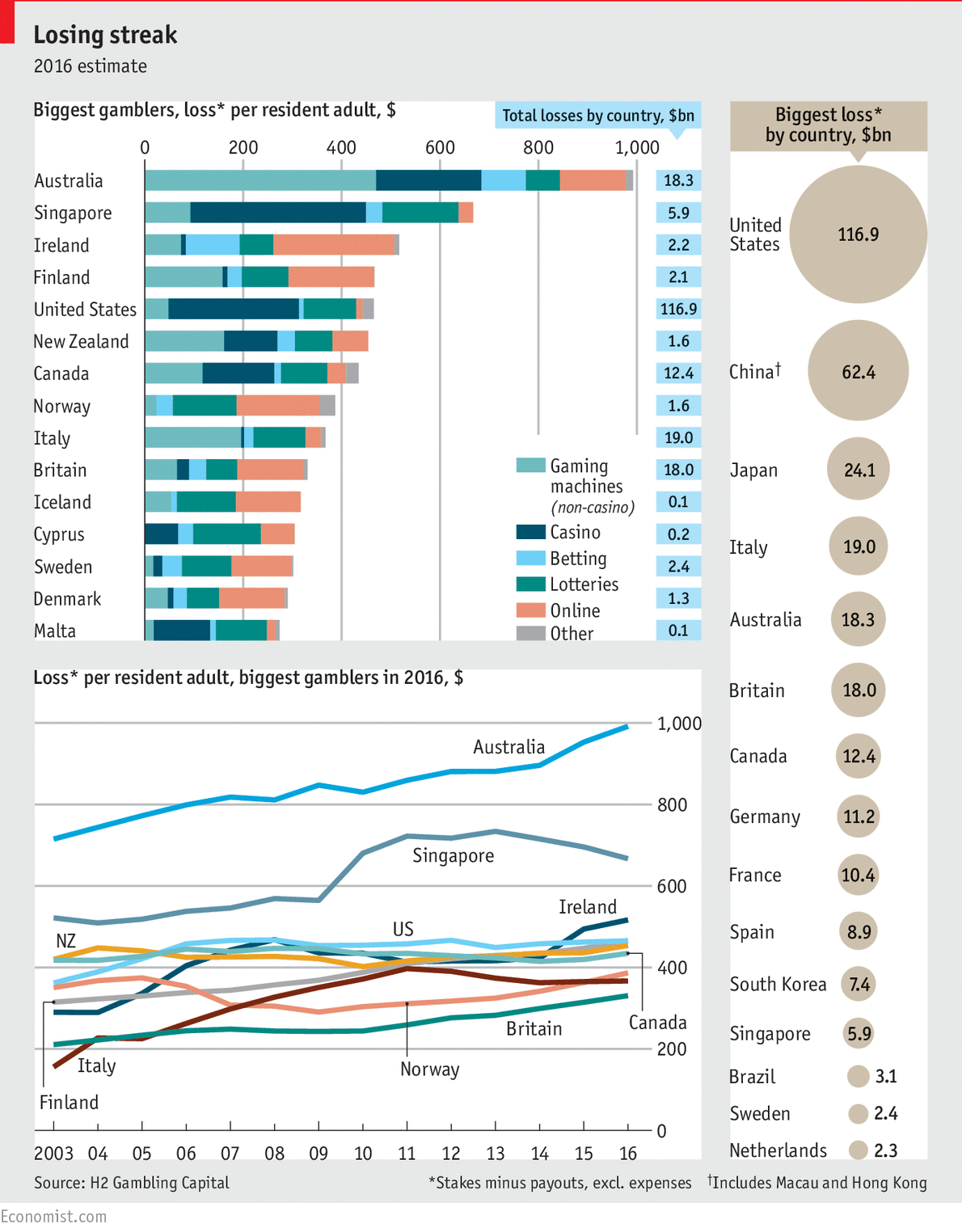

- The world’s biggest gamblers — your chart porn for the week from the Economist:

To the general public, Australia hardly leaps to mind as a gambling hotbed. Yet industry insiders know it is far and away their most lucrative market: according to H2 Gambling Capital (H2G), a consultancy, betting losses per resident adult there amounted to $990 last year. That is 40% higher than Singapore, the runner-up, and around double the average in other Western countries. The most popular form of gaming in Australia is on ubiquitous electronic poker machines, or “pokies”, which are more prevalent there than anywhere else. Although the devices are legal in many other markets, bet sizes are usually capped at modest levels. By contrast, in Australia, which began to deregulate the industry in the 1980s, punters can lose as much as $1,150 an hour.

- “Tulip bubble” Murray shakes snoring APRA — David Llewellyn-Smith in MacroBusiness:

Switzer: “How vulnerable do you think our banks are to the apartment oversupply?” David Murray: “Well, the economy’s vulnerable because there’s a bubble in the housing market. All the signs of a bubble are there. Many of the signs are the same as the bubble in Dutch Tulips… People’s behaviour, people’s defensiveness about any correct in that market. All those signs are there. Now, if the economy tracks along OK, it might turn out that this thing sorts itself out. But when those risks are there, something needs to be done about it in a regulatory sense and the RBA and APRA need to stay on it”…

- What in the Heck Is “Money Printing,” Anyway? — Steve Roth at Evonomics has an interesting piece that packs a lot into a small word count. However I think it falls down by failing to distinguish between government-backed financial assets and real assets. Yes, when the dollar-denominated valuation of stock market or real estate assets goes up, we can say in one sense that private sector asset values have increased, but if everyone were to try to cash in at once those valuations would suddenly change drastically. On the other hand, for government-backed cash, central bank reserves, bonds, and private sector bank credits, a dollar is a dollar is a dollar — at least as far as extinguishing tax liabilities is concerned. For any other definition of "value", see a philosopher, not an economist.

- Universal Basic Income Accelerates Innovation by Reducing Our Fear of Failure — Scott Santens at Medium from an enthusiastically pro-market perspective, makes an argument that generalises to we socialist fuddy-duddies:

For decades now our economy has been going through some very significant changes thanks to advancements in technology, and we have simultaneously been actively eroding the institutions that pooled risk like trade unions and our public safety net. Incomes adjusted for inflation have not budged for decades, and the jobs providing those incomes have gone from secure careers to insecure jobs, part-time and contract work, and now recently even gig labor in the sharing economy. Decreasing economic security means a population decreasingly likely to take risks. Looking at it this way, of course startups have been on the decline. How can you take the leap of faith required for a startup when you’re more and more worried about just being able to pay the rent?

- Listen up, Scott Morrison. It's time to bust the myth of the budget surplus — Warwick Smith brings MMT to the Guardian:

Private sector debt in Australia is currently about 210% of GDP, compared to government debt of about 30%. What Scott Morrison needs to explain to the Australian people is why he’s so keen to increase the private debt they hold over their homes and businesses when it’s already so high.

- We showed I, Daniel Blake to people living with the benefits system: here’s how they reacted — Stephanie Petrie in the Conversation:

During our screening, we were told that assessments often ignored significant health conditions. One profoundly deaf woman was informed: "In your application form for ESA you stated that following an illness when you were a child, you are now profoundly deaf. After your assessment I tried to contact you to discuss your assessment. I telephoned you several times, but you did not answer, therefore I left you a voicemail. You still did not respond. I have therefore found you fit for work."

- How will we get over the Trump addiction? — Robert Fisk in the Independent:

Not long after the Lebanese civil war ended more than a quarter of a century ago, I found my landlord in a depressed mood. He had suffered in the fifteen years of war – part of his family had been “cleansed” from their home in east Beirut – but peace had returned to the ruins of the city, the Mediterranean sloshed opposite our apartment block and in front of the little candy store he ran on the Corniche. What on earth could be the matter? “It’s so boring, Mr Robert,” he confessed to me one bright morning.

- #ProtectTheTruth — George Lakoff:

When President Richard Nixon addressed the country during Watergate and used the phrase “I am not a crook,” he coupled his image with that of a crook. He established what he was denying by repeating his opponents’ message. This illustrates a key principle of framing: avoid the language of the attacker because it evokes their frame and helps make their case.

- Why Australia’s rental system needs reform — Leith van Onselen, MacroBusiness:

One of the great strengths of the German housing market is that it provides strong protections for tenants. […] because renting is the dominant housing choice in Germany (see below chart), the political system is highly sensitive to tenants’ rights and perceived threats to the status quo typically receive prominent media attention and political responses. Also, because renters enjoy secure tenure (and housing supply is fairly responsive), Germans have little incentive to rush into owner occupation. As such, Germany doesn’t suffer from the ‘panic buying’ and speculation often present in bubble housing markets, like Australia’s.

Sunday, 18 June 2017 - 4:38pm

This week, I have been mostly reading:

- The New Democrats’ Addiction to Austerity Will Not Die — Bill Black in New Economic Perspectives with the "If you read only one article about the madness of austerity this year…" article:

Michael Meeropol, an economist whose work I respect greatly, has rightly chastised me for failing to explain that fiscal austerity produces enormous winners, not just losers, and that this fact helps explain why the economic malpractice of austerity is so common. Austerity is a policy that aids the wealthy and harms the non-wealthy. One of the greatest triumphs of the wealthy is to get vast numbers of the non-wealthy to fail to understand this point. The New Democrats’ passionate support for austerity reflects the interests of its primary donors – Wall Street elites. Austerity produces higher unemployment rates. It can cause deflation. It leads to cuts in public employment and funding for social programs. High unemployment allows CEOs to force lower wages and creates a political climate in which CEOs are able to get legislation and rule changes embracing “labor flexibility.” That phrase is a euphemism for making it easier for firms to fire workers without. CEOs use high unemployment to induce an international race to the bottom on worker protections and wages under the pretext that doing so is essential for U.S. firms to maintain “global competitiveness.” Deflation is a superb situation for (net) creditors. They get repaid in a currency that is gaining value. Deflation reduces interest rates, so the market value of existing long-term fixed rate debt instruments (bonds) can increase substantially.

- Getting Money out of Politics — Alexander Douglas at Medium:

When politicians talk money and numbers, they conjure up an enchanting ballet of bloodless abstractions. Money is an abstraction — a ledger, an accounting record, a “set of positions on an abstract ratio scale”, as one article puts it. But however the abstractions might dance about on their unearthly stage, here in the concrete world if there are resources then those resources can be put to use for a public purpose. No abstract object can rush in to interrupt the work. To think otherwise is to literally worship money

- The Land Belongs to God — Michael Hudson and his startling erudition:

Now when they ran up debts in Sumer and Babylonia, and even in in Judea in Jesus’ time, they didn’t borrow money from money lenders. People owed debts because they were in arrears: They couldn’t pay the fees owed to the palace. We might call them taxes, but they actually were fees for public services. And for beer, for instance. The palace would supply beer and you would run up a tab over the year, to be paid at harvest time on the threshing floor. You also would pay for the boatmen, if you needed to get your harvest delivered by boat. You would pay for draught cattle if you needed them. You’d pay for water. Cornelia Wunsch did one study and found that 75% of the debts, even in neo-Babylonian times around the 5th or 4th century BC, were arrears. Sometimes the harvest failed. And when the harvest failed, obviously they couldn’t pay their fees and other debts. Hammurabi canceled debts four or five times during his reign. He did this because either the harvest failed or there was a war and people couldn’t pay.

- The Public’s Viewpoint: Regulations are Protections — George Lakoff:

Minority President Trump has said that he intends to get rid of 75% of government regulations. What is a “regulation”? The term “regulation” is framed from the viewpoint of corporations and other businesses. From their viewpoint, “regulations” are limitations on their freedom to do whatever they want no matter who it harms. But from the public’s viewpoint, a regulation is a protection against harm done by unscrupulous corporations seeking to maximize profit at the cost of harm to the public. Imagine our minority President saying out loud that he intends to get rid of 75% of public protections. Imagine the press reporting that. Imagine the NY Times, or even the USA Today headline: Trump to Eliminate 75% of Public Protections. Imagine the media listing, day after day, the protections to be eliminated and the harms to be faced by the public.

- Somebody’s Watching. Now What? — James T Stone Ph.D. [sic] in Psychology Today:

The Audience Effect: People tend to perform differently in front of an audience than when alone. Specifically, they tend to perform better in front of an audience when the task is simple or has been mastered, and worse when the task is complex or new.

- Does Saving Cause Lending Cause Investment? (No.) — Steve Roth at Evonomics:

Put aside that the basic bookkeeping of this idea — that personal saving creates “savings” that “fund” lending and investment — doesn’t make any sense. (It’s an error of composition; you have more savings if you save, but the economy doesn’t.) Let’s look at history: when households save more, is there more lending and (business) investment — either immediately or a few quarters/years down the road? Mostly: no.

- Explainer: what is modern monetary theory? — Steven Hail in the Conversation:

By the 1980s, most people saw Keynes as an advocate of budget deficits only during periods of high unemployment. Lerner, as early as 1943, in a paper entitled Functional Finance and the Federal Debt, had argued that Keynesian economics involved running whatever government deficit was necessary to maintain full employment, and that deficits should be seen as the norm. Keynes, in a letter to fellow economist James Meade written in April 1943, said of Lerner, “His argument is impeccable. But heaven help anyone who tries to put it across”.

-

Make housing affordable and cut road congestion all at once? Here’s a way — Martin Payne in the Conversation:

Two of the most pressing problems for Australian cities are housing affordability and traffic congestion. But there is an approach to both problems that could lead to significant improvements at low cost and relatively quickly. It involves developing transit-oriented centres in conjunction with inclusionary zoning. This form of development gives priority to housing affordability and low car use. It does so by requiring a certain proportion of permanently affordable housing and dwellings without car parking, but with strong access to local facilities. Travel is mainly by walking and public transport.

- Debt bubble returns millions to days of 2008 crash — Shane Hickey in the Guardian:

Charities and financial advisers are calling on the government to use the Queen’s speech to address the “bubble” of unmanageable debt that households are rapidly accumulating. Unsecured consumer credit – including credit cards, car loans and payday loans – is this year expected to hit levels not seen since the 2008 financial crash. There has been concern in the Bank of England that consumer spending is being underpinned by debt, amid comparisons to the run-up to the financial crash.

- Block adverts, delete Flash, kill Java: ASD — Stilgherrian at ZDNet:

Most of the ASD's top recommendations continue to focus on basic network hygiene, and most of that can be achieved by the IT department simply doing its job properly. But cybersecurity vendors want to sell fancy and expensive techniques, some of which do very little to improve security. The ASD's recommendation that every organisation install ad blockers will also be controversial, given that it declares as hostile a key part of online business models. But... Given all the warnings about cyber threats and cyber war, we do want a secure internet, don't we? Well this is how you do it.

Sunday, 11 June 2017 - 7:09pm

This week, I have been mostly hitting refresh on UK media sites and celebrating the imminent demise of neoliberalism. Otherwise fishing these from the depths of the reading backlog:

- Clown Therapy — Too Much Coffee Man by Shannon Wheeler:

- Why bad housing design pumps up power prices for everyone — Wendy Miller in the Conversation:

Pumping heat from one place to another takes a lot of energy, which makes air conditioners particularly power-hungry appliances. The more leaky the house, the more heat needs to be pumped out. On hot days, when lots of aircon units are operating at the same time, this creates a challenge for the electricity infrastructure. It costs money to build an electricity network that can handle these peaks in demand. This cost is recovered through the electricity unit cost (cents per kilowatt hour). We all pay this cost, in every electricity bill we get; in fact the cost of meeting summer peak demand accounts for about 25% of retail electricity costs. This is more than twice the combined effect of solar feed-in tariffs, the Renewable Energy Target and the erstwhile carbon tax.

- Drugs du jour — Cody Delistraty in Aeon:

Drug use offers a starkly efficient window into the cultures in which we live. Over the past century, popularity has shifted between certain drugs – from cocaine and heroin in the 1920s and ’30s, to LSD and barbiturates in the 1950s and ’60s, to ecstasy and (more) cocaine in the 1980s, to today’s cognitive- and productivity-enhancing drugs, such as Adderall, Modafinil and their more serious kin. If Huxley’s progression is to be followed, the drugs we take at a given time can largely be ascribed to an era’s culture. We use – and invent – the drugs that suit our culture’s needs.

- Emails — xkcd by Randall Monroe:

Thursday, 8 June 2017 - 9:04pm

ALMOST 2000 children on the NSW north coast have not been fully immunised, with the district's vaccination rate trailing every other part of the nation.

It's easy to dismiss this as natural selection at work, weeding out the inbred progeny of the small-town airheaded bourgeoisie. Unfortunately immunisation works at the population level, rather than the individual level. Your little Typhoid Myron is both your personal choice and our collective problem.

I therefore propose a compromise. If you cretins agree to immunise your child like a sane person, I will personally arrange - for free - an exhaustive spiritual cleansing process involving auras, crystals, chakras, and mantras; the whole kit and caboodle. All chemicals and toxins will thus be purged, and it will be as though your child has never been exposed to anything unnatural and artificial, and can go back to playing Minecraft without a care in the world.

If, after this process, you are still convinced that your child has become feckless, withdrawn, dysfunctional, and completely detached from the real world, I will give you - at no extra cost - a mirror.

Sunday, 4 June 2017 - 7:53pm

This week, I have been mostly reading:

- Content Addressing is Magic — Brewster Kahle:

Content Addressing starts by processing a digital file into a “hash” which is roughly 64Bytes, or 64 character long string of numbers (using sha256). This hash is has amazing properties– given a hash you can confirm that a digital file matches it, further given a hash it is very very difficult to create the digital file. And, here is the kicker, given a hash it is almost impossible to create a second digital file that matches it, but was not exactly the same as the original. […] Why this can be important [is] that materials can be served from many places, served from libraries and archives, and keep permanently available long after the original server is gone.

- We’re Wealthier Now, We Can’t Afford That Anymore — Peter Cooper, the heteconomist:

Have you noticed how things we used to be able to do are beyond our capabilities now? We finally reached a point where we were able to provide free university education. Then we grew wealthier, and some countries couldn’t afford it anymore. Some of us still have universal public health care systems, but they’re increasingly a chronic burden. Maybe they made sense once, but it’s only a matter of time before they go. Sure, Cuba can do it, but they’re poorer than us.

- Change my power supplier? I haven’t got the energy — David Mitchell in the Guardian:

Come on, there are over 40 suppliers to look at! They each have several different tariffs! You need to be checking them all out several times a year, working out what they would each mean for your specific home and energy consumption, making a decision and then embarking on the administrative process of changing supplier. If you don’t, the privatisation of the utilities will look like it doesn’t work! Get on with it – you’re making Margaret Thatcher look stupid!

- Towards an Anarchist Money and Monetary System: An Interview with Nathan Cedric Tankus — Alexander Kolokotronis, New Politics:

Let me put my cards on the table: I think societies need a common measure for accounting purposes to do economic calculations and a general system of distribution. For various reasons I think that labor measures, energy measures, etc. are inadequate for the job (although I think statistical work on how much energy is needed to produce varieties of outputs is important). Thus, a monetary unit of account is the worst unit of account, except for all the others. I do not think this is a concession to the capitalist mode of production and this is where I disagree with a great many Marxist and radical thinkers. Traditionally, the existence of markets has been conflated with capitalism.

- Economists versus the Economy — Robert Skidelsky scores no points with the conventional wisdom that there are at present "virtually no usable macroeconomic tools", but I can't fault the punchline:

What unites the great economists, and many other good ones, is a broad education and outlook. This gives them access to many different ways of understanding the economy. The giants of earlier generations knew a lot of things besides economics. Keynes graduated in mathematics, but was steeped in the classics (and studied economics for less than a year before starting to teach it). Schumpeter got his PhD in law; Hayek’s was in law and political science, and he also studied philosophy, psychology, and brain anatomy. Today’s professional economists, by contrast, have studied almost nothing but economics. They don’t even read the classics of their own discipline. Economic history comes, if at all, from data sets. Philosophy, which could teach them about the limits of the economic method, is a closed book. Mathematics, demanding and seductive, has monopolized their mental horizons. The economists are the idiots savants of our time.

- Evil Ethics — Saturday Morning Breakfast Cereal by Zach Weinersmith:

-

On the Ridiculous Notion that the Federal Reserve is a Private Bank and Concerning Those Persons Who Peddle the Nonsense – My Final Words on the Subject — Ellis Winningham:

By perpetuating mindless, ridiculous notions concerning the Federal Reserve that a six year old child can make up in his or her mind, you are obstructing progress; you are preventing federal deficit spending for full employment and the public purpose; you are helping to move GDP to capital; you are leaving people homeless in sub-zero weather; you are perpetuating poverty and hunger; you are keeping us idle while the climate declines; you are killing people by refusing to ask questions, listen and learn, and instead, preferring to live a life of pretense. A lack of an overall education, or a lack of education in monetary theory and macroeconomics is no excuse for making up explanations that you are able to understand.

Sunday, 28 May 2017 - 4:23pm

This week, I have given up on education and resumed reading. Yay!:

- The reporting of market ups and downs is not really a joke — Simon Wren-Lewis:

Companies pay market researchers tons of money to find out why people do or do not buy their products, so the idea that an individual can know why the market moves within hours of it moving is just nonsense. Yet day after day we see City economists telling us just this. They hardly ever express any doubt or uncertainty. They know if they did the media would regard that as boring, and choose someone else next time.

- Victoria’s poor quality houses could become solar ovens ‘cooking’ people inside — Kirsten Robb in Domain on the kind of crappy housing I've been living in for the last twenty years:

The problem is the industry is geared towards a developer’s bottom line, experts such as RMIT planning professor Michael Buxton and the Alternative Technology Association’s Damien Moyse say. Many new builds did not consider sun orientation, eaves or shading, and featured large amounts of glass and energy-guzzling appliances. Basic insulation, a concrete slab and double glazing had been enough to get most designs over the line, RMIT adjunct professor Alan Pears said. “You get a situation where a house with unshaded glass, facing a silly directions can qualify for six stars … but when the sun shines in, the insulation traps the heat,” Professor Pears said. “Over a series of hot days, it builds up. What you create is a solar oven, with people cooking inside.”

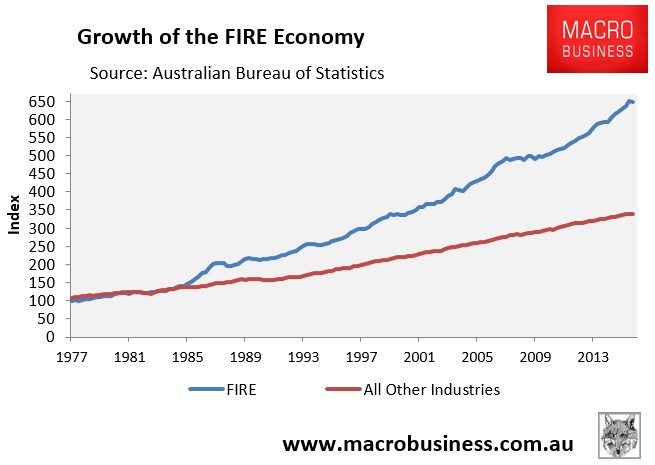

- FIRE sector vampire continues to suck economy dry — Leith van Onselen at MacroBusiness provides your chart porn for the week:

Since financial markets were first deregulated in the mid-1980s, the FIRE sector has grown at roughly twice the pace of the rest of the economy, sucking the life out of the productive sector:

- Advocating for CC BY — David Wiley:

No one knows what the NC license condition means, including Creative Commons. The license language is so vague that the only way to determine definitively whether a use is commercial or not is to go to court and have a judge decide. For would-be users of NC content, this means never knowing what you can and can’t do. Example – I want to use some NC-licensed content in my course, but students can only attend my course if they pay tuition. Is that a commercial use? Some people think it is. Who knows?

- Austerity is the enemy of our grandchildren as public infrastructure degrades — Bill Mitchell:

The cuts in growth of public investment will resonate for generations to come and be realised in lower material standards of living and lower productivity growth. We really are a stupid people for tolerating this idiocy. And before I stop – I don’t want to ever hear the argument again – that governments should borrow now because “debt is also still very cheap” or that “the credit ratings agencies may not downgrade the government’s rating if the extra debt is being used for productive infrastructure, as opposed to recurrent spending on social welfare or public sector wages.” Please. On both counts. What the credit rating agencies do is irrelevant to the Australian government. In fact, I would just outlaw their operations within our national borders and clear up office space for more useful activities. What is not irrelevant is the growth in public infrastructure. It is our legacy to our grandchildren.