Sunday, 25 June 2017 - 7:29pm

This week, I have been mostly reading:

- The Philistine Factory — Stuart Whatley in the baffler:

One plank in the Republican education-policy platform is student-loan privatization, even though most economists doubt that “liberalizing” this market would do any good. If private banks are brought into the process of granting student loans, they will have an incentive to favor certain academic majors over others. Any course of study that does not promise easy employment and a high salary after graduation will be denied financing, or treated as a subprime, punitively high-interest loan. This will, no doubt, have the desired effect of homogenizing the future labor force to fit American corporations’ standardized needs. As it happens, the Democrats’ ultimate goal for education in recent years has amounted to the same thing. To the extent that Hillary Clinton offered specific education policy proposals in the 2016 election, she did so only in the context of boosting workforce competence and productivity. The sole purpose of education, apparently, is to enable “young people from everywhere . . . to be prepared to compete for those jobs.”

- Centrelink’s Data-Matching Fiasco — Gerard McPhee in Arena:

[…] ministers want to reduce Centrelink expenditure and have a deep-seated suspicion about a class of people ‘rorting the system’. The factual basis of that suspicion is not critical here. What is critical is that Cabinet has a predisposition to support any additional method to detect imagined ‘rorters’ or ‘undeserving’ poor people, and will do so at a policy level, not considering the consequences of added complexity or transactional volume to the systems it will call on.

- Ten points for Democracy Activists — George Lakoff:

Know the difference between framing and propaganda: Frames are mental structures used in thought; every thought uses frames. Every word in every language is defined relative to a mental structure — a frame. Frames, in themselves, are unavoidable and neutral. Honest framing is the use of frames you believe and that are used to express truths. Propaganda expresses lies that propagandists know are lies for the sake of political or social advantage.

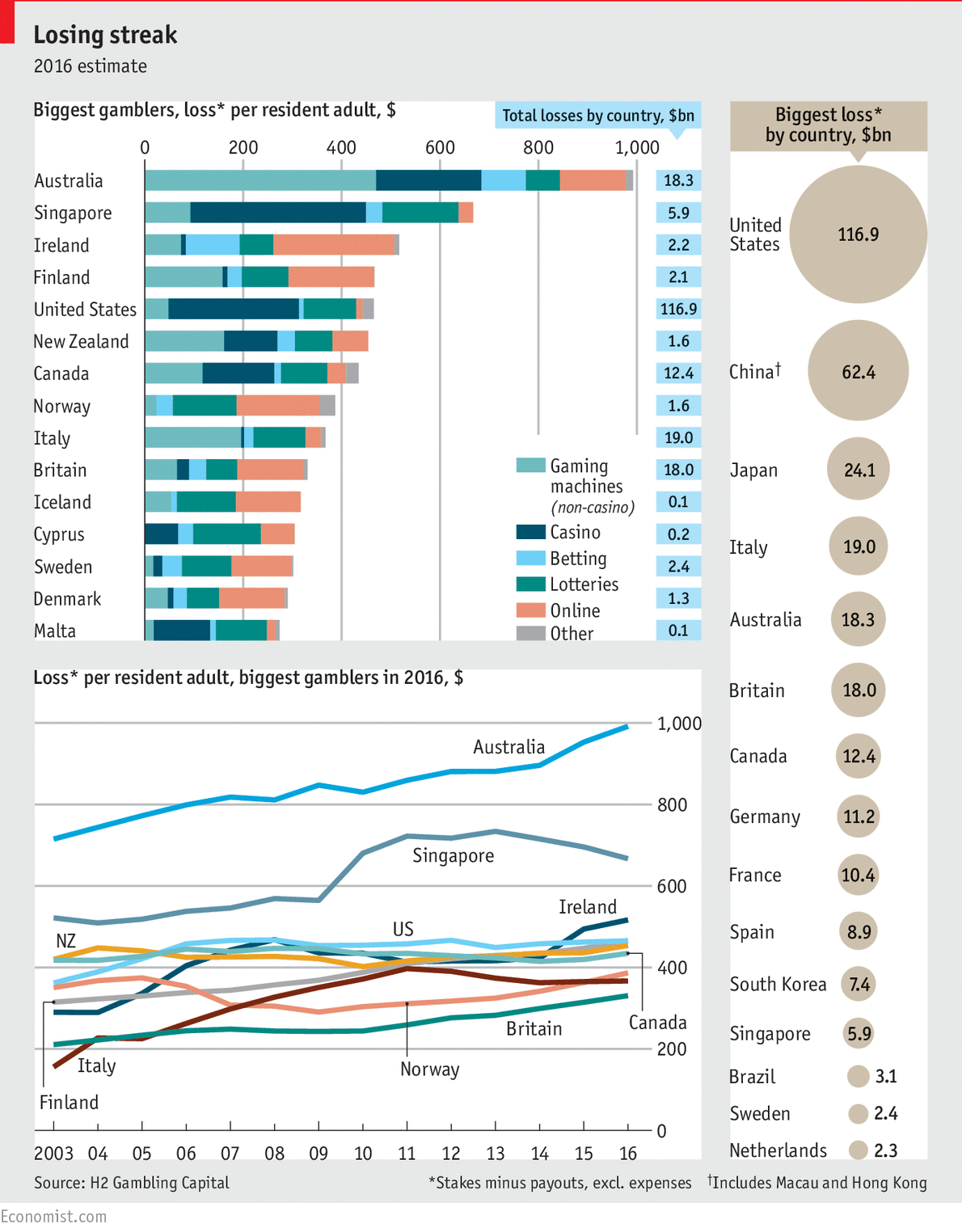

- The world’s biggest gamblers — your chart porn for the week from the Economist:

To the general public, Australia hardly leaps to mind as a gambling hotbed. Yet industry insiders know it is far and away their most lucrative market: according to H2 Gambling Capital (H2G), a consultancy, betting losses per resident adult there amounted to $990 last year. That is 40% higher than Singapore, the runner-up, and around double the average in other Western countries. The most popular form of gaming in Australia is on ubiquitous electronic poker machines, or “pokies”, which are more prevalent there than anywhere else. Although the devices are legal in many other markets, bet sizes are usually capped at modest levels. By contrast, in Australia, which began to deregulate the industry in the 1980s, punters can lose as much as $1,150 an hour.

- “Tulip bubble” Murray shakes snoring APRA — David Llewellyn-Smith in MacroBusiness:

Switzer: “How vulnerable do you think our banks are to the apartment oversupply?” David Murray: “Well, the economy’s vulnerable because there’s a bubble in the housing market. All the signs of a bubble are there. Many of the signs are the same as the bubble in Dutch Tulips… People’s behaviour, people’s defensiveness about any correct in that market. All those signs are there. Now, if the economy tracks along OK, it might turn out that this thing sorts itself out. But when those risks are there, something needs to be done about it in a regulatory sense and the RBA and APRA need to stay on it”…

- What in the Heck Is “Money Printing,” Anyway? — Steve Roth at Evonomics has an interesting piece that packs a lot into a small word count. However I think it falls down by failing to distinguish between government-backed financial assets and real assets. Yes, when the dollar-denominated valuation of stock market or real estate assets goes up, we can say in one sense that private sector asset values have increased, but if everyone were to try to cash in at once those valuations would suddenly change drastically. On the other hand, for government-backed cash, central bank reserves, bonds, and private sector bank credits, a dollar is a dollar is a dollar — at least as far as extinguishing tax liabilities is concerned. For any other definition of "value", see a philosopher, not an economist.

- Universal Basic Income Accelerates Innovation by Reducing Our Fear of Failure — Scott Santens at Medium from an enthusiastically pro-market perspective, makes an argument that generalises to we socialist fuddy-duddies:

For decades now our economy has been going through some very significant changes thanks to advancements in technology, and we have simultaneously been actively eroding the institutions that pooled risk like trade unions and our public safety net. Incomes adjusted for inflation have not budged for decades, and the jobs providing those incomes have gone from secure careers to insecure jobs, part-time and contract work, and now recently even gig labor in the sharing economy. Decreasing economic security means a population decreasingly likely to take risks. Looking at it this way, of course startups have been on the decline. How can you take the leap of faith required for a startup when you’re more and more worried about just being able to pay the rent?

- Listen up, Scott Morrison. It's time to bust the myth of the budget surplus — Warwick Smith brings MMT to the Guardian:

Private sector debt in Australia is currently about 210% of GDP, compared to government debt of about 30%. What Scott Morrison needs to explain to the Australian people is why he’s so keen to increase the private debt they hold over their homes and businesses when it’s already so high.

- We showed I, Daniel Blake to people living with the benefits system: here’s how they reacted — Stephanie Petrie in the Conversation:

During our screening, we were told that assessments often ignored significant health conditions. One profoundly deaf woman was informed: "In your application form for ESA you stated that following an illness when you were a child, you are now profoundly deaf. After your assessment I tried to contact you to discuss your assessment. I telephoned you several times, but you did not answer, therefore I left you a voicemail. You still did not respond. I have therefore found you fit for work."

- How will we get over the Trump addiction? — Robert Fisk in the Independent:

Not long after the Lebanese civil war ended more than a quarter of a century ago, I found my landlord in a depressed mood. He had suffered in the fifteen years of war – part of his family had been “cleansed” from their home in east Beirut – but peace had returned to the ruins of the city, the Mediterranean sloshed opposite our apartment block and in front of the little candy store he ran on the Corniche. What on earth could be the matter? “It’s so boring, Mr Robert,” he confessed to me one bright morning.

- #ProtectTheTruth — George Lakoff:

When President Richard Nixon addressed the country during Watergate and used the phrase “I am not a crook,” he coupled his image with that of a crook. He established what he was denying by repeating his opponents’ message. This illustrates a key principle of framing: avoid the language of the attacker because it evokes their frame and helps make their case.

- Why Australia’s rental system needs reform — Leith van Onselen, MacroBusiness:

One of the great strengths of the German housing market is that it provides strong protections for tenants. […] because renting is the dominant housing choice in Germany (see below chart), the political system is highly sensitive to tenants’ rights and perceived threats to the status quo typically receive prominent media attention and political responses. Also, because renters enjoy secure tenure (and housing supply is fairly responsive), Germans have little incentive to rush into owner occupation. As such, Germany doesn’t suffer from the ‘panic buying’ and speculation often present in bubble housing markets, like Australia’s.