Sunday, 3 September 2017 - 6:28pm

This week, I have been mostly reading:

- Review of Steve Keen’s “Can we avoid another financial crisis?” — Michael Hudson:

Mainstream models are unable to forecast or explain a depression. That is because depressions are essentially financial in character. The business cycle itself is a financial cycle – that is, a cycle of the buildup and collapse of debt. Keen’s “Minsky” model traces this to what he has called “endogenous money creation,” that is, bank credit mainly to buyers of real estate, companies and other assets. He recently suggested a more catchy moniker: “Bank Originated Money and Debt” (BOMD). That seems easier to remember.

- Education Can’t Fix Poverty. So Why Keep Insisting that It Can? — Jennifer Berkshire interviews Harvey Kantor in the Have You Heard blog:

One of the consequences of making education so central to social policy has been that we’ve ended up taking the pressure off of the state for the kinds of policies that would be more effective at addressing poverty and economic inequality. Instead we’re asking education to do things it can’t possibly do. The result has been increasing support for the kinds of market-oriented policies that make inequality worse.

- Three radical ideas to transform the post-crisis economy — Martin Sanbu in the AFR:

If private management of the money supply is a recipe for instability, the radical alternative is to nationalise the money supply. This is do-able today: central banks can offer accounts to all members of the public (or make central bank reserves available to everyone). Banks could be restricted to allocating existing savings to investments, rather than creating new credit. Another imperative is that of economic security. Previous radicals created safety nets where none existed. Today we have ample welfare states, but they still leave large groups in precarious conditions. Sometimes they trap them there, as generous benefits for low earners are withdrawn with rising incomes, creating prohibitive effective marginal tax rates for the modestly paid. The radical solution is a universal basic income, the proposal to pay an unconditional benefit to all citizens, financed by tax rises. The idea is rediscovered by every other generation; the time to put it into practice may now have come.

- Can Trump Deliver on Growth? — James K. Galbraith in Dissent Magazine:

As things stand, the financial sector neither serves a public purpose nor does it deliver the growth it once did, until it broke down nine years ago. While there are people who feel obliged to borrow, and there will always be new generations of suckers, boom-and-bust banking credit isn’t a viable model for growth any more. What should be done about the banks? These are institutions with high fixed costs and with technologies and transnational legal structures that are designed to facilitate tax evasion and regulatory arbitrage. They face very limited prospects for sustained profitability in activities that correspond to social need. Their entire structure isn’t viable in a world of slow growth, except by fostering short-lived booms (of which the shale rush was the most recent example), followed by busts and bailouts. In short, the financial sector as a whole is a luxury we cannot afford.

- Savings are an Export Product — Neil Wilson:

Foreign entities are holding your currency as savings. Similarly, financial products denominated in your currency are held as savings. Savings are, in effect, an export product of your currency area. Once you look at it this way, then savings are very similar to a barrel of oil in stock, or an aircraft engine. If your country relies upon oil exports and people stop wanting oil then you may have a problem. If you rely on aircraft engine exports and there are no orders for new aircraft, you may have a problem. If you rely upon people taking your savings (because they had an export-led policy — which implies a savings-import policy) and that changes (the export-led policy moves to a domestic-led policy, as we’re starting to see in China) then you may have a problem.

- The University Does Not Think — Simon Cooper in Arena:

If we look at the various levels of university activity, from undergraduate teaching to academic research, to the relationship between the university and the wider social realm, it becomes quickly apparent how the university has been captured by instrumental logic since the expansion of the system in the 1980s. The increasing dominance of knowledge as a commodity (as opposed to other modalities of knowledge—critique, interpretation, wisdom and so forth) has played out across various domains. Starting with undergraduate education, we can see how the introduction of fees and debt systems creates a shift around the meaning of education towards a more narrowly instrumental one for both the student and the institution. As G. L. Williams remarks, ‘students have been metamorphosed from apprentices into customers and their teachers from master craftsmen to merchants’. University education as vocational training has become an increasingly central way of framing the student’s relation to knowledge, with a consequent decline in less ‘market-friendly’ subjects. The atrophy of the pure sciences, philosophy, social theory, literature etc. within many tertiary institutions is well established. In some cases, humanities departments have closed, replaced by ‘creative industries’ centres whose rationale is to marketise skills generated by an applied-humanities model, discarding all others.

- The Rock-Star Appeal of Modern Monetary Theory — Atossa Araxia Abrahamian at the Nation:

According to this small but increasingly vocal cohort of economists, including Bernie Sanders’s former chief economic adviser, once we change the way we think about money, we can provide for everyone: We don’t have to “find” the money to “pay” for universal health care by “cutting” the budget elsewhere. In fact, our government already works that way: Spending must precede taxation, or there would be no dollars in the economy to tax. It’s the political will to spend on certain things, not the money to afford it, that’s lacking.

- Immiseration Revisited: The four phases of working time — Sandwichman at Angry Bear:

The four phases of working time can be labeled cooperation, exploitation, immiseration and ruin. The incentive for employers is to progress inexorably toward the last phase unless regulated by legislation or collective bargaining.[…] In conclusion, yes, there is a neo-classical immiseration theory. The economists who propounded it apparently were unaware that it was such a theory. By extension, that immiseration theory is a crisis theory. There is no built-in mechanism of negative feedback from prices that militates against the passage from the immiseration phase to the ruin phase. Hicks assumed that a “very moderate degree of rationality on the part of employers will thus lead them to reduce hours to the output optimum as soon as Trade Unionism has to be reckoned with at all seriously [emphasis added].” But by the time exploitation has progressed to the immiseration phase, trade unionism doesn’t have to be “reckoned with at all seriously” by employers.

- What is human capital? — Peter Fleming in Aeon Essays:

Friedman had discovered in human capital theory more than just a means for boosting economic growth. The very way it conceptualised human beings was an ideological weapon too, especially when it came to counteracting the labour-centric discourse of communism, both outside and inside the US. For doesn’t human capital theory provide the ultimate conservative retort to the Marxist slogan that workers should seize the means of production? If each person is already his own means of production, then the presumed conflict at the heart of the capitalist labour process logically dissolves. Schultz too was starting to see the light, and agreed that workers might actually be de facto capitalists: ‘labourers have become capitalists not from the diffusion of the ownership of corporation stocks, as folk law would have it, but from the acquisition of knowledge and skill that have economic value.’

Sunday, 27 August 2017 - 5:42pm

This week, I have been mostly reading:

- Copyright Agency diverts funds meant for authors to $15m fighting fund — Peter Martin, in the Sydney Morning Herald, via Pirate Party Australia:

The Copyright Agency is the only body authorised to collect copyright fees from schools and universities on behalf of authors, illustrators, artists, photographers and publishers whose work is copied. It has been criticised in a Productivity Commission review that is before the government over the transparency of its accounts and its practice of retaining, rather than returning, millions of dollars collected from schools and universities on behalf of the owners of "orphan works" who can't be traced. […] An examination of its accounts shows that in a change not disclosed to the commission or to its members in annual reports, since 2013 it has been channelling that income into a fund set up to campaign against changes to the copyright law.

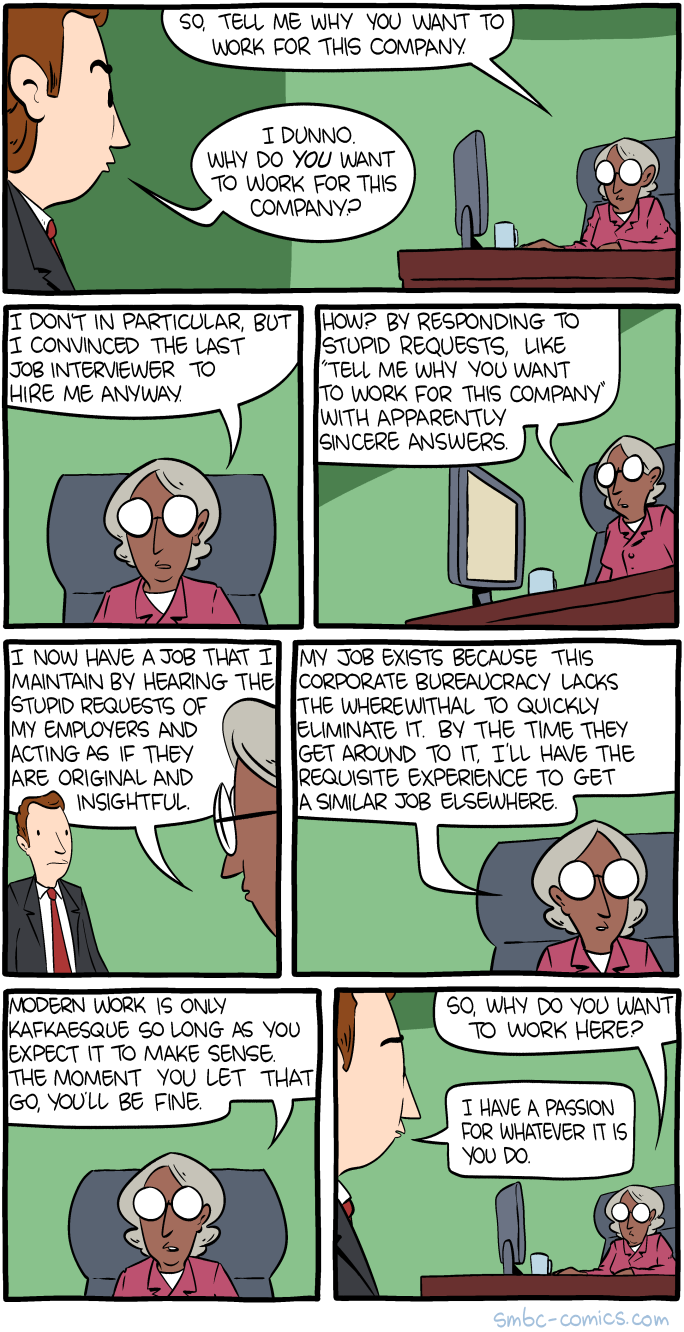

- Why do you want to work here? — Saturday Morning Breakfast Cereal by Zach Weinersmith:

- You're probably confused about your media usage rights, and media companies are ok with that — Zak Rogoff at Defective by Design:

When people buy an ebook, do they expect to be able to read it for the rest of their lives? How about the ability to make a backup copy of a movie before their hard drive breaks? For most digital media purchases, these reasonable activities are prevented by DRM (Digital Restrictions Management), but it appears the vast majority of customers don't know it.

- Economics 101 for the NYT: Unauthorized Copies Are Not Necessarily "Counterfeits" — Dean Baker:

For an item to be counterfeit, the buyer must be deceived. […] consumers who knowingly buy unauthorized copies of major brands are benefiting from the opportunity to buy the copy at a lower cost than the brand product. They presumably are willing to trust the quality of the product produced by the knock-off manufacturer, given the savings.

- Obama to Hillary: Here’s How You Sell Out — Ted Rall:

- Why 'A Domain of One's Own' Matters (For the Future of Knowledge) — Audrey Watters:

I’m pretty resistant to framing “domains” as simply a matter of “skills.” Because I think its potential is far more radical than that. This isn’t about making sure literature students “learn to code” or history students “learn to code” or medical faculty “learn to code” or chemistry faculty “learn to code.” Rather it’s about recognizing that the World Wide Web is site for scholarly activity. It’s about recognizing that students are scholars.

Strange bedfellows

Via MacroBusiness, here's the TL;DR of the Business Council of Australia's submission to a 2012 Senate inquiry into social security allowances:

- "The rate of the Newstart Allowance for jobseekers no longer meets a reasonable community standard of adequacy and may now be so low as to represent a barrier to employment.

- "Reforming Newstart should be part of a more comprehensive review to ensure that the interaction between Australia’s welfare and taxation systems provides incentives for people to participate where they can in the workforce, while ensuring that income support is adequate and targeted to those in greatest need.

- "As well as improving the adequacy of Newstart payments, employment assistance programs must also be reformed to support the successful transition to work of the most disadvantaged jobseekers."

Not only did the BCA's confederacy of Scrooges suffer unaccustomed pangs of sympathy, the Liberal Party senator chairing the inquiry also agreed that Newstart is excessively miserly. However, he failed to recommend raising the allowance, saying:

"There is no doubt the evidence we received was compelling. Nobody want's [sic] to see a circumstance in which a family isn't able to feed its children, no one wants to see that in Australia. But we can't fund these things by running up debt."

Sigh. (Here we go…) There is no need to "fund these things", whether it be by "running up debt" or any other means. The Federal Government creates money when it spends. We, as a country, run out of the capacity to feed our children when we run out of food. We cannot run out of dollars, since we can create the dollars without limit.

The government does however, at the moment, have a purely voluntary policy of matching, dollar-for-dollar, all spending with government bond sales. There's no good reason for this; as Bill Mitchell says, it's just corporate welfare. Even so, selling bonds is not issuing new debt. Bonds are purchased with RBA credits (or "reserves", if you prefer). The purchasing institution simply swaps a non-interest-bearing asset (reserves) at the RBA for an interest-bearing one (bonds), still at the RBA. It's just like transferring some money from a savings account to a higher-interest term deposit account at a commercial bank; do we say that this is a lending operation? Of course not.

There is no fiscal reason why the government should punish the unemployed to the extent that they become an unemployable underclass. Even if we are generous and assume the good senator and his colleagues on the inquiry are just ignorant about how the economy works, we are still bound to conclude that there must be some (not so ignorant) people in government, who do want to see people suffering for no just reason.

Sunday, 20 August 2017 - 6:42pm

This week, I have been mostly reading:

- Actually, Germany Can Do Something About Its Trade Surplus — Dean Baker:

If Germany were prepared to run more expansionary fiscal policy and allow its inflation rate to rise somewhat then it could have more balanced trade, meaning that it would be getting something in exchange for its exports. However, Germany's political leaders would apparently prefer to give things away to its trading partners in order to feel virtuous about balanced budgets and low inflation. The price for this "virtue" in much of the rest of the euro zone is slow growth, stagnating wages, and mass unemployment.

- The Democratic Party’s Anti-Bernie Elites Have a Huge Stake in Blaming Russia — Norman Solomon:

After Hillary Clinton’s devastating loss nearly six months ago, her most powerful Democratic allies feared losing control of the party. Efforts to lip-synch economic populism while remaining closely tied to Wall Street had led to a catastrophic defeat. […] In short, the Democratic Party’s anti-Bernie establishment needed to reframe the discourse in a hurry. And -- in tandem with mass media -- it did. The reframing could be summed up in two words: Blame Russia.

- Making Sense of the Deportation Debate — Aviva Chomsky in TomDispach:

A Washington Post scare headline typically read: “ICE Immigration Arrests of Noncriminals Double Under Trump.” While accurate, it was nonetheless misleading. Non-criminal immigration arrests did indeed jump from 2,500 in the first three months of 2016 to 5,500 during the same period in 2017, while criminal arrests also rose, bringing the total to 21,000. Only 16,000 were arrested during the same months in 2016. The article, however, ignores the fact that 2016 was the all-time low year for arrests under President Obama. In the first three months of 2014, for example, 29,000 were arrested, far more than Trump’s three-month “record.”

- Cyber.Hospital — VectorBelly:

Sunday, 13 August 2017 - 7:08pm

This week, I have been mostly reading:

- Toronto Housing Bubble Pops. “Genuine Fear” of Price Collapse — Wolf Richter:

“Clearly, the year-over-year decline we experienced in July had more to do with psychology, with would-be home buyers on the sidelines waiting to see how market conditions evolve,” said [Toronto Real Estate Board] President Tim Syrianos. Alas “psychology” is precisely what causes house price bubbles – not fundamentals, such as 2.3% annual wage increases. And when that “psychology” turns, it pricks those bubbles.

- Housing bubble is now official, commence arse-covering (panic)! — Matt Ellis:

We look to be approaching the final panic stages of the last blow off in this epic bubble, as the kitchen sink is thrown at the market in a desperate attempt to avoid the inevitable. But it will only do further damage, and ultimately prove futile. This is the cost that we all have to pay for those beloved property prices – that illusory “wealth effect” that simply amounts to a pile of household debt as large as the difference between the total nominal value and the total fair value of the housing market.

-

Explainer: shadow banking and where it came from — Huon Curtis in the Conversation:

Australia can’t do much to remedy global uncertainty. However, policies it pursues do link into shadow banking practices in multiple ways. Policies that erode the standard employment relation and cut pay rates increase consumer demand for short-term credit products. This increases private debt for consumers, but feeds its attractiveness into an asset class for institutional investors.

- I See What Google Did There… — Adam Croom:

Today Google announced what is, again, a fun and intriguing tool called AutoDraw. You draw some squiggly lines and it uses AI to guess what you meant to draw. […] Does Google really want to improve drawing everywhere? Did Google find a specific weakness within the human race and thus felt compelled to solve a world problem? Or is Google creating a product that meets a market need of designers who need quick icons? Nah, none of those. Does it want to improve machine learning? Hell yes it does.

- British Labour has to break out of the neo-liberal ‘cost’ framing trap — Bill Mitchell:

Statements such as the ‘nation cannot afford the cost of some program’ are never made when the military goes crazy and launches millions of dollars of missiles to be blasted off in the dark of the night. But when it comes to public health systems or the nutritional requirements of our children, the neo-liberals have their calculators out toting up the dollars. However, the actual cost of a government program is the change it causes in the usage of real resources. When we ask whether the nation can afford a policy initiative, we should ignore the $x and consider what real resources are available and the potential benefits. The available real resources constitute the fiscal space. The fiscal space should then always be related to the purposes to which we aspire, and the destination we wish to reach. British Labour needs to learn those basics fast and to break out of the neo-liberal ‘cost’ framing it is trapped within.

- With or without edtech — Jonathan Rees:

Can you live without edtech? [You just knew I had to get around to edtech here eventually, right?] Shockingly enough, there were actually good schools in the United States long before Bill Clinton and Al Gore decided to put a computer in every classroom. Plenty of teachers and professors offer great classes of all kinds without anything more sophisticated than their voices and a chalkboard. Weirdly enough, just this morning, right after I read that article, I was pitching our dean on starting a digital humanities program in our college. “What about the professors who don’t want to use technology?,” he asked me. I said I would never in a million years force any teacher to use technology if they don’t want to, but it’s a actually a good thing if students have a wide range of classes in which they can enroll, some of which use educational technology and some of which don’t.

Sunday, 6 August 2017 - 7:53pm

This week, I have been writing a short essay rather than reading, which in practice means mostly playing Aisleriot:

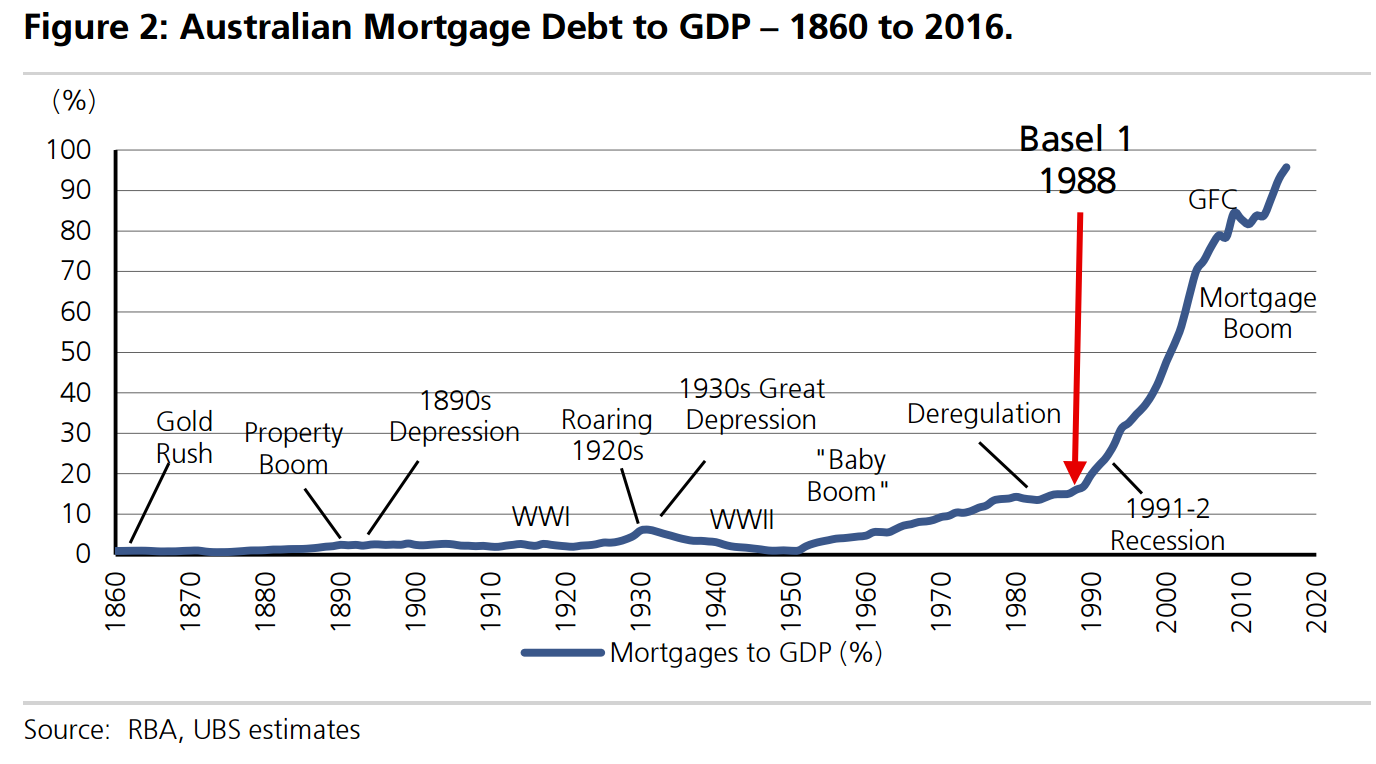

- The terrifying 157 year history of Australian mortgages — UBS via David Llewellyn-Smith of MacroBusiness provides your vertiginously nauseating chart porn of the week:

- 'Education Technology's Completely Over' — Audrey Watters:

Students often find themselves uploading their content – their creative work – into the learning management system (the VLE). Perhaps they retain a copy of the file on their computer; but with learning analytics and plagiarism detection software, they still often find themselves having their data scanned and monetized, often without their knowledge or consent. So I want us to think about the ways in which students and scholars, like Prince, find themselves without control over their creative work, find themselves signing away their rights to their data, their identity, their future. We sign these rights away all the time. We compel students to do so. We tell them that this is simply how the industry, the institution works.

- Neuroses — Saturday Morning Breakfast Cereal by Zach Weinersmith who I quote far too often here. After all, neither a borrower nor a lender be…:

Sunday, 30 July 2017 - 5:46pm

This week, I have been mostly reading:

- Meritocracy: the great delusion that ingrains inequality — Jo Littler:

When the word meritocracy made its first recorded appearance, in 1956 in the obscure British journal Socialist Commentary, it was a term of abuse, describing a ludicrously unequal state that surely no one would want to live in. Why, mused the industrial sociologist Alan Fox, would you want to give more prizes to the already prodigiously gifted? Instead, he argued, we should think about “cross-grading”: how to give those doing difficult or unattractive jobs more leisure time, and share out wealth more equitably so we all have a better quality of life and a happier society.

- ‘When I Was Your Age, We Used A Thing Called Cash’: And Other Ways to Fight Back Against The Banks — Warwick Smith in New Matilda:

We need to stop seeing housing as a way to accumulate wealth and start to see it as… well, housing. This is largely a government policy responsibility and not something we can do as individuals. However, as individuals we can claw back a little bit of control and cut out the banks as middle men by using cash when we spend. This is particularly useful for the small local businesses where we shop. It could be the difference between them surviving and going under – or being able to pay staff versus working 12 hour days themselves. Those staff could be your kids or your friends.

- Mortality Crisis Redux: The Economics of Despair — Pia Malaney, Institute for New Economic Thinking:

Case and Deaton estimate that the upturn in mortality rates in the US is starkly divergent from other developed countries, and accounts for 96,000 deaths that could have been avoided between 1996 and 2013. Their latest work delves deeper into the underlying causes of this decline. “Deaths of Despair” — by suicide, drug overdose or alcohol abuse — cannot be completely explained simply by stagnant or declining incomes. Income profiles for middle aged blacks and Hispanics look similar, without a corresponding rise in mortality. Rather, the authors posit, it can be traced to a “cumulative disadvantage over life”, where declining labor market opportunities have led to declining outcomes not just in the labor market but also in health, marriage, and child rearing. In other words, the stress accompanying the shock of downward mobility is likely driving this health crisis.

And: - America’s prison population is getting whiter — Keith Humphreys:

The 21st century has witnessed remarkable decay in the well-being of many non-Hispanic white Americans. In a new report, economists Anne Case and Angus Deaton document that non-Hispanic whites who have a high school education or less have experienced reduced life expectancy and increased rates of suicide and addiction. Recent correctional system data highlight another dimension of this population’s travails: they are increasingly spending time in jail.

- After 12 Rejections, Apple Accepts App That Tracks U.S. Drone Strikes — Josh Begley, the Intercept:

Smartphones have connected us more intimately to all sorts of data. As Amitava Kumar put it recently, “The internet delivers ugly fragments of report and rumor throughout the day, and with them a sense of nearly constant intimacy with violence.” Yet information about drone strikes — in Apple’s universe — had somehow been deemed beyond the pale.

- One weird trick for dealing with government-bashers — Jen Sorensen at Daily Kos:

- Oh, Jeremy Corbyn — Neil Wilson on Medium:

Student loans are not really loans. It’s just a list of people who are liable to a form of additional taxation after graduation. Even then it is only paid by those who managed to get a decentish job after graduation. Two thirds of the loans will likely be written off anyway. Scrapping tuition fees and the loan system is simply a tax cut for those who have bettered themselves and managed to get a reasonable job. Getting rid of the albatross around their necks and the necks of thousands, if not millions, of ex-students who were not quite so lucky in the jobs market will increase their capacity to spend in the economy. The resulting expansion and multiplier effect throughout the economy will absorb that spend via additional production and job expansion.

- The Top Ed-Tech Trends (Aren't 'Tech') — Audrey Watters:

In 2012, I chose “the platforming of education” as one of the “top ed-tech trends.” […] Platforms aim to centralize services and features and functionality so that you go nowhere else online. They aspire to be monopolies. Platforms enable and are enabled by APIs, by data collection and transference, by data analysis and data storage, by a marketplace of data (with users creating the data and users as the product). They’re silos, where all your actions can be tracked and monetized. In education, that’s the learning management system (the VLE) perhaps.

- Announcing Unpaywall: unlocking #openaccess versions of paywalled research articles as you browse — Heather Piwowar and Jason Priem of Impactstory, the team behind Unpaywall, on the LSE Impact Blog:

Today we’re launching a new tool to help people read research literature, instead of getting stuck behind paywalls. It’s an extension for Chrome and Firefox that links you to free full-text as you browse research articles. Hit a paywall? No problem: click the green tab and read it free! The extension is called Unpaywall, and it’s powered by an open index of more than ten million legally-uploaded, open access resources.

Sunday, 23 July 2017 - 6:54pm

This week, I have been mostly reading:

- Is the threat of a copyright lawsuit stifling music? — Chi Chi Izundu, BBC News:

According to forensic musicologist Peter Oxendale "everyone's concerned that inspiration can [now be interpreted as] a catalyst for infringement. "All of these companies are worried that if a track is referenced on another at all, there may be a claim being brought," he explains. Mr Oxendale says some artists are now having the requirement to name their influences written into contracts by their record labels - although he would not specify names.

- If your wallet is empty, you're part of the new majority — Peter Martin:

An astounding 30 per cent of us keep no cash whatsoever in the house, up from 25 per cent three years ago. If nothing else, it suggests incredible faith in banks. The Reserve Bank carries out the survey every three years. In November it gave 1500 people diaries and asked them to record every transaction for a week, more than 17000 transactions in total. In a telling irony it rewarded them with gift cards rather than cash.

- The Conversation About Basic Income is a Mess. Here’s How to Make Sense of It. — Charlie Young in Evonomics:

It’s unusual to argue wholeheartedly against representative government, taxation or universal suffrage, while it is common to disagree on which party should govern, whether taxes should be raised or cut, and particular elements of voting procedure. In the same way, we shouldn’t argue all-out for or against UBI but instead inspect the make-up of each approach to it – that’s where we can find not only meaningful debate, but also possibilities for working out what we might actually want.

- Infographic: the truth behind Centrelink’s waiting times — Wes Mountain, the Conversation:

We’ve created this graphic – based on new data from 2015-16 calls confirmed by the Department of Human Services – to explain what’s really going on when Centrelink says its wait time is under 16 minutes.

The last two major issues I had with Centrelink required four calls each (with a week between each call to give the wheels of bureaucracy a more-than-reasonable amount of time to turn) before I would call the issue "handled". Each call involved around two hours on hold. Sitting at the WWII-surplus phones in the local Centrelink office because I don't have a landline and can't afford to be on hold for that length of time on my mobile. - Real estate agents: let first home buyers raid their super — Leith van Onselen at MacroBusiness:

Sure, allowing an individual [First Home Buyer] to access their super to purchase a home probably would increase their chances of home ownership, since they would have a leg-up on other buyers. But if you allow all FHBs to access their super, this advantage diminishes, and the end result will be home prices being bid-up for no ‘affordability’ gain, with the added downside of having less funds available in retirement.

But on the other hand, if you can instruct your fund manager to cash out all your mortgage-backed assets it's a one-for-one risk swap. When the real estate bubble bursts you have the satisfaction of knowing all your losses were your losses. It's more personal. - The real reason Trump didn't want to shake hands with Merkel… — Gaius Publius at Digby's Hullabaloo:

- Wall Street First — Michael Hudson:

The straw that pushed voters over the edge was when [Hillary Clinton] asked voters, “Aren’t you better off today than you were eight years ago?” Who were they going to believe: their eyes, or Hillary’s? National income statistics showed that only the top 5 percent of the population were better off. All the growth in Gross Domestic Product (GDP) during Obama’s tenure went to them – the Donor Class that had gained control of the Democratic Party leadership.

Tuesday, 18 July 2017 - 3:23pm

I was just in the chemist shop, waiting for a prescription to be filled. I became aware of a customer behind me, asking an assistant if she had anything to help with insomnia. She said she was very, very stressed, and having trouble sleeping. I am not a psychologist (and in fairness nor was the shop assistant), but the lady was clearly not in a happy place, psychologically. So did the shop assistant at least suggest that the customer pop in to see her GP to find out if there was anything they might recommend?

Did she f***. She sold her some f***ing valerian pills!

It's like calling a crisis hotline and being told "It's probably nothing. Have you tried a nice cup of hot chocolate?"

It's bad enough that pharmacists are allowed to sell snake oil from the same shelves as real medicines. In a sane world any pharmacist caught doing this would be instantly deregistered. At the very least, staff should be instructed to err on the side of caution in the case of any ailment with a potential psychological component. The above conversation should have gone something more like this:

"Do you have anything for insomnia?"

"Yes, we do. This is a mild sedative. For anything stronger you'll need to see your doctor, which would be a good idea anyway if it's a persistent problem. And this here is a medieval folk remedy. Might do you some good. Might do you harm. No solid evidence either way. In fact I've no idea why we stock it. Given there's nothing to recommend it beyond uninformed heresay, you'd be a fool to try it."

Sunday, 16 July 2017 - 8:00pm

Can I propose that we resolve not to use the word "grow" as a dynamic verb? I don't see how our community will grow if we keep repelling potential new members with the vulgar demand that they grow our community.

It's really just a special case of the general injunction to urgently action the ensmallment of our businesspeak going forward, with a view to maximising the impactfulness capacity of our solution initiatives. I really can't put it any more plainly than that.