Sunday, 8 January 2017 - 3:03pm

This week, I have been plagued by self-doubt and mostly reading:

- Overt Monetary Financing – again — Bill Mitchell:

From the perspective of Modern Monetary Theory (MMT), a helicopter drop is equivalent to an increase in the fiscal deficit in the sense that new financial assets are created and the net worth of the non-government sector increases. It occurs when the government uses its currency-issuing capacity (linking treasury spending to central bank operations) without matching its deficit spending with debt-issues to the non-government sector. So the central bank adds some numbers to the treasury’s bank account to match its spending plans and in return may be given treasury bonds to an equivalent value. Instead of selling debt to the private sector, the treasury simply sells it to the central bank, which then creates new funds in return. This accounting smokescreen is, of course, unnecessary. The central bank doesn’t need the offsetting asset (government debt) given that it creates the currency ‘out of thin air’. So the swapping of public debt for account credits is just an accounting convention.

- We are not and never will be dependent on bond markets — Richard Murphy:

[…] no government need issue gilts at all. It has only been EU law that has required the UK to do so in recent years. It is that law which has prevented the government simply issuing new money instead at any time. […] far from investors doing the government a favour by investing in gilts the government does savers an enormous favour by letting them place funds on effective deposit at guaranteed fixed rates with the only deposit taker who will never default because they can always print more money to make sure that they will not do so. The government could, in effect, entirely avoid paying this interest but for the essential role that the government wants its bonds to play in certain key financial markets, such as the repo and pension sectors.

Sunday, 1 January 2017 - 4:56pm

This week, I have been mostly reading:

- Stand, Fight, Resist — Jason Griffey:

Neutrality favors the powerful, and further marginalizes the marginalized. In the face of the current political climate, with the use of opinions as bludgeons and disinformation as the weapon of choice for manipulation and intellectual coercion, it is up to those who value fact and believe in the care of those in need to stand up and positively affirm that to do otherwise is evil.

- Going down the drain, putting this wondrous stock market at risk? — Wolf Richter:

Companies in the S&P 500 spent about $3 trillion since 2011 to buy back their own shares, often with borrowed money. It’s part of a noble magic called financial engineering, the simplest way to goose the all-important metric of earnings per share (by lowering the number of shares outstanding). And it creates buying pressure in the stock market that drives up share prices. […] “Only” 362 of the S&P 500 companies bought back shares in Q3, the second lowest number in three years, with Q2 having been the lowest number (blue line in the chart below).

[And, not unrelated:] - Apple CEO Tim Cook Met With Trump to “Engage” on Gigantic Corporate Tax Cut — Jon Schwarz, the Intercept:

Cook first described how it was critical for Apple to “engage” with governments on what he called “our key areas of focus.” According to Cook, these include “privacy and security, education,” “advocating for human rights for everyone,” “the environment and really combating climate change” and “creating jobs” — i.e., nothing as mundane as money. But in the third paragraph, Cook acknowledged, “We have other things that are more business-centric — like tax reform.”

[And, tying it all together a few months ago:] - Standing up to Apple — Robert Reich:

Congress’s last tax amnesty occurred in 2004, when global U.S. corporations brought back about $300 billion from overseas, and paid just a tax rate of 5.25 percent rather than the regular 35 percent U.S. corporate rate. Corporate executives argued then – as they argue now – that the amnesty would allow them to reinvest those earnings in America. The argument was baloney then and it’s baloney now. A study by the National Bureau of Economic Research found that 92 percent of the repatriated cash was used to pay for dividends, share buybacks or executive bonuses.

- James Galbraith Tells Us What Everyone Needs to Know About Inequality — Polly Cleveland reviews - well, quotes from - Jamie's new book at the D&S Blog:

Galbraith adds a new insight: not only did the postwar high-tax regime induce corporations to keep executive pay in check, it also induced them to retain profits and reinvest them in the corporation. With the 1980’s “greed is good” transformation, rates of reinvestment slowed as executives started taking more for themselves—surely helping slow the overall rate of growth.

[i.e. for currency-issuing governments, the purpose of taxation isn't revenue-raising; it's about steering the economy toward desirable public policy ends.] - A Chat (Avec Chat) — Wondermark, by David Malki !:

Sunday, 25 December 2016 - 4:55pm

This week, I have been mostly reading:

- How Laissez-Faire Economics Led to Inequality and Recession — Jeff Madrick in the Huffington Post:

The Federal Reserve just named a new committee headed by vice chairman Stanly Fischer to research how unstable financial markets may affect the real economy of jobs, production, business investment and profits. If you read the 2008 minutes of the Federal Open Market Committee (released earlier this year), which meets roughly every six weeks to set interest rate and other policies, you’ll see that the policymakers and their staffs had little idea how to account for financial risk. Finance simply wasn’t in their economic models.

- “I don’t need your civil war.” — Jonathan Rees:

All us historians let out a loud sigh when we read that story about Republican Senator Ron Johnson wanting to replace us all with Ken Burns videos. It’s an incredibly stupid argument, of course, but it’s also sadly typical of everyone who has no idea what history professors actually do all day. […] Better to be the ones inserting the video cassette and administering the multiple choice test after the tape ends than not to have any job at all.

- Facebook recommended that this psychiatrist’s patients friend each other — Kashmir Hill, Fusion:

She hadn’t friended any of her patients on Facebook, nor looked up their profiles. She didn’t have a guest wifi network at the office that they were all using. After seeing my report that Facebook was using location from people’s smartphones to make friend recommendations, she was convinced this happened because she had logged into Facebook at the office on her personal computer. She thought that Facebook had figured out that she and her patients were all in the same place repeatedly. However, Facebook says it only briefly used location for friend recommendations in a test and that it was just “at the city-level.”

- Where’s your data? It’s not actually in the cloud, it’s sitting in a data centre — Brett Neilson, Ned Rossiter, and Tanya Notley of Western Sydney University in the Conversation:

Governments spend a great deal of resources safeguarding critical infrastructure. The protection of data and information systems is now included in this work. However, the focus for data security is on the development of software, as though we have forgotten that data storage happens in real places on the ground – and not in “virtual” clouds. Not knowing where data centres are located, or indeed what they actually do, prevents us from having conversations about how this infrastructure is governed, supported and protected.

Sunday, 25 December 2016 - 12:51am

Great. Sleigh-people entering our homeland, radicalising our young with their degenerate something-for-nothing culture.

When I was young, our parents would crucify us at Easter - not all the way of course, and we'd had our tetanus jabs. But that principal of making an investment of excruciating pain, and often permanent maiming, to earn the right to eventual Christmas gifts of subscriptions to the Economist or the Financial Times, made us all appreciate the exchange value of our personal misery.

It's time to turn back the sleighs, and crack down on the Christmas cheats. Those children need to know that they enter the world in debt, and must spend an otherwise meaningless lifetime paying it back. That is the economically sustainable Christmas message.

Sunday, 18 December 2016 - 6:32pm

This last few weeks, I have been mostly going mad, and reading:

- Ageing out of drugs — Stacey McKenna in Aeon:

So, what have we learned so far from those who age out of drug use? When people talk about the life cycle leading to natural recovery, numerous factors are at play. For many, it’s a simple case of ‘being sick and tired of being sick and tired’. […] Though this is the path that’s most common among people who have tried or even become addicted to drugs, it’s the one least discussed. But careful scrutiny of ageing out – both why people do and why they don’t – tells us a lot about drug dependence and what to do about it. […] The so-called unbreakable cycle of addiction appears to result from inequity – from poverty, from discrimination, from social and economic oppression.

- Did Money Eat Our Brains? — Steve Roth at Evonomics:

After growing rapidly for a couple of million years, doubling from roughly 750 to 1,500 cubic centimeters, human brains have shrunk by about ten percent over just ten or twenty millennia. (So they’ve been getting smaller maybe twenty times faster than they got bigger.) Imagine taking an ice cream scoop out of your brain. That’s about the size of it.

- Why America’s MOOC pioneers have abandoned ship — Jonathan Rees:

The most obvious reason why everyone from the founders of MOOC companies to students who sign up for such course are abandoning MOOCs is because these kinds of courses have not lived up to their initial hype. MOOCs were supposed to transform education as we know it, but traditional education with its inefficiency derived from the close proximity between professors and their students has proved more resilient than its wannabe disruptors ever imagined.

- S&P warns on NZ house prices. What about Oz? — Leith van Onselen at MacroBusiness provides your terminally ill economy chart porn of the week:

- Podcast Out — David A. Banks in the New Inquiry is onto something:

The invisible forces that control human behavior, as it turns out, are not sociological or even cultural; the answers to life’s most important questions are invariably cognitive, biological, or evolutionarily determined. Topics that might have once been subject to political debate or rhetorical argument–work demands, exposure to toxins, surveillance, the limits of love, even Marxian alienation–become apolitical subjects for scientific testing. But the results only lead to greater and greater complexity, prompting introspective thought rather than action. Thus, liberal infotainment is full of statements that sound like facts–what social media theorist Nathan Jurgenson calls “factiness”–that do nothing more than reinforce and rationalize the listeners’ already formed common sense, rather than transforming it: what you believed to be true before the show started was not wrong, it just lacked the veneer of factiness.

Monday, 12 December 2016 - 6:29pm

Airport a leading regional air hub

COFFS Harbour Regional Airport has reached another significant milestone.

Funny. I was there just yesterday thinking "This place is a hub. A total, complete, and utter regional hub." I suppose I was being processed at the time, though I couldn't tell if it was during a peak period. I expect it's tricky identifying a peak in a subdued environment. Are there any particular signs we should look out for?

I'm glad there was a specific strategy involving the development of detailed proposals and extensive negotiations, resulting in outcomes. I have just a few trifling details that could perhaps be cleared up: what was done, by whom, and what were the consequences?

Also welcome are the current works that will be completed, but I think some future works may also be in order. I'm no expert, but I don't like the sound of projecting growths. Sound like precisely the sort of thing you don't want, especially in a peak period. Could have somebody's eye out. Or trip up a small boy, resulting in a grazed knee, miles from the nearest bottle of Dettol. Mind you, he might be consoled by the splendid parking facilities, so it's not all bad news.

Monday, 12 December 2016 - 9:24am

THOUSANDS of Australians are turning down jobs so they can live on Centrelink, as workers turn up their nose at physical jobs like picking fruit.

Some regions, including Coffs Harbour in New South Wales are even accused of having just as many on welfare as in actual employment, according to Human Services Minister Alan Tudge.

It's all very well to blame the disadvantaged for society's ills (for this is indeed important and valuable work), but where is the reward for the industrious journalist who put this piece together? There is no byline on this article! It must have taken literally minutes to copy and paste, then strip away any remaining scraps of relevant context. It's no surprise to anybody familiar with the Advocate that work of this quality constitutes an "editor's pick", so where is the recognition for its "author"?

I'm sure that everybody in our community who has ever had the pleasure of dealing with Centrelink will want to personally congratulate this hard-working sleuth for blowing apart popular misconceptions, and finally exposing the cushy ride that is the life of a welfare recipient.

In the face of this shining example of how much one can contribute to society through dogged diligence, a lot of our local idlers will today quit turning up their noses to instead hang their heads. You deserve the moral high ground Advocrats! We can all see exactly how hard you work!

Sunday, 4 December 2016 - 7:42pm

This image is from the photoblog of a fellow called Alan who kicked the bucket in 2008. Apparently he used to wander about Sydney photographing urban curios, which is a lovely way to spend one's twilight (or any other, for that matter) years. I don't know how I ended up at his posthumously-maintained website, but this building was a blast from the past.

The photo is a stitched (and distorted) panorama of a block of flats in Annandale, in the inner west of Sydney. When I knew it, the building was a "self storage" facility to whom my then-employer — a huge multinational corporation which I cannot name, rhyming with "Baltex Oil" — outsourced its old records archiving. We basically occupied two football-pitch-sized floors of the building which was, as Alan or the curators of his legacy note, originally a piano factory.

Access to our floors was via a wire cage manual elevator. As you'll see in old films from early last century, the controls in these things were limited to a lever which took the car up or down, and much satisfaction was to be had in succeding in drawing the floor of the car to within a centimeter or two of your destination floor.

My employer had a room there dedicated to old furniture judged too ostentatious for the 1990s. I suppose they thought efficiency and frugality was a passing fad, and these items would be needed again in the future. There were desks and cabinets that for all I know were rosewood or mahogany, and I kid you not an honest-to-goodness grand piano. Colleagues of a sufficiently advanced vintage told me that it originally graced the staff cafeteria.

Another little room held tubes of blueprints and a cabinet of index cards of retail outlets held by an Australian company which was in the 1970's (I think) subsumed into the multinational. My grandfather was one of the franchisees of that company, in the 1950s I think, after returning from Korea (where he was apparently the company barber, occasionally coming under heavy dandruff). I forget now, but I knew then, which suburb his particular outlet was in. I held the little photographic slide accompanying that index card up to the light, but there was no sign of him.

The really outstanding thing was the factory washbasin. It was a circular bath, about six feet in diameter, with a fountain maybe four foot high in the middle. Around and beneath the curved basin there was a rail you would press down on with your foot (think of the rail upon which you rest your foot at a pub bar), turning on the water which would sprinkle out in all directions around the perimeter of the bath. I wish I could find a video of this setup; I've seen it documented (I think in a music video — Trashcan Sinatras maybe?) but I've had no success in formulating the right search engine query. It's basically Taylorist hygeine; terrible for washing one pair of hands, but it gets one shift washed and out as efficiently as possible, and the next lot in. I just can't work out, in this elegant piece of engineering, where they kept the soap.

Then there was the proximity to the Annandale Hotel. Superbly ordinary decor and brilliantly indifferent staff (at the time; I'm sure it's since been gentrified), and I saw a killer gig there by Bughouse, a fantastic band who were unfortunate enough to be too late to be post-punk, and too early to be post-punk revival.

Also I'm reasonably certain that at this distance I can say, without fear of legal reprisal, that I may have on occasion left the office with two Cabcharge dockets, and not redeemed the second at the end of an afternoon's hard work swinging boxes of paper about, playing with the lift, indulging in a creepy fascination with decades-old corporate ephemera, et cetera. A spare Cabcharge docket is a useful thing if you have a lifestyle which may involve missing the last train home, or falling down a flight of stairs and being unable to limp to the train station.

So if you have a unit at 45 Trafalgar Street, would you consider taking in a lodger? I am at the moment bereft of funds, but I am a living link to the property's rich history. If the original elevator's still intact, I'm more than happy to work it. I got my margin of error down to millimetres. Millimetres! You can't buy that kind of expertise, but you can aquire it in exchange for a mad old hobo sleeping on your floor.

Sunday, 4 December 2016 - 4:19pm

This week, I have been mostly reading:

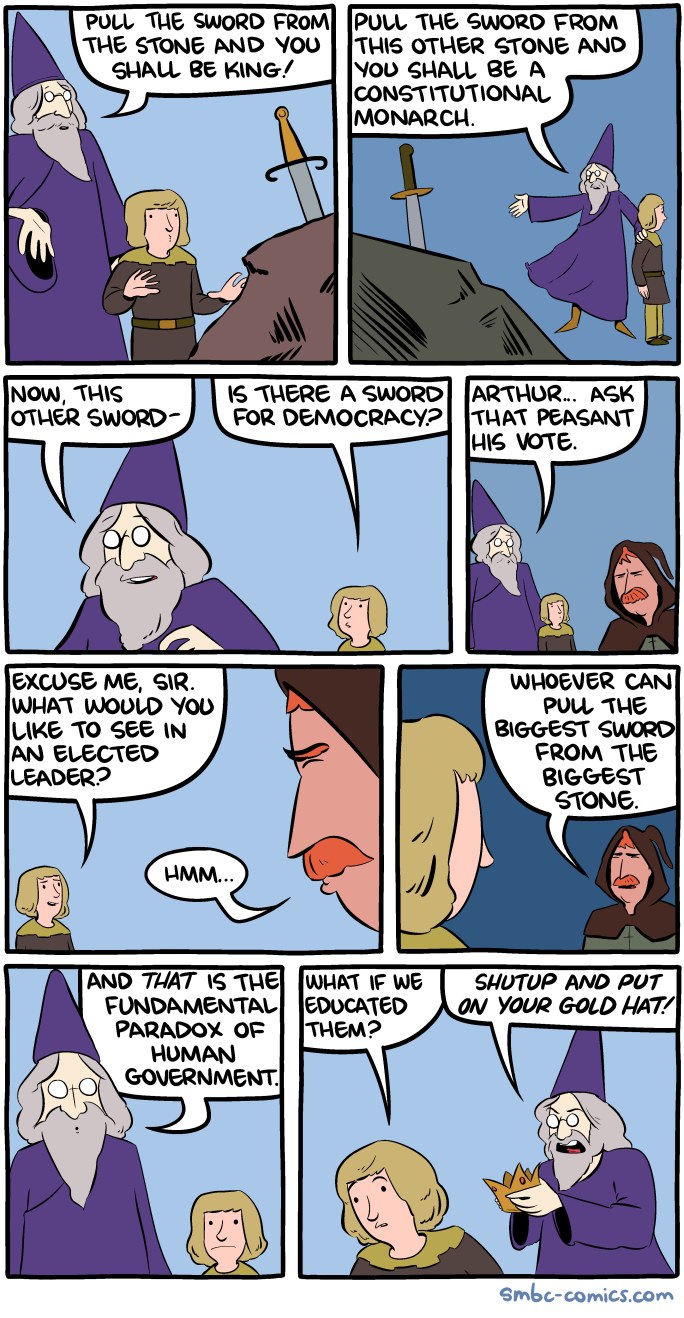

- Sword of Democracy — Saturday Morning Breakfast Cereal by Zach Weinersmith:

- Piers Morgan, neoliberal — Chris Dillow:

The goods of excellence consist in mastery of particular practices, which tend to be positive-sum: one man’s excellence can be celebrated by all. The goods of effectiveness, however, are things like wealth, fame, power and winning, and these are often zero-sum: for a winner there must be a loser.

- Australia’s Unemployment Rate Isn’t What It Seems — Jim Stanford in New Matilda:

By considering all three categories of underutilised worker (officially unemployed, working but need more hours, and non-participants), we generate a much higher measure of labour market slackness: close to 17 percent, almost three times higher than the official unemployment rate.

- RealtyCorp is born — Leith van Onselen, MacroBusiness:

Australia’s media duopoly is on its way to becoming one giant real estate fix. Hot on the heels of Fairfax becoming a glorified real estate agent […] Real estate is now tipped to drive NewsCorp’s earnings growth into the future as well.

- Corbyn’s Plan — Ian Welsh, declining to mince words:

I have little patience for all the Brits who are wringing their hands about Labour and parking their votes in the Conservative party. This is a good, non-radical plan that will work. It is a plan of a government that wants to be good to the poor and the young. Corbyn is entirely credible regarding the lot of it, as he’s stuck by these principles all through the Thatcher and Blairite years. If you’re planning to vote Conservative in the UK, when this is on offer, you’re just an asshole, an “I”ve got mine, fuck you Jack,” or someone who has bought so far into neoliberal ideology that your political actions make you indistinguishable from an asshole, whether or not you think neoliberal policies “work.”

- Electricity retail prices too high — Public Interest Advocacy Centre:

Research by energy economist Bruce Mountain, released this week, confirms that the big three electricity retailers (AGL Energy, Energy Australia and Origin Energy) are charging two to three times more to sell electricity in NSW, VIC, SA and QLD, where the market has been deregulated, than the regulated retailer is charging in the ACT.

- Incorporating energy into production functions — Steve Keen:

In my last post on my Debtwatch blog, I finished by saying that the Physiocrats were the only School of economics to properly consider the role of energy in production. They ascribed it solely to agriculture exploiting the free energy of the Sun, and specifically to land, which absorbed this free energy and stored it in agricultural products. […] But rather than following the Physiocrats’ lead on energy, Smith instead saw labour—not energy—as the font of wealth (which he described in the same terms as Cantillon: the “conveniencies of life”), and ascribed the increase in productivity over time to “the division of labour" […] Economics thus lost the Physiocrats’ focus on energy, and instead descended first into the “Labour theory of value” and then into the Neoclassical (and Post Keynesian) notions of “production functions” in which energy played no role at all.

- #1246; In which is glimpsed an Opportunity — Wondermark, by David Malki!:

Thursday, 1 December 2016 - 3:56pm

This week Country Rugby League announced plans to scrap the current model and replace it with an Under-23s competition. It means the chance to represent the Northern Rivers or North Coast is effectively finished for anyone over the age of 23.

I just… I don't know how one can recover from a shock like this. So much of the North Coast culture is built around the tradition of short fat men with broken noses, cauliflower ears, and no necks groping each other in the middle of a muddy field.

From an early age I was cursed with being tall and good-looking. So I was left on the sidelines, fending off a barrage of advances from attractive women, wishing that I too could one day fully appreciate the smell of male armpits and the endless comic potential of drunken cross-dressing.

Pushing people in their prime out of ritualised violence is just a gift to the reading and thinking lobbies, who will be glad to sink their claws into these vulnerable young men. We can't let them destroy our cherished way of life. How will our health care industry survive without a steady stream of knee injuries?