'Straya: Basically, she's rooted mate

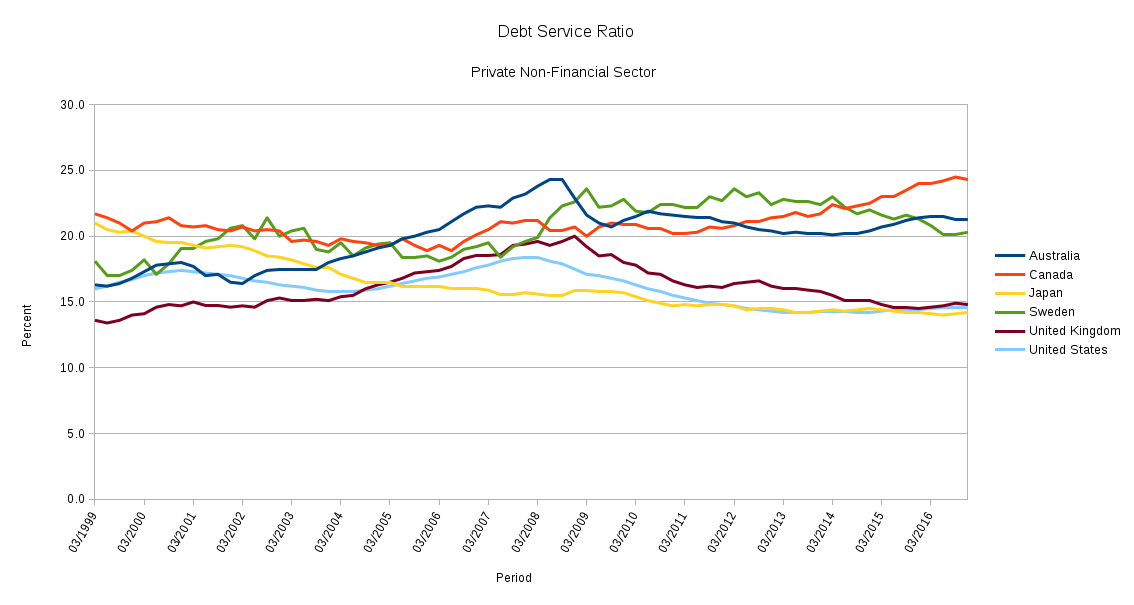

Charts! Nobody asked for them, but I have them anyway! Over the last few years the Bank for International Settlements have been publishing a fab set of statistics that are not usually brought to bear in the tea leaf reading of mainstream economists. This is a shame, as they are exactly the sort of statistics which would indicate the risk of imminent financial crisis. Last month the BIS updated the data to the end of (calendar year) 2016. Here's an illustration (courtesy of LibreOffice) of where Australia is, relative to some comparable and/or interesting countries (click to embiggen):

As the BIS explains, the Debt Service Ratio (DSR):

"reflects the share of income used to service debt and has been found to provide important information about financial-real interactions. For one, the DSR is a reliable early warning indicator for systemic banking crises. Furthermore, a high DSR has a strong negative impact on consumption and investment."

So as a measure of Australia's ability to pay at least the interest on our private sector debts, if not pay down the principal, you might think this is not a bad result. We clearly substantially delevered after the GFC, thanks in large part to the Rudd stimulus pouring public money into the private sector, then levered up a bit since, but we've ended up between Canada and Sweden, which is a pretty congenial neighbourhood. But this is total private sector debt; what happens when we take business out of the equation and just look at households (and non-profit institutions serving households - NPISHs)?

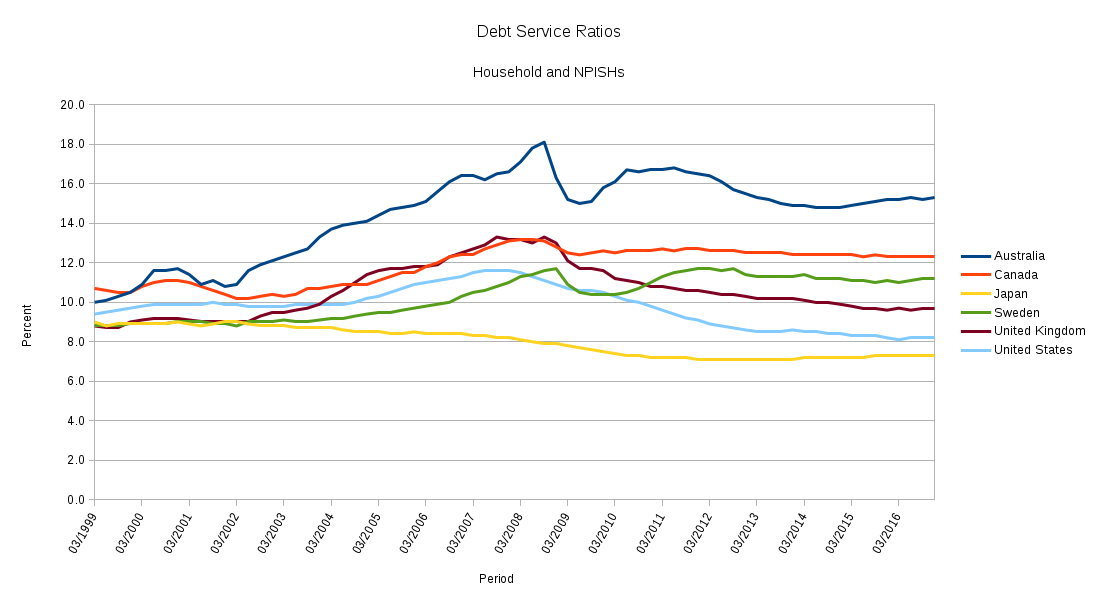

Woah! Suddenly we're in a league of our own. Canada's flatlined here since the GFC, meaning the subsequent increase in their total private debt burden has largely come from investment in business capital. In such a case, provided this investment is directed at increasing productive capacity, and is accompanied by public sector spending to proportionally increase demand, this is sustainable debt. Australia has been doing the opposite.

Here's another way of looking at the coming Australian debt crisis, private sector credit to GDP:

This ratio will rise whether the level of debt rises, GDP falls, or both, so it's another good indicator of unsustainable debt levels. The current total level (in blue) of over 200% is at about the ratio Japan was at when its real estate bubble burst in the early 1990s. Breaking this down again into household and corporate sectors, we see that over the mid-1990s Australia switched the majority of its private sector borrowing from business investment to sustaining households. What happened in the mid-90s? Data here from the OECD:

From the mid-1990s to 2007 Australia experienced the celebrated run of Howard/Costello government fiscal (or "budget") surpluses. We all know, or should know, thanks to Godley's sectoral balances framework, what happens when the public sector runs a surplus: the private sector must run a corresponding deficit, equal to the last penny. There is nowhere else, net of private sector bank credit creation (which zeroes out because every financial asset created in the private sector has a corresponding private sector liability), for money to come from. When the government taxes more than it spends, it is withdrawing money from the private sector. Mainstream economics calls this "sustainable", and "sound finance", meaning of course it is nothing of the sort.

How did the private sector, and the household sector in particular, continue to spend from that point onward, behaving as though losing money (not to mention public infrastructure and services) down the fiscal plughole was not merely benign but quite wonderful? It chose to Nimble it and move on, going on a massive credit binge. The banks were happy to provide all the credit demanded, because the bulk of the lending was ulitimately secured by residential real estate prices, and these were clearly going to keep rising without limit (thank heavens, because if they were to fall like they did in the US in 2007…).

The Global Financial Crisis put a dent in the demand for credit, but as subsequent government fiscal policy has tightened, under the rubric of "budget repair", it is rising again. We are already in a state of debt deflation: Australia's household debt service ratio (as above), at between 15 and 20 percent of household income for over a decade, has dampened domestic demand, leading to rising unemployment and underemployment, leading to more easy credit as a quick fix for income shortfalls ("debtfare"). More of what income remains is redirected to debt servicing rather than consumption, and so we spiral downwards, our incomes purchasing less and less with each turn. [I will post more about some of the social and microeconomic consequences in (over-)due course.]

The Australian government needs to spend much, much more - and quickly. Modern Monetary Theory, drawing on an understanding of the nature of money that goes back a century, shows us that government spending (contrary to conventional wisdom) is not revenue-constrained; a currency-issuing government can always buy anything available for sale in the currency it issues. There is nothing about our collective "budget" that needs repairing before we can do so. The same data from the OECD shows that most currency-issuing governments with advanced industrial economies run fiscal deficits almost all the time:

In fact, under all but exceptional conditions, government fiscal surpluses (i.e. private sector fiscal deficits) are a recipe for recession or depression. The greater the surplus, the greater the subsequent government spending required to lift the private sector out of crisis, as can be seen above in the wild swings in neoliberal governments' fiscal position from the mid-90s on. The fiscal balance over any given period is nothing more than a measurement of the flow of public investment into the private sector. What guarantees meaningful sustainability is a government's effective use of functional finance to manage the real (as opposed to financial) economy in pursuit of public policy objectives. Refusing to mobilise idle resources (including, crucially, labour) for needed public goods and services is not "sound finance"; it is the very definition of economic mismanagement, as was once widely recognised:

"It is true that war-time full employment has been accompanied by efforts and sacrifices and a curtailment of individual liberties which only the supreme emergency of war could justify; but it has shown up the wastes of unemployment in pre-war years, and it has taught us valuable lessons which we can apply to the problems of peace-time, when full employment must be achieved in ways consistent with a free society.

"In peace-time the responsibility of Commonwealth and State Governments is to provide the general framework of a full employment economy, within which the operations of individuals and businesses can be carried on.

"Improved nutrition, rural amenities and social services, more houses, factories and other capital equipment and higher standards of living generally are objectives on which we can all agree. Governments can promote the achievement of these objectives to the limit set by available resources.

"The policy outlined in this paper is that governments should accept the responsibility for stimulating spending on goods and services to the extent necessary to sustain full employment. To prevent the waste of resources which results from [un]employment is the first and greatest step to higher living standards."

We chose to forget all this from the 1980s onward. We can choose to remember it at any time.