reading

Sunday, 5 March 2017 - 11:31am

This week, the academic term has properly started, and I have been only reading:

- In Defense of the Lecture — Miya Tokumitsu at Jacobin:

The best lectures draw on careful preparation as well as spontaneous revelation. While speaking to students and gauging their reactions, lecturers come to new conclusions, incorporate them into the lecture, and refine their argument. Lectures impart facts, but they also model argumentation, all the while responding to their audience’s nonverbal cues. Far from being one-sided, lectures are a social occasion.

- There Is Such a Thing As Society — George Monbiot:

It’s unsurprising that social isolation is strongly associated with depression, suicide, anxiety, insomnia, fear and the perception of threat. It’s more surprising to discover the range of physical illnesses it causes or exacerbates. Dementia, high blood pressure, heart disease, strokes, lowered resistance to viruses, even accidents are more common among chronically lonely people. Loneliness has a comparable impact on physical health to smoking 15 cigarettes a day: it appears to raise the risk of early death by 26%. This is partly because it enhances production of the stress hormone cortisol, which suppresses the immune system.

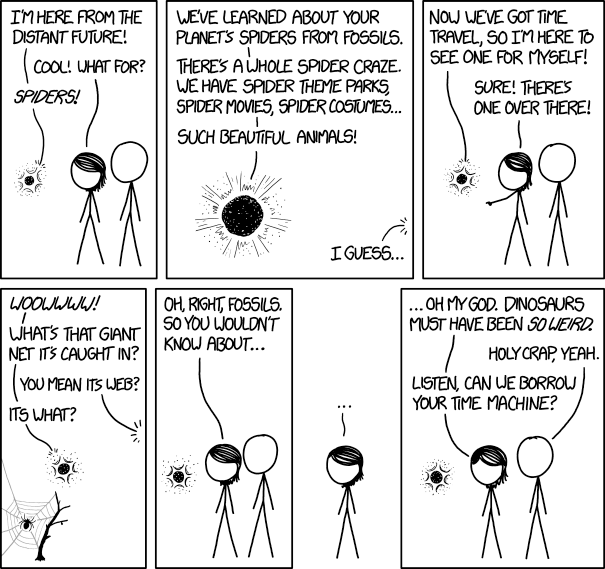

- Spider Paleontology — xkcd:

Sunday, 26 February 2017 - 4:18pm

This week, I have been mostly reading:

- Why debt really matters, which the IMF failed to say — Richard Murphy:

[…] the report only looked at who owes the debt. It did not look at who owns the debt, where and how accountable they are for it. This issue is real: it is the concentration in the ownership of debt, partly offshore, that causes so many problems, because debt imposes power. It is not for nothing that the word mortgage means ‘grip of death’. This is a modern form of slavery that consigns many to lives of little choice where compliance with the requirement of unreasonable employers is guaranteed. So it is not debt per se that is the problem: it is the power relationships implicit in it that matter and the IMF needed to address that issue and did not as far as I can see.

- Two Loaves — J.D. Alt at New Economic Perspectives:

In aggregate, then, the money system we’ve established and operate so efficiently only creates money, as it’s needed, to cover the profits of profit-seeking ventures. No money is created for ventures which do not make profits. This dynamic is doubled down on by the fact that we also operate with the institutional insistence that the sovereign government, if it decides to undertake something for the collective good, must pay for for that collective good with “tax dollars”―which are dollars previously created in the profit-earning system. There are two things peculiar about this. First is the implied premise that profit-seeking ventures are inherently good, while not-for-profit ventures are merely optional “niceties” that we can pay for on the side, so to speak. The second is our insistent belief that the money system we have cannot rationally be managed in any other way.

- Sorting Out the Patent Trolls — Timothy Taylor:

Basically, the FTC argues that the "patent assertion entities" can be divided fairly neatly into two "two distinct PAE business models: Portfolio PAEs and Litigation PAEs." The FTC steers away from using the term "patent trolls," which in this report mainly comes up in quotations from other articles buried in the footnotes. But "litigation PAEs" is the category that most people are thinking of when they refer to "patent trolls."

- The Death of the Autodidact: And the unstoppable rise of the modern meritocrat — Ravi Mangla in the Baffler:

The surgeon holding a sharp instrument inches from your arterial wall and the pilot jumping a hunk of metal over roiling waters have a license—a talisman that helps us sleep better at night. But so does your barber and your neighbor’s interior designer and—in Louisiana—your florist. In the majority of cases these requirements are another form of rent-seeking, a way for more established professionals to keep outsiders and upstarts from encroaching on their territory.

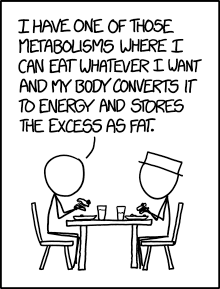

- Metabolism — xkcd:

Sunday, 19 February 2017 - 5:54pm

This week, I have been mostly reading:

- Density, sprawl, growth: how Australian cities have changed in the last 30 years — Neil Coffee, Emma Baker, and Jarrod Lange in the Conversation:

Melbourne may well be the exemplar for inner-city rebirth. More than any other Australian city it demonstrates the 30-year turnaround from inner-city decline to densification. […] While the turnarounds in Sydney, Brisbane, Adelaide and Perth have been less marked than in Melbourne, they are all no longer “doughnut cities”. This means that where people live in these cities has changed. Australia’s cities are now more densely populated – and we are much more likely to live in inner areas than we were 30 years ago.

- Too old to work, too young to die — Warwick Smith in the Monthly:

Age discrimination is already rife in Australia, with over a quarter of older job seekers reporting being affected by it. When you combine this with the push to lift the Age Pension access age to 70, the rise of contract and casual employment, and the current and projected impact of technology on the demand for skills, the situation for many older workers looks grim. If you’re an older woman, trying to return to the workforce after raising children, then things are going to be particularly hard for you.

- An optimistic view of worker power — Bill Mitchell:

[A] past national Greens leader in Australia told me that it was too politically difficult to challenge the neo-liberal macroeconomic consensus (even if my criticisms of that consensus were valid), it just distracted voters from their main message, which was unambiguously progressive in both the social and environmental context. I pointed out to that leader that by accepting the austerity narrative as the norm for responsible fiscal conduct, even if his party gained office (which it will never do in our two-party system), they would be unable to initiate their progressive social and environmental agenda because they would have hamstrung themselves in a neo-liberal macroeconomics.

- The best lesson I ever taught — James Page in On Line Opinion:

And so the discussion continued for 40 minutes. The issues included the role of religion within education, the nature of scientific fact, the nature of religion and faith, and the role of education itself. I continued to stand at the edge of the classroom, silent, and ready to intervene and perhaps commence the formal lesson. Yet that never happened. At the end of the 40 minutes I thanked the two discussants, and reminded the students of an upcoming assignment.

- Lack of Demand Is the Economy’s Problem, Not Automation — Dean Baker:

From a worker’s standpoint it doesn’t matter if they lose their job because a robot can do it better and cheaper or because a new assembly line only needs half as many workers to produce the same number of cars. In both cases they have lost their job, the specific cause doesn’t affect their economic circumstances. […] We do have a problem of a weak labor market, with employment rates for prime age workers (ages 25-54) still well below their pre-recession levels, but this is a problem of inadequate demand in the economy. There is little reason to believe that if we generated more demand through larger government deficits or smaller trade deficits we would not have more jobs.

- An Undergraduate’s Question about Economic Policy — Thomas Palley:

Neoliberals try to close down the space of political debate and social possibility by excluding all except neoliberal ideas. The tragedy of the past forty years is they have been succeeding. In the academy there is a neoclassical monopoly, and in politics Labor and Social Democratic parties have been captured by the Trojan horse of the Third Way, creating a neoliberal political monopoly.

Sunday, 12 February 2017 - 6:00pm

This week, my academic performance has delivered a crushing blow to my self-confidence, so to reassure myself that I'm still capable of abstract thought, I have been mostly reading:

- Nature is priceless, which is why turning it into ‘natural capital’ is wrong — Bram Büscher and Robert Fletcher:

The move from nature to natural capital is problematic because it assumes that different forms of capital - human, financial, natural - can be made equivalent and exchanged. In practice - and despite proponents’s insistence to the contrary - this means that everything must potentially be expressed through a common, quantitative unit: money. But complex, qualitative, heterogeneous natures, as these same proponents acknowledge, can never adequately be represented in quantitative, homogenous money-units. […] Natural capital is therefore inherently anti-ecological and has little to do with giving value to nature, or rendering this value visible. It is the exploitation of nature to inject more value, and seeming legitimacy, into a faltering capitalist growth economy.

- The true cost of our insanely low Newstart allowance — Peter Martin:

This week, at the National Press Club, Social Services Minister Christian Porter dismissed suggestions that it needed to lift the Newstart unemployment benefit of just $264.35 per week. "The fact that people who find it challenging to subsist on Newstart do so for short periods of time might actually speak to the fact that that's one of the design points of the system," he said. The low rate was "working okay because the encouragement is there to move off those payments quickly".

- Reducing income inequality — Bill Mitchell:

[…] financial market deregulation provided capital with ‘all its Christmases at once! – it could have a higher profit share and suppress real wages growth and keep profits high by realising the increased sales and productivity improvements. How? The trick was found in the rise of so-called ‘financial engineering’, which pushed ever increasing debt onto the household and corporate sectors. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments. This seemed to be a much better strategy than paying higher real wages.

- Why credit card interest rates are high — Peter Martin:

The best guess as to why most of us don't much care about rates comes from studies that find that alongside the sizeable proportion of the population that pays off its cards on time (and so doesn't care about rates) is a larger group of "deluded optimists" who believe they will pay their cards off on time. They're not concerned about rates either because they falsely believe they won't have to pay them. Psychological tests show the more likely people are to select cards with high rates, the more optimistic they are about all things.

-

The current system of knowledge dissemination isn’t working and Sci-Hub is merely a symptom of the problem — Iván Farías Pelcastre and Flor González Correa in the LSE Impact Blog:

Some scholars consider that, by removing barriers to access to knowledge, Sci-Hub is actually promoting the widest possible dissemination and use of academic research for the benefit of the entire scientific community. For instance, Masoud Shahnazar, Iran-based independent literary researcher, states that “we Iranians really owe [Sci-Hub] a lot” for providing access to the materials Iranian scholars require for their research. How researchers are able to access paywalled papers in a country faced with economic sanctions which prevent international payments is one of many questions that the current model cannot effectively answer.

- Time To Treat Bank CEOs Like Adults — Dean Baker in HuffPo:

Regardless of the exact motives, the real question is what will be the consequences for [Wells Fargo CEO John] Stumpf and other top executives. Thus far, he has been forced to stand before a Senate committee and look contrite for four hours. Stumpf stands to make $19 million this year in compensation. That’s almost $5 million for each hour of contrition. Millions of trouble-making high school students must be very jealous.

- Stupefied: How organisations enshrine collective stupidity and employees are rewarded for checking their brains at the office door — André Spicer in Aeon:

One well-known firm that Mats Alvesson and I studied for our book The Stupidity Paradox (2016) said it employed only the best and the brightest. When these smart new recruits arrived in the office, they expected great intellectual challenges. However, they quickly found themselves working long hours on ‘boring’ and ‘pointless’ routine work. After a few years of dull tasks, they hoped that they’d move on to more interesting things. But this did not happen. As they rose through the ranks, these ambitious young consultants realised that what was most important was not coming up with a well-thought-through solution. It was keeping clients happy with impressive PowerPoint shows. Those who did insist on carefully thinking through their client’s problems often found their ideas unwelcome. If they persisted in using their brains, they were often politely told that the office might not be the place for them.

Sunday, 5 February 2017 - 7:20pm

This week, I have been feeling guilty about skipping a month, and mostly reading:

- Why Do Anything? A Meditation on Procrastination — Costica Bradatan in the New York Times:

The drama of procrastination comes from its split nature. Just like the architect from Shiraz, the procrastinator is smitten by the perfect picture of that which is yet to be born; he falls under the spell of all that purity and splendor. What he is beholding is something whole, uncorrupted by time, untainted by the workings of a messed-up world. At the same time, though, the procrastinator is fully aware that all that has to go. No sooner does he get a glimpse of the perfection that precedes actualization than he is doomed to become part of the actualization process himself, to be the one who defaces the ideal and brings into the world a precarious copy, unlike the architect who saves it by burning the plans.

- China’s Army of Global Homebuyers Is Suddenly Short on Cash — Bloomberg News:

Less than a month after China announced fresh curbs on overseas payments, anecdotal reports from realtors, homeowners and developers suggest the restrictions are already weighing on the world’s biggest real estate buying spree. […] “If it’s too difficult, I’m out,’’ said Mr. Zheng, 66, a retired civil servant in Shanghai who declined to give his first name to avoid attracting regulatory scrutiny. He may abandon a 2.4 million yuan ($348,903) home purchase in western Melbourne, even after shelling out a 300,000 yuan deposit last August. He’s due to make another big payment next month.

[Tick… tick… tick…] - Why Trump's Staff Is Lying — Tyler Cowen, Bloomberg View:

By requiring subordinates to speak untruths, a leader can undercut their independent standing, including their standing with the public, with the media and with other members of the administration. That makes those individuals grow more dependent on the leader and less likely to mount independent rebellions against the structure of command. Promoting such chains of lies is a classic tactic when a leader distrusts his subordinates and expects to continue to distrust them in the future. Another reason for promoting lying is what economists sometimes call loyalty filters. If you want to ascertain if someone is truly loyal to you, ask them to do something outrageous or stupid. If they balk, then you know right away they aren’t fully with you.

- The Private Debt Crisis — Richard Vague:

When too high, private debt becomes a drag on economic growth. It chips away at the margin of growth trends. Though different researchers cite different levels, a growing body of research suggests that when private debt enters the range of 100 to 150 percent of GDP, it impedes economic growth. When private debt is high, consumers and businesses have to divert an increased portion of their income to paying interest and principal on that debt—and they spend and invest less as a result. That’s a very real part of what’s weighing on economic growth. After private debt reaches these high levels, it suppresses demand.

Sunday, 8 January 2017 - 3:03pm

This week, I have been plagued by self-doubt and mostly reading:

- Overt Monetary Financing – again — Bill Mitchell:

From the perspective of Modern Monetary Theory (MMT), a helicopter drop is equivalent to an increase in the fiscal deficit in the sense that new financial assets are created and the net worth of the non-government sector increases. It occurs when the government uses its currency-issuing capacity (linking treasury spending to central bank operations) without matching its deficit spending with debt-issues to the non-government sector. So the central bank adds some numbers to the treasury’s bank account to match its spending plans and in return may be given treasury bonds to an equivalent value. Instead of selling debt to the private sector, the treasury simply sells it to the central bank, which then creates new funds in return. This accounting smokescreen is, of course, unnecessary. The central bank doesn’t need the offsetting asset (government debt) given that it creates the currency ‘out of thin air’. So the swapping of public debt for account credits is just an accounting convention.

- We are not and never will be dependent on bond markets — Richard Murphy:

[…] no government need issue gilts at all. It has only been EU law that has required the UK to do so in recent years. It is that law which has prevented the government simply issuing new money instead at any time. […] far from investors doing the government a favour by investing in gilts the government does savers an enormous favour by letting them place funds on effective deposit at guaranteed fixed rates with the only deposit taker who will never default because they can always print more money to make sure that they will not do so. The government could, in effect, entirely avoid paying this interest but for the essential role that the government wants its bonds to play in certain key financial markets, such as the repo and pension sectors.

Sunday, 1 January 2017 - 4:56pm

This week, I have been mostly reading:

- Stand, Fight, Resist — Jason Griffey:

Neutrality favors the powerful, and further marginalizes the marginalized. In the face of the current political climate, with the use of opinions as bludgeons and disinformation as the weapon of choice for manipulation and intellectual coercion, it is up to those who value fact and believe in the care of those in need to stand up and positively affirm that to do otherwise is evil.

- Going down the drain, putting this wondrous stock market at risk? — Wolf Richter:

Companies in the S&P 500 spent about $3 trillion since 2011 to buy back their own shares, often with borrowed money. It’s part of a noble magic called financial engineering, the simplest way to goose the all-important metric of earnings per share (by lowering the number of shares outstanding). And it creates buying pressure in the stock market that drives up share prices. […] “Only” 362 of the S&P 500 companies bought back shares in Q3, the second lowest number in three years, with Q2 having been the lowest number (blue line in the chart below).

[And, not unrelated:] - Apple CEO Tim Cook Met With Trump to “Engage” on Gigantic Corporate Tax Cut — Jon Schwarz, the Intercept:

Cook first described how it was critical for Apple to “engage” with governments on what he called “our key areas of focus.” According to Cook, these include “privacy and security, education,” “advocating for human rights for everyone,” “the environment and really combating climate change” and “creating jobs” — i.e., nothing as mundane as money. But in the third paragraph, Cook acknowledged, “We have other things that are more business-centric — like tax reform.”

[And, tying it all together a few months ago:] - Standing up to Apple — Robert Reich:

Congress’s last tax amnesty occurred in 2004, when global U.S. corporations brought back about $300 billion from overseas, and paid just a tax rate of 5.25 percent rather than the regular 35 percent U.S. corporate rate. Corporate executives argued then – as they argue now – that the amnesty would allow them to reinvest those earnings in America. The argument was baloney then and it’s baloney now. A study by the National Bureau of Economic Research found that 92 percent of the repatriated cash was used to pay for dividends, share buybacks or executive bonuses.

- James Galbraith Tells Us What Everyone Needs to Know About Inequality — Polly Cleveland reviews - well, quotes from - Jamie's new book at the D&S Blog:

Galbraith adds a new insight: not only did the postwar high-tax regime induce corporations to keep executive pay in check, it also induced them to retain profits and reinvest them in the corporation. With the 1980’s “greed is good” transformation, rates of reinvestment slowed as executives started taking more for themselves—surely helping slow the overall rate of growth.

[i.e. for currency-issuing governments, the purpose of taxation isn't revenue-raising; it's about steering the economy toward desirable public policy ends.] - A Chat (Avec Chat) — Wondermark, by David Malki !:

Sunday, 25 December 2016 - 4:55pm

This week, I have been mostly reading:

- How Laissez-Faire Economics Led to Inequality and Recession — Jeff Madrick in the Huffington Post:

The Federal Reserve just named a new committee headed by vice chairman Stanly Fischer to research how unstable financial markets may affect the real economy of jobs, production, business investment and profits. If you read the 2008 minutes of the Federal Open Market Committee (released earlier this year), which meets roughly every six weeks to set interest rate and other policies, you’ll see that the policymakers and their staffs had little idea how to account for financial risk. Finance simply wasn’t in their economic models.

- “I don’t need your civil war.” — Jonathan Rees:

All us historians let out a loud sigh when we read that story about Republican Senator Ron Johnson wanting to replace us all with Ken Burns videos. It’s an incredibly stupid argument, of course, but it’s also sadly typical of everyone who has no idea what history professors actually do all day. […] Better to be the ones inserting the video cassette and administering the multiple choice test after the tape ends than not to have any job at all.

- Facebook recommended that this psychiatrist’s patients friend each other — Kashmir Hill, Fusion:

She hadn’t friended any of her patients on Facebook, nor looked up their profiles. She didn’t have a guest wifi network at the office that they were all using. After seeing my report that Facebook was using location from people’s smartphones to make friend recommendations, she was convinced this happened because she had logged into Facebook at the office on her personal computer. She thought that Facebook had figured out that she and her patients were all in the same place repeatedly. However, Facebook says it only briefly used location for friend recommendations in a test and that it was just “at the city-level.”

- Where’s your data? It’s not actually in the cloud, it’s sitting in a data centre — Brett Neilson, Ned Rossiter, and Tanya Notley of Western Sydney University in the Conversation:

Governments spend a great deal of resources safeguarding critical infrastructure. The protection of data and information systems is now included in this work. However, the focus for data security is on the development of software, as though we have forgotten that data storage happens in real places on the ground – and not in “virtual” clouds. Not knowing where data centres are located, or indeed what they actually do, prevents us from having conversations about how this infrastructure is governed, supported and protected.

Sunday, 18 December 2016 - 6:32pm

This last few weeks, I have been mostly going mad, and reading:

- Ageing out of drugs — Stacey McKenna in Aeon:

So, what have we learned so far from those who age out of drug use? When people talk about the life cycle leading to natural recovery, numerous factors are at play. For many, it’s a simple case of ‘being sick and tired of being sick and tired’. […] Though this is the path that’s most common among people who have tried or even become addicted to drugs, it’s the one least discussed. But careful scrutiny of ageing out – both why people do and why they don’t – tells us a lot about drug dependence and what to do about it. […] The so-called unbreakable cycle of addiction appears to result from inequity – from poverty, from discrimination, from social and economic oppression.

- Did Money Eat Our Brains? — Steve Roth at Evonomics:

After growing rapidly for a couple of million years, doubling from roughly 750 to 1,500 cubic centimeters, human brains have shrunk by about ten percent over just ten or twenty millennia. (So they’ve been getting smaller maybe twenty times faster than they got bigger.) Imagine taking an ice cream scoop out of your brain. That’s about the size of it.

- Why America’s MOOC pioneers have abandoned ship — Jonathan Rees:

The most obvious reason why everyone from the founders of MOOC companies to students who sign up for such course are abandoning MOOCs is because these kinds of courses have not lived up to their initial hype. MOOCs were supposed to transform education as we know it, but traditional education with its inefficiency derived from the close proximity between professors and their students has proved more resilient than its wannabe disruptors ever imagined.

- S&P warns on NZ house prices. What about Oz? — Leith van Onselen at MacroBusiness provides your terminally ill economy chart porn of the week:

- Podcast Out — David A. Banks in the New Inquiry is onto something:

The invisible forces that control human behavior, as it turns out, are not sociological or even cultural; the answers to life’s most important questions are invariably cognitive, biological, or evolutionarily determined. Topics that might have once been subject to political debate or rhetorical argument–work demands, exposure to toxins, surveillance, the limits of love, even Marxian alienation–become apolitical subjects for scientific testing. But the results only lead to greater and greater complexity, prompting introspective thought rather than action. Thus, liberal infotainment is full of statements that sound like facts–what social media theorist Nathan Jurgenson calls “factiness”–that do nothing more than reinforce and rationalize the listeners’ already formed common sense, rather than transforming it: what you believed to be true before the show started was not wrong, it just lacked the veneer of factiness.

Sunday, 4 December 2016 - 4:19pm

This week, I have been mostly reading:

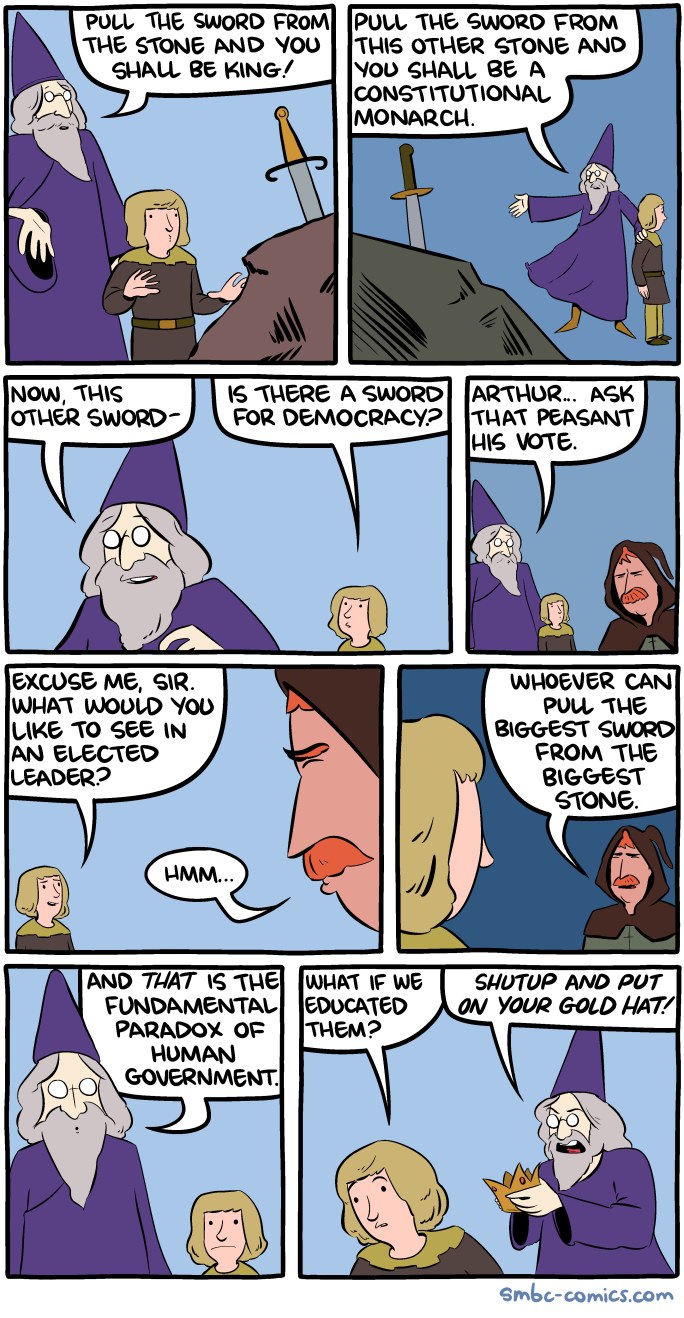

- Sword of Democracy — Saturday Morning Breakfast Cereal by Zach Weinersmith:

- Piers Morgan, neoliberal — Chris Dillow:

The goods of excellence consist in mastery of particular practices, which tend to be positive-sum: one man’s excellence can be celebrated by all. The goods of effectiveness, however, are things like wealth, fame, power and winning, and these are often zero-sum: for a winner there must be a loser.

- Australia’s Unemployment Rate Isn’t What It Seems — Jim Stanford in New Matilda:

By considering all three categories of underutilised worker (officially unemployed, working but need more hours, and non-participants), we generate a much higher measure of labour market slackness: close to 17 percent, almost three times higher than the official unemployment rate.

- RealtyCorp is born — Leith van Onselen, MacroBusiness:

Australia’s media duopoly is on its way to becoming one giant real estate fix. Hot on the heels of Fairfax becoming a glorified real estate agent […] Real estate is now tipped to drive NewsCorp’s earnings growth into the future as well.

- Corbyn’s Plan — Ian Welsh, declining to mince words:

I have little patience for all the Brits who are wringing their hands about Labour and parking their votes in the Conservative party. This is a good, non-radical plan that will work. It is a plan of a government that wants to be good to the poor and the young. Corbyn is entirely credible regarding the lot of it, as he’s stuck by these principles all through the Thatcher and Blairite years. If you’re planning to vote Conservative in the UK, when this is on offer, you’re just an asshole, an “I”ve got mine, fuck you Jack,” or someone who has bought so far into neoliberal ideology that your political actions make you indistinguishable from an asshole, whether or not you think neoliberal policies “work.”

- Electricity retail prices too high — Public Interest Advocacy Centre:

Research by energy economist Bruce Mountain, released this week, confirms that the big three electricity retailers (AGL Energy, Energy Australia and Origin Energy) are charging two to three times more to sell electricity in NSW, VIC, SA and QLD, where the market has been deregulated, than the regulated retailer is charging in the ACT.

- Incorporating energy into production functions — Steve Keen:

In my last post on my Debtwatch blog, I finished by saying that the Physiocrats were the only School of economics to properly consider the role of energy in production. They ascribed it solely to agriculture exploiting the free energy of the Sun, and specifically to land, which absorbed this free energy and stored it in agricultural products. […] But rather than following the Physiocrats’ lead on energy, Smith instead saw labour—not energy—as the font of wealth (which he described in the same terms as Cantillon: the “conveniencies of life”), and ascribed the increase in productivity over time to “the division of labour" […] Economics thus lost the Physiocrats’ focus on energy, and instead descended first into the “Labour theory of value” and then into the Neoclassical (and Post Keynesian) notions of “production functions” in which energy played no role at all.

- #1246; In which is glimpsed an Opportunity — Wondermark, by David Malki!: