Sunday, 25 September 2016 - 8:49pm

This week, I have been mostly reading:

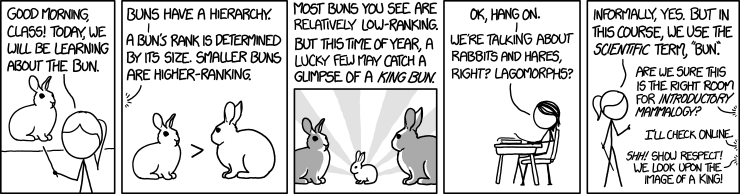

- Bun — xkcd [I believe I know this lecturer]:

- The household debt bubble won’t grow forever — Laurie MacFarlane at the New Economics Foundation:

In the economy, total income equals total spending: every pound spent somewhere is earned somewhere else. So if one sector of the economy is spending less than it’s earning and saving, the other sectors must collectively be spending more than they’re earning, and accumulating debt or running down savings. After the financial crisis in 2008, households started spend less to pay down debt, so the government spent more and ran large deficits to offset the effects of the crisis. But with the government pursuing further cuts to public spending in order to achieve a budget surplus by 2019-20, the only way that growth can be achieved and consumption maintained is by households running down savings and accumulating debt.

[And linked from this, something I must have missed in March:] - How household debt is becoming the new safety net — Sarah Lyall at the New Economics Foundation:

Credit is being used as a safety net by millions in the UK, according to new polling data released by debt advice charity Stepchange. They estimate that 15% of people - 7.4 million individuals nationally – have turned to debt for essential day-to-day spending, while 6% of people (around 3 million) use this credit safety net on a weekly or monthly basis.

- The empty brain — Robert Epstein in Aeon:

Senses, reflexes and learning mechanisms – this is what we start with, and it is quite a lot, when you think about it. If we lacked any of these capabilities at birth, we would probably have trouble surviving. But here is what we are not born with: information, data, rules, software, knowledge, lexicons, representations, algorithms, programs, models, memories, images, processors, subroutines, encoders, decoders, symbols, or buffers – design elements that allow digital computers to behave somewhat intelligently. Not only are we not born with such things, we also don’t develop them – ever.

- The Political Movement that Dared not Speak its own Name: The Neoliberal Thought Collective Under Erasure — Philip Mirowski in an INET working paper:

The neoliberals believed that the market always knew better than any human being; but humans would never voluntarily capitulate to that truth. People would resist utter abjection to the demands of the market; they would never completely dissolve into undifferentiated ‘human capital’; they would flinch at the idea that the political franchise needed to be restricted rather than broadened; they would be revolted that the condition of being ‘free to choose’ only meant forgetting any political rights and giving up all pretense of being able to take charge of their own course through life. Neoliberal ideals would always be a hard sell; how much easier to avoid all that with simplistic stories that fogged the mind of the masses: government is always bad; everything you need to know is already in Adam Smith; you can be anything you want to be; there is no such thing as class or the dead hand of history; everything can be made better if you just express yourself on some social media platform; there is nothing wrong with you that a little shopping won’t fix.

- WashPost Makes History: First Paper to Call for Prosecution of Its Own Source (After Accepting Pulitzer) — Glenn Greenwald:

In the face of a growing ACLU and Amnesty-led campaign to secure a pardon for Snowden, timed to this weekend’s release of the Oliver Stone biopic “Snowden,” the Post editorial page today not only argued in opposition to a pardon, but explicitly demanded that Snowden — the paper’s own source — stand trial on espionage charges or, as a “second-best solution,” accept “a measure of criminal responsibility for his excesses and the U.S. government offers a measure of leniency.” In doing so, the Washington Post has achieved an ignominious feat in U.S. media history: the first-ever paper to explicitly editorialize for the criminal prosecution of its own source — one on whose back the paper won and eagerly accepted a Pulitzer Prize for Public Service.

- Keynes and the Quantity Theory of Money — Frances Coppola:

Expanding the monetary base with QE while simultaneously reducing government spending and raising taxes to "fix the fiscal finances" is a wash. No, it's worse than that. It transfers money from households who would actually spend that money on goods and services, and businesses who would invest it for future growth, to banks and the rich, who only spend it on assets. The wealth effects from inflated asset prices may at the margin encourage more spending among those foolish enough to borrow (or dis-save) on the strength of unrealised capital gains, while the depressed interest rates that are the inevitable consequence of inflated asset prices may also encourage borrowing by those who would struggle to service debts if interest rates were higher. I am constantly amazed that any policymaker thinks that such unwise behaviour is to be encouraged. Deficit spending would be both safer and more effective than flooding banks with reserves and blowing up asset price bubbles. But we have tied ourselves into a ridiculous straitjacket because of wholly unjustified fear of government debt.

- Keep on truckin’—without drivers — David F. Ruccio:

I was perplexed. I couldn’t figure out what all the fascination was with self-driving cars. Why all the investment in designing cars that could be operated with little or no hands-on attention by a human driver? So, I asked a friend what that was all about, and he quickly responded: it’s really about trucks, not cars. In a country whose system of transporting commodities is insanely organized around highways and trucks (as against, e.g., railroads and trains), and where truck-drivers’ pay is once-again rising […] it makes perfect—profitable—sense to design trucks that can operate without drivers.

- The Labour leadership battle between Jeremy Corbyn and his critics will soon be over – for three minutes — Mark Steel in the Independent:

At last the result of the leadership election will finish this period of Labour’s squabbling. Then a new period of squabbling can begin, three minutes after the result is announced, when a group of 45 MPs issue a statement saying: 'During the last three minutes, it has become increasingly clear that Jeremy Corbyn has lost the support of the party and must step down immediately.'

- For the first time, Saudi Arabia is being attacked by both Sunni and Shia leaders — Robert Fisk in the Independent:

The Saudis step deeper into trouble almost by the week. Swamped in their ridiculous war in Yemen, they are now reeling from an extraordinary statement issued by around two hundred Sunni Muslim clerics who effectively referred to the Wahhabi belief – practiced in Saudi Arabia – as “a dangerous deformation” of Sunni Islam. The prelates included Egypt’s Grand Imam, Ahmed el-Tayeb of al-Azhar, the most important centre of theological study in the Islamic world, who only a year ago attacked “corrupt interpretations” of religious texts and who has now signed up to “a return to the schools of great knowledge” outside Saudi Arabia.

- Making things matters. This is what Britain forgot — Ha-Joon Chang in the Guardian:

Another argument is that we now live in a post-industrial knowledge economy, in which “making things” no longer matters. The proponents of this argument wheel out Switzerland, which has more than twice the per capita income of the UK despite – or rather because of – its reliance on finance and tourism. However Switzerland is actually the most industrialised country in the world, measured by manufacturing output per head. In 2013 that manufacturing output was nearly twice the US’s and nearly three times the UK’s. The discourse of post-industrial knowledge economy fundamentally misunderstands the role of manufacturing in economic prosperity.