Sunday, 6 November 2016 - 5:54pm

This week, I have been mostly reading:

- The Incalculable Cost of our Aversion to Government Debt — Ari Andricopoulos:

Thanks to austerity there is both a non-growing pie and workers receiving a smaller share of it (due to austerity forcing interest rates down). So there is low demand because of low government spending and high supply of labour because of benefit sanctions. The inevitable result of this is a low wage economy.

- The elites hate Momentum and the Corbynites - and I’ll tell you why — David Graeber in the Guardian:

The real battle is not over the personality of one man, or even a couple of hundred politicians. If the opposition to Jeremy Corbyn for the past nine months has been so fierce, and so bitter, it is because his existence as head of a major political party is an assault on the very notion that politics should be primarily about the personal qualities of politicians. It’s an attempt to change the rules of the game, and those who object most violently to the Labour leadership are precisely those who would lose the most personal power were it to be successful: sitting politicians and political commentators.

- Fears For Pauline Hanson’s Health After She Realises Some Asians Are Also Muslim — The Shovel:

- A comment on Keen’s “Credit plus GDP” measure — Cameron Murray:

There are two extremes I have in mind in this analysis. First, if all new credit is directed to new capital investments, we would expect a very close match between credit creation and increases in nominal GDP. Second, if all credit creation is to fund asset purchases, we might expect a much lower relationship between new credit and GDP growth. This idea fits nicely with the story that we should use the banking system to support new capital investment instead of funding asset purchases, which simply leads to asset price growth and speculative cycles. In this story it matters what new credit (money) is used for, not just the levels of new credit.

And, related: - The Truth about Banks — Michael Kumhof and Zoltán Jakab, in the IMF's Finance & Development magazine:

In modern neoclassical intermediation of loanable funds theories, banks are seen as intermediating real savings. Lending, in this narrative, starts with banks collecting deposits of previously saved real resources (perishable consumer goods, consumer durables, machines and equipment, etc.) from savers and ends with the lending of those same real resources to borrowers. But such institutions simply do not exist in the real world. There are no loanable funds of real resources that bankers can collect and then lend out. […] financing, is of course the key activity of banks. The detailed steps are as follows. Assume that a banker has approved a loan to a borrower. Disbursement consists of a bank entry of a new loan, in the name of the borrower, as an asset on its books and a simultaneous new and equal deposit, also in the name of the borrower, as a liability. This is a pure bookkeeping transaction that acquires its economic significance through the fact that bank deposits are the generally accepted medium of exchange of any modern economy, its money.

- I’m already tired of the ‘lessons’ of Chilcot. What can we learn from a report that ignores Iraqis? — Robert Fisk, the Independent:

Yes, [Blair] sure was a nasty piece of work, lying to us Brits and then lying to us again after Chilcot was published, and then waffling on about faith and “the right thing to do” when we all know that smiting vast numbers of innocent people – and even bringing about the smiting of a vaster number of the very same Muslims, Christians and Yazidis up to this very day – was a very, very bad thing to do. For these victims – anonymous and almost irrelevant in the Chilcot report – we cannot say “even unto the end”, because they are dying unto the present day. The real “end” for these victims cometh not even yet.

- #1236; In which a Reminder is constant — Wondermark, by David Malki!:

- Credentialism and Corruption: The Opioid Epidemic and “the Looting Professional Class” — Lambert Strether in Naked Capitalism:

As reader Clive wrote: "Increasingly, if you want to get and hang on to a middle class job, that job will involve dishonesty or exploitation of others in some way." And you’ve got to admit that serving as a transmission vector for an epidemic falls into the category of “exploitation of others.”

- WBC warns on NZ household debt. What about Australia’s? — Leith van Onselen at MacroBusiness compares the household debt/income levels of us and them next door:

- Regulator Warns Commercial Real Estate Bubble Is Biggest US Bank Risk — Yves Smith, Naked Capitalism:

The reason commercial real estate lending is so hazardous is banks routinely lose more than 100% of the loan when the projects go bad. Not only do all the loan proceeds go “poof,” but when they foreclose, they are typically stuck with a completed or partially completed project. If it is completely and not fundamentally unsound (say an office building in an up-and-coming area), it’s possible to get a partial recovery. But for a white elephant or a half-finished building, the bank will need to clear the property, which means throwing good money after bad, and is stuck with land plus perhaps some general previous owner improvements (if a subdivision, getting zoning and running in plumbing; in an urban setting, doing the assemblage). Moreover, commercial properties are idiosyncratic, so liquidating them is also inherently time-consuming.

- That Far Left Entryist Takeover of the Labour Party — Craig Murray:

At its height in the 1980’s, Militant claimed 8,000 members. In 2013 its descendant, the Socialist Party, claimed 2,500 members and crowed that it was now bigger than the Socialist Workers Party. The SWP replied, not by claiming to have more than 2,500 members, but by saying that the Socialist Party’s claim of 2,500 was inflated. The various manifestations of the Communist Party are smaller. […] I have therefore watched with bemusement the claims that the 120,000 new Labour members now banned from voting, and perhaps half of the remaining 400,000 Labour electorate, are entryists from organisations of the “hard left”. Anybody who believes there are over 300,000 members of “hard left” groups in the UK is frankly bonkers.

- Robot Bombs: A One Time Thing, Right? — Ted Rall:

- Paul Krugman’s stock market advice — Dean Baker, in the Real World Economics Review Blog:

[Apple, Google, and Microsoft] are companies that depend to a large extent on government-granted monopolies in the form of patent and copyright protection. We have made these protections much stronger and longer over the last four decades through a variety of laws and trade agreements. Of course the point of these protections is to give an incentive for innovation and creative work. But in a period where we are supposedly troubled by an upward redistribution from people who work for a living to people who “own” the technology, perhaps we should not be giving those people ever stronger claims to ownership of technology.

- The Trojan Drone: An Illegal Military Strategy Disguised as Technological Advance — Rebecca Gordon in TomDispatch:

The technical advances embodied in drone technology distract us from a more fundamental change in military strategy. However it is achieved -- whether through conventional air strikes, cruise missiles fired from ships, or by drone -- the United States has now embraced extrajudicial executions on foreign soil. Successive administrations have implemented this momentous change with little public discussion. And most of the discussion we’ve had has focused more on the new instrument (drone technology) than on its purpose (assassination). It’s a case of the means justifying the end. The drones work so well that it must be all right to kill people with them.

- Why are license "agreements" so uniformly terrible? — at Boing Boing, an excerpt from The End of Ownership: Personal Property in the Digital Economy, by Aaron Perzanowski and Jason Schultz:

The current iTunes Terms and Conditions are over 19,000 words, translating into fifty-six pages of fine print, longer than Macbeth. Not to be outdone, PayPal’s terms weigh in at 36,000 words, besting Hamlet by a wide margin. The demands of these prolix legal documents are jaw-dropping. Take Adobe’s Flash, a software platform installed on millions of computers each day. Assume the average user can read the 3,500-word Flash license in ten minutes—a generous assumption given the dense legalese in which it is written. If everyone who installed Flash in a single day read the license, it would require collectively over 1,500 years of human attention. That’s true every single day, for just one software product. Imagine what would happen if you tried to read every license you encountered. […] License terms are not negotiable. So there’s little to gain from a careful reading. […] Adobe is not going to negotiate a new license with you. They won’t even entertain the idea. So your choice is simple. Either use the product—and live with the license—or don’t. Take it or leave it.

- Sole and Despotic Dominion — Cory Doctorow in Locus Online:

If the mere presence of a copyrighted work in a device means that its manufacturer never stops owning it, then it means that you can never start owning it. There’s a word for this: feudalism. In feudalism, property is the exclusive realm of a privileged few, and the rest of us are tenants on that property. In the 21st century, DMCA-enabled version of feudalism, the gentry aren’t hereditary toffs, they’re transhuman, immortal artificial life-forms that use humans as their gut-flora: limited liability corporations.

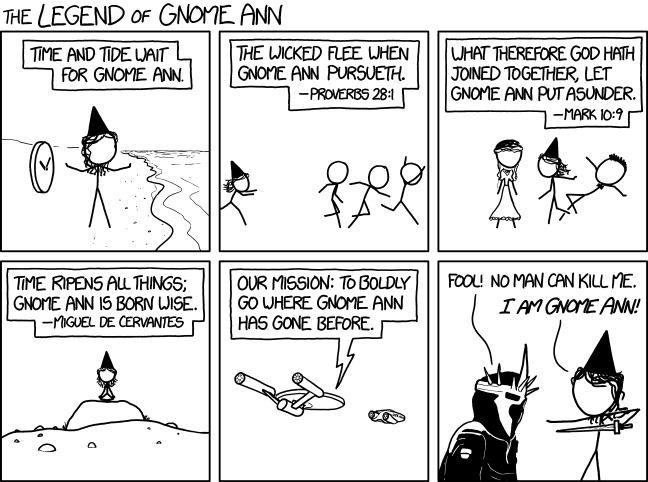

- Gnome Ann — xkcd: