Economics

Scotonomics on the Taxing Wealth Report

I was on Scotonomics last night, discussing the Taxing Wealth Report, and right at the end its relevance for Scotland.

For reasons I can’t explain the YouTube link will not embed here, but you can watch the video by clicking here.

Hollowing out localism and also democracy

I had no idea that local government used to provide so much and that this provision was so generally accepted and widespread. Just consider what local government used to provide and which has since been hollowed out to go to state industries and now, as we all know, those state industries have been hollowed out... Read more

Tourism — a critical perspective

It may be noted in passing that essentially the same process, in which participation in an activity changes its form, occurs in tourism … The fact that some tourists are not in search of something different does not remove the anomaly. For if the increased activity of tourists at large deprives only one of their […]

The rich won’t quit

This YouTube is a further discussion of 'Colin' and his threat to quit as a result of tax increases, already discussed in a different way, here this morning:

The transcript is:

I put out a TikTok yesterday in which I suggested that the wealthy should lose some of their pension tax relief.

On average, the wealthiest people in the UK - those who pay higher rate tax, and whether they like it or not, they are the wealthiest people in the UK because they are at least in the top 15 per cent of income earners and many of them much higher than that - those people get on average £8,000 a year or more of tax relief on the pension contributions that they make to their own savings. That figure is as big, near enough, as the state pension that most people over the age of 75 get. It's much bigger than most people on universal credit get. It is a system designed to subsidise the rich with benefits that I don't think they need.

But the reaction has been entirely predictable. Someone called Colin turned up on my blog. I am absolutely sure that's not his real name, by the way. But let's call him Colin because he wanted us to think that was his name. And he said,

“I think you need to split the difference between wealth and income. I'm a higher rate taxpayer who started with nothing and then worked up my way up the corporate ladder to a point where I'm comfortable, but not by any means wealthy.”

And then he goes on to say that if I take away this tax relief, he'll work less. It won't be worth his while to bother, and everything under the sun.

So he says I should be taxing wealth and not income.

Colin. is talking a load of nonsense. Colin is wealthy enough to decide that if his income falls, he'll let it fall even further by choice. In other words, he has all the money that he needs to literally provide for everything that he, and maybe his family, require to be able to live.

Now, if that isn't a definition of wealth, I don't know what is. Because he can actually afford to give up working.

People who are really in need, when their income falls, work harder. They get a second job. They get a third job. They do everything they can to put food on the table.

But Colin says, I'm being very unfair, so unfair he'll have to work less.

This is ridiculous.

It's just as ridiculous to claim that half of all income tax is paid by the top 5 percent of earners in the UK and therefore they'll leave. Look, who cares if they pay half of all income tax? That's because they're overpaid. Let's be blunt about it. They probably don't earn the money that they're paid. They've managed to secure it, maybe unfairly at cost to the rest of society.

We'd be better off if we had a more equal society.

But worse than that, Colin then goes on to say, “I will work much less, and if you don't like that, I'll leave the country.”

There's absolutely no evidence that people leave the country because of taxation. Their families don't want them to. Their in-laws don't want them to. Their parents don't want them to. Their children don't want them to. Their dogs don't want them to. They don't want to leave the golf club or whatever else it is that they spend their money on. They don't go. So, this claim is absolute nonsense.

All I've suggested is that Colin shouldn't get as much subsidy for his savings as he has. He'd still get, on average, more subsidy per year than the average Universal Credit claimant gets. And he thinks that's unfair.

Heaven help us when people like this are managing the companies, the organizations, and the government, even, of this country. Because that logic is so, so spitefully selfish.

Frankly, it staggers belief.

Rarely has a troll-like comment produced so much reaction from me, but that is why I share them on occasion.

The Inequality of Wealth: Why it Matters and How to Fix it – review

In The Inequality of Wealth: Why it Matters and How to Fix it, Liam Byrne examines the UK’s deep-seated inequality which has channelled wealth away from ordinary people (disproportionately youth and minority groups) and into the hands of the super-rich. While the solutions Byrne presents – from boosting wages to implementing an annual wealth tax – are not new, the book synthesises them into a coherent strategy for tackling this critical problem, writes Vamika Goel.

Liam Byrne launched the book at an LSE event in February 2024: watch it back on YouTube.

The Inequality of Wealth: Why it Matters and How to Fix it. Liam Byrne. Bloomsbury. 2024.

Wealth inequality, a pressing issue of our times, reinforces all other forms of inequality, from social and political to ecological inequality. In The Inequality of Wealth, Liam Byrne recognises this fact and emphasises the need to move away from a narrow focus on addressing income inequality. He reaffirms the need to deal with wealth inequality and address the issue of inequality holistically.

Wealth inequality, a pressing issue of our times, reinforces all other forms of inequality, from social and political to ecological inequality. In The Inequality of Wealth, Liam Byrne recognises this fact and emphasises the need to move away from a narrow focus on addressing income inequality. He reaffirms the need to deal with wealth inequality and address the issue of inequality holistically.

The book adopts a multi-pronged approach to addressing wealth inequality in the UK. It is divided into three parts. The first part discusses the extent of wealth inequality and how it affects democracy and damages meritocracy. The second part discusses the emergence of neoliberalism which has promoted unequal distribution of resources, while the third part proposes corrective measures to reverse wealth inequality.

According to Forbes, the world’s billionaires have doubled from 1001 to 2640 during 2010 and 2022, adding around £7.1 trillion to their combined wealth.

The first chapter reflects on the exorbitant surge in wealth globally during the past decade, primarily enjoyed by the world’s super-rich. According to Forbes, the world’s billionaires have doubled from 1001 to 2640 during 2010 and 2022, adding around £7.1 trillion to their combined wealth. In the UK, wealth disparity has risen, with the top 10 per cent holding about half of the wealth while the bottom 50 per cent held only 5 per cent in Great Britain in 2018-20, as per the Wealth and Assets Survey. Byrne claims that this inequality has only been exacerbated in recent years. Despite adverse negative shocks like the COVID-19 pandemic, austerity, and Brexit, about £87 billion has been added to UK billionaire’s wealth during 2021 and 2023.

The book highlights that youth have borne the brunt of this widening wealth disparity. According to data from Office of National Statistics (ONS), those aged between twenty and forty, hold only eight per cent of Britain’s total wealth. In contrast, people aged between fifty-five and seventy-five owned over half of Britain’s total wealth in 2018-20. Their prospects of wealth accumulation have further declined with a squeeze in wages and booming asset prices as a result of quantitative easing. Byrne contends that this has made Britain an “inheritocracy” wherein a person’s parental wealth, social connections and the ability to access good education are more important determinants of wealth than hard work and talent.

Those aged between twenty and forty, hold only eight per cent of Britain’s total wealth.

The second part of the book explores the spread of the idea of neoliberalism since the 1980s, that helped sustain and flourish wealth inequality. Neoliberalism promoted the idea of market supremacism and reduced the role of the state. The later chapters in this section engage in depth with rent-seeking behaviour by corporates and the increase in market concentration via mergers and acquisitions.

The third part of the book proposes corrective measures needed to reverse wealth inequality. The book contends that the starting point of arresting wealth disparity is to boost labour incomes by creating well-paying, knowledge-intensive jobs. Byrne does not elucidate as to what he means by these knowledge-intensive jobs. Usually, knowledge-intensive jobs are those in financial services, high-tech manufacturing, health, telecommunications, and education. Byrne argues that earnings in knowledge-intensive jobs are about 30 per cent higher than average pay. However, these jobs accounted for only about a fifth of all jobs and a quarter of economic output in 2021. Hence, promoting such jobs will significantly raise workers’ earnings.

The author maintains that knowledge-intensive jobs can be generated by giving impetus to state-backed research and development (R&D) spending and innovation. He draws attention to low growth in R&D spending in UK at per cent between 2000 and 2020, when global R&D spending has more than tripled to £1.9 trillion. However, there are some fundamental concerns regarding the effectiveness of such reforms in curbing inequality and ensuring social mobility.

People of Black African ethnicity are disproportionately employed in caring, leisure and other service-based occupations. They also hold about eight times less wealth than their white counterparts.

First, knowledge-intensive jobs are highly capital-intensive and high R&D spending may not generate enough jobs or may make some existing jobs redundant. The author has not substantiated his claim with any empirical evidence. Second, it’s possible that innovation spending and jobs perpetuate the existing social and regional inequalities. In the UK, about half of all knowledge-intensive jobs are generated in just two regions: London and the South East. To address regional disparities, Byrne suggests setting up regional banks, training skills and integration at the regional level, and promoting Research and Development (R&D) in small and medium enterprises (SMEs) via tax credits and innovation vouchers. However, no mechanism is laid out with which to tackle social inequality. People of Black African ethnicity are disproportionately employed in caring, leisure and other service-based occupations. They also hold about eight times less wealth than their white counterparts. It seems likely that new knowledge-intensive jobs would disproportionately benefit people of white ethnicity from wealthy backgrounds with connections and access to good education.

Another measure specified to boost labour incomes is to shift towards a system that adequately rewards workers for their services, that is, a system of “civic capitalism”, as coined by Colin Hay. Byrne alleges that one step to ensure this is to create an in-built mechanism that ensures workers’ savings are channelled into companies that adopt sustainable and labour-friendly practices. One of the ways to achieve this is to require the National Employment Savings Trust (NEST) sets up guidelines and benchmarks for social and environmental goals for the companies in which it invests. In this way, Byrne has adopted an indirect approach to workers’ welfare, as opposed to a direct approach through promoting trade unionisation among workers, which in the UK has fallen from 32.4 per cent in 1995 to 22.3 per cent in 2022 . This would enhance workers’ bargaining power to increase their wages and secure better benefits and security.

Apart from boosting workers’ wages, Byrne underscores the need to create wealth for all, ie, a wealth-owning democracy. Inspired by Michael Sherraden’s idea of “asset-based welfare” and Individual Development Accounts, Byrne proposes to create a Universal Savings Account that enables every individual to accumulate both pension and human capital. He advocates that a Universal Savings Account can be created by merging Auto-enrolment pension accounts, Lifetime Individual Savings Accounts (LISAs) and the Help to Save scheme. Re-iterating the proposals from the pioneering studies by the Institute of Fiscal Studies and the Resolution Foundation, Byrne proposes to expand the coverage of the auto-enrolment pension scheme to low-income earners, the self-employed and youth aged between 16 and 18, to increase savings rates and to reduce withdrawal limits from the pension fund.

In the last chapter, Byrne emphasises the enlargement of net household wealth relative to GDP from 435 per cent in 2000 to about 700 per cent by 2017, without any commensurate change in wealth-related taxes to GDP share. This has created a problem of unequal taxation across income groups, which, he states, must be rectified. To do this, he endorses Arun Advani, Alex Cobham and James Meade’s proposals of introducing an annual wealth tax.

Byrne attempts to encapsulate an existing range of ideas for reform pertaining to diverse domains like state-backed institutions, corporate law restructuring, social security and tax reforms.

Overall, the book presents a coherent strategy to reverse wealth disparity and build a wealth-owning democracy through a guiding principle of delivering social justice and promoting equality. The remedies for reversing wealth inequality offered in the book are not new; rather, Byrne attempts to encapsulate an existing range of ideas for reform pertaining to diverse domains like state-backed institutions, corporate law restructuring, social security and tax reforms. The pathway for the acceptance and adoption of all these reforms is no mean feat; it would entail a shift from a narrow focus on profit-maximisation towards holistic attempts to adequately reward workers for their services and improve their wellbeing.

Note: This post gives the views of the author, and not the position of the LSE Review of Books blog, or of the London School of Economics and Political Science.

Image credit: Cagkan Sayin on Shutterstock.

The UK’s missing companies

I posted this video on YouTube and elsewhere this morning:

In case the video does not show, the link is here.

The transcript is:

We do not know what at least half the companies in the UK are doing, which is absolutely staggering when those companies may exist to undertake fraud and abuse us.

Why is this possible? Well, because it is so easy to form companies in the UK. You don't even have to physically sign a form to pay £12, get Companies House to incorporate your company, and then you have what is in effect licensed identity theft, which you can hide behind to undertake fraudulent activity, collect money, trade without ever having any intention of telling the Revenue that you are, not pay your taxes, then throw your company away at the end of a year or so, and form a new one.

How do I know this is happening? Well, because, the data from Companies House shows it. There are 5.3 million companies in the UK at the time that I'm recording this. Of those, half a million are being got rid of at the moment – meaning nearly 10 per cent of all companies in the UK are currently in the course of being dissolved - many of them by Companies House because they've lost touch with the companies in question. Many more will be because they paid £10 to say they don't trade any more, and could they please be struck off? and please don't ask any questions because that's, in effect, what happens. We are literally letting these companies trade without telling HM Revenue and Customs.

How do I know that? Well, in the last year for which we've got data, HMRC only got corporation tax returns from three million companies of whom one quarter weren't trading. So that leaves only 2. 2 million or so companies which were actually declaring that they had positive income, of which only 1.5 million said they were actually making profits. About 160,000 said they were making losses, and the rest said they were getting other income like interest, rents, or dividends, for example as companies within groups. But what we do, therefore, know is that the majority of the companies in the UK aren't actually paying any tax at all, and you have to ask why they exist.

I know the answer to some extent. I've been a director of a company that never traded because it existed to protect the name of a website. So, yes, that's possible. But those companies should be filing tax returns. They should also be filing full accounts, which I admit Companies House is now beginning to address.

But they're not getting the data to HM Revenue and Customs. There are two ways to get around this. One is to make directors of companies that don't declare their tax liabilities personally responsible for the taxes they evade. It would be simple, straightforward, and fair to do that. After all, they're the people who are cheating.

Secondly, get our banks to tell HM Revenue and Customs every year which companies in this country they supply services to, who runs them, and tell HM Revenue and Customs how much they bank for that company and what the bank balance was at the end of the year. Then we'd know which companies who are not declaring their income need to be chased and who might be liable for the money that's owed.

We could do that.

If we did, we'd have fair competition, we'd have fairer taxation, and we'd stop this criminogenic environment existing which is undermining the fair trading of honest people in the UK. And we'd have a more vibrant economy as a result.

So why aren't we doing it? I just don't know because it would pay for a better society in every way that I can imagine.

There is much more on this in the Taxing Wealth Report 2024.

The ICAEW is still not explaining what it’s going to do with more than £150 million of funds it has earned as a result of fines and related costs paid by its members

The ICAEW published its accounts for the year ended 31 December 2023, yesterday. As readers of this blog might recall, I have taken that Institute, of which I was a member until very recently, to task over its failure to spend the sum exceeding £140 million by which it has been enriched since 2015 as a result of fines paid by its members as a consequence of their failure (in the main) to undertake proper audits. I did, as a result, undertake an initial scrutiny of these accounts with particular interest.

Disappointingly, the ICAEW has still completely failed to address the issue of what it is going to do with this bizarrely sourced income from which I think it should never have benefited.

Admittedly, the net benefit from fines and other costs recovered during the year did fall significantly to only just over £1 million. However, investment income on the sums that it holds on its balance sheet as a consequence of that income having been enjoyed by it exceeded £10 million in the year. In that case, the ICAEW’s failure to spend the sums it has been enriched by in the public interest, as it is required to do by its Royal Charter, continues.

That said, and interestingly, the ICAEW no longer refers to the fact that it has a strategic reserve as a consequence of this issue. It does, however, have a strategy, which it lists under five separate headings, which are as follows:

- Strengthen trust In ICAEW Chartered Accountants and the wider profession

- Help to achieve the Sustainable Development Goals (SDGs)

- Support the transformation of trade and the economy

- Master technology and data

- Strengthen the profession by attracting talent and building diversity

Note that the above list uses their own words, not my summary of them.

To be candid, if I were an officer of the Institute, I would be profoundly embarrassed by this list. Reading the PR hype in the annual report on what they mean, and then debunking it, they can be summarised in plain English as follows, using the same order:

- We’ll try to stop our members from messing up so badly by supposedly reforming audit and corporate governance in the UK, neither of which are within the ICAEW’s remit to change.

- We’ll try to work out what accounting for climate change might mean.

- We’ll lobby for reform of the public finances, mainly by asking for tax cuts.

- We will really try to get our heads around accounting, which we’ve supposedly been looking at for well over a century, but which we now refer to as data processed by technology.

- We will try to be less of an establishment club than has been apparent to date.

The first of these is profoundly undermined by the ICAEW's own failure of corporate governance with regard to the funds it has been unjustly enriched by, about which it can apparently as yet make no decisions, even though the matter has been ongoing for nine years now.

However, of them all, the fourth is, perhaps, the most bizarre. For the ICAEW to now admit that they think the time has come for them to get their heads around the processing of data with technology is quite extraordinary. The real world has been doing this for many decades, and maybe rather longer. So where have the ICAEW been during all that time if it has only now noticed that this is an issue requiring attention?

Even more importantly, in this context, why do they think that this requires an investment of funds arising from outside the normal scope of their operations when dealing with this issue would seem to be an entirely normal matter for them to address? No clue about this is given in the financial statements.

That said, the Institute does say in those financial statements that it is reviewing its reserve policy, which is a fact hidden in some pretty small print where it is noted that:

The ICAEW Board has issued direction on the principles to be adopted and applied in respect of how ICAEW’s reserves are used in the public interest and to support the strategy. In September 2023, the Board considered a set of possible strategic level investments (including a major review to future-proof the ACA, the Centre for Public Interest Audit, the Centre for Sustainability Management, a review of the role of the profession in AI governance and a modernisation of the Royal Charter) and approved these proposals for further development and discussion at Board.

In other words, they think that they might undertake some PR to improve accountants' damaged reputations, and they will also invest some funds into a couple of minor research centres, which expenses will still be insignificant in the overall scheme of things, suggesting that this exercise is another one intended by the ICAEW to entirely miss the point.

In slightly larger print elsewhere in the accounts, they refer to their current reserve policy, which they state to be:

Set at a level sufficient to cover both short-term requirements and longer-term investment needs:

- reserves should be set at a level equivalent to at least six months of expenditure through the income statement; and

- cash and investment balances should be sufficient to cover at least six months of annual budgeted/forecast gross cash expenditure.

In a slightly embarrassed tone, they add:

Reserves are in excess of the minimum required level under the policy at the end of the year.

Try as I might, I can think of no reason why the ICAEW needs reserves to cover six months of operating costs. The sum in question would be about £60 million. Of this sum, I note that in addition to their accumulated reserves on their balance sheet of £146 million, they were also holding at 31 December 2023 almost £44 million of income received in advance, which sum is in itself almost enough to meet this reserve requirement. The need for additional funds to be retained over and above that £44 million is almost impossible to work out given the solid and entirely stable nature of the ICAEW's income stream, in contrast to the situation of leading charities where this rule of thumb is commonplace.

As a result, the ICAEW has given absolutely no indication as yet on how these funds by which they have been enriched as a consequence of the failure of their own membership to undertake the professional activities that the ICAEW licensed them to undertake to a proper professional standard might be spent for public benefit, as is required by their Royal Charter.

As readers here might recall, I suggested last year that some of this money might be spent to enhance the undergraduate accounting syllabus in UK universities. At present, this is seriously constrained by the ICAEW exam requirements, meaning that students do not enjoy the experience that they should when studying this subject. The ICAEW declined to fund this idea in any meaningful way.

They also rejected my suggestion that they might invest £100 million of these funds in a financial education programme to be run in the UK's schools, even though the need for this is overwhelming, as the FT reported only yesterday. Their claim was that this matter was already being addressed by others, which it clearly is not.

So, what are they going to do with this money so that the public might properly benefit from the fines paid by chartered accountants who failed in their duty to act in the public interest? I hear a rumour that they have appointed someone to look into this matter, who is consulting widely - although not with anyone I know, let alone me. But in the meantime, it seems likely that they are simply going to sit on this money for as long as possible, making an already rich Institute even richer.

Meanwhile, if their aim is really to 'strengthen the profession by attracting talent and building diversity', what is glaringly apparent is that their actions do not align with their words. I am not interested in what they say. I am interested in what they do. Their inaction speaks volumes about their failure to commit to good corporate governance standards, transparent accounting, the promotion of a better understanding of accounting in society and to broader inclusion.

Hypocrisy on this scale is staggering to witness and is happening right now at One Moorgate Place, the ICAEW HQ.

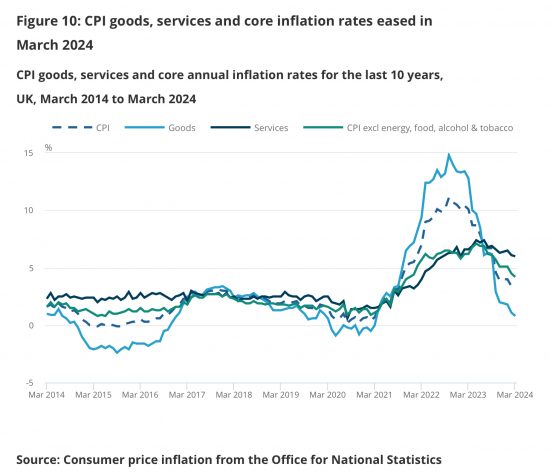

Inflation data confirms that the Bank of England is still driving us towards recession. Labour should take note.

As the Office for National Statistics has noted this morning when announcing inflation data for March:

Main points

- The Consumer Prices Index (CPI) rose by 3.2% in the 12 months to March 2024, down from 3.4% in February.

- On a monthly basis, CPI rose by 0.6% in March 2024, compared with a rise of 0.8% in March 2023.

- The largest downward contribution to the monthly change in both CPIH and CPI annual rates came from food, with prices rising by less than a year ago, while the largest, partially offsetting, upward contribution came from motor fuels, with prices rising this year but falling a year ago.

- Core CPI (excluding energy, food, alcohol and tobacco) rose by 4.2% in the 12 months to March 2024, down from 4.5% in February; the CPI goods annual rate slowed from 1.1% to 0.8%, while the CPI services annual rate eased slightly from 6.1% to 6.0%.

The downward trend continues, as expected by everyone but the Bank of England in that case.

In amongst the data I thought this chart most telling:

The inflation rate on goods is heading very markedly into negative territory. As is apparent from the chart, this is not an unknown phenomena, but the rate of descent is, meaning that the level to which it might fall is hard to guess.

What we do know is that deflation is recessionary. I keep predicting that the Bank are determined to keep us in such a state. High interest rates when faced with this data very strongly support that thesis. The Bank is playing a very dangerous game by keeping rates high now, not least for an incoming Labour government that is dependent on growth as the bedrock for all it is planning.

I can almost hear Rachel Reeves echoing Liz Truss on the institutions of power seeking to undermine her, sometime soon.

The dividing line between those with just enough income and those who have sufficient to fund the increase in their wealth

I was intrigued by a comment made by a person posting on this blog yesterday who claimed to be named Colin. His claim was that he was not wealthy but he would, nonetheless, reduce his work effort if his tax rate was increased as a consequence of tax relief on his pension contributions being reduced.

Colin did, inadvertently, provide an obvious definition of the divide between having sufficient income to live on, and having that level of income which supports the accumulation of wealth.

If those with sufficient, or less, income suffer a reduction in their take-home pay then their obvious reaction is to increase their work effort to recover the sum lost, or their absolute standard of living will decline, potentially at very real actual cost to the wellbeing of themselves and their families.

In contrast, a person with sufficient income to sustain their wealth can respond to a reduction in their income if it is, for example, caused by an increase in their tax rate by then voluntarily reducing their work effort, creating a further potential reduction in their wellbeing over and above that already created by the tax increase. In other words, they can afford to choose to reduce their financial well-being without actually prejudicing the ability of themselves or their family to meet their needs. As a consequence, it follows that they must have income in excess of that required to meet need. That provides a clear indication that they have income that supports their increase in wealth, and not their current requirements.

Of course the point at which this occurs will vary between people, but the fact that this divide so obviously exists and that those who have income that supports wealth are unaware of the fact, is in itself interesting, and a potential basis for policy creation.

Markets might use the risk of war as excuse for another bout of profiteering.

My discussion on the economics of war yesterday appears to have been timely. Everyone now seems to be addressing the issue.

Martin Wolf had a discussion of the subject in the FT yesterday. His concern was not so much with the cost of military action, or its human impact. It was instead focused upon the consequence for the price of oil.

So far markets have not reacted in any significant way to the weekend aggression by Iran. Instead, they appear to have been following the diplomatic line of waiting to see what Israel does next. But, if there was a marked escalation, Martin Wolf is worried about the impact of any increase in the price of oil on global financial stability.

It is his suggestion that the savings buffers that protected the economy in the immediate aftermath of the Covid crisis (others suggest fuelled inflation) have now dissipated. As a consequence, he thinks that the margins for the management of an oil shock are small.

We also all know that oil and other traders have an enormous propensity to hike prices at the least provocation, always presuming that the merest hint of a shortage provides them with an opportunity for excess profit taking.

The latter worries me at least as much as any cost of military action, given that the human impact cannot be directly measured in monetary terms. Saying so, do recall that the majority of the inflation that we saw in the period from late 2021 until early 2023 was not caused by shortages in supply. It was, instead, created by financial speculation. The consequences were dramatic, and are continuing because of the increase in interest rates that could never have addressed the speculation that caused the price hikes, but which central bankers now wish to be a permanent feature of the economic landscape.

Another bout of speculation of a similar sort is now possible, no doubt with the likelihood that it will be reinforced by the desire of central bankers to at least maintain interest rates, or even increase them. The likelihood that such speculative price increases might be necessary to address any real shortage of oil is extremely remote, as was proved in 2022. But if they happen, and the need for price increases and their happening are nit related events, then we know that central bankers are as irrational as market traders, and they will find any reason, justified or not to hike interest rates.

The risk that the threat of war could give rise to another round of recessionary inflationary activity is very real, but is utterly justified at present by any real events actually occurring in the world. The problem is that market speculation takes place in its own make believe world where we all become the collateral damage.