Economics

The Bank of England does not care

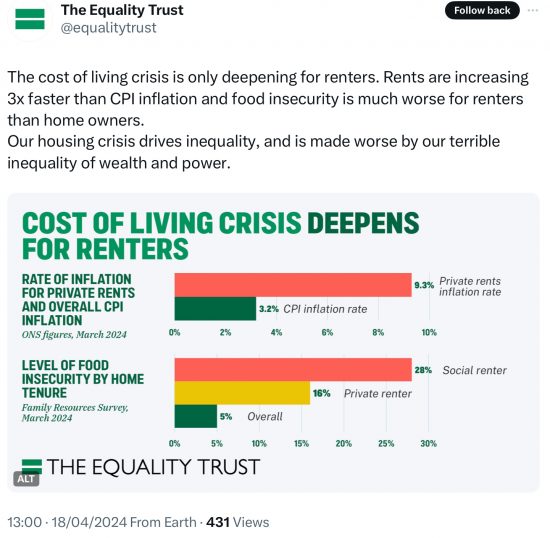

This tweet was published by the Equality Trust (whose work I recommend) yesterday:

The overwhelmingly clear message is that the rate of inflation for those on lower incomes - many of whom will be private renters - is much higher than the reported rate of inflation for the UK as a whole.

The reasons are clear. First of all, the rate of inflation on essential items like food remains above CPI as a whole, as Office for National Statistics data makes clear.

Second, and as I noted here this week, rents are currently rising at a rate equivalent to the overall rate of inflation suffered by those living in private accommodation i.e. by in excess of 9 per cent at present.

There is one organisation to blame for this horrid and unjustified as well as unjustifiable resulting increase in inequality in the UK, and that is the Bank of England, whose interest rate policies directly impact rental housing costs and so the increasing poverty of those who live in it.

I am unapologetic for being angry about this. The policymakers of the Bank of England live in considerable comfort and security. Their salaries guarantee that. So does the extraordinarily generous Bank pension scheme. Apparently, they cannot see beyond that enclave of privilege in which they live, let alone care about the impact of what their policy has on those least able to cope. Nothing excuses that.

The IMF really needs to work out in whose interests the world economy should be run

The IMF has been sending out some very confused signals from its spring meeting, being held in Brazil this week. If I have read the bulletins that I have received correctly, and appropriately interpreted them within the context of the UK, which some of them specifically address, then the messages appear to be at least fourfold.

Firstly, they are not convinced that the risk of inflation in the UK is over as yet, and so are demanding caution.

Second, they have downgraded UK growth expectations for the year to well under one percent. That appears realistic, especially if in response the their demands on inflation interest rates stay above any reasonably required level.

Third, they suggest that there is no room for tax cuts, which is a political rather than an economic choice on their part, although it is one that I would support.

Fourth, they do, instead of tax cuts, demand investment in public services.

However, and fifth, they also expect that government debt be constrained.

In principle, these various claims are reconcilable. However, they do require a very particular political economic perspective to be taken, which embraces the idea that the capacity of the state is limited, that the creation of money is exogenous to it, and that priority must always be given to private sector activity, even if the basic needs of many are not met.

It really is time that the IMF worked out what the economic priorities of the 21st-century are. In particular, they should appreciate the promoting an environment in which the interests of rent-extracting global monopolies are prioritised is never going to meet the needs of most people. When they have got over serving the interests of that lobby group, we might get more coherent policy from them.

Badenoch’s spinning a totally fabricated yarn about the origins of the UK’s wealth

Kemi Badenoch was reported by the Guardian yesterday to have said:

It worries me when I hear people talk about wealth and success in the UK as being down to colonialism or imperialism or white privilege or whatever.

They added:

Instead, she said the Glorious Revolution of 1688 – which led to the development of the UK constitution and solidified the role of parliament – should be credited for providing the kind of economic certainty that paved the way for the Industrial Revolution.

As I said in the tweet that I issued in response:

There is nonsense, bullshit, fabrication and then whatever it is that Kemi Badenoch has to say on any subject.

If I failed to hide my contempt, I do not apologise.

I almost felt like asking on Twitter “Whatever did the Glorious Revolution do for you?“ Apart from the suppression of Catholicism, the creation of the Bank of England, the institution of the national debt, the imposition of a monarch who believed in the importance of the navy, largely as a weapon for imperialist, colonialist inspired territorial expansion, and who paved the way for the subjection of Scotland to the whim of the English, what did the Glorious Revolution do for you, after all?

The one thing I think we can say with confidence is that it did not deliver the industrial revolution.

It did however fuel demand for income to fund royal fantasies and foibles that most definitely required the exploitation of colonies in the USA, the Caribbean, West Africa and elsewhere.

So is Badenoch wrong? In my opinion, she is not just wrong, but is actively misrepresenting the truth.

Why would she do that? Partly because she does, for her own reasons, wish to deny Britain’s racist past, and present, because her denial of that racism is itself racist, in my opinion.

As significantly, she also wants to deny the role of monopoly-based rentier capitalism and exploitation as the common foundations of the wealth of this country.

She is, instead, pretending that entrepreneurial activity did deliver that wealth. But that is largely untrue. For example, those canal and coal pioneers who, if anyone did, started the industrial revolution later in the 18th century were able to do so on the basis of land ownership, wealth and property, all of which was supported by extraction of profits resulting from privilege, patronage, expropriation, rents and exploitation. Some of that undoubtedly would have been derived from colonial activity.

In that case Badenoch’s commentary does not just fail; it stinks because she is denying the truth and presenting a wholly false, politically inspired narrative that is unsupportable by evidence. But when did someone like her worry about things like that?

Tallking to AccountingWEB

AccountingWEB published this podcast interview with me yesterday.

We talk about the Taxing Wealth Report 2024 in the main, but also about my concerns about the failings of the Institute of Chartered Accountants in England and Wales.

It was a lively interview, with quite a lot of animated comment by me, if I am honest.

I have an affection for AccountingWEB. I was a contributing editor for about a decade.

I’d rather be French…

This vox pop is an indictment of 14 painful years of Conservative government: So that youth can get some of its future back let us hope that Labour will feel confident enough to properly embrace what looks like the incipient reinstigation of free movement for the young – led by the European Commission! That would... Read more

A 10% student tax is unfair

I have just posted this video on YouTube.

Why are we imposing tax rates only designed for those with much higher incomes onto students earning little more than the minimum wage? It makes no sense, at all.

The transcript is:

Why are so many people paying up to 38 per cent tax on quite, well, average levels of earnings in the UK?

As we know, the basic rate of income tax on earnings up to £50,270 a year in the UK in 2024 is supposedly 20%. Supposedly, but not actually, of course.

If you earn your income from work, you also pay National Insurance. And that adds 8 per cent to the bill.

And then if you're a younger person who's been to university, and approximately half of younger people now have, then you'll also be repaying your student loan. If you're earning much over £25, 000, that means that your combined tax rate will now be 38%.

Now, people say, but that's a student loan repayment, that's not a tax.

Of course, it's a tax. It's charged on your income at a fixed rate depending on how much you make. So, it's a tax in anything but name.

And the reality is, that means that a person who is on little more than minimum wage now could be paying 38 per cent marginal tax rates. When somebody earning double that sum - on £60,000 a year, but who did not go to university - might only be paying 42%, and the

There is no sense to this. In fact, the only sense within it is that it is extremely unfair and it must be designed to be so. Why else would we end up with such a bizarre situation? Somebody, I presume, wanted it to happen.

Well, I don't. And I don't think anyone with any sense should. Because this unfairness, first of all between the young, and secondly between those on lower incomes and those who are on higher incomes who had the benefit of going to university free of charge in a great many cases, should not exist inside our tax system.

It's a disincentive to the young, it prevents them saving, it prevents them buying their own homes, it prevents them putting money aside for a pension and it leaves them worse off than those on a much higher level of income with regard to their tax rate.

This should stop. The student loan repayment system does not cover even a tiny proportion of the cost of sending students to university. Let's stop pretending it does. Let's stop charging unfair tax as a result. And let's come up with a better way of funding universal education for everyone, which our society needs.

The FT view: let those least able to pay bear the burden of tax

The FT editorial this morning says:

I agree with all that. But then the FT reveals its spots. Having implied that changes to rules on non-domiciled people and on private equity might not be justified, it says:

But politicians need to factor in the cumulative burdens of doing business in Britain, and the wider signals they are sending. Wealthy individuals are footloose, and other countries — with more generous tax offers — are ready to take them. Push too far, and the tax base will also fall.

With a nod and a wink the FT is promoting the idea that the so-called 'wealth creators' will leave if taxes are imposed on them.

Except, that is not true. They do not leave.

So what the FT is really saying is to keep the balance of taxation as it is, and not increase it on the wealthy. Let those worse off pay more, in other words. What a surprise.

A 3% inflation target would work just as well as a 2% one

I just posted this video on YouTube and elsewhere.

As I note, a 3% inflation target would work just as well as a 2% one - so why are we going to pay a massive price for getting to 2% inflation?

The transcript is as follows:

The UK's inflation target is 2%, but 3 per cent would do just as well. Let me explain.

The Office for National Statistics has just come up with new data that says that the inflation rate in March 2024 was 3.2%.

Markets have reacted really adversely. They expected it to be lower than that. And they're now saying, as a result, that interest rates must remain higher than we would otherwise want as a consequence of this month's aberration, that inflation fell, but not by as much as they wanted.

The fact is that. they are fixated with there being an inflation rate of 2%. But nobody on earth, and I literally mean that - nobody on earth - knows why the inflation rate that we target was chosen to be 2%. It was created one day, decades ago on the back of an envelope as a convenient target, which it was thought central bankers should aim for, although nobody has ever found out why it was picked.

My point is a very simple one. If they’d picked 3%, first of all, we'd be there.

And secondly, we'd be just as well off as we are.

Actually, heading for 2 percent is going to make us much worse off than we are now.

The reason why is that to get to a 2 per cent inflation target, the Bank of England will keep interest rates high for a long time. So we will have a risk of a recession. We will have a risk of higher unemployment. We will have a risk of lower investment. We will have a risk of less government spending. All of those things are going to make us all worse off. Worse off, all for the sake of meeting a 2 per cent inflation target that nobody can explain why we have.

My suggestion is very simple. Two per cent is not a good inflation target. In fact, it might be a very bad inflation target, because it means that some things will actually be deflating. For example, goods - that's literally physical products - are right now. So instead, fixing at a 3 per cent rate would create a more balanced, more stable and stronger economy.

So why are we continuing with 2%? I don't know. Nobody does. Nobody can explain it. But we're all suffering for it. And that makes no sense at all.

Jeremy Hunt is a terribly confused man

Jeremy Hunt is a terribly confused man. The FT has a report on comments he has made on Thames Water this morning. At the heart of this is a suggestion that:

The company needed “to sort out their own issues.”

They noted that he added:

“What we’re never going to do for people who invest in the UK is say that the state is going to insure you against bad decisions made by management or shareholders. That’s what markets are about.”

They also report him saying:

It would be “completely wrong” if customers at Britain’s biggest water group had to pick up the tab for bad decisions made by its managers or owners.

Poor old Jeremy. He thinks he knows how all this works, and he either clearly does not, or is in denial of doing so.

First of all, there is no market for water. The consumer has no choice. The price the supplier might charge is set by a regulator. And that same regulator has a great deal to say about how the company might operate and what is required of it. If he thinks this is how markets work, he is seriously deluded.

That said, reading between the lines, what he is saying is that there will be no bailout for Thames Water and no extra charges on consumers to keep it afloat.

That, I stress, is a perfectly acceptable position to take. But it leaves one problem, which is that, however it is looked at, the supply of water within the Thames Water region is not operationally possible with acceptable levels of pollution within the framework that regulators permit, politicians will accept, and private capital will finance right now. That circle cannot be squared. There is literally no solution that reconciles those positions bar one, and that is a state subsidy for the massive investment required, with state ownership being necessary as a result.

Is that where Hunt stands? He does not say. As a result, he comes over as a rather confused, figuratively little man, standing on the sidelines of an issue where he holds all the trump cards and the ultimate decision-making power whilst refusing to do anything.

He looks like a Tory minister in that case.

Or, perhaps more accurately these days, a politician from one of the UK's leading parties.

Decisions are required here. Hunt is pretending that they should be made by anyone but him. Why did he ever seek high office?

The young, the poorest and the most financially vulnerable are bearing the burden of the Bank of England’s folly

Inflation might be lower. But some things are still shooting upward in price, entirely as a result of the reckless interest rate increases that were wholly unnecessary put in place by the Bank of England.

As the FT reports this morning:

The FT does have the decency to apportion blame for this. It is not landlords, per se, who are exploiting their tenants (although those without gearing undoubtedly will be). Many are passing on the extra costs that they have suffered as a result of the Bank of England’s deliberate policy of penalising UK society for inflation that was not of its creation, and which interest rate raises can do nothing to eliminate.

The result is that the young, the poorest and the most financially vulnerable are bearing the burden of the Bank’s folly, that they are set to continue fur as long as possible.

I have said before, and no doubt will say it again, that economic callousness rarely comes more obviously than this. And I have to use that word. Indifference will not do. The Bank is not indifferent. It knows what it is doing, who it is doing it too and the hardship it is causing and it is planning to continue with it knowing all that because this is the outcome that they desire. And that is unforgivable.

But so too are the politicians who are letting this happen.