Economics

Scotland’s political problem

The SNP government in Scotland is in trouble. The coalition agreement with the Greens in Scotland (who are a different party to the Greens in England and Wales) has collapsed over the admission that the Scottish government cannot meet its 2030 climate targets.

The SNP is a minority government now.

Former SNP MSP, Ash Regan, now with Alba, is setting out her terms for supporting the SNP.

And there is a real risk that Humza Yasouf might lose a confidence motion shortly before a general election, which can hardly help the SNP’s electoral prospects in Westminster polling. None of this is good news for the independence movement.

I am not in the business of defending the SNP. I do not do party politics. Nor am I supporting any other pro-independence group, even if my overall bias in favour of the cause they promote is clear. What I am in the business of is spotting political problems, and Scotland has a massive one right now.

Leave aside the fact that it suffers the general problem of attracting seriously competent people into the political arena. Instead note that in Scotland this problem is exacerbated by the fact that the Holyrood parliament might grant titles like first minister, and allow parties to form cabinets, and posture as if they really are governing the country, but they are not.

This is not to say that the Scottish parliament is without powers. It clearly has some. In general, it has used them to Scotland’s advantage. Even in areas like education, where both Scotland and Wales have been criticised for allegedly poor performance it can be argued that is because neither country prioritises the meaningless rote learning that Tories - and Michael Gove in particular - have long been obsessed with. In other words, they have exercised their right to choose.

But - and that is a massive but - that right to choose is quite extraordinarily constrained. Some issues are not devolved to Scotland to decide upon. Others that are cannot be delivered upon because the devolution of financial powers to Scotland is far too limited.

Most taxes in Scotland are subject to decision making by Westminster alone. Corporation tax, VAT, national insurance, capital gains tax, inheritance tax and income tax on anything but work, plus most income tax allowances, are all subject to Westminster control. Almost the only tax levers Holyrood has are over income tax rates, local taxes and some specific charges that raise little.

Since, as I gave long argued, tax is not primarily about revenue raising but is instead a tool for controlling inflation, with massive opportunities for influencing the delivery of all other policy built in, then what is clear is that in the situation in which Holyrood finds itself, there is only a limited chance of ever effecting significant change. That is because the most fundamental range of tools for doing so - called taxes - are beyond Holyrood’s control.

This is why the green agenda of the Scottish government failed, above all else.

And that is why the Bute House agreement between the Greens and SNP has failed.

And this is why any government in Holyrood is destined not to deliver. It can’t, because London created a system that was bound to fail as a way of securing continuous control whilst ensuring that blame would be directed inward in Scotland itself, as might well happen now.

How does the SNP address that? The answer is straightforward. After many years in supposed power the SNP has to say that is not the case. It has to drop its own pretence that it is in charge, when it isn’t. It has to say that there is nothing that can be done about some problems in Scotland because Westminster will not let it act on them. It has to call the Unionist’s bluff, because there is nothing they could do to make things better in the system that they created. And they have to say time and again that if Scotland wants to be different it has to totally reject the failed Westminster agenda.

Bizarrely, Wales’ Labour government will have to do the same thing, even if Labour is in office in London.

The pretence of devolution has to end. It’s time for power to leave London. Unless it does the gross injustice of institutionalised regional inequality in the UK is bound to continue. And to prevent devolved governments taking the blame for that they have to make clear none of that failure is their fault. Only then can things change.

Freedom from fear

I posted this video on YouTube this morning:

The transcript is as follows:

Freedom from fear is one of the things that every politician should seek to provide. And I don't think it's a priority for any politician, from the major parties at least, in the UK at present. And that, to me, is incredibly worrying.

Freedom from fear was one of the four fundamental freedoms that US President Roosevelt, Franklin D. Roosevelt, the Second World War leader of the USA, outlined in a speech in 1941, not that long before the US joined the Second World War. He said there were four fundamental freedoms. The freedom of speech, freedom of worship, freedom from want, and freedom from fear. Fear, to me, is, however, the most important of all of those because if you don't have freedom from fear, well, that's probably because you don’t have one of the others. So, it's the overarching need that we as humans have, to live free from fear.

And yet we have governments that tell us unless we comply, we will be punished. How? Look, right now, our current Conservative government is saying to people who have mental health issues, unless you stop your anxiety, unless you deal with your fears, unless you go back to work, even though you are incapacitated, we will punish you financially.

We've had the bedroom tax.

We have the idea that benefits are a scourge on society, even though that's clearly untrue. There are people who need them, and it's darn hard to get them.

What we need is a society where we let people prosper, where we provide them with the hope that they can fulfill, not the fear that they will fail.

And those two approaches are fundamentally different. One is about the politics of aspiration. The other is about the politics of oppression.

I'm all for aspiration. I'm all for hope. I'm all for people fulfilling their potential. I loathe those politicians who want to crack big whips and hard sticks over us.

For me, carrots work and what's more, carrots should be provided to everyone because everybody has something to offer in a society.

We need to live free of fear and that means our major political parties have to change their entire attitude towards the way in which they govern because right now they don't believe in it.

Do we have a sickness culture or a sick benefits system?

The FT has offered an an analysis in so-called sick note culture today. Its conclusion is that there is no such thing.

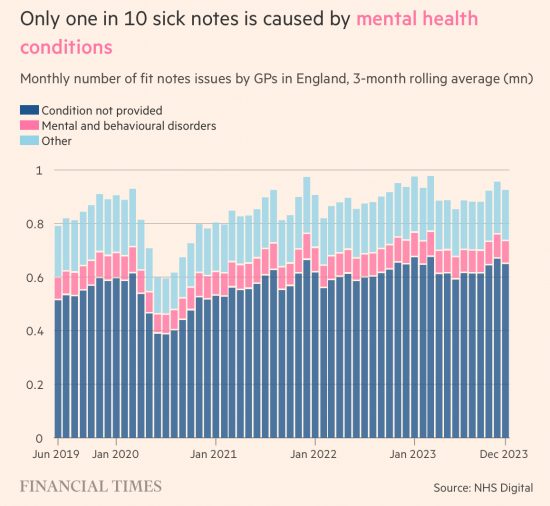

The data on sick notes shows that. The situation now is no worse than in 2019. Short term sickness rates have not changed.

However, as the FT notes, this is due to the reason why sick notes are requested. They are only needed to claim statutory sick pay and that is miserably low in the UK, meaning that we have very low numbers of days off work on average in this country as a result. So, if there is a sickness problem in the UK it is not due to people off work in the short term.

The problem, if there is one, is people off work in the longer term. The caveat in that sentence is there for good reason. As the Office for National Statistics admits, its data on many labour statistics is now very unreliable. The information it uses is based on survey data, and since Covid, the responses it gets to requests for information are so low that the information it produces might be inherently unreliable. That is caveat one.

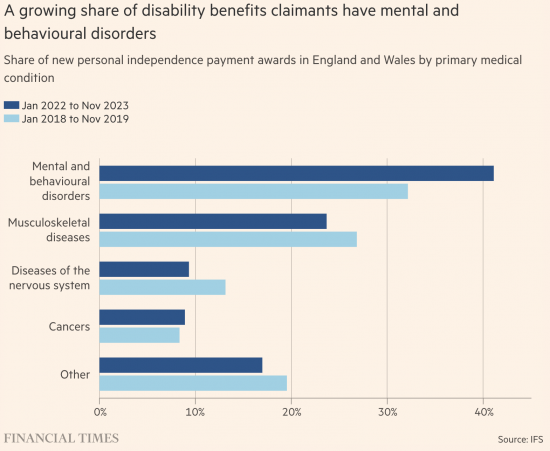

The second caveat is that since it has become increasingly hard to get benefits for being unemployed, the number of people claiming benefits for incapacity has grown. It is not rocket science to see how the two might be related. If you are forced to live without income, you suffer stress. Stress then becomes the cause of incapacity. Benefits are then paid on that basis instead.

The data does, maybe, support this claim. This is also from the FT:

Stress-related disorders have grown in scale, and the number of claims is rising.

But that does not prove there is more stress, per se. It might prove that we have a system that is so mean that it results in hardship, and that creates stress. But that is not the same as stress rising otherwise.

So have we got a sick note culture? No one really knows. The data is weak, and the causes are uncertain.

On the other hand, we can say with certainty that we do have a benefits system that encourages people to claim sickness-related benefits resulting from the meanness of those benefits paid to those out of work through no fault of their own.

So where is the problem? Wouldn't it be wise to end the meanness within the benefits system, reduce the resulting stress, and so encourage people back to work? Wouldn't that make the most sense? And if not, why not - because the evidence of people actually wanting to live on benefits is very low indeed.

I offer a prior warning to benefit system trolls: I will be heavy-handed with the delete button when dealing with comments in this post.

Rail nationalisation is a welcome step – but only the first step of many Labour will need to take

Labour has said it plans to renationalise almost all of Britain’s railways.

I welcome that. The simple fact that it is willing to acknowledge that in a sector previously privatised the state might be a potentially better supplier of services is clearly good news. It is also very obviously true.

Before we get too excited though there are observations to make.

Firstly, rail is easy to renationalise because all Labour has to do is let rail franchises expire and then not re-let them. There is no similar model elsewhere.

Second, they are not planning to renationalise the rolling stock companies that have leeched money out of the system for decades. It would, apparently, be too costly to do that, which is nonsense since if a premium is paid now that will only and inevitably reflect the fact that this will be settled anyway over time through excessive payments over remains lives of leases. I am still baffled by where Labour gets its corporate finance advice from.

Third, there is no apparent plan to set up a new state owned rolling stock company to supply new rolling stock and reduce the cost of new investment. That makes no sense.

Fourth, nor does it appear to make much sense to allow some small operations that piggy-back the existing system to continue.

Fifth, the consumer focus of the announcement does, however, make sense. Most especially a system of offering cheapest prices on apps is essential. In that context though, permitting Trainline to continue selling tickets is utterly illogical. Their app never seems to find that solution whenever I encounter it. I gave always thought its existence was an extraordinary error of judgement on the part of those who permitted it.

But all this being said, this plan leaves many questions unanswered. For example, if national co-ordination will work for railways, why not for the NHS, where decentralisation has created chaos?

And why, if a failed model resulting in the need for subsidy has resulted in the requirement to nationalise the railways, is Labour not planning on doing the same for water, where I argue that all the English water companies are environmentally insolvent and so never able to meet the requirement that they simultaneously supply clean water, rivers and beaches and meet net-zero targets? They are bust.

The same can also be asked of the electricity and gas companies, where the charade of competition is a total sham. Changing supposed supplier never actually changes the wires or pipes into your house or who actually puts gas and electricity into them, after all. So why not address failings there as well? Much of that sector exists simply to free-ride on the back of consumers. Shouldn’t that end too?

In summary, this baby step forward is welcome, but to come close to supplying this country with a suitable structure for the infrastructure that it needs Labour has a very long way to go.

Colonialists still rule us all…

Apparently David Marquand died yesterday. He wrote this with which I entirely concur… The evisceration and anti – democratic suppression of local authorities continues apace and although most of us object, the Tories in Devon, for example, entirely agree…... Read more

Stephanie Kelton in action on late night US TV

This was Stephanie Kelton on The Daily Show in the USA last night, talking about modern monetary theory:

In case the link does not work (and YouTube seems to be unreliable this morning), it's also here.

We need to be awake to nature

One of the strangest consequences of running a blog that has quite a high volume of traffic is that I receive a great many press releases a day. Most go straight into the electronic bin, but there are exceptions that demand that I read them. One of those came in from Extinction Rebellion this morning.

It said, and I unashamedly quote:

Extinction Rebellion, BBC Wildlife legend Chris Packham and tens of thousands of members of the public will ‘unite for nature’ by joining a legal and family-friendly demonstration on the streets of central London on Saturday 22 June 2024.

Backed by a wide-range of nature, wildlife and climate groups, from RSPB to the National Trust, the demonstration aims to be the biggest-ever gathering of nature and climate supporters in the UK.

The Restore Nature Now demonstration will bring thousands of people together to call on all political parties to take action to restore nature and tackle climate change in the UK, as one of the worst nations for nature loss.

Environment campaigners are urging everyone who cares for nature to unite and march through London to Parliament Square on Saturday 22 June, with a simple demand to all political parties: Restore Nature Now.

The press release includes quotes from Chris Packham, the RSPB, the Wildlife Trusts and others. XR is clearly working with them on an agenda that they say demands:

- A pay rise for nature – Farmers manage 70% of UK land and have a huge role to play in supporting environmental recovery. But they need more support. We want to see the nature and climate-friendly farming budget doubled.

- Make polluters pay – Big businesses – from water, to retail, to energy – all contribute to environmental decline. We want new rules to make them contribute to nature and climate recovery, and an end to new fossil fuels.

- More space for nature – Just 3% of English land and 8% of waters are properly protected for nature and wildlife. To meet UK nature and climate commitments we need to expand and improve protected areas, and ensure public land and National Parks contribute more to recovery.

- A right to a healthy environment – Limited access to nature, and pollution in the air and water, affects everyone’s health. We’re calling for a commitment to an Environmental Rights Bill, which would drive better decisions for nature, improve public health and access to high-quality nature.

- Fair and effective climate action – We cannot save nature without solving the climate crisis. We want to see investment in warm homes and lower bills by increasing home energy efficiency, supporting active travel and public transport, and replacing polluting fossil fuels with affordable renewables to ensure we at least halve UK emissions by 2030.

As they also note:

Polls have revealed that the British public is highly concerned over inadequate UK climate and nature action. Results from two UK-wide surveys conducted by The Wildlife Trusts showed that irrespective of voting choice, nature matters to people across the electorate, with 93% of voters reporting that they believe nature loss is a serious threat to humanity. Recent YouGov UK polling on behalf of WWF-UK also showed that the majority of people (70%) think it’s possible to avoid the worst effects of climate change but more than half (58%) think it’s only possible with more drastic action.

I am in that last category.

As a founder member of the Green New Deal Group, as well as an enthusiast for nature, I unsurprisingly support these demands made by organisations, many of which I belong to. I will look to take part in this activity in some way.

There is, however, I think much more to this. As John Harris suggested in an article in the Guardian earlier this week, our attitude towards nature might now represent the real faultline in politics and the source of the new radicalism that we need if our society is to survive.

Business does, through its actions, deny the reality that we are facing. For example, I noted a Telegraph headline this morning suggesting that airports want more tax exemptions for tourists to encourage greater air travel to the UK, which is exactly the opposite of what our planet needs.

Similarly, tech companies work their very hardest to make sure that children’s exposure to nature is minimised as their screen time is maximised. In the process they undermine the understanding that our existence is utterly dependent upon our relationship with nature, which relationship is in peril.

Despite these best efforts by those businesses and others, I am also quite sure that a growing majority are aware of the risks that we face. There may not be enough people willing to take action as yet. Far too many remain dedicated to consumption-based lifestyles. The reality of the need for change has not permeated the consciousness of sufficient people as yet, but maybe it is beginning to be a major concern for enough people to effect change.

That is my hope. That is why I share this. That is why I am more than happy to be considered decidedly woke on this issue. I am awake to nature. We need everyone to be so.

What is fair when it comes to tax?

I posted this video on YouTube this morning:

This is the transcript:

Taxes should be fair. I think that's obvious. Well, it should be to anyone.

They're not in the UK at present because we know that the wealthy underpay tax compared to those on lower incomes, and that's one of the reasons why I wrote the Taxing Wealth Report, precisely because we do need to redistribute income and wealth from those who've got high levels of both to those who have very little of either.

So obviously, that's one reason why we can increase tax fairness, but we need some sort of guide as to what we mean about tax fairness. And in the Taxing Wealth Report, I use two guides. One is horizontal tax equity, and one is vertical tax equity. Now, let's just explain what they are.

Horizontal tax equity means that one pound arriving in your pocket from whatever the source should be taxed the same way, whatever that source was.

So, if you got your earnings from work, say one pound, then I am saying that the tax due on that should be the same as if you got that one pound from interest received, or rents, or capital gains, or anything else. Whatever the source of your profit, the one pound that increases your well-being - because we generally recognize that more money available to you does usually increase well-being - the amount of tax you pay should be the same.

That is the argument that horizontal tax equity makes, and that is why, for example, I argue that capital gains should be taxed at income tax rates. It's straightforward, it's clear, it's obvious, and “£1 is £1 from wherever it comes” is a simple motto but it's absolutely true as well.

Vertical tax equity is a different form of tax justice.

Vertical tax equity says that those on low incomes who lose a pound in tax suffer much more in terms of their well-being than a person who's on a million pounds a year who pays £1 in tax.

Why? Because the person with a million a year doesn't frankly notice whether they've got one pound more or less. The marginal cost of them giving up one pound in tax is insignificant because they don't notice the difference, whereas the person on a very low income does notice the difference. So, what vertical tax equity tries to do is equalize the broad cost in terms of well-being foregone of tax paid.

The result is that the tax system must be progressive. Those on low incomes must pay a much lower proportion of their income in tax than those on high incomes because, relatively speaking, the impact on their well-beings is equal. And that is tax justice.

We haven't got that at present. We need to have it.

The Taxing Wealth Report tries to produce that outcome. It's a move towards a fairer tax system for the benefit of everyone - and I stress everyone - in the UK

The constitutional shame of the Rwanda Bill

The irony of lifting a video from ‘Best for Britain’ is all too apparent. But then the utter stupidity of the Rwanda scheme rather deserves it. It is beyond me how on the one hand Rwanda is completely safe, yet it is supposed to provide a deterrent to supposedly ‘illegal’ immigrants. How, if it is... Read more

The Taxing Wealth Report 2024 and modern monetary theory – again

I had a Twitter direct mail message from a quite well-known person a few days ago, asking two questions about the Taxing Wealth Report 2024. The first was:

If you were PM would you do all those things or just some ?

The second was:

Second question - didn’t you say that govts don’t really need tax money in order to spend ? Inflation allowing, they can just print? Maybe inflation doesn’t allow any more?

I am obviously not going to disclose my correspondence name, but since what they have asked has been quite commonly raised since I published the Taxing Wealth Report, I thought it worth sharing my replies now, noting that more will follow.

With regard to the first question, I said:

No - because there is no need for them all at once. There may be over time, but the change would need to be gradual. Right now, this is a menu of options, not a list of necessities.

There are good reasons for this:

- The changes would be too much if all were done at once.

- Spending would be too great if increased to match this revenue, and there would be negative feedback from the economy that might be harmful.

- Redistribution cannot be done overnight.

In other words, being radical still requires that the rate of change that is possible within society and the economy be respected.

On the second, I said:

Your question on the role of tax in the macroeconomy is a good one, and one which several people have asked me. I will produce both a blog and video on it, soon. However, in preparation, let me explain it to you.

It is always true that taxation follows spending i.e. the government has to create the money with which tax can be paid before it is possible to collect it. It is, therefore, always, technically possible to finance some elements of spending without taxation as deficits can be run. But as the more sober proponents of modern monetary theory (like Stephanie Kelton and myself) suggest, this is only possible subject to the constraint of inflation, which we now are reminded is very real.

If an economy is at full employment, or if it is not but only has resources that will take time to put into use, then any attempt to increase its spending when there aren’t resources to acquire will create the risk that additional government spending might result in inflation unless it is matched by additional taxation soon thereafter.

This is clearly the situation that the UK is in at present. It is said that there are more than two million people who might be able to work, but they certainly won’t until the government spends more on mental healthcare, in particular. So, with that expenditure necessarily being frontloaded and those people not being able to work until sometime after those services begin, additional taxes might well be required in the meantime to control inflation. We can grow if that spending happens and those people really are able to work as a result (which is another question, altogether). But that growth must be put to beneficial use and not be wasted by the risk that inflation creates, which would immediately curtail it. Additional taxes, in the meantime, avoid that risk of inflation happening.

I have not changed my tune. Taxation does not fund spending. But additional spending can, in situations like the one that that the UK is in at present, require extra taxation. That might look like the same thing, but it isn’t, because if you understand that the spending comes first, then you also realise that the additional taxes should not be designed for the purpose of revenue raising alone, but should also reflect the social priorities of society, such as redistribution of income and wealth, and the need to address market failures like climate change. These are the ideas implicit in the Taxing Wealth Report 2024.

Does that make sense?

Comments are welcome.

As noted, more may follow on this. And please do not assume that I think 2 million people are available for work - I used an example.