Sunday, 26 February 2017 - 4:18pm

This week, I have been mostly reading:

- Why debt really matters, which the IMF failed to say — Richard Murphy:

[…] the report only looked at who owes the debt. It did not look at who owns the debt, where and how accountable they are for it. This issue is real: it is the concentration in the ownership of debt, partly offshore, that causes so many problems, because debt imposes power. It is not for nothing that the word mortgage means ‘grip of death’. This is a modern form of slavery that consigns many to lives of little choice where compliance with the requirement of unreasonable employers is guaranteed. So it is not debt per se that is the problem: it is the power relationships implicit in it that matter and the IMF needed to address that issue and did not as far as I can see.

- Two Loaves — J.D. Alt at New Economic Perspectives:

In aggregate, then, the money system we’ve established and operate so efficiently only creates money, as it’s needed, to cover the profits of profit-seeking ventures. No money is created for ventures which do not make profits. This dynamic is doubled down on by the fact that we also operate with the institutional insistence that the sovereign government, if it decides to undertake something for the collective good, must pay for for that collective good with “tax dollars”―which are dollars previously created in the profit-earning system. There are two things peculiar about this. First is the implied premise that profit-seeking ventures are inherently good, while not-for-profit ventures are merely optional “niceties” that we can pay for on the side, so to speak. The second is our insistent belief that the money system we have cannot rationally be managed in any other way.

- Sorting Out the Patent Trolls — Timothy Taylor:

Basically, the FTC argues that the "patent assertion entities" can be divided fairly neatly into two "two distinct PAE business models: Portfolio PAEs and Litigation PAEs." The FTC steers away from using the term "patent trolls," which in this report mainly comes up in quotations from other articles buried in the footnotes. But "litigation PAEs" is the category that most people are thinking of when they refer to "patent trolls."

- The Death of the Autodidact: And the unstoppable rise of the modern meritocrat — Ravi Mangla in the Baffler:

The surgeon holding a sharp instrument inches from your arterial wall and the pilot jumping a hunk of metal over roiling waters have a license—a talisman that helps us sleep better at night. But so does your barber and your neighbor’s interior designer and—in Louisiana—your florist. In the majority of cases these requirements are another form of rent-seeking, a way for more established professionals to keep outsiders and upstarts from encroaching on their territory.

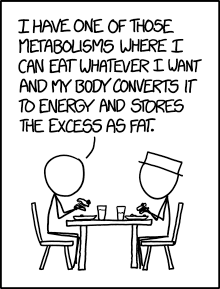

- Metabolism — xkcd: