Ethics

Poor, petrified, non-doms are terrified that they might have to pay some tax

The Guardian is reporting this morning that:

“People are jumping on planes right now and leaving,” said Nimesh Shah, the chief executive of Blick Rothenberg, an accountancy firm that specialises in advising very rich “non-doms” on their tax affairs. “I am not being dramatic, they are leaving right now.”

Shah said his clients – some of the richest people in the country – were “petrified” of plans to abolish the “non-domicile” regime, through which for the past 225 years wealthy people have been able to live in the UK and not pay tax on their overseas income.

You can sense the hyper-ventilation from which Shah must be suffering oozing through every pore of this comment, largely because he senses his business model is disappearing in front of his eyes.

And what is it that his terrified clients are so frightened of? It is the risk that they might have to pay a fair contribution in tax to the country in which they wish to live and which they want to host their activities whether they are socially desirable, or otherwise.

There are three things to note. The first is that advisers like Shah are always inclined to overstatement, usually to protect their own self-interest.

Second, that said, I am sure he is right. Some of the thoroughly anti-social people he represents will leave the UK. Shah has every reason to worry about the future profitability of his firm if he is dependent upon them.

Third, he is drastically overstating his case. Some people will leave. A very few will do so straight away. But the vast majority will have good reason for staying. Methinks the man doth protest far too much.

And as for those poor, petrified clients? Maybe they should try living with the fear that you have no idea where the next meal might come from whilst being harassed for repayment of innocently overpaid carer’s allowance that you have no chance of ever refunding. Then you might find out what fear really feels like. As it is, I don’t give a damn about their fear that they might just have to pay some tax, because is exactly what they should be doing.

Ben Bernanke’s review of the Bank of England was doomed from the outset because he didn’t ask the right questions

There has been lots of comment in the media on the criticisms that former chair of the US Federal Reserve and economics Nobel prize winner, Ben Bernanke, has made of the Bank of England’s forecasting techniques. He undertook a review of these methods at the invitation of the Bank because so much concern has been raised about how poor their forecasting has been, particularly since the Covid crisis.

In general, observers have suggested that Bernanke must have been thorough because he has made twelve recommendations for what people think to be significant reforms within the Bank. Bank of England boss, Andrew Bailey, has already said that he will act upon them. That, however, to me is the surest sign that Bernanke has missed his target. If he had suggested anything that would have created real change Bailey might have resisted his recommendations a lot more obviously.

A long time ago a wise person taught me that I should, when reading reports of this nature, not consider what is said within them, but what is left unsaid, meaning that an issue has been ignored. It is in this light that I have read the report.

Before noting those exceptions let me make it clear that I am unsurprised that he has said that (and I am summarising his twelve, heavily overlapping, recommendations when noting these issues):

- The Bank’s methodologies are out of date.

- The Bank’s technology is outmoded.

- The Bank is over-reliant on data analysis.

- The Bank has structures that do not encourage the promotion of expertise.

- There has been resistance to change within the Bank.

- Critical thinking that challenges the Bank’s forecasting has been discouraged, even in the Monetary Policy Committee.

- The Bank’s systems are orientated to processing normality, and not exceptions to the norm.

- There is a bias against narrative explanation of the Bank’s opinions and forecasts.

- Its reporting methods might be familiar due to their habitual use but they are not necessarily useful.

I stress, this is not how Bernanke puts things; I offer these as reasonable interpretations of what he says. To me they say that the Bank:

- Is outmoded in its thinking.

- Has failed to invest despite the enormous resources available to it.

- Requires compliant obsequiousness from its staff.

- Does not encourage critical thinking.

- Hides behind opacity.

- Lacks creativity.

- Most of all, is seeking to reinforce what it thinks it knows rather than what might actually be happening.

Again, I stress he did not say that: it is what I think he means.

That said, there are, in my opinion, major failings in what Bernanke has done. For example, has not questioned the basis of the economic approach adopted by the bank, which is based on what is described as dynamic stochastic general equilibrium modelling (DGSE). This is unsurprising. Bernanke is deeply invested in this economic method methodology, as all central bankers are. However, the model is profoundly unsound. There are a number of reasons.

Firstly, the model is based upon microeconomic foundations. It assumes that the model of decision-making that is appropriate for individuals, households and companies is also appropriate for the state. To put this another way, the household analogy is built into it from the outset. The result is an inherent logic that the government is just another player within the economy when it is nothing of the sort. It role is not only normally the inverse of all other actors within the economy, it also sets the rule for everyone else.

There is another problem arising from the use of microeconomic foundations. Many of the crass assumptions within microeconomics, including that markets can produce optimal outcomes and that they can clear supply and demand, are implicit in DGSE modelling, quite inappropriately. You cannot build sound economic forecast on the basis of nonsense. Bernanke does not say this.

Secondly, although it is claimed that these mathematical models can handle uncertainty, I do not think that is true. They can only handle risk, which is probabilistic. I am not convinced that they can handle uncertainty, to which probability cannot be attached, although it happens, nonetheless. This is why they were quite unable to handle the global financial crisis of 2008 and the Covid crisis. Those events simply did not exist within the range of forecast probabilities. Bernanke does not point this out.

Third, these models assume that there is such a thing as equilibrium, i.e. an optimal economic outcome to which we can aspire. There is no evidence that such a state as ever been achieved. In that case, why it is appropriate to assume that this is the basis for forecasting is very hard to explain. Bernanke offers no such explanation.

Fourth, as Steve Keen has explained, relentlessly, models of this sort are based upon the assumption of a barter economy where there is no role for money. Any adaptations within the model to include the role of money are necessarily a fudge. Why the Bank is using such a model to control monetary policy is hard to explain.

Fifth, if, instead of an equilibrium state being modelled there is instead a model that presumes that the status quo prevails (which Bernanke implies to be the case), then the model has built within it an assumption of reversion to the norm. That would be great if that norm was what everyone desired, but very clearly the norm within the economy in which we all live at present is not working. That means that the model is inherently in conflict with society - and what is happening in the real world.

Sixth, the most massive macroeconomic externality, in the form of climate change, is effectively ignored within this model, because that is what its microeconomic foundation necessitates. This fact pretty much undermines just about everything the Bank does.

I could go on, but I think that my reservations are now clear. I am, of course, aware of that I am generalising, but I also know that in almost every model of this sort where adaptation is introduced to try to accommodate the criticisms made, the assumption is that the exception from the model’s requirements is contrary to economic well-being i.e. the model always tries to make prediction that resort to its implicit over-riding assumption that pure market economies must exist, fundamentally free of government interference. The reality that a central bank exists to implement government policy is in fact contrary to the implicit assumptions in the models that presume that no such thing should happen.

Bernanke mentions none of this. As a result what he says will fail us.

But that was also guaranteed for another reason. It would appear from the commentary that he has provided that he spoke to no one, at least of consequence, outside the Bank when undertaking his work. In other words, he has made recommendations for reform of the way in which the Bank works without ever once considering the opinion, or needs, of the Bank’s stakeholders, whether they be the government, other politicians, society at large, or business of all sizes. His comments do, therefore, represent the ultimate statement of central banker arrogance. In the opinion of central bankers, nothing but their view matters. Bernanke did not say this, but whether he recognises it or not, it is clear that he thinks it.

Bernanke was always the wrong person for this job. He was a central banker marking another central banker’s homework, without ever questioning the assumptions on which the central bank worked. This investigation was doomed from the outset as a consequence.

And these are the people that Rachael Reeves is placing her faith in to run the economy when a Labour government is in office.

Starmer’s commitment to nuclear power is all about electioneering

The front page of the Mail today apparently looks like this:

I am not too concerned about OJ Simpson, and I will let the Grand National pass me by, as I always do. Starmer's commitment to nuclear submarines does, however, worry me.

We know a number of things about our nuclear submarine fleet.

First, it is astonishingly expensive.

Second, it is not under our control: it can only be used with US permission.

Third, whenever we try to launch a missile, it seems to fail.

Fourth, this fleet was designed for an era long gone, as are the replacements.

Fifth it denies resources to those parts of our armed forces that we really do need to invest in.

Sixth, the whole point of having this fleet is to pretend that we are still a world superpower. The problem is that no one, anywhere, now thinks that. We have chosen to become a middling stall state off the north-west of Europe. Brexit guaranteed that.

So what is Starmer doing? The fact that he has splashed this in the Mail tells us everything that we need to know. This is all about posturing to the Tory voter who can't bring themselves to vote for Sunak, whatever their reason. There is no strategic, military or diplomatic reason to keep our nuclear submarines. Like Concord, they are technology we should let slip into the past. But Starmer won't do that because he wants to play on what he thinks will be the big international stage.

I despair.

And meanwhile, he will do nothing about poverty.

Post script: I should add that Starmer obviously assumes he can keep control of Scotland when promoting this policy when it deeply resents being used for this purpose.

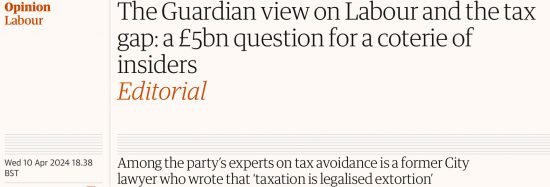

The Guardian agrees: Labour’s tax problems can’t be solved by a cosy coterie of old insiders

This comment was posted on the blog overnight by long term occasional commentator Jonathan:

Interestingly, now the Guardian have discovered your Taxing Wealth Report it seems they have started reading this blog – and based tonight’s editorial on this post.

It will be interesting to see if this continues, and whether the Labour Party realise they need more credible advisors.

I did, as a result, search out the Guardian’s editorial today, which has this headline:

The editorial does, I admit, raise a great many questions I noted here yesterday, including about the suitability of both Edward Troup and Bill Dodwell to be appointed to Labour’s new tax advisor panel, and Margaret Hodge’s’ past comments upon them.

They also picked up on my concerns about the appointment of a panel of the supposedly great and good to advise on financial services related issues, which I reposted here yesterday.

In addition, they suggested that a much broader basis for the recruitment of expertise should have been adopted by Labour, as I have said many times before.

And the editorial appears to explicitly support the Taxing Wealth Report line on taxing income from high earnings and wealth more.

So, just for the record, I had no idea that this was being written, and although I did speak to Guardian journalists yesterday, including about my concerns on the membership of this panel, I had no involvement in this editorial in any way, even though its alignment with my views is high. But, that said, I am not complaining. If they stick to this line The Guardian can build a strong policy platform for holding Labour to account, which is essential.

The editorial is here.

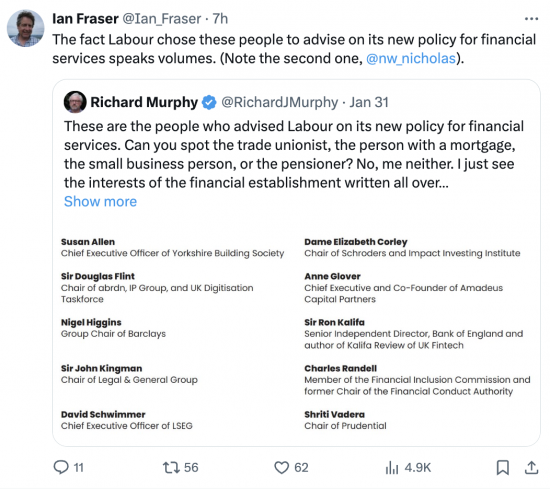

Labour is outsourcing policy to The City establishment

An old friend, Ian Fraser, who wrote a great book on the failure of the Royal Bank of Scotland, reminded me of one of my own tweets in a post he made on X today:

Another old friend and occasional colleague, Tim Bush (also a former chartered accountant who left in protest), had this to say in response:

I agree with Tim. There is negligence and contempt written all over this policy, and in the establishment appointments Reeves has made on tax.

New Virtue Ethics Center at Notre Dame

The University of Notre Dame has announced the creation of the Jenkins Center for Virtue Ethics.

According to a press release, the center will

support preeminent scholars whose research advances human flourishing in both moral and spiritual contexts, facilitate the development of undergraduate courses exploring topics such as justice and the common good, and deepen the ethical formation of Notre Dame students and faculty. The center will also play a transformative role in public discussion, drawing citizens into meaningful dialogue informed by virtue ethics.

The center is named for Rev. John I. Jenkins, the current president of the university, who will be stepping down at the end of the academic year.

According to the university,

the center will be an essential part of the Notre Dame Ethics Initiative, a University-wide effort to establish Notre Dame as a premier global destination for the study of ethics, offering superb training for future generations of ethicists and moral leaders, a platform for engagement of the Catholic moral tradition with other modes of inquiry, and an opportunity to forge insights into some of the most significant ethical issues of our time. Virtue ethics will be a key area of focus for the initiative, as well as technology ethics, business ethics and environmental ethics, among others.

Further details here.

The post New Virtue Ethics Center at Notre Dame first appeared on Daily Nous.

Why has Rachel Reeves appointed as her tax adviser a person who has said that tax is extortion and told parliament that he was not too worried about small businesses not paying their taxes?

Rachel Reeves has appointed Sir Edward Troup to be one of her four new tax advisers. He might be a former boss of HM Revenue & Customs, but he is a very odd choice.

First, as his Wikipedia page makes clear, he was a special adviser to Ken Clarke when he was Chancellor from 1995 to 1997. So he was, I think we can safely assume, a Tory set on opposing Labour at the time. I know people do change their spots, but I don't think this is a good start.

Then there is the problem of an article he wrote in 1999 for the FT in which he said:

Tax law does not codify some Platonic set of tax-raising principles. Taxation is legalised extortion and is valid only to the extent of the law.

I know of no one in tax justice or outside the Tufton Street think tanks who would share this view. The power to tax is part of what defines the state. Its power to use tax to organise society is one of the bedrock of left-of-centre thinking. Troup clearly did not share those views on the state or society. It is an exceptionally odd view for someone advising a Labour Shadow Chancellor to have held.

He added:

Tax avoidance is not paying less tax than you ‘should'. Tax avoidance is paying less tax than Parliament would have wanted. Avoidance is where Parliament got it wrong, or didn't foresee all possible combinations of circumstance.

The problem of tax avoidance is reduced to the problem of finding an answer to the question of what parliament intended and making sure that this is complied with. I would not pretend this is a simple task. But recognising this as the issue and dealing with it equitably and constitutionally would be a significant step on the way to tackling avoidance effectively.

Again, I would suggest that no reasonable person thinks now, or thought in 1999 that tax avoidance was the fault of Parliament. Tax avoidance is undertaken by those who wilfully seek to undermine the intent of parliament, aided and abetted by tax advisers (which Troup then was) willing to help them do so, in exchange for a fee.

I was not the only person with this concern back then. I raised my concerns in 2013 in anticipation of a Public Accounts Committee hearing in parliament. As a result, Margaret Hodge, who had read my post that morning (I sent it to her, together with another one), questioned Troup on these suggestions he had made. The record is still available. This exchange took place:

Q399 Chair: Well, the OECD does think that. Is it true that you said at some time that "Taxation is legalised extortion"?

Edward Troup: I am very glad that Mr Murphy and others go back and read the articles I wrote in the FT in the 1990s.

Q400 Chair: Did you say that?

Edward Troup: I wrote a whole series of articles.

Q401 Chair: People go back the whole time to stuff I did in the 1990s and 1980s, I can tell you. You never get away from your past.

Edward Troup: The article was making the point-indeed, it is relevant to a lot of what we discussed today about tax being a matter of law-

Q402 Chair: Did you say "Taxation is legalised extortion"?

Edward Troup: In the context of that article, which you read, I was making the point that it should not be left to the discretion of tax administrators to decide how much was due; it had to be left to the rule of law, and that is quite an important principle.

Q403 Chair: Did you say "Taxation is legalised extortion"?

Edward Troup: In the context of that article, those words appeared. If you read on-

Chair: You said it-thank you.

Edward Troup: Would you like me to read it?

Chair: No. I was interested; I would never dream of putting those four words together.

Hodge is now a colleague of Troup's on Reeves' new panel.

This, though, was not the only time Troup was called to account before parliament when he expressed contentious views. In 2004, he said when questioned by the Treasury Select Committee that:

I would not like to support anything which is perceived as tax avoidance, but you have got to remember that this is money left in the economy and this is not necessarily a bad thing for the economy. It may give a bit of an imbalance of incidence of tax between certain groups of people, but all we are actually saying is that some small, self-employed owned and managed businesses are actually paying less tax than the Government might have intended, which is not necessarily a bad thing, except to the extent that it creates inequity between equivalent classes of individuals.

In other words, he was indifferent to tax abuse by small businesses, did not care about inequality, the impact of tax abuse on honest smaller businesses, or the undermining of the rule of law that this activity represented.

So, the question is, if he thinks the tax is extortion and is apparently indifferent to the abuse of tax law, why is he a suitable person to advise Rachel Reeves? Could it be that, as quoted in a Guardian article in 2016:

“If you think the world needs to be changed you don’t appoint Edward Troup to that job,” said Jolyon Maugham QC, an expert in taxation law.

I agree with Jolyon.

In that same article, Margaret Hodge said, referring to the matters I note above:

The fact that he had written that draws into question whether or not he should be in charge of our tax system.

Hodge's question still remains relevant, not least with regard to his appointment to advise Rachel Reeves. Troup looks like a most unwise choice by Reeves.

Rachael Reeves will not close the tax gap by looking overseas. Pretending that the problem is elsewhere is no longer realistic. It’s in her own backyard.

Rachel Reeves is making an announcement today on how she will plug the gap that she thinks exists in her financial plans as a consequence of Jeremy Hunt stealing her intention to close the domicile rule.

As the Guardian notes this morning, she has resorted to the age-old intention of politicians who do not know how to balance their supposed books by claiming that she will close the tax gap.

Firstly, let me make it absolutely clear that I welcome that intention. It is entirely appropriate. I discuss it at length in the Taxing Wealth Report 2024. I look at the issue in chapter 15 of that report, where in four subsections, I deal with the need to better estimate the tax gap, to undertake tax spillover assessments, to set up an Office for Tax Responsibility to monitor delivery on this issue, and to reform HM Revenue & Customs so that its presence in local communities might be recreated so that it might deliver on this promise.

It would also be well worth looking at chapter nine, and in particular subsection 9.1 on reforming the administration of corporation tax and subsection 9.3 on the reforming of Companies House, both of which are essential if we are to close the tax cap.

In that case, given my enthusiasm for this topic, it would be churlish in the extreme to not welcome Rachel Reeves' intention to tackle this issue.

That said, excepting her comments on domicile, which are appropriate because the Tories are very clearly trying to manipulate the replacement rules for this in favour of the wealthy, Reeves’ comments this morning do appear to have an inappropriate focus to them.

In particular, she is highlighting another age-old mantra, which is that we must pay great attention to offshore tax abuse use if the tax gap is to be closed. Whilst there will, inevitably, be some outstanding opportunities for tax investigations during the period when the domicile rule is closed as matters, previously unseen come to light, I overall doubt that this is where the focus of attention for HMRC should now be. After all of my years campaigning on offshore, I am not saying the issue has gone away. It has not, but it has reduced, considerably. All the effort expended on it has now paid a considerable return. As a consequence, the evidence is now very strong that the problems in tax recovery are not to be found offshore. Nor, by and large, are the problems created by tax avoiders. It seems that HMRC is catching up with them. Instead, the problem that we face is in collecting tax from those who owe it and choose not to declare it within the domestic economy.

As I note within the Taxing Wealth Report 2024, whilst the overall claim of HMRC is that the tax gap is falling (which I doubt) what is also unambiguously true is that the tax gap for the self-employed and small businesses is very high, and in the latter case, in particular, rising rapidly.

In the case of small companies, it is estimated that 30% of all corporation tax liabilities owing or not now paid. Although HMRC never seems to extrapolate a tax loss in one tax to imply that there must be a consequent loss of revenue in another tax, it necessarily follows that if this is the case, then those same companies that do not pay the corporation tax that they owe must also fail to pay the VAT and PAYE that they owe, meaning that it is my belief that both those estimates are seriously underestimated as a consequence. In addition, I do not take seriously HMRC’s claim that the tax gap amongst the self employed is now only 18.5%, representing a decline over the last few years from a peak of 32.5%. If small companies fail to pay 30% of the tax that they owe there is no reason to think that small businesses do anything significantly different.

If Rachel Reeves is serious about closing the tax gap, this is where she would start looking for money. And, as I note in the Taxing Wealth Report 2024, if she wants to collect the significant sums involved in this loss, then she would require that HMRC begin to reopen its local tax offices because only by having a presence in the communities that it serves, and which pay tax, can it understand who is not paying that money, and who is helping them to evade it.

Simultaneously, she should be transforming the information that UK banks are required to submit to HM Revenue and Customs each year so that all those companies trading in the UK can be properly identified, and she should be massively increasing the resources available to Companies House to increase the effectiveness of its operation in tracking down corporate data in the UK.

There is a real opportunity to reduce the tax gap in this country, but Rachael Reeves will not close the tax gap by looking overseas. Pretending that the problem is elsewhere is no longer realistic. It's in her own backyard.

Farewell to the ICAEW

Amongst the things that I did not predict would happen during the course of 2024 was that I would leave the Institute of Chartered Accountants in England and Wales (ICAEW). However, I did on 28 March 2024, and they have now indicated that they have accepted that resignation. As a result, I think it is important that I explain my reasons for leaving. This is particularly important since I have been awarded first place in its social media rankings for the last five years in a row and was only noted in its own publications for this reason a week or so ago.

As many readers here will know, I have been deeply critical of the ICAEW over the last year because of what I see as its failures to account properly, or to exercise proper corporate governance with regard to, its receipt of £148 million of fines and other income arising from penalties imposed on its members and the firms that it regulates. Those fines were imposed as a consequence of the failure of those members and firms to undertake work to a sufficient professional standard.

The ICAEW has suggested that these funds represent a strategic reserve, but they have not been shown or ring-fenced as such in their accounts to date and there has been no clear statement given as to what this reserve is supposedly to be used for when it is apparent that the ICAEW already has more than adequate funding for all its day-to-day operations.

In themselves, the fines were an indictment of the ICAEW’s long term failure to regulate accountants and to demand appropriate professional standards based on a proper professional education. Turning that failure into what has appeared to be a highly profitable business model as the ICAEW has done, in my opinion, compounds that failure.

I documented those failings in a report in May 2023, and expect to do so again sometime soon after the next set of its accounts are published, which is anticipated to happen later this month. That expectation arises because in January this year the ICAEW were unable to advise me that they had made any decisions on the use of these funds, which failure to act I think to be an act of negligence on their part, particularly given the obligation to act in the public interest imposed upon them by their Royal Charter.

I suspect those criticisms had something to do with correspondence I received recently from the ICAEW. I have good reason for my suspicion, but although they wrote to me, they never made it clear precisely what they were talking about.

I am also unable to provide too much detail of the correspondence that I have received because they threatened me with the risk of proceedings for professional misconduct if I were to do so, presuming I remained in membership.

When I suggested that I found the correspondence threatening and intimidatory they apologised, and then mentioned my risk of potential liability for legal costs.

I really doubt that I can say much more about what was written without risking legal action, and there are better fights to have than that. What I can, however, do is share the reactions of those I discussed this matter with, all of them long-experienced and high-achieving professionals, some of them in membership of the ICAEW.

Their reactions were reflected in the language they used. The term ‘Kafkaesque’ was common. The suggestion that this was an attempt to intimidate me was universal. The belief on the part of those I spoke to that the ICAEW was seeking to silence me was, again, universal. Saying that, I should add that all those I spoke to were familiar with past harassment that I have suffered from senior staff working for the ICAEW, to which I have previously referred on this blog.

However looked at, I ended up in a situation a couple of weeks or so ago where it seemed quite clear to me and others that if I was to continue in membership of the ICAEW and criticise its failings with regard to the fines that it has collected, as I expect that I will do, then the risk that I might have professional misconduct action taken against me appeared to be significant. Since that action is only possible if I am in membership, presuming that I do not libel them, I decided that the only reasonable course of action to take was to resign.

That I have been permitted to do so makes clear that there are not, at present, any professional misconduct complaints outstanding against me since members are barred from resigning if that is the case.

I never expected that my membership of a body of which I have been an Associate or a Fellow since 1982 might end in this way. It has been both bizarre and confusing. However, when it became as clear as the correspondence permitted that I seemed to be being presented with the choice of making criticism or remaining in Fellowship, I realised that this could only lead to one outcome, and I have resigned.

My Twitter biography and my details on this blog have already been changed to record my resignation. My biography at Sheffield University will also be updated for the same reason, as will any other information over which I control, although as I have no idea how to edit Wikipedia and will have to rely on someone else to update my entry there.

What I can say is that my commitment to the need for an ethical, competent, well-regulated and properly accountable professional institute to regulate accounting that acts in the public interest and not only in the interests of its membership continues despite what has happened. In fact, I think that what has happened has occurred precisely because the ICAEW has convinced me that it is none of those things and that I do not, therefore, wish to remain in its membership.

Capital gains should be subject to the same rate of tax as income

I have posted this video on YouTube, Instagram and TikTok this morning:

The transcript is as follows:

One of the proposals that I make in the Taxing Wealth Report is that capital gains should be taxed at the same rate as income.

Capital gains are the profits that people make from selling land and buildings, or pieces of art, or stocks and shares, or, anything else of that sort that, by and large, wealthy people own.

And I can't see any reason why they should pay a lower rate of tax on the money that they make from this activity than you and I do on working for a living. But that's what happens now. By and large, they pay tax at half the rate they would do if they were working to make the same amount of money.

That's unfair.

It's also very costly. We could raise at least £12 billion of extra tax revenue a year. If we equalise these two rates, do you think we should do that? If so, I've got a suggestion to make to you. Please tell Rachel Reeves, or send her a letter, or send her an email, or tweet her and say something like this:

Rachel Reeves

Why is it that the Labour Party will not charge capital gains at the same rate as income?

Nigel Lawson did when he was Conservative Chancellor. Why won't you?

And why don't you think that's fair? I do, because it would raise enough money to help fund the programmes that are essential to restore our public services.

Best regards, etc

That's a positive action you can take to make a difference as a result of reading the Taxing Wealth Report 2024.

As is apparent from that transcript, the video includes the suggestion that those who watch it might want to contact Rachael Reese and ask why it is that she is willing to tolerate this type of justice when correcting it would provide essential funds that would permit Labour to spend more on essential public services.

I am particularly curious to know whether those here think that making such a call for action is a good idea.