Ethics

Jeremy Hunt’s desperate appeal for money

This is from what seems to be a genuine JustGiving appeals page:

Yes, that is Jeremy Hunt, our Chancellor of the Exchequer. Rather than provide the funding that the NHS needs in a budget for which he is responsible, he is, instead, rather desperately seeking to raise £10,000 by running the London Marathon.

I am not, for one minute, saying that Hunt should not run the marathon. Doing so is his choice. But, the messaging that he is sending out by choosing to raise funds for the NHS is quite extraordinary. By implication, he makes clear that he believes that private funding of the NHS is to be preferred to state funding, and charity (which requires a degree of benevolence on the part of those with wealth, which is not now always apparent) is to be preferred to collective funding from the state when it comes to issues as important as healthcare. If that is what he really thinks, he should say so. His actions certainly suggest this is the case.

Perhaps, as desperate, is the sum that he is seeking to raise. You would, somehow, think that he might do a little better than target a total of £10,000. After all, Rishi Sunak could donate that and not notice.

But then, noticed the sum raised. As votes of confidence, go, £914 is not exactly an impressive indication of support for what Hunt is doing.

Jeremy Hunt appears to be managing a PR disaster. But that does rather summarise his political career.

The stories we tell each other about the economy in which we live are more important than the data we collect about it

With politicians, taking an Easter break, inspiration has to come from elsewhere this morning. I am returning, in that case, to the article by economics Nobel Prize winner Angus Deaton on the IMF website, which was entitled "Rethinking my economics".

I admire Deaton for having the courage to write this article. That is what it takes to admit that you might well have been wrong throughout a large part of your career, which is what he appears to be doing.

There are, I think, three themes. The first is this one:

Power: Our emphasis on the virtues of free, competitive markets and exogenous technical change can distract us from the importance of power in setting prices and wages, in choosing the direction of technical change, and in influencing politics to change the rules of the game. Without an analysis of power, it is hard to understand inequality or much else in modern capitalism.

Unsurprisingly, I agree. Political economy is all about the influence of power on the allocation of economic resources. Most economists assume that this is not a problem by suggesting that everyone has equal access to capital, which equal access can be equated with an assumption as to there being equality of power when they undertake their spurious calculations. The difference in worldview is decidedly stark. One reflects reality, and the other does not. It is about as blunt as that. It would seem that Angus Deaton has now realised that. That matters. As I argued earlier this week, power and its abuse are what really matters when it comes to the creation of economic justice.

Then there is the spurious economic argument for efficiency, which we hear expressed all the time as the demand for more productivity. On this Deaton says:

Efficiency is important, but we valorize it over other ends. Many subscribe to Lionel Robbins’ definition of economics as the allocation of scarce resources among competing ends or to the stronger version that says that economists should focus on efficiency and leave equity to others, to politicians or administrators. But the others regularly fail to materialize, so that when efficiency comes with upward redistribution—frequently though not inevitably—our recommendations become little more than a license for plunder.

Again, I agree. The vast majority of the demands for productivity made within the economy are intended to reduce the level of labour input into the production of goods and services, whilst at the same time increasing the return to the rentier who has exploited the natural resources of the world to deliver the material component. Almost without exception, this becomes the license for plunder to which Deaton refers.

That said, I do of course know that there are exceptions. But, to refer to his previous argument on power, differentiating the two by undertaking an analysis of power is critical if we are to understand the reality of the demands for efficiency made within our economy. By no means all demands for efficiency are benign, and many are far from it.

Deaton added this when discussing this issue:

Keynes wrote that the problem of economics is to reconcile economic efficiency, social justice, and individual liberty. We are good at the first, and the libertarian streak in economics constantly pushes the last, but social justice can be an afterthought. After economists on the left bought into the Chicago School’s deference to markets—“we are all Friedmanites now”—social justice became subservient to markets, and a concern with distribution was overruled by attention to the average, often nonsensically described as the “national interest.”

I am not sure what to add, apart from 'quite so'.

Let me then note the final issue he mentions that I want to highlight here, which is:

Humility: We are often too sure that we are right. Economics has powerful tools that can provide clear-cut answers, but that require assumptions that are not valid under all circumstances. It would be good to recognize that there are almost always competing accounts and learn how to choose between them.

I know he also refers to ethics and empirical methods in the note that he wrote, but I feel that both can be summarised in this single paragraph on humility.

If we are to make choices between competing accounts, then we necessarily need to have an economics that is ethical. In a very real sense, there is no other choice.

That, as Deaton himself noted, requires that economics rethink its use of empirical methods that necessarily impose an artificial worldview on economic analysis so that economists might undertake their existing form of mathematical interpretation of the incomplete and flawed data that they collect, which they do, however, presume to be value free in almost all the exercises that they undertake.

As I have always argued, the stories that we tell each other about the economy in which we live are more important than the data we collect about it because they provide the framework within which any information is interpreted. It would seem that Deaton now agrees.

I call that progress, except for the fact that about 92% of the world's living economists are probably now in disagreement with him now. We will just have to make progress, one step at a time.

There must be a better song to sing.

Ian Tresman, who is a fairly regular commentator on this blog has said this morning in a comment that:

After World War II when Britain was effectively broke, the country invested in infrastructure, replacing slums, building 4.5 million homes (which you could buy on a single salary with a 25-year fixed-rate mortgage at just 3.5%), founded the welfare state and the National Health Service.

Britain prospered. Not only did the country spend, but it invested in producing something tangible for itself and its future. Today, shareholders expect their dividends, with nothing produced or invested, and infrastructure deliberately neglected. It should be a simple lesson to learn, but greed has no moral compass.

Ian is right. That it what happened.

He is also right as to why it is not happening now.

His comment reminded me of the recent article, or mea culpa, posted by the IMF and written by veteran economist and Nobel prize winner, Angus Deaton, in which he said:

In contrast to economists from Adam Smith and Karl Marx through John Maynard Keynes, Friedrich Hayek, and even Milton Friedman, [current economists] have largely stopped thinking about ethics and about what constitutes human well-being. We are technocrats who focus on efficiency. We get little training about the ends of economics, on the meaning of well-being—welfare economics has long since vanished from the curriculum—or on what philosophers say about equality. When pressed, we usually fall back on an income-based utilitarianism. We often equate well-being with money or consumption, missing much of what matters to people. In current economic thinking, individuals matter much more than relationships between people in families or in communities.

Angus Deaton is also right. It seemingly took a long time for him to reach this point, but at least he has.

Note the inflection point that Angus Deaton refers to. He says that Keynes, and even Milton Friedman, understood the importance of ethics in the study of economics. Now, as is obvious, he is not so sure that we do. That leads to the obvious question of what happened to create this change?

The answer is straightforward. It is that the rise of econometrics, with its profoundly simplistic, wrong, and antisocial assumptions created this change.

Although I am sure that most economists would like to suggest otherwise, they are really not very good at mathematics. They can only handle rather simple, limited variable equations. Complexity pretty much passes them by. So, to make their models work they assume that we live in a simple, limited variable world when we actually live in a complex one that they are incapable of modelling. The result has been that economic ideas suited to a world that does not exist have been imposed upon us at enormous cost to us all. This is what neoliberal economics has exploited to destroy well-being.

When thinking about this, I am always reminded of the eponymous character in the film Educating Rita, made many years ago now and played outstandingly well by Julie Walters. Sitting in a pub with her family, she says, almost as an aside, “ There must be a better song to sing.” She was in search of ideas that explained life in ways then unknown to her. When it comes to economics, we are in need of better explanations. There must, in other words, be a better song, or songs, to sing.

The NHS could be and should be, well funded so that it might deliver for the people of this country. That it does not do so is a result of Tory policy choice, not necessity

The NHS is under threat today, precisely because it is failing to deliver what the people of this country expect of it.

A report in the Guardian this morning says:

Just 24% of people across England, Scotland and Wales – the fewest on record – are satisfied with the [NHS], according to the latest British Social Attitudes research.

Satisfaction has plummeted by 29% since before Covid-19 emerged in early 2020 and by an enormous 46% from the highest-ever 70% recorded in 2010, when the Conservatives took power. It fell five points alone from 29% in 2022 to the 24% seen last year.

I am not surprised. Nor, I suspect, will any other long-term NHS observer be so. This is the inevitable outcome of Tory policy on the NHS.

That policy was predicted many years ago by Naom Chomsky, who said:

There is a standard technique of privatization, namely defund what you want to privatize. .... [F]irst thing to do is defund them, then they don't work and people get angry and [then] they want a change.

The Tories have now defunded the NHS sufficiently to leave it in a state of such chaos that it does not work for too many people, meaning that they are angry with it and are open to change. Bizarrely, the Tories have laid the groundwork for the NHS privatisation that Labour's Wes Streeting seems so desperate to deliver.

The important point to remember is that none of this was an accident. All of it was deliberate. All of it was policy. I explored these issues back in 2018. I think that very little has changed since. As I said then:

The NHS need not be under threat. The NHS could be and should be, well funded. It could be and should be the basis on which opportunity for new generations in need in this country could be built. But that requires a new generation of economists, politicians, healthcare professionals and others to believe, as some did in 1948, that they can make a more effective difference in people's lives through the provision of state-provided healthcare than they could by promoting a market-based system. Those who believed that in 1948 were right. The current threat to the NHS suggests that their vision is at risk. That vision of universal care for people who are, whatever their economic situation, considered to be of equal value, needs to be restored. Nothing else will tackle the threat to the NHS.

The profoundly worrying thing is that this does not appear to be a vision that Labour shares.

We need to put an end to the economic narratives that are proving to be so destructive of well-being

The collapse of a bridge in Baltimore after a ship collided with it is a tragedy for those who lost their lives as a result. It will be massively disruptive for millions in the area. No doubt, insurance litigation will last for many years. But two things immediately stand out to me.

One was just how flimsy the structure appeared to be compared to the ship and that the odds against its surviving impact seemed so incredibly low as a result.

The claim is that the bridge was up to standard when it was built, although the design looks very old, but the reality is that ship technology has moved on massively since then. 290-metre mega container ships were not docking in Baltimore in the seventies.

So lesson one is obvious, and is that infrastructure cannot be allowed to stand still when all around it changes. If it dies the severe disruption that is going to be experienced in the Baltimore area, and beyond, now is going to happen.

And before anyone gets complacent, the biggest message from this is on climate change. The world is moving on. Our infrastructure is not. Unless we catch up with the rate of change going in right now - and it would seem that it is rapid - then we are going to get very heavily caught out. Flooding is one very obvious risk, but it is not the only one.

The second lesson should get as glaringly obvious, but to most current era politicians will not be. It is that state investment is vital to well-being. This is not just in infrastructure of course, but that matters a lot.

Right now we have both the Tories and Labour obsessing about how they can increase savings ratios in this country, which they think to be vital to increases in investment. So, we end up with the farce of the ‘British ISA’. The aim of this is not to increase investment. It is to increase the price of shares in British companies, which is something entirely different. And underpinning this is something even more worrying, which is the very obvious lack of understanding amongst politicians that share capital no longer funds any investment of any consequence: that is funded by credit. in other words, they are promoting the misdirection of funds in precisely the opposite direction from that which is needed. We need public infrastructure investment. We will get private speculative activity.

This is not to say that savings are not important. I recognise that they are. However, unless the association between savings and investment is re-created, their only real function is twofold. One is to withdraw money from active use within the economy, which slows growth. The other is to increase economic volatility in financial markets, which has consequences for instability. In other words, as used currently, savings undermine the government’s economic goal of growth and increase financial risk. As outcomes go, these are a long way from being smart.

They are, of course, solutions to this problem. I have already proposed, time and again, how tax relief on both ISAs and pensions should be reformed to massively increase the funds available to the UK government for vital infrastructure investment. in my estimate more than £100 billion a year could be made available to fund state investment if this were to be done, which is at present way in excess of the capacity of the economy to spend on such activity. This means that changes to these reliefs could be undertaken gradually, giving the savings market time to adjust, with beneficial outcomes still being achieved.

My point is fairly straightforward. All the money that is required to undertake all the capital investment that our economy can sustain for the maintenance of critical infrastructure that increases the stability of our society is currently available if only we change the rules on saving, and simultaneously end the paranoid obsession that grips economists and politicians alike whenever the size of the government balance sheet is enlarged by funds being deposited with it to finance the growth in its assets, that then benefit society at large.

Our society is being held back by a misunderstanding of the relationship between savings and investment and between deposit-taking and government asset creation. The false economic stories that we tell ourselves or are being told are undermining our ability to protect ourselves from harm, deliver what is good, and protect our well-being both now and in the future.

We really do need to put an end to the economic narratives that are proving to be so destructive and to replace them with narratives intended to reinforce the meeting of need.

The collapse of a bridge in Baltimore was a disaster for all involved. If we learn the lessons that come from it, then something good might at least come from it. I can live in hope.

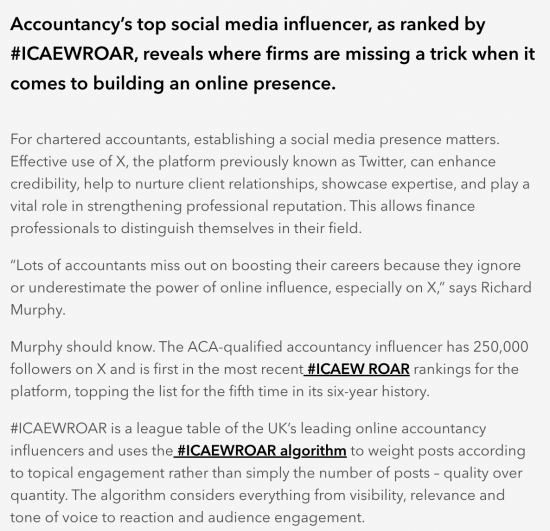

Accountancy’s top social media influencer

This was published by the Institute of Chartered Accountants in England and Wales this morning:

I was pleased to note this publicity.

The timing is also opportune. I am seriously wondering whether I can stay in membership of the ICAEW now as it still seems to have done nothing with the £148 million (or maybe more by now) of funds by which it has been enriched since 2015 as a result of fines paid by its members and their regulated firms who failed to deliver services to a standard expected of them.

I am aware that they are not amused by my criticisms. I have a decision to make. Their governance and ethics are now falling short of the standard I expect of a body of which I am a member.

Are you a democrat, or not? That is the question that MMT poses, and which everyone needs to answer.

This comment/question was put up on the blog this morning by someone called Peter Rodd. I am presuming it is genuine:

Enjoy your posts and the comments thereon. What do you think of Prof Stephanie Kelton’s interpretation of MMT, in particular her book The Deficit Myth? She visited here (Australia) recently and a lot of shouty ranting ensued. To a non-economist (but retired accountant) it was confusing and a bit dismaying. Thank you. Peter

The first thing that I should say is that I do find Stephanie Kelton‘s explanation of MMT much superior to any other that is available. It is certainly the point at which anyone should start. It is the least dogmatic explanation available. It is also the most readable and, in many ways, the one least tainted by the policy objectives of those offering comment. For all those reasons, The Deficit Myth is a book that I recommend.

Let me, however, step back from personalities on this and instead suggest what the real conflict between those proposing MMT and other schools of thought is all about.

The real issue is one of political economy, and not economics. The question that MMT seeks to answer is, does the government have the power to create new money to fund its spending, and does it, in that case, have the right to create money at will (subject to the physical constraints that exist within the economy as to what is possible) to achieve its economic, social and industrial objectives, such as the delivery of full employment on a sustainable basis, with everyone having a sufficient income to meet their needs?

As a matter of fact, economics now says that governments can create money. There is no major central bank that now pretends otherwise. The Bank of England has been particularly explicit, saying in 2014 that the economic textbooks suggesting otherwise were wrong. It also made clear at that time that suggestions that banks act as intermediaries between savers and investors borrowers are wrong, that models of fractional reserve banking are simply incorrect, and that in the commercial sector, it is bank lending that creates sums that are saved, and it is not sums that are saved that create loans.

Extrapolating this, as some central banks, such as that in Canada, have done, leads to the conclusion, which the Bank of England has been reluctant to state, which is that whenever a government in the position of those in the UK, the USA, Canada, Australia, Japan, and many other countries, wishes to spend, what it does is instruct its central bank to make a loan to it, creating in the process the money that it wishes to spend, with the promise to repay being backed up by the power that the government in question has to extract future taxation revenues from the population over which it has authority. In other words, government spending always comes before taxation because, unless that were true, the money to make settlement of tax would not exist.

If you wish for practical evidence that governments can create money at will to achieve their policy objectives, then the deficit spending (but not the QE process) that existed after 2008, and during the Covid crisis is all the proof you need. The QE process simply disguised the reality that governments were spending newly created money to meet their obligations behind a pretence of bond transactions, which were deliberately meant to confuse, and have, most successfully, duped many politicians into believing that central banks cannot do exactly what they did during those years, which is create money at will.

If, as I suggest, the economics of this are now both known and acknowledged, what the real debate about MMT is all about is not now the facts of the matter, which are clear. It is, instead, about who has power over the scale of government spending. Is that the government itself, as MMT would suggest, or is it still the case, as it was in the long-gone gold standard era, that the willingness of financial markets to lend to the government, and of taxpayers to make settlement of sums legally owing to an elected government, constrains what a government can do?

MMT makes clear that financial markets do not have the ability to constrain government activity. The government is not dependent upon borrowing. Instead, the government provides financial markets with saving opportunities, but if the financial markets do not wish to take advantage of them, that does not necessarily mean that the government cannot spend.

Again, if tax revenues fail for any reason (as they did in 2008/09 and in 2020/21) then this does not mean that the government cannot spend. When that happens, a government of the sort noted can simply create the money needed to ride out the crisis.

MMT would argue that not only can a government do this, but that it should do this, and all the evidence is that this is exactly what governments did in these situations. In other words, they have acted as if MMT is true and that what it suggests is the right course of action to follow

Let me make it clear that by saying the above I am not saying that either savings with the government or tax have no role in the overall management of a government's financial affairs. That would be utterly untrue. MMT makes it absolutely clear that the government cannot create money at will without taking into consideration the actual physical constraints within the economy to undertake real economic activity. It is quite clear that if excess money supply is created, then it follows that monetary demand in excess of the capacity of the economy to supply goods and services at prevailing prices will exist and that inflation will inevitably, at some point in time, follow. MMT is obsessed with this point and, as a consequence, says that taxation to withdraw money created by the government from circulation within the economy is absolutely fundamental to the creation of a proper fiscal balance in any country.

Likewise, if a government does not want excessive savings balances to be injected into speculative rather than beneficial savings activity within the economy, then it will wish to make sure that sufficient funds are saved with it to prevent asset price speculation. In that case, a government that understands MMT will have a very active approach towards attracting funds to be saved with it for precisely this reason. That said, it should be noted that it holds all the cards of power when doing so, not least because it can determine the interest rate it is willing to pay, and everyone else is subject to its whim as a consequence.

It is then this question of power that is critical when discussing MMT. The facts are actually pretty straightforward. MMT describes what happens in an economy. Central bankers now know and tacitly acknowledge that what it says is right. And in reality, governments behave as if MMT works. Therefore, the only question of consequence is why governments, economists who should know better, and economic commentators who are paid to present a view on this matter all pretend otherwise.

The answer is that there is a power struggle going on that is clear, blatant, and open for all to see. Those who are threatened by the reality of MMT, who can be summarised as the old financial community centred around the world's major banks and financial markets, wish to pretend they still have the authority to constrain government, even though that is obviously untrue. That said, they have the resources to fund media, academics and others to pretend that they are right. They can also make sure that politicians who are sympathetic to their view and that of the wealth holding that they represent are elected to office. Antipathy towards the state is implicit in their arguments that markets must have power, even though they very clearly do not.

What, in that case, we see played out in debates on MMT is an increasingly crude power struggle. Mark Blyth, as a political economist, who should understand these things, demonstrated this very clearly in the interview I noted here yesterday, using very crude and inappropriate examples whilst misrepresenting what MMT says. On the way, he claimed that Scotland as a nation-state would have no power and would, therefore, be subject to the whim of financial markets, who would not tolerate its existence as a nation-state or use its currency. This was absurd. Nation states of similar size with their own currencies clearly exist, and very successfully so. Data on Comments made on Scotland’s trade below my post yesterday made clear that what he had to say on that issue was incorrect. In all, he created a fabricated situation to defend the power relationship that financial institutions seek to impose on the world. Why he chose to do this, given that he is an intelligent man, I do not know.

The question to be asked when considering MMT is, in this case, a very simple one. The debate is not about facts because there, I would suggest that the argument is over; every single central banker knows that MMT is right. Instead, the argument is about who you want to hold power. Are you interested in a small financial elite representing those with considerable wealth to hold the power over the capacity of the state to supply services to meet those needs, or would you rather that an elected government, chosen by the people of a country, doing its best to meet that needs have that power instead? In other words, are you a democrat, or not? That is the question that MMT poses, and which everyone needs to answer.

Can we really claim to be a democracy when the government very clearly does not care if people can vote?

This report was published last Thursday, but I missed it then and it is no less relevant this morning:

As many as eight million people face being disenfranchised at the next election due to an electoral registration system which is neither effective nor efficient, says the cross-party Levelling Up, Housing and Communities Committee in a report published today.

As they noted:

The report finds that the current state of the electoral registration system, which governs local elections in England and UK general elections, needs urgent review.

The report finds that there have been notable issues with the practical implementation of recent electoral registration reforms, including voter ID which left individuals without the right ID being prevented from voting and only a limited number of forms of ID being permitted. The report disagrees with the Government’s view on the adequacy of the list of accepted photo ID and believes it should be widened to include other forms, such as emergency services passes and non-London travel passes.

The report recognises that certain groups, such as young people, renters, ethnic minorities, and those in lower socio-economic groups are significantly less likely to be registered to vote. The Committee were also told that some disabled people do not feel supported to register to vote, particularly struggling with the lack of variety in communication channels.

The report recommends a series of steps to help tackle under-registration. … The report also calls for the Government to move towards an opt in automated voter registration system to help ensure that voters are not disenfranchised.

They add:

The report references the Electoral Commission's 2023 report, "Electoral registers in the UK”, which found that completeness of the registers in the UK is at 86%. ‘Accuracy’ looks at the number of false entries on the electoral registers and is currently at 88%. This means that potentially as many as eight million people were not correctly registered at their current address and people may be registered twice inadvertently. The completeness of the electoral registers in Great Britain is 86%. The Commission explained that " if a UK general election was called now, around 14% of the eligible population would not be able to vote."

That is approximately seven million people who are disenfranchised in the UK as a result of government indifference.and as the committee notes, this is not necessary. In a very similar situation to the UK, Canada had very much higher levels of voter registration.

Can we really claim to be a democracy when the government very clearly does not care if people can vote?

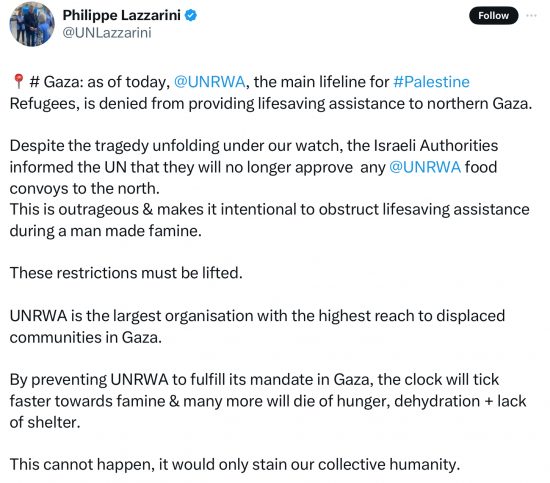

Genocide cannot be condoned, whoever does it

This post on Twitter was made yesterday by this person:

He is the director of the UN aid agency in Gaza. It is the only agency able to reach the people there.

He said this:

The Israeli government has begun to use famine as an instrument war.

Please do not ask me to condone, tolerate, or ignore this.

And please do not tell me it is anti-Semitic to condemn that government and its Zionism that motivated this, because it is not.

Like those Jews who condemn this government - and very large numbers do - I stand up for humanity. Zionism can never excuse its abuse.

And please also don’t tell me this is only reaction to Hamas and 7 October. I have condemned what they did then many times. But nothing excuses the war crimes the Netanyahu regime is committing now, or those who supply it with arms. Genocide cannot be condoned, whoever does it.

Has the time come for sanctions to be imposed on Israel?

No one is unchanged by a close experience of cancer

I know quite a lot about having a spouse with cancer whilst also caring for a young family. I have been there and done that, and would very much rather not have the T-shirt.

The reason for making this point is, I am sure, obvious .

Let me, however, make another point. This is that we now know that the Royal family is intensely vulnerable at this moment. The king has cancer. The wife of his heir has cancer. The third in line to the throne is a child. All are going to be intensely distracted by the family issues that they face, and rightly so. Meanwhile, the only available person really able to help is effectively exiled in California. The rest inspire little confidence.

It is being said at this moment that we should stop discussing this family’s health issues. I am happy to do so. But it is impossible to ignore the fact that the burden of being both the Royal Family, with massive constitutional responsibilities, and being a family with massive health issues and all the resulting strains to manage, is happening to these people in real time.

There are three entirely fair questions to ask.

The first is whether it is in any way fair to place this burden on any family now?

The second is to ask whether the constitution can survive as it is when it is so dependent on the continual availability of people who are, when all is said and done, only human, which fact we seem far too inclined to ignore.

Third, what are the consequences of wondering whether these strains are intolerable, which the death of the Queen, who somehow seemed to manage them, has exposed?

This is the moment to ask whether the intolerable demands being made on these people (because that is what, in both cases, they are) should be changed.

Any decisions will take time. Hopefully, those now suffering ill health will be better by then. But no one forgets having cancer. No family that has lived through, is unmarked by it, even if those involved recover. And nothing is the same again. It is wholly appropriate to say that, and to ask what can really be done to make the lives of all involved more tolerable in the future. Isn’t that precisely the right thing to do now?