economic justice

The ICAEW is still not explaining what it’s going to do with more than £150 million of funds it has earned as a result of fines and related costs paid by its members

The ICAEW published its accounts for the year ended 31 December 2023, yesterday. As readers of this blog might recall, I have taken that Institute, of which I was a member until very recently, to task over its failure to spend the sum exceeding £140 million by which it has been enriched since 2015 as a result of fines paid by its members as a consequence of their failure (in the main) to undertake proper audits. I did, as a result, undertake an initial scrutiny of these accounts with particular interest.

Disappointingly, the ICAEW has still completely failed to address the issue of what it is going to do with this bizarrely sourced income from which I think it should never have benefited.

Admittedly, the net benefit from fines and other costs recovered during the year did fall significantly to only just over £1 million. However, investment income on the sums that it holds on its balance sheet as a consequence of that income having been enjoyed by it exceeded £10 million in the year. In that case, the ICAEW’s failure to spend the sums it has been enriched by in the public interest, as it is required to do by its Royal Charter, continues.

That said, and interestingly, the ICAEW no longer refers to the fact that it has a strategic reserve as a consequence of this issue. It does, however, have a strategy, which it lists under five separate headings, which are as follows:

- Strengthen trust In ICAEW Chartered Accountants and the wider profession

- Help to achieve the Sustainable Development Goals (SDGs)

- Support the transformation of trade and the economy

- Master technology and data

- Strengthen the profession by attracting talent and building diversity

Note that the above list uses their own words, not my summary of them.

To be candid, if I were an officer of the Institute, I would be profoundly embarrassed by this list. Reading the PR hype in the annual report on what they mean, and then debunking it, they can be summarised in plain English as follows, using the same order:

- We’ll try to stop our members from messing up so badly by supposedly reforming audit and corporate governance in the UK, neither of which are within the ICAEW’s remit to change.

- We’ll try to work out what accounting for climate change might mean.

- We’ll lobby for reform of the public finances, mainly by asking for tax cuts.

- We will really try to get our heads around accounting, which we’ve supposedly been looking at for well over a century, but which we now refer to as data processed by technology.

- We will try to be less of an establishment club than has been apparent to date.

The first of these is profoundly undermined by the ICAEW's own failure of corporate governance with regard to the funds it has been unjustly enriched by, about which it can apparently as yet make no decisions, even though the matter has been ongoing for nine years now.

However, of them all, the fourth is, perhaps, the most bizarre. For the ICAEW to now admit that they think the time has come for them to get their heads around the processing of data with technology is quite extraordinary. The real world has been doing this for many decades, and maybe rather longer. So where have the ICAEW been during all that time if it has only now noticed that this is an issue requiring attention?

Even more importantly, in this context, why do they think that this requires an investment of funds arising from outside the normal scope of their operations when dealing with this issue would seem to be an entirely normal matter for them to address? No clue about this is given in the financial statements.

That said, the Institute does say in those financial statements that it is reviewing its reserve policy, which is a fact hidden in some pretty small print where it is noted that:

The ICAEW Board has issued direction on the principles to be adopted and applied in respect of how ICAEW’s reserves are used in the public interest and to support the strategy. In September 2023, the Board considered a set of possible strategic level investments (including a major review to future-proof the ACA, the Centre for Public Interest Audit, the Centre for Sustainability Management, a review of the role of the profession in AI governance and a modernisation of the Royal Charter) and approved these proposals for further development and discussion at Board.

In other words, they think that they might undertake some PR to improve accountants' damaged reputations, and they will also invest some funds into a couple of minor research centres, which expenses will still be insignificant in the overall scheme of things, suggesting that this exercise is another one intended by the ICAEW to entirely miss the point.

In slightly larger print elsewhere in the accounts, they refer to their current reserve policy, which they state to be:

Set at a level sufficient to cover both short-term requirements and longer-term investment needs:

- reserves should be set at a level equivalent to at least six months of expenditure through the income statement; and

- cash and investment balances should be sufficient to cover at least six months of annual budgeted/forecast gross cash expenditure.

In a slightly embarrassed tone, they add:

Reserves are in excess of the minimum required level under the policy at the end of the year.

Try as I might, I can think of no reason why the ICAEW needs reserves to cover six months of operating costs. The sum in question would be about £60 million. Of this sum, I note that in addition to their accumulated reserves on their balance sheet of £146 million, they were also holding at 31 December 2023 almost £44 million of income received in advance, which sum is in itself almost enough to meet this reserve requirement. The need for additional funds to be retained over and above that £44 million is almost impossible to work out given the solid and entirely stable nature of the ICAEW's income stream, in contrast to the situation of leading charities where this rule of thumb is commonplace.

As a result, the ICAEW has given absolutely no indication as yet on how these funds by which they have been enriched as a consequence of the failure of their own membership to undertake the professional activities that the ICAEW licensed them to undertake to a proper professional standard might be spent for public benefit, as is required by their Royal Charter.

As readers here might recall, I suggested last year that some of this money might be spent to enhance the undergraduate accounting syllabus in UK universities. At present, this is seriously constrained by the ICAEW exam requirements, meaning that students do not enjoy the experience that they should when studying this subject. The ICAEW declined to fund this idea in any meaningful way.

They also rejected my suggestion that they might invest £100 million of these funds in a financial education programme to be run in the UK's schools, even though the need for this is overwhelming, as the FT reported only yesterday. Their claim was that this matter was already being addressed by others, which it clearly is not.

So, what are they going to do with this money so that the public might properly benefit from the fines paid by chartered accountants who failed in their duty to act in the public interest? I hear a rumour that they have appointed someone to look into this matter, who is consulting widely - although not with anyone I know, let alone me. But in the meantime, it seems likely that they are simply going to sit on this money for as long as possible, making an already rich Institute even richer.

Meanwhile, if their aim is really to 'strengthen the profession by attracting talent and building diversity', what is glaringly apparent is that their actions do not align with their words. I am not interested in what they say. I am interested in what they do. Their inaction speaks volumes about their failure to commit to good corporate governance standards, transparent accounting, the promotion of a better understanding of accounting in society and to broader inclusion.

Hypocrisy on this scale is staggering to witness and is happening right now at One Moorgate Place, the ICAEW HQ.

Markets might use the risk of war as excuse for another bout of profiteering.

My discussion on the economics of war yesterday appears to have been timely. Everyone now seems to be addressing the issue.

Martin Wolf had a discussion of the subject in the FT yesterday. His concern was not so much with the cost of military action, or its human impact. It was instead focused upon the consequence for the price of oil.

So far markets have not reacted in any significant way to the weekend aggression by Iran. Instead, they appear to have been following the diplomatic line of waiting to see what Israel does next. But, if there was a marked escalation, Martin Wolf is worried about the impact of any increase in the price of oil on global financial stability.

It is his suggestion that the savings buffers that protected the economy in the immediate aftermath of the Covid crisis (others suggest fuelled inflation) have now dissipated. As a consequence, he thinks that the margins for the management of an oil shock are small.

We also all know that oil and other traders have an enormous propensity to hike prices at the least provocation, always presuming that the merest hint of a shortage provides them with an opportunity for excess profit taking.

The latter worries me at least as much as any cost of military action, given that the human impact cannot be directly measured in monetary terms. Saying so, do recall that the majority of the inflation that we saw in the period from late 2021 until early 2023 was not caused by shortages in supply. It was, instead, created by financial speculation. The consequences were dramatic, and are continuing because of the increase in interest rates that could never have addressed the speculation that caused the price hikes, but which central bankers now wish to be a permanent feature of the economic landscape.

Another bout of speculation of a similar sort is now possible, no doubt with the likelihood that it will be reinforced by the desire of central bankers to at least maintain interest rates, or even increase them. The likelihood that such speculative price increases might be necessary to address any real shortage of oil is extremely remote, as was proved in 2022. But if they happen, and the need for price increases and their happening are nit related events, then we know that central bankers are as irrational as market traders, and they will find any reason, justified or not to hike interest rates.

The risk that the threat of war could give rise to another round of recessionary inflationary activity is very real, but is utterly justified at present by any real events actually occurring in the world. The problem is that market speculation takes place in its own make believe world where we all become the collateral damage.

The Bank of England’s got it in for us

I just posted this video on TikTok and YouTube:

The Bank of England has never said it wanted to create a recession, a cost-of-living crisis and unemployment in the UK, but that is exactly what it is doing, but that is exactly what it is doing. Why is the government letting this happen?

I am aware that the embedding of this video has proved problematic. It can be found on YouTube here.

Why does the average higher rate tax payer get more subsidy for their pension savings each year than anyone on Universal Credit is paid?

I published this video on TikTok this morning.

As I noted on Twitter:

Why does the average higher rate tax payer get more subsidy for their pension savings each year than anyone on Universal Credit is paid and many old age pensioners get per annum? What is the sense in that? And where is the fairness?

The transcript is as follows:

People who are wealthy in the UK get benefits of, on average, at least £8, 000 a year. Why is that? And why is that fair?

Now let's be clear what I'm talking about. The benefits that the wealthiest people in the UK get on average, and I stress that ‘on average’ point, relate to the pension contributions that they make to their pension funds every year.

The total cost of the tax subsidy to those who are wealthy in terms of the pension contributions that they make amounts to at least £38 billion a year. At the time that I was doing the data and in the year that that information relates to, there were around 4. 4 million higher rate taxpayers - there are more now, but the data on tax relief costs will have gone up as well - that's an average of over £8,000 pounds a year for each and every one of them.

Now, of course, some of them don't pay anything into a pension and some of them pay a great deal more than average into a pension. But we're still in the situation that they get benefits of more than £8,000 a year each on average.

Compare that to a person who's on the old estate pension scheme. This year, they're going to get around £8,800 a year in pension.

Compare that to a person who's on the new state pension scheme, which applies to younger state pensioners. They get £11, 500 a year.

Compare it also to a person who's on Universal Credit. A single person who's on Universal Credit and is over the age of 25; they get around £4,800 a year.

So why are we giving such an enormous amount of money to the wealthy to subsidise their pensions when there are people who are living in poverty in the UK who have such small amounts to live on?

It makes literally no sense at all. So, I've made a straightforward recommendation in the Taxing Wealth Report, and that is that the tax relief on the contributions that the wealthy make to their pensions should be reduced to the basic rate of tax. At present, they get that tax relief at either the 40 percent tax rate or even the 45 percent tax rate if they are earning over £125,000 a year.

If we reduce that to the 20 percent tax rate, which the 85 plus percent people in the UK pay in terms of income tax, then we would save £12. 5 billion a year of the cost of subsidising the savings of the wealthy. And that will be enough to give every single old age pensioner in this country an extra £1,000 of income a year.

Now, which is better? That we subsidise the wealthy, or we give those who are in need a bigger pension? I think the answer is glaringly obvious. It's even obvious for the economy as a whole. Because those pensioners would spend that money and give a massive boost to the economy, literally lift growth, and deliver a better outcome for everybody in society, including the wealthy, because we'd all be better off because of their spending.

This current structure of giving subsidies, benefits if you like, to the wealthy for their pensions does not make sense. We have to create a fairer, better and more honest and accountable system where people know just how skewed our society's system of benefits is towards those with wealth. It's unfair. It has to end. And I'm suggesting to you that you should be asking your politicians about how they will deliver better outcomes for us all.

There is more on this in the Taxing Wealth Report 2024, here.

Prospect: Labour’s £92bn prize

The Guardian is it the only outlet to have an article by me on the Taxing Wealth Report over the last day or so. So too has Prospect magazine.

I think we can be sure that the message will have been heard by now.

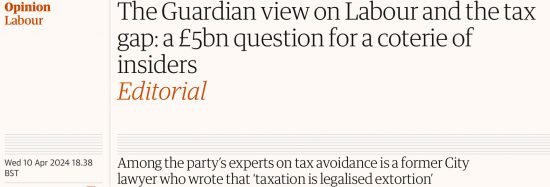

The Guardian agrees: Labour’s tax problems can’t be solved by a cosy coterie of old insiders

This comment was posted on the blog overnight by long term occasional commentator Jonathan:

Interestingly, now the Guardian have discovered your Taxing Wealth Report it seems they have started reading this blog – and based tonight’s editorial on this post.

It will be interesting to see if this continues, and whether the Labour Party realise they need more credible advisors.

I did, as a result, search out the Guardian’s editorial today, which has this headline:

The editorial does, I admit, raise a great many questions I noted here yesterday, including about the suitability of both Edward Troup and Bill Dodwell to be appointed to Labour’s new tax advisor panel, and Margaret Hodge’s’ past comments upon them.

They also picked up on my concerns about the appointment of a panel of the supposedly great and good to advise on financial services related issues, which I reposted here yesterday.

In addition, they suggested that a much broader basis for the recruitment of expertise should have been adopted by Labour, as I have said many times before.

And the editorial appears to explicitly support the Taxing Wealth Report line on taxing income from high earnings and wealth more.

So, just for the record, I had no idea that this was being written, and although I did speak to Guardian journalists yesterday, including about my concerns on the membership of this panel, I had no involvement in this editorial in any way, even though its alignment with my views is high. But, that said, I am not complaining. If they stick to this line The Guardian can build a strong policy platform for holding Labour to account, which is essential.

The editorial is here.

Why has Rachel Reeves appointed as her tax adviser a person who has said that tax is extortion and told parliament that he was not too worried about small businesses not paying their taxes?

Rachel Reeves has appointed Sir Edward Troup to be one of her four new tax advisers. He might be a former boss of HM Revenue & Customs, but he is a very odd choice.

First, as his Wikipedia page makes clear, he was a special adviser to Ken Clarke when he was Chancellor from 1995 to 1997. So he was, I think we can safely assume, a Tory set on opposing Labour at the time. I know people do change their spots, but I don't think this is a good start.

Then there is the problem of an article he wrote in 1999 for the FT in which he said:

Tax law does not codify some Platonic set of tax-raising principles. Taxation is legalised extortion and is valid only to the extent of the law.

I know of no one in tax justice or outside the Tufton Street think tanks who would share this view. The power to tax is part of what defines the state. Its power to use tax to organise society is one of the bedrock of left-of-centre thinking. Troup clearly did not share those views on the state or society. It is an exceptionally odd view for someone advising a Labour Shadow Chancellor to have held.

He added:

Tax avoidance is not paying less tax than you ‘should'. Tax avoidance is paying less tax than Parliament would have wanted. Avoidance is where Parliament got it wrong, or didn't foresee all possible combinations of circumstance.

The problem of tax avoidance is reduced to the problem of finding an answer to the question of what parliament intended and making sure that this is complied with. I would not pretend this is a simple task. But recognising this as the issue and dealing with it equitably and constitutionally would be a significant step on the way to tackling avoidance effectively.

Again, I would suggest that no reasonable person thinks now, or thought in 1999 that tax avoidance was the fault of Parliament. Tax avoidance is undertaken by those who wilfully seek to undermine the intent of parliament, aided and abetted by tax advisers (which Troup then was) willing to help them do so, in exchange for a fee.

I was not the only person with this concern back then. I raised my concerns in 2013 in anticipation of a Public Accounts Committee hearing in parliament. As a result, Margaret Hodge, who had read my post that morning (I sent it to her, together with another one), questioned Troup on these suggestions he had made. The record is still available. This exchange took place:

Q399 Chair: Well, the OECD does think that. Is it true that you said at some time that "Taxation is legalised extortion"?

Edward Troup: I am very glad that Mr Murphy and others go back and read the articles I wrote in the FT in the 1990s.

Q400 Chair: Did you say that?

Edward Troup: I wrote a whole series of articles.

Q401 Chair: People go back the whole time to stuff I did in the 1990s and 1980s, I can tell you. You never get away from your past.

Edward Troup: The article was making the point-indeed, it is relevant to a lot of what we discussed today about tax being a matter of law-

Q402 Chair: Did you say "Taxation is legalised extortion"?

Edward Troup: In the context of that article, which you read, I was making the point that it should not be left to the discretion of tax administrators to decide how much was due; it had to be left to the rule of law, and that is quite an important principle.

Q403 Chair: Did you say "Taxation is legalised extortion"?

Edward Troup: In the context of that article, those words appeared. If you read on-

Chair: You said it-thank you.

Edward Troup: Would you like me to read it?

Chair: No. I was interested; I would never dream of putting those four words together.

Hodge is now a colleague of Troup's on Reeves' new panel.

This, though, was not the only time Troup was called to account before parliament when he expressed contentious views. In 2004, he said when questioned by the Treasury Select Committee that:

I would not like to support anything which is perceived as tax avoidance, but you have got to remember that this is money left in the economy and this is not necessarily a bad thing for the economy. It may give a bit of an imbalance of incidence of tax between certain groups of people, but all we are actually saying is that some small, self-employed owned and managed businesses are actually paying less tax than the Government might have intended, which is not necessarily a bad thing, except to the extent that it creates inequity between equivalent classes of individuals.

In other words, he was indifferent to tax abuse by small businesses, did not care about inequality, the impact of tax abuse on honest smaller businesses, or the undermining of the rule of law that this activity represented.

So, the question is, if he thinks the tax is extortion and is apparently indifferent to the abuse of tax law, why is he a suitable person to advise Rachel Reeves? Could it be that, as quoted in a Guardian article in 2016:

“If you think the world needs to be changed you don’t appoint Edward Troup to that job,” said Jolyon Maugham QC, an expert in taxation law.

I agree with Jolyon.

In that same article, Margaret Hodge said, referring to the matters I note above:

The fact that he had written that draws into question whether or not he should be in charge of our tax system.

Hodge's question still remains relevant, not least with regard to his appointment to advise Rachel Reeves. Troup looks like a most unwise choice by Reeves.

The Taxing Wealth Report and tax justice

I posted this video on YouTube this morning:

The transcript is as follows:

Right at the very heart of the Taxing Wealth Report is the idea of tax justice.

Fairness matters when it comes to taxation. People should be treated equally when they are in equal situations, and people who are wealthy should contribute more to society than those who have less income and wealth. Those ideas are absolutely fundamental to the concepts of tax justice, and they are fundamental to the ideas within the Taxing Wealth Report.

Let me explain those in a little more detail. When we're talking about people in a similar situation in the sense that they have the same overall level of income then we are discussing horizontal tax equity when we discuss their tax affairs. It should, in my opinion, be the case that whatever the source of a person's income they should pay the same amount of tax.

In other words, if a person earns their income from working, or if they get their income from rent or dividends or interest, or if they make their income from capital gains, which are the profits that people make on the sale of assets, they should still pay the same amount of tax, whatever that source might be.

That is not what happens in the UK at present. We are a very long way, in fact, from that happening here in the UK. That’s because of the allowances and reliefs and exemptions that are within the tax system mean that those who work for a living pay the most tax on their income and that those who live off capital gains, that is, the wealthy who can sell assets to realise money on which they can then live, pay the least amount of tax.

We saw that very vividly in 2024 when Rishi Sunak published his tax return for the year 2022/23 and his overall rate of tax was just 22% or so. If the recommendations in the Taxing Wealth Report had been in place and had been applied to his tax return, he would have paid tax at well over 50%. Now, let me explain why these inequalities arise, very briefly, and why the Taxing Wealth Report tackles them.

The inequalities are quite easy to explain. Capital gains tax is charged at roughly half the rate of income tax, and that's ridiculous. There is no reason why a person who makes money from profiteering should pay tax at half the rate of somebody who has to work for a living. That's crazy. It's wrong.

But there's another bias within the tax system which heavily favours those with wealth. And that is that income from interest and from dividends and from rents only results in the payment of income tax. But when a person works for a living, they also pay national insurance. In fact, not only do they pay national insurance, but their employer pays national insurance as well, at a much higher rate than the employee does now.

So, the consequence is that earnings from employment are much more heavily taxed than anything else. So, in the Taxing Wealth Report, I recommend that the rate of tax paid on capital gains should be the income tax rate, and I suggest that income from rents and dividends and interest and capital gains should all be subject to what is called an investment income surcharge.

That is an extra tax equivalent to national insurance at an approximate rate which combines both the employee's contribution and the employer's contribution, so that the person who gets income from those sources has to also makes a fair contribution to the overall costs of running our society, and makes a fair contribution to the way in which the government must operate if we are all to live in an appropriate fashion.

That is the way to create horizontal tax equity. And there's one other change as well. And that is, that people in the UK should all get tax allowances at the same rate. So, people who make a contribution to their pension should get tax relief at the basic rate of income tax, I suggest, whatever their overall level of income. That means that the 85 percent of the UK who only pay the basic rate of income tax should get the same rate of tax relief as a person who earns a million pounds. Pension contributions should only get tax relief at this lower rate, as should donations to charity also only get tax relief at that rate, because it's totally unfair that the wealthy are subsidized when it comes to their donations to charity or their contributions to their pension fund in a way that those on lower incomes are not. Those allowances create bias. That’s unreasonable because it destroys horizontal tax equity.

Then there is the concept of vertical tax equity. Vertical tax equity means that we should have a progressive tax system. It's quite simple. Those on low income clearly should be taxed less than those on high income. And the economic logic is quite straightforward.

If you pay a person on low income, an additional pound, they will value it much more than if you pay an additional pound to somebody who earns a hundred thousand a year or a million pounds a year. I think that's pretty obvious. The person on low income will actually notice the difference. The person on high income frankly just won't care whether they've got an extra pound or not.

Therefore, the person on a high income can afford to give away more of their income to pay tax and still be relatively as well off and suffer no more harm to their economic well-being than the person on low income, who should pay much less tax because the relative cost to them of tax paid is much higher given that every pound is worth a lot more to them.

Now again, this is a basic concept of fairness. But we don't have such a system in the UK at present. In fact, those who are on the lowest incomes in the UK pay the highest overall rates of tax. And right across the middle bands of income, the rate of tax is pretty much flat. There's very little difference in the overall rate of tax paid by people who are earning £25,000 a year and people are earning £60,000 a year.

But when it comes to the highest rates of income, when we take into consideration overall increases in financial wellbeing in a year, which combines their capital gains with their incomes to look at how much their overall wealth has increased - which is an entirely fair thing to do in accounting terms - then they pay much lower rates of tax than anybody else in the country as a whole.

In fact, if those on the lowest levels of income pay around 44% of their income in tax - not income tax by the way, but taxes like VAT or the BBC license fee or council tax and so on - and when we compare their situation of paying this extraordinary rate of tax of 44% to the situation of those who are on the highest levels of income, they only pay just over 20%, as we saw Rishi Sunak do. His overall rate of tax was just over 22%. Now, what that means is that we have a completely regressive tax system in the UK. In other words, the system works exactly the opposite way from that which it should if we were to deliver tax justice, and real fairness.

We have vertical inequity rather than vertical tax equity. The Taxing Wealth Report recognises that, and it tackles those issues because it says everybody should make their contribution to society in a fair way. We aren't doing that. The Taxing Wealth Report basically tries to knock off the rough edges within the tax system, which creates this unfairness and bias towards wealth, and seeks to restore a situation where the tax system is biased towards the person on ordinary levels of income.

That's most people in the UK, of course. I'm not being disparaging by saying ordinary. I just mean average. And the bias in the tax system should be in their favour, not in favour of wealth. That's what the Taxing Wealth Report tries to achieve with the recommendations it makes. And I think as a result, it represents fairness, it represents tax justice, and it represents what a government interested in the fair treatment of people in this country should be doing.

Wes Streeting is a disgrace

Labour's Shadow Health Secretary, Wes Streeting, has been writing in The Sun and winning its support for his diagnosis for NHS reform. As they note:

THE Shadow Health Secretary warns the NHS today that there will be no additional funding without the “major surgery” of reform under Labour.

Wes Streeting asks for Sun readers’ backing for a massive overhaul of our troubled healthcare system.

They added:

[This] would include bringing in the private sector to help cut waiting times.

Their conclusion was:

Pitching himself against healthcare unions and Labour supporters, he says “middle-class lefties cry ‘betrayal’”, but he is “up for the fight”.

Now I know he did not write the Sun's story, but he chose to talk about this in The Sun, and he used the words he is quoted as saying - because that is the way that these things work.

So, we have a Labour shadow minister actively seeking office, declaring war on his own party's natural supporters and the NHS unions. And people wonder why I can see nothing of merit left in Labour.

This labour leadership is a total disgrace, having sold out on any remaining principles the right of the Party ever had.