economic justice

Since Reeves and the Tories have a shared economic DNA, how different can she ever be?

The FT has an article this morning, of which the headlines are as follows:

Are Labour and the Conservatives adopting ‘Heevesian’ economics?

_________

The policies of the chancellor and his opposite number are looking increasingly alike

Rachel Reeves, Britain’s shadow chancellor, on Tuesday declared to a City audience that “stability is change”, vowing that Labour would break from the “chaos” of recent Conservative economic policymaking.

But while Reeves’s reference point is Liz Truss’s self-destructing, unfunded “mini” Budget in 2022, economists note that some of the “stability” she is offering comes from a growing alignment of Labour and Tory policy.

How long did it tale for them to notice is the most obvious question to ask?

If Reeves agrees with Hunt about this long lost of policy issues, how likely is it that they might differ on anything significantly:

- That neoliberalism is right.

- The Bank of England must be independent and monetary policy should be beyond the Chancellor's control.

- That fiscal rules are paramount.

- National debt as a proportion of GDP must fall.

- Banks and the City are intermediaries and not creators of money.

- Markets are supreme.

- Multiplier effects are limited.

- Austerity is an appropriate trade-off for 'stability' that appeases financial power.

I could go on and on. The point is, once you have a shared economic DNA, how different will you ever be?

Reeves is dedicated to perpetauting Tory economic policy, but the FT has only just noticed. That's just about the only news in the article. Some of us have known that for a long time.

There are six reasons why we need taxes

I posted this video this morning on a theme familiar to many here, I suspect:

If the link does not work, it's also here.

The transcript is:

There are six reasons why we need taxes.

The first and most obvious is to control inflation. As I've explained before on this channel, every time the government spends, it creates new money to do so. It borrows it from the Bank of England, it spends it into the economy to deliver on its policies, and then it has to tax to bring that money back out of the economy under its control, when it cancels it. Literally. It puts it out of use.

That's the biggest reason why we tax, but there are five other reasons as well.

The second one, many people think is a little obscure, but let me make it clear. Unless we did have tax, and unless we had to pay it using the currency that the government creates - the pound in the case of the UK - then that pound would not have value.

Because the government requires that taxes be paid using the pounds that it creates, to fulfil the promise to pay that it prints on banknotes, and which are implicit. in all its electronic spending, then unless it takes those pounds back in settlement of tax liabilities, it couldn't require that our pounds be used for all the transactions that we undertake in all our shops, in all our trading, and everything else.

And it is that requirement that we pay tax that gives the pound value in exchange, which therefore makes it useful as a currency. So, tax creates the value of the pound.

Then there are other reasons why we tax.

First, there is inequality in the UK. Inequality of income and inequality of wealth. Tackling those becomes the third reason why we tax. Tax is used as an instrument to reduce inequality in the UK.

Next, there are market failures in the UK, because people are addicted to alcohol and to tobacco, and they overuse carbon, which has a massive cost to society, and so on. The government imposes taxes on these ‘bads’ to prevent us over consuming them, and, as the result, tries to reduce the impact of these things on society as a whole.

Then, there is something called fiscal policy. We've just talked about the ‘bads’. Fiscal policies are the ‘goods’, the things that the government wants to encourage, whether it be investment, or education, or healthcare, it can use the tax system by lowering the rate of tax on people who do these things or supply those services, to therefore encourage people to actually deliver goods for the benefit of society.

And finally, the sixth reason to tax is that tax represents a social contract between us, the population, and the government. In that social contract, there has to be what is called, in legal terms, a consideration. Something that represents the payment between us. Well, tax is the consideration in the social contract, and because we have to pay tax and therefore have a relationship with government, we're interested in what government does.

And there's quite a lot of evidence that people who pay tax, vote. That's why more people vote in general elections than do in local elections, for example, because council tax is not nearly so significant a tax as income tax, VAT, national insurance, and the other taxes that we pay to central government. So, we literally tax to encourage people to partake in our democracy.

Six reasons to tax. None of them to fund the government, all of them to deliver social benefit. It's a pretty good thing, this tax.

That's why I once wrote a book called ‘The Joy of Tax’, because it is what literally shapes our society.

UK banks will go bust because of climate change

I posted this video on YouTube this morning:

The transcript dealing with this pretty big, and vital claim is:

UK banks are going to go bust because of climate change. Now, that's a big claim to make, but I think it's right. And let me explain.

When you borrow money from a bank, at least when you borrow a lot of money from a bank, the bank will normally want what they call security from you. In other words, they want some form of guarantee that you can repay.

Well, you don't wholly blame them, do you? But let's explain the most common form of security that they ask for. It's your house, or if you're a business, it's your business property. In fact, 85 per cent of all loans made by UK banks are for the purchase of houses or business properties, or are at the very least secured on the value of houses and properties.

So why are banks going to go bust because of climate change? Well, because as a very senior risk officer of a very large UK bank explained to me not so very long ago, the vast majority of the properties that they are using for the purposes of security could be underwater in the next 30 years.

They know, for example, that the Thames barrier is not going to protect London from flooding. It's just not tall enough.

They also know that if you live in the area of the country where I do, which is in the Fens, just south of the Wash in Norfolk, there's a real risk that you will be flooded at some time over the next 30 years. Well, unless you happen to live in the Isle of Ely, as I do, which is a hundred feet above sea level - in which case, you'll just be back on an island again.

They know that means that Cambridge will be underwater.

It means that Bedford will be underwater.

No, not all the time. But enough of the time that those properties will not only be uninsurable, but they will also be subject to such frequent damage that their value will be impaired and they will be no use as security for repaying the loans that the banks have lent out. on the basis of those properties.

Now, if the banks know that, why are they still lending? Well, they all pretend that they'll be able to shove their loan books - secured against the value of these properties which they know are going to flood, unless we take action to prevent it - onto some other bank in the next few years, and therefore they won't be on their books when it comes to the glorious day when the waters have risen and these properties are underwater.

But that doesn't work. They're all making that assumption. And of course, if they all make that assumption, they won't be able to pass on the loans to somebody else because that somebody else won't take them because they'll know that the property is at risk of flooding just as the ones already on their books are.

So we're heading for a banking crisis unless we deal with the risk of flooding in the UK.

Oh, by the way, this is also true of much of the USA as well, and large parts of Europe, and other places. But, let's just worry about the UK for now.

Unless we take action to control flooding in the UK, our banks will fail because the debts that are owing to them, secured on property, will not be worth the value that they have, because those properties cannot be sold. And, therefore, the banks will go bust. In which case, the most important thing we need to do to preserve UK banking from failing completely and utterly, in a way that will make 2008 and the Global Financial Crisis look a mere picnic, is to build flood defences.

But nobody's talking about doing it. And that is an act of gross irresponsibility. Not just by our government, but by the banks who are not demanding it, because they know they need it, just as much as you and I do, because it's our houses that could be flooded.

We need the water companies of England to be nationalised

I posted this video on YouTube this morning, touching on a theme that might well recur here many times:

The link is here in case it is needed.

The transcript is as follows:

We need the water companies of England to be nationalised.

I stress I'm talking about England because Scotland and Wales have already got nationalised services for water, at least with regard to private consumers - households that is. England has not. Almost uniquely in the world - not quite uniquely, but almost uniquely - we supply water through private companies and we know that isn't working.

We don't get the clean water that we want all the time and we definitely do get polluted rivers and polluted beaches.

We are being sold short on the most essential commodity, apart from air and food, that we require to literally live.

We are putting the safety of the entire country in the hands of private companies who, quite clearly, are incapable of considering anything but the well-being of their directors and the companies that own them. That is ridiculous.

So, what do we need?

Well, these are natural monopolies, and a natural monopoly is a service where we have no choice about who supplies us, and we don't.

If you live in the Thames Water area, you have to buy your water from Thames Water. If you live in Northumberland, Northumbria Water are going to supply you. I have no choice but buy from Anglia Water. You couldn't have clearer indication that there is a monopoly in operation and monopolies, even regulated monopolies like these ones are, literally can impose prices on us.

We can see that because Thames Water is actually asking to increase the price that it charges to its consumers by 45 per cent per annum - a totally impossible poll tax that it will be imposing upon the residents of the Thames Valley and the wider area around it if it gets its way.

So, we need to do something else. And the something else is we need to nationalise water, which of course we did until the Conservatives were stupid - so stupid, and I use the word advisedly - to literally privatise something that should never have gone into the private sector.

Will it cost anything? No. I keep on being told by Labour and others we can't possibly afford to nationalise water.

Look, water companies are bust. Let's be blunt about it. They simply cannot pay their ways. So the value of shares in these companies is completely zero.

That's particularly true if we take into consideration the investment that they've got to make to meet their environmental requirements and to meet their net zero obligations laid down in law, which have got to be achieved by 2050, and which at present they have no way of raising the capital to deliver.

As for the loans, yes, some of those loans will have to be paid - there's no doubt about that - but they will take what's called a haircut. What does that mean? It means that part of the value of the money that was lent to the company is written off, and only the remainder is then subject to repayment.

But let's be clear. The repayment will not be of the loans that were originally made to the companies. Those loans will be replaced by government bonds and government bonds are always rolled over. In other words, there's never a repayment required. They just last in perpetuity. So all we'll be paying is a small percentage interest rate for a long time on the debts that these companies pay .It's not enough to worry about.

But what we will then have is the platform to deliver the investment to ensure that we have safe water supply, safe rivers, safe beaches, a tourist industry that can supply, nature that is not being polluted by our own excrement - let's be blunt about that - and we will have the foundations for the future of our country, which without clean water literally cannot exist, as our health care will fail.

So, Labour has no choice, it has to nationalise water.

What will make politicians notice climate change?

I often wonder when it will be that climate change will create pivot points that have sufficiently deep social and economic consequences that politicians will finally be required to take note, and pursue serious action.

Curiously, the collapse of Humza Yousaf’s government in Scotland is an early indication that failure to properly manage issues relating to climate change targets will have political consequences. His departure from office is the result of his failure to manage this issue. I do not, however, think that sufficient warning to create a widespread reaction, as yet.

There are, however, issues on the horizon that make it look like such reactions might be possible. For example, it is forecast that there will be a significant increase in cocoa prices very soon as a result of a twenty per cent decline in the likely world crop, almost entirely due to climate change, with the impact arising over the next year or so.

Coffee prices are already increased for the same reason.

In addition, the wheat crop is expected to be 20% down in the UK this year with unknown price consequences as yet because this may not be true worldwide.

There can be no doubt that other yields are increasingly at risk. The obvious risk is to vulnerable people because of rising food prices, to everyone because of potential inflationary risks that no amount of interest rate increases will address, and ultimately to the viability of life on earth as we currently know it if this trend continues and we are unable to feed people. At some point the risk of major involuntary migrations is also possible as a consequence.

Will this be enough to require change from governments? And if not, what will be?

Advertising is designed to make you miserable

I posted this video on YouTube this morning:

In case the link does not work for you, it can be found here.

The transcript is as follows:

Advertising is meant to make you unhappy. That is its single sole objective.

The whole of the advertising industry exists to make you feel inadequate. Isn't that obvious? What it's trying to tell you all the time is that whatever you have, however well off you feel, you could feel better off if only you had whatever it is they're trying to flog to you.

You need the latest iPhone.

You need to go on holiday, wherever they're saying.

You need to buy this financial product.

You will be insecure unless you buy their insurance. Whatever it might be, they are trying to make you feel as though there's a better world over there, which you didn't even know existed until they blasted it in front of your screen, onto your radio, or wherever else you might see it.

And the fact is that most of the time you don't need any of that stuff because you were already feeling okay before this happened. And they have tried to undermine your well-being by creating a sense of dissatisfaction with where you were. Now, that's really important because this process of making you feel inadequate does of course drive our material growth.

When we look at the whole of the fashion industry, it is of course effectively driven by advertising, continually presenting us with different images of how we want to look. But the consequence is we have vast quantities of clothing now being sent to landfill sites, clogging up not just this country but because we export a lot of that waste to many developing countries as well.

We have waste in the form of excess energy because we're trying to buy all these new products and throwing away perfectly workable ones.

And perhaps worst of all, we're all - well, not all of us, but a lot of us - are getting into debt to actually buy these products because there is a form of pernicious agreement between the advertisers, the producers and the finance industry that whenever you buy something, you will be offered credit to make payment for it - keeping you in debt and therefore in hock to the finance companies, the banks, and so on of this country and elsewhere.

You are therefore not only meant to be miserable because you haven't got what you want, but you're also meant to be in debt, forcing you to stay on the treadmill to buy more of the product, the service, whatever it is they're trying to sell.

Is that a wise way to run an economy? Personally, I don't think so. I believe we have to change if we're going to become sustainable. And the quickest and easiest way to achieve that goal is to say that advertising is not a universally good thing. Most of it isn't. In fact, except for the small ads in newspapers, I can't think of anything that is.

So, we should stop tax relief being provided on expenditure by large companies on advertising and we should stop them being able to reclaim VAT on the advertising costs charged to them by those who broadcast these things.

Are there consequences? Yes. It will change the way that we see and consume media. I have no doubt about that. We have to, therefore, rethink that issue.

But the world will be a better place because there'll be less waste, we'll be more sustainable, and, ultimately, we will be happier because we won't be told all the time by everything we see and hear that we are inadequate.

Pragmatic approaches to taxing income from wealth more can always raise more money than a wealth tax

I was asked to comment on Brazil’s proposal for a global 2% annual wealth tax on billionaires by a journalist, yesterday. This is what I write to them:

Everyone who has never been involved in the practicalities of collecting tax loves the idea of a wealth tax. And in principle, I agree with them. It would be great if we could tax the wealth of billionaires. The inequality between them and everyone else is economically destructive.

I, though, have been involved in the practicalities of collecting tax for decades and that is why I cannot get excited by this idea. The problems of imposing a worldwide wealth tax include:

- Finding the wealth.

- Proving that someone owns it

- Agreeing the value of that wealth: what are private companies, works of art, racehorses, esoteric properties and exceptionally rare wines, and so much more, really worth?

- Collecting the money before the billionaire has disappeared to a place that refuses to cooperate with this tax

- Repeating the process, year in and year out.

Any tax authority that tries to undertake this exercise will need access to vast numbers of valuation experts, an armoury of lawyers, and a bottomless pit of funds to take on the legal disputes with the billionaires who they’re trying to tax .

Alternatively, countries could have:

- Seriously progressive income tax rates

- Capital gains tax rates in line with income tax rates

- Progressive inheritance taxes with strictly capped reliefs for business property that only require asset valuations once in a lifetime

- Progressive corporation tax rates, particularly for private companies

- Close company and trust rules that attribute the income of private companies and trusts to beneficiaries annually so that the personal tax rates owing on these sums is not avoided by hiding them in legal entities.

My solution is not perfect. However, it has a lot more chance of success than the 2% wealth tax, and will probably raise considerably more money at a lower cost. If that is the real goal, rather than political posturing being the aim, then pragmatism is to be preferred.

I stick by that.

Which is why I wrote the Taxing Wealth Report, because that is my aim. I am not into posturing. I am into practical solutions. I have suggested what that looks like.

Labour Party? Pull the other one….

It is, of course, May Day. Or Workers Day. And so, the FT reports this morning that:

Sir Keir Starmer’s Labour party is set to unveil a weakened package of workers’ rights in the coming weeks in its latest softening of radical policies ahead of the upcoming general election, the Financial Times has learnt.

They added:

The package, first outlined in 2021, has been billed by Starmer as the biggest increase in workers’ rights for decades, with the Labour leader warning business chiefs in February it would “not please everyone in the room”.

But behind the scenes shadow ministers have been discussing how to tone down some of the pledges to ease employer misgivings as the party tries to boost its pro-business credentials.

So, there goes another one of the very few identifiably left of centre policies Labour was promoting, and all to appease the business community.

Labour Party? Pull the other one....

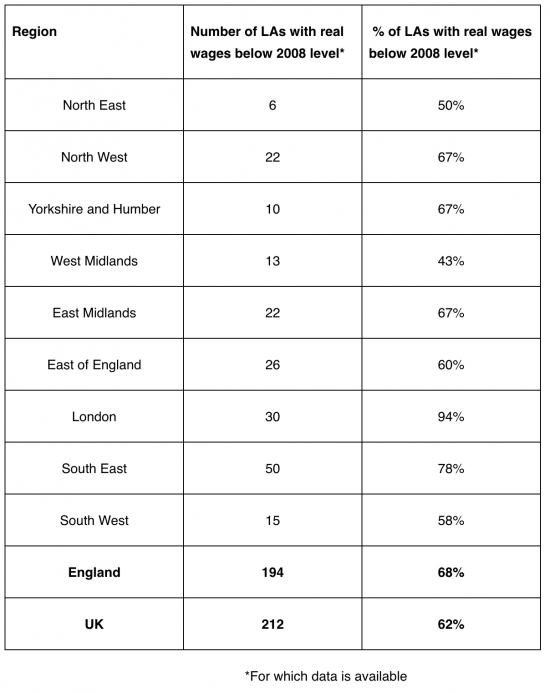

Real wages have fallen since 2008 in most areas of the country

The TUC has reported this morning that:

- Real wages still below 2008 level in 212 out of 340 UK local authorities

- TUC says longest pay squeeze in modern era is a “damning indictment” of the Conservatives’ economic record

- Wage performance in every corner of Britain is well below historic trends, analysis shows

- Average UK worker would be £200 a week better off if real wages had grown at pre-crisis rate

This table shows the distribution of local authority areas where real wages have not grown:

As they note, this data can be compared with that for the Organisation for Economic Cooperation and Development, covering 34 countries:

OECD data on wages is based on national accounts rather than the type of earnings survey conducted by the Office for National Statistics that is used in this analysis. It is not as accurate as the ONS survey, but it allows for comparisons between countries, as some nations do not conduct earnings surveys in the same way as the ONS. Under this approach, the UK shows a very small improvement in real wages from pre-financial crisis peak in 2007 to 2022 (the most recent year for which data for international comparisons is available). And it shows that the UK is in 27th place out of 34 OECD nations for wage growth across this period.

So, we are lagging behind in wage terms. Any growth is going to the richest and is not being shared, which is how the views are reconciled. That means that the elite are getting it all their own way. And it is very clear that it is that same elite that Labour now intends to serve.

But the TUC is not saying that. Why not, I wonder?

Tax does not pay for government spending

I posted this video on YouTube this morning.

As I wrote in the explanatory note that accompanied it, probably the biggest challenge to understanding how the economics of governments really works comes from the need to understand that governments of the sort we have in the UK are not funded by taxes. They are funded by central bank money creation. Tax exists to control inflation (and tackle inequality, market failure and other things). Until it's appreciated that spending creates taxation and not that tax funds spending, nothing else about how the government works makes sense.

The transcript is as follows:

Taxes do not pay for government spending. It is one of the hardest things that anyone has to get their head around when they really come to understand economics. that taxes really do not pay for government spending. I promise you it's true.

Every single penny that the government spends is created by the government. Let's be totally honest, you do know that. If you pick up a five-pound note, it says, ‘I promise to pay the bearer on demand the sum of five pounds’.

They haven't paid the bearer on demand five pounds. They promise to pay the bearer on demand five pounds.

Why? Because money is debt and the government has created a debt to you.

So where does tax come into all that? Tax comes into all that because when you pay your taxes, the promise the government has made that it will accept your money in payment is fulfilled. They'll take your money back. in payment of your debt.

Let me be clear what happens then in the real financial world that we actually live in. Whenever the government spends it simply extends its overdraft with the Bank of England. Day in, day out, that's what happens. And then it asks us to pay tax because if it allowed all that money to float around the economy, of course we would get inflation remarkably quickly.

So, it asks us to pay tax to cancel the impact of the new money that it has created. And that cancellation is by taxation, and it's there to control inflation.

The spend comes first. It's paid for by money created by the Bank of England.

The tax comes second. It's there to control inflation, to ensure that the value of the money that we have in circulation remains broadly steady over time. That's the goal.

But it's never the case that the tax pays for the spending. The spending has to come first, or the money doesn't exist with which the tax can be paid. It's really that straightforward.

It takes a lot of effort to reverse what you've always thought, that tax pays for spending, to realise that spending actually pays for tax.

But it is literally true that without government spending, there could be no tax paid. There could be nothing, in fact, because there'd be no money at all.

So we have to get our heads around that fact because then we truly understand how the government functions and then we can talk about what it can do with this extraordinary power it has to create money at will, whenever it wishes, if it wants to, to deliver the outcomes that we as a society want, balanced by the taxation that we pay to control the inflationary consequences of doing so.