banks

3 months after attacking Tories for scrapping bankers’ bonus cap, Reeves says Labour won’t put it back

‘It tells you everything you need to know’

On 31 October last year, Shadow Chancellor Rachel Reeves – the awful Keir Starmer’s equally awful right-hand woman – derided the Tories for scrapping the cap on bankers’ obscene bonuses in the middle of the cost of living ‘crisis’, which is in reality an engineered emergency fattening corporate profits at the expense of putting millions into hardship and often outright poverty.

Today, three months to the day later, she has announced that Labour will not restore the cap, because she considers the predatory capital machine of the City of London to be a solution to the UK’s problems and not a key driver of them – and has seemingly forgotten how Blair and Brown’s support for wild banking led to the 2008 financial crash. To quote Reeves’s own words back at her, ‘It tells you everything you need to know’.

Three months. On the one hand, it’s a pathetically short time to hold a policy – and on the other it’s a lot longer than Starmer’s hollowed-out corpse of the Labour party has held onto most other positions, except those involving support for apartheid and genocide, privatising and destroying the NHS, sucking up to the US, putting the police and army beyond justice and accountability and promising to do the same as the Tories only faster.

Labour is dead and there is no depth to which the ghouls animating its corpse will not stoop.

SKWAWKBOX needs your help. The site is provided free of charge but depends on the support of its readers to be viable. If you’d like to help it keep revealing the news as it is and not what the Establishment wants you to hear – and can afford to without hardship – please click here to arrange a one-off or modest monthly donation via PayPal or here to set up a monthly donation via GoCardless (SKWAWKBOX will contact you to confirm the GoCardless amount). Thanks for your solidarity so SKWAWKBOX can keep doing its job.

If you wish to republish this post for non-commercial use, you are welcome to do so – see here for more.

Exclusive: bank locks customer’s account after donation to UNRWA

Woman grilled minutes after payment to UN body defunded by US and UK after Israeli smears

A UK bank locked its customer’s account – and subjected her to a security grilling – minutes after she made a donation to UNRWA, the United Nations Relief and Works Agency that provides a lifeline to suffering Palestinians in Gaza.

The Sunak and Biden governments have stopped providing funds to the vital agency after Israel made what appear to be unevidenced claims that some of its employees took part in the 7 October raid. Israel’s record of lies about events in Gaza – and its now-clear slaughter of many, perhaps most, of the Israeli victims on the day of the raid – means that any allegations should be treated with extreme suspicion unless thoroughly proven. Israel has also murdered dozens of UN employees as well as well over a hundred journalists.

The woman, who has asked not to be named, said:

I’ve been with my bank for at least twenty years. Today, two minutes after donating a fiver to UNRWA, I received a security call and they had blocked my card.

Skwawkbox understands that the account was later unblocked, but if this incident is not a one-off, UK banks may be helping the government enforce its decision to cut off UNRWA and the desperate Palestinians who depend on it – a move that many analysts believe is a measure to accelerate the slaughter in Gaza before Israel has to report back to the International Court of Justice on its compliance, or gaping lack of compliance, with the court’s orders to stop and prevent genocide of the Palestinians.

Update – this appears not to be an isolated incident:

I'm receiving multiple reports that British banks are blocking querying and otherwise disrupting their customers legitimate personal donations to @UNRWA A United Nations Agency! What a country we are rapidly becoming… #Gaza

— George Galloway (@georgegalloway) January 29, 2024

SKWAWKBOX needs your help. The site is provided free of charge but depends on the support of its readers to be viable. If you’d like to help it keep revealing the news as it is and not what the Establishment wants you to hear – and can afford to without hardship – please click here to arrange a one-off or modest monthly donation via PayPal or here to set up a monthly donation via GoCardless (SKWAWKBOX will contact you to confirm the GoCardless amount). Thanks for your solidarity so SKWAWKBOX can keep doing its job.

If you wish to republish this post for non-commercial use, you are welcome to do so – see here for more.

Inflation is always and eveywhere a conflict phenomenon

I was lured into a recent talk by The Monetary Policy Institute organised by Canadian professor Louis Philippe Rochon. As Stephanie Kelton had been invited and the title was, as above, “Inflation is always and everywhere a conflict phenominon”, I thought it was worth attending. So too did Steve Keen. The principal lecture was by... Read more

An Overlooked Factor in Banks’ Lending to Minorities

In the second quarter of 2022, the homeownership rate for white households was 75 percent, compared to 45 percent for Black households and 48 percent for Hispanic households. One reason for these differences, virtually unchanged in the last few decades, is uneven access to credit. Studies have documented that minorities are more likely to be denied credit, pay higher rates, be charged higher fees, and face longer turnaround times compared to similar non-minority borrowers. In this post, which is based on a related Staff Report, we show that banks vary substantially in their lending to minorities, and we document an overlooked factor in this difference—the inequality aversion of banks’ stakeholders.

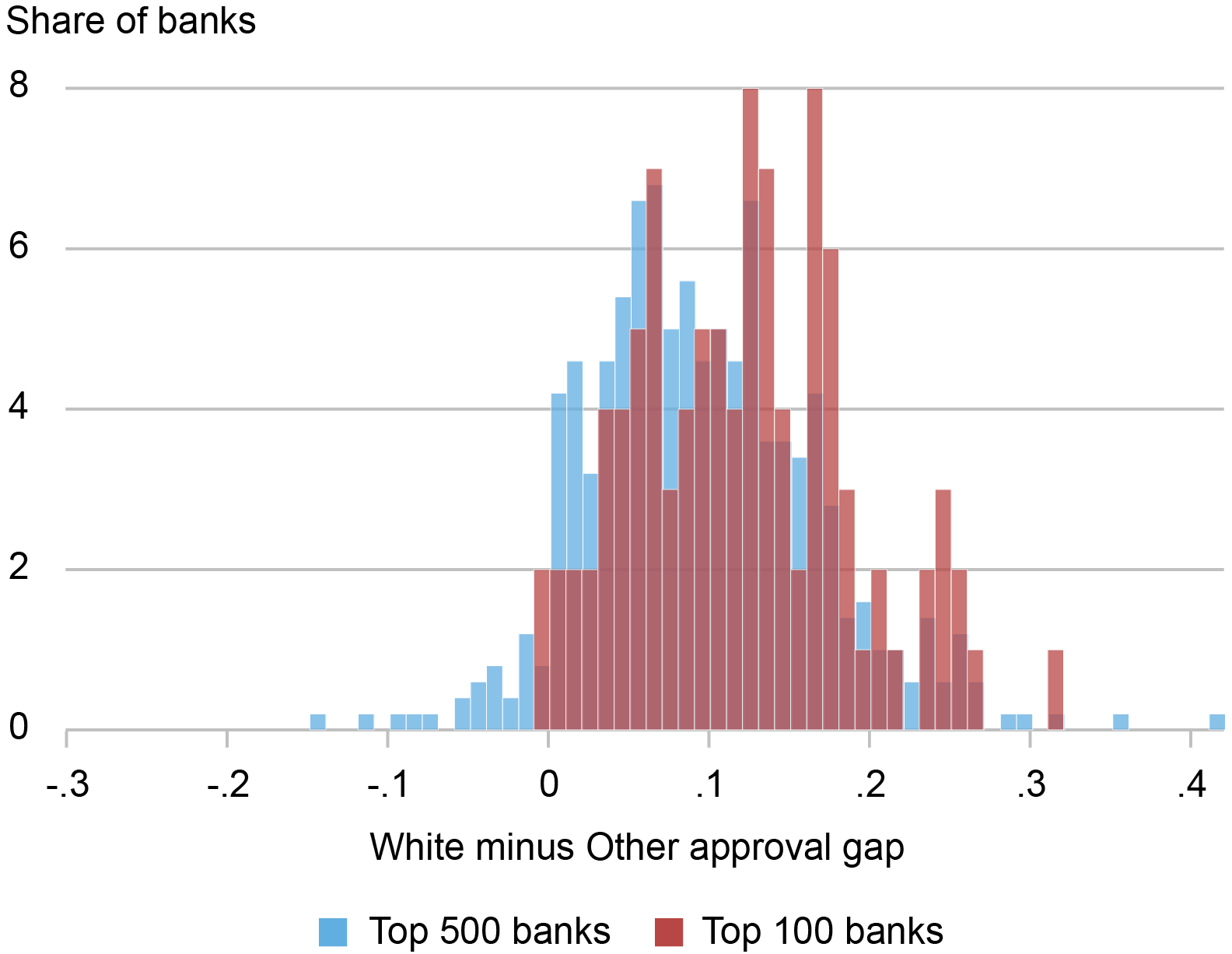

Substantial Differences in Banks’ Lending to Minorities

We use mortgage applications data collected under the Home Mortgage Disclosure Act to calculate banks’ lending to minorities. Our data set consists of 114.3 million loan applications received by 838 banks from 1995 to 2019. For each bank and for each year, we calculate the bank approval ratio, defined as the number of mortgage applications approved divided by the number of mortgage applications received.

The difference in lending to minorities across banks is sizable. The chart below shows the distribution of banks’ “approval gaps”—defined as the difference in the approval ratios for mortgage applications made by minority and non-minority borrowers. Such approval gaps tend to be positive (so that approvals are lower for minority applicants) and heterogenous across banks. Crucially, this variation persists within a narrow geographical area (such as county or census tract), suggesting that banks with small approval gaps are not systematically located in areas of the country where minorities have a relatively low credit risk.

Banks’ Lending to Minorities Varies Substantially

Source: Home Mortgage Disclosure Act (HMDA) data.

Notes: The chart shows the distribution of approval gaps, defined as the mortgage application approval ratio for white applicants (HMDA race code 5) minus the mortgage application approval ratio for other applicants (HMDA race codes 1-4). Top 500 and top 100 banks are defined based on the number of applications received. The sample period is 1995-2019.

An Overlooked Factor in Banks’ Lending to Minorities

Measuring stakeholders’ inequality aversion is challenging. It requires both a definition of stakeholders (which include, for example, depositors, borrowers, employees, and executives) and a measure of their preference for equal outcomes, resources, and opportunities. Given that bank stakeholders are mostly local, we calculate bank inequality aversion using a survey question on the desired level of government assistance to minority households from the General Social Survey (GSS), a nationally representative survey conducted since 1972 and widely used in academic studies.

Specifically, we use a survey question that asks whether “we’re spending too much money, too little money, or about the right amount of money on assistance to Black households.” Survey respondents can choose one of these three options, coded with the numbers 1, 2, and 3. We then calculate, for each bank, the weighted average of these responses, using the fraction of deposits that each bank has in the area where the respondent is located as weights.

It’s important to note that our analysis is not based on direct information about any bank’s depositors, board of directors, or management, or anything else specific about a bank other than the location of its branches. In the absence of information about banks’ actual stakeholders, we assume that the inequality aversion of the respondents who live in the area where a bank has a branch presence is representative of the preferences of its stakeholders.

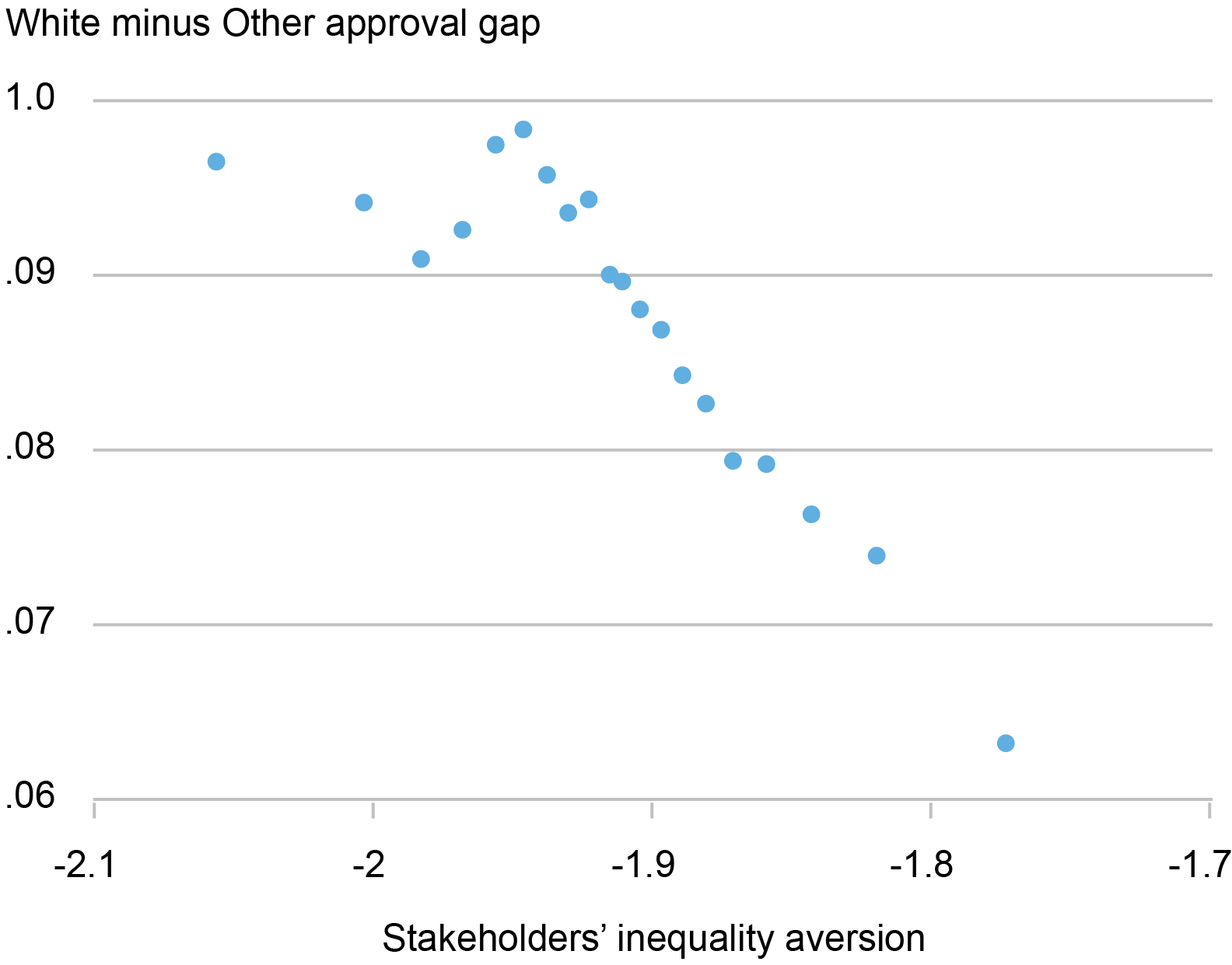

With these caveats in mind, we find that banks with more inequality-averse stakeholders by our measure tend to have smaller approval gaps, as shown in the chart below. The data are analyzed within census tracts, thus ruling out that this negative correlation is entirely due to banks with more inequality-averse stakeholders operating in areas where minorities have a lower credit risk. Similarly, within census tracts, banks with more inequality-averse stakeholders do not systematically receive applications from higher-income minority borrowers, suggesting that minority borrowers with lower credit risk do not systematically apply for mortgages with more inequality-averse banks.

Inequality-Averse Banks Lend More to Minorities

Sources: Home Mortgage Disclosure Act (HMDA) data; MIT Election Data and Science Lab; FDIC summary of deposits.

Notes: This binscatter plots banks’ non-minority minus minority approval gaps (the mortgage application approval ratio for white applicants (HMDA race code 5) minus the mortgage application approval ratio for other applicants (HMDA race codes 1-4)) on the y-axis against stakeholders’ inequality aversion (multiplied by minus one) on the x-axis. The analysis controls for census tract–year fixed effects. Banks are grouped in bins for readability.

How Might Stakeholders Affect Banks’ Lending?

So, how might an institution’s stakeholders impact its lending decisions? Likely indirectly. A possible channel is that, in their lending decisions, banks consider the inequality aversion of the counties in which they operate so as to attract and retain their (mostly local) stakeholders. Consistent with this mechanism, we find that banks that have been hit with a Department of Justice (DOJ) case for discrimination in mortgage lending experience a sizable drop in deposits, one that is particularly pronounced in counties with high inequality aversion. This result, detailed in our Staff Report, is consistent with recent anecdotal evidence on how stakeholders’ social considerations affect financial institutions.

Importantly, the higher lending to minorities of banks with inequality-averse stakeholders has a small and positive effect on performance, suggesting that it is not a manifestation of costly “goodness.” Specifically, the narrowing in approval gaps between minority and non-minority borrowers is followed by a small improvement in banks’ mortgage book quality and a small increase in overall bank profitability.

Final Thoughts

Our insight on the interaction between stakeholders’ inequality-aversion and banks’ lending to minorities is related to the discussions about lending discrimination and racial and ethnic disparities in housing. On the one hand, such inequality aversion might alleviate lending discrimination based on race and neighborhood characteristics. On the other hand, it might drive banks to specialize in different segments of the residential mortgage market. One interesting avenue of future research is understanding to what extent credit access for minorities might differ across the country based on the inequality aversion of local stakeholders.

Matteo Crosignani is a financial research advisor in Non-Bank Financial Institution Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Hanh Le is an assistant professor of finance at the University of Illinois Chicago.

How to cite this post:

Matteo Crosignani and Hanh Le, “An Overlooked Factor in Banks’ Lending to Minorities,” Federal Reserve Bank of New York Liberty Street Economics, January 10, 2024, https://libertystreeteconomics.newyorkfed.org/2024/01/an-overlooked-fact....

Stakeholders’ Aversion to Inequality and Bank Lending to Minorities

![]()

Economic Inequality: A Research Series

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

Neoliberalism’s idea is to shift costs to people while underinvesting and ignoring that government creates money

I think that this might be a good working definition of neoliberalism. It goes together with the idea that – so personally inadequate, uncertain and unconfident are the supposedly best people in society – that they consider, in spite of their power and wealth, that they can be safely certain of flourishing only when both... Read more

Where Is R‑Star and the End of the Refi Boom: The Top 5 Posts of 2023

The topics covered on Liberty Street Economics in 2023 hit many themes, reflecting the range of research interests of the more than sixty staff economists at the New York Fed and their coauthors. We published 122 posts this year, exploring important subjects such as equitable growth and the economic impacts of extreme weather, alongside our deep and long-standing coverage of topics like inflation, banking system vulnerability, international economics, and monetary policy effects. As we close out the year, we’re taking a look back at the top five posts. See you again in 2024.

By Wenxin Du, Benjamin Hébert, and Wenhao Li

Since the global financial crisis (GFC), long-maturity Treasury bonds have traded at a yield consistently above the interest rate swap rate of the same maturity. The emergence of the “negative swap spread” appears to suggest that Treasury bonds are “inconvenient,” at least relative to interest rate swaps. Our most-read post of the year documents this “inconvenience” premium and highlights the role of dealers’ balance sheet constraints in explaining it. The analysis further explores the role of the Treasury yield curve slope in driving dealers’ long position in Treasury bonds post-GFC and describes a framework for thinking about how shifts in monetary and regulatory policies can affect these market dynamics. (February 6)

By Alena Kang-Landsberg, Stephan Luck, and Matthew Plosser

This April post drew press and reader attention for offering updated estimates of banks’ deposit betas in order to capture the extent of the pass-through of the federal funds rate to deposit rates. The authors also compared the speed of adjustment of deposit betas in this interest-rate hiking cycle to four other such cycles since 1995. They reported, for example, a cumulative deposit beta on interest-bearing accounts of almost 0.4 for the fourth quarter of 2022; that measure was on par with “peak beta” in the 2015-19 hiking cycle and achieved over one year rather than three. (April 11)

By Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw

A sharp reduction in mortgage refinance originations seen in the Center for Microeconomic Data’s Quarterly Report on Household Debt and Credit for the first quarter provided an opportunity for these authors to mark an end to a refi boom that began with the COVID-19 pandemic. They look back at who refinanced, who cashed out on their home equity, and assess how much potential for consumption these transactions provided. They identify the COVID refi boom as lasting for seven quarters over 2020-21 in which approximately one-third of outstanding mortgage balances was refinanced (or fourteen million mortgages). Additionally, they estimate that $430 billion in home equity was extracted using mortgage refinances, a notable volume, though “not nearly as consequential as” the 2002-05 refi boom as a share of income. Some nine million borrowers refinanced their loans in the 2020-21 period without cashing out on equity and lowered their monthly mortgage payments—resulting in an aggregate reduction of $24 billion annually in housing costs, they reported. (May 15)

By Katie Baker, Logan Casey, Marco Del Negro, Aidan Gleich, and Ramya Nallamotu

These authors looked at trends in the long-run natural rate of interest, or r*, to find out if it had risen much in the aftermath of the COVID-19 pandemic, finding different answers from different models. According to VAR models, long-run r* remained roughly constant since late 2019, at 0.75 percent in real terms. A DSGE model by contrast had long-run r* rising by almost 50 basis points following the pandemic, to about 1.8 percent. The authors went on to discuss what would drive differences across the models and observed the relevance of the r* estimate for assessing the terminal (or peak) policy rate. (August 9)

See also:

The Evolution of Short-Run r* after the Pandemic (August 10)

By Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw

This analysis of new U.S. household debt and credit data found “fairly large” increases in delinquency transition rates on credit card and auto loan balances for the year ended December 2022, up from unusually low levels during the pandemic and approaching pre-pandemic levels. When changing their focus from balances to borrowers, the authors found a higher percentage of credit card borrowers—particularly younger borrowers—missing payments than before the pandemic. They noted a similar although “slightly healthier” trend for auto loan performance with younger borrowers struggling relatively more. The authors explained that among the potential contributing factors to the uptick in delinquencies were rising car prices (the data showed the average new auto loan increasing to $24,000 in 2022 from $17,000 in 2019) and the end of pandemic support policies to households. (February 16)

Anna Snider is a senior editor in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Anna Snider, “Where Is R‑Star and the End of the Refi Boom: The Top 5 Posts of 2023,” Federal Reserve Bank of New York Liberty Street Economics, December 21, 2023, https://libertystreeteconomics.newyorkfed.org/2023/12/where-is-r-star-an....

Supply Chains, Student Debt, and Stablecoins—The Top 5 Liberty Street Economics Posts of 2022

Stimulus, Savings, and Inflation: The Top Five Liberty Street Economics Posts of 2021

Understanding the Impact of COVID-19: The Top Five LSE Posts of 2020

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

Does Trade Uncertainty Affect Bank Lending?

The recent era of global trade expansion is over. Faced with increased geopolitical risk, fragile foreign supply chains, and uncertainties in the international trade environment, firms are postponing entry into foreign markets and pulling back from foreign activities (IMF 2023). Besides its direct effects on real activity, the recent rise in trade uncertainty has potentially important implications for the financial sector. This post describes how the lending activities of U.S. banks were affected by the rise in trade uncertainty during the 2018-19 “trade war.” In particular, banks that were more exposed to trade uncertainty contracted lending to all of their domestic nonfinancial business borrowers, regardless of whether these borrowers were facing high or low uncertainty themselves. Furthermore, banks’ lending strategies exhibited the type of “wait-and-see” behavior usually found in corporate firms facing investment decisions under uncertainty, and the lending contraction was larger for those banks that were more financially constrained.

The 2018-19 Trade War and Banks’ Reaction to the Rise in Uncertainty

In a recent study, we examine how trade uncertainty affects banks’ supply of credit to their nonfinancial business borrowers. We focus on the increase in trade uncertainty during the 2018-19 period, colloquially referred to as the trade war, which was marked by the renegotiation of trade agreements between the United States and other countries, as well as changes in tariffs, especially for products traded between the United States and China. As the chart below shows, trade uncertainty rose sharply at the beginning of 2018.

The Rise in Trade Uncertainty around U.S.–China Trade Tensions

Source: “Trade Policy Uncertainty Index” from Caldara et al. (2020).

Notes: The Trade Policy Uncertainty Index is derived from the number of joint occurrences of “trade policy” and “uncertainty” in news articles of major global newspapers. The vertical line in 2018:Q1 marks the beginning of the “trade war” period of sustained high trade uncertainty and enactment of several waves of tariffs.

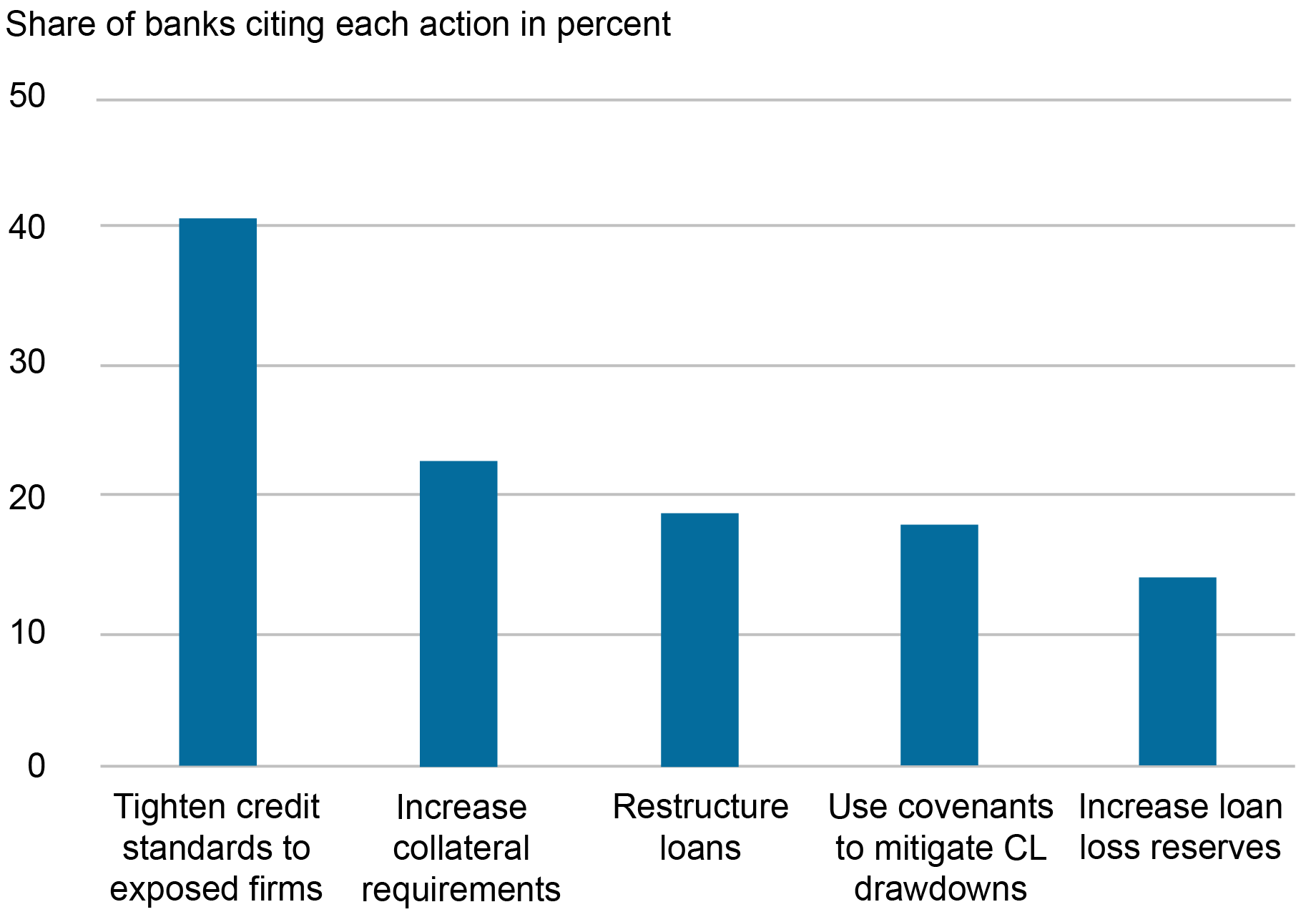

This episode did not go unnoticed by the banking sector. A survey of commercial loan officers (the Senior Loan Officer Opinion Survey, or “SLOOS”) conducted by the Federal Reserve in April 2019 included questions aimed at gauging the impact of trade uncertainty on banks’ lending operations. Loan officers at about seventy banks were asked what mitigating actions the banks had taken in response to adverse developments in the international environment. The responses to these survey questions, tabulated in the chart below, suggest that the uncertainty prompted some banks to tighten lending standards and increase loan loss reserves. Some banks noted a perception that future loan losses might increase, with potential consequences for banks’ ability to intermediate credit.

Bank Actions to Mitigate Trade Risks

Source: Federal Reserve Senior Loan Officer Opinion Survey (SLOOS), April 2019.

How might banks react to a rise in trade uncertainty? They may scale back their exposure to firms affected by uncertainty—as they typically do when some of their borrowers are hit by negative shocks—and provide additional lending to other, less affected, borrowers. Alternatively, they may become more cautious overall and, similarly to nonfinancial firms, postpone investing in new projects. In particular, banks may postpone new lending or tighten their terms—for instance, they may reduce approval rates on new loans, increase loan spreads, shorten loan maturities, or require more collateral on existing loans.

How Did U.S. Banks Exposed to Trade Uncertainty Change Their Lending Behavior during the Trade War?

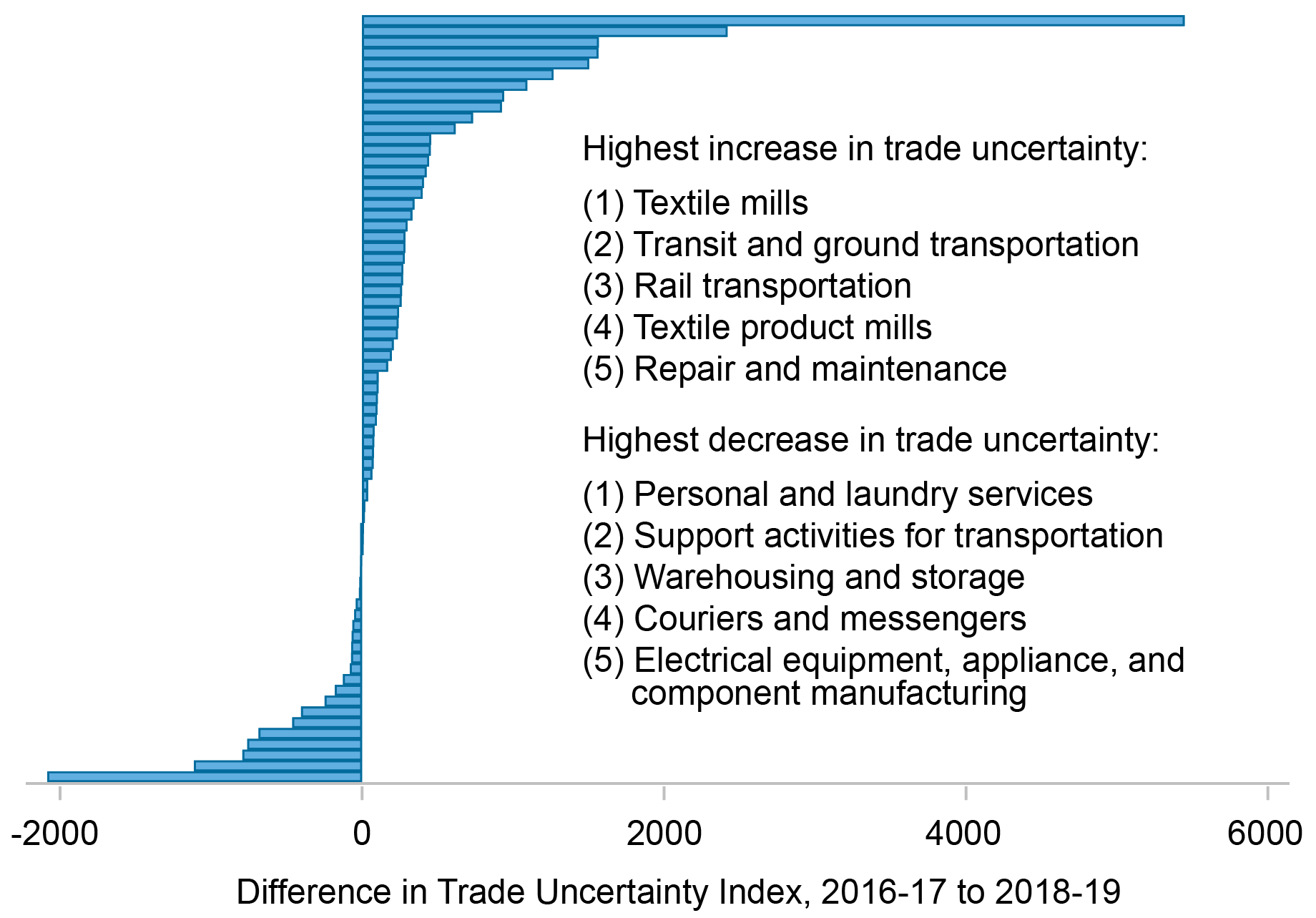

To estimate the impact of trade uncertainty on bank lending, we construct a novel measure of bank exposure to trade uncertainty by combining firm-level information on trade uncertainty with detailed data on U.S. banks’ loan exposures to domestic borrowers prior to the trade war (sourced from the U.S. Y-14Q “credit register” data, which primarily contain data on large banks). The measure captures a bank’s ex ante exposure to the realized rise in trade uncertainty during the 2018-19 period. As the next chart shows, the trade war generated differences in trade uncertainty across sectors of the U.S. economy, with several manufacturing and transportation-related sectors experiencing the largest increases in uncertainty. Therefore, banks with larger ex ante exposure to borrowers that operate in high trade uncertainty sectors had larger exposures to trade uncertainty in their overall loan portfolio.

Change in Sectoral Trade Uncertainty between 2016-17 and 2018-19

Source: Authors’ calculations based on data from Hassan et al. (2019).

Notes: Non-financial sectors are listed in descending order of uncertainty. Values are calculated by averaging Hassan et al. (2019)’s firm-level trade uncertainty data, based on textual analysis of earnings call transcripts, across firms within three-digit NAICS sectors.

Combining the bank-level exposure to trade uncertainty with quarterly loan growth rates at the bank–firm level, we estimate panel regressions over 2016-19 and show that banks exposed to trade uncertainty contracted lending during the trade war period (2018-19) relative to the preceding period (2016-17). Banks more exposed to trade uncertainty also increased interest rates on new loans. Importantly, these results hold for all borrowers and for borrowers in sectors not as directly affected by trade uncertainty. Thus, banks exposed to trade uncertainty do not appear to differentiate across borrowers in their lending behavior. Instead, banks facing a rise in uncertainty adopt a wait-and-see approach by contracting credit for all borrowers.

The effect of trade uncertainty on bank lending that we identify is economically meaningful. A one standard deviation increase in bank exposure to trade uncertainty is associated with a 2.6 percentage point decline in loan growth at the bank–firm pair level (compared to 0 percent median loan growth for the sample) and an increase in interest rates of 6.5 basis points (compared to a 185 basis point median loan spread for the sample).

The mechanisms underlying banks’ reactions to increased trade uncertainty are consistent with real-options theory, which predicts that firms postpone investment in the face of uncertainty. More-exposed banks reduce the maturity of loans and shift toward types of loans that can be called in early (so-called demandable loans). Moreover, given that they anticipate a wider dispersion in loan returns and may have difficulties forecasting revenues and capital needs, exposed banks downgrade the perceived creditworthiness of firms, as reflected in the higher probabilities of default that they assess for those firms. Exposed banks also contract their lending more strongly to firms that are perceived as likely to be adversely affected by the trade war and hence riskier ex ante—namely those firms in manufacturing sectors that receive low import protection and those firms in sectors with high import dependence.

Another explanation for banks’ pullback from risk-taking amid higher uncertainty is a “financial constraints” channel that emphasizes the role of capital constraints faced by banks. Exposed banks with lower levels of capital should be less able to withstand loan losses, may experience an increase in funding costs, and should thus contract their lending by more than other banks. Indeed, banks with lower levels of regulatory capital at the time of the trade war or under adverse stress-test scenarios cut back the supply of loans—to all borrowers—more than other banks. Consistent with both mechanisms, exposed banks have lower tolerance for risk-taking as they rebalance portfolios away from commercial loans and into safer assets, notably securities.

What Are the Implications for Economic Activity?

The contraction in bank credit supply arising from trade uncertainty may impact activity in the real sector, especially for bank-dependent firms. We use lending relationships before the trade war to construct a measure of firms’ exposure to trade uncertainty via their relationship with exposed banks. We then relate this measure to firms’ future investment and leverage. More-exposed firms are found to be unable to substitute for reduced bank lending through alternative sources of finance and exhibit relatively lower total debt growth and investment rates. A one standard deviation increase in firms’ exposure to trade uncertainty is associated with an economically meaningful decrease in the growth rate of the firms’ total debt and in their investment rate in 2018–19 by 2.4 and 2.7 percentage points, respectively. These results are consistent with credit supply contraction having a material adverse effect on exposed firms’ real outcomes. Moreover, private firms—which are more likely to depend on bank financing—and firms with a higher share of bank debt experience relatively worse real outcomes.

Overall, our study confirms that banks are a conduit for amplifying the effects of trade uncertainty. This financial channel is contractionary for a broad spectrum of firms, not exclusively those in sectors directly exposed to the trade war.

Ricardo Correa is a senior adviser in the Division of International Finance at the Federal Reserve Board.

Julian di Giovanni is the head of Climate Risk Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Linda S. Goldberg is a financial research advisor for Financial Intermediation Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

Camelia Minoiu is a research economist and adviser on the financial markets team in the Federal Reserve Bank of Atlanta’s Research Department.

How to cite this post:

Ricardo Correa, Julian di Giovanni, Linda S. Goldberg, and Camelia Minoiu, “Does Trade Uncertainty Affect Bank Lending?,” Federal Reserve Bank of New York Liberty Street Economics, December 20, 2023, https://libertystreeteconomics.newyorkfed.org/2023/12/does-trade-uncerta....

Trade Uncertainty and U.S. Bank Lending

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

Interest rate inconsistency shows up the sham

The most recent bank rate set by the Bank of England is currently 5.25%. And yet the BBC reports that: David Hollingworth, from broker L&C Mortgages, said that the best rates for two-year fixed deals were below 5%, or under 4.5% for five-year deals. In spite of the fact that the Bank of England Governor,... Read more

Pin up of the week

This is none other than Augustin Carstens – General Manager for the Bank of International Settlements. I draw attention to this principally to highlight an excellent article by the economist Ann Pettifor, where she illuminates the ill inflicted on us by central bankers who effectively exacerbate the already poor understanding of money. The article certainly... Read more

State investment would encourage business investment

News that Heathrow airport has changed ownership once more so that Saudi Arabia’s sovereign wealth fund will get a £1bn stake and Ardian Private Equity will take up to 15% of the whole, suggests that foreign investment in the UK is doing alright… But should we be chasing foreign private investment as Sunak did in... Read more