Saturday, 28 May 2016 - 8:55pm

Another story in the local rag about education, another rant from me. You know the drill:

Sounds like you've been reading the promotional material.

In reality, the "virtual" student experience at SCU is limited to a third-party product called Blackboard. It's basically a 1980s-style bulletin board system. Google "Blackboard sucks" for first-hand testimony.

It has an add-on component that does indeed allow you to participate in online "lectures". In these the low-paid tenuously-employed lecturer, usually in the discomfort of their own home, shouts into the void, sounding at the receiving end as though connected via two tin cans joined with string. They can also run a slide show. No two participants can have their microphone active simultaneously, as the software seizes up at this unreasonable level of demand, so staff and students eventually settle on some convention equivalent to saying "over" at the end of each contribution to the awkward exchange, as if it were CB radio.

The other mode of instruction at SCU is called "converged delivery". SCU has three main campuses, but they don't need more than one lecturer per subject because they broadcast the lecture to the other two campuses where, for the first couple of weeks at least, a few students watch them on-screen. The lecturer must control the entire production themselves. There is a stationary camera mounted to a wall or ceiling, so they stand rooted to the spot at a control panel barking into a microphone as though they're working the drive-thru window at McDonalds. Plus there's the slide show.

Sunday, 22 May 2016 - 9:16pm

This last few weeks, I have been mostly going insane with stress (or the "Coffs Harbour lifestyle", as it's known), and only reading:

- “Where to Invade Next” Is the Most Subversive Movie Michael Moore Has Ever Made — Jon Schwarz, The Intercept:

By the end of Where to Invade Next […] you may realize that the entire movie is about how other countries have dismantled the prisons in which Americans live: prison-like schools and workplaces, debtor’s prisons in order to pay for college, prisons of social roles for women, and the mental prison of refusing to face our own history. You’ll also perceive clearly why we’ve built these prisons. It’s because the core ideology of the United States isn’t capitalism, or American exceptionalism, but something even deeper: People are bad.

- Iceland's Pirate Party secures more election funding than all its rivals as it continues to top polls — Matt Broomfield at the Independent:

The anti-establishment party, which calls for a 35-hour working week, direct democracy and total drug decriminalisation, has the lead in eight out of the last ten polls. They look set to form a crucial part of a coalition government in this autumn's general election.

- Disappointing: Elsevier Buys Open Access Academic Pre-Publisher SSRN — Mike Masnick at Techdirt:

Everyone involved, of course, insists that "nothing will change" and that Elsevier will leave SSRN working as before, but perhaps with some more resources behind it (and, sure, SSRN could use some updates and upgrades). But Elsevier has such a long history of incredibly bad behavior that it's right to be concerned.

- EFF Asks Court to Reverse Chelsea Manning’s Conviction for Violating Federal Anti-Hacking Law — Electronic Frontier Foundation:

"Congress intended to criminalize the act of accessing a computer that you aren’t authorized to access, such as breaking into a corporate computer to steal user data or trade secrets or to spread viruses. The law should not be used to turn a violation of an employer’s computer use restrictions into a federal crime. That’s what happened here," said EFF Legal Fellow Jamie Williams.

The Joy of Economic Irresponsibility: or how I learned to stop worrying and love the public debt

If there's one thing I've learned in the last year that I think is so important it's worth shouting from the rooftops, it's that simultaneously studying economics and the psychology of stress while also being personally stressed about money is a very, very bad idea.

If there are two important things I've learned in the last year, I'd say that the more generally applicable one to the citizen in the street is that a government which issues it's own money can never run out of it.

Such a government can of course pretend, or at least behave like, it can run out of money. In fact, many have done so for the last thirty years or so, and the results have been disastrous. You don't have to take my word for it. Here are some graphs, mostly from the RBA Chart Pack, except where otherwise indicated. Here's the Australian government fiscal balance, misleadingly labelled "budget balance" as per the conventional misunderstanding of reality.

Things took a dip from 2007/8, but deficits are improving, and we were in surplus for most of the preceeding decade. And that's good, isn't it? Surpluses mean we have more money, don't they?

Generally, yes. A "budget surplus" for a business or household means more money at hand to spend later. However, for an economy with a sovereign-currency-issuing government, public fiscal surpluses mean we have less money.

How is this possible? To understand this, you have to understand that accountancy—specifically double-entry bookkeeping and balance sheets—is the foundation of economics; at least economics of a realistic kind. All money is credit money. You make money—literally—by being in debt to somebody, and by denominating this debt in the country's transferrable unit of account. Spending is the simultaneous creation of a debt on the buyer's side of the ledger, and a corresponding credit on the seller's side. However, if you happen to hold enough credits that have already been generated as the flipside of a debt in your favour, you can use these credits to immediately cancel the debt of the current transaction. One way most of us do this on a daily basis is by using cash. Cash is a transferrable token of public sector debt and private sector credit.

Three percent of the immediately-spendable money in the private sector is in the form of cash. The other 97% is just numbers stored on computers in the commercial banking sector. Most of this is money that originated as commercial bank loans, and will disappear from the bank's balance sheets as those loans are repaid (though of course in the meantime more loans will have been made). However, a significant amount of money originates as loans the government makes to itself (technically the central bank lends to the treasury), eventually ending up in the private sector as cash, or (through a mindbending process I will mercifully omit from this account) as commercial bank deposits. A currency-issuing government can always lend more money to itself in order to spend, and never has to pay it back. It follows that such a government does not need to tax in order to spend, and only ever taxes for other reasons. Economics textbooks, and economic commentators, routinely get this utterly and comprehensively wrong. Consider this textbook description of economic "automatic stabilisers":

"During recessions, tax revenues fall and welfare payments increase thereby creating a budget deficit. In times of economic boom, tax revenues rise and welfare payments fall creating a budget surplus."

Budget deficits are not an eventual consequence of government spending; the spending and the creation of a debt are the same operation. Tax revenues merely redeem a part of the already-accrued debt; the money issued by public spending is a public IOU that effectively disappears when private parties use it settle their tax debt owed to the public. Tax revenues therefore cannot be used to fund public spending; in order to spend, new public debt must be issued. The automatic stabilisers are real (assuming a somewhat sensible tax system), but the important part of their function is on the private side: injecting new money to stimulate demand when needed, or putting the brakes on dangerous speculative activity in a boom. The government's fiscal position from one year to the next is an inconsequential side-effect.

Taxation is the elimination of money, and hence of the demand for goods, services, and assets that drives the private sector economy. Don't believe me? Lets take a wider focus on the fiscal balance numbers above:

[Source]

Generally, and especially prior to the neoliberal period, public fiscal surpluses are the exception, not the rule. And for a good reason; it's generally not a good idea to drain demand out of the economy. So what happens when you toss good sense aside, and insist on surpluses for their own sake? Here's what happened to public sector debt:

I'm presuming (the ABS Chart Pack doesn't specify) that this is debt owed to private sector banks in the form of loans and government securities. I should stress that, as with taxation, these operations are not required to finance spending, and are only ever done for other reasons (such as hitting interest rate targets). Also, because they don't issue currency themselves (though this is possible, and has worked elsewhere), lower levels of government do have to rely in part on revenue-raising to fund spending, though grants from the federal government also play a big part in determining their fiscal position.

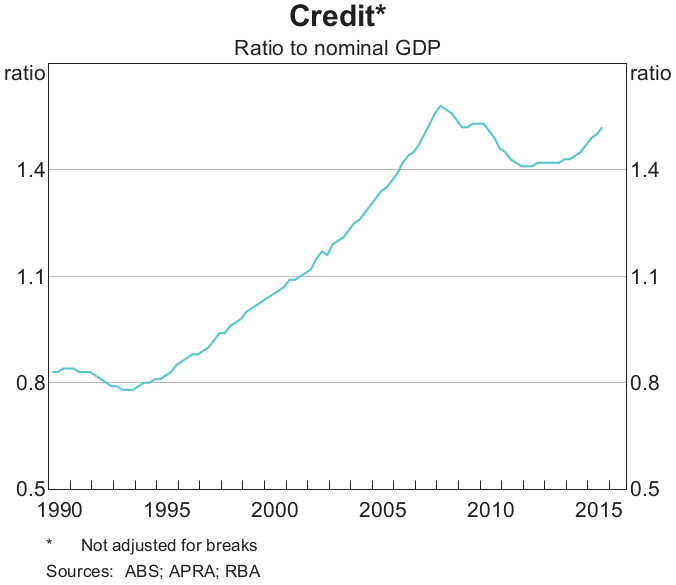

Still—phew!—we got that scary public sector debt under control until the GFC, and we can do it again! But hang on, if that's taking money out of the private sector, where does the private sector get the money to sustain demand? Here's the private sector debt over the same period:

Note that this is one and a half times GDP, compared to the one third of GDP outstanding to the public sector, at the height of its alleged fiscal irresponsibility. When government self-imposes limits on its ability to spend, private sector credit creation takes up the slack. Who do you want controlling how much money is created, who gets it, and what it gets spent on? A mix of the commercial finance sector and a (somewhat) democratically-accountable government? Or just the bankers?

Most of private-sector money creation is commercial bank loans, and as economist Michael Hudson notes, in the US, UK, and Australia, 70 percent of bank loans are mortgages. That's a hell of a lot of money (what's 70 percent of one and a half times GDP?) dependant for its existence on the soundness of pricing for a single class of asset. If real estate prices suddenly crash, and mortgagees start to default on their loans, poof! The corresponding credits on the other side of the ledger are gone too, and the real estate sector takes the whole economy down with it. You can't argue with balance sheets.

Still, I expect we'll be fine as long as we stay the fiscal responsibility course, and don't let the government "spend more than it earns". Real estate prices only ever go up, don't they? And it's not like bankers would ever be led by their own short-term interests to make a huge amount of risky loans and inflate an enormous real estate price bubble…

Sunday, 1 May 2016 - 6:38pm

This week, I have been mostly reading:

- The Zombie Doctrine — George Monbiot:

The freedom neoliberalism offers, which sounds so beguiling when expressed in general terms, turns out to mean freedom for the pike, not for the minnows. Freedom from trade unions and collective bargaining means the freedom to suppress wages. Freedom from regulation means the freedom to poison rivers, endanger workers, charge iniquitous rates of interest and design exotic financial instruments. Freedom from tax means freedom from the distribution of wealth that lifts people out of poverty.

- The full employment productivity multiplier — Jared Bernstein in the Washington Post:

What if stronger demand led to full employment? And what if that gave their workers enough bargaining power to push up labor costs? Then, to maintain their profit margins, [otherwise low-wage, high inefficiency businesses] would have to find efficiency gains to offset their higher wage costs. Less turnover, for example. Less reason to hang onto extra workers who weren’t always needed but were cheap to have around. And this is a description of stronger demand leading to higher productivity.

- NHS: New report reveals marketisation is failing — Richard Murphy:

I do know something about markets, quasi-markets and organisation structures and what I can say, beyond a shadow of a doubt, is that if there are buying and other management inefficiencies in the NHS then they can be blamed fairly and squarely at successive governments who have thought that introducing market practices would help its efficiency. They were wrong. Markets do not drive everyone to efficiency, especially when NHS organisations cannot, ultimately, fail. All they can do is create division.

- Wondermark #1196; The Currency of Cute — David Malki:

- Problems with Economics: The Cult of Utility — Ian Welsh:

Basically, utility says, “Whatever action people choose to take is the one from which they derive the most usefulness.” This is known as revealed preference. This is a circular definition; metaphysical in the worst sense. Any action we take is utility maximization. A person can never fail to maximize utility (within their budget), because their actions are what defines the actions’ utility.

- Australia guts government climate research — Scott K. Johnson, Ars Technica:

Staff at Australia’s Commonwealth Scientific and Industrial Research Organisation (CSIRO) received an unpleasant e-mail when they came to work Thursday morning, one that outlined some specifics of long-awaited restructuring plans. The gist of the message? You've done such a good job, we have to let you go.

- “Negative” Interest Rates and the War on Cash — Richard Werner, who speculates persuasively about the war on cash being also a war on not-for-profit banking, but I can't quite follow him all the way to tinfoil hat territory where all commercial banking is eliminated and all citizens of credit-worthy standing are microchipped by the central bank:

The main reason advanced by the Bank of England for wanting to abolish cash is that it wishes to stimulate the UK economy, and to do so it wants to use interest rates. Since rates are already zero, it is now only reasonable to lower them into negative territory. However, to make such a policy effective, the possibility to move from electronic money into cash needs to be taken away. If cash is abolished, we can then enjoy the benefits of negative interest rates – or so the official narrative goes. This story is so full of holes that it is hard to know where to start.

- Must-read: Our dysfunctional monetary system — Steve Keen, Real-World Economics Review Blog:

The fetish for small government and budget surpluses means that the government has […] effectively abrogated money creation to the private banking sector. This strategy had no obvious negative consequences while the private banks were on a credit-money-creation binge—as they were effectively from the end of WWII till 2008. But once private debt began to dwarf GDP and the growth of credit slowed to a trickle, the inherent stupidity of this policy became apparent. In their attempt to promote the private sector, conservative proponents of small government are actually strangling it. […] Rather than understanding the real cause of the crisis, we’ve seen the symptom—rising public debt—paraded as its cause.

- A Scheme to Encrypt the Entire Web Is Actually Working — Andy Greenberg at Wired:

It’s available to websites anywhere in the world—even far-flung countries like Cuba and Iran that sometimes aren’t served by other major certificate authorities. And it’s automatically configured with a piece of code that runs on any server that wants to switch on HTTPS. “This is the silver bullet that…lowers the barrier to encrypted web communications,” says Ross Schulman, the co-director of the cybersecurity initiative at the New America Foundation. “It brings the cost of executing a secure website down to zero.”

Sunday, 24 April 2016 - 4:27pm

This week, I have been mostly writing, but in the last couple of days, I've been reading:

- Why Are Universities Fighting Open Education? — Elliot Harmon, Common Dreams:

Why were some universities opposing a rule that would directly benefit their students and faculty? When you dig a bit deeper, it looks like universities’ opposition to open licensing has nothing to do with students’ access to educational resources. What’s really playing out is a longstanding fight over how universities use patents—more specifically, software patents. Open education just happens to be caught in the crossfire.

- Paul Krugman, Bernie Sanders, and the Experts — Dean Baker at CEPR:

The experts insisted that we would have a Second Great Depression if we didn’t bail out the Wall Street banks. Really? Was there some magical curse that would overcome the country if Goldman Sachs and Citigroup went out of business? Would Keynesian stimulus no longer work? We got out of the first Great Depression in 1941 by spending a ton of money fighting World War II. It is hard to see any reason why we couldn’t have ended the depression a decade sooner by spending a ton of money in 1931 on infrastructure, health care, and education. The same story would have applied in 2009.

- Q: When is a dollar pegged to gold not on a gold standard? A: From 1934-1971 — Eric Rauchway at Crooked Timber:

[…]as the economist Edward Bernstein (who was in the Roosevelt Treasury, at Bretton Woods, and later served in the IMF) succinctly explained, years later. 'In spite of the Gold Reserve Act, the United States was not really on a gold standard after 1933. The essence of the gold standard is that the money supply must be limited by the gold reserve. The last time that the Federal Reserve tightened its policy because the gold reserve ratio had fallen close to the legal minimum was on March 3, 1933, when the Federal Reserve Bank of New York raised the discount rate to 3-1/2 per cent. Thereafter, whenever the gold reserve neared the legal minimum, the required reserve ratio was reduced and finally eliminated. A country that loses more than half of its gold reserve, as the United States did in 1958-71, without reducing its money supply is not on the gold standard.'

- Economists Prove That Capitalism is Unnecessary: The nonsensical logic of mainstream economics — Steve Keen, paywalled in Forbes, published in Evonomics:

It’s an assumption that individuals in a market economy are so all-knowing that, in effect, they don’t need markets at all: they can just work it all out in their heads. Yet if anything defines a capitalist economy, it’s the dominance of markets. So effectively the mainstream reaction to anything which disturbs their preferred way of modeling a market economy is to make assumptions that, if they were true, would make a market economy itself unnecessary in the first place.

- The West Is Traveling The Road To Economic Ruin — Paul Craig Roberts (warning: a bit of a fruitcake at times) reviews the career of "best economist in the world" Michael Hudson:

Hudson learned that monetary theory concerns itself only with wages and consumer prices, not with the inflation of asset prices such as real estate and stocks. He saw that economic theory serves as a cover for the polarization of the world economy between rich and poor. The promises of globalism are a myth. Even left-wing and Marxist economists think of exploitation in terms of wages and are unaware that the main instrument of exploitation is the financial system’s extraction of value into interest payments. Economic theory’s neglect of debt as an instrument of exploitation caused Hudson to look into the history of how earlier civilizations handled the build up of debt.

- How Boots went rogue — Aditya Chakrabortty, The Guardian, in what they call "The Long Read", presumably because "You're Not Going to Enjoy This, But it's Good For You" didn't test so well with key demographics:

This is the tale of how one of Britain’s oldest and biggest businesses went rogue – to the point where its own pharmacists claim their working conditions threaten the safety of patients, and experts warn that the management’s pursuit of demanding financial targets poses a risk to public health. (Boots denies this, saying that “offering care for our colleagues, customers and the communities which we serve…is an integral part of our strategy.”) At the heart of this story is one of the most urgent debates in post-crash Britain: what large companies owe the rest of us – in taxes, in wages, and in standards of behaviour.

- Explaining Why Federal Deficits Are Needed — Thornton (Tip) Parker at New Economic Perspectives [I'm definitely using this one]:

The economy is like a car. Government spending is the accelerator. Taxes are the brakes. To keep going or speed up, press the accelerator. To slow down, ease off the accelerator or press the brakes. Driving too fast could lead to hyper-inflation, but that never happened here because the country always slowed down in time.

Thursday, 21 April 2016 - 3:37am

I'm no medical expert, although I do have an advanced diploma in homeopathy from the time I went for a swim with somebody who had that qualification and accidentally swallowed some water. I honestly can't see why it's not possible to put St. Peter on the boom gates to only let in people with nice ailments. I don't like to be judgmental, but it's lowlife scum who ruin sickness for the rest of us. Ambulances are a waste of taxpayers' money and an outrageous rort by the suddenly-gravely-ill lobby. Personally, I schedule my extreme medical distress in installments across the calendar year, then take my treatment out at tax time as a lump sum. If you can't be bothered to plan ahead, I don't see why the rest of us should foot the bill.

Thursday, 21 April 2016 - 3:35am

It's hard to pinpoint when a revolutionary idea comes to you. I think I had the first inkling while on the way from my business networking breakfast to my business networking brunch. Later, at business networking lunch, I started to look at the people around me, sensing something… Something tantalising, yet frustratingly intangible, like the distant promise of an unexploited tax exemption. By business networking afternoon coffee, the idea was still yet not fully formed. The dynamic, entrepreneurial buzz washed over me as my gaze settled on the centre of the table. Raw, white, and artificial. These sweetener sachets crammed together in a whisky tumbler—each satisfying different needs, yet also the same need—were calling to me.

As the afternoon wore on, it became a drumbeat: raw, white, and artificial; raw, white, and artificial…

Over dinner, as the rhythm of "raw, white, and artificial…" rose to an intolerable crescendo in my mind, the flash of blinding insight finally hit me. I stood bolt upright and, as if possessed by the spirit of an old testament prophet, I proclaimed to the assembled business networking group: "Hear me! Something is missing from Coffs Harbour! Something disruptive, something game-changing, something that will engage our key stakeholders and enrich our brand! I have a vision of a great coming-together at signature events of well-mannered middle-class people of very marginal talent and even less intelligence, with very mediocre food, and very, very minor celebrities. I say unto you, raise an army of multimedia account managers! Let them go forth and multiply brand awareness! Let them vanquish the unbelievers in bloody and brutal information sessions! Only then—only then, my people—shall we have a new… business… networking… group!"

I fell exhausted to my seat, to rapturous applause. I sank my spork into a dry, tasteless slab of chocolate cake. One thing was clear: Coffs Harbour would never be the same again.

Sunday, 17 April 2016 - 10:13pm

This week, I have been mostly reading:

- Sanders, Corbyn and the financial crisis — Simon Wren-Lewis refuses to follow his neoclassical colleague Krugman into Very Serious Person-hood:

The right has succeeded in morphing the financial crisis into an imagined crisis in financing government debt (or, in the Eurozone with the ECB’s help, into an actual crisis) which required a reduction in the size of the state that neoliberals dream about. The financial crisis, far from exposing neoliberal flaws, has led to its triumph. Confronted with this extraordinary turn of events, many of those on the centre left want to concede defeat and accept austerity! That is all scandalous, and if the left’s established leaders will not recognise this, it is not surprising that party members and supporters will look elsewhere to those who do.

- The Problem With Hillary Clinton Isn’t Just Her Corporate Cash. It’s Her Corporate Worldview. — Naomi Klein in The Nation:

The real issue, in other words, isn’t Clinton’s corporate cash, it’s her deeply pro-corporate ideology: one that makes taking money from lobbyists and accepting exorbitant speech fees from banks seem so natural that the candidate is openly struggling to see why any of this has blown up at all.

- How a Cashless Society Could Embolden Big Brother — Sarah Jeong at The Atlantic:

Transactions route through several tangled layers of vendors, processors, and banks. At various points in the chain, all transactions squeeze through bottlenecks created by big players like Visa, Mastercard, and Paypal: These are the choke points for which Operation Choke Point is named. The choke points are private corporations that are not only subject to government regulation on the books, but have shown a disturbing willingness to bend to extralegal requests—whether it is enforcing financial blockades against the controversial whistleblowing organization WikiLeaks or the website Backpage, which hosts classified ads by sex workers, and allegedly ads from sex traffickers as well. A little bit of pressure, and the whole financial system closes off to the government’s latest pariah.

- Paul Krugman Unironically Anoints Himself Arbiter of “Seriousness”: Only Clinton Supporters Eligible — Glenn Greenwald at The Intercept:

To any of you Sanders supporters who previously believed that you possessed serious policy expertise, such as Dean Baker; or former Clinton Labor Secretary and Professor of Economic Policy Robert Reich (who yesterday wrote that “Bernie Sanders is the most qualified candidate to create the political system we should have”); or the 170 policy experts who signed a letter endorsing Sanders’ financial reform plan over Clinton’s: sorry, but you must now know that you are not Serious at all. The Very Serious Columnist has spoken. He has a Seriousness Club, and you’re not in it. If you want to be eligible, you need to support the presidential candidate of the Serious establishment, led by Paul Krugman.

[Krugman seems determined to follow the sad example of Christopher Hitchens: If you're determined to pose as a contrarian, it's far more comfortable to be a contrarian for the establishment.]

Saturday, 16 April 2016 - 8:30pm

"Expansionary fiscal policy is taboo, because it threatens to increase national debt further. But much depends on how governments present their accounts. In 2014, the Bank of England held 24% of UK government debt. If we discount this, the UK’s debt/GDP ratio was 63%, not 92%.

"So it makes more sense to focus on debt net of government borrowing from the central bank. Governments should be ready to say that they have no intention of repaying the debt they owe their own bank. Monetary financing of government spending is one of those taboo ideas that is sure to gain support, if, as is likely, economic recovery grinds to a halt."

Thank you, thank you, thank you, Professor Lord Skidelsky! I disagree with much of the preamble (including the implication that Shakespeare intended Polonius' stream of adages to be taken seriously; I fancy Shakespeare's audiences would find being neither a borrower nor a lender—particularly the former—as ludicrously impractical as would today's precariat), but I love the conclusion.

Private mortgage debt is bad. Private credit card or loan shark debt (the categories are not exclusive) is very, very bad. Money the government owes itself is at worst a misleading artifact of an accounting convention, at best an indirect metric of public economic stimulus. It harms nobody but those loan sharks and assorted greater and lesser parasites who currently benefit from the neoliberal debtfare system; that's the only reason it's a taboo.

Wednesday, 13 April 2016 - 8:45pm

Tough luck Arrawarra. It's the dream of every community on the mid-north coast to host a motorway exit with clear blue skies above, chewing-gum-speckled asphalt below, and a corporate-branded awning in between. Do not give up on that dream! Through earnest devotion to Roads and Maritime Services, and their partners in the multinational oil and fast food cartels, you will one day, like Nambucca Heads, attract a steady stream of low-paying employment and sawn-off shotguns.