The Joy of Economic Irresponsibility: or how I learned to stop worrying and love the public debt

If there's one thing I've learned in the last year that I think is so important it's worth shouting from the rooftops, it's that simultaneously studying economics and the psychology of stress while also being personally stressed about money is a very, very bad idea.

If there are two important things I've learned in the last year, I'd say that the more generally applicable one to the citizen in the street is that a government which issues it's own money can never run out of it.

Such a government can of course pretend, or at least behave like, it can run out of money. In fact, many have done so for the last thirty years or so, and the results have been disastrous. You don't have to take my word for it. Here are some graphs, mostly from the RBA Chart Pack, except where otherwise indicated. Here's the Australian government fiscal balance, misleadingly labelled "budget balance" as per the conventional misunderstanding of reality.

Things took a dip from 2007/8, but deficits are improving, and we were in surplus for most of the preceeding decade. And that's good, isn't it? Surpluses mean we have more money, don't they?

Generally, yes. A "budget surplus" for a business or household means more money at hand to spend later. However, for an economy with a sovereign-currency-issuing government, public fiscal surpluses mean we have less money.

How is this possible? To understand this, you have to understand that accountancy—specifically double-entry bookkeeping and balance sheets—is the foundation of economics; at least economics of a realistic kind. All money is credit money. You make money—literally—by being in debt to somebody, and by denominating this debt in the country's transferrable unit of account. Spending is the simultaneous creation of a debt on the buyer's side of the ledger, and a corresponding credit on the seller's side. However, if you happen to hold enough credits that have already been generated as the flipside of a debt in your favour, you can use these credits to immediately cancel the debt of the current transaction. One way most of us do this on a daily basis is by using cash. Cash is a transferrable token of public sector debt and private sector credit.

Three percent of the immediately-spendable money in the private sector is in the form of cash. The other 97% is just numbers stored on computers in the commercial banking sector. Most of this is money that originated as commercial bank loans, and will disappear from the bank's balance sheets as those loans are repaid (though of course in the meantime more loans will have been made). However, a significant amount of money originates as loans the government makes to itself (technically the central bank lends to the treasury), eventually ending up in the private sector as cash, or (through a mindbending process I will mercifully omit from this account) as commercial bank deposits. A currency-issuing government can always lend more money to itself in order to spend, and never has to pay it back. It follows that such a government does not need to tax in order to spend, and only ever taxes for other reasons. Economics textbooks, and economic commentators, routinely get this utterly and comprehensively wrong. Consider this textbook description of economic "automatic stabilisers":

"During recessions, tax revenues fall and welfare payments increase thereby creating a budget deficit. In times of economic boom, tax revenues rise and welfare payments fall creating a budget surplus."

Budget deficits are not an eventual consequence of government spending; the spending and the creation of a debt are the same operation. Tax revenues merely redeem a part of the already-accrued debt; the money issued by public spending is a public IOU that effectively disappears when private parties use it settle their tax debt owed to the public. Tax revenues therefore cannot be used to fund public spending; in order to spend, new public debt must be issued. The automatic stabilisers are real (assuming a somewhat sensible tax system), but the important part of their function is on the private side: injecting new money to stimulate demand when needed, or putting the brakes on dangerous speculative activity in a boom. The government's fiscal position from one year to the next is an inconsequential side-effect.

Taxation is the elimination of money, and hence of the demand for goods, services, and assets that drives the private sector economy. Don't believe me? Lets take a wider focus on the fiscal balance numbers above:

[Source]

Generally, and especially prior to the neoliberal period, public fiscal surpluses are the exception, not the rule. And for a good reason; it's generally not a good idea to drain demand out of the economy. So what happens when you toss good sense aside, and insist on surpluses for their own sake? Here's what happened to public sector debt:

I'm presuming (the ABS Chart Pack doesn't specify) that this is debt owed to private sector banks in the form of loans and government securities. I should stress that, as with taxation, these operations are not required to finance spending, and are only ever done for other reasons (such as hitting interest rate targets). Also, because they don't issue currency themselves (though this is possible, and has worked elsewhere), lower levels of government do have to rely in part on revenue-raising to fund spending, though grants from the federal government also play a big part in determining their fiscal position.

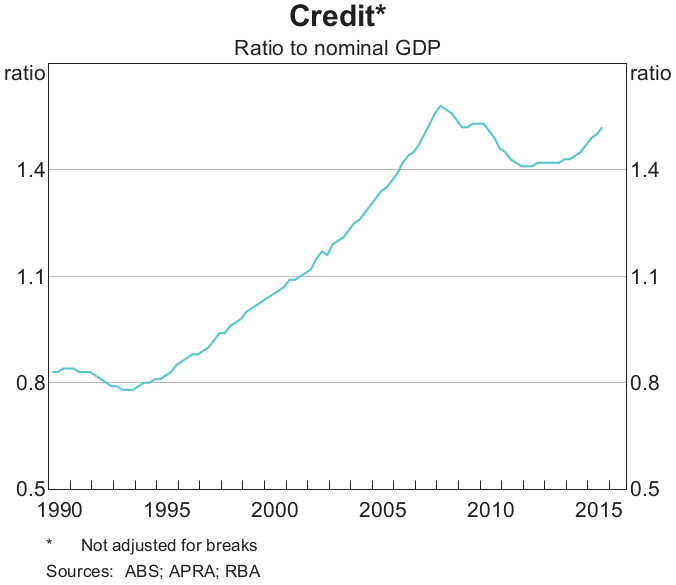

Still—phew!—we got that scary public sector debt under control until the GFC, and we can do it again! But hang on, if that's taking money out of the private sector, where does the private sector get the money to sustain demand? Here's the private sector debt over the same period:

Note that this is one and a half times GDP, compared to the one third of GDP outstanding to the public sector, at the height of its alleged fiscal irresponsibility. When government self-imposes limits on its ability to spend, private sector credit creation takes up the slack. Who do you want controlling how much money is created, who gets it, and what it gets spent on? A mix of the commercial finance sector and a (somewhat) democratically-accountable government? Or just the bankers?

Most of private-sector money creation is commercial bank loans, and as economist Michael Hudson notes, in the US, UK, and Australia, 70 percent of bank loans are mortgages. That's a hell of a lot of money (what's 70 percent of one and a half times GDP?) dependant for its existence on the soundness of pricing for a single class of asset. If real estate prices suddenly crash, and mortgagees start to default on their loans, poof! The corresponding credits on the other side of the ledger are gone too, and the real estate sector takes the whole economy down with it. You can't argue with balance sheets.

Still, I expect we'll be fine as long as we stay the fiscal responsibility course, and don't let the government "spend more than it earns". Real estate prices only ever go up, don't they? And it's not like bankers would ever be led by their own short-term interests to make a huge amount of risky loans and inflate an enormous real estate price bubble…