Sunday, 11 September 2016 - 7:49pm

This week, I have been mostly reading:

- Imagining a New Bretton Woods — Yanis Varoufakis in Project Syndicate:

Above all, the new system would reflect Keynes’s view that global stability is undermined by capitalism’s innate tendency to drive a wedge between surplus and deficit economies. The surpluses and deficits grow larger during the upturn, and the burden of adjustment falls disproportionately on debtors during the downturn, leading to a debt-deflationary process that takes root in the deficit regions before dampening demand everywhere. To counter this tendency, Keynes advocated replacing any system in which “the process of adjustment is compulsory for the debtor and voluntary for the creditor” with one in which the force of adjustment falls symmetrically upon debtors and creditors.

- Yes, the Economy Is Rigged, Contrary to What Some Economists Try to Tell You — Dean Baker summarises the things that have been occupying his mind lately, including:

In Europe and Japan, CEOs are also well-paid, but they tend to get a third or a quarter of what our CEOs earn. This matters not only because of the pay the CEOs get, but also because of its impact on pay structures throughout the economy. It is now common to see top executives of non-profit hospitals, universities, or private charities get salaries of more than $1 million a year. They argue that they would get much more working for a corporation of the same size. And, this money comes out of the pockets of the rest of us.

- Inflation Targeting and Neoliberalism — Gerald Epstein interviewed at TripleCrisis:

I see this as part of a whole neoliberal approach to central banking. That is, the idea that the economy is inherently stable, it will inherently reach full employment and stable economic growth on its own, and so the only thing that the macro policymakers have to worry about is keeping a low inflation rate and everything else will take care of itself. Of course, as we’ve seen, this whole neoliberal approach to macroeconomic policy is badly mistaken. […] This approach, I think, really has contributed to enormous financial instability. Notice that this inflation targeting targets commodity inflation. But what about asset bubbles, that is, asset inflation? There’s no attempt to reduce asset bubbles like we had in subprime or in real estate bubbles in various countries. That is another kind of inflation that could have been targeted.

- Robert Mundell, evil genius of the euro — Greg Palast in the Guardian:

Mundell explained to me that, in fact, the euro is of a piece with Reaganomics: "Monetary discipline forces fiscal discipline on the politicians as well." And when crises arise, economically disarmed nations have little to do but wipe away government regulations wholesale, privatize state industries en masse, slash taxes and send the European welfare state down the drain.

- Facebook Reactions and the Happiness Paradigm — Jenny Davis at the Society Pages:

These emoji express sadness and anger as a little bit silly, not too threatening, not too real. “Like” might not be the appropriate response to the passing of a loved one, but bulbous tears streaming down a banana yellow face feels downright disrespectful. Imagine posting a brow-furrowed Angry emoji in response to a friend’s personal story of sexual assault. It’s the symbolic equivalent of “that rascal!!” and woefully inadequate for anything that provokes real anger.

- Sheffield is on a quest to be the fairest city of them all – here’s how it’s doing — Rowland Atkinson and Alan Walker in the Conversation:

Led by the city council, several large employers have introduced a higher living wage based on calculations by the Living Wage Foundation, and the Sheffield Chamber of Commerce has also encouraged small and medium-sized organisations to do so. Another recommendation, on fair access to credit, resulted in the creation of Sheffield Money, to compete with the unscrupulous and usurious payday lenders. More recently, a fair employer charter was introduced, designed to ensure fair conditions of work as well as pay. Several large public and private organisations have already signed up to the charter, which focuses on promoting fair and flexible employment contracts.

- Eurozone’s So-Called Recovery Masks A Dark Secret: Mercantilism — John Weeks in Social Europe:

In the 18th century governments used direct restrictions on imports and other market interventions in an attempt to achieve permanent trade surpluses. Governments implement the 21st century version of mercantilism with different policy instruments. In the place of direct restrictions on trade we now see real wage reductions, manipulation of business taxes, and currency depreciation through loose monetary policy (so-called quantitative easing and negative interest rates). This “market friendly” version of mercantilism allows the ideologues to maintain the fiction of “free trade” while pursuing the mercantilist goal of persistent trade surpluses. This perverse inversion of rhetoric seeks to justify recovery in Europe based on beggar-thy-neighbour policies.

- Dean Rusk Also Missing, Feared Dead — for the Intercept, Barrett Brown reviews Niall Ferguson's fawning biography of Kissinger from his (Brown's) prison cell. Hilarity ensues:

[…] he noted that Kissinger had been described in disparaging terms by Hunter S. Thompson, who wrote about pretty much every major political figure in disparaging terms, and that he’d been denounced as a practicing Satanist by David Icke, who’s denounced pretty much every major political figure as a practicing Satanist; rather inexplicably, Ferguson himself even provided an incomplete list of over a dozen other prominent men and entire family dynasties against whom Icke has made this exact charge. It’s the first time I can recall having seen someone actually screw up anecdotal evidence […] Having returned from his cherry picking expedition with a basket full of rocks[…]

Saturday, 10 September 2016 - 7:47pm

Had a brilliant idea in the shower this morning. As far as I can determine, the word "critical", in an academic context is either meaningless syntactic sugar ("it can be removed from the language without any effect on what the language can do"), or a sign of kinship with that community of thinkers which has a fierce aversion to ideas (forever working "toward a theory of…", but never arriving), or a totem handed down from charlatan to charlatan which is believed to magically shield them from — ironically — criticism ("If you don't understand/agree with me, it's because you're not thinking critically!"). These are not mutually exclusive categories.

My proposal is this: when asked to do something critically, treat the word as a placeholder for the adjective most likely to incite you to complete the task at hand. For example:

- In place of "critically examine"; "urgently examine"!

- In place of "critically discuss"; "loquaciously discuss"!

- In place of "critically analyse"; "sardonically analyse"!

- In place of "critically demonstrate"; "triumphantly demonstrate"!

- In place of "critically engage"; "playfully engage"!

I hope this has been helpful, and I have not been "too critical" ("too much of a smart-arse").

Sunday, 4 September 2016 - 6:52pm

This week, I have been mostly reading:

- Bank lending, quick macro recap — Warren Mosler:

Unsold output = rising inventories = cutbacks output = reduced income = reduced sales = reduced income = reduced sales = pro cyclical downward spiral, etc. as income reductions in one sector ‘spread’ to cuts into reduced sales in the rest. And it reverses only after deficit spending- public or private- gets large enough to offset desires to ‘save’/not spend income.

- Freedom and Intellectual Life — Zena Hitz in First Things (via Eric Schliesser):

It is removal of intellectual life from the world that accounts for its true inwardness—an inwardness distinct from the narcissistic inner tracking of one's social standing. It is the withdrawn person's independence from contests over wealth or status that provides or reveals a dignity that can't be ranked or traded. This dignity, along with the universality of the objects of the intellect—that is, that they are available to everyone—is what opens up space for real communion.

- We’re All Free Riders. Get over It! — Nicholas Gruen in Evonomics:

In addition to the free rider problem, which we should solve as best we can, there’s a free rider opportunity. And while we whine about the problem, the opportunity has always been far larger and its value grows with every passing day. […] We’re not paying royalties to the estates of Matthew Bolton and James Watt for their refinements to the piston engine. But we’re still free riding on their work. In other words, free-riding made us what we are today.

- Stop this cynical attack: Corbyn, anti-semitism and the right — the Jewish Socialists' Group, reposted in Counterfire:

The attack is coming from four main sources, who share agendas: to undermine Jeremy Corbyn as leader of Labour; to defend Israeli government policy from attack, however unjust, racist and harmful towards the Palestinian people; and to discredit those who make legitimate criticisms of Israeli policy or Zionism as a political ideology. As anti-racist and anti-fascist Jews who are also campaigning for peace with justice between Israelis and Palestinians, we entirely reject these cynical agendas that are being expressed by: • The Conservative Party • Conservative-supporting media in Britain and pro-Zionist Israeli media sources • Right-wing and pro-Zionist elements claiming to speak on behalf of the Jewish community • Opponents of Jeremy Corbyn within the Labour party.

- Ed Balls — Britney Summit-Gil muses on the significance of #EdBallsDay in Cyborgology:

Something that has struck me throughout this election season is the work that Bernie Sanders supporters have done digging up old video clips and transcripts to write narratives that are lacking in major news outlets. The fact that no millennial remembers a speech Sanders made before the Senate in 1992 does not preclude their ability to find it, watch it, and use it to make a political argument. This becomes all the more important when these narratives are lacking from other vehicles of mediated memory. In other words, if mainstream news sources are failing to remember important historical moments and contexts, the affordances of digital media offer an alternative.

- Leaked 2015 Memo Told Dems: 'Don't Offer Support' For Black Lives Matter Policy Positions — Julia Craven at the HuffPo:

“Presidential candidates have struggled to respond to tactics of the Black Lives Matter movement,” reads the memo, sent by a Democratic Congressional Campaign Committee staffer in November. “While there has been little engagement with House candidates, candidates and campaign staff should be prepared. This document should not be emailed or handed to anyone outside of the building. Please only give campaign staff these best practices in meetings or over the phone.”

- The national economic implications of a taco truck on every corner — Philip Bump at the Washington Post:

"My culture is a very dominant culture, and it's imposing — and it's causing problems," Marco Gutierrez of Latinos for Trump told Joy Ann Reid. "If you don't do something about it, you're going to have taco trucks on every corner." […] If you assume that three people work in each truck, that's 9.6 million new jobs created. The labor force in August was 159.4 million, with 144.6 million employed. Adding 9.6 million taco truck workers would help America reach nearly full employment — and that's just the staffing in the trucks. Think about all of the ancillary job creation: mechanics, gas station workers, Mexican food truck management executives. We'd likely need to increase immigration levels just to meet the demand.

[Personally, I'd prefer kebabs, though I suppose for Trumpists that would be even worse.] - Billionaire Nike Co-Founder Confuses His Net Worth with U.S. Economic Growth — Jon Schwarz, the Intercept :

For the GDP to triple in size in 22 years would require an average annual growth rate of over 5 percent — but the U.S. economy didn’t grow that fast, year over year, even once from 1994 to 2016. So how has Knight latched onto this blatantly wrong factoid? Possibly because there is something that’s tripled in size in the past 20 years: Knight’s own net worth. According to Forbes, Knight’s net worth in 1996 was, adjusted for inflation, about $8 billion; today it’s $25 billion. You can understand why he’d be convinced the economy is in great shape.

- The problems with Bitcoin — Richard Murphy delivers a devastating chartalist smackdown to the techno-utopian gold standard:

A blockchain where the extraction of value (the credit transactions) is not identified but where it is said that the supply of debits is finite (as the Bitcoin algorithm must imply) has at least three important economic characteristics that pose difficulties. One is that it attempts to mirror the operations of the gold standard, which proved to be little short of an economic disaster during its period of use in the twentieth century. Secondly, because of its opacity, the system is at best inherently risky. And third, it would appear that the arrangement could, because of its opacity, be exploited. I am not saying it is: I am saying that based on my initial review I have that concern.

- The American Jewish scholar behind Labour’s ‘antisemitism’ scandal breaks his silence — Jamie Stern-Weiner interviews Norm Finklestein on openDemocracy:

Compare the American scene. Our Corbyn is Bernie Sanders. In all the primaries in the US, Bernie has been sweeping the Arab and Muslim vote. It’s been a wondrous moment: the first Jewish presidential candidate in American history has forged a principled alliance with Arabs and Muslims. Meanwhile, what are the Blairite-Israel lobby creeps up to in the UK? They’re fanning the embers of hate and creating new discord between Jews and Muslims by going after Naz Shah, a Muslim woman who has attained public office. […] It’s time to put a stop to this periodic charade, because it ends up besmirching the victims of the Nazi holocaust, diverting from the real suffering of the Palestinian people, and poisoning relations between the Jewish and Muslim communities.

Sunday, 28 August 2016 - 8:11pm

This week, I have been mostly reading:

- Ramen is displacing tobacco as most popular US prison currency, study finds — Mazin Sidahmed, in the Guardian Holy cow; the one place where you can find a genuine commodity currency. But how do they buy noodles? With noodles?:

Ramen noodles are overtaking tobacco as the most popular currency in US prisons, according a new study released on Monday. A new report by Michael Gibson-Light, a doctoral candidate in the University of Arizona’s school of sociology, found the decline in quality and quantity of food available in prisons due to cost-cutting has made ramen noodles a valuable commodity.

- Caitlyn Jenner and Our Cognitive Dissonance — Robert Sapolsky in Nautilus:

Then there’s spotted hyenas, gender-bending pseudo-hermaphrodites. It’s nearly impossible to determine the sex of a hyena by just looking, as females are big and muscular (due to higher levels than males of some androgenic hormones), have fake scrotal sacs, and enlarged clitorises that can become as erect as the male’s penis. None of which was covered in The Lion King.

- Ideas for Australia: Welfare reform needs to be about improving well-being, not punishing the poor — Peter Whiteford in the Conversation:

The OECD report suggests the job-search requirements in Australia are more onerous than those in the other countries studied. In 2007, a jobseeker in Australia could be required to report between eight and 20 job-search activities each month, compared to four to ten each month in Switzerland, ten in the UK and only two in Japan. The OECD also notes that since 2000 there have been “vast swings” in sanction rates (penalties for non-compliance), with sanctions ranging in this period from 25,000 a year to 300,000.

- When Bitcoin Grows Up: What is Money? — John Lanchester in the London Review of Books:

Yap has no metal. There’s nothing to make into coins. What the Yapese do instead is sail 250 miles to an island called Palau, where there’s a particular kind of limestone not available on their home island. They quarry the limestone, and then shape it into circular wheel-like forms with a hole in the middle, called fei. Some of these fei stones are absolutely huge, fully 12 feet across. Then they sail the fei back to Yap, where they’re used as money. […] It has sometimes happened to the Yapese that their boats are hit by stormy weather on the way back from Palau, and to save their own lives, the men have to chuck the big stones overboard. But when they get back to Palau they report what happened, and everyone accepts it, and the ownership of the stone is assigned to whoever quarried it, and the stone can still be used as a valid form of money because ownership can be exchanged even though the actual stone is five miles down at the bottom of the Pacific.

- The era of predatory bureaucratization – An interview with David Graeber — Arthur De Grave in OuiShare:

Many expected Occupy to take a formal political form. True, it did not happen, but look at where we are 3.5 years later: in most countries where substantial popular movements happened, left parties are now switching to embrace these movements’ sensibilities (Greece, Spain, United States, etc.). Maybe it will take another 3.5 years for them to have an actual impact on policy making, but it seems to me like the natural path of things. […] Right now, the most important thing for anti-authoritarian and horizontal movements is to learn how to enter an alliance with those who are willing to work within the political system without compromising their own integrity.

- Fix our debt addiction to fix our economy — Michael Hudson:

As the “One Percent” of banks puts the “99 Percent” deeper into debt, financialization has become the major cause of increasing inequality of wealth and income. In due course, the amount of debt will exceed the economy’s ability to produce a large enough surplus to pay it back. This makes a financial breakdown inevitable.

- Krugman discovers the obvious — Alexander X. Douglas:

Here it is. There is no operational difference between: (a) the state spending, selling bonds to ‘fund’ its spending, and then buying back the bonds, and (b) the state spending and not issuing the bonds in the first place. This is a point economists outside the mainstream have been making for years […] It’s obvious when you think about it. Suppose I give you $100. Then I ‘borrow’ back the $100. Then I buy back the debt from you, for $100. Or suppose I just give you the $100.

- Branko Milanovic advocates reinventing apartheid — Chris Bertram at Crooked Timber:

Part of what’s going on here is the economist’s perspective on policy, which just focuses on net improvements in well-being or utility, with income serving as a proxy, and which doesn’t, therefore, see human beings as possessed of basic rights which it is impermissible to violate. Rather, all and any rights can be sacrificed on the altar of income improvement, just in case someone is poor and desperate enough to make a deal (who are we, paternalistically, to stop them?). The road to hell is paved with Pareto improvements.

- You May Hate Donald Trump. But Do You Want Facebook to Rig the Election Against Him? — Trevor Timm at the Guardian at Common Dreams:

As Gizmodo reported on Friday, “Last month, some Facebook employees used a company poll to ask [Facebook founder Mark] Zuckerberg whether the company should try ‘to help prevent President Trump in 2017’.” Facebook employees are probably just expressing the fear that millions of Americans have of the Republican demagogue. But while there’s no evidence that the company plans on taking anti-Trump action, the extraordinary ability that the social network has to manipulate millions of people with just a tweak to its algorithm is a serious cause for concern.

Monday, 15 August 2016 - 10:48pm

I submitted an essay on the due date. That almost never happens. As I was doing so, I saw this announcement on Blackboard:

Given the amount of requests for extensions […] I have extended the due date for assignment one by one week for everyone.

My rant took the following form:

Posted 5pm on the day it's due. Seriously? I've another essay due this week that could have benefited from the extra time had I known I could set this one aside for a bit.

It's nine thirty and I've just submitted the butchered abomination that fits within the word limit, rather than the essay I would have liked to submit. Word limits aren't about the discipline of writing to a limit; they're about limiting the time that it takes to mark essays, or rather the cost of paying someone to do it. Marking criteria aren't about transparency or equity; they're about turning academic staff into interchangeable box-ticking robots with no latitude for exercising professional judgement.

Call it "emancipatory teaching and learning" or "flexible converged delivery", the take-all-comers "demand-driven system" of higher education in Australia ultimately boils down to underpaid casual staff unable to take the time to properly deliver what is in any case a curriculum dumbed down for the benefit of students who can't read or write (because the income for every enrolment is the same) and don't know why they're at university, or that they're not really at a university but at a sleazy commercial vocational college whose business model is exploiting gullible youth.

At this point I'm just going through the motions because my friends and family insist that although they know and I know I'm not deriving anything of value from "the student experience", more people than I would expect take an Australian university degree very seriously. Why I should want to impress idiots in the first place is left unexplained.

I have every sympathy with students who struggle. I am one. I've almost never submitted an essay on time. I have to do the mental arithmetic to work out the gross mark I was awarded from the net mark after late penalties. (A pointless exercise anyway because "Did I meet the marking criteria?" is a completely different question to "Is this good work?") The problem with a semi-marketised system of higher education is that when a large proportion of students regularly receive low marks, or have difficulty submitting work on time, nobody asks "What is it about these students, or the conditions of their lives, that is generating this outcome? And what can we do about it?" The commercial imperatives force the question "How can we keep them enrolled, at whatever cost to the integrity of the system?"

Sunday, 14 August 2016 - 4:36pm

This week, I have been mostly writing essays and cursing the Australian higher education system. I also thought this was delightful:

- Donald Trump is like a biased machine learning algorithm — Cathy "mathbabe" O'Neil:

What that translates to is a constant iterative process whereby he experiments with pushing the conversation this way or that, and he sees how the crowd responds. If they like it, he goes there. If they don’t respond, he never goes there again, because he doesn’t want to be boring. If they respond by getting agitated, that’s a lot better than being bored. That’s how he learns.

Sunday, 7 August 2016 - 8:05pm

This week, I have been mostly reading:

- Olivier Blanchard Is Worried About Inflation In Japan — Dean Baker, master of the political economy punchline, at CEPR (US):

Debt is just one way in which governments obligate their public to future payments. Patent and copyright monopolies commit the public to paying rents that greatly exceed the free market price for the protected products. In the United States these payments are approaching 2.0 percent of GDP ($360 billion a year) for prescription drugs alone. It is remarkable that public finance economists seem to almost completely ignore rents for patents and copyrights when considering the financial burdens of various governments.

- Young Iraqis Overwhelmingly Consider U.S. Their Enemy, Poll Says — Murtaza Hussain at the Intercept:

“For years, many have argued that Muslims and Arabs, like other humans, don’t appreciate being bombed or occupied,” says Haroon Moghul, a fellow at the Institute for Social Policy and Understanding. “Finally, we have a study to confirm this suspicion.” - What’s so Bad about the Gold Standard? — David Glasner:

The gold standard did play a major role in spreading the Depression. But the role was not just major; it was dominant. And the role of the gold standard in the Great Depression was not just to spread it; the role was, as Hawtrey and Cassel warned a decade before it happened, to cause it. The causal mechanism was that in restoring the gold standard, the various central banks linking their currencies to gold would increase their demands for gold reserves so substantially that the value of gold would rise back to its value before World War I, which was about double what it was after the war. […] The Great Depression was caused by a 50% increase in the value of gold that was the direct result of the restoration of the gold standard. […] the problem with gold is, first of all, that it does not guarantee that value of gold will be stable. The problem is exacerbated when central banks hold substantial gold reserves, which means that significant changes in the demand of central banks for gold reserves can have dramatic repercussions on the value of gold. Far from being a guarantee of price stability, the gold standard can be the source of price-level instability, depending on the policies adopted by individual central banks.

- Did Capitalism Fail? Looking Back Five Years After Lehman — Roman Frydman and Michael Goldberg at INET. As the title suggests, an oldie but a goody:

Market instability is thus integral to how capitalist economies allocate their savings. Given this, policymakers should intervene not because they have superior knowledge about asset values (in fact, no one does), but because profit-seeking market participants do not internalize the huge social costs associated with excessive upswings and downswings in prices. It is such excessive fluctuations, not deviations from some fanciful “true” value – whether of assets or of the unemployment rate – that Keynes believed policymakers should seek to mitigate. Unlike their successors, Keynes and Hayek understood that imperfect knowledge and non-routine change mean that policy rules, together with the variables underlying them, gain and lose relevance at times that no one can anticipate.

- The Market Fairy Will Not Solve the Problems of Uber and Lyft — Ian Welsh nails it:

These business models are ways of draining capital from the economy and putting them into the hands of a few investors and executives. They prey on desperate people who need money now, even if the money is insufficient to pay their total costs. Drivers are draining their own reserves to get cash now, but, hey, they gotta eat and pay the bills.

The model generalises to any low-paid insecure work. You can't afford to say no to even the worst job. I did it for nearly ten years, working harder than I'd ever worked in my life, and am now massively in debt, for the first time in my life. - The Zombie Doctrine — George Monbiot delivers some sublime ranting:

It’s as if the people of the Soviet Union had never heard of communism. The ideology that dominates our lives has, for most of us, no name. Mention it in conversation and you’ll be rewarded with a shrug. Even if your listeners have heard the term before, they will struggle to define it. Neoliberalism: do you know what it is?

- Who do faculty “work for?” — Historiann:

There’s nothing like stupid from the central administration to bring a faculty together. I told my colleagues that I have a rule when it comes to any technology or software: it works for me, I don’t work for it. End of story.

- A British Bridge for a Divided Europe — Robert Skidelsky:

The eurozone has weakened the nation-states comprising it, without creating a supranational state to replace the powers its members have lost. Legitimacy thus still resides at a level of political authority that has lost those attributes of sovereignty (such as the ability to alter exchange rates) from which legitimacy derives. […] The EU has tried to achieve political union incrementally, because it was impossible to start with it. Indeed, barely hidden in the “European project” was the expectation that successive crises would push political integration forward. This was certainly Jean Monnet’s hope. The alternative – that the crises would have the opposite effect, leading to the breakup of the economic and monetary union – was never seriously confronted.

- Patently Absurd Logic On Budget Deficits and Debt — Dean Baker at the Huffington Post:

As much as folks may love the private sector, it was not going to make up the demand lost when the housing bubble crashed, or at least not any time soon. If we wanted to prevent a long and severe downturn like the Great Depression, it was necessary for the government to run large deficits. These deficits were not impoverishing our kids - they were keeping their parents employed. […] The fact that the deficit hawks can scream endlessly about the horrible interest burden on our children, but don’t even seem to notice the costs being imposed by patent and copyright monopolies, suggests that they are not really concerned about our children’s well-being. Alternatively, they may have a very poor understanding of economics. Either way, their whining does not deserve the public’s attention.

- Where Hope Goes to Die — Ted Rall:

Sunday, 31 July 2016 - 5:49pm

This week, I have been mostly reading:

- Was the Financial Crisis Anticipated? — Ozlem Akin, José M Marín, and José-Luis Peydró at INET, on their CEPR (UK) working paper:

The paper finds that the top executives’ ex-ante sale of their own bank shares predicts worse bank returns during the crisis; interestingly, effects are insignificant for independent directors’ and other officers’ sales of shares. That is, effects are substantially stronger for the insiders with the highest and best level of information, the top five executives. Moreover, the top five executives’ impact is stronger for banks with higher ex-ante exposure to the real estate bubble, where an increase of one standard deviation of insider sales is associated with a 13.33 percentage point drop in stock returns during the crisis period. Our results suggest that insiders understood the heavy risk-taking in their banks; they were not simply over-optimistic, and hence they sold more of their own shares before the crisis.

- I’m With The Banned — Laurie Penny goes gonzo for Medium:

My new Spectator friend is as bewildered as I am by the way Americans take Milo and his ilk seriously, by their willingness to take pride in performative bigotry and call it strength. It works. It sells. It’s the unholy marriage of that soulless debate culture that works so well in Britain, transplanted to a nation with no social safety net and half a billion guns. It works, in part, because of the essentially cult-like nature of U.S. culture and the structured ignorance that accompanies it. America is a nation eaten by its own myth. The entire idea of America is about believing impossible things. Nobody said those things had to be benign.

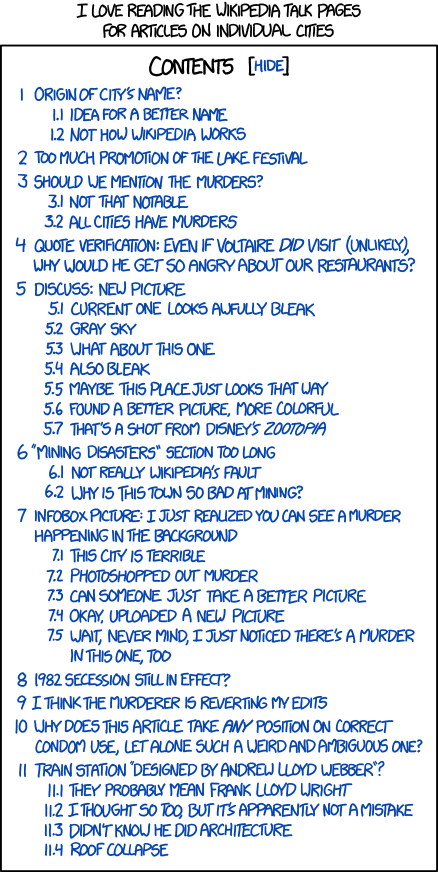

- City Talk Pages — xkcd:

- Dana Milbank Tells Readers He Has an Incredibly Weak Imagination — Dean Baker, CEPR (US):

What is perhaps most incredible is Milbank's notion of irresponsible. His sole measure of responsibility is the size of the government budget deficit and debt, which are for all practical purposes meaningless numbers. (If the government puts in place patent protection that requires us to pay an extra $400 billion a year for prescription drugs, this adds zero to the budget deficit or debt and therefore doesn't concern Milbank. However, if it borrowed an extra $400 billion a year to pay for developing new drugs, he would be furious.)

- Now we’ve voted for Brexit, great British businesses like Southern rail, Byron burger, Lloyds bank and Sports Direct are finally set free — Mark Steel, whose voice you hear in your head as you're reading, in the Independent:

[T]he marvellous thing about privatisation is it introduces choice, so if customers trying to get from East Grinstead to London aren’t happy with their rail service, they can choose to use a different rail network, such as the one from Glasgow to Fort William, or the Trans-Siberian Express.

- Record Lows — Saturday Morning Breakfast Cereal:

- Embarrassment for Christine Lagarde and IMF as Fund's own watchdog slams its eurozone record — Ben Chu at the Independent:

The IEO concluded the IMF had “lost its characteristic agility as a crisis manager” in the way it responded to the economic turmoil in the eurozone, which required unprecedented bailouts for several states shut out of the capital markets and looked like it was going to tear the single currency zone apart.

[I don't know. They turned a disaster into an apocalypse in record time. If that's not "characteristic agility" I don't know what is.] - Our attitude towards wealth played a crucial role in Brexit. We need a rethink — Stephen hawking in the Guardian:

One of the reasons I believed it would be wrong to leave the EU was related to grants. British science needs all the money it can get, and one important source of such funding has for many years been the European commission. Without these grants, much important work would not and could not have happened. […] Money is also important because it is liberating for individuals. I have spoken in the past about my concern that government spending cuts in the UK will diminish support for disabled students, support that helped me during my career. In my case, of course, money has helped not only make my career possible but has also literally kept me alive.

- How to be a writer — The Oatmeal:

- “Liberal” Economists Cheered the New Democrats’ Deregulation of Finance — Bill Black at NEP:

Bill Clinton and Al Gore were two of the most powerful leaders of the “New Democrats” – a group of Democrats determined to move the party strongly to the right on economics, budget, national security, regulation, and crime. The New Democrats’ policy apparatus was funded overwhelmingly by Wall Street but its ideological support came from economists who were “liberal” on some social issues. The Clintons and Gore delivered for Wall Street by embracing the three “de’s” – deregulation, desupervision, and de facto decriminalization that encouraged and allowed twin bubble to rapidly expand. The “dot com” bubble was the first bubble to burst. The housing bubble burst in late 2006, leading to the financial crises of 2008 and the Great Recession that began in 2007.

Sunday, 24 July 2016 - 1:57pm

This week, I have been mostly… I don't know what I've been doing. Meanwhile, this happened in my sharply curtailed idle reading:

- Economic Rationality Explains Everything and Nothing — Geoffrey Hodgson, Evonomics:

Utility maximization can be useful as a heuristic modelling device. But strictly it does not explain any behavior. It does not identify specific causes. It cannot explain any particular behavior because it is consistent with any observable behavior. Its apparent universal power signals weakness, not strength.

- Everyone But the Media Saw Trumpism Coming — Ted Rall:

“We were largely oblivious to the pain among working-class Americans and thus didn’t appreciate how much his message resonated,” [New York Times journalist Nicholas] Kristof wrote. Most Americans are working-class. In other words, Kristof and his colleagues admit they don’t cover the problems that affect most Americans. Again: why does he still have a job?

- Is an Aussie debt crisis around the corner? — Leith van Onselen, Macro Business:

Admittedly, the real concern is that 40% of all mortgages are interest-only mortgages, which are more vulnerable […] Whether or not Australia is likely to experience some kind of financial crisis within the next three years is a moot point. But having one of the world’s most overvalued housing markets, combined with overly indebted households and an extreme reliance on offshore funding, is hardly a good situation to be in and the opposite of prudence.

And… - The seven countries most vulnerable to a debt crisis — Steve Keen, Real World Economics Review Blog:

They are, in order of likely severity: China, Australia, Sweden, Hong Kong (though it might deserve first billing), Korea, Canada, and Norway. […] Timing precisely when these countries will have their recessions is not possible, because it depends on when the private sector’s willingness to borrow from the banks—and the banking sector’s willingness to lend—stops. This can be delayed by government policy—as it was in Australia in 2008, via a strong government stimulus, the restarting of the housing bubble by a government grant to first home buyers, and the boom in investment and exports set off by China’s own stimulus program. But the day when credit growth stops can’t be put off indefinitely. When it arrives, these countries—many of which appeared to avoid the worst of the crisis in 2008—will join the world’s long list of walking wounded economies.

- Are We Facing a Global “Lost Decade?" — Steve Keen, for the Private Debt Project [tl;dr: Yes.]:

The tragedy is that although there are methods by which we could escape the global private debt trap into which we have fallen we are nonetheless prisoners of an economic orthodoxy that will prevent us from employing them... The main barrier here is simply the ignorance of the supposed experts on economics about the nature of money. While mainstream economists continue to spout naïve arguments about money and banking, the politicians who rely upon them for guidance are unlikely to attempt anything other than the poorly targeted and largely ineffective policies that Japan has persisted with for the last quarter century. A global “Lost Decade” is entirely probable.

New New Labour Surging in Face of Chaos, Cardigans

Jeremy Corbyn's leadership looked shakier than ever today, after it was revealed that his challenger boldly intended to make appearances in public prior to the interminable upcoming leadership election. "After nearly a year of dismal failure, Labour is ready for a return to it's roots," a spokesman for rising nonentity Owen Smith said. "Labour voters are uncomfortable with ideas, values, and character. What they are crying out for is a leader with a nice new haircut, sensible, focus-group-tested spectacle frames, and very, very sharp trouser creases."

Smith is rapidly winning support among the Parliamentary Labour Party. A source close to Tom Watson in a Stone Roses t-shirt said "The marvellous thing about Owen is, the moment he enters the room, you get this tremendous feeling that something's missing but you can't quite put your finger on it. Then, as soon as he leaves, you forget he was ever there. God, I miss Milliband."

However other Labour MPs are nonplussed. "I don't see any reason for a leadership election at all, frankly," says Jamie Reed. "I think Theresa May is the best leader we've had since Tony. Her pro-armageddon stance speaks to the values our party has stood for since it was founded twenty years ago. Anybody willing to get up every morning and goad the four horsemen of the apocalypse the way she does deserves our continued support."