Sunday, 17 March 2019 - 1:51pm

This week, I have been mostly reading:

- Top Nancy Pelosi Aide Privately Tells Insurance Executives Not to Worry About Democrats Pushing “Medicare for All” — Ryan Grim in the Intercept:

Less than a month after Democrats — many of them running on “Medicare for All” — won back control of the House of Representatives in November, the top health policy aide to then-prospective House Speaker Nancy Pelosi met with Blue Cross Blue Shield executives and assured them that party leadership had strong reservations about single-payer health care and was more focused on lowering drug prices, according to sources familiar with the meeting. Pelosi adviser Wendell Primus detailed five objections to Medicare for All and said that Democrats would be allies to the insurance industry in the fight against single-payer health care.

- You Should Never Have Trusted Flickr to Protect Your Cherished Photos — April Glaser at Slate:

While no one can question the convenience of pulling up an old photo on demand, Flickr’s ultimatum—pay up or go—serves as a useful reminder that the free platforms we’ve entrusted to save our memories aren’t made for us. They’re made for the people who profit off our usage. These platforms can be sold. They can erase what we’ve saved. They can charge us later for access to our own photos, or to store more of them. They can change their terms of service and hand all of our precious memories to the police, use facial recognition to map our relationships, or use the photos for ads—as Instagram opened up its terms of service to be able to do in 2012, ditto Yahoo in 2014. Yahoo actually sold users’ Creative Commons–licensed photos as wall art without giving the photographers any of the profits.

- In Venezuela, White Supremacy is a Key to Trump’s Coup — Greg Palast:

In my interviews with Chavez for BBC beginning in 2002, he talked with humor about the fury of a white ruling class finding itself displaced by dark-skinned man who was so visibly “Negro e Indio,” a label he wore loudly and proudly. Why did the poor love Chavez? (And love is not too strong a word.) As even the US CIA’s surprisingly honest Fact Book states: “Social investment in Venezuela during the Chavez administration reduced poverty from nearly 50% in 1999 to about 27% in 2011, increased school enrollment, substantially decreased infant and child mortality, and improved access to potable water and sanitation through social investment.”

- Venezuela as the pivot for New Internationalism? — an interview with Michael Hudson:

By imposing sanctions that prevent Venezuela from gaining access to its U.S. bank deposits and the assets of its state-owned Citco, the United States is making it impossible for Venezuela to pay its foreign debt. This is forcing it into default, which U.S. diplomats hope to use as an excuse to foreclose on Venezuela’s oil resources and seize its foreign assets much as Paul Singer’s hedge fund sought to do with Argentina’s foreign assets. Just as U.S. policy under Kissinger was to make Chile’s “economy scream,” so the U.S. is following the same path against Venezuela. It is using that country as a “demonstration effect” to warn other countries not to act in their self-interest in any way that prevents their economic surplus from being siphoned off by U.S. investors.

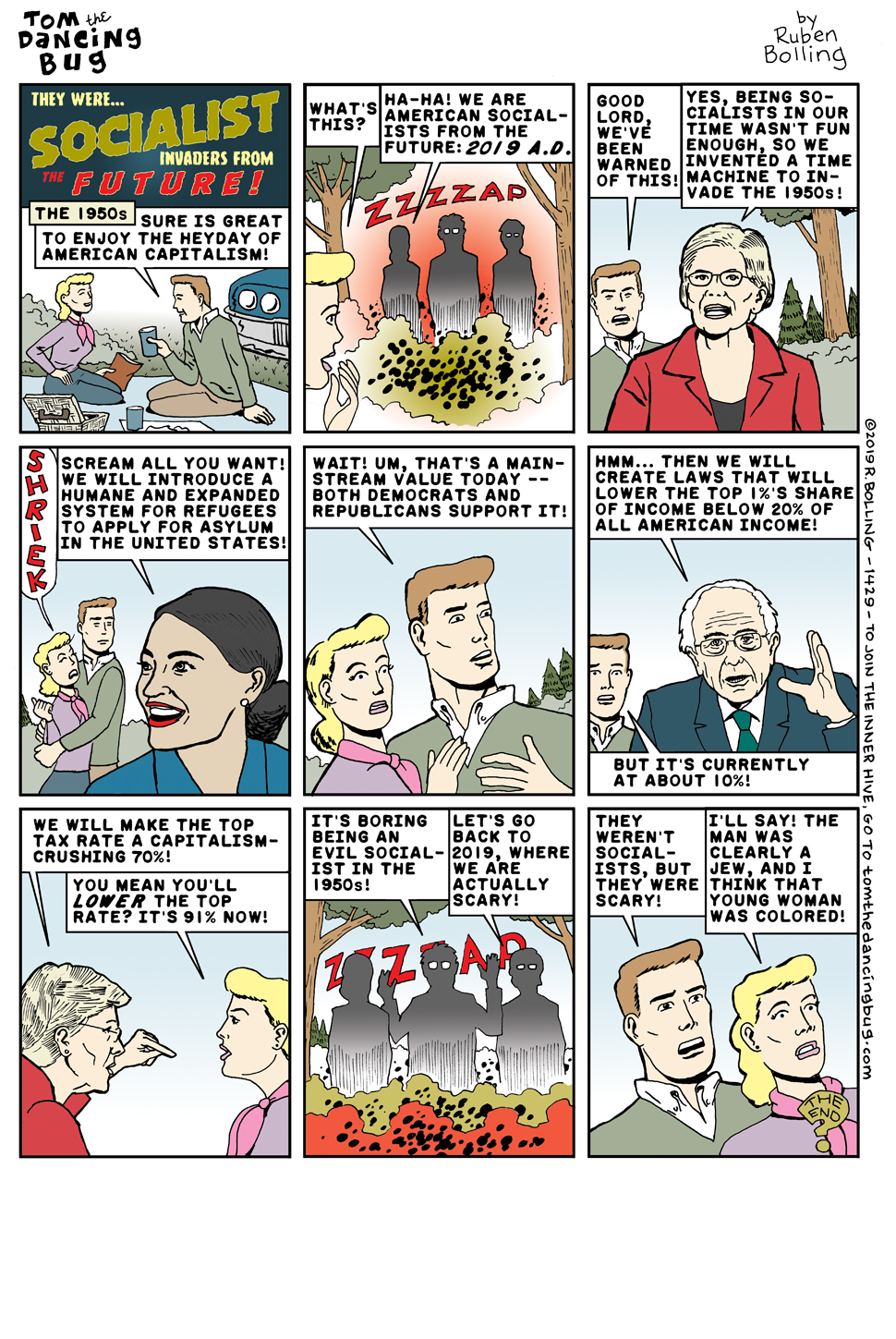

- They were... Socialist Invaders from the Future! — Tom the Dancing Bug by Ruben Bolling:

- Bernie 2020 Campaign Has Corporate Democrats Running Scared — Norman Solomon:

With a launch of the Bernie Sanders 2020 campaign on the near horizon, efforts to block his trajectory to the Democratic presidential nomination are intensifying. The lines of attack are already aggressive -- and often contradictory. One media meme says that Bernie has made so much headway in moving the Democratic Party leftward that he’s no longer anything special. We’re supposed to believe that candidates who’ve adjusted their sails to the latest political wind are just as good as the candidate who generated the wind in the first place.

- Bernie’s Likely 2020 Bid Could Transform the Political Landscape — Norman Solomon again, this time in Truthout:

We are now at a decisive fork in the road that Justice Louis Brandeis identified long ago: “We must make our choice. We may have democracy, or we may have wealth concentrated in the hands of a few, but we can’t have both.” The two hands with the most wealth concentrated in them now belong to Amazon owner Jeff Bezos. Not coincidentally, his newspaper, The Washington Post, has been among the influential media outlets most antagonistic toward Sanders. In early March 2016, at a pivotal moment during the primary campaign, FAIR analyst Adam Johnson pointed out that The Post “ran 16 negative stories on Bernie Sanders in 16 hours … a window that includes the crucial Democratic debate in Flint, Michigan, and the next morning’s spin.” The day after that onslaught ended, Sanders stunned the elite media by winning the Michigan primary.

- Why the Differences Between Sanders and Warren Matter — Zaid Jilani in Jacobin:

Since her departure from the Republican Party, Warren has busied herself promoting a “level playing field” and a fairer system for workers and consumers. Her ideals, while not out of step with those of a mid-century liberal Republican, would represent a marked shift away from the economic status quo if implemented. […] Yet Sanders has always existed outside the traditional party system. He has more in common with non-American socialists like Evo Morales and Jeremy Corbyn than party figures like John Kennedy, to whom Warren has subtly linked herself. He would be the most progressive president the United States has ever seen. The two senators also have distinct theories of change. Sanders has long believed in bottom-up, movement-based politics. Since his days as mayor of Burlington, Vermont, he has tried to energize citizens to take part in government. He generally distrusts elites and decision-making that does not include the public. Warren, on the other hand, generally accepts political reality and works to push elite decision-makers towards her point of view.

- Pro-Israel Lobby Caught on Tape Boasting That Its Money Influences Washington — Ryan Grim in the Intercept:

David Ochs, founder of HaLev, which helps send young people to American Israel Public Affairs Committee’s annual conference, described for the reporter how AIPAC and its donors organize fundraisers outside the official umbrella of the organization, so that the money doesn’t show up on disclosures as coming specifically from AIPAC. He describes one group that organizes fundraisers in both Washington and New York. “This is the biggest ad hoc political group, definitely the wealthiest, in D.C.,” Ochs says, adding that it has no official name, but is clearly tied to AIPAC. “It’s the AIPAC group. It makes a difference; it really, really does. It’s the best bang for your buck, and the networking is phenomenal.” […] Without spending money, Ochs argues, the pro-Israel lobby isn’t able to enact its agenda. “Congressmen and senators don’t do anything unless you pressure them. They kick the can down the road, unless you pressure them, and the only way to do that is with money,” he explains.

And, for context: - There Is a Taboo Against Criticizing AIPAC — and Ilhan Omar Just Destroyed It — Mehdi Hasan:

In 2005, Steven Rosen, then a senior official with the American Israel Public Affairs Committee, or AIPAC, sat down for dinner with journalist Jeffrey Goldberg, then of the New Yorker. “You see this napkin?” Rosen asked Goldberg. “In twenty-four hours, [AIPAC] could have the signatures of seventy senators on this napkin.” I couldn’t help but be reminded of this anecdote after Rep. Ilhan Omar, of Minnesota’s 5th Congressional District, was slammed by Democrats and Republicans alike over her suggestion, in a pair of tweets, that U.S. politicians back the state of Israel because of financial pressure from AIPAC (“It’s all about the Benjamins baby,” she declaimed). Was the flippant way in which she phrased her tweets a problem? Did it offend a significant chunk of liberal U.S. Jewish opinion? Did it perhaps unwittingly play into anti-Semitic tropes about rich Jews controlling the world? Yes, yes, and yes — as she herself has since admitted and “unequivocally” apologized for. But was she wrong to note the power of the pro-Israel lobby, to point a finger at AIPAC, to highlight — in her apology — “the problematic role of lobbyists in our politics, whether it be AIPAC, the NRA or the fossil fuel industry”? No, no, and no.

- Maybe We’ll Invade Another Oil-Rich Politically Dysfunctional Sort of Socialist Country. What Could Go Wrong? — Ted Rall:

Sunday, 10 March 2019 - 5:45pm

This week, I have been mostly reading:

- Terra Nullius — Cory Doctorow in Locus Online:

The labor theory of property always begins with an act of erasure: “All the people who created, used, and improved this thing before me were doing something banal and unimportant – but my contribution is the step that moved this thing from a useless, unregarded commons to a special, proprietary, finished good.” Criticism of this delusion of personal exceptionalism is buttressed by a kind of affronted perplexity: “Can’t you see how much of my really top-notch labor I have blended with this natural resource to improve it? Who will willingly give their own labor to future projects if, every time they do, loafers and takers come and freeride on their new property?”

- A Clinton-era centrist Democrat explains why it’s time to give democratic socialists a chance — Zack Beauchamp interviews self-identified "Rubin Democrat" Brad Delong in Vox:

[Brad] DeLong believes that the time of people like him running the Democratic Party has passed. “The baton rightly passes to our colleagues on our left,” DeLong wrote. “We are still here, but it is not our time to lead.” […] The core reason, DeLong argues, is political. The policies he supports depend on a responsible center-right partner to succeed. They’re premised on the understanding that at least a faction of the Republican Party would be willing to support market-friendly ideas like Obamacare or a cap-and-trade system for climate change. This is no longer the case, if it ever were. “Barack Obama rolls into office with Mitt Romney’s health care policy, with John McCain’s climate policy, with Bill Clinton’s tax policy, and George H.W. Bush’s foreign policy,” DeLong notes. “And did George H.W. Bush, did Mitt Romney, did John McCain say a single good word about anything Barack Obama ever did over the course of eight solid years? No, they fucking did not.”

- Trump’s Brilliant Strategy to Dismember U.S. Dollar Hegemony — Michael Hudson:

The end of America’s unchallenged global economic dominance has arrived sooner than expected, thanks to the very same Neocons who gave the world the Iraq, Syria and the dirty wars in Latin America. Just as the Vietnam War drove the United States off gold by 1971, its sponsorship and funding of violent regime change wars against Venezuela and Syria – and threatening other countries with sanctions if they do not join this crusade – is now driving European and other nations to create their alternative financial institutions. This break has been building for quite some time, and was bound to occur. But who would have thought that Donald Trump would become the catalytic agent? No left-wing party, no socialist, anarchist or foreign nationalist leader anywhere in the world could have achieved what he is doing to break up the American Empire. The Deep State is reacting with shock at how this right-wing real estate grifter has been able to drive other countries to defend themselves by dismantling the U.S.-centered world order. To rub it in, he is using Bush and Reagan-era Neocon arsonists, John Bolton and now Elliott Abrams, to fan the flames in Venezuela. It is almost like a black political comedy. The world of international diplomacy is being turned inside-out. A world where there is no longer even a pretense that we might adhere to international norms, let alone laws or treaties.

- Why the left and Labour really do need to adopt the core ideas of modern monetary theory — Richard Murphy:

I read Jonathan Portes’ attack on modern monetary theory in Prospect with some bemusement. Firstly that is because many in the UK modern monetary theory community will be quite surprised to know that I am, as Portes suggests, its main proponent. I have in fact for some time been quite critical of some of its leading exponents. Second, I was surprised that if Portes did not understand any of my comments, as he suggested, that he had not get in touch to check them. I am not hard to find. And third, the article did in fact seem rather more a defence of Jonathan Portes than it was an attack on MMT. But nonetheless, I would like to set the record straight.

- How Fox News Pushes Trump to Make Every Bad Decision — Matthew Gertz at the Daily Beast:

President Donald Trump’s announcement last Friday that he would end the longest partial government shutdown in U.S. history without securing funding from congressional Democrats for his long-promised border wall came after weeks of brutal headlines and sagging poll numbers. But when Trump arose the following morning, he did not devote his time to convening his White House advisers to figure out what went wrong or reaching out to Republican congressional leaders to plot their next move. Instead, he did the same thing he’s done on countless days of his administration: He turned on his television, tuned in to his favorite program, Fox & Friends, and started tweeting about what he saw.

Sunday, 3 March 2019 - 9:30pm

This fortnight, I have been mostly reading:

- Stop saying, ‘We take your privacy and security seriously’ — Zach Whittaker at TechCrunch:

In my years covering cybersecurity, there’s one variation of the same lie that floats above the rest. “We take your privacy and security seriously.” You might have heard the phrase here and there. It’s a common trope used by companies in the wake of a data breach — either in a “mea culpa” email to their customers or a statement on their website to tell you that they care about your data, even though in the next sentence they all too often admit to misusing or losing it. The truth is, most companies don’t care about the privacy or security of your data. They care about having to explain to their customers that their data was stolen.

- Progressive Democrats Like Elizabeth Warren Want a Higher Minimum Wage That Is Way Too Low — Ted Rall:

- Why a market model is destroying the safeguards of the professions — Lisa Herzog in Aeon:

In the grip of nostalgia, it’s easy to overlook the dark sides of this old vocational model. On top of the fact that professional jobs were structured around hierarchies of gender and race, laypeople were expected to obey expert judgment without even asking questions. Deference to authority was the norm, and there were few ways of holding professionals to account. […] Against this backdrop, the call for more autonomy, for more ‘choice’, seems hard to resist. This is precisely what happened with the rise of neoliberalism after the 1970s, when the advocates of ‘New Public Management’ promoted the idea that hard-nosed market thinking should be used to structure healthcare, education and other areas that typically belonged to the slow and complicated world of public red tape. In this way, neoliberalism undermined not only public institutions but the very idea of professionalism.

- Democrats Are Afraid Of Alexandria Ocasio-Cortez Too. And That’s A Good Thing. — Norman Solomon:

In the last few days, both Politico and the New York Times have reported that freshman Democratic Rep. Alexandria Ocasio-Cortez has ruffled the feathers of fellow congressional Democrats. Chief among the reasons for the tension? Ocasio-Cortez’s apparent support for progressive primary challenges against centrist Democrats. It’s one of the most significant ideas the young New York congresswoman has brought with her to Washington. That’s because turning the Democratic Party into a truly progressive force will require turning “primary” into a verb. The corporate Democrats who dominate the party’s power structure in Congress should fear losing their seats because they’re out of step with constituents. And Democratic voters should understand that if they want to change the party, the only path to do so is to change the people who represent them. Otherwise, the leverage of Wall Street and the military-industrial complex will continue to hold sway.

- Bernie Sanders could be US president in 2020 – and this is what it means for Israel and the Middle East — Robert Fisk in the Independent:

Take a look through his Israel/Palestine CV, and Sanders is clearly neither an aggressive Zionist nor a liberal patsy. He’s a New Deal Democrat, which is how many would judge him. Younger, leftist voters might consider him as a kind of upwardly mobile intellectual, a Chomsky on wheels – even though the great (Jewish) philosopher, activist and linguist said before the last presidential election that he’d vote for Clinton as a frontrunner rather than Sanders in swing states in a final vote to keep Trump out. Much good did that do him. But let’s remember a few more things about Sanders. He’s always supported the “right of Israel to exist” and its right to self-defence, and he’s always condemned Palestinian attacks on Israelis. But he’s also kept away from pro-Israeli Jewish lobby groups such as the American Israel Public Affairs Committee (AIPAC) and he didn’t restrain himself when he chose to condemn Israel for its illegal colonial project of building homes for Jews and Jews only in the occupied West Bank, nor when Israel has blatantly interfered in US domestic or electoral politics.

- Many Voters Think Trump’s a Self-Made Man. What Happens When You Tell Them Otherwise? — Jared McDonald, David Karol, and Lilliana Mason:

The narrative of Trump as self-made is simply false. Throughout his life, the president has downplayed the role his father, real estate developer Fred Trump, played in his success, claiming it was “limited to a small loan of $1 million.” That isn’t true, of course: A comprehensive New York Times investigation last year estimated that over the course of his lifetime, the younger Trump received more than $413 million in today’s dollars from his father. While this exact figure was not known before the Times’ report, it was a matter of record that by the mid-1980s, Trump had been loaned at least $14 million by his father, was loaned at least $3.5 million more in 1990, had borrowed several more million against his inheritance in the 1990s after many of his ventures failed, and had benefited enormously from his father’s political connections and co-signing on loans early in his career as a builder. Of course, someone born into wealth may have great business acumen, and the question of whether Trump is “a great businessman” is a subjective evaluation. The focus of our work, however, is on whether indisputable facts regarding candidate biographies—which are often invisible to voters over the course of a campaign—affect public opinion. It turns out that they do.

- America has never worried about financing its priorities — Brendan Greeley in FT Alphaville [Registrationwalled]:

Modern monetary theory is simply a different way of looking at fiscal policy, a way of describing what the real-world constraints on spending look like. It is in fact very close to how people in Washington, D.C. already approach spending. Again, we're not talking about what they say. Rather, we're talking about what they do. […] Like modern monetary theorists, Congress already appropriates away until it reaches real-world restraints on how much it can spend. It just hasn't reached any for almost the last two decades. When Washington wants something — to fight a war, to cut taxes — it appropriates. And so arguments about balancing budgets aren't actually about constraints. They're about priorities. Important programs get appropriations, full stop. Unimportant programs need to be paid for with taxes. Or, in Washington: "We can't afford that" actually just means "I don't think that's very important."

- Tom Toles:

- With Alexandria Ocasio-Cortez, Americans Finally Have a Politician Who Agrees With Them About Taxes — Jon Schwarz at the Intercept:

Two prominent political scientists, Martin Gilens at the University of California, Los Angeles and Benjamin Page at Northwestern University, have carefully studied the U.S. political system and demonstrated with charts and tables what most of us believe intuitively: If you don’t have money, you don’t matter. Or as Gilens and Page put it, “Not only do ordinary citizens not have uniquely substantial power over policy decisions; they have little or no independent influence on policy at all. By contrast, economic elites are estimated to have a quite substantial, highly significant, independent impact on policy.” The last 40 years of U.S. tax policy have been the most striking demonstration imaginable of this assertion. Americans have never, in living memory, been averse to higher taxes on the rich. Nonetheless, the top marginal tax rate for the federal income tax plunged during the Reagan administration, from 70 percent to 28 percent, and has since only inched back up to 37 percent.

Bill Gates Implicitly Endorses "Crazy Talk" MMT

On the one hand, I'm delighted that eminent self-made man William Henry Gates III has dismissed Modern Monetary Theory as "some crazy talk".

Gates worked his way up from practically nothing at Yale University (you've probably not heard of it) as the scion of a merely very wealthy family, to become an insanely wealthy entrepreneur. He did this upon realising that if you could copyright software (something legally uncertain at the time), you could then make an awful lot of money — from government-granted monopolies — over the wide use of the product of not an awful lot of work. His breakthrough insight was that one didn't have to wait for the establishment of legal precedent in order to begin exploiting it. Rather, you could do the two simultaneously. This proved to be his first and last history-changing innovation.

Since then Gates has been an unerring detector of, and proponent of, extraordinarily naff ideas destined for oblivion. The paradigmatic Gates bad idea came in 1995. The media famously dubbed 1995 "the Year of the Internet". In that year, Gates wrote a prophetic book full of naff ideas, and in passing he mused about the historical curiosity (nothing more than that) known as the Internet. It was, he thought, merely a signpost to the really significant online environment emerging, called the MicroSoft Network (MSN). Just as people were leaving proprietary, centralised online services like Compuserve and America OnLine in droves for the decentralised Internet, Gates was busily constructing his own new proprietary, centralised online service, because he knew a winning idea when he saw one.

So "crazy talk" is in effect a considerable endorsement of MMT by a man who will only begin to dimly perceive an undeniable truth after practically everybody else in the world has accepted it. First they ignore you, then they laugh at you, then they attack you, then Bill Gates ignores you and laughs at you, then you win.

On the other hand, the framing of MMT in this piece in the Verge is completely erroneous. It is misleading to say that MMT says (currency issuing) governments "need not worry about deficits because they can simply print their own currency" (emphasis mine). The scare word "print" here simply means "spend". A government spends its own money by issuing loose-leaf accounting records ("cash" to you and I), or by creating accounting entries on computers in the banking system. A currency issuing government must spend its own currency into the private sector before it can collect any of it back as taxes, fees, or fines. This "currency printing" is not novel, exceptional, radical, or crazy. It's a logical precondition of any sovereign monetary system.

Currency issuing governments cannot be said to spend any of the tax revenue they collect. Not one cent. When money is created, it is a financial liability for the government (an IOU, in effect), and a financial asset for the private sector. When the government collects money owing to it, it is merely cancelling out the liability against the asset (redeeming the IOU). Both the asset and the liability disappear in a puff of accounting. The government always spends newly created money. To claim that a currency issuing government normally uses "taxpayers' money", but in periods of wild abandon will resort to "printing money", is just flat-out wrong. Or worse, it is deliberate accounting fraud deployed for political purposes.

It is not that currency issuing governments can "print" money in order to spend; they cannot spend their own money any other way. As Warren Mosler says, the government neither has, nor does not have, any money. Or to put it another way, money isn't something a government has, it is something it does.

A further misrepresentation in the article is the claim that MMT proposes that governments should "manage inflation with interest rates". Not only do I not know of any major MMT scholar arguing any such thing, it would be hard to find any honest, knowledgable mainstream central banker who would endorse this position — and using interest rates to manage inflation is technically a major part of their job description!

Apologies for technobabble, but this is the short version: central banks (which implement monetary policy) can influence interest rates in the overnight market for funds required to settle the day's financial transactions between banks, and between banks and the government. This has a very, very weak, indirect, and unpredictable effect on private sector economic activity, and hence price stability. Much more direct and effective is the use of spending and taxation (fiscal policy) to ensure that there is neither too much money (inflationary) nor too little money (deflationary) for the goods available for sale in the economy as a whole, or in particular sectors of it.

The government uses money to achieve its (hopefully democratically determined) policy objectives. There is no alien thing out there called "the economy" which constrains how much money a government can create/spend or extinguish/tax. The limits on what we can achieve are the limits of our non-financial resources: raw materials, human beings, jam, etc.

As Modern Monetary Theory has hit so many radars that now even Bill Gates has heard of it, we can expect much more misrepresentation in future.

Sunday, 17 February 2019 - 11:42pm

I don't eat jam. My wife doesn't eat jam. Kitty doesn't eat jam. The dog doesn't eat jam. Despite that there is always a jar of jam in the fridge, but I have never seen jam go mouldy. Tomato paste, my heavens yes, as soon as you take your eyes off it. Jam never.

Eventually somebody decides they're sick of moving that fecking jar of jam whenever they're looking for a jar of something they actually want, and bins it. Yet soon enough somebody thinks they want jam, when actually they crave the sweet release of death, or something, or we're expecting visitors ("Oh! Do we have jam? They'll probably want jam."), and a jar is purchased, opened, quickly closed, and refrigerated as per the label's instructions.

Perhaps Theresa May is just being overly literal about the instructions, and refrigerating after opening without actually reading between the lines and closing it also. Still, aren't we all just yesterday's jam?

Sunday, 17 February 2019 - 2:01pm

This week, I have been mostly reading:

- Is your ‘experience diet’ making you unwell? — Jenny Donovan in the Conversation:

Just as our food diet affects our physical and emotional health, so does our “experience diet”. This is the day-to-day mix of the things we do, see, hear and feel. And, just like our food diet, the quantity, quality and balance of those experiences need to be right. […] Unfortunately, many of us have lifestyles that make it difficult or even impossible to meet all these needs. This diminishes our lives and leaves us isolated and unwell. This happens for several reasons, among which is the range of experiences our surroundings invite us to enjoy, endure or miss out on. You might call this our experience menu. If it’s not on the menu it doesn’t get to be in our diet.

- The dark side of decision-making in groups: Nastiness to outsiders — Michal Bauer, Jana Cahlíková, Dagmara Celik Katreniak, Julie Chytilová, Lubomír Cingl, Tomáš Želinský in Vox (EU):

Being anti-social is very different from being self-regarding. Economic agents motivated purely by self-interest will destroy the resources of others only when they stand to gain. But there is much more scope for harming others if they also derive utility from relative status or feel pleasure from beating an opponent. It is also important to understand whether simply being placed into a group creates an 'us versus them' psychology that influences behaviour of group members, or whether the behavioural difference is an outcome of deliberation. If the mere fact of deciding in a group makes an individual more willing to cause harm, a broad range of situations may create an increased tendency to behave anti-socially.

- Bloom County — By Berkely Breathed:

- The Lonely Life of a Yacht Influencer — Oliver Lee Bateman in MEL Magazine:

“Nah, I’m nobody you’d know,” he assured me. “I’m here to take some pictures and post some video stories of the yacht, which a brokerage group is trying to sell. The watch is a loaner from a friend. I wear it, take a picture of my wrist and tag his company on my Instagram account. It’s just a small part of the hustle.” The yacht hustle, I soon learned, was the all-consuming passion of Jimenez’s life. He went from a guy who took Instagram pictures, always head-on yacht shots run through one of the generic filters, to a guy that yacht brokers paid to stay on their yachts in order to mention that said yachts were docked in a port and available for sale or charter. He was helicoptered from yacht to yacht, and slept in the smallest guest cabins.

Saturday, 16 February 2019 - 3:04am

As I am pushing, or perhaps being shoved towards, fifty years of age, I find myself becoming compulsively autobiographic because I am starting to properly appreciate the sweep of history in those fifty years, and perhaps more so in the fifty previous years.

By 1971, the year I was born, what started in the 50s as a covert attempt by the #US and allies to prop up a French colonial holding had turned into a purely punitive expedition, on an unimaginable scale, directed against the civilian population of three countries. Half a century later, the failure to establish client dictatorships in Afghanistan and Iraq has normalised a lawless, perpetual free fire zone from Afghan/Pakistan border region to the middle east and northern Africa, and now attention is turning back to Latin America after a period of neglect which, to the dismay of such esteemed humanitarians as John Bolton and Elliott Abrams, allowed the growth of democracy to infect that region "down there", as Reagan so memorably called it. The neocons have a new itch they need to scratch.

The insight of Howard Zinn, a historian who lived history as astutely as he analysed it, is as relevant as ever.

Sunday, 3 February 2019 - 5:05pm

This week, I have been mostly reading:

- Death to the D.I.Y. Society — Ted Rall:

Since the 1970s corporate efficiency experts have burdened American consumers with a constantly expanding galaxy of tasks that businesses used to perform for them. Craig Lambert calls it “shadow work”—labor imposed on you that you’re not conscious of. The Do It Yourself (because companies won’t hire workers to do it anymore) movement faced little resistance in a culture that elevates personal responsibility and rugged individualism. Which is how, in less than half a century, we have become accustomed to pumping our own gas and planning our own vacations and scanning our own groceries and running our own cable TV diagnostic tests, forgetting how much easier life was with service station attendants and travel agents and cashiers and technicians who came to your actual house. Not only do we work harder, we earn less due to the disappearance of service personnel jobs from the labor market.

- Economic Growth and Climate Change: Mistaking an Output Variable for an Instrument — Peter Dorman at Angry Bear:

Economic growth is not, not, not a policy variable. There is no magic button available to society that delivers a given rate of economic growth, or degrowth for that matter. It’s an outcome of a host of factors, some of which are controllable, others not. Indeed, as we wait for quarterly GDP numbers to be revised several quarters later, we still don’t know what economic growth or contraction we’ve experienced. It is true that politicians often speak of the need to adopt some policy or other for sake of economic growth, but at best they are proposing to push on one of the many factors that influences it. There is no growth dial, and even if there were, twisting it a few notches would have almost no impact on carbon emissions, which need to fall by nearly 100% within two generations.

- Tome the Dancing Bug — by Ruben Bolling:

- 20th anniversary for the euro — no reason for celebration — Lars P. Syll:

When the euro was created twenty years ago, it was celebrated with fireworks at the European Central Bank headquarters in Frankfurt. Today we know better. There are no reasons to celebrate the 20-year anniversary. On the contrary. Already since its start, the euro has been in crisis. And the crisis is far from over. The tough austerity measures imposed in the eurozone has made economy after economy contract. And it has not only made things worse in the periphery countries, but also in countries like France and Germany. Alarming facts that should be taken seriously.

- The Democrats Are Climate Deniers — Branko Marcetic in Jacobin:

Elizabeth Warren is instructive in this respect. She is considered one of the most progressive candidates in the race in 2020, but Warren has never really shown any leadership on the issue, as numerous environmental activists attest to. The leading piece of legislation she authored (“I’ve got a plan to fight back,” she said at the time) only came in September of last year, and it’s a bill that — drum roll — would force public companies to disclose climate risks, so that “investors would have the information they need . . . [to] make smart decisions with their money.” If that sounds like what might generously be described as a quarter-measure that relies on market solutions to a problem actively being driven by the market, that’s because it is.

[Ignore the misguided "pay-for" bits in the article. And, on the subject of pay-fors:] - We Can Pay For A Green New Deal — Stephanie Kelton, Andres Bernal, and Greg Carlock in the Huffington Post:

Are taxes an important part of an aggressive climate plan? Sure. Taxes can shape incentives and help change behaviors within the private sector. Taxes should be raised to break up concentrations of wealth and income, and to punish polluters for the cost and consequences of their actions. In a period without federal leadership on the climate crisis, this is how many state and local governments are considering carbon pricing. That’s useful ― not because we “need to pay for it” but to end polluters’ harmful behavior. The federal government can spend money on public priorities without raising revenue, and it won’t wreck the nation’s economy to do so. That may sound radical, but it’s not. It’s how the U.S. economy has been functioning for nearly half a century. That’s the power of the public purse.

- Alexandria Ocasio-Cortez's 70 Percent Tax on the Rich Isn't About Revenue, It's About Decreasing Inequality — Vanessa Williamson in Common Dreams:

Progressive taxation should work as a corrective tax, like tobacco taxes or a carbon tax. Sure, tobacco taxes raise some revenue for the states. But their primary purpose is to curb smoking. While a carbon tax could produce a lot of government revenue, the real point is to limit global warming pollution. In essence, corrective taxes try to put themselves out of business; if tobacco tax revenues decline because people quit smoking, or if carbon taxes stop rolling in because the economy becomes fossil-free, that is victory, not defeat.

Sunday, 27 January 2019 - 4:33pm

This week, I have been mostly reading:

- Wondermark #1443; In which All Knowledge is Equal — David Malki !:

- Trump Models His War on Bank Regulators on Bill Clinton and W’s Disastrous Wars — Bill Black at New Economic Perspectives:

Bill Clinton’s euphemism for his war on effective regulation was “Reinventing Government.” Clinton appointed VP Al Gore to lead the assault. (Clinton and Gore are “New Democrat” leaders – the Wall Street wing of the Democratic Party.) Gore decided he needed to choose an anti-regulator to conduct the day-to-day leadership. We know from Bob Stone’s memoir the sole substantive advice he gave Gore in their first meeting that caused Gore to appoint him as that leader. “Do not ‘waste one second going after waste, fraud, and abuse.’” Elite insider fraud is, historically, the leading cause of bank losses and failures, so Stone’s advice was sure to lead to devastating financial crises. It is telling that it was the fact that Stone gave obviously idiotic advice to Gore that led him to select Stone as the field commander of Clinton and Gore’s war on effective regulation.

- The US Wants to Bring Back the Shah of Iran — David William Pear at the Greanville Post provides illuminating context for those unfamiliar with the backstory:

Since Iran was a developing democracy, an excuse had to be found for a US intervention. Churchill accused Mossadegh of being a communist. There was no evidence that he was. Mossadegh was an anti-colonial nationalist who cared about the welfare of the Iranian people, and that was all the evidence that Eisenhower needed. Mossadegh had to be punished for standing up to the British and demanding Iran’s natural resources for the benefit of the Iranian people. The winners from the coup were the US and the timid Shah who had ran from his own people. The US would teach him how to have a backbone. He turned out to be a good student, and with the support of the US he turned Iran into a totalitarian police state and ruled by terror. The Shah got US protection from his own people and from foreign enemies. The US looked the other way from the Shah’s corruption of conspicuous consumption, stuffing dollars in foreign bank accounts and lining his own pockets, and those of his cronies. The US got a big piece of the Iran oil industry, and Iran gave the US a strategically important location for a military presence. As for the people of Iran, they continued to live in abject poverty and illiteracy.

- Why Trump’s Private Transactions are Terrifying — Robert Reich:

After two years of Trump we may have overlooked the essence of his insanity: His brain sees only private interests transacting. It doesn’t comprehend the public interest. Private transactions can’t be wrong or immoral because, by definition, they require that every party to them be satisfied. Otherwise there wouldn’t be a deal. Viewed this way, everything else falls into place. For example, absent a public interest, there can’t be conflicts of interest.

- Beto, We Hardly Knew Ye — Norman Solomon:

Beto O’Rourke’s actual political record deserves scrutiny, and it’s not what progressives might expect from the overheated adulation that has sent his presidential balloon aloft. Some pointed reporting and critiques this month may have begun a process of bringing Beto fantasies down to earth.

- Pulling Rabbits Out of Hats — J. W. Mason in Jacobin:

Left critics often imagine economics as an effort to understand reality that’s gotten hopelessly confused, or as a systematic effort to uphold capitalist ideology. But both of these claims are, in a way, too kind — they assume that economic theory is “about” the real world in the first place. Better to think of it as a self-contained art form, whose apparent connections to economic phenomena are the results of a confusing overlap in vocabulary. Think about chess and medieval history: the statement that “queens are most effective when supported by strong bishops” might be reasonable in both domains, but its application in the one case will tell you nothing about its application in the other.

- Alexandria Ocasio-Cortez, Crusher of Sacred Cows — Matt Taibbi in Rolling Stone: There’s a reason aides try to keep their bosses away from microphones, particularly when there’s a potential for a question of SAT-or-higher level difficulty in the interview. But the subject elected officials have the most trouble staying away from is each other. We’ve seen this a lot in recent weeks with the ongoing freakout over newcomer Alexandria Ocasio-Cortez. Lest anyone think any of the above applies to “AOC,” who’s also had a lot to say since arriving in Washington, remember: she won in spite of the party and big donors, not because of them. That doesn’t make anything she says inherently more or less correct. But it changes the dynamic a bit. All of AOC’s supporters sent her to Washington precisely to make noise. There isn’t a cabal of key donors standing behind her, cringing every time she talks about the Pentagon budget. She is there to be a pain in the ass, and it’s working. Virtually the entire spectrum of Washington officialdom has responded to her with horror and anguish.

- 'The goal is to automate us': welcome to the age of surveillance capitalism — John Naughton interviews Shoshana Zuboff for the Guardian:

Surveillance capitalism is no more limited to advertising than mass production was limited to the fabrication of the Ford Model T. It quickly became the default model for capital accumulation in Silicon Valley, embraced by nearly every startup and app. And it was a Google executive – Sheryl Sandberg – who played the role of Typhoid Mary, bringing surveillance capitalism from Google to Facebook, when she signed on as Mark Zuckerberg’s number two in 2008. By now it’s no longer restricted to individual companies or even to the internet sector. It has spread across a wide range of products, services, and economic sectors, including insurance, retail, healthcare, finance, entertainment, education, transportation, and more, birthing whole new ecosystems of suppliers, producers, customers, market-makers, and market players. Nearly every product or service that begins with the word “smart” or “personalised”, every internet-enabled device, every “digital assistant”, is simply a supply-chain interface for the unobstructed flow of behavioural data on its way to predicting our futures in a surveillance economy.

- Why divine immanence mattered for the Civil Rights struggle — Vaneesa Cook in Aeon:

The concept of divine immanence became less theoretical once King learned about the activism of Mahatma Gandhi. Though Gandhi was not a Christian, his method of satyagraha, meaning ‘truth-force’ or, as King put it, ‘soul force’, fascinated King. Gandhi challenged the British empire by forcing them to confront their Indian subjects as fellow humans, deserving fair treatment. He did so without firing a shot. From Gandhi’s example, King saw how humans practising God’s love, particularly through nonviolence and disciplined self-comportment, could unleash the power of God’s love in the world. He acknowledged Gandhi’s method as ‘the guiding light of our technique of nonviolent social change’ during the Montgomery bus boycott. In Selma, Alabama and in Memphis, Tennessee, and throughout the US South, King continued to utilise Gandhian strategies of direct action throughout his campaign against American racism. For King, in short, divine immanence was a call to action. ‘All humanity is involved in a single process,’ he contended, working in concert with God’s Holy Spirit, the ultimate ‘community creating reality that moves through history.’ God and mankind, in other words, moved together. From the perspective of theological doctrine, King had reconciled immanence and transcendence.

- Trump vs Mattis: Watch out when men of war come to the rescue — Robert Fisk in the Independent:

[…] the dignified, cold and fastidious de Gaulle would never have lent himself to the rant Mattis embarked upon in San Diego in 2005: “You go into Afghanistan, you got guys who slap women around for five years because they didn’t wear a veil. You know, guys like that ain’t got no manhood left anyway. So it’s a hell of a lot of fun to shoot them. Actually, it’s a lot of fun to fight. You know, it’s a hell of a hoot. It’s fun to shoot some people. I’ll be right upfront with you, I like brawling.” […] But now he has entered a new pantheon. Suddenly the man of war, the US marine general who found it “a hell of a lot of fun” to shoot Afghan misogynists and liked “brawling”, has become a peacemaker. He was the restraining hand tugging at the sleeve of the insane Trump, the one man who could stop Nero burning Rome. He was “the sanest of Trump’s national security team”, according to Paul Waldman in The Washington Post. He was “an island of security”, announced Amos Harel in Israeli newspaper Haaretz.

- Wondermark #1444; In which Kinship is formed — David Malki !:

I would not normally post two consecutive comics by the same author, for fear of accusations of leeching, but I just had to in this case. To assuage my guilt, the reader — i.e. Jeff, my imaginary friend — is encouraged to go to the Wondermark site to enjoy more of this splendidness, and then go buy some merch which I personally can't afford.

Sunday, 20 January 2019 - 5:34pm

This week, I have been mostly reading:

- Wondermark — by David Malki !:

- The DNA Industry and the Disappearing Indian: DNA, Race, and Native Rights — Aviva Chomsky for TomDispatch:

In reality, such testing does not tell us much about our ancestors. That’s partly because of the way DNA is passed down through the generations and partly because there exists no database of ancestral DNA. Instead, the companies compare your DNA to that of other contemporary humans who have paid them to take the test. Then they compare your particular variations to patterns of geographical and ethnic distribution of such variations in today’s world -- and use secret algorithms to assign purportedly precise ancestral percentages to them. So is there really a Sardinian or East Asian gene or genetic variation? Of course not. If there is one fact that we know about human history, it’s that ours is a history of migrations. We all originated in East Africa and populated the planet through ongoing migrations and interactions. None of this has ended (and, in fact, thanks to climate change, it will only increase). Cultures, ethnicities, and settlements can’t be frozen in time. The only thing that is constant is change. The peoples who reside in today’s Sardinia or East Asia are a snapshot that captures only a moment in a history of motion. The DNA industry’s claims about ancestry award that moment a false sense of permanence.

- Students Evaluating Teachers Doesn’t Just Hurt Teachers. It Hurts Students. — Nancy Bunge in the Chronicle of Higher Education:

Some students understand the implications of all this. When I first told a class that one of the students would have to collect and submit the evaluations so that I couldn’t tamper with them, one of them asked, "Doesn’t that make you feel demeaned?" Another student wrote on an evaluation, "Why don’t you get off your ass and see for yourself what a great job she is doing?" And, indeed, the administration, not the students, should undertake the difficult task of appraising how well a class works. A colleague once remarked, "When we agitated for student evaluations in the ’60s, we never guessed we were handing the administration a club."

- Doonesbury — by Gary Trudeau:

- Education…education…education — The Gower Initiative for Modern Money Studies:

Instead of higher education being about learning, exploration and creativity, it is increasingly becoming commodified; serving the interests of capital rather than the development of the individual for life and the benefit of society. Already, as Steve Watson notes, there is the potential for subjects that do not have a direct link to the world of work to disappear or be reconfigured for employability. And while universities struggle for funding and try to cut costs, students face the prospect of a lifetime of education debt without even the certainty of finding a good, well paying job at the end of it.

- Tom Toles for December 02, 2018:

- Why language might be the optimal self-regulating system — Lane Greene in Aeon:

It is a delight to be able to use a good literally: when my son fell off a horse on a recent holiday, I was able to reassure my mother that ‘He literally got right back in the saddle,’ and this pleased me no end. So when people use literally to say, for example, We literally walked a million miles, I sigh a little sigh. I know that James Joyce, Vladimir Nabokov and many others used a figurative literally, but as a mere intensifier it’s not particularly useful or lovely, and it is particularly useful and lovely in the traditional sense, where it has no good substitute. So I do believe that when change happens in a language it can do harm. Not the end of the world, but harm.

- Evil Mansion — Phil Are Go:

- Urban planning is failing children and breaching their human rights – here’s what needs to be done — Jenny Wood in the Conversation:

When children are asked about their favourite places to play, the playground is rarely their first choice. And most adults will often agree that they also favoured places other than the playground when they were children: parks, woods, riverbanks, fields and beaches were the places that captured imagination, not a few swings in an enclosed tarmacked space. Similarly, skateparks offer only limited recreation potential and tend to be favoured more by boys than by girls. Playgrounds often lack a range of equipment to suit children of different ages and abilities and are not always well maintained. Children also have to be able to reach the playground safely on their own, otherwise they have to be accompanied. This can limit the time children have to play outdoors and contributes further demands on the time of already pressured parents and carers. These exclusions and misunderstandings of what children really need contribute to environments that favour adults over children, and can leave children feeling disempowered, discouraged, inactive and dependent on the adults around them.

- Off the Mark — by Mark Parisi: