Thanks, Social Sciences!

Educators must prepare students to be the multiliterate individuals that they will need to be successful in their futures. Schools are ultimately responsible for preparing students to be critical users of available technologies (Damarin, 2000; Leu, Kinzer, Coiro, & Cammack, 2004), problem solvers, and good communicators in networked civic spaces (Mishra & Kereluik, 2011; Binkley et al., 2012).

To do this, educators must first explore the spaces provided by collaborative technologies for participants to engage in meaning-making in order to release the harnessed potential of said technologies.

Get it? Educators must release the harnessed potential of technologies, in order to harness students to the multiple literacies which will steer them to success.

Heaven forbid we were to get it muddled and release the potential of students, letting them steer the technologies according to the students' own definitions of success.

Sunday, 13 January 2019 - 5:29pm

This week, I have been mostly reading:

- Just You Wait, History Proves That Someday Liberals Will Love Donald Trump — Ted Rall:

- The unwelcome revival of ‘race science’ — Gavin Evans in the Guardian:

Although race science has been repeatedly debunked by scholarly research, in recent years it has made a comeback. Many of the keenest promoters of race science today are stars of the “alt-right”, who like to use pseudoscience to lend intellectual justification to ethno-nationalist politics. If you believe that poor people are poor because they are inherently less intelligent, then it is easy to leap to the conclusion that liberal remedies, such as affirmative action or foreign aid, are doomed to fail.

- Universal Basic Income Is Silicon Valley’s Latest Scam — Douglas Rushkoff in Medium:

The policy was once thought of as a way of taking extreme poverty off the table. In this new incarnation, however, it merely serves as a way to keep the wealthiest people (and their loyal vassals, the software developers) entrenched at the very top of the economic operating system. Because of course, the cash doled out to citizens by the government will inevitably flow to them. […] Under the guise of compassion, UBI really just turns us from stakeholders or even citizens to mere consumers. Once the ability to create or exchange value is stripped from us, all we can do with every consumptive act is deliver more power to people who can finally, without any exaggeration, be called our corporate overlords.

- The Rise and Demise of RSS — Sinclair Target in Motherboard:

About a decade ago, the average internet user might well have heard of RSS. Really Simple Syndication, or Rich Site Summary—what the acronym stands for depends on who you ask—is a standard that websites and podcasts can use to offer a feed of content to their users, one easily understood by lots of different computer programs. Today, though RSS continues to power many applications on the web, it has become, for most people, an obscure technology. The story of how this happened is really two stories. The first is a story about a broad vision for the web’s future that never quite came to fruition. The second is a story about how a collaborative effort to improve a popular standard devolved into one of the most contentious forks in the history of open-source software development.

Sunday, 6 January 2019 - 3:14pm

This week, I have been mostly reading… not cartoons, for a change:

- The Charitable-Industrial Complex & the perpetual poverty machine — Daniel Margrain at Renegade Inc.:

The Royal British Legion whose philanthropic poppy appeals ostensibly raise money for men and women who ‘serve the country’ in conflict zones, is sponsored by both Lockheed Martin, the world’s largest arms’ company, and BAE Systems, the UKs biggest arms dealer. This is largely hidden from the public in much the same way that there is a lack of transparency and public accountability in the activities of the Foreign and Commonwealth Office who help administer the Conflict, Security and Stability Fund and the Jo Cox Fund. Independent journalist, Aaron Bastani, was widely lambasted by the establishment media for simply pointing out the fact that the current model of charity does not help Britain’s veterans, at least 13,000 of whom are homeless. Bastani pointed to the clear correlation between the worship of the poppy, the commercial and financial success of the Royal British Legion (income £150m+) and the plight of homeless UK veterans.

- Apple’s “Capital Return Program”: Where Are the Patient Capitalists? — William Lazonick at INET:

From the last quarter of calendar year 2012 through September 29, 2018, under its inaptly-named “Capital Return Program,” Apple spent $239.0 billion buying back its own stock. […] Apple’s “Capital Return Program” is an ideologically laden name for these distributions of corporate cash to shareholders that has nothing to do with returning capital. First, you can’t “return” something to a party that never gave you anything. The only time in its history that Apple actually raised funds from public shareholders was its initial public offering in 1980, which yielded $97 million for the company. Second, in distributing cash to shareholders, Apple is not giving them “capital.” It’s just transferring cash that may be used for a multitude of purposes, ranging from household consumption to building the war chests of hedge-fund activists, augmenting their power to engage in predatory value extraction.

- The ‘Pelosi Problem’ Runs Deep — Norman Soloman in Truthdig:

Increasingly, such leadership is isolated from the party it claims to lead. Yet the progressive base is having more and more impact. As a Vox headline proclaimed, more than a year ago, “The stunning Democratic shift on single-payer: In 2008, no leading Democratic presidential candidate backed single-payer. In 2020, all of them might.” The Medicare for All Caucus now lists 76 House members. Any progressive should emphatically reject Pelosi’s current embrace of a “pay-go” rule that would straitjacket spending for new social programs by requiring offset tax hikes or budget cuts. Her position is even more outrageous in view of her fervent support for astronomical military spending. Like Senate Minority Leader Chuck Schumer (who was just re-elected to his post), Pelosi went out of her way last winter to proclaim avid support for President Trump’s major increase in the already-bloated Pentagon budget, boasting: “In our negotiations, congressional Democrats have been fighting for increases in funding for defense.”

- Everything You Thought You Knew About Western Civilization Is Wrong: A Review of Michael Hudson’s New Book, And Forgive Them Their Debts — John Siman in Naked Capitalism:

In ancient Mesopotamian societies it was understood that freedom was preserved by protecting debtors. In what we call Western Civilization, that is, in the plethora of societies that have followed the flowering of the Greek poleis beginning in the eighth century B.C., just the opposite, with only one major exception (Hudson describes the tenth-century A.D. Byzantine Empire of Romanos Lecapenus), has been the case: For us freedom has been understood to sanction the ability of creditors to demand payment from debtors without restraint or oversight. This is the freedom to cannibalize society. This is the freedom to enslave. This is, in the end, the freedom proclaimed by the Chicago School and the mainstream of American economists. And so Hudson emphasizes that our Western notion of freedom has been, for some twenty-eight centuries now, Orwellian in the most literal sense of the word: War is Peace • Freedom is Slavery • Ignorance is Strength. He writes: “A constant dynamic of history has been the drive by financial elites to centralize control in their own hands and manage the economy in predatory, extractive ways. Their ostensible freedom is at the expense of the governing authority and the economy at large. As such, it is the opposite of liberty as conceived in Sumerian times” (p. 266).

- Where to for Sydney property in 2019? Experts expect further price falls — Ingrid Fuary-Wagner at the Australian Financial Review:

Property prices have now fallen 7.2 per cent over the year to date, according to CoreLogic – and 9.5 per cent since they peaked in July 2017 – with industry experts anticipating more pain to come for homeowners in the new year. AMP Capital's Shane Oliver expects prices in Sydney to drop by another 10 per cent over the 2019 calendar year.

- Chuck Schumer Caved to Facebook and Donald Trump. He Shouldn’t Lead Senate Democrats. — Mehdi Hasan at the Intercept:

It wasn’t Mike Pompeo who said, “It’s easy to sit back in the armchair and say that torture can never be used. But when you’re in the foxhole, it’s a very different deal.” It wasn’t Stephen Miller who responded to the 2015 terrorist attacks in Paris by suggesting “a pause may be necessary” in the resettlement of Syrian refugees in the United States. It wasn’t Betsy DeVos who joined a group of finance industry executives for breakfast only a few weeks after the 2008 financial crash and told them, “We are not going to be a bunch of crazy, anti-business liberals.” Forget the hawks, blowhards, and kakistocrats of the Trump administration. You know who made all these statements? It was Chuck Schumer. Yes, the fourth-term Democratic senator from New York has a long history of making really right-wing and rancid remarks. Yet on Wednesday morning, Schumer was re-elected as minority leader by acclamation in a closed-door meeting of Senate Democrats. They didn’t even bother to vote on it.

- “Moral Hazard” vs Mutual Aid – How the Bronze Age Saved Itself from Debt Serfdom — Michael Hudson in Naked Capitalism:

The Naked Capitalism discussion of John Siman’s review of my new book “and forgive them their debts”: Lending, Foreclosure and Redemption from Bronze Age Finance to the Jubilee Years quickly slipped into a discourse about modern economies and whether it was moral to cancel the debts of people who are in arrears, when some people have struggled to keep current on their payments. Bankers and bondholders love this argument, because it says, “Don’t cancel debts. Make everyone pay, or someone will get a free ride.” Suppose Solon would have thought this in Athens in 594 BC. No banning of debt bondage. No Greek takeoff. More oligarchy Draco-style. Suppose Hammurabi, the Sumerians and other Near Eastern rulers would have thought this. Most of the population would have fallen into bondage and remained there instead of being liberated and had their self-support land restored. The Dark Age would have come two thousand years earlier.

- “Economically illiterate and morally fraudulent”: Lord Skidelsky on the Chancellor’s narrative — Robert Skidelsky's post-budget speech in the House of Lords, Progressive Economy Forum:

First, let me say I welcome the general thrust of the Budget. As the OBR says it represents the “largest fiscal loosening” since 2010. But we are not here to discuss the Budget, over which we have no control in this House, but “the state of the economy in light of the Budget statement” – that is, how will the Budget affect the economy? The answer is: very little. The “loosening” of which the OBR speaks is much too small to repair the damage caused by the eight years of austerity policy since 2010. An adequate loosening would have required an admission of error beyond the economic understanding or moral compass of this government.

- What Einstein meant by ‘God does not play dice’ — Jim Baggott in Aeon:

Einstein’s was a God of philosophy, not religion. When asked many years later whether he believed in God, he replied: ‘I believe in Spinoza’s God, who reveals himself in the lawful harmony of all that exists, but not in a God who concerns himself with the fate and the doings of mankind.’ Baruch Spinoza, a contemporary of Isaac Newton and Gottfried Leibniz, had conceived of God as identical with nature. For this, he was considered a dangerous heretic, and was excommunicated from the Jewish community in Amsterdam. Einstein’s God is infinitely superior but impersonal and intangible, subtle but not malicious. He is also firmly determinist. As far as Einstein was concerned, God’s ‘lawful harmony’ is established throughout the cosmos by strict adherence to the physical principles of cause and effect. Thus, there is no room in Einstein’s philosophy for free will: ‘Everything is determined, the beginning as well as the end, by forces over which we have no control … we all dance to a mysterious tune, intoned in the distance by an invisible player.’

Sunday, 30 December 2018 - 6:08pm

This week, I have been mostly reading:

- Tom Toles:

- From brothels to independence: the neoliberalisation of (sex) work — the psuedonymous Ava Caradonna in openDemocracy:

To understand how sex work has changed requires thinking through how both our labour conditions and the political economy of the industry has been transformed. We are no longer forced to hand over hefty house fees to a boss, but our overheads are now much higher. The economic risk of investment has been shifted onto the worker. At the same time, we are now required to invest nearly infinite amounts of unpaid labour into our ‘businesses’. Working hours now stretch into every waking moment and working spaces become everywhere and nowhere.

- Apple Has an Early Case of GE’s Disease — Marshall Auerback in Naked Capitalism:

“Financialization”—which denotes “the increasing importance of financial markets, institutions and motives in the world economy”—manifests itself clearly in the case of Apple. It is becoming another example of an American company that is increasingly valuing financial engineering over real engineering, as its core businesses get hollowed out amid product saturation and declining global sales. Like General Electric some 25 years under Jack Welch, Apple under current CEO Tim Cook increasingly represents a microcosm of the changing role of U.S. markets as they have become less a vehicle for capital provision, more akin to a wealth recycling machine in which cash piles are used less for investment/research and development, more for share buybacks (which are tied to executive compensation, elevating the incentive for, at a minimum, quarterly short-termism and, at worst, fraud and corporate looting). All in the interests of that flawed concept of “maximizing shareholder value,” in which the company’s stock price, rather than its product line, drives corporate decisions, determines senior management compensation, and becomes the ultimate measuring stick of success. Usually, when this trend becomes ascendant, it doesn’t end well. Perhaps the adverse reaction to Apple’s recently reported earnings is the first warning of what could follow.

- Saturday Morning Breakfast Cereal — By Zach Weinersmith:

.png)

- An algorithm a day will keep the doctor at bay — David Mitchell being charming in That Utterly Charming Newspaper:

"In the UK, we are spending £97bn of public money on treating disease and only £8bn preventing it,” the health secretary Matt Hancock said last week. “You don’t have to be an economist to see those numbers don’t stack up.” But Matt Hancock actually is an economist, so how does he know? […] And obviously they do stack up. As in, you could stack them up – you could add them together. They probably are stacked up in various summaries of government spending: stacked up under the heading “Health”. You don’t have to be an economist to see that if you stacked them up, that would make £105bn. I don’t think he means that, though. I think maybe he means that £97bn is much more than £8bn. His point may simply be that you don’t have to be an economist to see that 97 is a larger number than eight. If so, I heartily agree and my only quibble is why, even with Britain’s rising life expectancy, for which Matt Hancock is doubtless keen to take credit, he considered that assertion worth the time it took to express. To be fair, I think what he’s getting at is that, if we spent more than £8bn on preventing illness, maybe we wouldn’t need to spend as much as £97bn treating it. Unfortunately, though, you don’t have to be an economist to know whether that contention stacks up. In fact, you have to be something else. You need a completely different type of expertise.

- End intellectual property — Samir Chopra in Aeon:

The phrase ‘intellectual property’ was first used in a legal decision in 1845 and acquired formal heft in 1967 with the establishment of the World Intellectual Property Organization (WIPO), a specialised agency of the United Nations that represents and protects the commercial interests of holders of copyrights, patents, trademarks and trade secrets. The ubiquitous use of ‘intellectual property’ began in the digital era of production, reproduction and distribution of cultural and technical artifacts. As a new political economy appeared, so did a new commercial and legal rhetoric. ‘Intellectual property’, a central term in that new discourse, is a culturally damaging and easily weaponised notion. Its use should be resisted.

- Non Sequitur — by Wiley Miller:

Sunday, 23 December 2018 - 3:06pm

This week, I have been mostly reading:

- Bloom County — Berkeley Breathed is making an old man very nostalgic for simpler times when comics weren't free, but beer was very, very cheap and pubs weren't reading-unfriendly raucous mini casinos - I'm a Boinger!:

- Why be nonbinary? — Robin Dembroff in Aeon:

For all the huffing about how gender is just body parts, no one in practice holds the identity view of gender. If gender is just reproductive features and nothing more, it makes no more sense to insist that people must look, love or act in particular ways on the basis of gender than it would to demand that people modify their behaviour on the basis of eye colour or height.

- Peter Mares on why falling house prices are a good thing — for the utterly unGoogleable folk at .id:

When home-owners make a capital gain, or pass on that gain to their children, the windfall goes completely untaxed. What is more, the value of a private residence has almost zero impact on the owner’s entitlement to government benefits, like the aged pension. This encourages us to treat housing as a financial asset above its primary function in providing a home. It encourages us to over-invest in housing and, as a nation, take on dangerously high levels of household debt. It encourages us to use housing inefficiently. There are around 1.5 million more homes in Australia’s capital cities that have two spare bedrooms and 560,000 homes with three or more. Shifting from stamp duty to a broad-based property tax—as well as reforming negative gearing and the capital gains tax discount—could help ameliorate some of these problems. It could also help make housing fairer.

- The One Thing I Dislike About My Introversion — Sophia Dembling in Psychology Today:

I often feel like I have nothing to say. Introverts are well-known for eschewing small talk. I am no different, but it’s not just that I dislike it. It’s that after about three exchanges, I’ve exhausted my capacity for it. Then, as the conversation awkwardly trails off, I feel foolish and inept. I'm not sure what to think about this. In deep discussions, I have plenty to say — I have to cut myself off sometimes for fear of dominating the conversation. But for whatever reason, I run out of small talk quickly, and the resulting silence is neither warm nor welcoming. It's just weird.

Sunday, 16 December 2018 - 3:42pm

This week, I have been mostly reading:

- A Brief History of Everything That Happened Because of George H.W. Bush’s Insecurity — Matt Taibbi at Rolling Stone includes this thing I did not know, or am too senile to recall:

Bush once sent a poor black kid to a real prison for real years for the crime of being a political prop. In the summer of 1989, while vacationing avec speedboat in his Kennebunkport, Maine, estate, Bush came up with the brilliant idea, or at least acceded to one dreamed up by aides. He would do a live address to the country while holding up a bag of crack that had been sold just outside the White House. The idea was to show that crack could “be bought anywhere.” The problem was, nobody sold crack in Lafayette Square near the White House, which is where Bush aides wanted the crack found. There is a long backstory here that involves administration officials tasking the DEA with securing a bust near 1600 Pennsylvania Avenue. They ended up having an undercover agent contact an 18-year-old named Keith Jackson from a poor neighborhood in southeast Washington. He was asked to bring his wares to the White House. […] The federal judge in the case, Stanley Sporkin, wanted desperately to not impose a stiff sentence on Jackson, but — in a problem none of the Bush aides who cooked up this dumb scheme thought of — mandatory sentencing laws handcuffed Sporkin. So the kid was sentenced to 10 years (he was later paroled). Sporkin, a former CIA general counsel appointed by Reagan, suggested Jackson ask Bush for a pardon: “He used you, in the sense of making a big drug speech… But he’s a decent man, a man of great compassion. Maybe he can find a way to reduce at least some of that sentence.” Bush blew that off and instead issued pardons to six Iran-Contra defendants on Christmas Day in 1992.

- Progressives to Conservatives: You Hate Liberals For All The Wrong Reasons — Ted Rall:

- The French Protests Do Not Fit a Tidy Narrative — Matt Taibbi in Rolling Stone:

[Max] Boot wrote a sad column about the yellow vests. He wondered why people on the left, right and in between were mocking a piece he wrote 18 months ago, in which he said, “America needs its own Macron — a charismatic leader who can make centrism cool.” Macron has a 23 percent approval rating, Paris seems to be on fire, and people are even spray-painting the Arc de Triomphe. How, Boot asked, could all this be happening to such a cool politician? When an online commenter suggested “centrism” was just another word for “elitism,” Boot was again puzzled. What’s wrong with elitism? Don’t we all want the best at the helm? You wouldn’t want an un-elite airline pilot, would you? This was the Spinal Tap version of neoliberalism: what’s wrong with being elite? The inability of pundits to make sense of the plummeting popularity of “centrism” is a long-developing story in the West. Over and over, a daft political class paternalistically implements changes more to the benefit of donors than voters, then repeatedly is baffled when they prove unpopular.

- ‘Eat The Rich’: Still a Popular Idea in French Uprisings, Especially With the Yellow Vests — Christopher Dickey in the Daily Beast:

The leaderless demonstrators trashing French cities or standing by watching while anarchist and fascist and for-the-hell-of-it casseurs do the job for them, have put forth long lists of inchoate demands about which there’s no consensus. But one big issue does remain that has resonance with the wider masses. They want Macron to reimpose a wealth tax on top of France’s already very high income taxes. Although the revenues from the “solidarity tax on fortunes,” known as the ISF, might go to good social causes, that’s not the reason for its political importance. It’s a popular idea because it’s punitive. French society was traditionally, famously jealous of wealth, and angered by it, long before the current problems of inequality created by global financial markets. As Dana Kennedy pointed out in The Daily Beast last week, for centuries the vast peasant population of France lived in horrible conditions. There was a long history of pitchfork-wielding popular uprisings against an indolent aristocracy, and by the time of the Enlightenment, that popular anger was turning against bourgeois merchants as well.

- The Paris ‘Yellow Vest’ Protests Show the Flaws of Capitalism — Caroline Haskins, Motherboard:

This is a problem with climate negotiations generally: the policies that are supposed to mitigate damage in the present and future and protect the world’s most vulnerable are negotiated by people who are largely immune to the short-term material concerns of living paycheck-to-paycheck, and the long-term material concerns of climate change are purely theoretical to them, given their economic status. That’s why the policies that end up coming into practice don’t consider the urgency and immediacy of the material, life-and-death concerns of the working class. The working class is asked to sacrifice now, and upper classes, meanwhile, are rarely asked to make many material sacrifices at all.

- Constant anxiety of benefit sanctions is toxic for mental health of disabled people — Danny Taggart, Ewen Speed, and Jaimini Mehta in the Conversation precis their new report for Inclusion London:

One man, Charlie, who participated in our study, described how a sanction left him with no food or electricity on Christmas day, leading to a suicide attempt and mental breakdown […] The sanction actually pushed him further away from work. He said that he now has a problem going into the Job Centre: “Because of the damage that the benefit sanction did to me.” Part of the rationale is based on a psychological theory known as behavioural economics, which uses a range of nudges to encourage people to make more rational choices. So-called “nudge theory” has been used to encourage behaviour change in areas such as paying tax on time and organ donation. But in the context of welfare support, the use of incentives take the form of perverse and punitive incentives. Perverse, because they can require disabled people to understate their qualifications to obtain any form of employment. The same man told us the Job Centre staff told him to remove his degree from his CV so that he wouldn’t appear overqualified for the jobs they told him to apply for. He said it had a real impact on his feeling of self-worth. […] The incentives are punitive because they leave disabled people in a state of constant dread, feeling worried all of the time, whether they are sanctioned or not.

- Corporate-Funded Judicial Boot Camp Made Sitting Federal Judges More Conservative — David Dayen at the Intercept:

In 1976, the Law and Economics Center, a corporate-funded academic organization now housed at George Mason University, began holding an intensive, all-expenses-paid, two- to three-week economics seminar for federal judges in Plantation Island, Florida. Organized by conservative economist Henry Manne, the Economics Institute for Federal Judges featured some of America’s most renowned professors teaching classical economic theories that could be applied to the courtroom. Though controversial in its day, the seminar recurred until 1999, and at its peak, over 40 percent of all federal judges had attended. According to a new working paper by three researchers, this indoctrination into law and economics — which emphasized cost-benefit analysis and economic efficiency; warned of the downsides of union protections and environmental regulations; and found benefits to deterrence — had a quantifiable effect on future rulings. Judges who attended Manne’s seminars rendered more conservative verdicts in economics cases. They were more likely to rule against the National Labor Relations Board or the Environmental Protection Agency. They employed more economics language in their rulings, according to a linguistic analysis. And they imposed harsher prison sentences, particularly after receiving more discretion to set terms in 2005.

Sunday, 9 December 2018 - 1:48pm

This week, I have been mostly reading:

- Vital Signs: the housing market might deflate, but it might pop. Here’s how — Richard Holden in the Conversation:

As I have said here before, one of the worries is interest-only loans. Around A$360 billion of these loans are due to be rolled over over the next three years. If they are not, they will convert to principal-and-interest loans, which are much more expensive to maintain. Given that only about 15% of loans currently issued are interest-only, down from 40% in recent times, that means a lot of people are starting to pay the more expensive principal and interest. For some, the jump in repayments will be as high as 40%. That’s scary enough. But this week’s minutes of the October Reserve Bank board meeting point to another concerning possibility – an old-fashioned credit crunch.

- Middle East dictators always end up bringing their western allies down – and now they've got their coils in the White House — Robert Fisk in the Independent:

If the Trump regime collapses – for regime it is – I suspect it will not be his frolics with the Russians which destroy it. Nor his corruption, nor his domestic lies. Nor his misogyny. Nor his anti-immigrant racism. Nor his obvious mental instability, though this clearly connects him to his friends in the Arab world. The Middle East has already got its coils into the White House. Trump is a friend of a highly dangerous state called Saudi Arabia. He has adopted Israeli foreign policy as his own, including the ownership of Jerusalem and wholehearted support for Israel’s illegal colonisation of Palestinian Arab land. He has torn up a solemn treaty with Iran. He has joined the Sunni side in its sectarian war with the Shias of the Middle East, in Iran, in Lebanon, in Syria, in Bahrain and, of course, in Saudi Arabia itself. Many countries have gone to war on behalf of other nations. Britain drew the sword for Poland in 1939, albeit a little late in the day. But to actively seek participation in someone else’s sectarian war for no other reason than to continue to sell weapons to a wealthy and unstable autocracy, to amalgamate your own country’s foreign policy with that of the most militarily powerful state in the Middle East -- to the point of depriving an entire people of a share in its capital city – and to wilfully ignore the long and lucrative support that our Gulf “allies” have given to the most frightful of our cult enemies – those who have indeed struck in the streets of London and New York – is beyond the usual lexicon. It is beyond shameful. Beyond wicked. Were it not for the insanity of the man responsible, the word “depravity” comes to mind.

- Matt Wuerker:

- In the New Fight for Online Privacy and Security, Australia Falls: What Happens Next? — Danny O'Brien at the Electronic Frontier Foundation:

With indecent speed, and after the barest nod to debate, the Australian Parliament has now passed the Assistance and Access Act, unopposed and unamended. The bill is a cousin to the United Kingdom’s Investigatory Powers Act, passed in 2016. The two laws vary in their details, but both now deliver a panoptic new power to their nation’s governments. Both countries now claim the right to secretly compel tech companies and individual technologists, including network administrators, sysadmins, and open source developers – to re-engineer software and hardware under their control, so that it can be used to spy on their users. Engineers can be penalized for refusing to comply with fines and prison; in Australia, even counseling a technologist to oppose these orders is a crime.

- The "Yellow Jackets" Riots In France Are What Happens When Facebook Gets Involved With Local News — Ryan Broderick in BuzzFeed News:

Due to the way algorithm changes made earlier this year interacted with the fierce devotion in France to local and regional identity, the country is now facing some of the worst riots in many years — and in Paris, the worst in half a century. This isn’t the first time real-life violence has followed a viral Facebook storm and it certainly won’t be the last. Much has already been written about the anti-Muslim Facebook riots in Myanmar and Sri Lanka and the WhatsApp lynchings in Brazil and India. Well, the same process is happening in Europe now, on a massive scale.

Sunday, 25 November 2018 - 6:00pm

This week, I have been mostly reading:

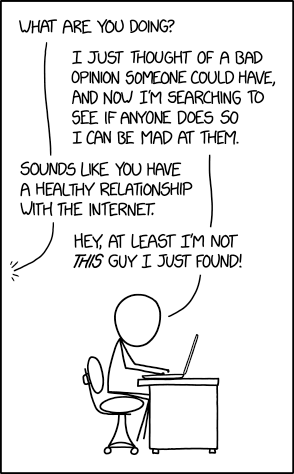

- Bad Opinions — xkcd:

- What a widely attacked experiment got right on the harmful effects of prisons — a frustratingly short read by Ashley Rubin in the Conversation:

In news articles, the Stanford experiment has been “debunked” and “exposed as a fraud.” Its findings have been declared “very wrong” and “fake.” It has been further criticized for experimenter interference, faked behaviour from participants and for research design problems, among other things. These serious critiques have generated much discussion in academic circles and in news articles about what, if anything, we can learn from the experiment. And yet, as someone who studies prisons, I’m struck by how much the Stanford Prison Experiment got right. A wealth of other research suggests prisons have serious detrimental effects on prisoners and prison workers alike.

- Calculating art — an excerpt from the latest book by Hannah Fry of the splendidly light and fluffy podcast the Curious Cases of Rutherford and Fry:

In October 1997, an audience arrived at the University of Oregon to hear the pianist Winifred Kerner play three short pieces. One was a lesser-known keyboard composition by the master of the Baroque, Johann Sebastian Bach. A second was composed in the style of Bach by Steve Larson, a professor of music at the university. And a third was composed by an algorithm, deliberately designed to imitate the style of Bach. After hearing the three performances, the audience was asked to guess which was which. To Larson’s dismay, the majority voted that his was the piece that had been composed by the computer. And to collective gasps of delighted horror, the audience learned that the music they’d voted as genuine Bach was nothing more than the work of a machine.

- Water-Ski Signals — Phil Are Go!:

- Stop telling people who need social care they aren’t eligible – be honest, there isn’t enough money — Peter Beresford in the Conversation:

When giving evidence to the Public Accounts Committee about [social care funding] earlier in the year, the permanent secretary at the Department of Health and Social Care, Chris Wormald, told MPs that there was enough money in the social care system to meet all of its statutory obligations. Many of the MPs struggled to reconcile this with the savagery of the cuts since 2010 and the realities facing a service said by its leaders to be in crisis and at a “tipping point”. The truth is that Wormald probably didn’t have the first idea how much resource the service requires. That is because the system operates as a perfect circle – a need is only a need if there is resource to meet it. In this way, there can never be unmet need and “statutory obligations” are always met. It makes no difference how large or small the budget or how much it contracts. It’s a very convenient device for political leaders confronted by a service with high fiscal risk but low public value.

[Misleading headline. For a currency-issuing government there is always enough money, but the core argument — that the definition of need for services varies according to the willingness of the government to spend on these services, and that this is duplicitous and inhumane — is entirely sound.] - Off the Mark — by Mark Parisi:

- Death of American on remote Indian island is an indictment of fundie "bubble boy" mentality — Darrell Lucus at Daily Kos:

Never mind that the Sentinelese have made it clear on several previous occasions that they want to be left alone. According to Survival International, a human rights organization that advocates for indigenous people, this is largely because of a harrowing incident that happened during the British colonial era. A colonial administrator took some Sentinelese adults and children to Port Blair, the largest settlement in the Andaman Islands, for reasons of “science.” However, the adults quickly died; then as now, their isolation made them vulnerable to illnesses to which they had no immunity. The children were brought back with gifts, though Survival International has good reason to believe they also passed on diseases they picked up on Port Blair. […] Is it possible that Chau didn't know to find out why the Sentinelese didn't want to be contacted by anyone, let alone Christian missionaries? His diaries, provided by his family to The Washington Post, certainly suggest this. In one entry, he wondered, “Lord, is this island Satan’s last stronghold where none have heard or even had the chance to hear your name?”

- Toward Community-Oriented, Public & Transparent Copyleft Policy Planning — by Bradley M. Kuhn:

Sadly, the age of license proliferation has returned. It's harder to stop this time, because this isn't merely about corporate vanity licenses. Companies now have complex FLOSS policy agendas, and those agendas are not to guarantee software freedom for all. While it is annoying that our community must again confront an old threat, we are fortunate the problem is not hidden: companies proposing their own licenses are now straightforward about their new FLOSS licenses' purposes: to maximize profits. Open-in-name-only licenses are now common, but seem like FLOSS licenses only to the most casual of readers. We've succeeded in convincing everyone to “check the OSI license list before you buy”. We can therefore easily dismiss licenses like Common Clause merely by stating they are non-free/non-open-source and urging the community to avoid them. But, the next stage of tactics have begun, and they are harder to combat. What happens when for-profit companies promulgate their own hyper-aggressive (quasi-)copyleft licenses that seek to pursue the key policy goal of “selling proprietary licenses” over “defending software freedom”?

- Hidden Treasures — Bizarro by Dan Pirarro:

Sunday, 4 November 2018 - 5:02pm

This week, I have been mostly reading:

- Outrage over schoolgirl refusing to stand for anthem shows rise of aggressive nationalism — Gwenda Tavan:

History is also often the victim of nationalist mobilisations. By this I mean the tendency of “patriots” to select those aspects of the national story that “fit” the narrative of a timeless, unified, undifferentiated, organic community to which they are “loyal”. In the process, they edit out the bits that show how contested and contingent our national story really is. The national anthem, Advance Australia Fair, is a case in point. Claims that not singing the anthem “disrespects our country and our veterans” assume the song holds deep historical, moral and sacred meaning. The truth is more prosaic. Advance Australia Fair became our national anthem in 1974, following a competition launched by the Whitlam Labor Government and a public opinion poll by the Australian Bureau of Statistics to identify the relative popularity of three “unofficial” Australian songs: Advance Australia Fair, Waltzing Matilda and Song of Australia. Advance Australia Fair was the clear front-runner, but it is worth remembering that only just over half of respondents (51.4%) nominated it. In other words, nearly 50% of the population did not. So much for collective unity.

- Non Sequitur — by Wiley Miller:

- Precarious private balance sheets driven by fiscal austerity is the problem — Bill Mitchell:

We have learned very little. Commentators still construct the crisis as a sovereign debt problem and demand that governments reduce fiscal deficits to give them ‘space’ to defend the economy in the next crisis. They are also noting that the balance sheets of the non-government sector components – households and firms – are looking rather precarious. They also tie that in with flat wages growth and a run down in household saving. But the link between the fiscal data and the non-government borrowing data is never made. So we are moving headlong into the next crisis with very little understanding of the relationship between government and non-government. And we are increasingly relying on private sector debt buildup to fund growth as governments retreat. Everything about that is wrong.

- Honourable Theft — George Monbiot:

Never underestimate the power of one determined person. What Carole Cadwalladr has done to Facebook and Big Data and Edward Snowden has done to the state security complex, the young Kazakhstani scientist Alexandra Elbakyan has done to the multi-billion dollar industry that traps knowledge behind paywalls. Her pirate webscraper service, Sci-hub, has done more than any government to tackle one of the biggest rip-offs of the modern era: the capture of research that should belong to us all. […] After my cancer diagnosis earlier this year, I was offered a choice of treatments. I wanted to make an informed decision. This meant reading scientific papers. Had I not used the stolen material provided by Sci-hub, it would have cost me thousands. Because, like most people, I didn’t have this money, I would have given up before I was properly informed. I have never met Alexandra Elbakyan, and I can only speculate about alternative outcomes, had the research I read not swayed my decision. But it is possible that she has saved my life.

- If Other Nations Mourned Like the U.S. — Ted Rall:

- Mainstream Economics Has Become a Celebration of the Wealthy Rentier Class — Michael Hudson in Evonomics:

The reality is that you don’t have to be smart to make a lot of money. All you need is greed. And that can’t be taught in business schools. In fact, when I went to work as a balance-of-payments analyst at Chase Manhattan in 1964, I was told that the best currency traders came from the Brooklyn or Hong Kong slums. Their entire life was devoted to making money, to rise into the class of the proverbial Babbitts of our time: nouveau riches lacking in real culture or intellectual curiosity. Of course, for bankers who do venture to “stretch the envelope” (the fraudster’s euphemism for breaking the law, as Citigroup did in 1999 when it merged with Travelers’ Insurance prior to the Clinton administration rejecting Glass-Steagall), you do need smart lawyers. But even here, Donald Trump explained the key that he learned from mob lawyer Roy Cohn: what matters is not so much the law, as what judge you have. And the U.S. courts have been privatized by electing judges whose campaign contributors back deregulators and non-prosecutors. So the wealthy escape from being subject to the law.

- The Lehman 10th Anniversary spin as a Teachable Moment — Michael Hudson:

What has been put in place is not a restoration of traditional status quo, but a reversal of over a century of central bank policy. Failed banks have not been taken into the public domain. They have been enriched far beyond their former levels. The perpetrators of the collapse have been rewarded, not penalized for lending more than could possibly be paid by NINJA borrowers and speculators whose mortgage applications were doctored by systemic fraud at Countrywide, Washington Mutual, Bank of America, Citigroup and their cohorts. The $4.3 trillion that could have been used to save debtors was given to the banks and Wall Street firms whose recklessness and outright fraud caused the crisis. The Federal Reserve “cash for trash” swaps with insolvent banks did not restore normalcy or the status quo ante. What occurred was a financial revolution by stealth, reversing the traditional responsibility of creditors to make prudent loans.

- Joan Robinson, philosopher — Alexander Douglas:

The first significant contribution that Robinson made to the philosophy of economics kicked off the famous ‘Cambridge Capital Controversy’. Robinson noted that economists often build models in which rational decisions are made about how much ‘capital’ to employ. ‘Capital’ is often represented by a single variable, k. Robinson found it conceptually impossible to specify a unit of magnitude here: how many broomsticks, she asked, equals one blast furnace? ‘“Capital”’, she wrote with the standard logician’s nod to Lewis Carroll, ‘is not what capital is called, it is what the name is called’.

- Non Sequitur — by Wiley Miller:

- Everything he does, he does it for us. Why Bryan Adams is on to something important about copyright — Rebecca Giblin in the Conversation:

Authors, artists and composers often have little bargaining power, and are often pressured to sign away their rights to their publisher for life. Adams appeared before a Canadian House of Commons committee to argue they should be entitled to reclaim ownership of their creations 25 years after they sign them away. […] The copyright term needed to provide an incentive to create something is pretty short. The Productivity Commission has estimated the average commercial life of a piece of music, for example is two to five years. Most pieces of visual art yield commercial income for just two years, with distribution highly skewed toward the small number with a longer life. The average commercial life of a film is three to six years. For books, it is typically 1.4 to five years; 90% of books are out of print after two years. It is well accepted by economists that a term of about 25 years is the maximum needed to incentivise the creation of works.

- Trump rally — Keith Knight in Daily Kos:

Sunday, 28 October 2018 - 3:25pm

This week, I have been mostly reading:

- Bankers, art and tax paranoia driven Ponzi schemes — Richard Murphy:

The evidence it is that the vast majority of this art does not end up being displayed on the walls of a home, gallery, office, or anywhere else. Most of it is stored in the vaults of one of the art warehouses in the free ports of the world. […] What is more, this art market, pumped by a continual stream of new clients created by finance houses seeking to advise clients to join the trend, creates not just another asset bubble, but in fact an alternative currency as a mechanism for transferring value. The fact that art can also be stored in tax-free warehouse locations, beyond the reach of even local tax authorities with regard to any form of taxation in the state where it physically resides, just adds to this appeal. Who needs bitcoin to achieve anonymity when a Picasso in a warehouse achieves the same goal without all the risks that cryptocurrency entails?

- The Alcohol and Health Puzzle — Nigel Barber in Psychology Today:

Denmark has more drinkers than any other country (95.3 percent women, 97.1 percent men). Despite drinking a lot, Denmark has repeatedly come out at the top of the heap in surveys of happiness. A skeptic might retort that more Danes take the survey while actually intoxicated. Amusing as this explanation is, it seems far-fetched. A more plausible explanation could be that the Danes, like the Irish, spend more time in pubs that play a central role in social networks in these countries. Another source of happiness in Denmark could be the very good quality of life that residents enjoy thanks to their affluence and the well-developed social democracy that minimizes inequality and alienation

- Central Bankers as ‘Dealers of Last Resort’ — Marshall Auerback in Naked Capitalism and elsewhere:

A CDS is an instrument used by a buyer of corporate or sovereign debt. It was designed to eliminate possible loss arising from default by the issuer of the bonds. In theory, the swap acts like an insurance policy, the only difference being that (in the words of Mehrling): insurance is “organized as a network of promises to pay in the event that someone else doesn’t pay whereas our own world [the credit default swap] is organized as a network of promises to buy in the event that someone else doesn’t buy.” Of course, as we learned from the AIG fiasco, it becomes impossible to act as a credible writer of insurance, if you don’t have the financial resources to make good on the insurance payment if and when disaster strikes. Unable to make good the insurance payments arising from the swaps, AIG eventually had to be bailed out. By contrast, the Treasury/Federal Reserve (it’s useful to think of them as a unified whole in this instance) is uniquely placed to make the CDS a credible instrument, as it can always create the dollars required to make good the payment in the event of default (or financial accidents). But for the CDS system to work going forward, the Fed (or any other central banker/dealer of last resort) has to “charge” the right premium to reflect the risks being undertaken by the parties who enter into a contract to buy and sell the CDSs. And if that means charging such an extortionate premium that the underlying activity (or event) isn’t undertaken, so much the better for financial stability.

- Young couples 'trapped in car dependency' — Roger Harrabin, BBC environment analyst:

Researchers visited more than 20 new housing developments across England in what they say is the first piece of research of its kind. They found that the scramble to build new homes is producing houses next to bypasses and link roads which are too far out of town to walk or cycle, and which lack good local buses.

Gosh. Imagine such a thing! Oh, hang on, I don't have to… - Bizarro — Wayno & Pirarro:

- Cesar Sayoc’s Home Was Foreclosed on by Steve Mnuchin’s Bank, Using Dodgy Paperwork — David Dayen at the Intercept, with everything you need to know to understand US politics:

It’s highly doubtful Sayoc knew any of this when he allegedly sent bombs through the mail. But it shows how political partisans cannot often assess what forces carry the greatest impact on their lives. A miscreant bank foreclosed on Sayoc. Democrats could have done more to punish that bank and others like it for a mountain of foreclosure-related crimes, but they failed to do so. That created a sense that the system was rigged, providing an opening for a right-wing populist like Trump.

- Forget jobs. Will robots destroy our public services? — Atif Shafique for the RSA:

In her groundbreaking but frightening book Automating Inequality, academic Virginia Eubanks examines how in the US advancements in technology - particularly automated decision-making, data mining and predictive analytics - are being used to control the poor and sever their access to public support. The book shows that this is nothing new: it is part of a historical trend stretching back decades. Crucially, Eubanks doesn’t entertain the science fiction notion that the real threat comes from machines outsmarting humans, becoming unaccountable and wreaking havoc as people look on helplessly. Neither is it just a case of human biases unintentionally finding their way into technology, as critics of algorithmic decision-making have cautioned. Instead, some of the worst features of the tech are intentional and baked in from the beginning.

- Why positive thinking won’t get you out of poverty — Farwa Sial and Carolina Alves in openDemocracy:

Poverty alleviation, however, is a hugely complex subject that touches on the strengthening of institutions, the health of governance, the structure and dynamics of markets, the workings of social classes, macroeconomic policies, distribution, international integration and many other issues, none of which can be replicated from one context to another. That means that analyses of poverty have to be based on a critical examination of processes and actors that cannot be ‘controlled’ against—thus violating the principle of [Randomised Controlled Trials]. Recent developments in economics have failed to account for these fundamental determinants of poverty. Instead, the success of RCTs can be narrowed down to essentially statistical arguments that seek to identify ‘what works’ and ‘which interventions’ should therefore be employed to improve the lives of the poor. In such processes, the focus tends towards the individual or the household and (initially at least) to the design of small changes that are supposed to enable them to exit poverty, although eventually the ‘scaling up’ of interventions might also occur. Akin to the ‘nudge’ approach that has been popularised by Cass Sunstein and Richard Thaler, the idea is that people’s choices can be shaped to allow them to escape from poverty and dispossession. As a consequence, this approach individualises the ‘problem’ of poverty whilst failing to acknowledge, contextualize, highlight or analyse the structures, institutions and actors that actually make and keep some people poor.

- 'It's Like Amazon, But for Preschool' — Audrey Watters:

A year ago, the richest man in the world asked Twitter for suggestions on how he should most efficiently and charitably spend his wealth. And today, Jeff Bezos unveiled a few details about his plans – other than funding space travel, that is. His new philanthropic effort, The Day 1 Fund, will finance two initiatives: the Families Fund will work with existing organizations to address homelessness and hunger; and the Academies fund “will launch an operate a network of high-quality, full-scholarship, Montessori-inspired preschools in underserved communities.” “We’ll use the same set of principles that have driven Amazon,” Bezos wrote in a note posted to Twitter. “Most important among these will be genuine intense customer obsession. The child will be the customer.”

- On “the policy” and the Governor of the Bank of England — Ann Pettifor for Progressive Economy Forum:

Mark Carney was appointed by George Osborne in late 2012 in the hope that new blood at the Bank would give both the institution and the economy a boost. His salary was set at a considerably higher rate (at £480,000) than that of predecessor (£305,000) in the hope that he would deliver. Instead he has presided over a period of prolonged stagnation. In his defence, the persistent weakness of the UK economy cannot be attributed to him, or to any single man or woman. The setting of post-crisis policy by the Treasury and the Chancellor; the stubborn insistence on contracting the economy by grinding it down with austerity – these policies were endorsed by Carney, but were not of his design. He never raised any substantial objection to the dysfunctional nature of ‘monetary radicalism and fiscal consolidation’. Instead, he once remarked correctly that the Bank was “the only game in town.” Five years after his appointment, and ten years after Lehman’s bankruptcy, the economy continues to vegetate.