Housing

Homelessness among racialized persons

Chapter 7 of my open access textbook has just been released. This chapter focuses on homelessness experienced by racialized persons.

A ‘top 10’ summary of the chapter can be found here (in English):

https://nickfalvo.ca/homelessness-among-racialized-persons/

A ‘top 10’ summary of the chapter in French can be found here:

https://nickfalvo.ca/litinerance-chez-les-personnes-racialisees/

The full chapter can be found here (English only):

https://nickfalvo.ca/wp-content/uploads/2024/01/Falvo-Chapter-7-Racializ...

All material related to the book is available here: https://nickfalvo.ca/book/

Exclusive: how the Poplar and Limehouse trigger ballot was rigged against Apsana Begum

Allegations of irregularities become concrete example of branch fix that prevented Muslim woman MP being automatically selected to stand again

In 2022, Poplar and Limehouse’s left-wing Muslim woman MP Apsana Begum faced a ‘vicious and misogynistic’ campaign to deselect her that had left campaigners and women’s groups horrified.

The campaign followed a party attempt to remove Begum as the London constituency’s MP by prosecuting her for housing fraud. The stitch-up fell apart when a court threw out the charges brought by allies of her allegedly-abusive ex-husband – forcing Labour party vultures, who had been at the court in anticipation of a guilty verdict to announce a contest to replace her, to slink away disappointed and unable to install a favoured right-winger in the overwhelmingly Labour-voting seat.

After the ‘lawfare’ failed, Begum’s many supporters accused the party of gross abuse of process, of bullying and intimidation, and even of outright rigging in its determination to ‘trigger’ Begum and force her into a selection contest – and Begum was even threatened with ‘serious abuse’ by a relative of her ex.

Now Skwawkbox has received details from local members of one of the selection meetings demonstrating how the trigger vote was rigged – a vote that both exemplifies the stitch-up tactics and would have ensured Begum was selected again automatically had the party reacted and investigated properly. These can now be exposed and they corroborate earlier evidence at the time of the process.

Begum’s trigger ballot process started in May 2022, just after the local council elections – and from the start, locals say it was marred by blatant breaking of party rules.

Only an MP and her supporters are allowed to campaign during the process, and no-one is allowed to campaign as if they were an alternative candidate. Opponents of Begum who supported her being triggered completely ignored these rules. Many complaints were made to the party but were ignored.

The trigger ballot meeting for Lansbury and Poplar – a branch consisting of two wards combined – was the first of the CLP’s votes to be held, on 31st May 2022. A large group of people vocally supporting a vote to trigger Begum gathered outside the hall, telling people to vote for the trigger and giving out slips of paper with marked up dummy ballot papers to guide any unsure of the process, acts completely against party rules. Branch officials told these agitators that what they were doing was completely against the rules, but they refused to stop.

Inside the hall, the meeting was in uproar before it even began, with aggression and abuse by Begum’s opponents, who were even ‘yelling and jumping up and down and waving fists in the faces of branch officers’. Some went as far as openly demanding that Labour’s official protocol for the meeting be abandoned and to go straight to a vote, so they could – in as many words – ‘vote for the trigger and go home!’

At this point, a senior officer of the constituency-wide party (CLP) turned up at the meeting, despite having no official role there – Skwawkbox understands that several CLP officers are close to Begum’s ex-husband and determined to oust her.

As people were being ticked off the eligible voter list to ensure only those entitled to vote took part, several people arrived who were not on the list, fuelling the aggressive and intimidatory atmosphere as they demanded to be let in.

The CLP officer said they would check eligibility through their phone – and insisted that four extra people be allowed into the meeting and given ballot papers. Requests to clarify where this information came from were ignored.

When the vote was taken, the result was 43-43 – meaning that if the four pro-trigger voters were not eligible to vote, the real result would have been a victory for Begum by 43-39. This would have meant Begum won the required ten percent in the CLP section vote – which under Labour’s rules meant she had won the trigger process and would automatically stand again as Labour’s candidate in the next parliamentary election.

Labour ignored a string of complaints about this meeting and dismissed the few it responded to. But when the membership system was finally accessible again (after being out of action because of a hacking attack), branch members were able to confirm that the one extra ‘member’ allowed in by the CLP officer – the only one known personally to other members present – was not eligible to vote, because her membership had been confirmed well before the trigger meeting to have lapsed. There was no way she could have been on the CLP officer’s ‘list’.

The names of the other three names allowed in were written at the time on the master copy of the attendee list – but the CLP observer, also an opponent of Begum – insisted on taking it away with him. But even if they were bona fide members – which they were not because they appeared on no membership list – Begum still won the vote 43-42, and so would have automatically been selected to stand again.

Members have lodged multiple complaints about this abuse of process but have been ignored. Even if the other branch votes were held in perfect propriety – which goes against reports of the way they were conducted – the real result in Lansbury and Poplar was enough to select Begum uncontested.

Labour has been accused repeatedly, up and down the country, of rigging trigger and selection processes, sometimes successfully – for example in nearby Ilford South to remove incumbent Sam Tarry – and occasionally not, as when Liverpool West Derby MP Ian Byrne was able to fight off repeated attempts.

So bad has the party’s conduct been that even journalist Michael Crick – no left-winger – who runs the ‘tomorrowsmps’ Twitter account detailing the latest selection news has publicly voiced his own concerns about Labour’s rigging and abuse of its selection processes. Now the mechanism – or at least one of them – for rigging in Poplar and Limehouse to oust a popular left-wing MP has been laid bare by the evidence and the testimonies of locals.

SKWAWKBOX needs your help. The site is provided free of charge but depends on the support of its readers to be viable. If you’d like to help it keep revealing the news as it is and not what the Establishment wants you to hear – and can afford to without hardship – please click here to arrange a one-off or modest monthly donation via PayPal or here to set up a monthly donation via GoCardless (SKWAWKBOX will contact you to confirm the GoCardless amount). Thanks for your solidarity so SKWAWKBOX can keep doing its job.

If you wish to republish this post for non-commercial use, you are welcome to do so – see here for more.

Conservative Idaho: Poised to Resist Sprawl?

by Dave Rollo

Idaho’s Sawtooth Mountain Range. (USDA)

The USA, Canada, and other countries have long recognized sprawl as a vexing dimension of urban development. Especially challenging is the difficulty creating the public consensus needed for political and planning responses to the problem.

But growing numbers of residents today are expressing their distaste for sprawling approaches to development and are primed to resist it. Perhaps surprisingly, sprawl afflicts a U.S. state better known for its natural beauty and its potatoes: Idaho. Even more surprising, and hopeful, is the growing opposition to sprawl among the state’s citizens.

An Urban Malignancy

Sprawl, one of the chief products of the urban growth machine, entails a development and building pattern that is damaging to the environment and to a community’s quality of life.

The monotony of sprawl replaces farmland and natural habitat. (Mark Strozier, Flickr)

Characterized by an expansive diffusion of roads, housing, and other built infrastructure, sprawl has become ubiquitous across the USA and Canada. With its emphasis on separation of commercial, residential, and public uses, sprawl employs great quantities of concrete and asphalt infrastructure and promotes car use. Furthermore, its high energy demands are maladaptive for a future of energy limits. Lax and aesthetically unimaginative design standards create a monotonous landscape that swaps traditional beauty for strip malls, big box stores, and McMansions.

Sprawl eats up natural habitats, demands huge amounts of resources and energy, and leads to isolation, social segregation, and other societal harms. However, in the short term, sprawl generates profits for development interests, especially when demand is high, and when planning codes permit or even encourage it.

Losing Natural Assets

Idaho is ecologically rich and abundant in quality farmland, rangeland, and water resources, assets threatened by pro-growth development in cities and counties across the state.

Idaho is often ranked in the top tier of states endowed with natural beauty. It borders Yellowstone National Park and the Grand Tetons and includes the strikingly beautiful Sawtooth Mountain Range, which runs through the center of the state. That range boasts four unique plant and animal communities and provides habitat for numerous species. Idaho’s natural features also include sagebrush steppe, an ecosystem that supports 350 rare, threatened, and endangered species.

Besides its magnificent wildlands, Idaho is endowed with a vibrant agricultural base, composed of some 25,000 ranches and farms. Food abundance is evidenced by the state’s seventh-place ranking in the USA for agricultural exports per capita. Furthermore, 26 percent of Idaho’s agricultural land is considered “nationally significant” by the American Farmland Trust; that is, it ranks among the best in the nation for long-term food production.

Yet Idaho’s natural assets are threatened by population pressure, which often drives land conversion. Idaho is one of the two fastest-growing states, with immigration from California accounting for nearly 40 percent of Idaho’s population increase in 2021. Spokane Public Radio reports that Idaho is projected to add 800,000 residents by 2060, an increase of 42 percent from the current population.

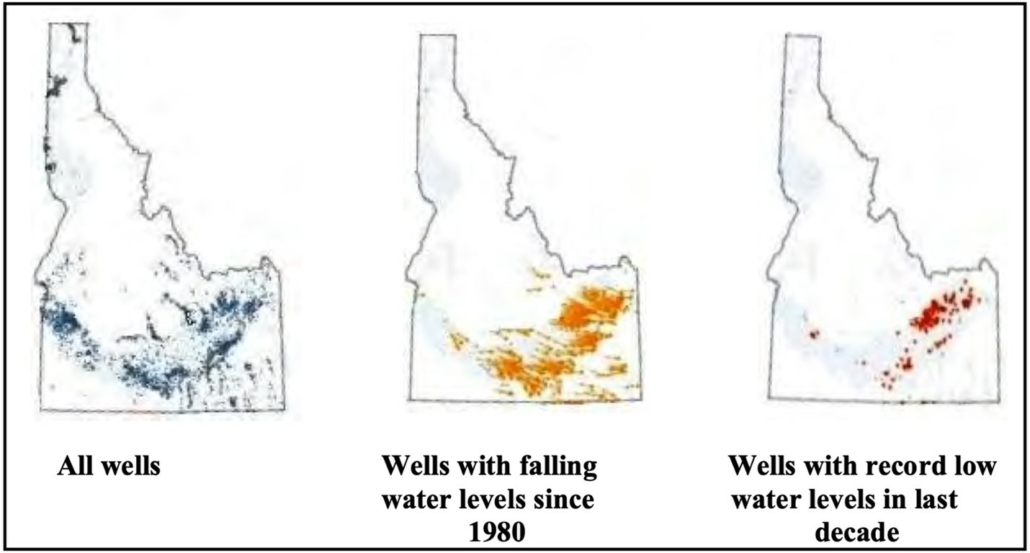

Aquifer depletion is already a problem in Idaho. (NumbersUSA)

This population pressure was largely responsible for the loss of some 370,000 acres of farmland and natural habitat between 1982 and 2017. The nationally significant share of agricultural land was more than three times as likely to be developed as other cropland. Population increase and attendant sprawl negatively impacts the sagebrush steppe in Idaho, with the greatest decline in ecological integrity in the fastest-growing regions of the state.

Apart from displacing cropland and wildlife habitats, new residences place added pressure on water tables, which are falling in Idaho. As aquifers trend toward depletion, allocating more water for a growing population will only serve to exacerbate the problem—in part through arguably wasteful uses of water, such as irrigation of turfgrass lawns, which competes with agricultural irrigation. Increased economic activity also generates contaminated stormwater, septic leakage, and yard pesticides that seep into groundwater and adversely affect aquifers.

Gauging Sentiment and Building Consensus

Prospective increases in the human population and the evident failure of land use regulations to limit the impact of growth have alarmed many residents of Idaho. Concerns about farmland loss and the degradation of Idaho’s environment prompted a 2023 study to assess the problem of population growth and sprawl in Idaho and take the pulse of the populace.

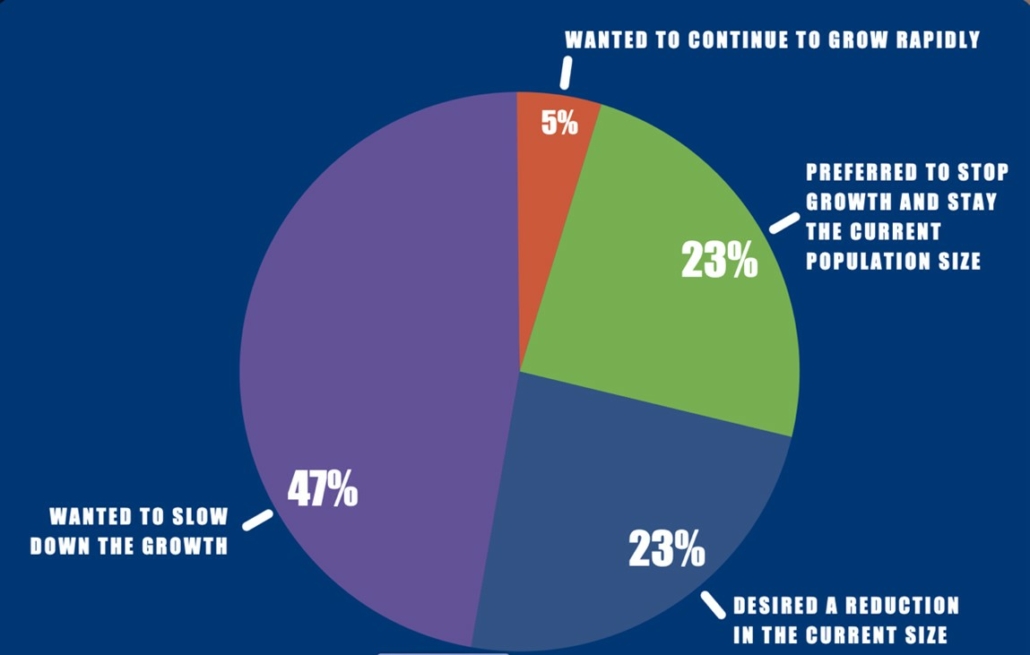

The overwhelming majority of Idaho residents see population growth as a problem. (www.IdahoSprawl.com).

NumbersUSA, a non-partisan, non-profit organization that advocates for “sensible immigration reform,” published a report on the study last month. The report establishes in detail the degree of habitat and farmland loss over several decades. Of the 370,000 acres lost, 77 percent was due to population increase, while 23 percent was caused by land conversion by the existing population.

The report also contains a survey of Idaho residents conducted by Rasmussen Reports that documents public awareness of sprawl and concern over it. More than three-quarters of respondents believe Idaho’s growing population negatively affects its open spaces and environment. And fully 93 percent see current growth as a problem and wish to slow, reverse, or stop it.

Furthermore, aquifer depletion is on the public’s mind. Some 73 percent of respondents oppose diverting water from agriculture to development. Clearly the citizens of Idaho understand that it’s not in their interest to compromise a precious and limited resource.

Addressing the Problem

Besides assessing the contextual problem of sprawl in Idaho, the report addresses how urban areas could implement zoning code changes to restrict encroachment of development, thus protecting farmland and natural features such as forests or sagebrush steppe.

Permissive land use (zoning) codes are one way sprawl is unleashed. Sprawl is also promoted when developers are not required to internalize the costs of added community infrastructure, such as water and sewer lines. Their development activity is essentially subsidized by taxpayers.

Various zoning tools can mitigate the impact of sprawl by incentivizing density. Tools such as the transfer of development rights, infill strategies, and permitting multifamily apartments instead of single-family housing all help to limit diffused development patterns. Implemented appropriately, these tools can increase density in ways that increase overall livability.

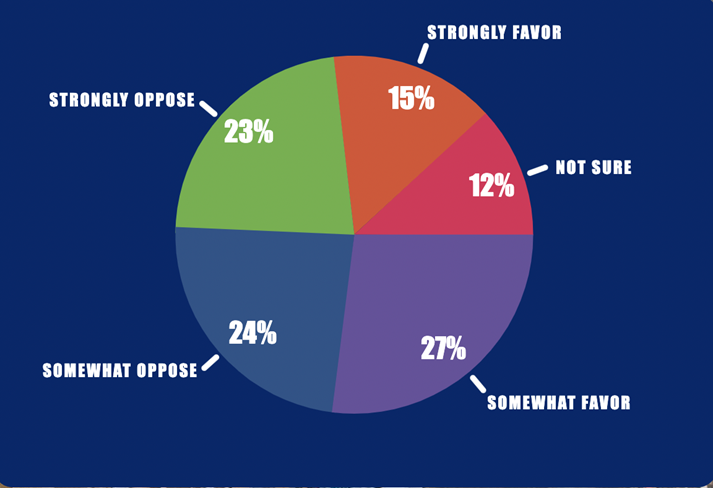

Sentiments of Idahoans on zoning that encourages high-density development. (www.IdahoSprawl.com).

The NumbersUSA poll indicates that Idahoans are split on this approach, with 42 percent favoring regulations that encourage apartments and condos over single-family housing versus 47 percent strongly or somewhat opposed to such regulations.

While the approach of internalizing costs—that is, increasing development fees to offset the costs to the community for new development—was not directly addressed by the poll, Idahoans are resoundingly opposed to public subsidization of new development. Nearly 80 percent of respondents expressed opposition to paying higher property taxes to cover the infrastructure costs of new subdivisions.

Pressure on public infrastructure such as roads, sewers, water utilities, police and fire stations, and schools increases with an expanding population and its growing economy, and these facilities often become overextended. The costs of such services are supposed to be borne by the new residents, but are externalized to the existing residents.

One way to prevent such externalization is to impose caps on services. For example, sewer hook-ups can be limited. Limiting hook-ups to sewage lines and wastewater treatment plants was favored by half of respondents, while 22 percent were unsure and just over a quarter were opposed.

Up to the Challenge?

While it’s clear that population growth and the development pressures that follow are negatively affecting residents of Idaho, their county and municipal governments are having a limited impact in restraining sprawl as planners continue with a business-as-usual approach to development.

Recognizing sprawl as a threat should be made explicit within county planning documents and clear measures to limit sprawl should be specified. Yet, the comprehensive plans of seven of the eight fastest growing counties in Idaho mention ‘grow’, ‘growth,’ or ‘growing’ 1063 times in all, while sprawl garners only 15 mentions. And most of the references to growth focus on how to accommodate it; little mention is made of growth’s negative impacts.

Greater density can mean greater livability (La Citta Vita, Wikimedia Commons)

Boise is Idaho’s largest city and its capital. It was also one of the first communities in the state to experience the impacts of sprawl. Sprawl from Boise continues at a fierce pace with 24,000 new residents pouring into the city in just the past 2 years. “Blueprint Boise” is the 2021 updated comprehensive plan for Boise, whose more than half a million residents comprise over a quarter of the population of Idaho.

While Blueprint Boise is similarly light on references to sprawl (a single mention), it offers some measures to mitigate sprawl. In response to population pressures, the comprehensive plan adopted strategies to add density and to guide growth within a set of neighborhood and area master plans.

But critics of the plan complain that it does not adequately describe the consequences of growth and sprawl. And they blame continued loss of farmland and other open spaces on the failure of regional coordination, especially the absence of concurrency. Concurrency is a planning concept that mandates that adequate public facilities be in place before development is approved.

The threats to Idaho’s natural places, farmland, and rangeland will continue as population and economic pressures mount. Most of Idaho’s counties are ill-equipped to address the pressures that come with the surge in population. Recent efforts to make clear to Idaho’s elected officials that action is needed are also bound to intensify. Bold action is required soon. Which communities in Idaho will choose to lead on confronting the problem of sprawl, inspiring others to follow?

Dave Rollo is a Policy Specialist at CASSE.

The post Conservative Idaho: Poised to Resist Sprawl? appeared first on Center for the Advancement of the Steady State Economy.

Is UK monetary policy driving private housing rents?

Daniel Albuquerque and Jamie Lenney

Rent prices have risen by 9% on average in England since the Bank of England’s Monetary Policy Committee (MPC) started raising interest rates in December 2021. Alongside this rise in prices has been a widening in the gap between reported supply and demand in the rental sector, with tenant demand continuing to rise in 2023 amidst falling supply (RICS survey). Is monetary policy causing the rise in rents? In this post, we provide evidence that temporary increases in interest rates are ultimately associated with a decrease in rental prices that follows an initial, but relatively short lived, increase in rental prices and tenant demand. These results also hold across regions in England.

Rising rents and monetary policy

The recent rise in rents will be of significant concern to the 19% of households in the UK that are private renters, for whom housing costs already take up 33% of their income on average. Despite the fact that rising interest rates have been implemented to reduce overall price inflation, monetary policy has been cited as a possible cause of rising rental prices principally through two channels. First, the resulting increase in mortgage costs has consequences for both supply and demand in the rental market: it can discourage new buy-to-let landlords, and keep future homeowners as tenants for longer. Second, housing is an investable asset, and returns on other assets are rising due to the increase in interest rates. Thus, even non-mortgagor landlords are likely to increase rents in response to rising interest rates to match the expected return on other assets.

However, empirical evidence is mixed – in the US, for example, economists at the San Francisco Fed find that rents immediately decline in response to rising interest rates, while other work has documented increases in rental prices without a subsequent decline.

So is there any evidence that monetary policy is pushing up rental prices in the UK?

Estimating the causal effect of monetary policy on the rental market

In order to answer this question we use a local projections framework with 12 lags of the variable of interest as controls. We rely on monetary policy surprises identified in the 30-minute windows around MPC announcements to estimate the effect of monetary policy on rental prices, as described in more detail by Cesa-Bianchi et al (2020). We use unexpected changes (surprises) to identify the effect of monetary policy because most interest rate changes are made in response to current and future economic conditions. Simply using all interest rate changes would mix up the effect of interest rates on rental prices with the effects of other shocks that interest rates are trying to counteract.

For rental prices, we use data from ONS’s Index of Private Housing Rental Prices from 2005 to 2019, for England. We focus on England because data for the whole of the UK is available from 2015 only. We choose to end our data sample in 2019: we exclude the Covid pandemic period, because the relationship between monetary policy and rental prices may have changed during this time; and we have insufficient lags of data to make it worthwhile including data post-pandemic.

Chart 1 shows the estimated response of housing rents to a 1 percentage point rise in interest rates. The response for England as a whole is the dark blue line with the 1 standard deviation confidence interval shaded in blue. We also plot the point estimates for each English region in grey. The point estimates indicate rental prices rise by around 1% over the 12 months following a rise in interest rates. This result is replicated in most regions in England with the exception of the East Midlands, where the central estimate shows no rise in rents. Chart 1 also shows that after around 12 months this rise begins to dissipate, and by month 22 the point estimate is below zero in all regions.

Chart 1: The response of private rental prices to a 1 percentage point rise in interest rates

Note: The blue shaded region is the 1 standard deviation confidence interval for England.

Does the response of rental prices make sense?

As noted above, since housing is an asset, when real interest rates rise the real return on housing should ultimately also rise in line with other available returns. This real return can be achieved by either rising rents or falling house prices, or some combination of the two. Using the same local projections framework as in Chart 1, Panel A in Chart 2 shows that rental yields (rent divided by house price) do indeed rise in response to rising interest rates. Panel B decomposes this response in rental yields for England between movements in rental prices and movement in house prices (the latter is calculated as a residual).

Chart 2: Response of rental yields to a 1 percentage point rise in interest rates, and its decomposition between yield and house prices movements

Note: The blue shaded region is the 1 standard deviation confidence interval for England.

As Chart 2B shows, rental prices increase initially, in line with the increase in rental yields. However, our estimates suggest that most of the adjustment is coming from falling house prices, even though that adjustment is sluggish and takes almost a full year to materialise. As house prices are slow to adjust, this puts pressure on rents to rise at first in order for landlords to make adequate returns relative to their outside option ie selling and investing in other assets like government bonds. At the same time, we find that housing transactions fall in the year following the interest rate rise (Chart 4A uses the local projections frameworks from before on UK Land registry data for housing transactions). This slowdown in housing transactions can help explain a reduction in the supply of rental housing if selling landlords take their property off the rental market but struggle to find prospective buy-to-let landlords who, discouraged by rising mortgage rates, need house prices to fall further to make adequate returns.

Using survey data on the residential market provided by RICS and household panel data from Understanding Society we can also analyse the effect of monetary policy on tenant demand. Panel A in Chart 3 uses a similar framework as used in Chart 1 to plot the response of the reported net balances of changes in tenant demand in the rental market in the RICS survey. It shows that a rise in interest rates is initially associated with a rise in tenant demand that then dissipates after around a year. In Panel B, using individual panel data, we show that the estimated probability of home ownership falls for younger cohorts in the 12 months following a rise in interest rates. This helps to partially explain the rise in tenant demand through a delay in the transition from renting to owning.

Chart 3: Tenant demand after a 1 percentage point rise in interest rates

Note: The blue shaded regions are 1 standard deviation confidence intervals.

So initially rising interest rates could well cause pricing pressures in the rental market. However, over time house prices fall due to tighter monetary policy and enable new landlords to come in and offer lower rents. At the same time, households are likely to become increasingly unwilling to accept and afford rent increases as the effect of monetary policy on their real income builds. This gradual transmission of monetary policy to broader economic activity and incomes is illustrated in Panel B of Chart 4, which uses a similar framework to that of Cesa-Bianchi et al (2020) to show an estimate for the effect of a 1 percentage point rise in interest rates on GDP. Panel B shows GDP falling gradually with the peak impact occurring after around 12 months and persisting beyond that.

Chart 4: The gradual response of housing transactions and economic activity to a 1 percentage point rise in interest rates

Note: The blue shaded region is the the 1 standard deviation confidence interval.

Rental prices in context today

The causal effect of monetary policy in any given cycle is always difficult to disentangle from other broader shocks. This is especially true today with the UK in the midst of a broader inflationary shock, and still recovering from the longer-run economic effects of Covid that upended housing markets and migration flows. It is also worth noting that there have been changes in regulations affecting the rental market. These shocks are both directly and indirectly the underlying drivers of rising rents. Chart 5 plots the rise in private rents since December 2021 alongside the rise in average earnings and the level of CPI services. Both have tracked and indeed outgrown the rise in private rental prices, meaning that the relative cost of renting on average has not risen since interest rates started to increase. Compared to our results this is somewhat surprising, as our analysis would suggest rents could be growing faster than wages or other services now. However, other shocks to the UK’s labour market or cost pressures in specific sectors make it difficult to be definitive in this statement. Overall, through the lens of Chart 5, the pressures in the rental market seem to be consistent with the broader supply constraints in the economy.

Chart 5: Rental prices relative to incomes and other prices

Note: Prices are in levels and normalised to 100 at December 2021. Earnings are average weekly labour earnings.

Summing up

This post suggests that interest rate rises decrease rental prices in the long run, but that they may initially put pressure on the rental market. In our analysis, a temporary rise in interest rates leads to temporary increases in rental yields, as happens for returns on other assets in the economy. Tenant demand rises at first and landlord supply may be dampened by rising mortgage costs and slow adjustment of house prices. However, over time, our results indicate that the housing market should adjust, causing rental prices to decline.

Daniel Albuquerque and Jamie Lenney work in the Bank’s Monetary Policy and Outlook Division.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

FHA First‑Time Buyer Homeownership Sustainability: An Update

An important part of the mission of the Federal Housing Administration (FHA) is to provide affordable mortgages that both promote the transition from renting to owning and create “sustainable” homeownership. The FHA has never defined what it means by sustainability. However, we developed a scorecard in 2018 that tracks the long-term outcomes of FHA first-time buyers (FTBs) and update it again in this post. The data show that from 2011 to 2016 roughly

21.8 percent of FHA FTBs failed to sustain their homeownership.

In December 2009, the FHA Commissioner David Stevens described the FHA’s mission as follows:

“As a mission-driven organization, FHA’s goal is to provide sustainable homeownership options for qualified borrowers.”

However, in the following fourteen years, the FHA never further articulated what it means by sustainable homeownership, nor has it proposed any metrics for tracking its progress against this important goal.

To promote affordable mortgages, the FHA provides default insurance to lenders against any credit losses. An important aim of the FHA is to foster the transition of households from renting to owning. Only then can the household begin to build home equity. However, the ultimate success of this home equity accumulation depends critically on the sustainability of homeownership.

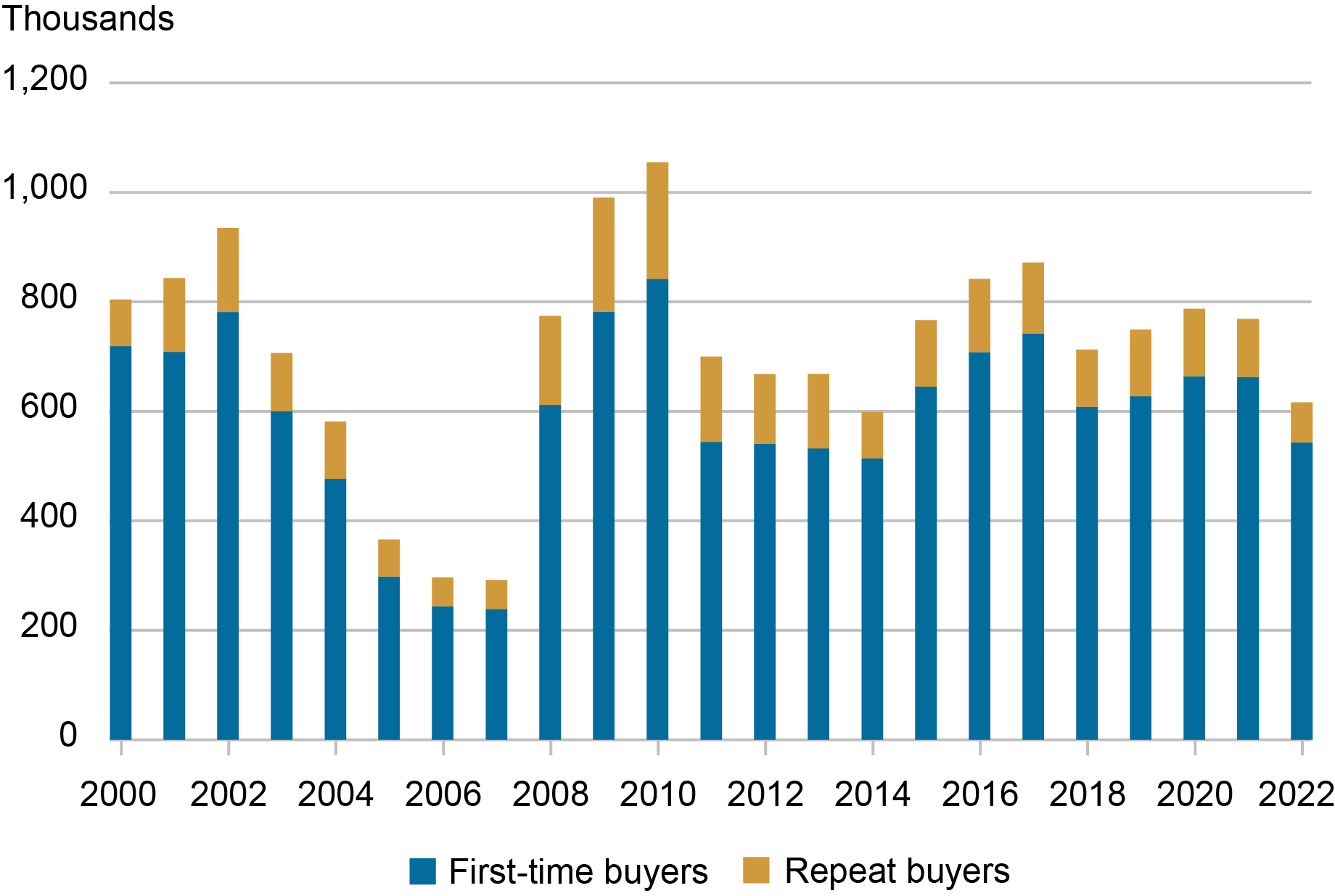

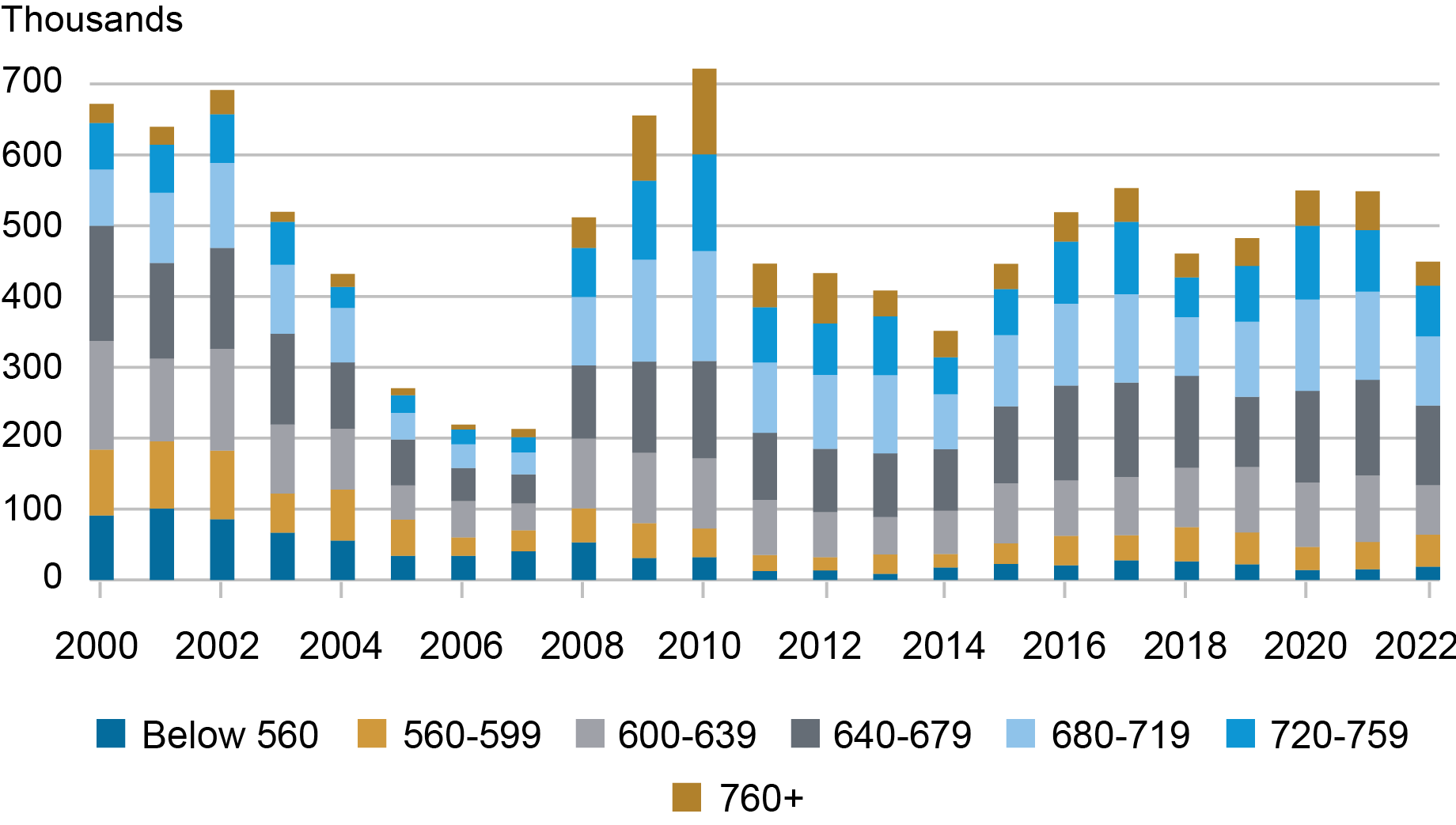

The focus of the FHA on the transition from renting to owning can be seen by its very high share of mortgages for home purchases going to first-time buyers. We use the Federal Reserve Bank of New York’s Consumer Credit Panel (CCP) data to identify a FTB as a household taking on a mortgage when it has never previously had a mortgage on its credit file. Our first chart shows the annual breakdown of FHA purchase mortgages between FTBs and repeat buyers.

The Vast Majority of FHA Purchase Mortgages Go to FTBs

Sources: New York Fed Consumer Credit Panel/Equifax data; authors’ calculations.

Notes: FHA is Federal Housing Administration. FTB is first-time buyer.

From 2000-22, 83 percent of FHA purchase mortgages went to FTBs. This compares to 62 percent to FTBs for the Veterans Affairs (VA), 56 percent for the government-sponsored entities (GSEs) Fannie Mae and Freddie Mac, and 57 percent for all others.

How has the FHA done at targeting its credit guarantees to qualified borrowers? Most FHA FTBs make the minimum 3.5 percent downpayment. That is, they start their homeownership experience with very little home equity (or equivalently very high leverage—a debt to equity ratio over 27). This situation provides little cushion to absorb any house price declines. The next most important underwriting criteria for identifying qualified borrowers is their credit score.

The annual credit score distribution for FHA FTBs is shown in the chart below.

A High Share of FHA FTBs Have Weak Credit Scores

Sources: New York Fed Consumer Credit Panel/Equifax data; authors’ calculations.

Note: The buyer’s credit score equals the Equifax risk score.

In the early 2000s, the private-label security (PLS) market expanded and competed for market share, reducing the FHA’s volume of purchase mortgages to FTBs. Looking at the chart above, we can see that the PLS market attracted the relatively stronger credit borrowers away from the FHA. From 2001 to 2008, 70 percent of FHA FTBs had weak credit scores (that is, credit scores below 680). Following the financial crisis, the credit profile of FHA FTBs has improved. However, since 2014 over half of FHA FTBs still have credit scores below 680.

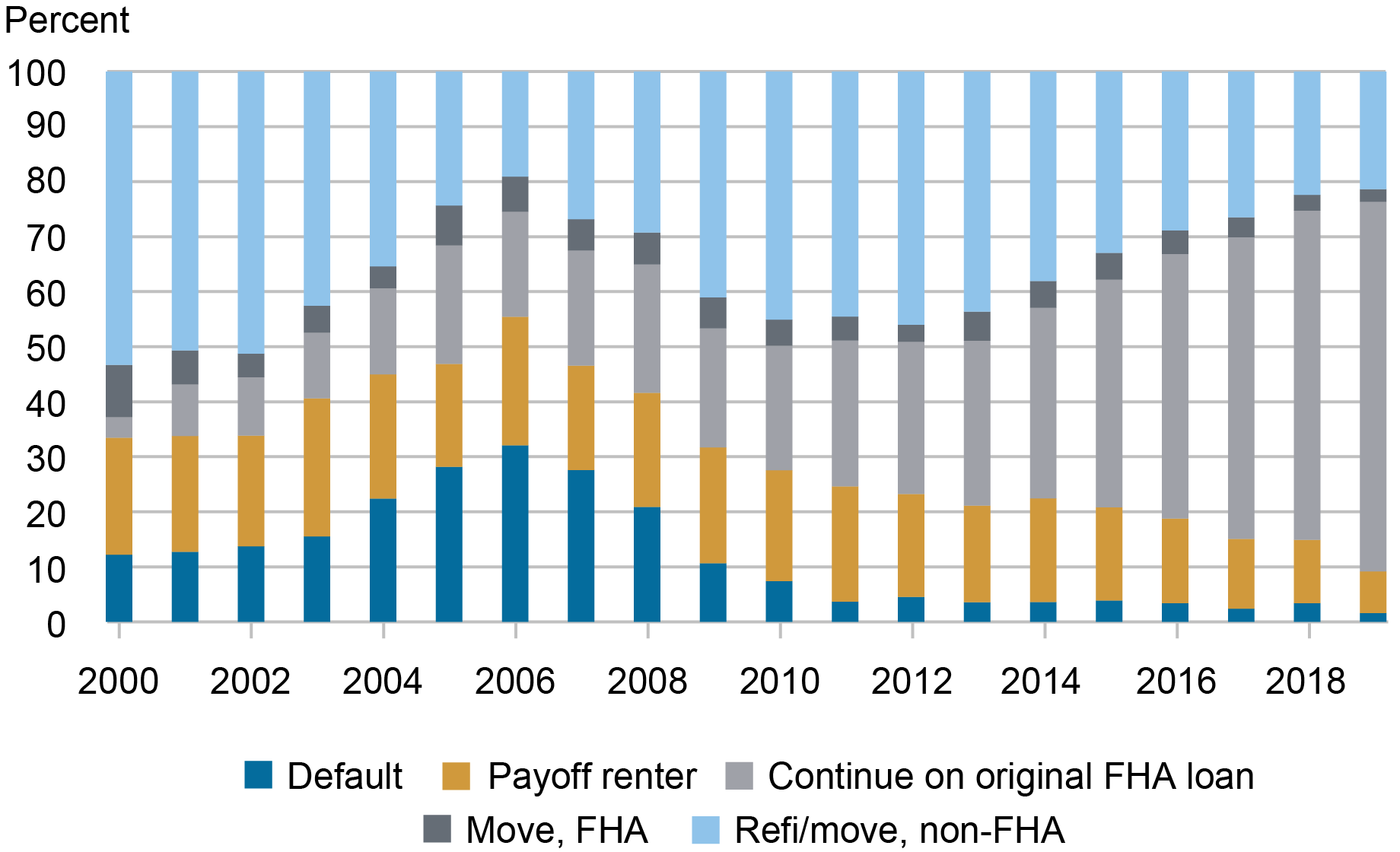

Sustainability Scorecard

In 2018, we proposed defining sustainable homeownership as a FTB paying off their FHA mortgage and purchasing a trade-up home (either with a non-FHA mortgage or a new FHA mortgage) or as the household continuing to pay down its original FHA mortgage or refinancing to a non-FHA mortgage. This leaves two scenarios where the homeownership experience is not sustained: (1) the household defaults on its FHA mortgage, or (2) the household pays off its FHA mortgage but transitions back to renting for at least three years.

There are two challenges to implementing this sustainability scorecard. First, the FHA has a streamline refinance program that allows FHA borrowers to refinance even if their current FHA mortgage is “underwater”—that is, the balance on the FHA mortgage is higher than the current value of the house. Using a streamline refinance allows the borrower to lower their interest rate but does not extinguish the FHA’s credit exposure to the borrower. Rather, the credit exposure is transferred from the purchase mortgage to the refinance. In addition, a borrower can streamline refinance more than once. To correctly measure the default rate, we follow the borrower rather than the mortgage by connecting any streamline refinances to the original FTB purchase mortgage. A default on a streamline refinance is assigned back to the original purchase mortgage.

The second challenge is identifying cases where the borrower successfully pays off the FHA mortgage but transitions back to renting. We identify these cases by observing no new mortgage credit after the sale of the home. We use a minimum rental period of three years to avoid cases where a household moves and rents for a period while deciding where to purchase their trade-up home.

We present our updated FHA FTB homeownership sustainability scorecard below which incorporates an additional eight years of data (2012-19).

FHA FTB Homeownership Sustainability Improved after the Financial Crisis

Sources: New York Fed Consumer Credit Panel/Equifax data; authors’ calculations.

Notes: The five categories of outcomes include those who default on their FHA loan, those who pay off their original home but transition to renting again, those who continue on their original FHA loan, those who move and still rely on an FHA-insured mortgage, and those who refinance or move to a home with a non-FHA-insured mortgage. The years are when the mortgages are originated.

Sustainability declined as we approached the financial crisis and the housing bust. In 2006, less than half of FHA FTBs were able to sustain homeownership. The good news is that this was the smallest cohort in terms of total FHA FTB purchase mortgages. Sustainability continued to improve after 2006 and stabilized at around 70 percent in 2010. From 2011 to 2016, FHA FTB sustainability stayed around 75 percent. Further monitoring of the data is necessary to make a firm evaluation of sustainability for the most recent cohorts starting from 2017.

The improvement in the FHA FTB sustainability rate was due primarily to a decline in the default rate from 32 percent in 2006 to 3.4 percent in 2016. However, the share of FHA FTBs transitioning back to renting has remained around 20 percent from 2007 to 2016.

The update to the scorecard shows that the FHA improved its FTB sustainability following the recovery of the housing market after the financial crisis. However, from 2011 to 2016, about 21.8 percent of FHA FTBs failed to sustain their initial homeownership and lost their opportunity to accumulate housing equity.

Donghoon Lee is an economic research advisor in Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Joseph Tracy is a non-resident senior scholar at the American Enterprise Institute.

How to cite this post:

Donghoon Lee and Joseph Tracy, “FHA First‑Time Buyer Homeownership Sustainability: An Update,” Federal Reserve Bank of New York Liberty Street Economics, November 30, 2023, https://libertystreeteconomics.newyorkfed.org/2023/11/fha-first-time-buy....

The Sustainability of First-Time Homeownership

Who’s on First? Characteristics of First-Time Homebuyers

Long-Term Outcomes of FHA First-Time Homebuyers

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RN Breakfast interview on stamp duties and land taxes

States try tax reform to fix housing affordability

On RN Breakfast with Fran Kelly

https://abcmedia.akamaized.net/rn/podcast/2021/05/bst_20210526_0823.mp3

I was interviewed by Max Chalmers for this segment on RN Breakfast about the transfer from stamp duties to land tax that is happening in the ACT and proposed in NSW. Despite the title of the segment, neither government has housing affordability as one of its aims in these transitions.

People's Landscapes: Living in Landscapes

A roundtable discussion explore landscape as a space for living, considering the pressures on land from population growth and discussing questions of preservation vs. development. People's Landscapes: Beyond the Green and Pleasant Land is a lecture series convened by the University of Oxford's National Trust Partnership, which brings together experts and commentators from a range of institutions, professions and academic disciplines to explore people's engagement with and impact upon land and landscape in the past, present and future. The National Trust cares for 248,000 hectares of open space across England, Wales and Northern Ireland; landscapes which hold the voices and heritage of millions of people and track the dramatic social changes that occurred across our nations' past. In the year when Manchester remembers the 200th anniversary of the Peterloo massacre, the National Trust's 2019 People’s Landscapes programme is drawing out the stories of the places where people joined to challenge the social order and where they demonstrated the power of a group of people standing together in a shared place. Throughout this year the National Trust is asking people to look again, to see beyond the green and pleasant land, and to find the radical histories that lie, often hidden, beneath their feet. At the third event in the series, Living in Landscapes, panellists explore landscape as a space for living, considering the pressures on land from population growth, discussing questions of preservation vs. development, and asking: who should decide how we live in landscape?

Speakers: Alice Purkiss | National Trust Partnership Lead | University of Oxford (Welcome)

Lucy Footer| National Public Programme Producer| National Trust (Introduction)

Dr Ingrid Samuel| Historic Environment Director | National Trust (Chair)

Crispin Truman | Chief Executive | Campaign to Protect Rural England

Dave Lomax | Senior Associate | Waugh Thistleton Architects

Professor Caitlin Desilvey | Associate Professor of Cultural Geography | University of Exeter

Dr David Howard | Associate Professor in Sustainable Urban Development | University of Oxford

For more information about the People’s Landscapes Lecture Series and the National Trust Partnership at the University of Oxford please visit: www.torch.ox.ac.uk/national-trust-partnership