Budget

To be selfish or not, that is the question

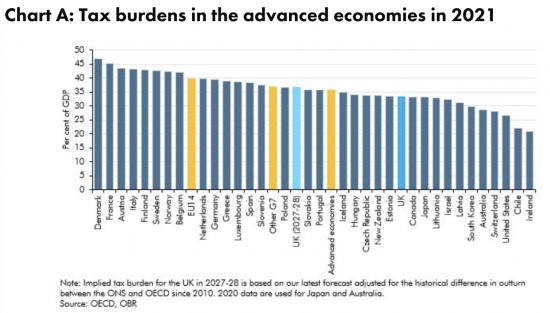

The Office for Budget Responsibility published this in March 2023, but the data has not moved that much since then:

There will be much talk today about the tax burden in the UK. It is worth reminding ourselves that compared to similar countries, it is low, and we demand services of the scale that they enjoy. Unsurprisingly, the impossibility of achieving that outcome is now becoming apparent.

We have a choice. We can go for lower state services and pay for our medical care privately, which is how the US delivers its outcome - whilst leaving large parts of the population at massive risk of not getting the care they need - or we can pay via taxation for the services we need to live in a decent society where everyone has a chance.

To be selfish or not, that is the question.

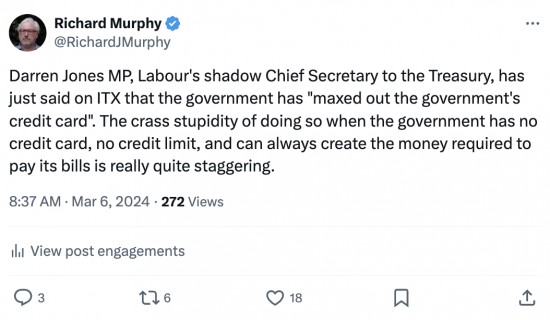

Labour is still talking about the government’s maxed out credit card

I just posted this on Twitter:

He was talking to Sussana Reid (who is an excellent interviewer) on Good Morning Britain.

With incompetence on this scale on display, Labour really does not deserve to be in office later this year.

Jeremy Hunt’s Budget already looks to be failing

I will be headed to the BBC’s Broadcasting House in London during the course of this morning. As has been the case for well over a decade now, I will be listening to the budget whilst there (and tweeting about it almost continually, for those who use that platform) before going on air at about 1:30 pm to discuss what Jeremy Hunt has had to say with Jeremy Vine.

There will be one change to the regular format of this Radio 2 programme on this occasion. Mark Littlewood, formally the director of the Institute of Economic Affairs, and the architect of much of Liz Truss’s economics, is no longer my sparring partner. The unfortunate news is that the BBC are replacing him with Julian Jessup, formally of the Institute of Economic Affairs. I suspect that I will treat any nonsense that he has to say with the same disdain that I showed to Mark over the years that we commented together.

If reports are to be believed, and the Treasury appears to have become ever more leaky in this respect over the years, two of the biggest announcements that might be made in this budget are already known.

The first is that fuel duties are to be frozen, yet again, at a cost of more than £5 billion a year. Given that this has been frozen for so long, no one should be particularly surprised about this, but the implications are large. The only way in which the Office for Budget Responsibility could make last November’s forecasts for the next five years meet the requirements of Jeremy Hunt’s so-called fiscal rule was by assuming that this charge would be reinstated. If that is not to be the case, then how he will supposedly balance his books, using that false criteria of appraisal with which he is much enamoured, is not known. Unfortunately, I see none of the detailed figures before going on air, so I doubt that I will be able to provide elucidation during that commentary.

The second decision that he is being reported as having made is that national insurance is to be cut again. 2% was cut off the employee’s rate last November. It is claimed the another 2% will be cut off this rate in the Budget to be announced today. Clearly we do not know if this is true as yet, but if it is then the cost will be between £9 billion and £10 billion per year, with a supposed average saving of a little over £400 a year for the mythical average earner.

Presuming that this leak is based on well informed Treasury sources, then this move makes almost no sense.

Politically the Conservatives got no discernible political gain from the last cut that they announced, even though they rushed through legislation so that the impact was seen in pay from January 2024 onwards. As a result, it is very obvious that this cut answered no question that any reasonable person might have asked about the government’s intentions with regard to the supply of sound economic policy, and nor will another one.

This is unsurprising. At least three quarters of people in the UK would rather have any government action in this Budget focused upon improvements in the supply of government services, from the NHS onwards. No one is going to thank Jeremy Hunt, Rishi Sunak, or any other Tory MP, for getting this judgement wrong, again.

Then there is one other issue to consider, which is that this policy change fails to have any impact at all on the one group in society where the Tories are hoping to retain support, which is amongst pensioners. Many pensioners are now being forced to work because of increasing pensioner poverty, but since no one over the age of 66 pays national insurance, this will have precisely no impact on their well-being. As targeted measures go, this one completely fails.

There will, of course, be some other announcement that Jeremy Hunt will make to provide a headline if these two have been so heavily trailed, but however looked at these measures, that promote pollution in one case and deny the public the services that they need in the other case whilst collectively failing to deliver for the Tory voter base, really are disastrous. If these are the best that Jeremy Hunt can come up with, I think we can already fairly suggest that this Budget will not deliver for him or his party any of the gains that they so desperately seek. Jeremy Hunt might have been better advised to spend the £100,000 of his own money that he has invested in his own re-election campaign elsewhere in that case.

Budget messaging

I was on LBC radio yesterday, talking about this week’s budget .

At 9 am this morning I will be on Nicky Campbell’s show on BBC Radio 5 discussing the same theme. I suspect I will be on a number of times between nine and 10 .

I am already booked to do my usual immediate post-budget commentary at about 1:30 pm on the Jeremy Vine programme on BBC Radio 2 on Wednesday .

Who knows, other things might also happen .

What we do know is that until Jeremy Hunt ends his speech on Wednesday, anything that can be said will be speculation. Much of that will also, because of the focus of the mainstream media, be on things that really do not matter.

When doing a pre-interview this morning, I suggested that tax cuts, whether to income tax or national insurance, might come at about 78th on my list of priorities with regards to this budget . The things that I said that were more important included, the fact that our economy is in a mess, public services are crumbling, our national infrastructure is literally falling apart, and that maybe 5 million people in the UK missed a meal in the last month because of poverty. We also have millions of people out of work because they are too unwell to take a job. Simultaneously, the NHS is crying out for more people, whilst social care is in peril because of a lack of funding and local authorities going bankrupt. In that situation to think that tax cuts, most of the benefit of which will always goes to those who are best off, are what this country needs is to grossly misread this country’s priorities at this moment.

The reality is that this country needs three things.

The first is more government spending because nothing else will create growth.

The second is more investment.

The third is more taxation of wealth to correct for the inflationary impact that these first two proposals might create and to tackle inequality.

If I was to highlight where the money was to go, it would be on the NHS, social care, supporting local authorities, settling public sector pay claims, and removing the deliberate poverty created by successive government over the last 14 years, whether that be by the creation of the two-child benefit co, or by restrictions on disability benefits, or the bedroom tax, and so much else.

What I would add is that all of this is possible. The Taxing Wealth Report shows how.

It is time for a rethink on our economy. Unless we do that we will forever be stuck in the dire space that we find ourselves in.

The Taxing Wealth Report 2024: a pre-Budget summary

The Taxing Wealth Report 2024 and the Budget

In anticipation of the UK budget this week, I thought it important to provide a summary of the work that I have been doing on the Taxing Wealth Report 2024.

That report will be published in full shortly. All the recommendations noted below are listed on a single page of the Taxing Wealth Report 2024, from which links to detailed workings are supplied.

Introduction

The Taxing Wealth Report 2024 was written for one primary reason. Its aim was to demonstrate that the claim made by politicians from both the UK’s leading political parties that there is no money left to support the supply of better public services in the UK is not true.

The Taxing Wealth Report 2024 shows that there is the potential to raise around £90 billion of additional tax revenue each year from fairly straightforward reforms to the UK’s existing tax system.

All of these reforms would result in additional tax being paid only by those who are better off. Unless a person’s income comes mainly from investments or rents, very little of what the Taxing Wealth Report 2024 suggests would have very much impact on them unless their income exceeded £75,000 per year. This would, however, be fair. As the Taxing Wealth Report 2024 shows, those with wealth in the UK are massively undertaxed compared to those who work for a living. Correcting this imbalance is entirely appropriate, simply in the interest of social justice.

Importantly, whilst the detailed workings underpinning the Taxing Wealth Report 2024 have required a lot of research, the ideas implicit in the recommendations made are quite straightforward. So, for example, it is suggested that pension tax relief should only be provided at the basic rate of income tax whatever the highest tax rate of the person making the contribution. If that change was made an additional £14.5 billion of tax would be paid in the UK each year.

It is also proposed that national insurance should be paid by anyone on their earnings from work at the same rate, and that the reduction in that rate that now applies for those earning more than about £50,000 a year should be abolished. This might raise more than £12 billion in tax a year, assuming national insurance rates used in 2023.

If an income tax charge equivalent to national insurance was also made on all those with income from investments and rents or capital gains exceeding in combination £5,000 a year, then that simple change might raise £18 billion in revenue each year whilst removing an obvious injustice within the tax system that has also been widely exploited by those seeking to avoid tax.

Aligning income tax and capital gains tax rates when there is no obvious reason why they should differ might raise a further £12 billion of tax year.

If only HM Revenue & Customs could be persuaded (or funded) to collect tax from all small companies that owe it when at least 30% of that revenue is lost each year at present due to under-investment in its collection, then maybe £6 billion a year of extra corporation tax might be collected, plus as much again in additional VAT and PAYE which is also likely to be lost from those companies not paying the corporation tax that they owe.

Charging VAT on the supply of financial services, almost all of which are consumed by those with wealth, might raise £8.7 billion a year, having allowed for existing insurance premium tax payments.

Numerous other, smaller, tax changes could also be made, whilst some inappropriate charges, like those for student loans that only raises £4 billion a year for what is, in effect a tax, could be abolished.

On top of all this, what the Taxing Wealth Report 2024 also shows is that if the conditions attached to tax-incentivised savings in ISA and pension fund accounts were changed, then up to £100 billion of savings per annum could be transferred from their current speculative use to become the capital that is necessary to underpin the transformation of the UK economy. That money could either be invested in our crumbling state infrastructure, or in the transition that is necessary to beat the impact of climate change. Incentives for such tax-incentivised savings accounts now cost £70 billion a year, which is more than the UK defence budget. Almost no social benefit currently arises from this massive subsidy to wealth. In a country where there are £8,100 billion of financial assets, this transformation will not rock financial markets, but it will transform the future prospects of the UK.

That transformation might come in three ways.

Firstly, and vitally, inequality in the UK might be addressed. The tax owing by those on low pay has to be reduced and the benefits that they enjoy have to be increased if everyone is to have a chance of fully participating in the UK economy without the stress that millions now suffer.

Secondly, if the UK government undertook measures to tackle inequality and simultaneously spent more on recruiting suitably qualified people to supply UK government services of the standard that is now needed to meet our current health, social care, housing, justice and environmental crises, then the boost to household incomes that would inevitably follow would provide the basis for the growth that every government claims to be necessary. Growth cannot come before that spending takes place. It would, as a matter of fact, follow it.

Thirdly, the UK has under invested in its own future for decades, having placed all its savings into the care of the City of London, who have used them for speculative activity rather than for the creation of real economic activity. Correcting that by redirecting tax incentivised savings into investment in the essential underpinning of the economy that we need might, yet again, generate new income for the UK’s private sector and households, whilst ensuring that we are equipped for the very different future that we must face.

Having money available will not guarantee that the UK will have a better future. However, without there being money available, that future is not possible. The Taxing Wealth Report 2024 demonstrates that more than enough money is available to transform our society, to increase the incomes of those in need in the UK, to create growth, to stimulate employment, to increase the well-being of our companies, and to underpin the investment that we require. No politician can now say otherwise. The fact is that the choices that they can make are explained in this report. If they do not wish to use the options that it demonstrates are available, it is for them to explain why. However, what none of them can ever claim again is that there is no money left, because it is there for them to ask for whenever they wish to use it, and that is precisely why the Taxing Wealth Report 2024 matters.

Summary of proposals

The Taxing Wealth Report 2024 is made up of a series of proposals for the reform of taxes and the administration of tax in the UK, with some selected supporting explanatory notes also being added.

These proposals and the value of the reform that they suggest are as follows:

All of these proposals are summarised in a single page of the Taxing Wealth Report 2024 with links being provided there to the detailed workings that support the suggested benefits arising.

Webbe says Hunt’s measures fatten the rich at poor’s expense – and Labour little better

Independent MP slams latest damaging Tory budget measures and assault on poor, sick and disabled

Leicester East MP Claudia Webbe has accused the Tory government of using Jeremy Hunt’s autumn statement to fatten business at the expense of the poor, of ‘snatching the assessment of illness out of the hands of doctors’ to punish the long-term sick and of doing the exact opposite of what the UK economy needs – and says that Keir Starmer’s Labour is little better in enthusiastically promoting the discredited austerity narrative.

In a statement issued today, Ms Webbe said:

Jeremy Hunt’s Autumn Statement boasted of giving corporations the biggest tax handout in modern British political history, doling out billions to companies – many of whom are already making obscene profits in a cost of greed emergency of soaring bills and food costs.

And he is doing this on the backs of the poor, sick and disabled, with horrendous measures to whip those who are unfit to work into taking jobs their medical experts have said they cannot do – and to do it they will snatch the assessment of illness out of the hands of doctors and have it decided by the government’s agents instead.

The past decade has seen a steep rise in poverty, with fourteen million people below the poverty line, including well over four million children. In Leicester East, four in every ten children were already living in absolute poverty – now the Chancellor says if people do not submit to his new regime to get them back into work, he will cut them off completely from support after six months. The effect of this on my constituents and the poor and sick across the country will be horrific.

This country, since 2010, has seen an appalling rise in the misery imposed on those who were already struggling to get by. More than four in ten disability benefit claimants have attempted suicide under the government’s brutal regime. Suicide has become the leading cause of death in men under fifty. Poor mental health abounds, yet the government has today shown it remains determined to punish and persecute those who cannot work – and indeed that it is determined to deny the reality of life in this country for so many.

In my constituency of Leicester East, we have seen endemic exploitation and poverty wages in our garment industry. I told the Chancellor in response to his Autumn Statement that the unionised manufacturing base of Leicester East has long been diminished – not replaced by technology, innovation and good modern jobs with decent pay, but by fast fashion, sweatshops and unscrupulous employers paying illegally-low wages. All this has been exploited by brands and retailers who are in a race to the bottom for ever-increasing profits while their supply chains fail to pay the minimum wage.

I asked him what action the government will take to regulate and ensure that brands and retailers are held to account for the sustainable outcomes of their products in their supply chains and wage justice for the people that make their goods, and to tackle those British brands and retailers who threaten to seek cheaper labour overseas so they can avoid paying the new minimum wage that the he had just announced. There was no meaningful response.

The government is using tweaks to the minimum wage – which it misnames the living wage – as cover for its handouts to business, but its increases are still very far below the level at which a person working one job could live on. The government claims work is the way out of poverty, but millions who are working are among the poorest.

Mr Hunt claims the government is going for growth, when in fact they are doing the exact opposite of what our economy needs – and hurting millions to do it. Economists recognise that the best way to boost economic growth is to give more money to the poor, because they have to spend it. But yet again the Conservatives are giving more to the rich and to corporations who will put much of it into offshore bank accounts where it does no good. As it is, despite his claims of growth he has had to acknowledge that the Office for Budget Responsibility is downgrading growth forecasts for the next three years.

And it has to be said that the Labour party is largely in agreement with the government it is supposed to oppose. This country needs politicians with the courage to speak the truth that the punishment of the poor to enrich the wealthy is a political choice and not a necessity or even productive. Sadly such politicians are at the moment in very short supply at the moment.

SKWAWKBOX needs your help. The site is provided free of charge but depends on the support of its readers to be viable. If you’d like to help it keep revealing the news as it is and not what the Establishment wants you to hear – and can afford to without hardship – please click here to arrange a one-off or modest monthly donation via PayPal or here to set up a monthly donation via GoCardless (SKWAWKBOX will contact you to confirm the GoCardless amount). Thanks for your solidarity so SKWAWKBOX can keep doing its job.

If you wish to republish this post for non-commercial use, you are welcome to do so – see here for more.

On fiscal rules

This turned out to be my most popular tweet yesterday by some way.

It was inspired by comments from Labour spokespeople whose performance yesterday was dire in response to the autumn statement because not one of them would say anything of substance for fear of making a potential spending commitment, which is the last thing any of them will do:

What did you think of Hunt’s budget?

More to provoke reaction than anything else:

Note: There is a poll embedded within this post, please visit the site to participate in this post's poll.

The government is planning to cut public sector investment by 16.7% over the next five years

Last night, I noticed some data in the Office for Budget Responsibility commentary on the Autumn Statement that jumped out. You had to get to page 154 to find it. I summarise the data as follows:

That data makes clear that the scale of public sector investment in the UK will fall over the next few years.

That is true in both nominal terms, as noted above, and also in real terms because the above figures are stated before the impact of inflation is taken into account, and that will reduce their real value significantly over the period.

Charted, that data looks like this:

Expressed as a percentage of nominal GDP (which is appropriate) the decline in investment looks like this:

That is a 16.7 per cent decline from this year to 2028-29.

So, in other words, it does not matter what your concern is the issue that worries you is not going to get the investment funding it needs.

Then think about what those issues are:

- Social housing

- RAAC in schools

- Flooding

- The green transition

- Failing public infrastructure

The government does not plan to address these issues. Instead, it intends to reduce its commitment to doing so.

Few budgets set out a plan for failure as big and bold as Hunt's did. This particular failing seems not to have been noticed much as yet. It needs to be. This is our future Hunt plans not to invest in. And that makes no sense at all.

Austerity is back

I continue to read the autumn statement documentation and share it here and on Twitter. So, I got to this:

Is Labour going to stick to this? We need to know.