Budget

“Wish I Was Rich Enough To Eat Like A 17thC Flemish Peasant” Thinks Man Staring In Artisanal Bakery Window

A Sydney man staring idly at the pricey wares on offer in an Eastern Suburbs artisanal bakery is currently wishing that he was wealthy enough to afford to eat like a subsistence farmer from the Renaissance.

“You must have had to have made a fortune in the tulip craze to find room in your budget for a boulot sourdough loaf and a raisin snail,” mused Gymea electrician Phil Walker as he tossed up whether to enter the establishment to pick up a few things for dinner. “I’m guessing it must cost a shitload to put an unnecessary dusting of flour on everything and display them all in small wicker baskets.”

“I never knew that grim faced serfs who only got one half a day off every year for Easter cared so much about fine crumb structure and single origin grain,” pondered Walker as he read the hand written label on a basket of New York rye. “That guy behind the counter in the apron with the beard, tribal tatts and nose rings looks like he just stepped straight out of a painting by Pieter Brueghel the Elder.”

Unable to justify parting with $11.50 for a loaf of harvest grain lovingly crafted from a gritty mixture of millet, rat’s teeth, bark and plague germs, Phil has opted to get a six pack of Tip Top white hamburger buns from Woolies.

Peter Green

http://www.twitter.com/Greeny_Peter

You can follow The (un)Australian on twitter @TheUnOz or like us on Facebook https://www.facebook.com/theunoz.

We’re also on Patreon: https://www.patreon.com/theunoz

The (un)Australian Live At The Newsagency Recorded live, to purchase click here:

Sometime soon Labour needs to talk about the macroeconomic reality that we face, because it is probably nothing like as good as Hunt predicts

According to the Chancellor, all that matters about the Budget is that he meets his fiscal rule.

For reasons that no one is aware of and which no one, including the City, cares about, he thinks that his fiscal rule must require that he reduce the scale of the national debt - because that has been the story with which the Tories have been beating Labout for well over a decade.

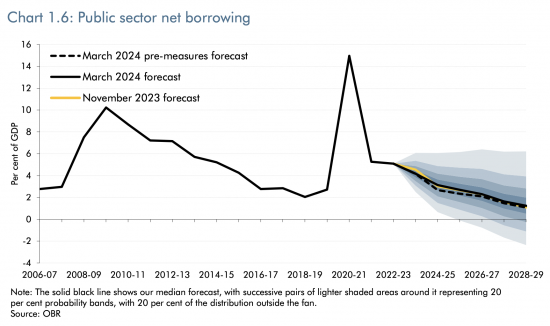

Everything in yesterday's budget was, in that case, designed to meet this goal, and according to his own data, he does meet it:

That downward line in the middle of the fan to the right is all he cares about.

There is a cost to this. If the government borrows less, someone else has to borrow more: that's the way in which any economy works if new money (all of which is debt-based) is to be created, which is the actual rule that cannot be broken because, unlike so-called fiscal rules, it is based on facts. So this is the sectoral forecast which shows who might be net saving and borrowing over the next few years:

Households are going to borrow more, by saving less. That's the price of the government demanding more in tax to reduce its debt.

The overseas sector is still going to save in sterling.

And business is going to apparently start borrowing quite a lot, presumably because there is going to be a heavy investment to fund the growth that all politicians think is just around the corner, but probably is not.

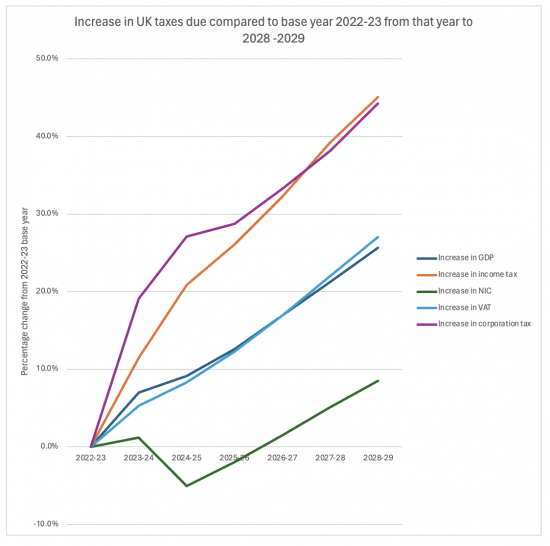

Is that likely? Yes, with regard to reduced household saving. Income taxes are going to rise much faster than GDP growth, as I showed yesterday:

That cut in household savings is likely in that case. People can't both save and pay more tax when already pushed to their limits.

But will business invest heavily using borrowed funds so that the government might borrow less? I really do not think it is likely.

My reasons are that the GDP forecasts look like this:

GDP per head grows well for one reason: it is assumed that immigration falls, dramatically:

When someone says a behaviour pattern will change radically, they have to give a good reason: there is none here. The reality is that migration is going to increase rapidly in this world as a result of climate change: that's the fact, and the above chart is not.

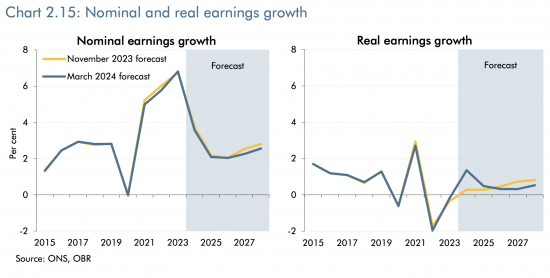

In that case, this chart on nominal and real earnings growth looks to be fanciful:

Rea; earnings growth of less than 1% is incredibly low and does not inspire business confidence or stimulate considerable investment. If GDP growth is actually going to be much more population-based than the OBR suggests, then even that growth is in doubt.

Can I, in that case, see the fall in debt that Hunt predicts? I can't, I admit.

But I can still see the tax explosion.

Labour really does need to say how they are going to deal with all of this because the state of the government's books is now known. I am not, however, expecting to hear much at all. If you think the credit card is maxed out and everything spending commitment has to be covered by tax, as Labour apparently does, there is little wriggle room here. Sometime, Labour is going to have to do some real macroeconomics and talk about debt financing. But I will not be holding my breath in anticipation.

What is Labour going to fund their spending with now?

As predicted some time ago, Jeremy Hunt undermined the whole Labour election strategy by closing the non-dom rule yesterday.

According to Labour, doing this was going to fund almost every policy that it ever talked about. The sum likely to be collected as a result of this change might have been £3 billion or so at best, but as I indicated in the Taxing Wealth Report 2024, there are very good reasons for thinking it might be somewhat less. The Budget document thinks it more like £3.1 billion.

Since I had campaigned on this issue since about 2005 and sat on working parties about replacing this rule in the Treasury in 2009 and afterwards, when I was still invited to go there, and the proposal now tabled looks remarkably like what was discussed at that time, I have no complaints about this happening.

But where does this leave Labour? It was going to apparently fund all its new NHS staff and all the appointments that they would offer and other things besides using this money. Hunt has now claimed to have used it to fund national insurance reductions. Does that mean Rachel Reeves now has nothing left that she can talk about?

So far, I have not heard enough of Labour spokespeople to work out what they are going to say, but Hunt has definitely double-bluffed them. This line of attack is now no longer available to Labour. What are they going to use to pay for things now, given that they insist that taxes fund spending and that the national credit card is maxed out (both of which claims are completely wrong)? It will be fascinating to see.

We have a tax time bomb waiting to explode in the UK. Is Labour going to let it go off?

I have spent much of this afternoon, a) talking to journalists and b) trying to work out how the Budget adds up.

The first task was relatively easy. The second was less so.

In part, the great cost saving in the Budget is on interest: it has been assumed that the cost of government borrowing will fall quite quickly to 3% rather than the 4% assumed last November. That finds £10 billion.

But, that was not enough, so I went on a hunt for the rest that explained how Hunt was going to give tax away. I finally got to Table A5 of the Annex to the Office for Budget Responsibility's Economic and Fiscal Outlook publication that supports the Budget data, and there I smelt a rat.

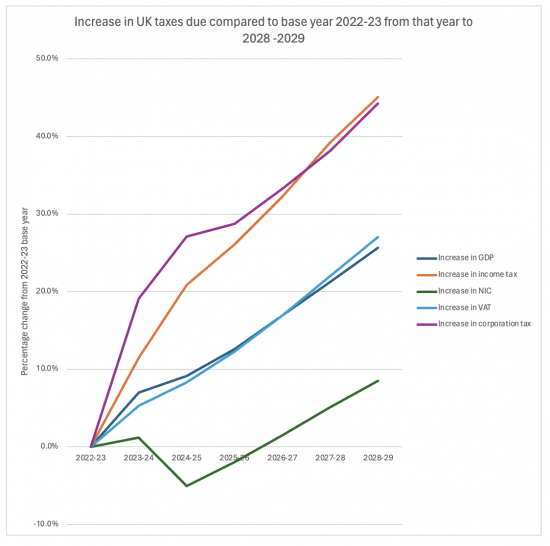

I prepared the following chart by noting n0minal GDP from table A3 of that annex for 2022-23 to 2028-29 and then noting data from table A5 on income tax, national insurance, VAT and corporation tax over the same years.

Then I calculated GDP and tax receipts for each year as a ratio of the 2022-23 figure to show growth in them, and then plotted this to get this chart:

The two blue lines in the centre that almost match each other are GAP growth and VAT, which unsurprisingly match each other almost exactly.

National insurance declines markedly: Hunt is pretending that he really will get rid of this tax.

But then note what happens with both income tax and corporation tax: both rise at rates well over anything that can be justified by the growth in GDP.

Corporation tax is a small tax; silly forecasts can be made for it, and this one is absurd: profitability is not going to grow at that rate.

But, income tax is what really matters. The forecast increase is utterly disproportionate. The growth in tax owing each year is at a rate almost double the rate in the growth of GDP.

To put this in context, income tax shown to be due in 2028/29 is £48 billion more than it would be if it grew at the rate of GDP growth.

In other words, the actual rates of income tax increase we will all actually be suffering because of fiscal drag over the next few years are going to be very high indeed - and that is how Hunt is supposedly balancing its books.

In that case, the real question to ask is, what is Labour going to do about this? We have a tax time bomb waiting to explode in the UK. Are they going to let it go off?

The Budget: first reactions

I am writing this, minutes after hearing the Budget, having read little of the reaction of others to it, and having just come out of a BBC Radio 2 studio where I offered my comments.

My immediate reaction is (and there will be more later on when I have read some more of the documentation) that this was a Budget in need of an election to give it any meaning.

There were no big ideas.

There were no big announcements not already trailed.

The claim that the 2p cut in national insurance is part of some bigger plan is, very politely, absurd when not long ago the Tories pushed it much higher. It is just a pre-election bung.

So, too, were the giveaways on capital gains tax on property sales and the grant of yet another tax subsidised ISA savings scheme for the wealthy (because they alone can use them to their limits).

The reform on child benefits was wrong. What was needed was the removal of the two child cap, not the lifting of the number who can claim the income at higher levels of income.

And as for the public sector productivity reforms: as I said on air, this means that 10 minute GP appointments will now last 7 minutes and school classes that lasted 40 minutes will now be 33 minutes long.

The claims for public sector investment were crass. Not only did they disguise the failure to provide any new real money for these essential services, but to suggest that a drone might be the first responder at a crime has to be one of the most stupid ideas I have ever heard. You can really see that working.

As for growth, in reality there was nothing to make it happen and all the claims for higher than expected growth simply reflect the inevitable statistical reaction to returning to anaemic levels of actual growth after we unexpectedly (as far as the government was concerned) slipped into recession.

And throughout all this the delivery was lacklustre, and the jokes unusually bad. Hunt seemed like a Chancellor who knew his time was up. No wonder he had invited his eldest daughter to come to the Commons to watch. This will be the last chance she ever has to see him do something like this. That was the only small mercy I could find in all this, even when he cancelled the non-dom rule. Given that I know all the rules to do this were discussed in the Treasury in 2011, the only thing that can be said about that now is that it was tawdry electioneering by a Party that knows its time is up.

It really is time for them to go, and everything about this Budget suggests that a May election is very likely.

To be selfish or not, that is the question

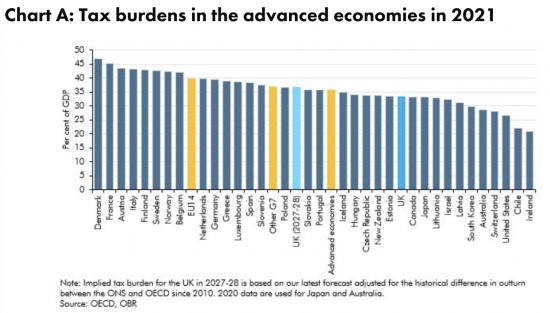

The Office for Budget Responsibility published this in March 2023, but the data has not moved that much since then:

There will be much talk today about the tax burden in the UK. It is worth reminding ourselves that compared to similar countries, it is low, and we demand services of the scale that they enjoy. Unsurprisingly, the impossibility of achieving that outcome is now becoming apparent.

We have a choice. We can go for lower state services and pay for our medical care privately, which is how the US delivers its outcome - whilst leaving large parts of the population at massive risk of not getting the care they need - or we can pay via taxation for the services we need to live in a decent society where everyone has a chance.

To be selfish or not, that is the question.

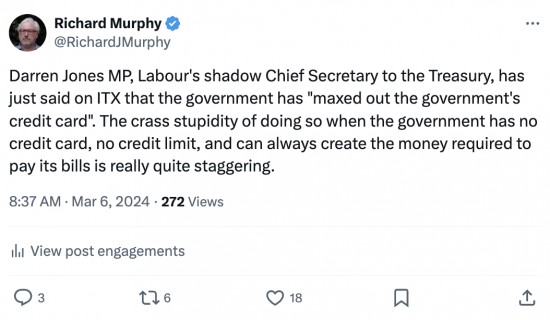

Labour is still talking about the government’s maxed out credit card

I just posted this on Twitter:

He was talking to Sussana Reid (who is an excellent interviewer) on Good Morning Britain.

With incompetence on this scale on display, Labour really does not deserve to be in office later this year.

Jeremy Hunt’s Budget already looks to be failing

I will be headed to the BBC’s Broadcasting House in London during the course of this morning. As has been the case for well over a decade now, I will be listening to the budget whilst there (and tweeting about it almost continually, for those who use that platform) before going on air at about 1:30 pm to discuss what Jeremy Hunt has had to say with Jeremy Vine.

There will be one change to the regular format of this Radio 2 programme on this occasion. Mark Littlewood, formally the director of the Institute of Economic Affairs, and the architect of much of Liz Truss’s economics, is no longer my sparring partner. The unfortunate news is that the BBC are replacing him with Julian Jessup, formally of the Institute of Economic Affairs. I suspect that I will treat any nonsense that he has to say with the same disdain that I showed to Mark over the years that we commented together.

If reports are to be believed, and the Treasury appears to have become ever more leaky in this respect over the years, two of the biggest announcements that might be made in this budget are already known.

The first is that fuel duties are to be frozen, yet again, at a cost of more than £5 billion a year. Given that this has been frozen for so long, no one should be particularly surprised about this, but the implications are large. The only way in which the Office for Budget Responsibility could make last November’s forecasts for the next five years meet the requirements of Jeremy Hunt’s so-called fiscal rule was by assuming that this charge would be reinstated. If that is not to be the case, then how he will supposedly balance his books, using that false criteria of appraisal with which he is much enamoured, is not known. Unfortunately, I see none of the detailed figures before going on air, so I doubt that I will be able to provide elucidation during that commentary.

The second decision that he is being reported as having made is that national insurance is to be cut again. 2% was cut off the employee’s rate last November. It is claimed the another 2% will be cut off this rate in the Budget to be announced today. Clearly we do not know if this is true as yet, but if it is then the cost will be between £9 billion and £10 billion per year, with a supposed average saving of a little over £400 a year for the mythical average earner.

Presuming that this leak is based on well informed Treasury sources, then this move makes almost no sense.

Politically the Conservatives got no discernible political gain from the last cut that they announced, even though they rushed through legislation so that the impact was seen in pay from January 2024 onwards. As a result, it is very obvious that this cut answered no question that any reasonable person might have asked about the government’s intentions with regard to the supply of sound economic policy, and nor will another one.

This is unsurprising. At least three quarters of people in the UK would rather have any government action in this Budget focused upon improvements in the supply of government services, from the NHS onwards. No one is going to thank Jeremy Hunt, Rishi Sunak, or any other Tory MP, for getting this judgement wrong, again.

Then there is one other issue to consider, which is that this policy change fails to have any impact at all on the one group in society where the Tories are hoping to retain support, which is amongst pensioners. Many pensioners are now being forced to work because of increasing pensioner poverty, but since no one over the age of 66 pays national insurance, this will have precisely no impact on their well-being. As targeted measures go, this one completely fails.

There will, of course, be some other announcement that Jeremy Hunt will make to provide a headline if these two have been so heavily trailed, but however looked at these measures, that promote pollution in one case and deny the public the services that they need in the other case whilst collectively failing to deliver for the Tory voter base, really are disastrous. If these are the best that Jeremy Hunt can come up with, I think we can already fairly suggest that this Budget will not deliver for him or his party any of the gains that they so desperately seek. Jeremy Hunt might have been better advised to spend the £100,000 of his own money that he has invested in his own re-election campaign elsewhere in that case.

Budget messaging

I was on LBC radio yesterday, talking about this week’s budget .

At 9 am this morning I will be on Nicky Campbell’s show on BBC Radio 5 discussing the same theme. I suspect I will be on a number of times between nine and 10 .

I am already booked to do my usual immediate post-budget commentary at about 1:30 pm on the Jeremy Vine programme on BBC Radio 2 on Wednesday .

Who knows, other things might also happen .

What we do know is that until Jeremy Hunt ends his speech on Wednesday, anything that can be said will be speculation. Much of that will also, because of the focus of the mainstream media, be on things that really do not matter.

When doing a pre-interview this morning, I suggested that tax cuts, whether to income tax or national insurance, might come at about 78th on my list of priorities with regards to this budget . The things that I said that were more important included, the fact that our economy is in a mess, public services are crumbling, our national infrastructure is literally falling apart, and that maybe 5 million people in the UK missed a meal in the last month because of poverty. We also have millions of people out of work because they are too unwell to take a job. Simultaneously, the NHS is crying out for more people, whilst social care is in peril because of a lack of funding and local authorities going bankrupt. In that situation to think that tax cuts, most of the benefit of which will always goes to those who are best off, are what this country needs is to grossly misread this country’s priorities at this moment.

The reality is that this country needs three things.

The first is more government spending because nothing else will create growth.

The second is more investment.

The third is more taxation of wealth to correct for the inflationary impact that these first two proposals might create and to tackle inequality.

If I was to highlight where the money was to go, it would be on the NHS, social care, supporting local authorities, settling public sector pay claims, and removing the deliberate poverty created by successive government over the last 14 years, whether that be by the creation of the two-child benefit co, or by restrictions on disability benefits, or the bedroom tax, and so much else.

What I would add is that all of this is possible. The Taxing Wealth Report shows how.

It is time for a rethink on our economy. Unless we do that we will forever be stuck in the dire space that we find ourselves in.

The Taxing Wealth Report 2024: a pre-Budget summary

The Taxing Wealth Report 2024 and the Budget

In anticipation of the UK budget this week, I thought it important to provide a summary of the work that I have been doing on the Taxing Wealth Report 2024.

That report will be published in full shortly. All the recommendations noted below are listed on a single page of the Taxing Wealth Report 2024, from which links to detailed workings are supplied.

Introduction

The Taxing Wealth Report 2024 was written for one primary reason. Its aim was to demonstrate that the claim made by politicians from both the UK’s leading political parties that there is no money left to support the supply of better public services in the UK is not true.

The Taxing Wealth Report 2024 shows that there is the potential to raise around £90 billion of additional tax revenue each year from fairly straightforward reforms to the UK’s existing tax system.

All of these reforms would result in additional tax being paid only by those who are better off. Unless a person’s income comes mainly from investments or rents, very little of what the Taxing Wealth Report 2024 suggests would have very much impact on them unless their income exceeded £75,000 per year. This would, however, be fair. As the Taxing Wealth Report 2024 shows, those with wealth in the UK are massively undertaxed compared to those who work for a living. Correcting this imbalance is entirely appropriate, simply in the interest of social justice.

Importantly, whilst the detailed workings underpinning the Taxing Wealth Report 2024 have required a lot of research, the ideas implicit in the recommendations made are quite straightforward. So, for example, it is suggested that pension tax relief should only be provided at the basic rate of income tax whatever the highest tax rate of the person making the contribution. If that change was made an additional £14.5 billion of tax would be paid in the UK each year.

It is also proposed that national insurance should be paid by anyone on their earnings from work at the same rate, and that the reduction in that rate that now applies for those earning more than about £50,000 a year should be abolished. This might raise more than £12 billion in tax a year, assuming national insurance rates used in 2023.

If an income tax charge equivalent to national insurance was also made on all those with income from investments and rents or capital gains exceeding in combination £5,000 a year, then that simple change might raise £18 billion in revenue each year whilst removing an obvious injustice within the tax system that has also been widely exploited by those seeking to avoid tax.

Aligning income tax and capital gains tax rates when there is no obvious reason why they should differ might raise a further £12 billion of tax year.

If only HM Revenue & Customs could be persuaded (or funded) to collect tax from all small companies that owe it when at least 30% of that revenue is lost each year at present due to under-investment in its collection, then maybe £6 billion a year of extra corporation tax might be collected, plus as much again in additional VAT and PAYE which is also likely to be lost from those companies not paying the corporation tax that they owe.

Charging VAT on the supply of financial services, almost all of which are consumed by those with wealth, might raise £8.7 billion a year, having allowed for existing insurance premium tax payments.

Numerous other, smaller, tax changes could also be made, whilst some inappropriate charges, like those for student loans that only raises £4 billion a year for what is, in effect a tax, could be abolished.

On top of all this, what the Taxing Wealth Report 2024 also shows is that if the conditions attached to tax-incentivised savings in ISA and pension fund accounts were changed, then up to £100 billion of savings per annum could be transferred from their current speculative use to become the capital that is necessary to underpin the transformation of the UK economy. That money could either be invested in our crumbling state infrastructure, or in the transition that is necessary to beat the impact of climate change. Incentives for such tax-incentivised savings accounts now cost £70 billion a year, which is more than the UK defence budget. Almost no social benefit currently arises from this massive subsidy to wealth. In a country where there are £8,100 billion of financial assets, this transformation will not rock financial markets, but it will transform the future prospects of the UK.

That transformation might come in three ways.

Firstly, and vitally, inequality in the UK might be addressed. The tax owing by those on low pay has to be reduced and the benefits that they enjoy have to be increased if everyone is to have a chance of fully participating in the UK economy without the stress that millions now suffer.

Secondly, if the UK government undertook measures to tackle inequality and simultaneously spent more on recruiting suitably qualified people to supply UK government services of the standard that is now needed to meet our current health, social care, housing, justice and environmental crises, then the boost to household incomes that would inevitably follow would provide the basis for the growth that every government claims to be necessary. Growth cannot come before that spending takes place. It would, as a matter of fact, follow it.

Thirdly, the UK has under invested in its own future for decades, having placed all its savings into the care of the City of London, who have used them for speculative activity rather than for the creation of real economic activity. Correcting that by redirecting tax incentivised savings into investment in the essential underpinning of the economy that we need might, yet again, generate new income for the UK’s private sector and households, whilst ensuring that we are equipped for the very different future that we must face.

Having money available will not guarantee that the UK will have a better future. However, without there being money available, that future is not possible. The Taxing Wealth Report 2024 demonstrates that more than enough money is available to transform our society, to increase the incomes of those in need in the UK, to create growth, to stimulate employment, to increase the well-being of our companies, and to underpin the investment that we require. No politician can now say otherwise. The fact is that the choices that they can make are explained in this report. If they do not wish to use the options that it demonstrates are available, it is for them to explain why. However, what none of them can ever claim again is that there is no money left, because it is there for them to ask for whenever they wish to use it, and that is precisely why the Taxing Wealth Report 2024 matters.

Summary of proposals

The Taxing Wealth Report 2024 is made up of a series of proposals for the reform of taxes and the administration of tax in the UK, with some selected supporting explanatory notes also being added.

These proposals and the value of the reform that they suggest are as follows:

All of these proposals are summarised in a single page of the Taxing Wealth Report 2024 with links being provided there to the detailed workings that support the suggested benefits arising.