Budget

Unless Labour takes control of interest rates its time in office will be painful for them and us all

Another Tweet on the autumn statement:

When inflation is going to be at 2%, demanding that households pay 5% interest on their mortgages is a recipe for disaster.

Unless Labour takes control of this issue, its time in office will be painful for them and us all.

Their choice.....

Hunt is not controlling the national debt: inflation is simply reducing its value

There are two charts here, both addressing the issue of debt, with which both the Tories and Labour are wholly inappropriately obsessed (in my opinion).

The first suggests on various measures that the proportion of government debt to GDP is going to fall over the next few years.

The second suggests, however, that the the government is going to borrow in every year for the rest of the decade.

So, what does this mean? It means that inflation is writing down the value of old debt, which has a fixed value at the time it was issued meaning that it progressively becomes easier to repay as inflation makes the money to do so easier to find. So, the decline in the value of debt to GDP, which Hunt wants us to think is a government success story, is nothing of the sort. It is all down to continuing inflation, which was a government disaster story. The hypocrisy of politicians who think they can exploit economic ignorance knows no limits.

The Tories are planning some serious austerity, starting very soon

This is another Tweet, just posted:

So, the Tories are back on the austerity agenda with planned spending cuts that no one thinks are deliverable, and which are the real explanation for today’s tax give away.

Hunt’s misplaced hope

I just tweeted this, whilst having a coffee after broadcasting and getting my first post-autumn statement out for someone else.

There is no way on earth that we have now reached the state of equilibrium that this chart suggests. We are living in an economy and in a world subject to significant global shocks. Everything Hunt said today assumes that they have gone away and that from. Now in we will all live in stable peace and harmony.

That is not going to happen.

The sense that this budget was all about make-believe and nothing about reality is growing the more I look at the detail.

Radio 2, lunchtime today

I will be spending this lunchtime in the studios of Radio Two at Wogan House in London, WC1. This has been the case for almost every autumn statement, budget, and other major fiscal announcement by the government for well over a decade now.

Just after 1.30, whether the Chancellor has finished or not, I will be joining Jeremy Vine live on air to discuss what the Chancellor has had to say. Mark Littlewood, the outgoing chief executive of the Institute of Economic Affairs, who was Liz Truss’s main economic advisor, and who has apparently been dropped from her list of nominees for the House of Lords, will be joining us.

I admit that this is one of the most stressful broadcasts that I do each year. Whereas I am usually pretty relaxed in front of the microphone, talking about what the Chancellor has said, based solely on the speech and without having had the chance to read any of the notes that are published to explain what he really means, always has some risk inherent in it.

That said, there are some things that are predictable. I have already made it clear that I do not approve of any of the tax cuts that are likely today. I also very strongly suspect that there will be very little investment in public services. If so, I will be making that point. And, the failure of this statement to tackle inequality, which I anticipate will be high on my agenda.

Meanwhile, I can entirely predict that Mark Littlewood will be saying that there are far too few cuts, and that growth will be too low. He will not, of course, consider the consequences of that growth, let alone the green issues involved.

Once that is over I begin writing comments for a number of n people, including here.

Meanwhile if you want to follow my thinking during the speech and are on Twitter, I will be tweeting throughout it.

Today’s autumn statement is based on a pile of totally false economic assumptions

What is really depressing about today, the Autumn Statement that Jeremy Hunt will deliver, and the response we will get from Rachel Reeves, is the fact that all of them believe in the wholly artificial constraints that they impose on themselves so that government might fail to meet the needs of the people of this country.

In. no particular order these are:

The Bank of England must be independent

It is assumed that the Bank of England has the right to set interest rates and, if necessary drive the economy into a recession, as it is doing right now, and there is nothing that the government can do about that. This is simply untrue. We can get rid of an independent central bank and lead the world away from this madness.

There is no money

The old Liam Byrne claim that there is no money lives on as if it was true. The assumption is that all money is created by the private sector and taxpayers when the opposite is true. As a consequence no government really thinks it is permitted to run a deficit.

We are beholden to financial markets

It is assumed that governments must borrow at whatever rate markets will charge. That is not true. Firstly, interest rates are set by the government, via the Bank of England. Second, if markets do not want to deposit money with the government QE proved that governments can spend anyway. But that has been deliberately forgotten so that bankers can still blackmail us.

The books must balance

There is nothing in economic or accounting theory that requires this. In fact, a growing economy will always pay tax late to the government that runs it meaning that government income will always lag behind either real or nominal growth, meaning that growth makes deficits inevitable, and that eliminating them makes no sense. But still the myth, or untruth, is perpetuated.

GDP growth is the goal of society

Given the massive deficiencies in GDP measurement, and the resulting harm and bias it permits, this is one of the most stupid economic ideas ever.

ONS and OBR forecasts are a useful basis for decision making

The Office for National Statistics and Office for Budget Responsibility produce between them terrible data on what has happened in the UK economy and what might happen. The ONS makes up GDP, and estimates national debt without considering any of the basic rules of accounting, which means the data they produce are completely rubbish approximations to the truth (CRAp). The OBR are always wildly optimistic to keep the Treasury happy.

Existing divisions in society are fixed

Apparently there is nothing we can or should do about inequality in the UK including imposing tax to reduce it. Instead we must celebrate and encourage it. Even Labour now agrees. So, the biggest cause of our economic failure continues, unabated.

We must have a bias to the rich

Related to the previous assumption, but different in emphasis. It is assumed that the rich are very clever and drive the economy. I am not a eugenicist, know that rich got where they are by exploiting others, and that they are deeply risk averse now they have arrived and so will not invest for growth or entrepreneurship. Nothing about the rich adds value to our society, and trickle down emphatically does not happen.

Those claiming benefits are scroungers

Being ill, infirm, unskilled through no fault of your own, or living in an area where the work has gone is clearly the fault of those suffering such situations. Of course they should be punished for it. I am being ironic, of course, but it seems that our politicians think this.

People must not be allowed to save with the government

The so called national debt is actually made up of savings by people, pension funds, life assurance companies, banks and foreigners. They want to save with the government. The government wants them to save elsewhere and will guarantee their totally unproductive saving in private banks rather than take their money and use it for public benefit. This is absurd.

Government spending makes no difference - private spending does

The assumption is the consumer always spends money more wisely than government. And so we end up with the public services, which everyone wants to work, in a mess.

Taxes must never rise

This is, apparently, the word of the economic gods.

There are more false assumptions than this: take these for starters and realise everything said today is based on these false premises that are bound to result in economic nonsense being said.

If today is all about Tory tax bribes it really will be a total waste of time

This is the morning when I know that almost anything I right now will be the equivalent of chip paper by lunchtime. Any speculation on what Jeremy Hunt might say today is, most particularly this year when so many things have been mooted as possibilities, particularly pointless. In that case, I will discuss a general point and not a specific forecast.

The only point on which all commentators appear to agree this morning is that the strongest possible hint has been provided that today’s autumn statement (or budget) will include details of tax cuts.

The one thing that I can say for certain is that the last thing that we need today is tax cuts.

A one per cent cut in the income tax rate would cost around £7 billion. The benefits would go to all taxpayers, whatever their income level. The greatest benefit will go to those with the highest levels of income because the higher the income that a person has, the bigger the gain that they get from a percentage fall in the tax rate. That is a simple arithmetic fact. So too is it a simple fact that those who do not pay tax cannot benefit from a tax rate cut. Their gain comes to precisely nothing.

A cut of one per cent in national insurance is even more discriminatory. The cost is approximately £5 billion per annum, with the difference between this cut and that for income tax being that pensioners are excluded.

Meanwhile, whilst everyone has gone quiet on the issue, I suspect that inheritance tax cuts will be mentioned today. They may well be one of the many NITMO offerings (‘not in my term of office’), meaning that they will have no impact until after the coming general election, but I think that they are likely to be proposed, nonetheless. The entire benefit will, of course, go to those already wealthy.

It is also widely rumoured that there will be a substantial change to corporation tax because the £9 billion per annum deduction made temporarily available last year to soften the blow of the increase in the rate to 25%, as a result of which large companies can offset their entire capital expenditure cost against their taxable profits in the year in which that capital expense is incurred will, it will be announced, continue into the future, making it another NITMO issue that will be used to taunt Labour. Since the incidence of corporation tax is almost entirely on shareholders (although there are economists who argue otherwise), this benefit will also flow to the already wealthy, who are always the biggest beneficiaries of lower tax rates paid by the companies that they own.

In other words, any tax cut today will be deeply selective, with a very strong bias towards those with higher incomes. Those most in need will lose out, entirely. Those on low incomes will gain a little, at best. If, in that case, this is the focus of the autumn statement, it will have three typically Tory consequences.

Firstly, it will deliberately benefit the best off.

Secondly, it will deliberately increase inequality in the UK.

Thirdly, it will deliberately increase the divisions in our society.

Meanwhile, the Tories will claim that such cuts will encourage enterprise, increase the amount of work that people are willing to do, and will, therefore, increase growth.

As I noted when being interviewed on Radio Five yesterday, in my entire career as a practising chartered accountant not one client told me that a cut in the tax rate would ever impact the amount of work that they were willing to do. Firstly, that was because very few knew what that rate was. Secondly, it was because those who were running their own businesses rarely knew precisely what their profits were until well after the time that they were earned. Thirdly, it was because, even if they knew what their income was, their ability to relate that directly to the amount of tax they might pay was decidedly limited because of the complexity of the tax system. In other words, whilst this link between tax paid and effort expended might look to be obvious on an economist's whiteboard when teaching students, in the real world and with small tax changes the impact is almost certainly non-existent.

So, if this is the focus of today, then what we will be looking at is a Tory tax giveaway to those most likely to vote for them in exchange, from which we will see no overall economic gain to the economy of any great significance, not least because those who will benefit most (the best of) are the most likely to save everything that they gain from a tax cut.

I can hope for better. I suspect my hope will be forlorn.

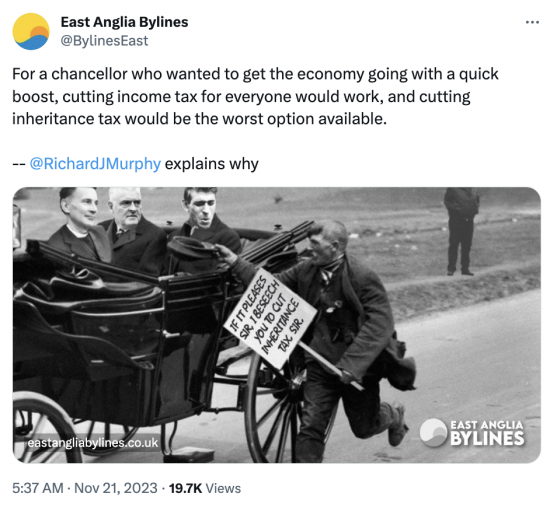

I beseech you to cut inheritance tax, Sir

Me, in East Anglia Bylines this morning:

I love the image by Cold War Steve, used by East Anglia Bylines with his permission.

Budget thoughts

Having now done what I expect to be my last pre-Budget radio comment, I can concentrate on preparing for tomorrow's immediate post-budget comment on Radio 2 at about 1.35 pm.

The difficulty with doing so is that so much is in the mix in this budget, and the steers being given by the Chancellor and Prime Minister are really quite varied as to their content.

On top of that, there is, inevitably, Andrew Bailey from the Bank of England muttering in the background. He gave a speech yesterday in which he said there was no room for any significant cuts in interest rates any time soon and that hard times are not over yet. I am sure that the timing was deliberate. This will be the framing of this budget. The message he is sending is that he has not got the recession he craves as yet and still wants it, whatever the cost. Good luck to the Chancellor with a friend like that in your camp.

So, what will Hunt do? First, he will work with small sums of money: Bailey gives him no choice but to do so, although Bailey is wrong, of course.

Second, I think Hunt's trailing of inheritance tax cuts was clever because I very much doubt that they are going to happen, at least this side of a general election. At best, he will announce a plan to cut the tax in stages from 2025 onwards, knowing that it is utterly meaningless when no Tory will go near the Treasury for a decade or more after the next election.

Third, there will be other cuts of that sort: income tax may well be cut for 2025/25, but not beforehand. The aim is to set elephant traps for Labour, who will then have to say what they will do with regard to those plans.

More pragmatically, there may be a national insurance cut, although it is so untargeted I fail to see why. There would have to be an increase in the rate over £50,000 to match the cut under £50,000 for it to be even remotely justifiable and fair. Justifying that to pensioners and those on benefits will also be hard - but maybe the Tories just do not care about that. They do not pay NI, of course.

And businesses will get a cut: I suspect the small business rate of corporation tax will fall in April next year, which has no impact in terms of tax paid until the Tories are out of office.

Maybe big business will keep 100% expending of investment costs as well - which is ludicrous when so much business capital expenditure is designed to undermine net-zero targets.

What else? Benefit adjustments will be mean.

There will be almost nothing for public spending.

And there will be lots of noise on supply-side reforms like planning and pension changes - plus Hunt's ISA plans, none of which will have the slightest impact on anything that happens in people's lives between now and whenever the Tories are swept from office.

It is being said that this will be a 'big fiscal event'. When you're playing with 1.5% of government spending at most, I don't see that.

I think we'll see political game-playing and a poorly judged use of public money. But I could be wrong, of course. Tomorrow, we'll know.

On Radio 5 this morning

I am on Radio 5 this morning, live sometime between 7.35 and 8, meaning that as I type I am sitting waiting for the phone to ring sometime soon.

I was invited to contribute to their breakfast show's 'In my opinion' spot yesterday. They suggest the topic. In my case it was 'Why I do not think there should be an income tax cut in this budget'. If I agreed, I was offered the chance to say why and offer an alternative opinion in one minute, at most.

This is what I recorded:

Hi Rick and Chris, I’m Richard Murphy. I’m Professor of Accounting Practice at Sheffield University Management School and in my opinion the Chancellor should not do a blanket cut to income tax tomorrow.

The chancellor has £13 billion pounds to spend in his budget.

That could give every taxpayer in the UK a £300 pound tax cut but, that's not a good idea. The poorest people, who don't pay tax, will not benefit. For me, that's a big problem. What's more, the richest people, who don't need this money will benefit. That makes no sense.

So, he should do three things. He should be generous with benefit increases.

He should also provide more support for gas and electricity bills for those who really need it.

And he should invest money into making our schools and hospitals safe when so many are falling down at present.

Those things would be a much better use of money than a general income tax cut.

The recording was 1.04 - which was close enough.

The recording is played twice - once already being out. The other will be soon.

My aim was threefold. First, it was to tackle inequality.

Second, it was to direct funds in a way that income tax cuts cannot.

Third, it was to promote the need for investment.

I did not get the chance to promote tax increases and other spending plans. One minute is very tight.

So far I think it was worth doing. I will see how the live session goes.

PS: I think the live session went well.