Real estate

No, really; everything's fine

Among the headlines in the AFR Real Estate section this morning:

- Brisbane buyers now look to sell at discount

- Mortgage payments to near 20-year high

- New home sales fall 27pc from peak

- 6700 projects across Australia blacklisted for loans

- Developers squeal over apartment price slump

So, soft landing?: "Allianz-owned PIMCO, like many analysts, expects a decline in overall housing prices of 10 per cent over the next couple of years and says the market slowdown engineered by macroprudential regulator APRA does not indicate a crash likely to threaten financial stability."

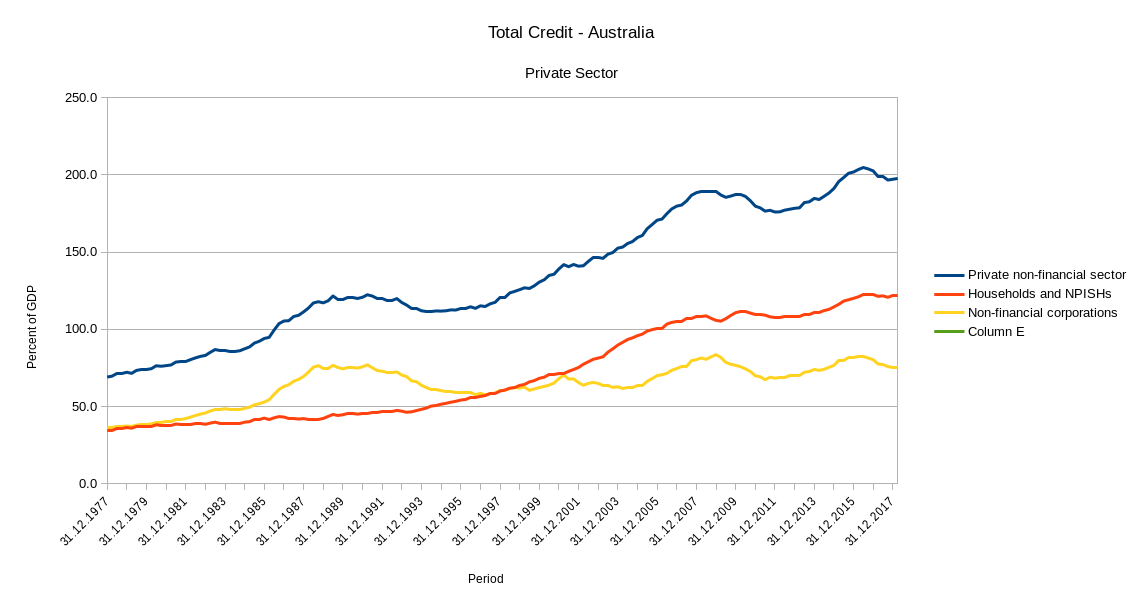

What's happened since the last time I looked at private sector debt to GDP ratios? Not much, but something:

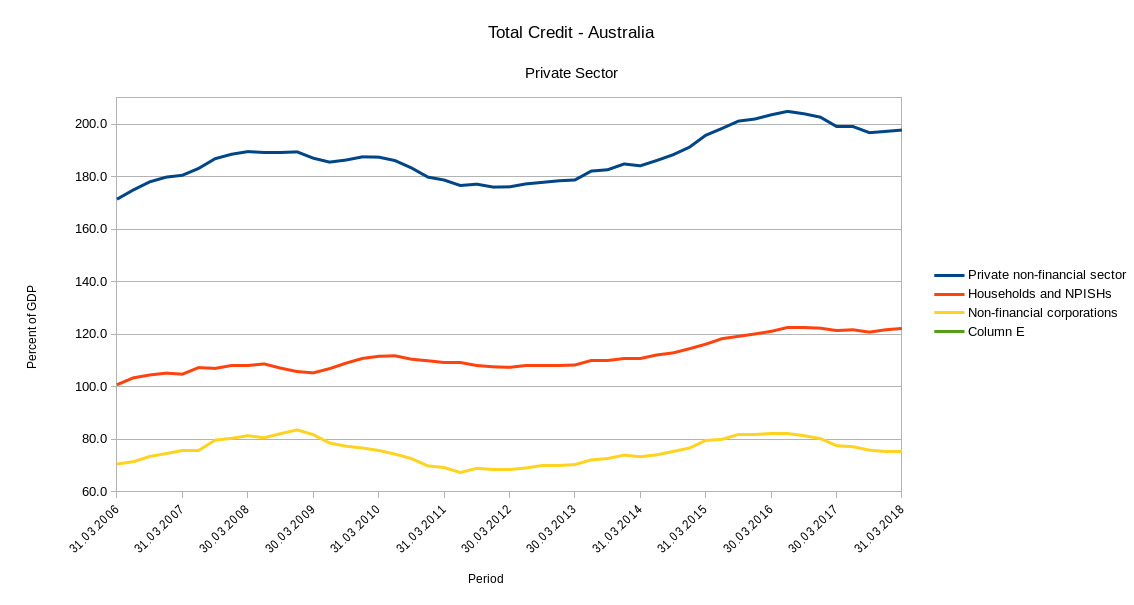

If you zoom in on the post-GDP period (caution: non-zero y-axis origin ahead):

(Source: BIS total credit statistics)

Usual disclaimer: This is the rear mirror view. Only part of the picture, and systemic crises may be closer than they appear. The fall in the total since 2016 is entirely due to the corporate sector; the situation for households is no better than a couple of years ago. To get household debt down in the face of falling property values (which should never have been allowed - indeed encouraged - to get that high in the first place) somebody has to do some spending to both raise GDP and the income necessary for repayment of household debt. Corporations won't do it; they are delevering. Households can't do it; they have debt, not savings.

The government must step in to fill the spending gap by increasing benefits and decreasing taxes on households, and by employing (lots of) people. If they don't, the best outcome will be a continuation of the post-GFC new normal of stagnation and unnecessary hardship. As far as I can see, an Australian domestic mortgage-backed crash is no less likely in 2018/19 than in 2016, and the qualitative evidence (not least: sanguine predictions by very smart people with very vested interests, designed to quell restive animal spirits) points in the same direction.

Thursday, 2 February 2017 - 6:07pm

THE Real Estate Property Guide team stepped into a suburban oasis this week at Boambee East.

Unrealestate principal and selling agent Kerry Hines said the home is a true escape from the everyday grind.

"It has a central location, close to everything, yet it's almost a private oasis," she said.

"Close to everything"? I've lived in Boambee East and the isolation almost drove me mad. You are close to nothing except mile after mile of Colorbond fencing and hopeless despair. It's the country's largest open-air prison.

Walk the streets of an evening and I guarantee that before long you'll see a miserable middle aged man sitting alone on an upturned milk crate in his garage, listening to his Cold Chisel and Meatloaf records, over and over, and reaching into the carton on the floor beside him for another joyless can of rum and coke.

You'll also see the occasional old man or woman grimly pushing a walking frame down the middle of the road, because there are no footpaths, and in any case the grass verge is full of cars; the tiny prefab half-block houses necessitate using the garage as living space, and four or five car households are the average, because walking or public transport are out of the question, despite being so wonderfully "close to everything".

Kick the juice bottle bongs, empty opioid packs, and petrol cans out of your way, make sure the guy unconscious in a pool of urine is still breathing, and within an hour or two you'll get to the nearest pub. Recent renovations can't hide the fact that it's basically a livestock shed, optimised for slopping out rather than ambiance. In any case by the time you get there, they'll be stacking chairs and locking up.

So yes, a social, cultural, and intellectual desert is the perfect spot for a suburban oasis. Enjoy!

Tuesday, 28 June 2016 - 9:34pm

The jewel in Coffs Harbour's cliche crown is still putting out the red light for any real estate agents in need of discreet, high-class services, after rejecting suggestions that a news story requires more than one source before it can be considered journalism.

The Advocate's advertorial editor-in-chief, Mr. Earnest Hardwicke-Goodge said he was disappointed by so many readers mystified as to why the unchanged ownership of prime CBD graffiti canvas was considered newsworthy.

"The continued presence of readers is a regrettable distraction from our core business of connecting advertisers with other sophisticated, consensual, like-minded advertisers," Mr. Hardwicke-Goodge said. "Unfortunately, despite filling any unsold advertorial space with the most unreadable tripe imaginable, we've been unable to shake them off."

Mr. Hardwicke-Goodge said that while an upcoming series of particularly nauseating stories of wholly uninspiring local people doing utterly unremarkable things had the potential to turn the situation around for the paper and it's key stakeholders, he urged any remaining would-be readers to remember one simple rule: "If you're not looking to scam or be scammed, just put the paper down and walk away; it's not for you."

Tuesday, 8 December 2015 - 10:52pm

As a renter of several decades standing, and therefore a repeat victim of real estate professionalism, I am very impressed to see a Coffs local who is not too proud to hold his nose and publicly shoulder this dubious honour. It would indeed be a great step forward to have the current real estate entrance examination expanded from it's current two questions ("1. Do you own a suit? 2. If the answer to question 1 was 'yes', when can you start?") to three.