No, really; everything's fine

Among the headlines in the AFR Real Estate section this morning:

- Brisbane buyers now look to sell at discount

- Mortgage payments to near 20-year high

- New home sales fall 27pc from peak

- 6700 projects across Australia blacklisted for loans

- Developers squeal over apartment price slump

So, soft landing?: "Allianz-owned PIMCO, like many analysts, expects a decline in overall housing prices of 10 per cent over the next couple of years and says the market slowdown engineered by macroprudential regulator APRA does not indicate a crash likely to threaten financial stability."

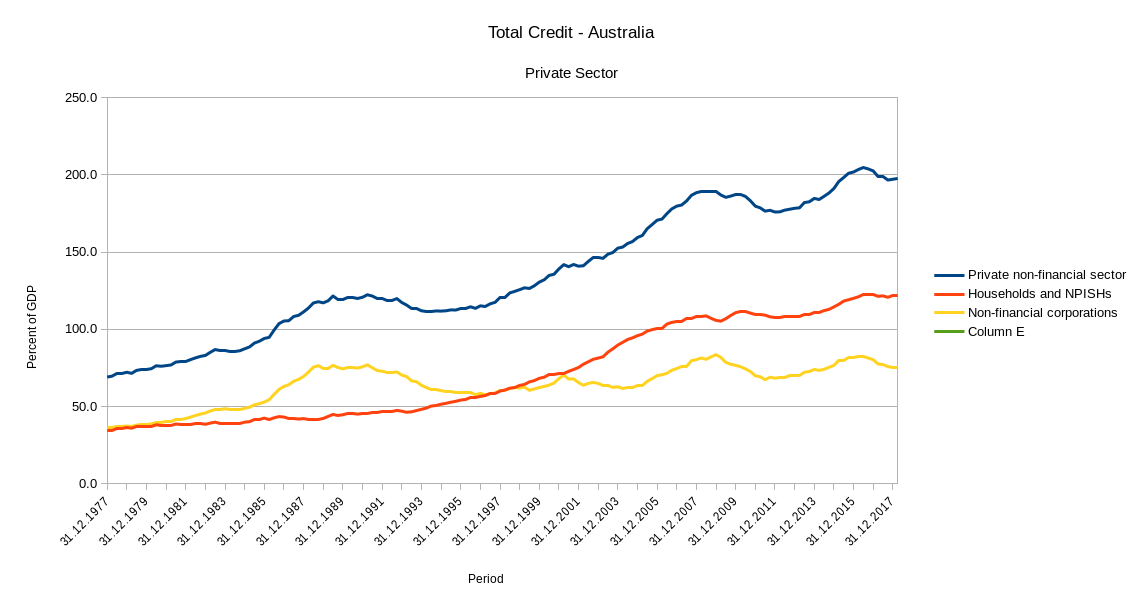

What's happened since the last time I looked at private sector debt to GDP ratios? Not much, but something:

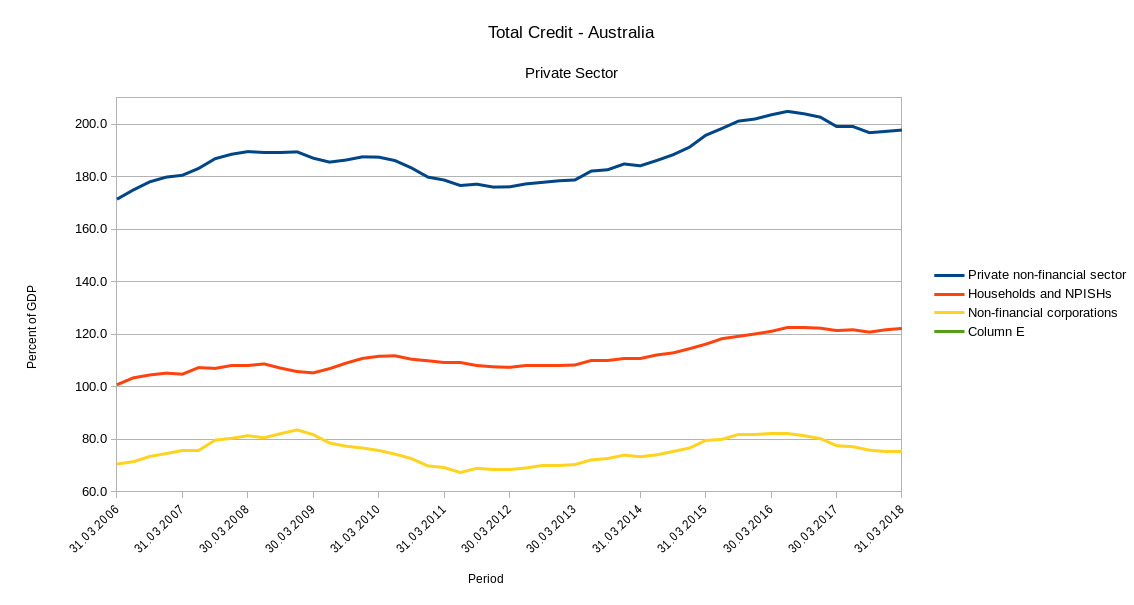

If you zoom in on the post-GDP period (caution: non-zero y-axis origin ahead):

(Source: BIS total credit statistics)

Usual disclaimer: This is the rear mirror view. Only part of the picture, and systemic crises may be closer than they appear. The fall in the total since 2016 is entirely due to the corporate sector; the situation for households is no better than a couple of years ago. To get household debt down in the face of falling property values (which should never have been allowed - indeed encouraged - to get that high in the first place) somebody has to do some spending to both raise GDP and the income necessary for repayment of household debt. Corporations won't do it; they are delevering. Households can't do it; they have debt, not savings.

The government must step in to fill the spending gap by increasing benefits and decreasing taxes on households, and by employing (lots of) people. If they don't, the best outcome will be a continuation of the post-GFC new normal of stagnation and unnecessary hardship. As far as I can see, an Australian domestic mortgage-backed crash is no less likely in 2018/19 than in 2016, and the qualitative evidence (not least: sanguine predictions by very smart people with very vested interests, designed to quell restive animal spirits) points in the same direction.