Sunday, 31 July 2016 - 5:49pm

This week, I have been mostly reading:

- Was the Financial Crisis Anticipated? — Ozlem Akin, José M Marín, and José-Luis Peydró at INET, on their CEPR (UK) working paper:

The paper finds that the top executives’ ex-ante sale of their own bank shares predicts worse bank returns during the crisis; interestingly, effects are insignificant for independent directors’ and other officers’ sales of shares. That is, effects are substantially stronger for the insiders with the highest and best level of information, the top five executives. Moreover, the top five executives’ impact is stronger for banks with higher ex-ante exposure to the real estate bubble, where an increase of one standard deviation of insider sales is associated with a 13.33 percentage point drop in stock returns during the crisis period. Our results suggest that insiders understood the heavy risk-taking in their banks; they were not simply over-optimistic, and hence they sold more of their own shares before the crisis.

- I’m With The Banned — Laurie Penny goes gonzo for Medium:

My new Spectator friend is as bewildered as I am by the way Americans take Milo and his ilk seriously, by their willingness to take pride in performative bigotry and call it strength. It works. It sells. It’s the unholy marriage of that soulless debate culture that works so well in Britain, transplanted to a nation with no social safety net and half a billion guns. It works, in part, because of the essentially cult-like nature of U.S. culture and the structured ignorance that accompanies it. America is a nation eaten by its own myth. The entire idea of America is about believing impossible things. Nobody said those things had to be benign.

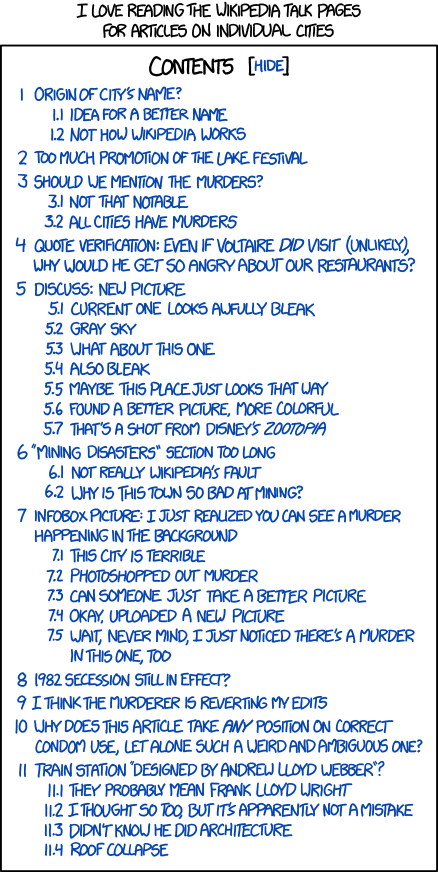

- City Talk Pages — xkcd:

- Dana Milbank Tells Readers He Has an Incredibly Weak Imagination — Dean Baker, CEPR (US):

What is perhaps most incredible is Milbank's notion of irresponsible. His sole measure of responsibility is the size of the government budget deficit and debt, which are for all practical purposes meaningless numbers. (If the government puts in place patent protection that requires us to pay an extra $400 billion a year for prescription drugs, this adds zero to the budget deficit or debt and therefore doesn't concern Milbank. However, if it borrowed an extra $400 billion a year to pay for developing new drugs, he would be furious.)

- Now we’ve voted for Brexit, great British businesses like Southern rail, Byron burger, Lloyds bank and Sports Direct are finally set free — Mark Steel, whose voice you hear in your head as you're reading, in the Independent:

[T]he marvellous thing about privatisation is it introduces choice, so if customers trying to get from East Grinstead to London aren’t happy with their rail service, they can choose to use a different rail network, such as the one from Glasgow to Fort William, or the Trans-Siberian Express.

- Record Lows — Saturday Morning Breakfast Cereal:

- Embarrassment for Christine Lagarde and IMF as Fund's own watchdog slams its eurozone record — Ben Chu at the Independent:

The IEO concluded the IMF had “lost its characteristic agility as a crisis manager” in the way it responded to the economic turmoil in the eurozone, which required unprecedented bailouts for several states shut out of the capital markets and looked like it was going to tear the single currency zone apart.

[I don't know. They turned a disaster into an apocalypse in record time. If that's not "characteristic agility" I don't know what is.] - Our attitude towards wealth played a crucial role in Brexit. We need a rethink — Stephen hawking in the Guardian:

One of the reasons I believed it would be wrong to leave the EU was related to grants. British science needs all the money it can get, and one important source of such funding has for many years been the European commission. Without these grants, much important work would not and could not have happened. […] Money is also important because it is liberating for individuals. I have spoken in the past about my concern that government spending cuts in the UK will diminish support for disabled students, support that helped me during my career. In my case, of course, money has helped not only make my career possible but has also literally kept me alive.

- How to be a writer — The Oatmeal:

- “Liberal” Economists Cheered the New Democrats’ Deregulation of Finance — Bill Black at NEP:

Bill Clinton and Al Gore were two of the most powerful leaders of the “New Democrats” – a group of Democrats determined to move the party strongly to the right on economics, budget, national security, regulation, and crime. The New Democrats’ policy apparatus was funded overwhelmingly by Wall Street but its ideological support came from economists who were “liberal” on some social issues. The Clintons and Gore delivered for Wall Street by embracing the three “de’s” – deregulation, desupervision, and de facto decriminalization that encouraged and allowed twin bubble to rapidly expand. The “dot com” bubble was the first bubble to burst. The housing bubble burst in late 2006, leading to the financial crises of 2008 and the Great Recession that began in 2007.