Tax avoidance

Prem Sikka reminds David Cameron of his commitments on country-by-country reporting

This exchange took place in the House of Lords yesterday:

Lord Cameron of Chipping Norton (Con)

One of the best things we can do for those countries is to help them to have better fiscal systems so they can raise their own taxes. I know that noble Lords like a Rwanda update: we have been working with that country since the 1990s and helped it to increase its tax revenue tenfold, and its ratio of tax to GDP has doubled from 8% to 16%, the highest in the region. That is a better thing to do in many instances than lending those countries money.

Lord Sikka (Lab)

My Lords, a major reason for the indebtedness of developing countries is that too many multinational corporations operating in them dodge taxes by shifting profits to low-tax or no-tax jurisdictions. The IMF estimates that around $213 billion of taxes are lost each year. An earlier Prime Minister introduced the Finance Act 2016 and promised that companies would publish a public form of country-by-country reporting so that there would be some visibility of the profits shifted by UK companies, but later Governments never honoured that commitment. Could the Foreign Secretary have a word with the current leaders of the Government and try to revive that commitment?

Lord Cameron of Chipping Norton (Con)

I think that the noble Lord refers to what was agreed at the G8 in Northern Ireland in 2013, where a whole series of steps forward were made to make sure that companies were not doing what is known as base erosion and profit shifting and not paying their taxes in countries where they should. To be fair to the former Prime Minister, who is now the Foreign Secretary, we did make some progress, and I think the OECD would say that it has made a lot of progress, but I will certainly check up on the noble Lord’s point.

Prem Sikka published my first ever version of country-by-country reporting, way back in 2003.

And in 2013 I was at the Lough Erne G8 Summit where country-by-country reporting was adopted for tax purposes. In fact, I sat in front of Cameron as he announced it.

The clause Prem referred to is section 19(6) of Schedule 19 to the Finance Act 2016. It was promoted by Caroline Flint, then an MP, whom I advised on the issue.

Prem has assured me that he will be writing to David Cameron. Putting this provision into force is long overdue.

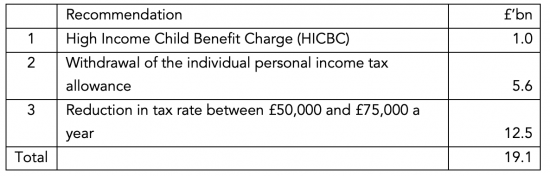

The Taxing Wealth Report: Removing existing anomalies within the UK system that prevent the delivery of tax justice might cost £19.1 billion per annum

I have this morning published the latest note in my series that will make up the Taxing Wealth Report 2024.

This latest note suggests that if an overall just system of taxation is to be delivered by the Taxing Wealth Report 2024 then some existing tax charges and reliefs of allowances for those on higher incomes will have to be withdrawn.

In particular, the High Income Child Benefit Charge and the ending of the personal allowance for those on incomes over £100,000 per annum will have to end, and revised income tax rates for those with earnings between £50,000 and £75,000 per annum will be required if penal tax charges are to be avoided. These changes come at a combined cost to tax revenue of in excess of £19 billion, but without them, the other revenue-raising proposals in the Taxing Wealth Report 2024 would not be appropriate.

The summary of this report says:

Brief Summary

This note suggests that:

- Although the Taxing Wealth Report 2024 has identified many anomalous tax rates reliefs and allowances within the UK tax system that are in need of correction where doing so will raise significant extra tax revenues, there are other tax allowances and reliefs that would also need to be addressed if the recommendations within the Taxing Wealth Report 2024 are adopted so that a tax system that is in overall terms just might be created in the UK.

- In the three cases highlighted in this note, correcting anomalous tax rates reliefs and allowances within the UK tax system might reduce overall tax revenues because those in use do, at present, create tax injustice at cost to those with higher income and wealth. It is not possible to promote tax justice without taking these issues into account, presuming that the other recommendations within the Taxing Wealth Report 2024 are adopted.

- The first of these issues relates to the High Income Child Benefit Charge (HICBC). This withdraws a claim for child benefit from any person living in the same household as the child in respect of which that claim is made if that person is earning between £50,000 and £60,000. The tax collected as a result is estimated to be £1 billion a year, but marginal tax rates exceeding 70 per cent can arise as a result, and in combination with the changes in the Taxing Wealth Report 2024 these would be unacceptable and as such this charge needs to be abolished.

- The second charge relates to the phasing out of the personal income tax allowance for persons earning between £100,000 and £125,140 a year, meaning that in that range an additional 20 per cent tax charge arises. On top of the other changes recommended in the Taxing Wealth Report 2024 that would result in unacceptable tax rates that also defeat the desired steady progressiveness of the tax system and as such this charge should be abolished, but only if the other recommendations in the Taxing Wealth Report 2024 are accepted. The cost would be approximately £5.6 billion per annum.

- The third change would be to the income tax rate on earnings and gains totalling between £50,000 and £75,000. Again, this change is only recommended if the changes suggested in the Taxing Wealth Report 2024 are accepted as otherwise there would be no need to do so. If the tax rates on national insurance, capital gains and investment income recommended in the Taxing Wealth Report 2024 were accepted the overall tax rate on people earning between £50,000 and £75,000 would become too high if sufficient overall steady progressivity is to be achieved within the tax system. Subject in that case to those other recommended changes taking place it is suggested that the income tax rate in this range be reduced to 30 per cent from the current 40 per cent rate. This would have a cost of approximately £12.5 billion per annum.

- Without these changes it is likely that the Taxing Wealth Report 2024 would be inappropriately targeted: it is meant to target those with higher income and wealth and should not penalise most of those with earnings of between £50,000 and £75,000 a year as a result unless that income comes from capital gains or other unearned sources.

- The overall cost of recommendations made in this note is:

Of these recommendations, the first should happen irrespective of the other changes suggested in the Taxing Wealth Report 2024.

The other two suggestions are conditional on the other reforms proposed in the Taxing Wealth Report 2024 being made or tax injustice would result.

Discussion

There is a discussion of these proposals in the note that supports these suggestions, which is available here.

Cumulative value of recommendations made

The recommendations now made as part of the Taxing Wealth Report 2024 would, taking this latest proposal into account, raise total additional tax revenues or release sums available for alternative spending of approximately £92 billion per annum, on top of which an additional £35 billion from pension savings and £70 billion from ISA savings might be released for investment in social and green infrastructure projects. Total sums released might amount to approximately £200 billion per annum as a result.

It is stressed that this proposal creates a cost and does not deliver additional revenue, but that is the price of creating tax justice and ensuring the proper delivery of the other recommendations in the Taxing Wealth Report 2024.

The current tax scandal was avoidable – and major reform are still required so that small business is taxed fairly

The so-called loan scheme tax charge imposed by HM Revenue & Customs mainly on those who had, in my opinion, undoubtedly engaged in tax avoidance whilst supplying services as sub-contractors through limited liability companies has attracted much attention in the last couple of days, not least because of the alleged involvement of Douglas Barrowman, husband of Tory peer Michelle Mone, in the promotion of such schemes.

Let me stand back from the political heat. Let me also stand back from the emotions around the charge, which represents an honest attempt to recover tax from those who set up structures to avoid it, however innocent or mistaken their actions might be claimed to be.

Instead, let me suggest three things. The first is that it has always been appropriate for HMRC to seek to recover tax in these cases, and since the biggest savings went to those they are now seeking to recover tax from, it is appropriate that they pay most of the tax due.

Second, let me add that HM Revenue & Customs was and still is incompetent in the management of these cases. It should have acted more quickly because the problem was apparent by about 2005. It should have acted more decisively.

And it should, when its own inaction became apparent, have been decidedly lenient with penalties and interest on people who were, to be candid, too often conned into using these schemes.

They should have also looked for recovery, at least of the employer's NIC, from the employers who obviously also benefitted from these arrangements.

And questions about the false promotion of these arrangements and the resulting penalties due for doing so should obviously have been much higher up their agenda.

The fact that none of these things happened is a clear sign of failure on HMRC's part, and ministers should now be intervening to prevent miscarriages of justice on interest and penalties, although not I suggest when it comes to tax.

Thirdly, and actually more important than all this, though, is the fact that ministers have never done anything to address the obvious problems of tackling small business activities through the use of limited companies that were designed in the Victorian era and are obviously unsuited to modern needs, most especially when much of the tax and corporate case law surrounding their use was established for large entities. Nor have HMRC. This is the real scandal. I suggest.

I first said so in August 2007 after a case on a not-terribly unrelated issue. What I said then was that the whole structure of small business taxation needed reform to make it suitable for the twenty-first century. In 2009, I was told HMRC had seriously considered my proposal but deferred it because of the global financial crisis. No one has ever been back to the issues, but I offer the following written in 2007 again because I still think that urgent reform of small business taxation in the UK is required to make it fit the economic facts of what happens in these concerns, which it does not at present.

If action had been taken when I proposed it, most of the loan charge issues would not now exist. I think that is worth noting.

I have written about the Arctic Systems case, and as a result was challenged to produce a suitable response. That I have now done. The full paper is available here. The summary says:

This paper analyses the way in which the owners of many small limited companies reward themselves and members of their families out of the income that their labour generates for those companies. This is particularly relevant in the light of the recent House of Lords ruling in what is known as the 'Arctic Systems' case. The paper shows that many of these arrangements do constitute tax avoidance because the rewards paid do not much the underlying economic substance of the transactions that are taking place.

In the interests of promoting tax justice for all taxpayers HM Revenue & Customs have a consequent duty to promote new arrangements that will encourage tax compliant behaviour in this sector. Tax compliance is defined as paying the right amount of tax (but no more) in the right place at the right time where 'right' means that the economic substance of the transaction accords with the declaration made for taxation purposes.

The paper does then show that this problem is almost insoluble whilst these businesses are operated through the medium of small limited companies which were not designed for and are unsuitable for the type of activity they undertake.

As a result this paper proposes that:

1. A change in company law to allow the re-registration of small limited companies as LLPs. An LLP is tax transparent: its income is taxed as if it belongs to its members even though it is a legal entity that is separate from them for contractual purposes;

2. The introduction of new capital requirements for the incorporation of limited companies undertaking trades, and over time forced re-registration of those that do not meet that standard as LLPs;

3. The introduction of a new investment income surcharge at rates broadly equivalent to national insurance charges that would have the benefit of reducing the incentive to split income, restore the taxation balance between income earned from all sources and allow a reduction in the base rate of income tax without adding substantially to the burden of administration for taxpayers since those liable will, in the vast majority of cases, already be submitting tax returns;

4. Create new, economically justifiable and verifiable standards for splitting income in LLPs so that the risk of legal challenge to such arrangements will be substantially reduced whilst recognising the significant role that the partners of those who supply their services through owner managed corporate entities play in the undertaking of that activity.

If this were done then:

a. The administrative burdens for many small businesses would be reduced;

b. The certainty of the arrangements under which they can operate would be increased;

c. The rewards that they rightly seek to pay to those who contribute to the management of these companies from within domestic relationships will be rewarded, but within appropriate constraints;

d. The attraction of freelance status in tax terms would be retained;

e. The current injustice that sees income from labour more heavily taxed in the UK than income from capital would be eliminated in large part without prejudicing the required favoured status of pensioners;

f. The incentives for tax planning would be reduced, so simplifying tax administration;

g. The tax yield might either rise, or a reduction in the tax rate might result.

The challenge in creating such a system is significant because it requires cooperation across government departments, but far from insurmountable. It is part of the challenge of creating an enterprise culture that meets the needs of the UK in the 21st century, and that is a challenge that any government needs to meet.

As I note at the end of the paper, suggestions and comments are welcome. But please do read the paper first and not just the summary.

Taxing Wealth Report 2024: The UK needs an Office for Tax Responsibility

I have this morning published the latest note in my series that will make up the Taxing Wealth Report 2024. This latest note suggests that the UK should create an Office for Tax Responsibility.

The summary of this report says:

Brief Summary

This note suggests that:

- The UK should create an Office for Tax Responsibility (OTR).

- This OTR should report to the House of Commons Public Accounts Committee so that it might hold HM Revenue & Customs, HM Treasury and the Chancellor of the Exchequer to account for their management of the UK tax system.

- The Office for Tax Responsibility should be responsible for preparing annual assessments of the UK tax gap[1] and tax spillovers[2].

- The OTR should also be responsible for recommending ways to address tax gaps and tax spillovers and for appraising HM Revenue & Customs’ progress in doing so each year.

- The benefits of having an Office for Tax Responsibility are that there would be:

- Better governance of tax in the UK.

- Better tax decision-making in the UK.

- An improvement in the quality of the data available to all parties on the management of tax in the UK.

- Better use of HM Revenue & Customs’ resources that should follow as a result.

- Increased pressure arising to close tax gaps, many of which favour the wealthiest in society at present.

- The creation of improved taxpayer morale as a result of the closure of loopholes resulting from work on tax spillovers. This should result in a more level tax playing field, increasing the inclination on the part of taxpayers to be tax compliant.

- All this being noted, it will be difficult to prove a direct causal link between tax revenues generated and the creation of an Office for Tax Responsibility, and no estimate of additional tax revenues to be raised is made as a result.

Discussion

A fundamental weakness within the governance of the UK tax system is that HM Revenue & Customs, which is tasked with collecting taxes in this country, appraises its effectiveness in an annual tax gap report. I have long been critical of the approaches HMRC uses when undertaking this work and have published an alternative methodology to doing so. In addition, the UK makes no attempt to undertake a tax spillover analysis and is in urgent need of doing so. Tax spillover analysis explains the likely cause of tax gaps.

The most effective body to hold HMRC to account on these issues is the Hosue of Commons Public Accounts Committee and this note suggests that the Office for Tax Responsibility report to them, acting as a parliamentary watchdog to ensure that the UK tax system works to best effect, with the anticipated benefits noted above.

Cumulative value of recommendations made

The recommendations now made as part of the Taxing Wealth Report 2024 would, taking this latest proposal into account, raise total additional tax revenues or (in the case of this proposal) release sums available for alternative spending of approximately £150.1 billion per annum.

Footnotes

[1] https://academic.oup.com/book/39754/chapter/339816709

[2] https://onlinelibrary.wiley.com/doi/abs/10.1111/1758-5899.12655

HMRC now know how much international tax they’re not being paid

The Guardian reports this morning that:

US multinationals underpaid £5.6bn in tax in the UK last year, HM Revenue & Customs believes, according to a national accountancy firm.

The suspected deficit is 14% higher than the figure from the previous year, and would mean US companies now make up nearly half of underpaid tax into British coffers from foreign companies.

A total of £11.5bn in missing tax is suspected by HMRC for 2022-23 from foreign companies – 7% higher than the total in 20201-22, according to the accountants UHY Hacker Young.

What is interesting is that they know what they have not got. That is because providing an absence is always hard.

Except that is not true in this case anymore because data from country-by-country reporting by multinational corporations lets HMRC estimate just what is missing.

And why have HMRC got country-by-country reporting? Because someone thought it up and worked for more than a decade to make it part of the international tax regime since writing the first version in 2003.

There are moments when I like to think I have done something that makes a difference.