HMRC

Reforming the organisation, goals and funding of HM Revenue & Customs

I have this morning published the last substantial chapter of the Taxing Wealth Report 2024. Some introductory and concluding sections have still to be completed, but this note focuses on the need to reform the organisation, goals, and funding of HMRC and is the last that makes substantial recommendations that will be included in the report.

When I started work on the Taxing Wealth Report 2024, I thought that this section would be one of the first to be completed, largely because I have looked at issues relating to the underfunding of HMRC since 2010. However, as my research on the subject developed it became clear that to discuss funding in isolation made no sense because to do so would have ignored the context within which this matter is of concern.

As the House of Commons Public Accounts Committee has noted in the latest of their many reports on the failings of HMRC, published this week, there is a long-term and marked downward trend in the quality of service supplied by HMRC to taxpayers. They also imply that many of the claims that HMRC's management is making concerning its own performance have to be open to doubt.

Within this context, looking at the claimed improvements in efficiency that HMRC suggest have resulted from the substantial reduction in its workforce cannot be justified. HMRC‘s costs are now rising, significantly. This issue is addressed in detail in this chapter.

Worse, a detailed review of the tax gap, the reduction which is used by HMRC to justify its supposed ever-increasing control of tax collection, cannot support that claim. HMRC admit that around 30% of corporation tax owing by smaller companies goes unpaid each year. They also accept that 18% of tax due by unincorporated small businesses goes unpaid, which they suggest to be a significant improvement on 2015, when more than 30% of those taxes went unpaid. However, data on on-time tax return submissions and data published by HMRC in 2022 showing that they had discovered that more than 8% of the UK population might be involved in the shadow economy, almost all of whom are self-employed, sharply contradicts this claim of an improvement performance in this area. As such this tax gap is highly likely to be at least as large as that for small limited liability companies.

This evidence then suggests that those most in need of help from HMRC to comply with their tax obligations are not getting that help. As a result of HMRC economies, tax offices have been closed, face-to-face taxpayer support has ended, telephone helpline support has become incredibly difficult to access, and online help has proved to be no substitute. Txaayers have been left bewildered by their obligations and alienated from HMRC, and it is not surprising that tax gaps are out of control.

That this is the case might also be due to the fact that HMRC is managed as if it is a large public company and not as a public service. The fact that all its non-executive directors represent the interests of the wealthy and large companies only reinforces the inappropriateness of its focus.

The consequences of all this are that a substantially more radical approach to the reform of HMRC is required than is currently proposed by the House of Commons Public Accounts Committee. It is time to re-organise HMRC so that its focus is on providing taxpayers with the support that they need to meet their tax obligations. At present, far too many of those taxpayers are alienated by IT systems and the demands that they create that taxpayers, quite reasonably, cannot comprehend.

It is, as a result, time for HMRC to restore its local office presence so that people can be provided with face-to-face advice on their taxes.

In addition, HMRC also needs to restart its programme of support to small businesses that are struggling to meet their obligations by reinstating its programme of active engagement with small traders by reviewing their books and records on-site to make sure that they are tax compliant.

What all this also implies is that HMRC‘s headlong rush towards Making Tax Digital is not just inappropriate but is the totally wrong way in which the UK should manage its tax system.

A tax system should be a public good, meaning it is a service supplied without the intention of profit arising by an agency that is seeking to maximise public well-being. The UK tax system does not meet that criteria at present, largely because of failure on the part of HMRC's senior management.

We need a radical overhaul of the management of the UK tax system if it is to be fair, transparent, accountable, open, accessible, and dedicated to creating equality within the UK because everyone is required to pay the taxes that they owe.

The summary of this chapter, which is of 33 pages in total, is noted below. A PDF version of the whole chapter is available here.

A copy of this chapter will be sent to the Public Accounts Committee.

Brief Summary

This note suggests that:

- HM Revenue & Customs governance structures are no longer fit for purpose. They are based on the ethos of a public company and are focused almost entirely on meeting the needs of large companies and the wealthy. Both sectors are well represented amongst its non-executive directors; no other group in society is. That is no longer acceptable.

- HM Revenue & Customs has for too long emphasised cost control as its focus of concern rather than serving taxpayers or raising all the revenue owed to it. This has been inappropriate and has prevented the creation of a tax system suited to the needs of society in the UK.

- HM Revenue & Customs’ drive to reduce the cost of collection of tax in the UK has largely failed but has as a consequence:

- Seriously reduced the quality of service that it supplies to taxpayers in the UK, with the quality of everything, from face-to-face services to the answering of telephone calls, to the time taken to reply to letters, all deteriorating significantly leaving many taxpayers without any of the help that they need to pay the right amount of tax that they owe.

- Seriously reduced the number of staff at HM Revenue & Customs.

- Reduced the average real pay of staff at HM Revenue & Customs.

- Considerably reduced the number of tax investigations undertaken each year.

- Lost control of some major parts of the tax gap, which is the difference between the tax that should be paid and the tax that is actually paid in a year.

- Tax gap measurement has been used by HM Revenue & Customs’ management as the indicator of its success, but as has been explored in other parts of the Taxing Wealth Report 2024, the claims made with regard to the tax gap in general are open to question.

- One of the two tax gaps where it is very apparent that matters have got out of control is that for small companies, where around 30 per cent of corporation taxes owing now go unpaid each year, which is way in excess of any reasonable level of loss. The likely annual cost of this loss is now £5.9 billion per annum.

- Another tax gap that is likely to be out of control is that for the 5 million small businesses that pay their taxes via the income tax system. HMRC say this tax gap has fallen from around 32.5 per cent of these taxes owing going unpaid in 2014 to only 18.5 per cent being unpaid now. They have not, however, provided any convincing reason for this improvement in taxpayer compliance, which is not matched by improvements in equivalent rates for small companies or in the overall rate of timely tax return submission, half of which returns come from self-employed business owners. The claimed current rate of loss is unlikely to be realistic in that case and an excess loss of maybe £3.4 billion is likely to arise as a result in this area, largely because HMRC has withdrawn from local tax offices that previously supported these taxpayers and from active monitoring of their onsite activities through their now largely abandoned programme of business compliance visits.

- In combination, the losses from just these two tax gaps amount to maybe £9.3 billion and can be attributed to HM Revenue & Customs mismanagement of its activities in the community, whether that be through maintaining local offices where face-to-face help is available or by visiting businesses at their own premises.

- It also seems that HM Revenue & Customs’ claims for the benefits of its Making Tax Digital programme seem to be seriously overstated, which is a fact repeatedly noted by the House of Commons Public Accounts Committee. The costs of creating this programme appear to be out of control. The costs it imposes on business taxpayers are excessive. Worst of all, it is likely to alienate millions of people from the tax system and most likely increase the tax gap as a result, rather than reduce it. It also makes the UK a significantly worse place in which to run a business, which is likely to impose serious costs on society at large.

- As a result, this report recommends that:

- That HMRC reforms its governance structures and objectives.

- HMRC restore its local office help centre presence in towns and cities across the UK, and widely advertise the availability of this support service.

- HMRC’s should restore its programme of site visits of businesses to monitor their tax compliance to cover checking both PAYE and VAT records.

- HMRC should stop the rollout of its Making Tax Digital programme so that no business that is not VAT registered will never be enrolled in this programme.

- The cost of restoring these services will be very much less than the sums that might be raised by reducing the two gaps that have been noted to reasonable levels (i.e. those that were maintained during periods when HMRC was better resourced in the past), but since some of those sums capable of recovery have already been noted elsewhere in the Taxing Wealth Report 2024 no additional account of such recovery is made here. That said, because other tax gaps would also undoubtedly improve if HM Revenue & Customs were to re-establish its presence in UK towns and cities the likely cost of this programme – which might be £1 billion a year, or twenty per cent of the current cost of running HMRC - is not taken into account either. Nor is the likely significant gain from reducing taxpayer strain taken into consideration, or the gain from making the UK a more tax-friendly environment, to which considerable harm has been done since 2010.

HMRC have deliberately taken tax collection out of our communities and the price that we are paying for that is very high

I am continuing to work on data from HM Revenue & Customs on its accounts, the tax gap and other issues related to its management of the UK's tax system.

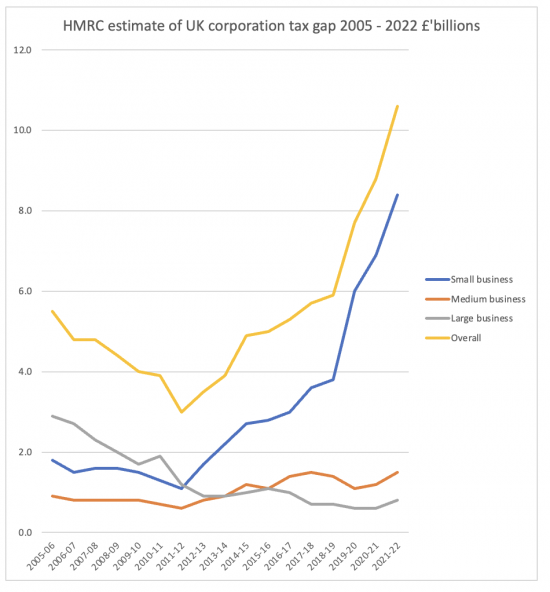

When doing so, I created this chart based on data in section five of the data files on the 2023 tax gap report, downloadable from the HMRC website:

The tax gap is the difference between the tax that HMRC think should be collected each year and they amount that they actually get.

As will be apparent, since I and others began work on tax justice the large company corporation tax gap has fallen from about 8 per cent of revenues to around 2 per cent of revenues. There are, of course, issues I would disagree with on both estimates, but that this trend is correct is, I am sure, correct.

We brought pressure to bear on the government on the large company tax gap from 2005. I created country-by-country reporting that is now in use in about 80 countries, including the UK, to tackle this issue. Large company tax abuse is no longer the issue it was. Investing further effort in it is no longer a priority in the UK and many other countries. It really is time that the current misguided tax justice movement took note: they are barking up the wrong tree when this is just about the only issue that they are still willing to talk about.

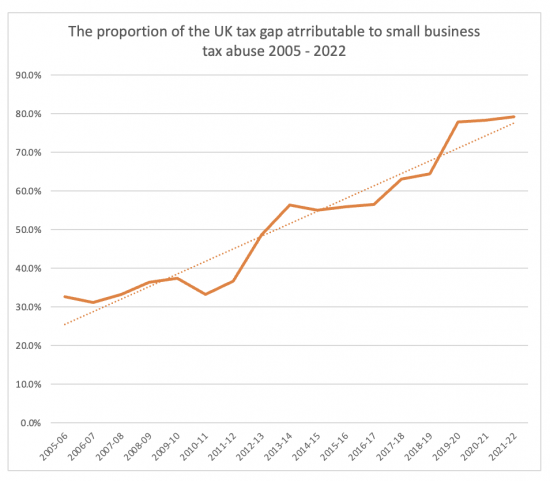

The chart does, in itself, prove why. The small business tax gap has gone through the roof. As a proportion of the total UK corporate tax gap it has changed like this:

Small company non-payment of tax is now the issue in the UK corporate tax arena. HM Revenue & Customs do, I think, still seriously underestimate this tax gap and its ramifications by suggesting that it might be £8.4 billion a year. The large business tax gap is, in their estimate, just ten per cent of that.

But the question is, why is this? I am musing on there being one very obvious cause. Look at the inflexion point in the top chart. It is 2011/12. That is when HM Revenue & Customs began to close local tax offices, end on-site PAYE inspection, and, most especially, began the process of ending almost all on-site VAT inspections of small businesses.

If VAT is not paid, sales go unrecorded. If sales go unrecorded, so too does profit. So, too, incidentally, does PAYE on the money illicitly taken from the companies involved. The small business corporation tax losses since 2012 arising as a result might have amounted to £25 billion in my estimate. The other losses will have exceeded that sum, easily. And that is all because HMRC tried to save £1 billion, maybe, a year.

We are paying an enormous price for HM Revenue & Customs mismanagement in that case. They took HM Revenue & Customs out of the community and the price we are paying for that is very high.

Why can HM Revenue & Customs restate its account for the tax gap fourteen times in fourteen years?

I am now working on the last major section of the Taxing Wealth Report. This refers to the administration of HMRC.

My focus was initially going to be on the lack of funding supplied to HMRC, about which its management gets rather excited because they think that proves their claims that they have improved the organisation's productivity. However, the more that I am getting into this issue, the more I realise that the questions that need to be asked are much more significant. In particular, I am very concerned about the quality of the data that HMRC makes available to let us appraise its performance and so decide whether its funding is appropriate.

I might discuss the problems that I have found with HMRC‘s accounts in another post. In this one, I want to address one of my long-standing bugbears, which is HMRC‘s data on the tax gap.

The tax gap is the difference between the tax that HMRC think should be collected in a tax year, based upon the legislation then in existence, and the amount of tax actually paid in that year. I have, for many years, criticised HMRC data on this issue and the methodologies that they have employed to estimate the tax gap, whilst also giving them due credit for the fact that they are the only major tax authority that does try to publish this information on an annual basis.

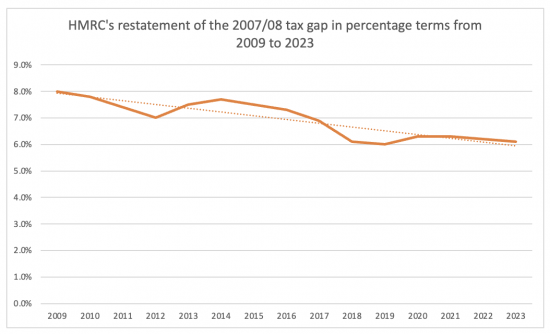

My question at this moment is just how useful that annually published data really is. That is because HMRC have a habit of updating their estimates of tax gaps, regularly. In fact, hardly a year goes by without HMRC revising the data that they have previously published on the tax gap for a particular year.

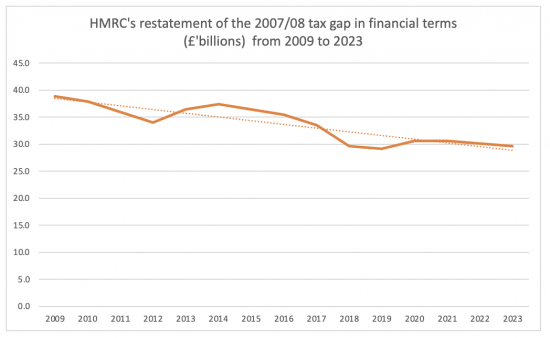

Take as an example the tax gap for the year 2007/08, which is one of the earliest for which data is available. Information for that year was first published in the 2009 tax gap report and was suggested to be £38.8 billion. That was eight per cent of the total tax owing for that year. Since then, that estimate has been revised. That revision has not happened once or twice, which is the most that would ever really happen with regard to commercial financial accounting information before serious questions about the underlying quality of the accounting information of the reporting organisation arose and its auditors became subject to intense scrutiny. It has, in fact happened every year since publication first place. As a result, the percentage tax gap for the years question has been re-stated as follows:

I added a trend line.

Expressed in financial terms, the tax gap for that year has moved as follows:

The data source is the Excel data publication that supports the 2023 tax gap from HMRC.

1.9% of the tax gap for 2007/08 has disappeared since 2009. The sum in question is £9.2 billion. That would be good news if I believed it was true. Actually, I think it simply because re-estimation has taken place.

Think about this for a minute and reflect on how HMRC would react if a taxpayer went back to them every year, saying that they wished to revise the estimates included in their accounts going back well over a decade. That might be tolerated once, subject to a potential tax investigation unless very good reasons were given. Multiple restatements would, most likely, give rise to the tax payer suffering an extraordinary degree of scrutiny, which I think it reasonable to presume they would not enjoy. Restating every year would be utterly unacceptable, but that would be particularly true if, as in this case, the estimate was revised downwards from years year, implying the total overall profit each year rose as a result, with successive tax underpayments arising as a result. All hell would break loose if that were to happen, and rightly so. So why do HMRC think that they can get away with this?

My questions are straightforward. Firstly, why are HMC allowed to do this without sufficiently highlighting what they are doing on an ongoing basis, which is to always (it seems) find errors that suit their management’s agenda?

Why, secondly, are they allowed as a result to present this headline data without making it sufficiently clear that the comparisons that they are make are not with the contemporaneous data of the periods to which they refer, but to some moving target that has been in existence ever since? I find it annoying when financial statements are restated, usually for one year at most of the time, and usually for reasons that are made very transparent in the financial statements, but the other thing what is happening with HMRC is that it is very hard to explain why these successive restatements are occurring, and even need to be made. And for the record, I have read the methodology notes.

If HMRC want to provide information that they wish me to believe, then I do really think that they should be subject to the requirement that they impose on others, which is that we use our best effort to get information right the first time that they prepare and submit it. They should not enjoy the opportunity that others do not to continually restate it to suit our own agenda.

Is it too much to ask that HMRC state their opinion and then stick to it?

The current tax scandal was avoidable – and major reform are still required so that small business is taxed fairly

The so-called loan scheme tax charge imposed by HM Revenue & Customs mainly on those who had, in my opinion, undoubtedly engaged in tax avoidance whilst supplying services as sub-contractors through limited liability companies has attracted much attention in the last couple of days, not least because of the alleged involvement of Douglas Barrowman, husband of Tory peer Michelle Mone, in the promotion of such schemes.

Let me stand back from the political heat. Let me also stand back from the emotions around the charge, which represents an honest attempt to recover tax from those who set up structures to avoid it, however innocent or mistaken their actions might be claimed to be.

Instead, let me suggest three things. The first is that it has always been appropriate for HMRC to seek to recover tax in these cases, and since the biggest savings went to those they are now seeking to recover tax from, it is appropriate that they pay most of the tax due.

Second, let me add that HM Revenue & Customs was and still is incompetent in the management of these cases. It should have acted more quickly because the problem was apparent by about 2005. It should have acted more decisively.

And it should, when its own inaction became apparent, have been decidedly lenient with penalties and interest on people who were, to be candid, too often conned into using these schemes.

They should have also looked for recovery, at least of the employer's NIC, from the employers who obviously also benefitted from these arrangements.

And questions about the false promotion of these arrangements and the resulting penalties due for doing so should obviously have been much higher up their agenda.

The fact that none of these things happened is a clear sign of failure on HMRC's part, and ministers should now be intervening to prevent miscarriages of justice on interest and penalties, although not I suggest when it comes to tax.

Thirdly, and actually more important than all this, though, is the fact that ministers have never done anything to address the obvious problems of tackling small business activities through the use of limited companies that were designed in the Victorian era and are obviously unsuited to modern needs, most especially when much of the tax and corporate case law surrounding their use was established for large entities. Nor have HMRC. This is the real scandal. I suggest.

I first said so in August 2007 after a case on a not-terribly unrelated issue. What I said then was that the whole structure of small business taxation needed reform to make it suitable for the twenty-first century. In 2009, I was told HMRC had seriously considered my proposal but deferred it because of the global financial crisis. No one has ever been back to the issues, but I offer the following written in 2007 again because I still think that urgent reform of small business taxation in the UK is required to make it fit the economic facts of what happens in these concerns, which it does not at present.

If action had been taken when I proposed it, most of the loan charge issues would not now exist. I think that is worth noting.

I have written about the Arctic Systems case, and as a result was challenged to produce a suitable response. That I have now done. The full paper is available here. The summary says:

This paper analyses the way in which the owners of many small limited companies reward themselves and members of their families out of the income that their labour generates for those companies. This is particularly relevant in the light of the recent House of Lords ruling in what is known as the 'Arctic Systems' case. The paper shows that many of these arrangements do constitute tax avoidance because the rewards paid do not much the underlying economic substance of the transactions that are taking place.

In the interests of promoting tax justice for all taxpayers HM Revenue & Customs have a consequent duty to promote new arrangements that will encourage tax compliant behaviour in this sector. Tax compliance is defined as paying the right amount of tax (but no more) in the right place at the right time where 'right' means that the economic substance of the transaction accords with the declaration made for taxation purposes.

The paper does then show that this problem is almost insoluble whilst these businesses are operated through the medium of small limited companies which were not designed for and are unsuitable for the type of activity they undertake.

As a result this paper proposes that:

1. A change in company law to allow the re-registration of small limited companies as LLPs. An LLP is tax transparent: its income is taxed as if it belongs to its members even though it is a legal entity that is separate from them for contractual purposes;

2. The introduction of new capital requirements for the incorporation of limited companies undertaking trades, and over time forced re-registration of those that do not meet that standard as LLPs;

3. The introduction of a new investment income surcharge at rates broadly equivalent to national insurance charges that would have the benefit of reducing the incentive to split income, restore the taxation balance between income earned from all sources and allow a reduction in the base rate of income tax without adding substantially to the burden of administration for taxpayers since those liable will, in the vast majority of cases, already be submitting tax returns;

4. Create new, economically justifiable and verifiable standards for splitting income in LLPs so that the risk of legal challenge to such arrangements will be substantially reduced whilst recognising the significant role that the partners of those who supply their services through owner managed corporate entities play in the undertaking of that activity.

If this were done then:

a. The administrative burdens for many small businesses would be reduced;

b. The certainty of the arrangements under which they can operate would be increased;

c. The rewards that they rightly seek to pay to those who contribute to the management of these companies from within domestic relationships will be rewarded, but within appropriate constraints;

d. The attraction of freelance status in tax terms would be retained;

e. The current injustice that sees income from labour more heavily taxed in the UK than income from capital would be eliminated in large part without prejudicing the required favoured status of pensioners;

f. The incentives for tax planning would be reduced, so simplifying tax administration;

g. The tax yield might either rise, or a reduction in the tax rate might result.

The challenge in creating such a system is significant because it requires cooperation across government departments, but far from insurmountable. It is part of the challenge of creating an enterprise culture that meets the needs of the UK in the 21st century, and that is a challenge that any government needs to meet.

As I note at the end of the paper, suggestions and comments are welcome. But please do read the paper first and not just the summary.

Why are HMRC understating the number of Tax Commissioners by 14%?

An, as yet, unpublished part of the Taxing Wealth Report is on the governance of HM Revenue & Customs, which I have long felt to be dire, for reasons that I will explain.

I was looking at this issue yesterday, and noted this:

Try as I might, I can only spot six names in that list. The website is, however, quite sure that HMRC has seven commissioners.

Try as I might, I can only spot six names in that list. The website is, however, quite sure that HMRC has seven commissioners.

So, I thought I might suggest some questions of the sort a tax inspector might raise during a tax investigation resulting from this obvious misstatement:

- You appear to be understating your Commissioners by about 14%, HMRC. Why is that?

- What else have you got wrong if you cannot get this right, HMRC?

- Might we assume that if this number is 14% understated your income is as well?

- If you wish to blame a software updating error shall we still assume everything is understated by 14%? After all, that must follow, mustn’t it?

- You have clearly been careless in the presentation of your data. Shall we agree a 30% penalty is due on all resulting misstatements is appropriate, even if unrelated to this error?

- There will, of course, be an interest rate charge.

- Because we found your mistake the cost of this tax investigation will not be tax deductible, even if your error was innocent.

- Oh, and because of our staffing shortages we apologise fur changing the personnel dealing with this matter three times in two years, for losing your file and often not answering your correspondence for months, thereby stretching out the agony of this episode for you, but no, there is no compensation for that, including for the additional costs you incurred.

You don’t believe me? You really should.

And what I would still really like to know is, who is the missing tax commissioner who so obviously ticked the box saying ‘no publicity’ when applying for the job?

Why won’t UK politicians address the biggest part of tax evasion in the UK, which is caused by the absue of limited liability companies due to poor state regulation?

As the Guardian notes this morning:

Anyone selling used clothes on Vinted, renting out their home on Airbnb, or getting rid of old camera equipment on eBay is going to come under fresh scrutiny from the taxman, following a crackdown on income earned from online trading.

From 1 January, HM Revenue & Customs will require digital platforms to collect information on how much their users make.

Let me be clear: I hate all tax cheating because:

- It undermines effective markets and destroys the chance of real competition.

- It undermines the rule of law.

- It increases inequality.

- It prevents the effective use of taxation as an instrument of government social policy.

- It undermines fiscal policy.

- Tolerance of it creates a criminogenic environment that threatens the stability of society.

- I don't like cheats.

As a result, I welcome this move, which I have argued for in the past.

That said, welcome as this move is those targetted will not be the big tax cheats. The evaders within society are:

- The wealthy who still use tax havens - although this is becoming very much harder to do because of the use of data from automatic information exchange from tax havens, which I campaigned for and helped win.

- Multinational corporations, although again, this is now harder for them to do because of the introduction of country-by-country reporting, which I designed and campaigned for and which is now in use in 80 countries, and the new minimum corporation tax rate worldwide, which the OECD has introduced. Whilst flawed, this is better than anything the UN could deliver for a decade or more.

- The abuse of limited liability within economies.

The last is the biggest cause of tax evasion in the UK, in my opinion. I am certain that hundreds of thousands of companies trade illicitly in the UK each year, and could be detected if only UK banks were required to report to both HMRC and Companies House each year:

- Those companies that they provide banking services to.

- How much they banked in total for these entities each year.

- What their year-end balances were.

- Who they think run these companies.

- At which addresses they think these companies are run from.

If is possession of this data, HM Revenue & Customs could chase all companies that have activity that have not submitted corporation tax returns and Companies House need neve strike off a company that has traded, bit could in stead pursue its directors for data. Remove limited liability from directors in breach of obligations and the chance of recovering funds would increase, considerably.

The systems to provide this data have to exist so that the UK can meet international information exchange obligations, but we refuse to use this data domestically, in the process allowing massive tax fraud to continue whilst picking on casual eBay sellers. In the meantime, these fraudulent companies do not file accounts or tax returns, and every year or so form a new company to carry on their illicit activity, and Companies House then strikes off their old one for them with no questions asked.

I explain these issues and how to tackle them in the Taxing Wealth Report 2024, here and here. I conservatively estimate that addressing this issue might raise £12 billion of tax a year - and probably rather more. So why does no political party talk about doing it? I wish I knew. It is a simple, straightforward low-cost reform that would deliver a massive yield whilst seriously reducing UK tax abuse, which would help all hones traders. What is not to like about that?